The simple — conventionally reported — inflation breakeven calculation might be misleading.

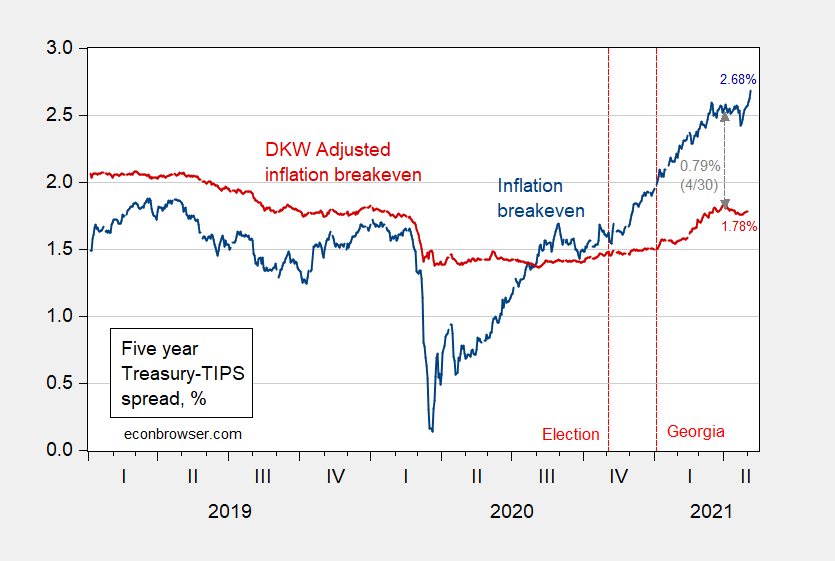

Figure 1. Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by term premium and liquidity premium per DKW, all in %. Source: FRB via FRED, KWW following D’amico, Kim and Wei (DKW) accessed 5/5, and author’s calculations.

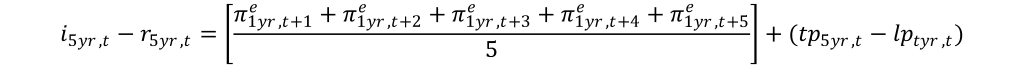

Recall, the unadjusted 5 year Treasury-TIPS spread is:

Where tp is the term premium on the Treasury yield, and the lp is the liquidity premium on the TIPS yield. Using the DKW estimates of the Treasury term and TIPS liquidity premia as reported by Kim, Walsh and Wei (2019, data 2021), one obtains the following estimates of expected inflation show as the red line above (where the red line is as calculated by KWW).

As of the 4/30/2021 observation, the unadjusted series is 0.79 percentage points higher than the adjusted; that is the expected inflation rate over the next 5 years is 1.8% instead of 2.6%. If the gap between the two premia has remained constant (no reason that would be true), then expected inflation remains below 1.9%.

Looks like the unadjusted breakeven has risen recently by about 0.2%. Is that mostly due to the 5 year note rate rising rather than the TIPS rate declining?

Here is TIPS:

https://fred.stlouisfed.org/series/DFII5

Some noise but generally near negative 1.8%.

Looks like enough decline to be responsible for most of that increase in he breakeven rate, although indeed pretty noisy.

Current price of USA gas at the pump is $2.94. Still a ways to go to meet oil consultant “Princeton”Kopits $4 per gallon prediction. I guess to be fair we can give him to end of June 2022. Although I could argue end of 2021. But we’ll give him an extra margin of time “to be fair” before we skewer him over a large fire like the wild boar he is.

WTI crude did reach $66 a barrel in early March but alas for Stevie’s forecasting record, it is only $65 a barrel now:

https://www.oilcrudeprice.com/wti-oil-price/#:~:text=WTI%20Oil%20Prices%20In%20US%20Dollar%20%20,%200.15623%20Barrel%20%205%20more%20rows%20

But soybean prices are rising so one has to wonder why CoRev is not dancing a gig.

Bamboo in the paper? So Trump’s cyber ninjas in Arizona have a new theory of how Biden stole the election. China had massive amounts of illegal ballots flown in and stuffed in the ballot boxes. Seriously? I did not even think those MAGA hat wearing bozos could come up with something this bizarre. But they have!

https://news.yahoo.com/secret-chinese-ballots-uv-lights-145729996.html

no it is bamboo on the brain

Ah, I see that Not Trampis has met our GQP.

