April employment figures were released today, showing a marked slowdown in the labor market. Here’s a depiction of these figures in the context of key macro indicators followed by the NBER Business Cycle Dating Committee:

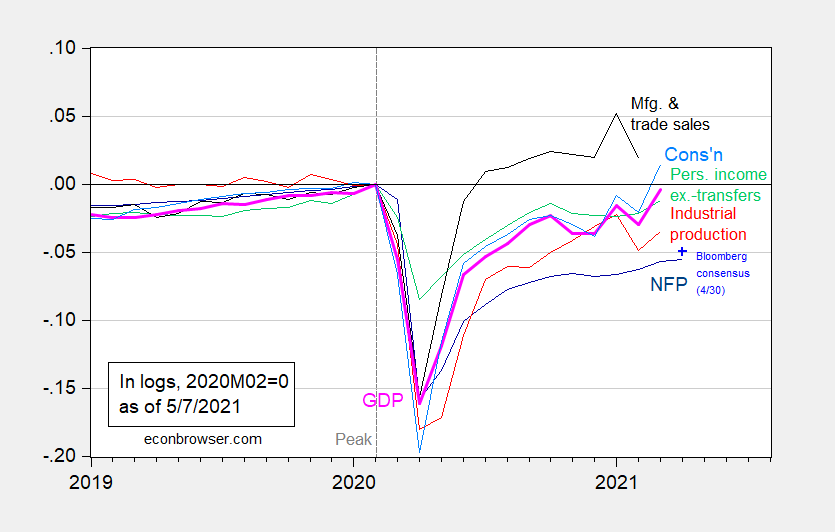

Figure 1: Nonfarm payroll employment from April release (dark blue), Bloomberg consensus as of 4/30 for April nonfarm payroll employment (light blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (5/3/2021 release), NBER, and author’s calculations.

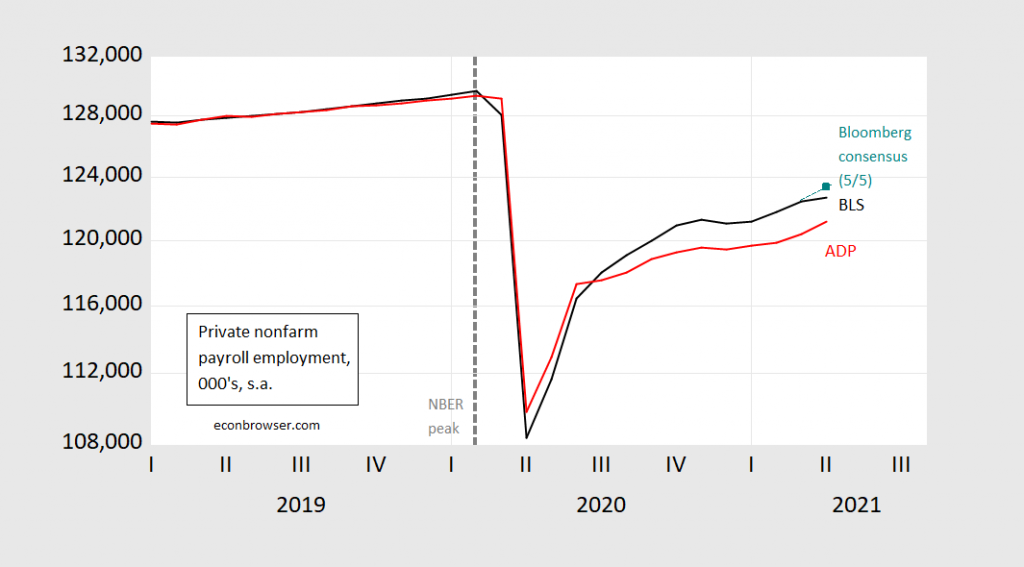

It’s interesting to note the shortfall in terms of the consensus, as well as the ADP release, for private nonfarm payroll employment.

Figure 2: Private nonfarm payroll employment from BLS April release (black), Bloomberg consensus for April as of 5/5 (teal square), ADP April release (red), all on log scale. Source: BLS, ADP via FRED, Bloomberg, and author’s calculations.

Discussion of the reasons for the relatively slow growth (supply, demand, statistical anomaly), by Irwin/NYT; Furman and Powell/PIIE.

https://theintercept.com/2021/05/07/worker-shortage-slavery-capitalism/

Does anyone know how things are going on with Moore’s family life?? ( I want the filthiest and most disgusting details people, none of this milquetoast stuff) It appears he has lots of free time for QAnon theories:

https://www.zerohedge.com/political/stephen-moore-something-very-fishy-about-biden-census-bureau-data

That out of control Chinese rocket could fall anywhere between 41 latitude to -41 latitude. The latitude for Mar-A-Lago Blvd, Florida 32459, USA is: 30.3. Would it be ironic if the remains of this rocket struck there?

https://babylonbee.com/news/chinese-rocket-breaks-apart-revealing-whimsical-fortune-inside/

From a CBS News story:

“On Saturday afternoon, the 18th Space Control Squadron, which tracks more than 27,000 man-made objects in space, narrowed its prediction to one orbit that includes Costa Rica, Haiti, Iberia, Sardinia, Italy, Greece and Crete, Israel, Jordan, Saudi Arabia, Australia and New Zealand, according to astronomer Jonathan McDowell, who has been tracking the rocket’s movement.

