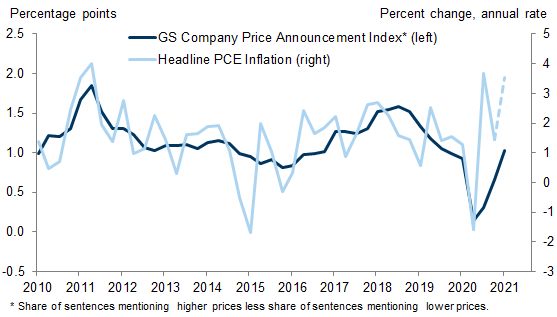

Goldman Sachs (Walker, “Company Pricing Announcements and the Inflation Outlook”) points out that changes company statements regarding price changes is contemporaneously correlated with PCE inflation, but not predictive. This puts in a different perspective media discussion of impending inflation.

The below is Exhibit 2 from their report:

Source: Walker, “Company Pricing Announcements and the Inflation Outlook,” Goldman-Sachs, April 16, 2021.

The index is a proprietary one, based on text analysis of company earnings calls for Russell 3000 firms. They find:

…the relationship between price commentary and measured inflation appears to be mostly contemporaneous rather than leading, even though companies sometimes talk about future price changes. …after controlling for core inflation or other official measures of the underlying trend inflation, producer price inflation, wage growth, or oil prices, the incremental value of company price announcements for predicting inflation is significantly reduced.

GS notes that the index of price commentary has returned to, but not exceeded, pre-pandemic levels.

For a discussion of price stickiness as measured by changes in items in the CPI, see this article by Nakamura/Steinsson (required reading in my macro course).

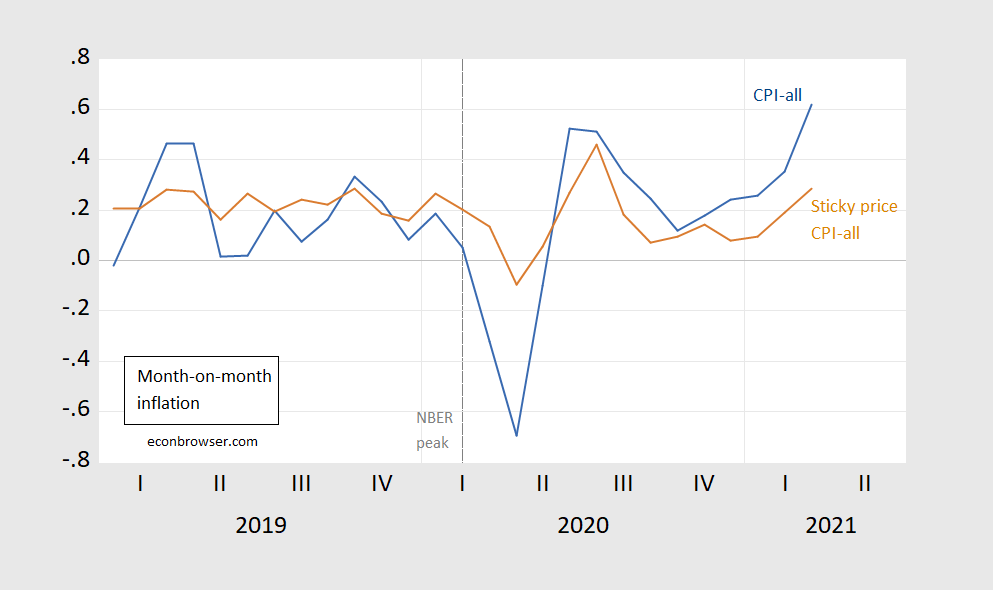

Is there anything to be gleaned from other measures? Some people pay attention to the sticky price CPI inflation rate. From Bryan/Mayer (Cleveland Fed):

We found that the flexible-price series tends to bounce violently from month to month, presumably as it responds to changing market conditions, including the degree of economic slack. On the other hand, sticky prices are, well, sticky, slow to adjust to economic conditions. Importantly, the sticky-price measure seems to contain a component of inflation expectations, and that component may be useful when trying to discern where inflation is heading.

Here’s a comparison of the CPI-all and sticky price CPI inflation rates over the past two years.

