From a new working paper by Candia, Coibion and Gorodnichenko:

Introducing a new survey of U.S. firms’ inflation expectations, we document key stylized facts involving what U.S. firms know and expect about inflation and monetary policy. The resulting time series of firms’ inflation expectations displays unique dynamics, distinct from those of households and professional forecasters. By any typical definition of “anchored” expectations, the inflation expectations of U.S. managers appear far from anchored, much like those of households. And like households, U.S. managers are largely uninformed about recent aggregate inflation dynamics or monetary policy. These results complement existing evidence on firms’ inflation expectations from other countries and confirm that inattention to inflation and monetary policy is pervasive among U.S. firms as well.

Fascinating revelations that must be heeded, especially by those whose first inclination is to assume rational expectations on the part of businesses.

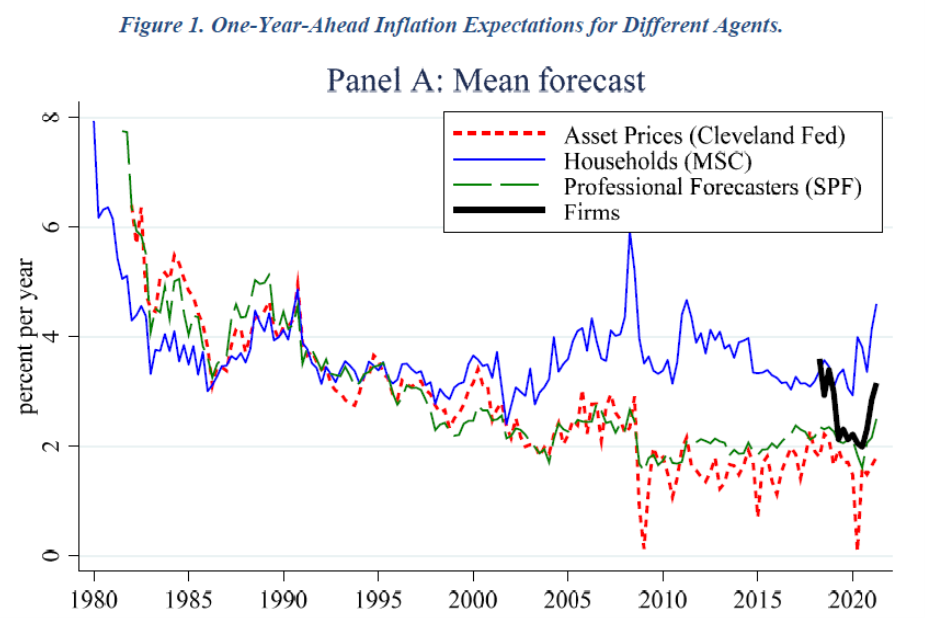

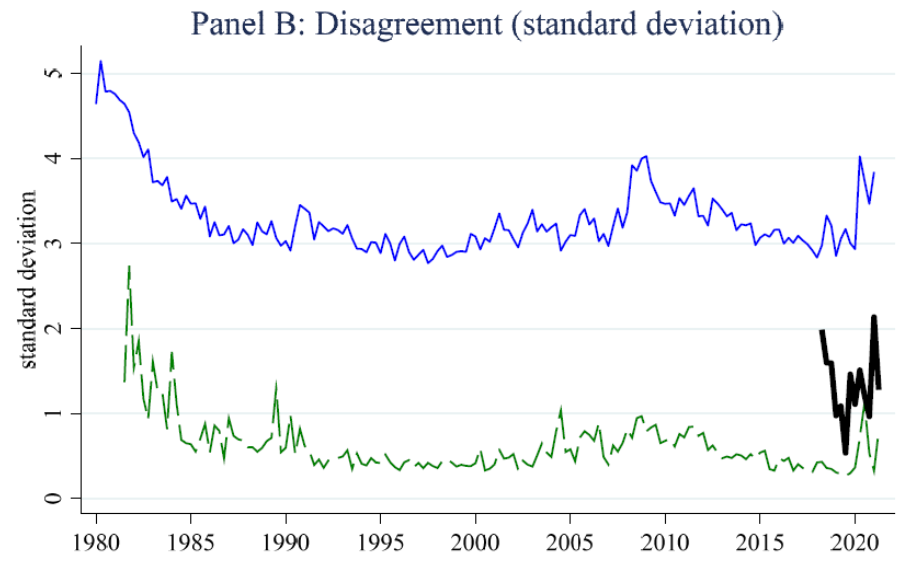

Source: Candia et al. (2021). Notes: Financial markets’ expectations are from the Federal Reserve Bank of Cleveland, households’ expectations are from the Michigan Survey of Consumers (MSC) and professional forecasters’ expectations are from the Survey of Professional Forecasters run by the Federal Reserve Bank of Philadelphia. We exclude responses of households that are greater than 15 percent or less than -2 percent. Firms’ expectations are from our new survey of CEOs. We exclude responses that are greater than 15 percentage points or less than -2 percentage points.

