Despite the recent runup in oil prices, measures of expectations do not spike.

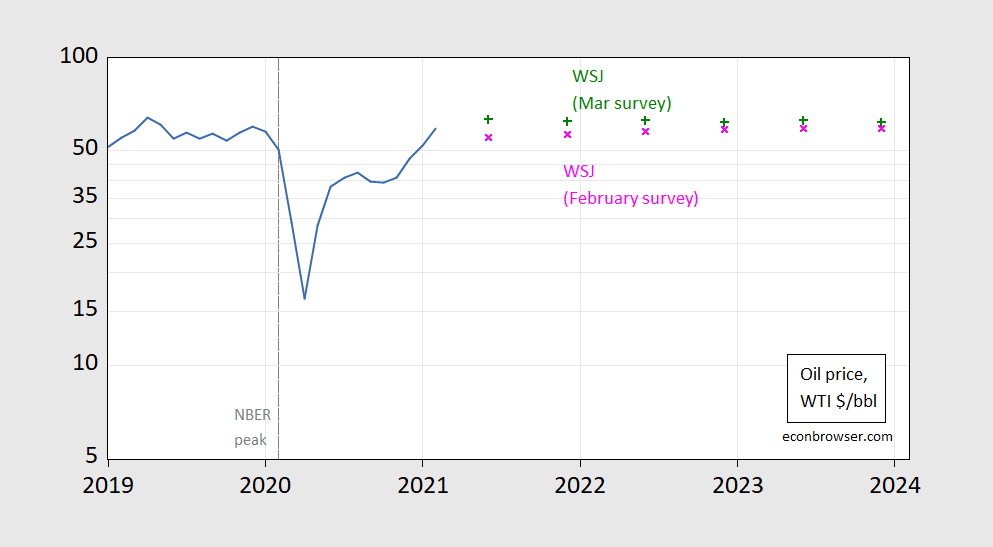

Figure 1: Price of oil (blue), from NYMEX futures as of 3/10/2021 5pm (red), from WSJ March survey (green +). Source: FRED, ino.com, WSJ March survey.

The Wall Street Journal survey conducted in early March as well as futures indicate prices at the end of 2021 in the mid-fifties. The mean forecasted price for end-2021 has gone up about $6/bbl, as shown in Figure 2.

Note that in general, futures do a so-so job (relative to random walk and simple ARIMA models) in out-of-sample forecasting, as discussed in this post.

Figure 2: Price of oil (blue), from WSJ March survey (green +), from WSJ February survey (pink +). Source: FRED, and WSJ survey.

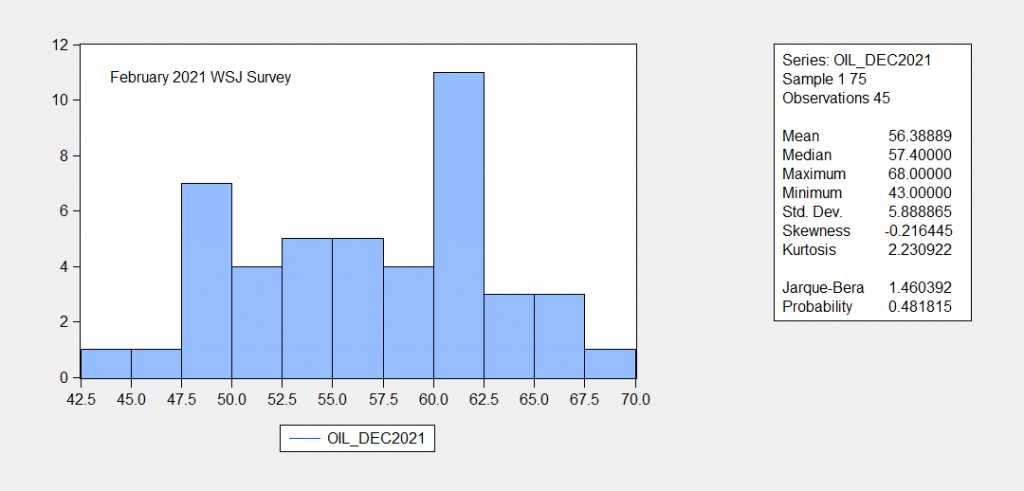

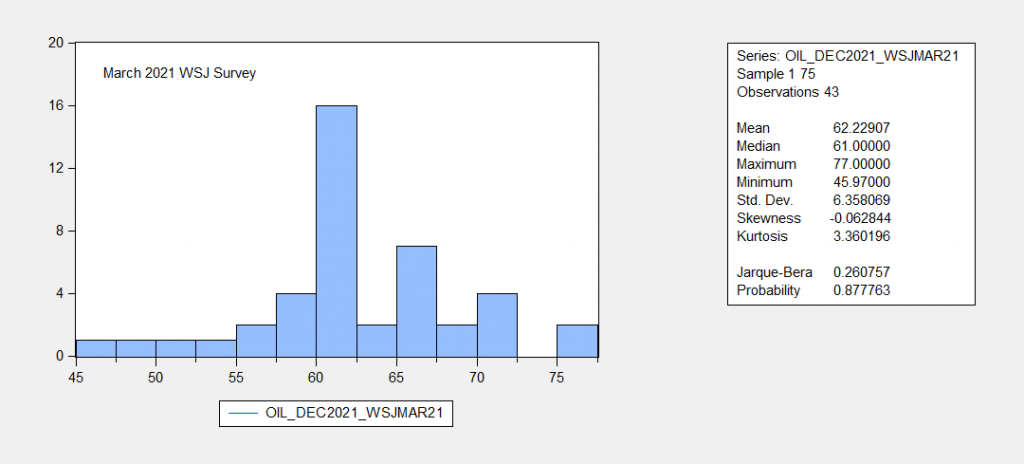

It’s of interest to look at the dispersion of prices as well as the mean. Figure 3 shows the histogram for oil prices at end-2021 from the February survey, while figure 4 shows the corresponding histogram from March survey.

