Accounting for term and liquidity premia can change the story.

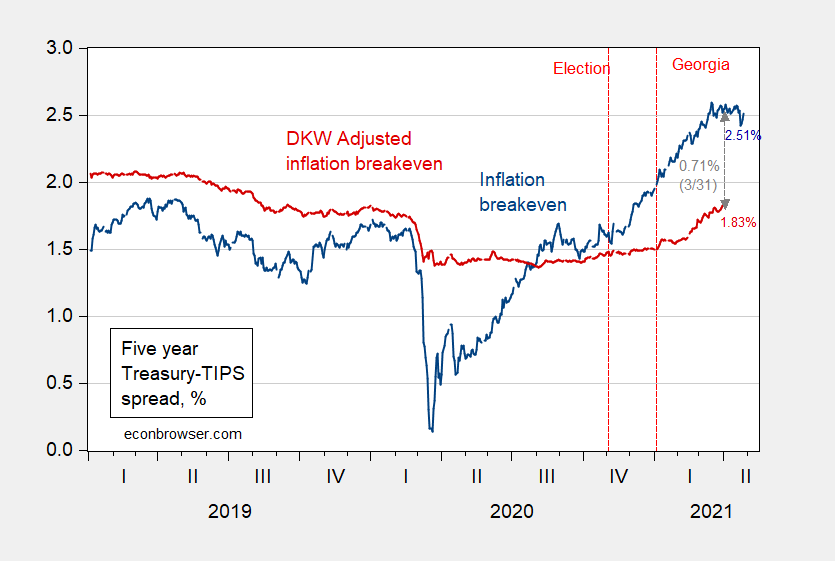

Figure 1. Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by term premium and liquidity premium per DKW, all in %. Red dashed line at 4/13, CPI release date. Source: FRB via FRED, KWW following D’amico, Kim and Wei (DKW) accessed 4/27, and author’s calculations.

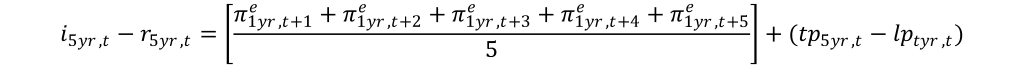

Recall, the unadjusted 5 year Treasury-TIPS spread is:

Where tp is the term premium on the Treasury yield, and the lp is the liquidity premium on the TIPS yield. Using the DKW estimates of the Treasury term and TIPS liquidity premia as reported by Kim, Walsh and Wei (2019, data 2021), one obtains the following estimates of expected inflation show as the red line above (where the red line is as calculated by KWW).

As of the 3/31/2021 observation, the unadjusted series is 0.71 percentage points higher than the adjusted; that is the expected inflation rate over the next 5 years is 1.8% instead of 2.5%. If the gap between the two premia has remained constant (no reason that would be true), then expected inflation remains below 1.8%.

More discussion here.

No agenda. Just passing on headlines and links.

Inflation indicators flashing red – Larry Summers

https://thehill.com/policy/finance/549536-summers-says-inflation-indicators-flashing-red-alarm

Investors shore up defences against rapid rises in US inflation

Odds rise of consumer price growth hitting 3% even as the bond sell-off cools

https://www.ft.com/content/fd30060f-cb7a-43b1-83aa-410b60a7dc1c

The Fed’s Inflation Blind Spot: Already-Surging Grocery and Housing Prices

https://www.barrons.com/articles/the-feds-inflation-blind-spot-already-surging-grocery-and-housing-prices-51619209825

Wow! Inflation might be hitting 3 percent! And now food and housing prices are rising! And last month gasoline prices were rising last month! But, oh, well, those prices have stopped rising. Gosh. Want to guess how much longer those grocery prices will keep rising noticeably?

Let’s be fair to Bruce as he has not been out of his basement for 14 months. Now if dear mother complains about the prices of the meals she has to go out to buy Brucie boy – how is he to know she is just frustrated with her yeoman service during the pandemic?

BTW – I just bought 6 pounds of chicken breasts for less than $12. So I’ll all ready for that alleged Biden beef ban. And tell Lawrence Kudlow I’m all stocked up on plant based beer!