Interestingly, firms have elevated their expectations of inflation even as dispersion has decreased. The increase is comparable to that evidenced by households, but the level of expected inflation remains considerably below that of households.

More on the role of expectations for actual inflation, here.

“And like households, U.S. managers are largely uninformed about recent aggregate inflation dynamics or monetary policy”

In the influential Lucas island model, firms knew the prices of their own goods but workers had to forecast such prices to make sense of the wage offerings. Of course, some of us have always doubted firms were all that informed or that expectations were rational.

Wow! So those smart, industrious job creators are pretty much as clueless as most of their employees.

So much for the idea that we should choose business persons for elected office. They’re not much more knowledgeable than the rest of us and disagree with each other almost as much as we do.

This wrecks my faith in the omniscient business owner as our savior. Maybe I should just go out and vote for a stupid, ignorant, lazy, incompetent proto-fascist again.

Don’t mind me as I go sulk in a corner …

We conveniently ignore how many businesses go bankrupt each year when giving credence to the idea government would be better run by elected businessmen.

This puts the emphasis on expectations among economists in a strange light – which I suppose is more or less what Menzie said about rational expectations. The Fed’s current monetary policy framework relies on the public knowing Fed policy.

As the authors note, this is not the first evidence that the public is largely ignorant of Fed policy goals. A young colleague of mine made me grin a couple if years ago by slipping mention of this same problem into something she wrote for me. Clever woman was writing briefings on potential changes to the Fed’s policy framework and identified a central weakness. (We, of course, weren’t paying her enough and she left. @#$&+/;:$) We also know from comments posted here, for instance by people who are certain the Fed doesn’t know it is creating inflationary pressure, that lots of people have badly mistaken ideas of Fed policy.

Monetary policy is weak in a low-rate environment. Efforts to strengthen policy by adopting a framework which relies on creating expectations of higher inflation apparently won’t help much because Fed action and communication have limited influence on expectations. Which means fiscal policy carries the main burden for counter-cyclical stabilization. Some people get that. Some don’t.

U.S. managers are largely uninformed about recent aggregate inflation dynamics or monetary policy.

That pretty much agrees with my anecdotal personal experience. I remember way back in college how business majors taking core macro did significantly worse than econ majors taking core macro. You see the same problem in politics. Candidates with a business background are assumed to be knowledgeable about macroeconomics. One of my sisters has three master’s degrees in various business areas, but when it comes to macroeconomics she’s as dumb as a fencepost.

Economics, at it’s core, is pretty right-brain, however left-brained much of modern teaching of economics may have become. I don’t want to say that business managers are overly left-brained, but, well, they do sometimes have a hard time with creative, big-picture stuff.

I once had to teach macroeconomics to an MBA class. Not saying my students were not trying but it was more difficult than usual to get them to get even the basics.

“Candidates with a business background are assumed to be knowledgeable about macroeconomics.”

Back in my Manhattan days, I used to hang at the bar ran by a friend who was slightly left of center but had some seriously right wing patrons. My favorite line ran something like this – “Obama never had to make payroll”. I would break out laughing pointing out he headed an incredibly large payroll – the Federal government that these right wingers kept complaining was too big. BTW Krugman never made payroll either – whatever that was supposed to mean.

“One of my sisters has three master’s degrees in various business areas, but when it comes to macroeconomics she’s as dumb as a fencepost.”

I have had fewer experiences with MBAs than with attorneys. Out of 100 law bros (and it’s always men with this attitude), 97 think they know econ, especially macro. Two of them are correct, and Dog forbid if you try to tell the others they’re wrong about something. My more limited experience with MBAs suggests a similar but much less extreme pattern.