U.S. Space Force officials currently estimate the rocket will re-enter the atmosphere between about 9 p.m. and 11 p.m. ET. The Aerospace Corporation has made a similar prediction. ”

https://twitter.com/AerospaceCorp/status/1391160460150382598/photo/1 Semi-useful breakdown on landing possibilities.

https://aerospace.org/debris-sighting-submission <—-click only if YOU see something

Furman and Powell do an excellent of reviewing the data and discussing the issues. Alas the Republicans will refuse to read this preferring to blame everything on Biden the socialist.

https://cepr.net/jobs-2021-05/

May 7, 2021

Economy Adds Just 266,000 Jobs in April; Unemployment Edges Up to 6.1 Percent

By DEAN BAKER

Unemployment due to voluntary quits remains extraordinarily low.

The April employment report was considerably weaker than had generally been expected, with the economy adding just 266,000 jobs. Furthermore, the prior two months numbers were revised down by 78,000. The unemployment rate edged up to 6.1 percent, but this was entirely due to more people entering the labor force. The employment-to-population ratio (EPOP) also edged up by 0.1 percentage point to 57.9 percent. That is still 2.9 percentage points below its average for 2019.

Performance Across Sectors was Very Mixed

The leisure and hospitality sector accounted for more than all the gains in April, adding 331,000 jobs. Restaurants added 187,000; arts and entertainment added 89,600; and hotels added 54,400. State and local government added a surprisingly low 39,000 jobs, almost all in education. Employment in state and local governments is still 1,278,000 below the pre-pandemic level. There should be large employment increases here as more schools reopen in May.

Several sectors were big job losers. Manufacturing lost 18,000 jobs, which was entirely attributable to a loss of 27,000 jobs in the car industry. This was due to shutdowns caused by a shortage of semiconductors.

There was a loss of 77,400 jobs in the courier industry and 111,400 in the temp sector. It’s not clear whether these declines reflect demand or supply conditions. These tend to be lower paying jobs, so workers may have better alternatives. On the other hand, as people feel more comfortable going out after being vaccinated there may be less demand for couriers.

There was also a loss of 49,400 jobs in food stores, which could reflect reduced demand as people increasingly are going to restaurants. Employment in the sector is still almost 40,000 higher than the pre-pandemic level. Nursing care facilities lost 18,800 jobs (1.3 percent of employment). These also tend to be low-paying jobs, so this could reflect supply conditions.

Construction showed no change in employment in April. This could just be a timing fluke, the sector was reported as adding 97,000 jobs in March, and there is plenty of evidence that the sector is booming.

Some Evidence of Labor Shortages in Low-Paying Sectors

If employers are having trouble finding workers, as many claim, then we should expect to see more rapid wage growth and an increase in the length of the workweek, as employers try to work their existing workforce more hours. We do see some evidence of both….

Failure of Biden policy. Too many people are too well paid not to work. Really a kind of traditional 1960s type of Democratic policy that one would have thought long dead.

You can hear supply constraints on labor anecdotally, for example, from MR:

[A]round this idea that extended Unemployment Insurance and the extra federal government stimulus being given out to unemployed workers having only a “marginal” effect on the amount of available workers. A great example of this – https://www.wsj.com/articles/millions-are-unemployed-why-cant-companies-find-workers-11620302440

Economists claim that these policies have little impact to availability of workers, but CHROs at every size company, every industry, in all markets are begging for workers right now, and every one of them I speak to complain that they have workers telling them they won’t come back until they have to because they can make as much, or more, or even slightly less, but don’t have to work because of these additional benefits.

Why the giant disconnects between what Economists believe about UI verse what the reality is on the ground for organizations trying to hire? Also, I’ll give you UI/Stimulus isn’t the only factor driving difficult hiring. We have a ton of older workers leaving the workforce for retirement, which is giving us this step-up kind of hiring, where younger workers are skipping traditional entry level jobs and getting opportunities up the job food chain, we have GenZ who doesn’t want to work some dirty, crappy $12/hr job, so we see fewer GenZ in the labor force than previous generations at the same age, fear of Covid, etc. I still believe, especially in the $12-22/hr job market, UI plays a significant impact to worker availability currently.

https://marginalrevolution.com/marginalrevolution/2021/05/the-excellent-tim-sackett-on-the-labor-shortage.html

Or you can look at it statistically:

Job openings are near historical highs, so to suggest that the hiring environment is somehow weak is not supported by the data.

https://1.bp.blogspot.com/-j01esbDkMRo/YGxqRy9TF4I/AAAAAAAA41I/fEyjlQSa2yQbW9rDYglibE9z3COla5glwCLcBGAsYHQ/s1120/JOLTSFeb2021.PNG

The evidence suggests that overly-generous benefits are discouraging work. Bad employment numbers do not reflect a bad economy, they reflect bad policy. Foreseeably bad policy.