FRED makes this so easy. Food prices as of March 2021 were 3.36% higher than they were as of March 2020. But notice most of this increase occurred in the first 3 months. Food prices have not been rising that much at all since June:

https://fred.stlouisfed.org/series/CPIFABSL

This is exactly why Menzie has asked us to provide reliable sources of data. Of course the reason why Bruce Hall NEVER complies is that it is so easy to check provided data and see quite clearly he is lying to us even faster than Donald Trump.

Okay, I’ve just wiped Financial Times and Barrons off my reliable list. The Hill? Well, that was just repeating what Larry Summers said so I’ve wiped Larry Summers off my reliable list.

But someone might have noticed that they were suggesting that the current situation strongly suggests increasing inflation in the future. But I’ll agree that if you start from a low baseline, increases are not always meaningful. It’s sort of that way with temperatures when the 1880s are the baseline. It’s sort of that way with GDP gains when 2nd qtr. 2020 is your baseline.

I’m now subscribing to Magic Economics.

bruce hall, what level of inflation would you expect to cause a problem. and what is the probability that we reach that level of inflation? lets start the conversation here.

Will inflation pick up? Probably, because inflation tends to be cyclical and we’re recovering from recession.

Will inflation pick up enough to satisfy the Fed’s goal of returning prices to some tend or other? Open question. The Barron’s headline, however, is criminally ignorant. Nobody who has any familiarity with the Fed could honestly write that headline.

The FT headline is better, but pretty weaselly. Have the odds of hitting 3% y/y inflation risen? Yes. So have the odds of reaching 20%. As inflation picks up, the odds of hitting any higher rate of inflation rise. What’s magic about 3%? The headline writer could have written “Odds of Fed reaching inflation goal improve.” Maybe the absence of scare mongering in my headline would be a problem for the FT.

Putting aside Summers’ yen for the spotlight, none of this breathlessness about inflation is warranted. We have been in a low inflation regime for some time, making inflation less of a risk to welfare than in decades past. The bias toward treating inflation as a serious risk relative to other aspects of economic welfare seen from Barron’s/FT/WSJ/Summers ignores the long period of too-low inflation we are (knock wood) working on putting behind us.

We’ve been through this before. A leaf hits Henny-Penny on the head and it’s “The sky is falling! We must tell the king!” Next thing you know, Cocky-Locky and Ducky-Daddles are freakin’ out, too. Freak it over inflation that might reach 3% and you just might miss so e greater risk. Hello, Foxy-Loxy.

Gee Bruce – Kelly Anne Conway just wiped you off her list. Oh well – extreme poverty is not the end of the world.

baffling,

bruce hall, what level of inflation would you expect to cause a problem. and what is the probability that we reach that level of inflation? lets start the conversation here.

Well, let’s think about that a bit. Biden is planning on spending trillions of dollars and hoping that he can tax the hell out of investors and corporations who will gladly hand over their gains/income to fund those programs. None of them will figure out ways to circumvent that like those wealthy French did when they were taxed to support France’s grandiose plans. Sure. But suppose we go up 2pp or 3pp. I guess the inflation rate could be 4% or 5% and the Fed could still attempt to justify its current funds rates. That would let the Fed buy all of that government debt at a level that might not wipe out the Federal budget’s discretionary spending, but it might do some strange things to banking and borrowing strategies.

But what happens if the Fed decides to become fiscally responsible again and raise rates while investors let their money sit on the sidelines or find workarounds? When the government says “you don’t need it”, some will say “you can’t have it”. How does the government fund its spending? Just print more paper ala Weimar Republic?

I guess I’d really like to see the budgetary assumptions laid out rather than “then a miracle happens”.

Bruce Hall: Risk and liquidity premia adjusted break even rates indicate about 1.8% expected *CPI* inflation over the next five years.

Bruce, you really did not answer my question. But you alluded to a 5% inflation rate as a possible problem. Ok, lets work with that. Not considering a short term blip, what is the probability that we maintain 5% over a sustained period of time?

“ But what happens if the Fed decides to become fiscally responsible again and raise rates while investors let their money sit on the sidelines or find workarounds? ”

That is a pretty low probability hypothetical. Lets worry about it when it happens.

“he can tax the hell out of investors and corporations who will gladly hand over their gains/income to fund those programs.”

More incredibly stupid right wing garbage. Look – when you stop writing such incredibly stupid statements, maybe we will not need to call you out on your incessant stupidity.