Pity the valuation expert who had to testify in some litigation involving the value of any particular intangible asset. The attorneys he tries to help are all know it alls whose knowledge of basic finance is so incredibly stupid that they make Princeton Steve look like Merton Miller by comparison. And of course the judges are usually even worse.

students in the professional degrees such as medicine, mba and law are often times taught to present their view with confidence, not open for discussion. it is not intentional, but they feel clients pay them to tell them what to do, not for a therapy session. you will go find a new doctor if yours does not seem confident that the risky surgery he proposes will be spectacularly successful. the professional degrees are not what you would call a liberal arts education.

Their clients DO want them to offer confident-sounding answers. They should be asking for complex problems to be made less complex, for decision rules, that sort of thing. The best clients want tose things. Most want decisions to ne tacitly made for them.

I often found scenario analysis got around the problem of “just tell me the answer”. Only hitch was, management required a central scenario with odds in excess of 50% attached to it. That way, we had “given them the answer” that so many clients wanted.

Off topic, i know.

“In a free country, you would think people would honor the idea that each individual would get to make the medical decision, that it wouldn’t be a big brother coming to tell me what I have to do,” Paul said.

Rand paul on people getting vaccines. Funny how he thinks big brother should tell women whether they can have an abortion. These guys are a bunch of hypocrites.

Rand Paul stands for the right to go into the Senate gym and make sure everyone else there catch his COVID-19. Hey Marjorie Taylor Greene has the 2nd Amendment right to take her gun on the House floor and kill Muslim members. MAGA!

Did Marjorie Taylor Greene say something wrong here?

https://www.cnn.com/2021/05/23/opinions/marjorie-taylor-greene-dangerous-holocaust-comments-obeidallah/index.html?iid=deanobeidallah

Not to the MAGA crowd as they hate Jews, Muslims, Mexicans, blacks, and just about everyone who is not a member of the KKK.

https://twitter.com/dynarski/status/1396673147768905729

Prof Dynarski @dynarski

But won’t the robots pay us humans high wages if we get scarce

Dean Baker @DeanBaker13

The horror story, the robots are taking all the jobs, and now we are running out of people

https://www.nytimes.com/2021/05/22/world/global-population-shrinking.html

How the Coming Population Bust Will Transform the World

Fewer babies’ cries. More abandoned homes. Toward the middle of this century, as deaths start to exceed births, changes will come that are hard to fathom.

11:43 PM · May 23, 2021

Special Purpose Acquisition Companies have always been a scam. It looks like people are beginning to figure this out:

https://www.wsj.com/articles/for-startup-leaders-spacs-have-lost-their-allure-11621774800?mod=searchresults_pos2&page=1

https://www.cfodive.com/news/spac-market-during-q1-showed-explosive-growth-duff-phelps/598972/?utm_campaign=6077037bbccc8d0001c8f16c&utm_content=6094a612549d8f00019d063a&utm_medium=smarpshare&utm_source=linkedin

Now this is a riot. The “professionals” at Doof & Phelps think SPACs are the cat’s meow. I guess these doofs did not read that WSJ story before writing this marketing fluff. Gee – the SEC has accounting issues with this supposed cat’s meow so pay Doof & Phelps lots of fees? Only a total idiot would hire Doof & Phelps so I guess this marketing letter was mailed out to MAGA hat wearing corporate executives!

If a blogger criticizes the Belarus government, they may force the plane the blogger is using for a trip to land so they can capture the dissident blogger:

https://www.nbcnews.com/news/world/belarus-forces-ryanair-plane-land-detain-opposition-blogger-n1268270

I bet Trump wished he could have done this to some of us!

http://ftp.iza.org/dp14378.pdf

May, 2021

By any typical definition of “anchored” expectations, the inflation expectations of U.S. managers appear far from anchored, much like those of households. And like households, U.S. managers are largely uninformed about recent aggregate inflation dynamics or monetary policy….

[ This is perfectly reasonable and can be an explanation of why Chinese monetary regulators a prone to use sectoral rather than a general approach in limiting price increases. Presently Chinese regulators are aiming to limit producer commodity price increases, such as steel or corn:

http://www.xinhuanet.com/english/2021-05/24/c_139966360.htm

May 24, 2021

China moves to keep commodity prices stable ]

https://fred.stlouisfed.org/graph/?g=E9yK

January 15, 2018

Global Price Index of All Commodities and Industrial Materials, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=E9un

January 15, 2018

Global Price Index of All Commodities and Industrial Materials, 2007-2021

(Indexed to 2007)

Correcting:

Chinese monetary regulators [are] prone to use sectoral rather than a general approach in limiting price increases….