And in all this no one looks worse than Janet Yellen.

Gee – did Mitch McConnell help you with this pseudo analysis? Try reading the Furman piece if you care to go beyond your usual Fox and Friends BS.

‘You can hear supply constraints on labor anecdotally, for example, from MR’

Yea Tyler Cowen does anecdotally whereas Yellen and Furman do actual analysis.

Come on Stevie – stick to forecasting oil prices as you suck at labor economics. BTW – how is your $100 a barrel forecast working out?

Many commodities have returned to 2012 levels, which in oil terms would be around $100. Oil continues to languish are $65 WTI because a cartel with a stranglehold on incremental supply decided to increase volumes rather than increase prices. Go figure. Not the strategy I would have recommended.

Having said that, oil rig additions have been very soft in the last month or so, even with applicable breakeven prices above $60 / barrel. Not sure how to read it, but at the current pace, we would end the year with around 380 horizontal oil rigs. We had 600 online before the pandemic, and production was falling then. If that’s the case, 2022 could be quite tight in oil markets. But we’re a long way from there and there’s some sort of financial crash on the horizon, but maybe that’s not for another year or two.

In any event, let’s wait and see how oil prices go. If they follow other commodities up, we may yet see some pretty high prices.

“Oil continues to languish are $65 WTI because a cartel with a stranglehold on incremental supply decided to increase volumes rather than increase prices.”

There was this fellow named Princeton Steve that told us that the OPEC cartel would not increase volumes. Why don’t you contact him so the two of you can make up your confused minds which spin is going to get you on Fox and Friends in the near future.

“Job openings are near historical highs”

They are not as high as they were in January 2019. Of course with rising populations – every labor statistic at some point is going to reach historical highs.

Any more stupid comments from the peanut gallery (like your nonsensical swipe at the 1960’s and those evil socialist Democrats)?

Jobs openings are at record highs today. By a big margin.

https://1.bp.blogspot.com/-fx2gAV80pi0/YJqPdGrc1FI/AAAAAAAA5Sg/MGe0fsEiePIcE7cnaY7EWgaOBXpQ30M0wCLcBGAsYHQ/s1115/JOLTSMar2021.PNG

No, the evidence does not suggest “that overly-generous benefits are discouraging work” unless one is trying to rationalize one’s hate-rant toward current policy. Notwithstanding their anecdotal “)evidence,” Tyler Cohen, the WSJ, and HR officers (who, after all, represent the employer, not the ‘human resources’) have no idea what real people are thinking. Around here, the people in the labor force are worried about supervision of their children (some daycare & after-school facilities still being closed or having reduced capacities) and, most importantly, whether they will catch a more virulent mutation from their MAGAt/Q-hole no vaccinating, non-mask-wearing fellow citizens.

Your ideological reflexes have betrayed you again.

“Your ideological reflexes have betrayed you again.”

Actually Princeton Steve’s motivations for this kind of intellectual garbage is that he is pleading to be invited back to Fox and Friends where he can join the trio of bozos ranting against immigrations from Central America.

You know, it’s incredible to me what a desert Econbrowser comments have become: Moses, pgl, ltr, the occasional Barkley and Bruce. Same, small insular group. What’s the point? The whole thing is a shadow of its former self.

Steven Kopits: Just for your information, the commenters are a small subset of readers. Typically, individuals who work for government/semi-government agencies or multilateral organizations, do not comment online, even anonymously. Another set of commentator I aim to dissuade from commenting by requiring an understanding of regression analysis or economics (as we teach it in college courses, not as understood on the WSJ editorial page) to comprehend what I am saying. Some people nonetheless plow forward w/o e.g., understanding what a confidence interval is, so I am only partially successful.

When you quit your day job as chief economist for Fox and Friends and decide to write coherent fact based comments as opposed to your usual intellectual garbage, I will be the first to applaud. But I am not holding my breath.

@ Menzie

Have “Princeton”Kopits take an aspirin and read this link, his mood will improve:

https://www.nytimes.com/2021/05/10/us/politics/gas-pipeline-hack.html

Steven,

You are lumping me with Bruce Hall? Sorry, but he fits with you more than he fits with me, I think. Gag.