Figure 1: CPI all urban inflation (blue), CPI all urban sticky price inflation (brown), all month-on-month seasonally adjusted, NOT annualized, in percentage points. NBER peak data at dashed line (2020M02). Source: BLS, Atlanta Fed via FRED.

Aside from the spike in 2020M07, the sticky price series looks unremarkable.

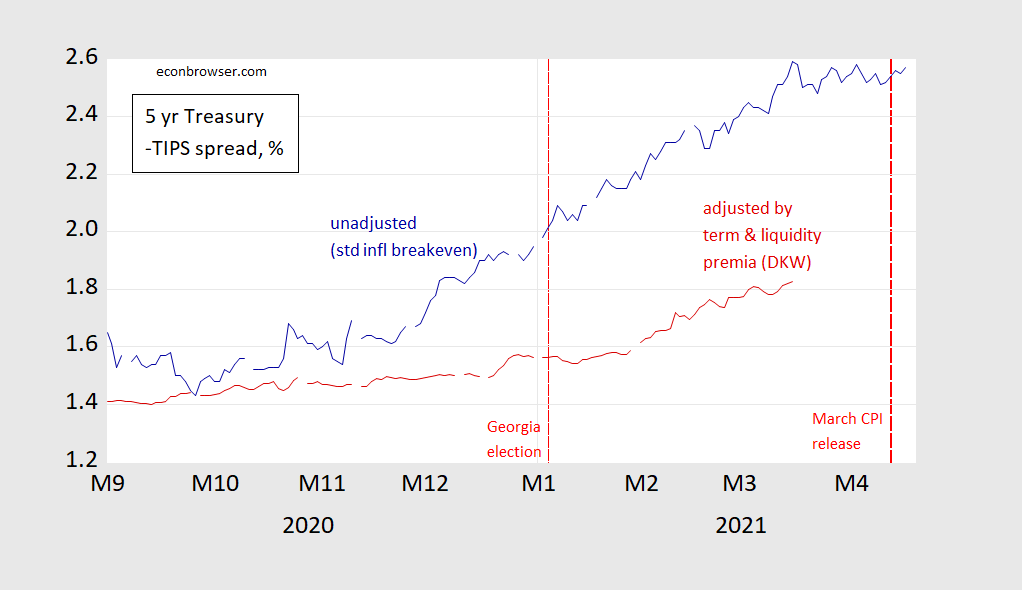

Finally, it’s of interest to see what the 5 year inflation breakeven looks like (even if it is a mismeasurement of the desired series).

Figure 2. Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by term premium and liquidity premium per DKW, all in %. Red dashed line at 4/13, CPI release date. Source: FRB via FRED, KWW following D’amico, Kim and Wei (DKW), and author’s calculations [updated 4/16 at 4:30pm CT].

As discussed a couple days ago, there was surprisingly little change to the inflation breakeven, although it must be restated that we would prefer to term and liquidity premium adjusted measure.

Cleveland Fed paper is pretty damned close to what I was asking for in my query, coincidence or not. And I will try to conquer my lazy bones, for once, and knock down that Nakamura paper. Much appreciated to the blog host, as always.

https://www.nytimes.com/2021/04/16/opinion/economy-inflation-retail-sales.html

April 16, 2021

Krugman Wonks Out: The Case for Supercore Inflation

It’s going to be a year of bottlenecks and blips.

By Paul Krugman

If Thursday’s retail sales report is anything to go by — and it is — we’re about to see a really big boom. Between stimulus checks and vaccinations, we’re very likely headed for a year of growth faster than anything since 1984. Happy times are here again!

But what about inflation? The debate we’ve been having over whether the American Rescue Plan is excessive is kind of surreal for those who remember the macro debates after 2008; this time, economists on the other side are neither knaves nor fools. There are indeed reasons to be worried about inflationary overheating. In fact, even those of us who think it will be OK expect to see above-normal inflation this year. We just think it will be a blip.

What do I mean by that? In 2011-12 it was fairly easy to debunk inflation worries by pointing to “core” inflation, which excluded volatile food and energy prices. Obviously we’ll be looking at the same measure this time. But there are reasons to think we’ll see a transitory surge in core inflation too, which doesn’t represent a deeper problem.

And it seems to me that we should make that argument now, so as not to be accused of making excuses after the fact. This is a good time to identify which aspects of inflation might worry us, and which shouldn’t.