The mean is $56.4, median 57.4, with maximum $66 and minimum $43 (Price/Ameriprise, and Deviney/ABN Amro, respectively).

Figure 3: Histogram for price forecasts from WSJ February survey. Source: WSJ, author’s calculations.

In the March survey, the mean(median) has risen to $62.3($61), while the maximum has risen to $77, the minimum to $46 (Roman/St. Mary’s, and Romero/NC A&T State, respectively).

Figure 4: Histogram for price forecasts from WSJ March survey. Source: WSJ, author’s calculations.

Dispersion has increased, with the standard deviation rising from 5.9 to 6.4, and the distribution becoming more fat-tailed (leptokurtotic). Despite the increase in spread, no forecast comes close to $100 by end-year; one forecast comes in at $93 by end-2023 (Roman/St. Mary’s).

If the mean stays below $68 (assuming no new Mid-East wars/ land grabs) can we get “Princeton”Kopits to buy all the regulars here a free steak dinner???

Knowing him – he will buy bologna sandwiches.

Not bologna, silly. Everyone knows that bologna comes in slices!

No, it’ll be hot dogs – you know, “tube steak.”

In the U.S., roughly 72% of a barrel of oil goes toward gasoline and diesel fuel production; another 9% goes toward jet fuel according to industry sources in 2018. Travel was curtailed significantly in the U.S. and it is likely that other nations experienced declines. So it would follow that until travel returns to a more “normal” level and pattern, oil production capacity will be greater than demand.

https://petroleumservicecompany.com/blog/oil-barrel-42-gallon-breakdown/

https://fred.stlouisfed.org/series/TRFVOLUSM227NFWA

While the U.S. consumes only about 20% of the world’s oil productions (DOE), significant swings in U.S. consumption can impact oil prices as shown by the sharp decline in 2020. Electric vehicles have yet to become a major player in the automotive market (~2%) so their impact on oil prices is presently minimal and should remain so for a decade.

There is some indication that 2021 air travel will be much higher than 2020. But that is a smaller part of the oil consumption.

https://boston.cbslocal.com/2021/02/26/travel-agents-increase-bookings-2021-coronavirus/

Until people feel comfortable driving beyond their local area and commuting to work returns to pre-COVID levels, passenger miles may remain depressed. The timing of that will depend on the rapidity of COVID-19 vaccinations and clear evidence that such vaccinations are effective against new strains of the virus, plus a general opening of states, the hospitality industry, and the news media broadcasting the “all clear”.

While the B.1.1.7 variant is “fully susceptible to vaccine-induced immunity,” B.1.351 is less susceptible but “still within the range where we expect some protection,” associate medicine professor Catherine Blish wrote in an email to The Daily. So they are “mostly effective”.

https://www.stanforddaily.com/2021/02/07/covid-19-vaccines-mostly-effective-against-new-strains-researchers-say/

Obviously, all bets would be off if the Iranian backed forced in Yemen successfully destroyed major portions of the Saudi oil production. The Iranians have recently become emboldened.

https://www.usnews.com/news/world/articles/2021-03-08/us-embassy-condemns-houthi-attacks-on-saudi-oil-heartland

https://www.forbes.com/sites/palashghosh/2021/03/08/brent-crude-surpasses-70-for-first-time-in-more-than-year-after-houthi-rebels-attack-saudi-oil-facilities/?sh=2ce7a0e6617f

Brent crude surpassed $70 per barrel earlier on Monday (March 8) for the first time in more than a year, after climbing $2.62 on Friday after OPEC decided to hold output steady and the U.S. posted strong job growth.

…

John Driscoll, director at JTD Energy Services, told CNBC that the attacks by the Houthis “serve as a reminder that the Mideast is vulnerable and rife with tensions and rivalries that could overheat at any time,” adding that the timing of the operations were “noteworthy,” since the U.S. recently took action against military targets in Syria and Iraq.

Are you working with Princeton Steve on this project? You tend to present a lot of dispersed and only marginally relevant babble with no coherent framework much in the way his bizarre comments read. OK with all of your babble maybe I missed it but is your forecast also oil prices to rise by $100 a barrel? Or are you afraid to make a commitment before you take your daily dose of bleach?

https://www.chron.com/news/article/Americans-have-started-leaving-home-even-more-16017279.php

Well duh. I saw more dogs on my early run this morning than I have seen in a year. But it is sort of warming up here. Plus got dose #1 of the Pfizer vaccine. Still wearing my mask and socially distancing. Then again I care about my neighbors.

I think we may have walked upon one of the reasons “Princeton”Kopits seems a little slow-witted sometimes. He reads a paper (Houston Chronicle) that was braindead enough to censor the cerebral prose of Molly Ivins.

Uh-Oh…….. it looks like President Biden has walked into the orange portion of the graph:

https://apnews.com/article/ap-fact-check-joe-biden-politics-pandemics-coronavirus-pandemic-71b80db13ee03ace2858228bbe52f099

“The CDC says 61% of people over 64 have received at least one dose but only 31% are fully vaccinated.”

Got my first dose this morning and it was quick and easy. Dose 2 on April 8. And yes – the mask is still part of the wardrobe.