I apologize, Barkley. But the universe of commenters seems to be greatly contracted and essentially set. The comments section has become an insular backwater, best I can tell.

And all that comes down to pgl. No one’s going to put up with the ad hominem stuff. It devalues the site. Epithet is not debate.

Menzie, you kept the unhousebroken dog in the living room and now it’s a pretty stinky place.

As for posts:

I think your posts are generally fine, Menzie, although not all are of particular interest to me.

I think, however, there is a need to more closely examine the overheating of the economy and paths and timing of unwind, for example. As you’ll recall, I argued that the economy was under suppression, not recession, and that’s proving right. So we’re seeing a kind of overheating I can’t recall since maybe the late 1960s or 1970s.

And I think it’s high time to start putting some more serious attention towards the systemic risks of cryptocurrencies. According to the Gemini report (below), 14% of US investors have crypto holdings. That’s a lot. And Yahoo reports that crypto’s shadow currency is surging past the deposits of most U.S. banks. The last time I heard the ‘shadow’ and ‘banks’ in one sentence, it ended very, very badly.

I have no idea of what all this means other than that it feels ominous. This is really more a Jim Hamilton topic, but I think the time has arrived to take a closer look at cryptocurrencies and what they mean for inflation, exchange rates, purchasing power and systemic financial risk.

https://finance.yahoo.com/news/crypto-shadow-currency-surges-past-111500954.html

file:///C:/Users/steve/Downloads/Gemini%20-%202021%20State%20of%20Crypto%20in%20the%20US.pdf

https://www.gemini.com/state-of-us-crypto

Barkley, mark this moment down, it’s probably the one and only time I’ll come to your defense, [ yeah, Gag ] Kopits’ complaint is about people who don’t unconditionally agree with him., Well, you’re close, but you’re not there. You’ve been too friendly with the most obvious racist who has yet to be banned on this blog. Do you feel that racist hung you out to dry with that comment??? Hhahahahahahahah!!!!!!!

I do have a sadistic streak it shames me to say, I think this actually improved my day, hahahahahahahaha!!!!!!!!!!! 55555555!!!!!!

Steven,

I shall make one comment on the crypto matter, regarding which I think what we do not know way exceeds what we do know, as I basically indicated in an earlier comment on this. It is that if one were to start from scratch to set up cryptocurrencies one would not make the most widely used and held one be something like bitcoin, but rather something more like ethereum or XRP. The latter are far more efficient and also potentially useful. Bitcoin is an example of a case of where first mover advantage is putting forward something that is massively inefficient.

Its clear inefficiency involves the amount of electricity that is consumed in its use because of its high computational mining costs. Other leading cryptos are far better than it for technical reasons that are rather complicated. But the upshot is that this large use of electricity is generating pollution, and the higher the price of bitcoin and the more it is used, the higher are those computational mining costs with their associated pollution-generating electricity demands. There are various estimates out there about how much this electricity is being used for the essentially pointless use of bitcoin, but recent ones I have seen from not completely unreliable sources have come to something like a half a percent of world electricity usage, like on the order of what the nation of Argentina uses, although I have also seen some questioning such estimates.

Anyway, whatever the possible systemic financial threat or lack thereof from cryptocurrencies, this massive electricity demand for using bitcoin is clearly a massive social cost for this particular part of it.

“And I think it’s high time to start putting some more serious attention towards the systemic risks of cryptocurrencies. ”

steven, i think it is fair to analyze the cryptos. however, it appears most of the people who have issues with crypto are either now well versed in the field or have an agenda that benefits from a fall in crypto. at any rate, i have asked this question before. explain to me why gold should be superior to a crypto such as bitcoin? both are really useless and simply operate as a store of value. if you don’t like crypto, you should also not like gold.

my foray into crypto has been more recent. i actually wanted to buy some several years ago, but it was more difficult to purchase at the time so i did not make a buy-too bad on my end. but i have not purchased bitcoin, rather ethereum. as barkley noted, it has some characteristics that are more useful than bitcoin. not sure if that means its more valuable, but time will tell. i think the perfect crypto has not been developed yet. not sure what happens to existing crypto once that happens.

as for systemic problems with crypto, i think that has less to do with crypto directly and more to do with leverage. many of the past financial problems were more of a leverage issue than a substance issue. housing would not have been a problem if leverage was not the primary component of all components associated with it. crypto is not the problem, in my opinion, but risky leverage is the problem.

I shall make two further comments on cryptos. The main problem with them, all of them, is their high level of volatility, which so far has mostly been on the upside, although with a lot of sharp, if temporaty, down movements (bitcoin itself has been mostly going down very recently with the flareup of inflation talk, some hedge). So while a big crash of them might knock down wealth of a bunch of people, there is very little linkage between them and the actual real economy. When hosing went down it took down hosuing finance that then took down related financial markets that were connected to the real economy, which then went down in 2008. But there is nothing like that going on now. Almost no real activity is backed by debts in any kind of cryptocurrency, so the main effect of a collapse might be some reduction of consumer spending by people too deeply into them. But most people holding them have them as a small portion of their assets and got in pretty recently, so a crash would mostly make disappear something they barely had anyway. Not too big a deal.