Grand QAnon Party?? I think you introduced me to a new acronym today. Accurate and catchy. I like it.

Best comic comment/solution on this: they should fly in some Pandas, throw some ballots on the floor, and see which ones the bamboo loving Pandas eat.

Sounds reasonable and much more definitive than going through millions of ballots with ultraviolet light.

I notice Mr Cochrane is worried about rising inflation. the question i ask to those who brood on the 1970s is exactly where is this wage breakout in response to supply side problems. No wages breakout then no long term rising inflation.

Cochrane was worried about hyperinflation 10 years ago. How did they work out?

The mating call of Republicans who notice there’s more healthy economic growth under a Democrat White House. Parrot John Cuckrant just keeps saying “inflation!!! Inflation!!!!…… Inflation!!!!! Inflation!!!!!…….. Inflation!!!!! Inflation!!!!!!!”

https://youtu.be/t8yZltrn2EY?t=36

I agree with you Not Trampis. Cochrane and others are conflating the wage bargaining power of millions of low paid workers who exist now with the millions of union members from the 70’s who expected 5% bumps per year.

Someone please tell me I am not the only one who feels a small tinge of sadness at CME closing their floor trading pits.

Moses,

Sorry, but it looks like you are the only one, sob!

Heck, as for me, I am just a tweedledum who sits in the Virginia mountains twiddling my thumbs (except for an occasional trip to Madison that has me passing through O’Hare Airport), so I could care less about pits disappearing from faraway places. Heck, everything is going to be replaced by cryptocurrencies pretty soon anyway.

https://www.federalreserve.gov/publications/files/financial-stability-report-20210506.pdf

Keisha Lance Bottoms chooses not to run for reelection as Atlanta’s mayor:

https://www.cbsnews.com/news/keisha-lance-bottoms-atlanta-mayor-not-seeking-reelection-major-surprise/

The citizens of Atlanta will likely be disappointed as she has been a good mayor. But maybe her plan to run for the state’s governor. She would certainly be a better choice that Trump’s boy in Georgia.

https://www.bls.gov/news.release/empsit.nr0.htm

Employment rose but by far less than expected. The employment to population rose rose from 57.8% to only 57.9%. We are still a long way from full employment. And Lawrence Summers is fretting about excess aggregate demand? WTF?

Caitlyn Jenner is incapable of not bombing even when s/he is on Hannity?

https://www.politico.com/states/california/story/2021/05/06/jenner-has-hangar-pains-after-hannity-interview-1380759

You see the only reason homelessness is a problem is California as people who own private jets might actually see one of them. I guess Jenner does all of her shopping on Rodeo Drive.

Dean Baker has sent out his comments on the BLS report in an email. Two key sections reproduced below:

Performance Across Sectors was Very Mixed

The leisure and hospitality sector accounted for more than all the gains in April, adding 331,000 jobs. Restaurants added 187,000; arts and entertainment added 89,600; and hotels added 54,400. State and local government added a surprisingly low 39,000 jobs, almost all in education. Employment in state and local governments is still 1,278,000 below the pre-pandemic level. There should be large employment increases here as more schools reopen in May.

Several sectors were big job losers. Manufacturing lost 18,000 jobs, which was entirely attributable to a loss of 27,000 jobs in the car industry. This was due to shutdowns caused by a shortage of semiconductors.

There was a loss of 77,400 jobs in the courier industry and 111,400 in the temp sector. It’s not clear whether these declines reflect demand or supply conditions. These tend to be lower paying jobs, so workers may have better alternatives. On the other hand, as people feel more comfortable going out after being vaccinated there may be less demand for couriers.

There was also a loss of 49,400 jobs in food stores, which could reflect reduced demand as people increasingly are going to restaurants. Employment in the sector is still almost 40,000 higher than the pre-pandemic level. Nursing care facilities lost 18,800 jobs (1.3 percent of employment). These also tend to be low-paying jobs, so this could reflect supply conditions.

Construction showed no change in employment in April. This could just be a timing fluke, the sector was reported as adding 97,000 jobs in March, and there is plenty of evidence that the sector is booming.