Summers said “Deterioration in IRS enforcement and information gathering is scandalous.@Joe Biden Plan would make our tax system fairer,more efficient, & raise more revenue than scorekeepers now forecast—likely a trillion dollars over ten years.

Agree, Brice Hall?

No agenda. Just following Kelly Anne Conway’s orders. Hey Bruce – the fellow that sold you all that bleach is in legal trouble.

https://cafehayek.com/2021/04/bonus-quotation-of-the-day-635.html

It is neither a fallacy nor ad hominem if it is true. But you do pick the most right wing sources ever. Cafe Hayek? Yes – your stupidity never disappoints.

Thanks for proving the point. I know you just can’t help believing that any thoughts other than your own have no value, even someone like Larry Summers. But that’s fine; I take your comments for what they’re worth since they offer little of substance and much of sophomoric flippancy.

“Summers qualified his remarks by noting that economists disagree about some fundamental issues and said there was a 1 in 3 chance that inflation doesn’t take hold in a significant way that leads to bad outcomes.”

Once again Bruce Hall shows he is incapable of reading past a headline! I bet Bruce has also skipped what Summers et al. wrote in Tax Notes about collecting more in taxes from the very rich even though I provided a link. It is a real shame that he is not allowed to read anything not preapproved by Kelly Anne Conway.

“Summers qualified his remarks by noting that economists disagree about some fundamental issues and said there was a 1 in 3 chance that inflation doesn’t take hold in a significant way that leads to bad outcomes.”

Well, by my calculations, that makes a 2 in 3 chance that inflation does take hold in a significant way that leads to bad outcomes. I checked the math with my third grade granddaughter and she agrees.

OK, now that your granddaughter has checked your math, have her check Summers’ math. ‘Cause Summers needs to be right in order for his estimate to be relevant. He has proven himself quite capable of being wrong when the stakes are high.

I am in the camp of dropping credibility for summers. he may be smart. but he does not seem to be very accurate lately. and his behavior leading up to his loss of the harvard presidency indicates his lack of credibility extends to outside his field of economics. just not a fan of the man, i guess.

At least Bruce did not start with some statement from Kudlow or Cafe Hayek!

Hey, I’m adding the Washington Post to my “unreliable” list. Okay, pgl? https://www.washingtonpost.com/us-policy/2021/03/29/summers-biden-economy-inflation/

From now on I’ll only read the Federal Reserve meeting minutes because Mr. Powell knows best. His law degree is so much more on target than that silly piece of paper Summers got from Harvard which used to be of value until certain political agendas and followers determined he was soooo outdated. Eh?

@ Bruce “I Miss the Economy Under Trump” Hall

Here’s your favorite economist on the leadership of President Obama:

https://www.youtube.com/watch?v=pYusAPYYHmg

Bruce, It’s too bad that donald trump chose not to take the Covid-19 virus seriously, because aside from hundreds of thousands of Americans dying because trump told people the virus was “a hoax” and not to wear masks as the leaders in India and Brazil cloned that MAGA policy on masks and are now also dying in the hundreds of thousands, we’ll never be able to “prove” that the MAGA economy would have been just as much of a failure had donald trump listened to the advice of Doctor Li Wenliang:

https://www.youtube.com/watch?v=ZtkSYY9Z2fE

Notice the date of the CNN video, and that all of these events with Doctor Li Wenliang happened before early February.

Forgive me for the YT link Menzie, but sometimes visuals are useful in the sense there can be little doubt it came from the horse’s mouth.

Did you take your shoes off to do that “calculation”? Maybe in the next 5 years you will finally graduate from preK!

I’ll give Don your personal regards. He’ll probably want to know the vowels between your consonants so he can contact you.

Just helping you through the tough ones, pgl. Just helping you out.

“Bruce Hall

April 28, 2021 at 4:27 pm

I’ll give Don your personal regards.”

I doubt you know him. If you do, how often does he fall on the floor laughing at you?

Bruce Hall Summers’ one-in-three chance is not some frequentist based probability; it’s a pure credence probability. Big difference. Summers really needs to provide a plausible path to accelerating inflation that would lead to bad outcomes. The old “cost push” pathway hasn’t been true for 40 years. And the “too much money chasing too few goods” pathway would only be true if Arthur Burns or Bill Miller unexpectedly rose from the dead and returned to the Fed. And yes, it rhymes. Also, note that Biden is not proposing big spending programs financed with big deficits. Biden’s programs are financed by higher tax rates on the rich and superrich. That will dampen any inflationary pressures. And unlike so many of the Reagan and Trump tax cuts, many of Biden’s proposals are true supply side policies; e.g., infrastructure spending, daycare, free community college, etc. because they either increase the size of the labor force or improve the quality of the labor force.