In man ways bitcoin in particular is like gold (ethereum and XRP have uses neither of those two have). But saying gold has no use is not correct. It has industrial as well as jewelry usages, although clearly its price reflects people buying it as a suspposedly safe store of value.

OTOH, bitcoin does get used for some transactions, mostly illegal ones, but also large sized international ones and some others involving large-valued transfers with, ironicallly, a lot of those in real estate. Nobosdy buys groceries with bitcoin, although there are an increasing number of places that will accept it. None of them will accept gold, which really is not usable as a medium of exchange.

BTW, I had sneered at cryptos for not generating income streams (being like gold in that rgard), but there are a couple of odd ones that will give you a 6% yield. These might pick up if there is a more serious shakeout.

Gold use in jewelry is really tied to a store of value. The Chinese and Indians who purchase a large amount of gold jewelry do so to store value rather than because it is simply that pretty. As for industrial use, if you valued gold based on its industrial use it would be at a fraction of its current value. Silver is a better industrial commodity. There is far too much gold available for it to have high value from industrial use.

Barkley, I think we are in agreement that crypto has less threat because of limited contagion. That is good for now. What is not clear to me, in the future, is how complex ethereum will become. It has these tools that creat smart contracts and other oddities. Not sure how this aspect will play into the idea of contagion and leverage. Would be interested to know more about exactly how these ethereum blockchain tools will work-the good and the bad. But I can envision its interconnectedness could lead to some contagion.

“There are some people who are quite honestly, right now at least, with the stimulus package,” preferring to stay at home, Roberson, head of Detroit-based Focus: HOPE, said in an interview. “I think that that will shift when some of that money begins to run out more,” said Roberson, who worked at the Justice Department during the Obama administration.

[The stimulus] bill provides $300 extra a week in unemployment insurance, sustaining a benefit that won bipartisan backing in December. For anyone who used to make under $32,000 a year, it’s better financially for now to receive unemployment benefits, according to Bank of America calculations.

The country added just 266,000 jobs in April, more than 700,000 fewer than the consensus prediction of economists. Biden said the enhanced benefits didn’t have a “measurable” effect on the April numbers, and pointed out that there was an increase in job seekers last month.

Former Treasury Secretary and Obama administration economic director Lawrence Summers disagreed.

“Respectfully, I think it is close to self-evident that the fact that people are being paid more to stay at home than they would be to work — in millions of cases — is reducing the available supply of labor,” Summers said in an interview with Bloomberg TV, for whom he is a paid contributor.

Roberson provides some anecdotal evidence. She says Michigan automakers and their suppliers have been “looking for 100 people or 50 people,” but haven’t been able to fill the openings. “I’m a little surprised by the fact that we haven’t been overwhelmed with folks coming in,” she said.

https://www.msn.com/en-us/money/markets/stay-at-home-americans-sow-white-house-angst-on-big-jobs-miss/ar-BB1gvB5y?ocid=uxbndlbing

Portia Roberson is not a labor economist so her anectodal evidence is almost as worthless as your incessant incremental garbage.

Portia Roberson majored in English at the University of Michigan, and holds a Juris Doctorate from Wayne State University Law School.

Yes I checked her resume. Princeton Steve did not. Stevie pooh puts this English major, JD, and public speaker up as a labor economist over Janet Yellen? And now he is whining that this place has become a “desert”. Stevie – you are the reason it feels like a desert with such brazen intellectual garbage.

I haven’t read anything about a Miss Portia Roberson. As a person, she may be as kind, amiable, and morally sound as they come. I suspect, but do not know, I would agree with pgl about Mrs Roberson’s ideology (disliking or disagreeing with Roberson’s ideology). But…….. I have to say, this is the problem when praising folks like Jerome Powell and praising folks like Neera Tanden. You can’t have it both ways, and you can’t eat your cake and be mesmerized by it’s appearance after eating it. Which is it, is a law degree “enough” and “suitable background” or is it a joke??? If you keep making comments on emotional/reflexive grounds, this is the problem. You get busted. Often of the same things you decry others for.

Maybe Portia Roberson should be head of OMB??? Now if pgl said that, THAT would be consistent.

Prices are rising everywhere you look

Everywhere you look, there are headlines about higher prices.

Some are tied to commodities, which are getting snapped up as the global economy emerges from its long slumber. Lumber prices are at an all-time high thanks to an epic home-building boom. Copper and steel prices have also reached records.