Smart. Our most at risk member of the household got their first shot February 26th. <Should have gotten a Pfizer shot about 10 days before but the state health dept here (OSDH) managed to F-up their appointment list. It was a Moderna, which if I understand correctly gives 80%–85% immunity on the first shot. They will get their 2nd shot March 28, which I guess will raise the immunity up another 9% up to 94%. Everyone in the house wears a mask out in public still and we will probably continue with the mask even after around April 14, which is when I guess almost all of the antibodies will be finished firing up. Even though we will continue with the hassle of the masks post-vaccination, we still have a lot of peace of mind now having our most at risk in the household pretty well covered, I think we can confidently say for the next 3 years. Assumably then any follow up shots will be much easier to get around 2024 or whatever. It’s a nice feeling not to have the risk hanging over your head everyday. You go out to the supermarket and absent mindedly forget to put the mask on for 2 minutes, and all the sudden your life has changed,

Biden just said all adults will be eligible for a vaccination as of May 1. Cool but damn the demand for this will be incredible. Get your shot NOW!

Got my first last week. Mrs. noneconomist will get her first today. Have been impressed by large percentage of mask wearers here even with a very vocal minority of Trumpidiots.

Gee no one seems to be backing Princeton Stevie’s $100 forecast – not even Bruce Hall’s latest babbling rant.

Of course the recent rise gets us back to 2019 prices and not much more.

Well, let’s see what happens.

@”Princeton”Kopits

Is this kind of like your “Xi Jinping will be overthrown by the proletariat anytime within the next 80 years” prediction?? Looks like they’ve “got him on the ropes”. Xi quivers in fear every night in bed as he’s simultaneously purging the public security bureau of those not “absolutely loyal” at a pace not seen in the last 20 years. Gong Daoan was “completely lacking the four awarenesses” and Zhou Yongkang was a “pernicious influence”.

I think our resident “China expert” “ltr” is going to have to get lubed up good before Chen Yixin comes to visit him and see the progress he’s made converting white devil minds here on the blog. Time for “ltr” to perform a “self-examination” to “ensure the job is done properly”.

“Obviously”, if we are to believe our resident geopolitical dunce “Princeton”Kopits this proves Xi will fall, sometime in the next 80 years, anytime in that small window of time, Kopits has it “narrowed down” that Xi will be overrun by the village peasants. Kopits has seen the realistic Hengdian produced footage where 3 Chinese soldiers fight off the half the Japanese army on celluloid film, so how could the analysis be wrong??

Oh dear, Moses, how many times do you have to be told that almost certainly ltr is a woman? And here you are yet again calling her “he.”

ltr is clearly Anne. And she has turned down Princeton Stevie advances over and over. Smart!

And here’s a little on illegal immigration:

The press has been replete with reports of a major uptick in illegal border crossings in the past month. Customs and Border Protection published numbers today, giving us insight into the month of February.

Border Patrol apprehended 96,974 migrants attempting to enter the US illegally across the US southwest border in the month of February. This was almost three times the level of one year earlier and the highest since 2006, that is, during the Bush administration. It was far worse than any February under either the Obama or Trump administrations. Nor should these developments have surprised the Biden administration. The surge was not only foreseeable, we actually forecast it.

In our November 23rd note, I wrote

…the numbers suggest the border problem will continue to worsen as long as the current ‘catch-and-boot’ regime lasts, possibly through Q1 2021. If so, the apprehension numbers in the December to March period could once again be eye-popping and a policy priority — or at least a policy headache — for the incoming Biden administration.

Not only was this qualitative guidance, we forecast the numbers, which can be seen updated with today’s CBP data on the graph below:

Reported apprehensions were even worse than our forecast, which itself might reasonably have been characterized as ‘alarmist’. That the Biden administration has been caught unawares is frankly surprising. The Obama administration had problems with its own surge, and consequently these issues should not have been novel or unexpected for President Biden. Expect some entirely Trumpian, and fairly nasty, measures to be implemented in the next month or so to control the surge.

I need hardly reiterate that all this could be resolved in short order without draconian measures if the Biden administration would consider a market-based visa program.

https://www.princetonpolicy.com/ppa-blog/2021/3/11/an-entirely-predictable-border-surge

@”Princeton”Kopits

So, you’re still strongly against punishing employers who use, abuse and act as sexual predators on Mexican immigrants?? Interesting how the knowing employment of illegal immigrants never bothers you Kopits. Didn’t seem to bother some of your heroes on FOX news either:

https://www.esquire.com/news-politics/a23471864/devin-nunes-family-farm-iowa-california/

https://www.thenation.com/article/archive/lou-dobbs-american-hypocrite/

https://www.vanityfair.com/news/2015/07/illegal-immigrants-donald-trump-hotel

https://www.washingtonpost.com/politics/if-youre-a-good-worker-papers-dont-matter-how-a-trump-construction-crew-has-relied-on-immigrants-without-legal-status/2019/08/09/cf59014a-b3ab-11e9-8e94-71a35969e4d8_story.html?noredirect=on

It must be fun for all of Kopits’ Republican idols to call Mexicans and Hispanic people “criminals and rapists” out of the left side of their mouth, and then on the right side of their mouth say “you’re hired” to those same “illegal” Mexicans to work on their properties and personal businesses. What a “Christian” act, to call the people who break their backs paying your bills “rapists and murderers”. You’re a true class individual Kopits. Really an A1 class act you are Kopits. Really.

“Princeton”Kopits, I want you to read this article, which was written in 2018, long after President Obama left office. Surely your parents (as sad as they must be at this point) sent you to school to learn how to read, so that you would actually USE that skill later in your life??

https://cmsny.org/publications/warren-undocumented-2016/

From an NPR story by Scott Horsley:

“No matter how decent they are, no matter their reasons, the 11 million who broke these laws should be held accountable,” Obama said.

In fact, the federal government under President Obama has steadily increased the deportation of illegal immigrants. The Immigration and Customs Enforcement (ICE) agency says it’s on track to expel some 400,000 people this year, 8 percent more than 2008 — the last year of the Bush administration.

In addition to deporting more immigrants, ICE is increasingly targeting those who’ve also broken other laws.