So let’s talk about why we needed a concept like core inflation to begin with, and why we might need an extended concept — supercore? — this time.

Inflation: It’s all about the inertia

Most official U.S. economic data extend back only to 1947 (labor markets, income distribution) or 1929 (G.D.P. and all that). Consumer price data, however, goes all the way back to 1913. So we can take a very long view of inflation, which looks like this:

https://static01.nyt.com/images/2021/04/16/opinion/160421krugman1/160421krugman1-jumbo.png?quality=90&auto=webp

The 70s were different.

Spikes in inflation aren’t a new thing. There was huge inflation during World War I; there were bursts of inflation during World War II, after the war when price controls were lifted, and again during the Korean War. However, all of these inflation surges were brief. It wasn’t until the 1970s that we got an extended period of high inflation.

And unlike previous bouts of inflation, the 70s inflation was sticky: It didn’t go away as soon as a wartime boom was over. Instead, inflation became embedded in the economy, so that bringing it down required putting the economy through a wringer. Paul Volcker slammed on the monetary brakes in 1979, not taking his foot off until 1982, and the economy went through years of very high unemployment:

https://static01.nyt.com/images/2021/04/16/opinion/160421krugman2/160421krugman2-jumbo.png?quality=90&auto=webp

Getting rid of embedded inflation is hard.

But wait: I just used evocative language without really explaining what it means. What are we talking about when we talk about “embedded” inflation?

The somewhat paradoxical answer is that embedded inflation, which is the kind of inflation we really need to worry about, is inflation in prices that don’t change very often.

Inflation persistence: The staggering truth

Some goods, notably things like oil and wheat, have constantly changing prices. But many don’t. There’s a large economic literature on how often prices change (here’s a summary); it’s important to distinguish between changes in base prices and occasional sales. When you do that, you find that many firms are reluctant to change prices too often; the median consumer price changes only around once every 7-11 months. And wages and salaries are normally set for a year.

Why is this true? Why does the frequency of price changes vary so much across goods? Those are deep, hard questions, which I have no intention of trying to answer.

Instead, let’s focus on the consequences of intermittent price adjustment, which takes place in a staggered way — that is, all prices don’t change at the same time.

Imagine an individual seller which changes prices infrequently, say once a year, but tries to keep its average price over time in line with costs and the prices charged by competitors. And imagine that this seller has been operating for a while in an environment in which the overall level of prices is rising at a moderately fast clip, say 10 percent a year. Then this seller’s price will look like this over time:

https://static01.nyt.com/images/2021/04/16/opinion/160421krugman3/160421krugman3-jumbo.png?quality=90&auto=webp

Staggering toward inertia.

That is, each time it resets the price it will mark it up both to make up for past inflation and to get ahead of expected future inflation. If it changes prices once a year, it will raise the price 10 percent on each reset.

And if there are lots of price-setters acting this way, it means that overall prices will rise at 10 percent a year, even if there’s no new inflationary pressure — that is, even if supply and demand are balanced and the economy isn’t overheating. This is pretty much what we mean when we talk about “embedded” inflation.

Now suppose that policymakers want to bring inflation down. They have a problem: inflation has a lot of inertia. To get it down they need to give sellers a reason not to raise prices as much as they have been in the recent past. They can do this by pushing the economy into a recession. And if the recession is deep and long enough, the economy can be purged of inflation: not only will sellers stop raising prices as quickly, but they’ll begin expecting lower inflation in the future, which means smaller price increases, and so on. Eventually the economy can be reflated, at a permanently lower rate of inflation.

That is, however, a hugely expensive process, as we saw in the 1980s. So you really don’t want to let inflation get embedded in the first place. But how do you know if that’s happening?

Core logic ….

Kevin McCarthy says the Republican Party is not the party of nativist dog whistles. It would be nice if that were true but a few questions for McCarthy.

https://www.msn.com/en-us/news/politics/mccarthy-gop-not-the-party-of-nativist-dog-whistles/ar-BB1fJGqx?ocid=uxbndlbing

Why have you not kicked out of Congress the many Republicans who agree with Marjorie Taylor Greene?

Why did you ever support Donald Trump who clearly is the head nativist?

Why are you not supporting voting rights and in fact are actively supporting voter suppression when it comes to minorities?

Why can’t you support reasonable police reform?