Agricultural products aren’t exempt. The price of corn is at its highest level since 2012. Same goes for soybean prices. Even sales of block cheese futures have been soaring in anticipation of grilling season.

Then there’s consumer products. Diaper prices have gone up in the past year, and two major producers — Kimberly-Clark (KMB) and Procter & Gamble (PG) — have warned customers that fresh hikes are coming. Shortages of computer chips, meanwhile, are helping to push up car prices, and could soon do the same for electronics and household appliances.

https://www.cnn.com/2021/05/09/investing/stocks-week-ahead/index.html

Who is in charge of all this policy at the White House? Is there a brain trust? Anyone with the lights on?

Best I can tell, Larry Summers is not only the smartest guy in the room, he’s the only guy in the room.

Your hysteria over inflation is perhaps the dumbest rant ever. I bet you do not read Kevin Drum but you should as he is openly mocking fools like you:

https://jabberwocking.com/the-price-of-bacon-is-up-8-1/

“Who is in charge of all this policy at the White House? Is there a brain trust? Anyone with the lights on?”

That would have been a good question from 2017 to 2020 when village idiots like Kudlow was seen as an economist. Yes someone even dumber than you was the chief advisor to Trump on economics. Biden is meeting with some of the best minds on these topic today but of course to a right wing troll like you he is meeting with a bunch of socialists.

What’s the matter Stevie pooh – Fox and Friends have lost your phone number?

SK,

Some portion of these price increases would be happening even if Biden had passed nothing and done nothing on fiscal policy. A lot of it, forecast by Bullard at the St. Louis Fed, is due to supply problems tied to the serious international shipping mess that is due to the pandemic. It is unclear how much of it is that, not all of it, but some of it. That will presumably get mostly fixed by end of year and thus reduce some of these price pressures you see for next year.

As for the labor supply matter, it seems to be a complicated mix of factors. I have seen estimates of how much is due to which factor, but I think these are all pretty noisy estimates. Of course people on one side or the other emphasize what they want to. But I see all three of the following playing roles: the affordable child care shortage, the fear of working in certain sectors due to the pandemic, and people enjoying getting money from the government. Unlike some here I do think there is some of the latter just based on my own anecdotal evidence: I know of people who say that is why they are sitting at home. But the first two are certainly important, with the fact that nearly all the increase in employment this past month was apparently due to men suggesting that. Of course more than one of these elements can be operating simultaneously on particular indiciduals, although we certainly would expect the first item, the affordable child care shortage, to especially affect women, and I suspect the second one affects them more also.

“he’s the only guy in the room.”

Oh that’s right – ladies like Janet Yellen cannot be taken seriously on things like economics. You are indeed a sexist POS!

DD,

“Tyler Cowan” not “Tyler Cohen.” He is of Irish ancestry, not Jewish.

I’m Irish but I am not responsible for the nonsense over at Marginal Revolution.

Mea culpa.

I know that I had it correct when I pecked it out on my phone because I was being careful. I am very aware of Cowan’s correct name, having read MR semi-regularly several years ago. However, I forgot that I have to check literally every surname except Einstein (for some odd reason only Einstein is OK), all nicknames, and most first names at least one more time to see what the damned autocorrect thinks they should be. It is indeed my fiend.

I will endeavor to be more mindful in the future. Thank you for correcting me.

i love apple products, but their autocorrect may be the worst IT system i have encountered in the modern world. how did the iPhone autocorrect and the apple mouse bottom charger get past quality control in a company priding itself on design?

steven, from what i can tell, there are a few things keeping people out of the workplace. women, in particular, cannot return to the workplace because daycare/school is either closed or cost more than minimum wage can pay. if you address this issue, you will get more people willing to work. perhaps employers should start using basic economics. if they cannot purchase labor at the current wage, they need to offer more. this is not rocket science, it is simply ignoring basic economics.

there are also a lot of people still on furlough. they are not taking new jobs, in the hopes that their old job will be offered back in the near term. this is impacting the ability to recruit new workers, especially for minimum and low wage positions. again, a basic economics approach would increase the incentive to attract people away from furlough and into a new position.

steven, this odd push to blame $300 a week of unemployment for the difficulty to acquire workers is disingenuous. if you do want to read the tea leaves on this, what it says very clearly is that the minimum wage should be INCREASED. why do you ignore the obvious?

“Looking forward there are good reasons to expect large increases in both demand for labor and supply of labor. Both labor supply and demand will be boosted by the continuing reopening of the economy as more people are able to get vaccinated, and COVID-19 cases, hospitalizations, and deaths continue to fall. This will hopefully help close much of the remaining jobs gap. Labor demand will get an additional boost as the fiscal stimulus continues to spend out and the monetary stimulus continues to be applied.”