Gee, he was good enough for Obama and the economics cheering section then. What happened?

Bruce Hall What happened?

What happened is the Summers was not invited to join the team so he’s taking his ball home with him. Summers is a smart guy, but he has one helluva fragile ego. Always has. Always will.

bruce, people lose credibility over time. the credibility of moore, laffer and kudlow has only shrunk over the years as well. at one time summers had much more credibility than he has today. michael jordan as a 30 year old was much more credible than as a 45 year old. it does not take away from what he did in the past. but you can change your opinion of them in the present.

“Biden’s programs are financed by higher tax rates on the rich and superrich.”

Ah but Bruce has already declared those higher tax rates will cripple civilization as we know. Yes – he is THAT stupid.

“I checked the math with my third grade granddaughter”

Do this more often. She gets arithmetic – you clearly do not. Such due diligence would count down on your incessant embarrassments.

I go grocery shopping roughly every 2–3 weeks (that is how I get my booze after all). There’s no difference in prices. Name it I can get it cheap. Just as an off hand example, I can get a generic version of Dr. Pepper, which I honestly can’t tell the difference in taste or caffeine rush~~68cents for a two liter bottle. I can get what I would call decent, large bottles of wine, 1.5 liter for between $6.75 to about $8.50. These are made in areas of California well known for producing solid wine. I have my last receipt from the supermarket on the fridge, I can go down the list.

Bruce says “no agenda” like FOX news says “no agenda”. Where was this sad sap crying about nonexistent inflation when the orange abomination was in the White House??

As far as Larry Summers, he’s slowly figuring out no one cares what he says anymore, unless it’s something to grab headlines. So the sad sick uncle has figured out the easiest way to get attention is to be the one lefty that tells illiterate FOX viewers what they want to hear. When Summers phoned Brooksley Born up around 1998 to help throw more gasoline on the 2007-2008 swaps and derivatives fire Larry Summers forfeited any right he has to tell grade school children, much less adults, what good policy decisions are. He threw the right to tell us anything right down the cr*pper.

I hope you were able to buy beef now that Biden has allegedly decided to ban it. And of course your beer was plant based. Only Lawrence Kudlow drinks beef based beer!

Hold on, let’s see, I think I’m stuck to this seat, I gotta go to the fridge for the receipt:

OK, none of these include tax, including the alcohol:

Heineken large can beer $2.62

Modelo large can dark beer $2.62

Bud Light Strawberry large can $2.33

I don’t have the weights here, but the ground lamb would easily serve 2, and the solid lamb shoulder most of the time would just be for one person:

•Ground Lamb: $7.98

•lamb shoulder: $8.82

•lamb shoulder: $8.06

•pack of 24 turkey hot dog franks: $4.48 (usually feed these to my neighbor’s dogs)

•A decent (typical sized) pack of bacon: $4.94 (that has raised a little bit, I’m pretty sure not that long ago I could get that for under $4. I’d have to see if I can find an old receipt laying around to know for certain, but I’m pretty sure it was under $4 a year back or so.

I only included the Strawberry flavored light beer because I figured Lawrence Kudlow considers that as a pork product. And I included the Modelo dark because I particularly enjoy drinking beer made by “murderers and rapists” and I know all my countrymen agree with me when they purchase Modelo dark beer at the grocers. Plus I was watching Mike Lindell on FOX news, and he said because of his personal petition they finally took the pork grinds out of Modelo dark, so as consumer, I really appreciate that.

Modelo Dark happens to be an excellent beer.