“More and more of the people we’re removing are criminal aliens,” said ICE spokesman Richard Rocha. “So that means they’ve been convicted of some sort of crime.”

The government is expanding a program called Secure Communities, now in use in about 450 cities. Rocha says police in those communities now match the fingerprints of everyone they arrest against a federal immigration database.

“With that information, we’ve been able to accurately identify who someone is, and we’re able to prioritize them, depending on the types of crimes they’ve committed — and remove them,” Rocha said.

The agency says 50 percent of the immigrants deported this year had some kind of criminal record. That’s up from about 30 percent two years ago. But immigrant rights advocates complain the government doesn’t provide a breakdown of what those crimes are.

The Obama administration is also targeting employers who hire illegal immigrants. But instead of conducting a few high-profile raids and hauling workers away in handcuffs, the government is auditing the working papers filed at hundreds more companies. And there’s been a nearly six-fold increase in the past two years in employer fines. “Ultimately, if the demand for undocumented workers falls, the incentive for people to come here illegally will decline as well,” Obama said this month.

https://www.npr.org/templates/story/story.php?storyId=128826285

https://publicintegrity.org/inequality-poverty-opportunity/immigration/immigration-decoded/employers-escape-sanctions-while-the-undocumented-risk-lives-and-prosecution/

It’s also interesting to note, Texas, a state said to be strongly Republican, and one Biden’s campaign made ZERO effort to win, does absolutely nothing to punish employers of illegal immigrants:

https://www.texastribune.org/2016/12/14/lawmakers-go-easy-employers-undocumented-workers/

Do hypocrites like Ted Cruz and Princeton”Kopits ever plan on challenging Republican state legislators in Texas why they feel there’s no need to punish those who knowingly hire people that Ted Cruz calls “rapists and murderers”??

“So, you’re still strongly against punishing employers who use, abuse and act as sexual predators on Mexican immigrants?? Interesting how the knowing employment of illegal immigrants never bothers you Kopits. ”

Moses, you are very, very far into the weeds. Why don’t you look up what I actually said, since I have written extensively on this topic. Here’s the blog. Knock yourself out. https://www.princetonpolicy.com/ppa-blog/

As regards specifics, I have said is that about two-thirds of Border Patrol should be repurposed to ICE for compliance, but in a quite different structure.

This would change under an MBV system. ERO — enforcement and removal operations — would be rechristened CERDO — compliance, enforcement, removal and detention operations. There is no compliance option today, so ICE is just running around punishing people. You can’t solve a black market with such tactics. If you provide a compliance option — MBVs in this case — then a big part of the mission becomes insuring migrants and employers are signed up. ICE would also enforce much more heavily against employers — but that can only work if the system acknowledges employer needs. If you’re starving businesses of workers, of course they will hire off the black market. Enforcement can work, but only if employers believe it is part of a coherent and reasonable system. They need a workable means to comply with the law.

You could have found that in ten minutes if you cared to look.

https://www.princetonpolicy.com/ppa-blog/2020/2/25/i4vdktsotxygy4x8g80i7zrbbu3ozc

I just watched a Lincoln Project clip entitled A Shining City on the Hill which contrasted Reagan’s dream for America v. the reality of Donald Trump. The question posed was what does the Republican Party stand for. In your case it is very clear you prefer the Trump version as it elevates people like Stephen Miller.

Maybe you might decide to listen to Reagan assuming you ever had a damn soul.

“Nor should these developments have surprised the Biden administration. The surge was not only foreseeable, we actually forecast it.”

Umm, “actually,” so did I predict it. No, not here, or anywhere in writing, “actually,” because I thought it was as obvious as the hands on an analog clock face, so everyone would realize it. As for it being a surprise to the Administration, all of the reporting I’ve seen, from enough sources that it seems to be common knowledge, is that they expected it but haven’t had time to put a set of comprehensive policies in place. They’ve been in power for only, what, seven weeks, right? And they’ve been kinda busy repealing, rescinding, replacing the incoherent, ill-advised, and/or downright evil policies of the previous Administration, not to mention trying to shepherd some minor piece of legislation through the Congress. I assume someone as well-informed as you has probably heard of it so I won’t waste everyone’s time discussing that minor bit of fluff. In fact, I’d say that Biden has had a very busy, and very productive, seven weeks.

” … consequently these issues should not have been novel or unexpected for President Biden.” As outlined about, I don’t think this is true.

I realize that you’re dragging on Biden to facilitate blowing your own horn. But really, the relentless self-promotion on someone else’s blog is well past being old. You have a lot that you can bring to these discussions. Just state your facts and move on. Stop selling. No one here is buying.

But he has lots of hits from his self promotion on Parler. Maybe he can get back on Fox and Friends where they love abuse of Hispanic kids.

“Umm, “actually,” so did I predict it.”

Really? So where did you publish it? Did you make a quantitative forecast? I did. And I published it.

And you were telling Menzie that he did forecast it. Make up your damn mind. Oh wait – your need for attention requires you to spin more racist crap.

The Biden administration should have been well aware of this problem a year ago. Nevertheless, they were clearly caught flat footed. No one in the Biden administration has said that, “Well, yes, we were anticipating 100,000 apprehensions at the border, and even though it is the highest for the month since the Bush administration, that was our design. We were well prepared and our goal was 100,000, and we achieved. it”

That’s not what they have said. This surge was not due to Trump policies, but due to Biden policies. They should have had a workable alternative in place before dismantling Trump’s policies. And, indeed, you’re now going to see them put some of those nasty policies right back in place.

Steven Kopits: The “Biden Administration” did not exist a year ago. Indeed, it didn’t exist more than 52 days ago. Given the Trump administration’s obstructionism in violating the transition rules, the effective arrival of the new administration was delayed.