Biden compared this to a marathon not a sprint. It is a race but more like a 5K with the potential for labor demand and labor supply being elite runners going for the gold and silver. Alas, McConnell is going to handicap the demand runner by blocking stimulus while Glenn Beck and the other anti-scientist Trumpians will handicap the supply runner wherever they can.

ttps://fred.stlouisfed.org/graph/?g=sxNb

January 4, 2018

Employment-Population Ratios for White, Black and Hispanic, * 2017-2021

* Employment age 16 and over

Correcting reference link:

https://fred.stlouisfed.org/graph/?g=sxNb

https://fred.stlouisfed.org/graph/?g=sxz6

January 4, 2018

Employment-Population Ratios, * 2017-2021

* Bachelor’s Degree and Higher, Some College or Associate Degree, High School Graduates, No College; Employment age 25 and over

Manufacturing employment fell 18k. Whether this is related to “jobs saved” with foreign intermediate inputs I have no idea. Maybe we can increase the foreign intermediate inputs some more and watch what happens?? After all, due to my supposed lack of traveling I didn’t “see” these 18k of job loses in a single month, so tweedledum in the Virginia mountains is sure to fill us in on all the economic gravy related to manufacturing jobs I’ve missed, the same I missed a “positive” 2020 2nd Q headline GDP. Only those with deep knowledge of Russia could see that “positive” 2nd Quarter number, so….. I could be missing something here.

https://tradingeconomics.com/united-states/manufacturing-payrolls

Somewhere out there, there’s an academic paper that says this a great idea, to increase foreign intermediate inputs in your supply chain. And if you lose your job tomorrow to assist in lower production costs, pop open a beer and call it your contribution to society.

Moses,

I have a new theory as to why you are so consumed with hatred of me that, as you have openly stared, you engage in “sadistic” (your term) bashing of me. This is just more out of control examples of it here, totally off the effing wall, sick, sick, sick.

So my theory is that I remind you of some econ prof you had at your second tier state school in NC, probably a place on the level of JMU more or less, and that this prof gave hard time/a bad grade/or otherwise annoyed the heck out of you. You have been resenting him ever since, and given that I am an econ prof in a place sort of like where you attended, well, you can get back at this meanie prof who mistreated you by engaging in this sort of repeated off-the-wall hateful and sadistic bashing. Is that it, Moses? Does that explain this sickness you exhibit repeatedly here.

In case you did not know, it disgusts Menzie, but he tolerates it within certain bounds.

@ Barkley Junior

You’re not going to update us, as an “expert” on Russia, how the potential fall of the Ukraine would effect Europe’s security and therefor also France’s national security?? As an “expert” on Russia that threat to Europe of Ukraine falling 100% into Putin hands doesn’t seem to register with you somehow. Strange….. Oh, I forgot you said UK is more responsible for France’s security than France is. I forgot. It’s almost as fun reading your thoughts on geopolitics as it is reading “Princeton”Kopits’ thoughts on the inner-workings of the communist party in China.

In fact, I never had a single economics class I disliked. The only one I even had a slight disliking for (and actually, not really) was taught by an Economics prof of Mexican ethnicity who would walk into class late 5 minutes every time, and unless his watch was off I could never figure out why. It was a summertime class though. I did feel I got an above average education in the class though, because he was very good about including graphs on the board with real world examples. I remember him discussing problems with Japanese banks which was very relevant at the time. He would often smile while discussing things and spoke with emotion, which I found to be engaging while sitting in class. He had his PhD from Clark University in Worcester Massachusetts. Another gentleman who I had a lot of respect for and enjoyed his class very much, had multiple degrees, and got his PhD from a little-known Economics Dept at the University of Chicago (circa 1980 if you’re curious). Now this has no bearing on his knowledge of Economics, but he also worked on the flight crew of an AWACS plane as part of the surveillance team, which I was impressed with on a personal level. I had a professor who got his PhD at Texas Tech but was also born and spent his burgeoning years in Iran, and I feel now that as a young man being exposed to professors from diverse backgrounds was beneficial to me. I had other Econ and Finance profs who I liked and respected, this comment will drag on enough as it is.

In most people’s views, JMU would probably rank slightly better than the university I graduated from. I feel, though I have been very open about graduating from a small state university that I got a well-rounded education, an above average knowledge of Finance for a person only obtaining their Bachelor’s (which in most Finance circles a Bachelor’s wouldn’t be regarded highly, as it’s an ultra-competitive field), and I want to make clear, any failing in my education were my own failings and not the institution’s of which I attended, or any of my professors. Certainly not the professors in the Economics Dept. who were kind and generous to me, to a man (each).