This list could go on forever as the modern Republican Party does support White Supremacy full stop. Trump’s Republican Party is the antithesis of what Lincoln stood for so stop pretending Kevin McCarthy’s party is the party of Lincoln.

They been living/feeding off that “party of Lincoln” stuff for a long time, luckily for Blacks, the only ones who are buying it are Uncle Toms like J.C. Watts, T.W. Shannon, and Michael Steele. Of course Colin Powell I would not label an Uncle Tom, I would however wonder why it was so easy to shove him out onto “the porch” to sell an invasion into Iraq, who had nothing to do with the Twin Towers strike, to the U.N.

https://www.c-span.org/video/?c4716794/user-clip-colin-powells-speech

Now that Iraq has become very near to a proxy for the Iranian military, I’m sure Powell feels he was very “useful” to the Bush family And Dick Cheney’s Halliburton. But maybe not useful to the parents of 4,431 soldiers who died inside the confines of Iraq. The number you want I believe is the third number down in the upper left. Happy to be corrected if I am quoting this number incorrectly.

https://www.defense.gov/casualty.pdf

I forgot to add this link:

https://theintercept.com/2018/02/06/lie-after-lie-what-colin-powell-knew-about-iraq-fifteen-years-ago-and-what-he-told-the-un/

Didn’t Powell turn in a report saying Mi Lai was just a few bad apples, with no culpability among the higher ranks?

‘Cause that’s the kinda guy who’d lie about weapons of mass destruction.

Off-topic

If you want a good laugh, go to Youtube and type in “Jimmy Kimmel Mike Lindell patriotic cr*p” Then take the scroller thing at the bottom of the video, and jump to the 7:30 time mark. I promise you, it will be as good as 85% of the SNL skits you’ve ever seen.

That was funny. Folks should watch the earlier parts for the take downs of Jim Jordan and Matt Gaetz.

Am I the only weirdo who keeps thinking of the film (a classic in my opinion) “You Were Never Really Here” while reading articles about the Matt Gaetz story??

If anyone is curious what “OER” is on the sticky price items list in the Cleveland Fed write up, that’s “owner’s equivalent rent”. I didn’t think that was self-apparent. There’s a “b” footnote that kind of explains it but still it doesn’t exactly hit you in the face when you’re reading it.

I just had this random thought, that I wonder how many people on ZH blog would learn a lot from looking at that Cleveland Fed paper or the Atlanta Fed graph/statistic. Because the authors/host on that site are always trying to take only 1 or 2 products rapid price increase and make it confluent with a national problem on “inflation”. “Coincidentally”, this nearly always happens when there’s a Democrat in the White House. I wager I could go to ZH now and not have to look even 3 weeks back to find more than one of these style posts where they blame “inflation” on Joe Biden. I wonder if it ever dawns on the ZH readers that although they may not move in “lockstep”, price increases are much more apt to happen during periods of economic growth. But that’s not what the sammys, peaktraders, Rick Strykers, and CoRevs want to concede when a Democrat is in the White House is it?? That if you look at the record not only do Democrats beat Republicans on keeping national deficits lower, but they also beat them on economic growth. That really kills their false narrative doesn’t it?? It also explains why the Rand Pauls of the world want to destroy the Federal Reserve, because with 2-3 mouse clicks over on FRED, you can see every other word that comes out of their mouth is a LIE.

https://voxeu.org/article/inflation-aftermath-wars-and-pandemics

Those slackers at GS are at it again. Maybe someday they’ll pick up my work ethic.

The problem with war, as regards inflation, is scaled up demand for military goods and manpower at the same time as supply interruptions and scaled up demand for civilian manpower.

The problem with most pandemics, as regards disinflation, is scaled down demand for labor because of supply chain bottlenecks.

The GS authors do the usual “every case is different” thing and that’s where inflationistas find their opening. Large, large fiscal boost on top of easy, easy monetary policy. That’s how this case is different and that’s why inflation is “inevitable “.(Who is this Daly guy? Too old to be Mary’s kid; remember, economics runs in the family. )

Back in the day my old office found that production lead times for military commodities increased with the macroeconomic growth rate. No real surprise. Contractors figured that they could put deliveries of military commodities on the backburner if it was more profitable to surge production for civilian commodities; e.g., tires, batteries, turbine blades, etc. What is less obvious is that the longer production lead times necessitated greater safety level investment for military commodities, which further drove up DoD budgets.