Menzie, if I could foresee it and Diz could foresee it and Stephen Miller could foresee it, then the Biden team certainly should have foreseen it. They had a year to prep and they should have either 1) left the Trump policies in place until they figured out a workable alternative or 2) created a workable alternative in the prior year and implemented that. Clearly, the ended certain Trump programs without replacing them with workable alternatives. To post the highest apprehension rates since 2006 right off the bat is no achievement, certainly not when you had a year to prepare.

Steven Kopits: Clearly, you’ve never worked in the US government. Lot’s of things can’t be planned for until you have authority…And even then there are rules that slow everything down (publishing in Federal Register rule changes before implementation).

Can I remind you: we didn’t know until November 10 or so that Biden was the winner. That’s just four months ago.

And this:

The number of migrants crossing the Mexico border shot up to more than 4,200 per day this week, nearly double the volume in January, the most recent statistics show. U.S. Customs and Border Protection is on pace to make more than 120,000 arrests and detentions in March, which would make it one of the busiest months in recent decades.

At a 120,000 pace, March would have the highest number of apprehensions at the border for any month — with the exception of May 2019, the worst of the Trump surge — since April 2006. Yes, that counts as a colossal screw up.

https://www.chron.com/news/article/ICE-asks-for-volunteers-to-deploy-to-border-as-16020687.php

Menzie –

Were this Biden’s first time in the White House, or had there been no surge under Obama, I might agree with you. But it’s not in either case. This is not one of the ‘Who knew?” things. This was entirely foreseeable, and all the makings of a fiasco if it happened. It was and it is.

If the incoming administration was unsure, they should just have announced a continuation of Trump policies until they were confident they had a workable alternative.

But if by saying, “Clearly, you’ve never worked in the US government,” you mean, “You have no idea how incompetent these guys are,” well, yes, I guess we now have an idea of how incompetent they are.

Personally, I don’t think it’s incompetence, but rather an unwillingness to deal with situations as they are. Thus, oil prices and illegal immigration reflect a common syndrome: wishful thinking over hard-nosed realism.

Rather than taking the ‘change or die’ message to the shale sector, Biden might have said,”Folks, we’re going to be on an oil standard for a long time, and right now, we have to make sure our industry is up and running soon, or else we’ll be facing $4 gasoline by summer. So I’m going to do everything to make sure oil and gas recovers fast. At the same time, we still have to contend with not only climate change, but the reality that US shales have carried the global oil system for the last seven years and are the only reason that oil is not $100 today. We need to realize that US shales can’t keep fueling the global system forever, and if and when our Permian basin loses its resilience, oil prices are going back up. We need to prepare for that time, and that includes accelerating the transition to electric vehicles, with their associated infrastructure, as well as self-driving technology.”

Biden could have said that. But no one on the Democratic side knows anything about oil fundamentals. So it’s all blah, blah with no appreciation of what it all means, and if gasoline goes to $4, Biden will own it.

Steven Kopits: As someone who worked in both a Democratic and Republican administration (admittedly a short time in both), I can say the Democratic administration officials were as well apprised of oil fundamentals as Republican, if not more.

Me thinks Stevie is angry at Biden for his speech last night where Biden called out all the racist hate directed at Asian Americans. So it is time for his kind to turn on Latino kids instead.

“Steven Kopits

March 12, 2021 at 9:17 am

Menzie, if I could foresee it and Diz could foresee it and Stephen Miller could foresee it, then the Biden team certainly should have foreseen it. ”

After all Stephen Miller is clearly Princeton Steve’s mentor!

If you’re saying Democrats know more about oil, then you are also saying that Biden is prepared to own $4 gasoline.

Steven,

I do not know why you brought up this off-topic matter of immigration, but offhand while Sean Hannity and folks will call it a “crisis,” I do not see that it is one. After all, migration is good for the economy, including the illegal kind, although it is true that a lot the Trump base does not get this and is easily upset over “caravans” coming to the border. It may be too bad these folks will be in crummy facilities, but probably still better than the ones on the other side of the border in Mexico they were getting put in before.

Sorry, but as far as I am concerned, this is a big snore. Let them come.

And as for gasoline prices, a non-trivial part of the most recent runup is due to the refineries shutting down in Texas due to the deep freeze there with Texas authorities managing their electricity sector not having winterized facilities and not being connected to the national grid, even though they had seen this sort of thing before. But I supposed the Biden administration is responsible for this event and should have been preparing for it starting a year ago.

Barkley –

We can estimate illegal immigration assuming open borders.

If we believe the primary driver of illegal immigration is the wage differential at the Rio Grande, then we would expect labor to move across that border until wages equilibrate, adjusted for the inconvenience of having to leave one’s home country and assuming a higher cost of living. (I refer to this required wage as the Relocation Wage.) Thus, the prevailing unskilled wage in Mexico is about $2.50 / hour, but the Relocation Wage, the wages Mexicans would demand to come to the US, is about $6.50 / hour. For Central Americans, the Relocation Wage is around $5 / hour.

Thus, migration would continue until either we ran out of migrants or the effective US minimum wage fell to, say, $6 / hour. This wage can be attained either by a lowering of the nominal wage or through unemployment, or a combination of both. Thus, if wages fell to $7.50 / hour, then unskilled Central American migrants would be willing to endure an unemployment rate of about 33%. Through surveys we know about 1/3 of Latin America would like to move to the US, so even if we limit the migrants to only Mexico and the Northern Triangle, you’re still talking about a potential market of 50 million people.

Clearly, the US minimum wage market would collapse well before then. About two million migrants would, I would guess, be sufficient to crater US wages at the low end. Thus, we would probably draw, say, three million migrants with one million of those chronically under- or unemployed.

And remember, this logic also extends to the skilled market, where we can count Indians and Chinese who may have even lower wage requirements than Central Americans.