One thing I am proud of, I do know what SAAR is. and I know SAAR is what is used when tabulating or quoting headline GDP numbers. Although, I think I learned reading the WSJ in my teenage years, before college. I can’t swear when I first learned that though. And I did learn the difference between a skewed distribution, a normal distribution, and a uniform distribution in basic Stats classes. Though we rarely discussed uniform distributions that I recall. They do exist though. I learned when I say or do something wrong or incorrect, the best thing to do is to “come clean”, admit error, and not create a spider’s web of lies that are very easy to see through. I remember my college years with great fondness and cherish the opportunity to get a 4-year university degree I probably didn’t deserve.

One thing I should thank you for Barkley, reminding me just now how lucky/fortunate I am for the miniscule efforts I have put forth in life, and yet got way more booty than I had coming to me. As for you I suggest trying Metamucil or some more veggies in your diet. Then have the grandkids update you on how Ukraine relates to Russia and likewise to Europe.

If I “disgust” Menzie, that bothers me, because I like Menzie as a person, and I respect Menzie as a person, and view him with admiration. Your views of me Junior, though yes, I took the time to address, don’t tend to bother me much at all. Other than the occasional giggle you give me. And your inflated/false ego IS kind of annoying. That one I have to admit.

Moses,

Only two comments on this pathetic rant. The first is that I have always come clean and admitted I have made mistakes when they have been caught and pointed out. I have agreed on more than one occasion that in the matter of the SAAR I was confused about when the data period started and ended. Once it was pointed out I had that wrong (by Menzie) I accepted it. You have, of course, endlessly brought up this mistake of mine like it is the most important thing I ever posted or said here. In any case, I never claimed I was right on that once it was made clear I was wrong. (You, on the other hand, have yet to admit that you have been wrong over and over and over and over and over again on the ridiculous matter of claiming that an even distribution across a genome implies an even distribution across a population, a matter you were again pushing very recently here.)

The other matter is that I never said that the UK was responsible for defending France. What I pointed out, which you clearly knew and apparently still do not know a thing about, was the 1998 Budapest Accord when Ukraine agreed to give up the nuclear weapons it had leftover from the Soviet era. The nations signing the accord agreed that the territorial integrity of Ukraine was to be protected. The four signatories involved were US, UK, Ukraine, and Russia. As it was the Us and UK did nothing to protect Ukraine’s territorial integrity when Putin seized Crimea militarily and then annexed it. France had nothing whatsoever to do with this, and this had nothing to do with UK and France. Your comments on all that were just massively ignorant and flagrantly wrong. This is not a topic you know anything at all about, and you really should keep your worthless know nothing mouth shut about it.

Moses,

Where France has been involved with Ukraine has been in the Minsk Accords/Protocol/Agreement, which has had several rounds and versions and is not fully obeyed by various parties involved in it, which have included the two breakaway “republics” in the Donetsk region of eastern Ukraine. The lead western figure in those negotiations, which have also involved Russia and Ukraine, has been Angela Merkel of Germany, although Macron of France has played a role. In the recent stress on this whatever-it-is, the main players have been Russia, Ukraine, and the US.

I lifted this from an Izabella Kaminska story in FT, in which they were quoting Jim O’Sullivan at TD Securities:

“Despite the 0.7% month over month rise, the year to year change for hourly earnings fell 0.3% from 4.2% (unrevised), The weakening reflects a reversal of the mix shifts that led to a surge when payrolls plunged a year ago. The year over year pace was around 3% pre-Covid.”

I don’t know, maybe this is just bla boring to most economists, but I thought it was interesting.

https://www.ft.com/content/3852bdd6-b3b0-485d-8220-fe3d3f41d02e

“reversal of the mix shifts”

In other words, last year more low-wage jobs were lost/cut than high-wage ones (most of the lower paid, i.e., service, jobs couldn’t transition to work-from-home). As a result, the mix of remaining jobs was skewed toward higher-paid jobs.

Last month, there weren’t that many higher-paid workers being rehired because they never lost their jobs. The lower-paid workers being rehired last month skewed the pay distribution downward.

OT: Come to think of it, “reversal of the mix shifts” should have been a George Clinton/P-Funk song lyric or title.

I’m more of a Flavor Flav type guy. This all gets back to timing of things:

https://images.app.goo.gl/KK6yMxTJK6rQSAkC8

I just watched the two suckiest football teams I’ve ever seen in my life do a ballet dance on an outdoor field. Sam Houston State won the ballet dancing.

JMU ballet dancers are now standing in a long line at the stadium exit. The Mayor of Huntsville is requiring them to hand over their man card before they leave town.

The irony is that 250K or so hires in a month is usually great news.

@ Willie

Careful, you’re hinting at asking a very intelligent question: “Increase of 250k FROM WHERE???” PhD “economists” employed around the Shenandoah Mountains of Virginia do not allow this category of question, and you could even receive a failing grade.

Yeah, Willie! We do not allow this category of question! You receive a failing grade!!!!!!! (Guggle Buggle Giggle Gaggle Bedazzle Snore…. ) 🙂