Hey Menzie, I bet you agree, we need a GDP measurement for the sewing/quilting this lady does:

https://www.kmbc.com/article/woman-has-lovingly-made-more-than-1-500-special-masks-for-children-s-mercy-hospital/36147605

I don’t think he’ll take the leap, because he’s going to lose so much movie income (maybe he could still produce??). And to forfeit that much income to get the ego boost of being Texas governor, I think that’s not a trade off McConaughey would bite on. Still….. I have to say this is one of the more interesting political storylines I’ve seen in awhile. How much worse could he be than Abbott, and leading 12% from the starting gate??

https://www.politico.com/news/2021/03/12/matthew-mcconaughey-considering-run-texas-governor-475507

What would be even better is if we could bring Molly Ivins back from the dead to write about this. And Molly follow McConaughey on the campaign trail across Texas. Would he “lower” himself to ride a chartered bus, alight from the bus at small local communities and shake hands with “the great unwashed”?? They don’t make them like they used to kids. Jack Germond……. Charles McDowell…… Haynes Johnson…… where have you all gone???

I think the only one still alive is satirist/pianist Mark Russell: “Pardon me, boys / Are you the cats who shot Ceauşescu?” (sang to the melody of Chattanooga Choo-Choo) Russell’s best jokes were slamming Reagan and Russell was Jon Stewart before Jon Stewart was Jon Stewart. Ask 1980’s Johnny Carson how easy it was to skewer Reagan in those days~~NOT easy if you wanted to pay your bills with punchlines people agreed with.

https://www.youtube.com/user/MarkRussellPBS

Did Mcconaughy appear in “Running Man”? If not, then I don’t like his chances.

Are we supposed to categorize this under “Gee, I didn’t expect that” ???

https://twitter.com/i/events/1383802217459720194

https://twitter.com/danielle_ivory/status/1383426539711209481

In other news….. it was recently reported that the former owner of a failed restaurant, named “sammy”, learned all his food service entrepreneurship expertise from Mike Lindell. It is said that when “sammy” (after advice “sammy” received from Lindell & Kopits Food Service Consultancy LLC) put Oleandrin and meth in customers’ apple pie to inoculate them from Covid-19, many customers were upset.

I just wasted an hour that could have been saved had I listened to what is often one of my pet peeves – that being to check the resume of the person who wrote some article or in this case was presenter a webinar.

The webinar was supposed to be on the intersection of transfer pricing and customs valuations – which both are supposed to adhere to the arm’s length standard (market pricing). But this clown went on for an hour and never really addressed the actual issue in any meaningful way, which meant an hour of wasted hot air.

So dumb me at the end of it all checked LinkedIn to see what this clown did before joining the 4th rate transfer pricing shop where he is supposed to be some sort of “expert”. His professional life seems to be doing tax law stuff for the European operations of Accenture which of course is a consulting services company. In other words, he has zero experience in the topic where he lists himself as the expert. And the stupid webinar demonstrates he is nothing more than hot air.

I guess anyone dumb enough to hire this clown also relies on Dr. Rand Paul for advice on COVID-19.

Got my first Moderna shot late this morning, at a local Wal Mart pharmacy. The folks there couldn’t have possibly been any nicer, and I literally could not feel the shot when it went in or out. I just turned my head the other way and tried as best I could to completely relax my upper arm and shoulder muscles. Bing bang boom it was done. And the people there were exceedingly exceedingly kind. I haven’t always been a Wal Mart fan, so when I give them high grades it says something. I’m even thinking of making the extra effort to say something nice about the local outfit on the Google reviews, which I don’t often do, so. Certainly I trust them more than our state health department.

I haven’t had time to comment lately but I want to say “Yay” for you! I had my second Moderna midmorning today (my new “lunchtime”), also at a local Walmart. Very smooth operation. The first time, they weren’t ready for people to show up early to do paperwork, so it was much kludgier. Today I spent more time after the jab waiting for side effects than I did checking in and getting the shot combined. Side effects? So far, sore shoulder only, and much less sore than after the first one.