If you want to do that, that’s fine. That’s essentially the position of CATO or the econ guys at GMU. But then you have zero chance of enforcing even current minimum wage laws, much less getting to $15.

In any event, I can assure you very few Americans would contemplate such a liberal immigration policy.

Steven,

Oh gag, I should not have gotten into this. Unlike your knowledge about energy markets, I have very little respect for your knowledge or proposals regarding immigration.

That I said immigration is in general good for the US economy does not mean I am for “open borders.” Poor arguing on your part.

Your argument that we know what will happen with labor markets is also worthless. There is far more involved in this than just wage differentials, so many costs of getting here, which will never be zero. Of course as long as wages are higher here people will keep coming. But the differential will never disappear. The flow will vary over time though.

The big variable on the south border is how loose US is about granting asylum. A case can be made that it was too loose in the past, even if it probably became too tight under Trump, not even counting all the horrors of taking children away from their parents and all that. But as it is while there are all these headlines about “crisis” on the southern border, that is not nearly as large a part of the immigration flow as most of the racist hysterics who get stupidly freaked about all that think. Trump also made it hard for high skilled immigrants to come in by other routes, and it is going to be hard getting those flows going again.

BTW, your visa proposal might help a bit on the high end stuff, but it is useless on the lower end asylum stuff on the southern border. It does not end people coming across illegally as long as that wage differential remains so high, which it will.

I am not going to discuss your migration ideas further. They are not worth it.

Well, you’re wrong almost across the board here, Barkley.

Let’s take a factual statement first:

You write: ” I said immigration is in general good for the US economy does not mean I am for “open borders.” Poor arguing on your part.”

But this in fact contradicts you previous comment, in which you write: “Sean Hannity and folks will call it a “crisis,” I do not see that it is one. After all, migration is good for the economy, including the illegal kind, although it is true that a lot the Trump base does not get this and is easily upset over “caravans” coming to the border. It may be too bad these folks will be in crummy facilities, but probably still better than the ones on the other side of the border in Mexico they were getting put in before. Sorry, but as far as I am concerned, this is a big snore. Let them come.”

So clearly, Barkley, you are pro-illegal — or at least unchecked — immigration. It’s what you wrote. You say stuff and don’t realize that these assertions can be quantified. That’s what market analysis is, and that’s what I have done for a lot of my career. But you are far from alone. In his book, “Open Borders”, GMU economist Bryan Caplan has a graphic showing the entry fee for migrant workers to the US at $1,000. (See page 144.) An on-demand work permit is obviously worth much more than that, and such a low fee would create almost the same tsunami of migrants that your view does. And Caplan wrote a book about it! But like you, he doesn’t know how to actually put numbers around those glib assertions, just like you are saying ‘let them come’ without a clue as to what that means in quantitative terms.

I imagine you must think that illegal immigrants are risking their lives, health, money and freedom to cross the border because they like the Dodgers or Yankees so much. If that’s the case, why don’t we see analogous illegal immigration from Canada? Could it be that the reason is the lack of a wage differential across the Canadian border? Would that not also explain why there are so many Poles working in England but not in Hungary, which is much closer to Poland?

To me, the appropriate analogies are the Pilgrims or pioneers, people who were willing to risk it all in hopes of a better life in America. That’s how I see illegal immigrants, and if I were a poor Honduran, I would also take a crack at the border, illegally if necessary. Indeed, as a struggling family in Argentina, that is exactly what we did (albeit legally).

Now, you may believe that illegal immigration is not a black market. I would then counter that you’re a pretty weak economist, and I can’t imagine you made it through the rent control example in your intro textbook, because that’s all illegal immigration is, with the difference that we are setting the quantity, rather than the price, at a level below market.

Black markets are resolved through a legalize and tax approach. I didn’t make that up, it’s in the textbook, too. It’s beyond basic. Economic analysis doesn’t get any simpler than that. If you don’t see that, well, I don’t know what to tell you. You’re going to see illegal immigration as this inexplicable phenomenon beyond the reach of economic analysis. I, on the other hand, see it as the most trivial of economic problems.

I see no evidence that Jennifer Granholm knows anything about fossil fuels, indeed, about energy more broadly.

Still campaigning to lock kids in cages separated from their parents? Stephen Miller would be so proud of you.

John’s also on my list.

https://www.reuters.com/article/us-global-oil-kemp-idUSKBN2B11Z7

Your buddy has written a rather mixed piece:

“At the same time, production of oil and other commodities will be constrained by lack of investment during the price slump in 2020 and early 2021 as well as the newfound enthusiasm for “capital discipline”.

In the case of oil, some analysts are forecasting one last supercycle over the next few years before widespread deployment of electric vehicles in the late 2020s and through the 2030s starts to hit consumption.”

Look I get the fact that the Saudis kept oil prices low lead to less investment in shale oil production but if he and you are right about oil prices, the cash flows for these companies are going to be quite high. And your buddy thinks this will mean continued low investment. Never mind whether you took freshman finance – this is the kind of BS that kids in preK laugh at.

But at least your buddy gets what Baffs was saying about EV cars – something you tried to mock. Try addressing what I posted on Tesla’s financials. Oh wait – it was finance so yea – over your head. Never mind.

Regarding Kemp’s piece, he does mention $100 as a cutoff where demand might be negatively impacted, and while he did not say it explicitly, buried in his discussion is that the US shale producers are also a lot more likely to start acting if the price goes above $100 and stays there.

I am one here viewing the situation as highly fluid with a wide range of outcomes possible. One sign of that is to look at the recent appearance of substantial dispersion among forecasters regarding future US GDP growth. That range of possible GDP growth paths also implies a substantial dispersion of possible crude oil price paths, quite aside from uncertainties on both the supply and demand sides in various parts of the world.