@ pgl

The best beer I ever had in my life, was Bud Ice, which I usually drank out of a pretty large bottle (I rarely see those large of size bottle, of beer, here in America, if ever, specifically talking beer here) when I lived in China (usually on Fridays but as time wore on about every day of the week for awhile there). Bud Ice was so smooth tasting it was like drinking spring water. I miss that “happy melancholy” feeling of drinking that beer alone in my apartment. And driving my updoors neighbor, a very kind Japanese girl who should have decapitated me at some point but never said a single word other than thanking me for opening the building door for her if we entered at the same time, crazy by listening to portions of Steve Vai’s “Ultra Zone” and Bob Dylan’s “Time Out of Mind” CD 50 million times.

https://punchdrink.com/articles/remember-budweiser-bud-ice-beer/

I CAN drink bitter beer, but the truth is I tend to like “smooth” tasting beers and sweet tasting stuff some of my friends used to call “sissy” drinks. Dark Modelo is pretty sweet tasting for a beer, and to my tummy is not acidic. The dark beers are a unique flavor and the closest thing I can describe Modelo to, (and it’s not really a good analogy, just the best I can think of) is a kind of mild tea flavor, which I enjoy vs a bitter style beer.

Brooksley Born, Elizabeth Warren and Janet Yellen walk into a bar…

I’m still working on this one, but if it were to happen, I’d buy a round.

And they have a serious discussion about economic policy with nothing funny said at all.

@ macroduck

Might be a few jokes about a sometimes emotionally insecure gender that some of us men wouldn’t want to hear, as the truth often hurts.

Not me though, ‘cuz, I’m, like, super-macho, and stuff. Plus I’m YUUUUUUUUGE!!!!! Did I ever tell you about the time I arm-wrestled Sylvester Stallone back in 1982?? I was only about age 10 at the time, and…….. Hey, pass me that container of Rogaine and 20 of those male enhancement pills would you??

We (yes you, Moses) are being a bit sexist in neglecting to mention Gary Gensler in the same (electrinic) breath as Born. AIG’s threat to the economy back in the late 2000s would jave been much smaller is Gensler hadn’t gotten the “Brooksley” treatment.

I can’t say for certain, because it’s hard to look at one’s self with an objective view, but I would say in defense of myself, if we went back on this blog and counted it up, no one mentioned Brooksley Born in a complimentary light more than me. I do like Gensler a lot as well. Maybe we should write Gary Gensler and ask him to make her “special consultant” to the SEC??? I don’t know….. But she’s an extraordinary woman with an extraordinary mind. Would Menzie want NEC Chair now?? I don’t know. If he wanted it, and I was President I’d give it to him. Does Mrs. Born want SEC Chair at this point?? I’d sure give it a long thought if Born said “Yes, I want the job”

I’m a big fan of the both of them.

Kudlow alert – he is slamming President Biden for making us have only plant based beer:

https://www.yahoo.com/news/fox-news-host-larry-kudlow-040847391.html

Now I get Kudlow is the expert on coccaine but as a beer lover, I can assure you that most beers do not have red meat as an ingredient. Water, barley, hops, and malt – all plant based. BTW Larry – I’m have a cheese burger tonight for dinner along with my microbrew beer. Yea Larry will likely be strong out on coke.

I guess expectations are well-anchored and the mandated monetary policy objective of “stable prices” is technically being met even if not at the committee’s stated desires. And let’s not forget that TIPS principal are tied to CPI.

https://www.treasury.gov/about/organizational-structure/offices/domestic-finance/documents/tips-presentation.pdf

See page 9 for how TIPS is indexed.

Right. CPI. Not PCE which is the central bank’s preferred metric when assessing policy.

London Business School presentation. Starting time at around 12:00 eastern time Wednesday (today)

That was good, forgot to add the link: https://www.youtube.com/watch?v=8jhn_zsX180

https://meaww.com/who-is-laura-italiano-ny-post-journalist-hands-over-resignation-over-incorrect-story-kamala-harris

Laura Italiano writes a dishonest rant about our Vice President for the NY Post because she was ordered to do so? It seems she lives in Manhattan which alas has more than its share of witches with a b but this coward takes the cake. Come on Laura – WTF gave you that order?