Anyone who hasn’t gotten it yet, please do, for your family and friends if not for yourself.

got my second shot of pfizer monday. no side effects after shot 1. different story after shot 2, with fever and chills. it was a funny thing. i describe it as symptoms of being sick without being sick. it kept me home for a day with fever and fatigue, but i lacked a headache or nausea which would normally accompany such a condition. it was uncomfortable, but tolerable in the big scheme of things. side effects lasted from hours 12 to 36, then disappeared. my advice is plan on taking the day off after the shot just in case. but today i feel great, so the effects do not linger. MUCH better than dealing with the virus for a week! for those worried about side effects, they exist but are not quite the same as being sick. the shot is worth it!

https://finance.yahoo.com/quote/PTON/

Peloton has been in the news of late because one set of parents who wanted to use their treadmill were not that careful with respect to whether their young kids would improperly use the equipment. I had kids in my younger days and if I were a parent now – I might be ordering their equipment (actually I have not as my runs in the park before the sun comes up have worked for me). But damn – I would hope I would not be so stupid to leave the equipment usable in the presence of a couple of babies.

The news says their stock has suffered. The link above suggests – not so much. And add to the fact that this pandemic has let to their sales booming to almost $3 billion for calendar year 2020. Sorry guys but I don’t feel too sorry for this company. Besides – my gym is allowing spin classes with appropriate social distancing and masks so I’m not wasting my money on Peloton.

It’s a strange world. When are they coming up with an app for how to emotionally care about your own children??

Wow,*take hold. I guess the vaccine went through a “hole”, I got confused somewhere there/

Can we put Chuck Grassley out to some secluded retirement home so he will no longer say such embarrassing things?

https://news.yahoo.com/sen-grassley-business-pressure-over-155947780.html

If Coca Cola or MLB stands up for the 15th Amendment (the right to vote) that is “economic terrorism”? Excuse me? Oh wait – corporations should not be involved in politics unless they are lining the pockets of corrupt politicians like Mitch McConnell.

@ pgl

Grassley is from my home/native state, Iowa, and you are exact correct. He is a SUPREME embarrassment. Go back to his first year in Congress and see if you can find 3 consecutive sentences where he got his grammar right. My average college English student in Dalian China had better English than Grassley, as an Iowan/midwesterner I wish I was exaggerating how bad Grassley’s English was/is.

God bless, wear your mask.

Moses,

I thought you were from North Carolina. Did you move there from Iowa?

now there are also pushes for legislation that directly targets protestors, especially in the arena of civil rights. the legislation changes arrests from misdemeanors to felonies. and attempts to keep people arrested from holding elected office or state positions.

now before we get into the weeds in all of this, lets acknowledge that many people get arrested by police in these situations. and many of these arrests are not legitimate. police arrest now and ask questions later. the police are known to make poor choices. and the result? we have legislation that will lock down the potential future of those arrested, simply because the police officer was having a bad day. this is poor legislation, and will have a chilling impact on the ability of people to impart change on the nation. and it is targeting those who protest in the name of civil rights.

let me give you a concrete example. this type of legislation would have made john lewis a felon. he would have been imprisoned. he would have been barred from holding public office. this type of legislation targets activists like john lewis. the nation would be much worse off if john lewis had been silenced. if you live in states like oklahoma, indiana, iowa, florida, arkansas, kansas, kentucky or any of the 34 states imposing such legislation, call your congressperson and tell them this is outrageous. silencing the american people is unpatriotic.

FRED on private employment in Georgia:

https://fred.stlouisfed.org/series/SMS13000000500000001

Just before the pandemic, it was approaching 4 million jobs but the pandemic took out almost 0.6 million jobs. Most have returned since.

Now I raise this because senile Senator Grassley declared that Atlanta losing the All Star game would mean the destruction of 100 million jobs. I know baseball is popular but come on Chuck. Even you are not this insane.

Oh my! Mike, Mike, Mike Lindell (the My Pillow nutcase) is suing Dominion Voting Systems:

https://nypost.com/2021/04/19/mike-lindells-my-pillow-countersues-dominion-voting-systems/

The basis? Dominion is apparently violating the First Amendment freedoms of Mike, Mike, Mike Lindell.

Of course Dominion is not part of the US government. Didn’t Mike, Mike, Mike say Dominion was working for the commies in Venezuela? But I guess objecting to blatant lies by Mr. Lindell could cramp his “right” to communicate his bogus rightwing BS. So hey!