While I view it as substantially less than 50% I do not rule out a spike to above $100 in the not too distant future. However, I do not see it staying there too long if it does get there, both because of that demand response noted by Kemp as well as highly likely supply responses from various quarters, including the US shale industry.

The EV story is important, but not in this near term that seems to be the focus of debate here right now.

While the Permian retains resilience, $100 oil is not sustainable, for sure. Afterwards, it could return to $100 in weeks to months.

But here, I think there may be +/- six month window to makes some nice money. $100 is an arbitrary number, but I expect to see some pretty stiff pricing from the middle of this year until shales start to get their act together.

I know how to make money – figure out the stocks you are recommending and then sell them short.

I’ve made only one recommendation in the last year, and that was the Williston Basin Fund exactly one year ago to the day when it was $2.44. Yesterday it closed at $4.05.

@ “Princeton”Kopits

Are you “long” or “short” on Stephen Miller?? Careful now, his future climbing the ranks in white supremacy may get clouded when he tells the Imperial Wizard he’s Jewish. This is definitely going to make the annals of bad career planning.

Why on God’s green Earth would you even name-drop Stephen Miller?? Does each Stephen Miller reference get you a guest invite to OAN??

You brought up Miller, not me.

I don’t know Miller; I have never met him. Via the Washington Examiner, I was told he knew about the predictable crisis piece and said he had also anticipated such a surge at the border. I personally think Miller during his tenure in the Trump administration came to be associated with ethnic hatred and displayed an ease with institutional cruelty which does not reflect my values.

@ “Princeton”Kopits

Look at the time stamp on the comment:

“Menzie, if I could foresee it and Diz could foresee it and Stephen Miller could foresee it, “

https://econbrowser.com/archives/2021/03/oil-prices-futures-survey-expectations#comment-250503

Does everyone on this blog exhibit selective memory?!?!?!?! Someone remind me, I’m “the drinker” on this blog, correct?? Or was it liquidized Vitamin E mislabeled as Strawberry Daiquiri?? I mean…….. how is it all of this stuff is here on this same damned blog in digital pixels for all to see and you idiots want to tell me “the sky is red” and “the afternoon of March 13th is ‘before’ the morning of March 12th”. Dude!!!! I’m [ ] looking at the sky right now and it’s NOT red!!!!

See pgl, March 12, 2021 at 4:23 pm

“I just watched a Lincoln Project clip entitled A Shining City on the Hill which contrasted Reagan’s dream for America v. the reality of Donald Trump. The question posed was what does the Republican Party stand for. In your case it is very clear you prefer the Trump version as it elevates people like Stephen Miller.”

He brings up Miller first.

The EV issue is long-term. Investment by shale oil companies, however, is more immediate. The idea that higher oil prices will not encourage more shale oil investment is sort of like saying higher prices do not lead to higher cash flows or that higher cash flows do not encourage more investment. Yes denial of basic economic concepts is strong with this Princeton Stevie pooh.

@ Menzie

For the love of God and all that is Holy Menzie, please don’t lose this hyperlink when discussing gas station prices months off into the future. “Gasoline” here clearly means “at the pump/station”. https://econbrowser.com/archives/2021/03/oil-prices-futures-survey-expectations#comment-250533 It could reach CoRev and Ed Hanson levels of comedy hilarity. Please please for the love of God Menzie don’t lose this comment. The laughs are useful for my mental health when you “revisit” these things.

What’s funny is how much of the popular press and commenteriat seems to implicitly or explicitly believe in “momentum” fallacy. Heck, if it were that easy, every hedge fund would do it. And then the futures market would adjust. And then the arbitrage opportunity would go away. Welcome to EMH. It ain’t clairvoyance. Who can predict Covid, wars, Trump/Biden, OPEC actions, etc? But it also doesn’t allow systemic, easily described, “Vegas beater” fallacies to persist. Not out of sample…

Yes, the out months are lower than the prompt. This is actually not unusual. Typically after a rise, we are backwardated (term structure sloping down). After a drop, we are in contango (sloping up). In other words, there is LESS variability of the 2 year contract than of the prompt (or spot). This has been well documented, with good popular articles (WSJ, Reuters, not even academic stuff).

[This doesn’t mean that out months don’t go up or down. In general, the whole structure will move up/down. But just more extremely with the near term than the out months. To an extent the out months sort of HAVE to go up/down, because there is an ability to buy/sell storage to trade across time. Yeah…we had that weird negative WTI bruhaha for a few days, but that’s really noteworthy as a temporary event for short duration and only for one instrument in one area, Brent didn’t do it. I think the general ability to time trade, using storage, is actually more the lesson to learn rather than the one flare up when a landlocked regional market had a “running out of storage” spook, near physical closing. (Almost like an electrical power market.) And the real insight was that the out months DIDN’T do the gyrations the prompt did.

The lower variability of traded out months makes sense microeconomically. After all, expectations are more averaged, further out. Think of hurricane outages in the GOM for instance (two years from now, we have some average expectation of them…but in a given SEP, we have/don’t have them.) Similarly for various political crises or even recession/growth.

An extreme example of this sort of thing occurs with natural gas, where storage is more difficult than with oil (less cushioning). And where an unusually cold/warm winter will dramatically change the price because near term demand will be higher (or lower) than near term supply. Then given the relative inelasticity of demand for residential heating, price has to adjust significantly (usually power burn and gas/coal switching as the adjustment). But looking a couple years out, nobody knows the weather and just has “average” expectations. Yet, every cold winter, you will get the natural gas bulls (many still way under water with investments from 5-10 years ago), wishcasting a near term runup into a long term reversion to the promised land. And then surprised their stonks don’t track the prompt. But of course a stock is valued on discounted future earnings. Granted, leverage, can increase the risk/reward.