Here she is again, using somebody else’s blog as if it were a state-controlled Chinese news outlet. How blatant.

Hey, gang. Has anyone else noticed that it’s been at least several days since we had to endure ano …

And, there it is. The latest encomium to the Chinese Communist Party. More microeconomic meddling on top of the announcement of a new digital version of it’s currency that’s engineered to facilitate even greater social control.

I will freely admit that I’m in a mood most foul tonight. It’s been a helluva couple days, not just at work but afterward when I read and hear about our homegrown fascists, all before I visit this blog. I come here to escape that. Nonetheless, …

I will speak only for myself here, ltr, but the last thing we need in the US is praise for any government anywhere in the world that resorts to authoritarian means to ‘promote the social good.’ This always leads to overt racism (see PGL’s comment about Marjorie Taylor Greene) and to increasing use of state authority (read, jackbooted force) to stifle dissent (see PGL’s comment about Belarus).

As I think I’ve made clear, we already have more than enough trouble with native and nativist fascists and proto-fascists becoming both louder and more brazen. Our miscreants will, and do, view all examples of another government using (abusing) central authority not as a cautionary story, but as an example to be followed.

[And no, I am not referring to state governors who issued executive orders to try to quell a once-in-a-century threat to our health and our lives, and anyone with a lick of common sense can clearly differentiate between that and our current threat.]

I have known only a few dozen Chinese or Chinese-American. They are all unfailingly intelligent, generous, and wonderful people, and my life is immensely richer for having known them. However, my respect and admiration does not extend to the CCP, nor to its dictator-in-all-but-title Xi Jinping. The Chinese people, yes. The authoritarians that pretend to speak for them, no.

Please stop providing encouragement to our resident authoritarians. They are emboldened enough.

My current home (Brooklyn) has lots of Chinese-American citizens who are indeed wonderful people. Sunset Park for example is the highest point in Brooklyn and I used to run to the top on Saturday mornings just to see the old ladies doing Tai Che while the old men tried to get them to dance with them. It all reminded me when I lived in San Francisco.

Now I know my Chinese friends are certainly no fans of the current government in China. Of course they are even less fond of the abuse they endure at times on the subway.

Rand Paul’s excuse for not getting the vaccine shows he has to be the dumbest person ever to serve in the Senate:

https://www.cbsnews.com/news/rand-paul-covid-19-vaccine/

Yea I do realize that the Senate has had its share of total morons but DAMN!

https://fred.stlouisfed.org/graph/?g=r93T

January 15, 2018

Global price of Iron Ore, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=E85z

January 15, 2018

Global Price for Corn, 2017-2021

(Percent change)

I really doubt these findings. When I was deeply involved in financial planning and budgeting for a Fortune 200 company, inflation expectations were a key assumption, well researched and clearly specified. Finance drove the process.

Has something changed? I seriously doubt it. But I suppose financial managers could have been lulled into complacency by years of low inflation.

Question is, who did those doing the survey speak to? Corporations are big places. And Chief Executive Officers may not concern themselves much with issues that Chief Financial Officers, who are responsible for financing decisions, would be deeply concerned about.

JohnH: The working paper describes the survey:

The authors are top authorities in inflation expectations; in addition to articles in AER, JPE, QJE, REStat, they have a survey article in JEL. You would be well advised to read one or two of those papers.

“a long history of collecting CEO’s and top executives’ perceptions and expectations for various firm-specific outcomes”

But but but JohnH thinks CEOs are clueless and they should have called the CFO. Of course CFOs work for the CEO in most companies. I guess JohnH worked for some rogue company where no one communicated with anyone else.

Yes, I read that. From my own personal experience of almost 20 years in management of a Fortune 200 company, the results do not pass the smell test. Perhaps they do hold true in smaller companies with less professional management processes.

judging by the management decisions of fortune 200 companies (see ATT and directtv in 2015, att and time warner 2016, and att by 2021 divesting of both) it is hard to argue that these large companies make good and rational decisions by default. just saying, not all large companies are rational.

Especially in JohnH’s company where according to his babble the CFO does not communicate with the CEO. Can you imagine a Fortune 200 company that had such awful internal communications? Did someone forget to tell them about Microsoft Outlook?