BTW she has been writing for the right wing rag known as the NYPost as well as other right wing pubs for a long time so spare me with your excuses you were ordered to write that pathetic hit story.

https://watson.brown.edu/costsofwar/figures/2021/human-and-budgetary-costs-date-us-war-afghanistan-2001-2021

April 15, 2021

Human and Budgetary Costs to Date of the U.S. War in Afghanistan

By Neta C. Crawford and Catherine Lutz

UNITED STATES COSTS TO DATE OF THE WAR IN AFGHANISTAN, 2001-2021

Estimated Congressional Appropriations and Spending in Current Billions of U.S. Dollars,

Excluding Future Interest Payments and Future Costs for Veterans Care

Total FY2001-FY2021

Defense Department Overseas Contingency Operations (OCO) (War) Budget ( $933)

State Department OCO (War) Budget ( $59)

Defense Department Base Budget War-Related Increases 443 Veterans Care for Afghan War Vets ( $296)

Estimated Interest on War Borrowing ( $530)

TOTAL in Billions of Current Dollars ( $2,261)

Since invading Afghanistan in 2001, the United States has spent $2.26 trillion on the war, which includes operations in both Afghanistan and Pakistan. Note that this total does not include funds that the United States government is obligated to spend on lifetime care for American veterans of this war, nor does it include future interest payments on money borrowed to fund the war.

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=3&isuri=1&select_all_years=0&nipa_table_list=5&series=q&1=5&2=2007&3=2018&4=q&5=x&first_year=2017&6=0&7=survey&last_year=2020&scale=-9&thetable=

March 25, 2021

Defense spending was 60.6% of federal government consumption and investment in October through December 2020 *

$904.4 / $1,493.4 = 60.6%

Defense spending was 23.6% of all government consumption and investment in October through December 2020

$904.4 / $3,835.2 = 23.6%

Defense spending was 4.2% of Gross Domestic Product in October through December 2020

$904.4 / $21,494.7 = 4.2%

* Billions of dollars

“Defense spending was 60.6% of federal government consumption and investment in October through December 2020”

Why do you persist in reporting this misleading ratio. Most nondefense government purchases is done by the state and local governments. And of course most of Federal government expenditure represents transfer payments.

https://spectator.us/topic/afghanistan-long-defeat-biden/

April 19, 2021

Afghanistan — the long defeat

The war has exposed US military primacy as a chimera

By Andrew Bacevich

Federal investigators raided Rudy Giuliani’s Madison Avenue apartment and his Park Avenue office this morning:

https://www.msn.com/en-us/news/politics/federal-investigators-search-rudy-giulianis-nyc-apartment/ar-BB1g9oR5?ocid=uxbndlbing

Damn it fellows – you could have told me so I could take the subway to Manhattan just to laugh at this weasel. Now I here there will be a 3PM interview where RUDY and his lawyers will have one of their patented bitch sessions.

Rudy-tootie is wicky-wacky

[Yeah, I stole that line]

RUDY was supposed to speak this afternoon but so far nothing. Which makes me sad as I need a good laugh!

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=3&isuri=1&select_all_years=0&nipa_table_list=5&series=a&1=5&2=2007&3=2017&4=a&5=x&first_year=2007&6=0&7=survey&last_year=2020&scale=-9&thetable=

March 25, 2021

Defense spending was 59.7% of federal government consumption and investment in 2020. *

$885.6 / $1,484.5 = 59.7%

Defense spending was 23.1% of all government consumption and investment in 2020.

$885.6 / $3,831.3 = 23.1%

Defense spending was 4.2% of GDP in 2020.

$885.6 / $20.936.6 = 4.2%

* Billions of dollars

[ Obviously, I need to be more persistent but persistence becomes me, and what this is about is especially important as it was to Joseph Stiglitz and Linda Bilmes in trying to make clear just how materially costly waging war in Iraq would prove.

http://articles.latimes.com/2006/jan/17/opinion/oe-bilmes17

January 17, 2006

War’s Stunning Price Tag

By Linda Bilmes and Joseph Stiglitz – Los Angeles Times ]

To have serious inflation you would have to get to a cycle where prices rise, then wages rise, then prices rise, etc.

Labor is way to weak to be able to demand immediate compensation for price increases – so I don’t see any chance of broad persistent wage increases. Sure we may get temporary sector specific shortage of labor, but its unlikely companies would/could increase prices to cover increased labor cost. They have plenty of exorbitant profits that they could use to cover increased wages.

“Labor is way to weak to be able to demand immediate compensation for price increases – so I don’t see any chance of broad persistent wage increases.”

is labor too weak, or management not too bright? there is not a lack of workers, but there seems to be an inability for firms to attract low wage workers. i would argue that firms need to start to increase pay to a level that makes it worthwhile to work. i get a bit tired of hearing firms cry they cannot hire good workers. higher wages would go a long way in solving that problem. in today’s environment, any manager who complains they cannot hire workers should receive a pay cut, because they are failing at their job.