[And then electrical power markets are even more variable than natty. Because for all practical purposes, there is zero storage. And peaker plants (idle capacity) have to absorb load variations. And residential demand can be incredibly inelastic, both from the nature of it, as well as the price paid by the end customer…rarely keyed to actual near term market.]

There are also issues of the ability of longer term demand (different engines) or supply (drilling) to adjust to price signals on longer time scales than near term switching behavior. An easy thing to think about is pumping a well versus drilling it. In the near term, a well is pretty digital. Most of the costs are sunk capital. You just have OPEX. With prices above, 30, almost all wells will pump. Shutoff can happen if oil (or gas) prices get low enough. But it’s a much lower level than the price required to make drilling and completing a new well justified. And then, even when you get to that price, it takes several months (years in some cases) to do the project. Of course, this isn’t some magical interesting insight about oil/gas. It’s a basic MBA concept. It’s no different than chemicals, where it can take several years to build a new silicone plant. But once it’s built, that thing runs 24-7, 365, Christmas and Easter. There are some limited opportunities for shorter term “debottlenecking” projects. But in general, addition of meaningful capacity takes a long time and can’t be perfectly predicted versus future demand.

Of course in oil, you have a pretty significant cartel operating as well (or Saudi dominant player with competitive fringe, if you prefer, same concept in that market is not free competition). It’s obviously not a free market of atomistic price takers, when so much oil is sitting idle. And that idle supply is from the LOW end of the cost curve, not the high end. And it is switching on/off at a very different rate than expected based on drilling/pumping decision timing for price taker producers.

Predicting the behavior/efficacy of OPEC is tricky. You can’t predict it perfectly. But you’re also incorrect to assume zero impact. Saudis are sitting on some of the best geology God gave to man. Massive production per well with relatively low decline rates, and onshore. With WAY longer reserve/resource lifetimes than Western companies have. Nobody knows how long…since they make up the numbers, but they’ve probably underestimated it…yes, even with the blip up during OPEC cartel quota games. As we’ve seen, they have no problem pumping 10+ MM bopd. When you see them doing 8? That’s “dominant behavior”. (They probably could do 20 MM bopd. But we know they can do 10+, because we saw it recently. This despite running at 8+ from mid 200s to mid 2010s. And despite all the conspiracy-tinged peak oiler speculation from a decade or more ago.

As far as the surveys, they’re interesting and fun, I guess. Think they have a tendency to be biased a few dollars high versus the term structure. And I trust the term structure more. That’s the “track odds” from actual betting.

It’s good that you show the term structure. So many talking heads ignores that. And it is almost literally a “betting line”. Very Bayesian. Of course, there’s even more structure out there. People trade fixed price contracts. So you can look at the price of an $80 or $100 future contract and get probability insights (in the form of price for the options, which implies betting odds) on amount of excursions to the up/down side–not just the mean expectation. EIA shows this every month in a simplified fashion within the Short Term Energy Outlook (STEO). They have a “funnel chart” showing the 95%* upper and lower bounds for prices over the next year. And the window is pretty massive. $25 to $110 for DEC2022 contract. And then the EMH haters, will say how come the term structure didn’t predict gyrations…but the market is actually giving a financial betting Bayesian indicator of the high uncertainty level. [It’s also interesting that the risk of a particular high/low excursions is larger, further out, but the observed variation of the mean expectation is lower. But that’s just math. And econ.]

*I think it is two separate tails at 95%, not 95% total, with two 2.5% tails. But this is a detail. Concept is the same.

Anonymous: Yes, I’m aware of contango/backwardation; see reference in this post.

As far as random walk versus term structure, I think it’s hard to differentiate given (1) fairly flat term structure itself, along with (2) high uncertainty about future (both up/down, the insights available from fixed price options and well displayed in the STEO funnel chart). That, along with just luck, for a particular commodity, for a set duration. Rationally, I would expect there to be information in the market’s Bayesian bet. I.e. EMH. But given the signal to noise, probably hard to differentiate versus random walk (which for a future fixed expectation, like actually buying a specific month contract, equates to future price most likely equals current price).

I’m pretty wary of papers that show market inefficiency since there can be the issue of cherrypicking (finding a particular time, commodity). Thus the out of sample jibe. Don’t get me started on stock pickers. I’d expect if we picked some other commodity and longer time sample, that we can find efficacy in market future guessing. Maybe natural gas, 6 month ahead? (Donno, just speculating, as there is both higher signal there and higher noise)

Anonymous: Indeed results can be specific to period; that’s why in Chinn-Coibion (and precursor papers and memos) we did out-of-sample forecasting (aka ex post historical simulations).

Thought experiment, just for gut Bayesian betting discussion.

Right now (as I type this), CME has the prompt CL contract (APR21) at $61.44. The DEC22 contract is at $54.69.

Now, if you had to bet on the outcome of the DEC22 contract (no side bets, hedging games, speaking contracts, just betting on this outcome on its own)…and you had two choices $61.44 or $54.60, which would you choose?

Note: I’m not trying to prove you wrong. Or right. Just a moderately honest thought experiment. Which do you bet on?

And why? Of course. Because I’m interested in if you are a Nate Silver type or not. Also, of course if you have some personal Bayesian hunch (irrespective of random walk versus better market). If you just have a guess on the market (high/low).

Don’t worry, I’m not trying to trap you. I just want you to play along and think about it and answer. I promise to have a non-gotcha response, regardless of if I agree or not.

Anonymous: If I were to bet, I’d use the futures contract expiring at the indicated time. For petroleum, they show the lowest RMSE and MAE for the horizons Coibion and I tested for. In general (true in most cases for exchange rates as well), the estimation error is sufficiently large to obviate the outperformance that one might get by estimating the underlying empirical relationships (see Cheung, Chinn, Garcia Pascual, Zhang, 2019).

For other commodities, it would depend on what empirical results we obtained for forecasting performance.

Thanks, man.