If you talk to almost any real estate agent, they are keenly aware of interest rate expectations, which are communicated regularly by corporate staff. The same for anyone who has a stock broker or financial advisor. Usually these communications are put into the context of expected inflation.

If it’s claimed that CEOs and CFOs are oblivious to inflationary expectations, then someone is trying to gaslight somebody else.

If not, then all the news stories and blog posts about expected inflation (and there are a lot!) are totally pointless.

Sure, JH. Ask any real estate agent, whose eye is squarely fixed on, wait for it, INFLATION.

That usually follows, somewhere down the line, “Lotta people looking at this house, won’t last long.” The 6% commission they’ll earn is purely coincidental. As is any concern with inflation.

Same goes with any financial “advisor”/salesperson whose eye on inflation trumps any concern they may have in getting you as a client or making a sale?

Where do you come up this stuff?

BTW, it’s been a while since you posted one of your breathless Florida minimum wage updates. But, hey, inflation!

JohnH,

I have no doubt that real estate people have strong views about expectations of interest rates, but those are only tied to inflation expectations in a rational expectations equilibrium, which only rarely holds. Fed can move interest rates around without any particular change in inflation expectations and has done so many times. Those smart realtors are paying attention to the Fed.

Curious nobody here has commented on today’s column in WaPo by Larry Summers. He is doubling down on his inflation forecast, including declaring that inflation expectations have surged, citing TIPS, although I suspect he has not made the corrections Menzie does for term and liquidity premia, which pretty much lead to there not being much change in 5 year inflation expectations, even as the “breakeven inflation” level has gone up some, oh, a whopping half percent or so, horrors.

He admits that some of the price hikes are due to supply bottlenecks that might get cleared up in the not too distant future, but he really stays away from specifics on that, seeming to suggest that this is not the case for many goods, and that even for those for which it is the case, demand will just keep surging ahead of supply adjustments. He is really going whole hog on this.

Does he say what level of inflation is coming? I have noticed many people warning of high inflation without defining exactly what that means.

Nope. Gets vague on that. But it will be higher. That’s all.

that has been my trouble with inflationistas. when you try to pin them down, they go silent. there is nothing new to the notion that inflation eventually will need to rise, since it cannot go much lower. and we also know that high inflation can be problematic. but the key word here is high. inflation needs to rise quite a bit from here, and be sustained, to be a legitimate problem. i just don’t see that happening, at least until wage increases become sustained.

i think a lot of people are compromised by the fact their current investment scheme and outlook is predicated on low interest rates, and any increase will reduce the profitability of their investment thesis over the past decade. if the interest rate environment changes, people will either need to work to develop a new strategy or keep their old strategy with much less profitability. so they complain loud enough to try to keep the old world a little while longer.

I have a little theory. Yes, it’s kind of of a personal nature. And it’s very subjective. But I often end up being right on these things (you’ll just have to take my word on that). Remember how much I laid into Cuomo on his death numbers before the NYAG got after him and then the sex harassment issue?? Remember how I laid into Bill Gates being a phony (“I saw the pandemic coming”) before the story broke on his divorce and the reasons there of?? No, not backlogging masks doesn’t have much to do with infidelity, but it tells you about that person’s propensity and ease in telling BIG lies.

Larry Summers has a smell to him. The type of smell that phones up Brooksley Born to intimidate her on enforcing financial regulations and then tries to tell everyone he was on the right side of history and now has the right to lecture the world about macroeconomic policy steps.

So here is my theory. Larry Summers is in the same boat as Rahm Emanuel now. He has in essence been “put out to pasture” over at Bloomberg by the White House and told that any presidential administration can exist and probably thrive without him. He has no place in the Biden White House, and neither does Rahm Emanuel after phoning up everyone he knows on his Rolodex, including at least one ex-President. It bothers the hell out of Summers. So he’s willing to sell inflation gobbledygook/boogeyman fears to children hiding under their red MAGA sheet covers in order to stay inside the conversation. It’s no different than the grade school kid goofing off in class because he knows the one way to get attention is bringing home an “F” grade to mom and dad. Summers wants credit for this, the same as our boy John Cuckrant over at National Review, but doesn’t want to define what rate he’s predicting, anymore than John Cuckrant does. And they won’t, because if they did that, later they would have to explain why they were wrong, instead of saying, “Oh, well I never said THAT, I just said it was a fear I had”.