Some Evidence of Labor Shortages in Low-Paying Sectors

If employers are having trouble finding workers, as many claim, then we should expect to see more rapid wage growth and an increase in the length of the workweek, as employers try to work their existing workforce more hours. We do see some evidence of both.

The annual rate of wage growth comparing the last three months (February, March, and April) with the prior three months, was 3.7 percent for production and nonsupervisory workers overall, 4.1 percent for retail, and 17.6 percent for leisure and hospitality. These data are erratic, but they do indicate some acceleration in wage growth, especially for hotels and restaurants.

There is also some evidence for an increasing length of the workweek, which is consistent with employers having trouble getting workers. For production and nonsupervisory workers overall, weekly hours are up 0.8 hours from the 2019 average. It is the same for retail, and 0.6 hours for leisure and hospitality.

Kevin Drum comments on the jobs report adding a really dumb last paragraph blaming unemployment compensation for the lack of job growth. I hate to say that as Kevin is normally a fairly bright fellow but being a parrot for the Chamber of Commerce is just dumb:

https://jabberwocking.com/chart-of-the-day-net-new-jobs-in-april/

But read the comments to his post which are a lot smarter. Getting this virus down and raising wage rates will do wonders for fulfilling any openings.

Something of a forecasting miss in April payroll data. Only 226,000 new jobs. A big drop in trade and transport vs a big rise reported by ADP, so we have a data problem. The housrhold surveyreports a 100k rise in employment, for what that’sworth.

The participationrate rose 0.2%, which undercuts any general claim that workers are not available. However, women left the labor force in April, which could be a child care problem.

The loss in construction jobs is probably just a timing issue – big gains in March and seasonas assuming those gains in April. The two-month average says constructionis fine.

Losts of folks who had been working from home went back to the office in April. Maybe that has something to do with the drop in female participation.

Local gas station prices where I am~~typically way below the national average, yesterday $2.57, today $2.51 where I go to pick up Krugman’s hardcopy column on Tuesdays. I’ll be paying attention to market prices trying to time it right with roughly half a tank left. Last 48 hours is dropping, if it keeps dropping I’ll wait at least until Saturday morning. Summer obviously rises, but who knows, we’ll see.

For whatever it’s worth, I suspect these numbers today which were labeled “surprising” really weren’t surprising. I have stressed that this has caused more permanent unemployment, or, if you prefer, a “droning on” of unemployment than our experts have told us. It’s not like switching on a light switch after arguably 14 months of this. Which is one of the reasons I said over-and-over-and-over-and-over that anyone who used “V-recovery” to describe this, or even hold out “V-shaped recovery”as “a possibility”, was being absolutely asinine, and we’ll spare using names in order not to harm the deceiver of Bluestone Drive. But hey, does anyone know when May 2020 consumption numbers get “revised”?? Some oaf is waiting by his school’s Bloomberg terminal waiting for the revision on May 2020 consumption that’s certain to bring in a “positive” 2nd Q GDP for 2020. It’s apt to be “a record increase”. Where those May consumption numbers were immediately before the “record increase” is not for, like, geniuses, and stuff, to discuss. That’s confined only to “the slow people” for discussion. Make a strict notation on that last part.

It could also be a seasonality problem. If you look at the NSA numbers it is indeed the case that we saw over 1 million new jobs in April. The SA numbers for March might be overstated. I’ve long suspected that the pandemic has played hell with the BLS monthly seasonality factors.

Surely true.

“However, women left the labor force in April, which could be a child care problem.”

actually, i believe this to be a HUGE problem. it will get better as kids return to school. but the trump administration really screwed up by not addressing child care during the pandemic and recovery. by failing to admit we had a coronavirus problem, he simply refused to really address any problems of significance.

in the current climate, we have some folks arguing unemployment benefits are too generous, keeping workers on the sidelines. that is not really true. while kids are at home, most minimum and low wage jobs cannot cover the cost of child care. there are many women (and men) on the sidelines because they need to care for their children and cannot afford (or it is not available) child care. if you address this issue of child care, you WILL increase worker availability. but it seems on this topic the republicans have become anti-family. child care was a big issue prior to the pandemic. post pandemic, if it is not addressed we will not recover. it if is addressed well, the nation will grow tremendously. a choice must be made, and it will not be cheap or easy.

Yep. The virus created timing amd sector problems which are masked in the headline data. The service jobs hit hardest had lots of women working them. The collapse of childcare services didn’t and still doesn’t match school-year seasonals. Female employment, especially among Hispanics, is important to track to understand current labor market dynamics.

This is way off-topic but perhaps of interest to some of you.

Dick Day has died. He was a major figure in complexity economics and in 1981 founded the Journal of Economic Behavior and Organizartion (JEBO), with me succeeding him as its editor in 2001. I have posted much more detail about his career and ideas on Econospeak. I shall also be editing a special issue to honor him at the journal I currently edit, the Review of Behavioral Economics (ROBE), which I founded in 2013 with his approval at the time.

Oh, a further tidbit, perhaps more for Menzie than anybody else, something he may not know.

Dick Day was at UW-Madison, 1963-1976, and I first met him there. He co-founded the UW’s Social Systems Research Institute with the late Guy Orcutt, grandfather of recent JB Clark award winner, Emi Nakamuea. That was well before Menzie’s time there.

Was Day’s time at UW-Madison before or after most people thought it common courtesy to spell people’s names correctly??

Nakamura, not Nakamuea. Letter e is next to r on keyboard. Sorry about that. I wrote that just before going out the door to catch an airplane to Madison.

Sounds like a much better place than Harrisonburg. I had faith one day you’d come to your senses. Let us know about the local craft beer scene, ok?? I’d ask Menzie but he’s strictly a Schlitz guy, and told me “When you’re out of Schlitz, you’re out of beer.”

I am in Madison with my wife visiting our daughter for Mother’s Day, with out daughter having just gotten engaged.

Even Rural Voices USA object to this tour by Matt Gaetz and Marjorie Taylor Greene:

https://www.msn.com/en-us/news/politics/rural-community-leaders-call-on-gaetz-greene-to-stop-dividing-america-ahead-of-us-tour/ar-BB1gtSJa?ocid=uxbndlbing

Those two perverts are touring together? Are they doing each other? If so – ewwww!

I was trying to think of a certain cheesy 1970s track for musical accompaniment . It’s one of those bow-chicka-bow-wow ones. Disco keyboardy?? Or was it like distorted pedal guitar?? Damn, my music knowledge has failed me. It’s going to kill me later when I finally remember it, because it’s perfect for these two.

How about “I Want Your Sex” by George Michael??? Runner up Right Said Fred’s “I’m Too Sexy”?? Until I think of that ’70s song that’s the best I can do for you.

Perfect song for Taylor Greene and Matt Gaetz, reality TV couple “Hello, I Love You” The Doors. This should be played every time Gaetz enters the courtroom for his pedo trial.

Inflation at our local big box store:

Bagels up 20%; jam up 6% since I last shopped there a month ago.

Ah yea – a broad based measure of the cost of living. This type of BS is what we expect from the Fox and Friends chief economist!

@ PrincetonKopits

Have you thought of doing guest posts on inflation at John Cuckrant’s “Grumpy Economist” blog?? Market researchers say Cuckrant has a larger following than the 4:00am slot on OANN.

Wasn’t one of the commenters here whining about the Fed not making it’s recent policy clear, and that they were totally confused on this??? I feel sad I can’t remember their name now as I always like naming people by name when I insult them (joke). Anywayz….. I remember thinking at the time this was false, and the Federal Reserve had specified their stance on policy and that even Menzie had touched on it in posts 2–3 times. But, I couldn’t remember where or if it had a name. I think it is loosely termed “FAIT”. I hope that reader or commenter sees this, this is where and how the Fed spelled it out:

https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm

If it’s still confusing, there has been a decent amount of commentary (including I believe Menzie’s, maybe Prof Hamiltons (???) ) on this, you can type in “Federal Reserve FAIT” and you will probably get quite a few informative links. So there!!! Annoying commenter whose name I cannot remember, take that!!!

I think word “implied” is important, because Pi^e are inflation rates implied by the formula. Implied Pi^e are low because tp-lp is high, most likely because the llp (!Fed keeps it so) is very low. That is the real question is: for how long will the Fed keep liquidity at its lowest?

So , to me, there is no real “expectation” calculation possible with this formula.