Today we are pleased to present a guest contribution written by Roland Beck, Virginia di Nino and Livio Stracca (all at the European Central Bank). The views expressed belong to the authors and are not necessarily shared by the institutions to which the authors are affiliated.

Criticism against globalisation and European integration is often coined in terms of a trade-off between enhanced efficiency and social justice. According to this line of argument, globalisation tends to violate the Rawlsian principles of fairness as it raises incomes of a few while leaving parts of the society behind.

The literature on the effects of globalisation on inequality was so far mainly focused on trade, i.e. an area where the distributional effects are relatively well understood (See e.g. Ebenstein et al (2014) for advanced economies and Goldberg and Pavcnik (2007) for emerging and developing economies). However globalisation is a multifaceted concept and other aspects deserve comparable attention. A literature on the distributional effects of financial liberalisation has emerged recently (Furceri and Loungani, 2015; Furceri, Loungani and Ostry, 2019) while studies looking at the effect of membership in “Globalisation Clubs” have limited their focus to the effect of such organisations on trade, which is however not trivial to establish (Rose, 2004; Rose, 2005; Subramanian and Wei, 2007).

In a recent paper (Beck et al., 2021), we re-visit the effects of globalisation on income and inequality by identifying exogenous changes in countries’ globalisation across a broad range of globalisation concepts including (i) accessions to “Globalisation Clubs” (ii) large financial liberalisation episodes and (iii) an external instrument for shifts in trade openness. This allows us to not only address endogeneity concerns to a large extent, but to also speak to the policy debate surrounding membership in organisations considered in our first definition of globalisation.

Our list of Globalisation Clubs includes the WTO, the EU and the OECD, which all require their members to pursue some form of either liberal trade or investment policies or a combination of both. In order to isolate the effects of financial openness shocks, we also look at pure financial openness shocks based on large changes in a popular measure of de jure financial openness as reported originally in Chinn and Ito (2006). In another robustness check, we use a Bartik-type instrument aimed at capturing “trade openness shocks” that are exogenous for individual countries, where we interact pre-determined exposures to international trade with the global rise in trade which is an exogenous change for most countries.

In all specifications, we take past growth of total factor productivity (TFP) into account, with the objective to disentangle trade integration from skill-biased technological change, which is otherwise difficult to separate from globalisation (Acemoglu, 2002). In addition, we control for several political and economic factors so that our episodes can be largely considered as globalisation shocks.

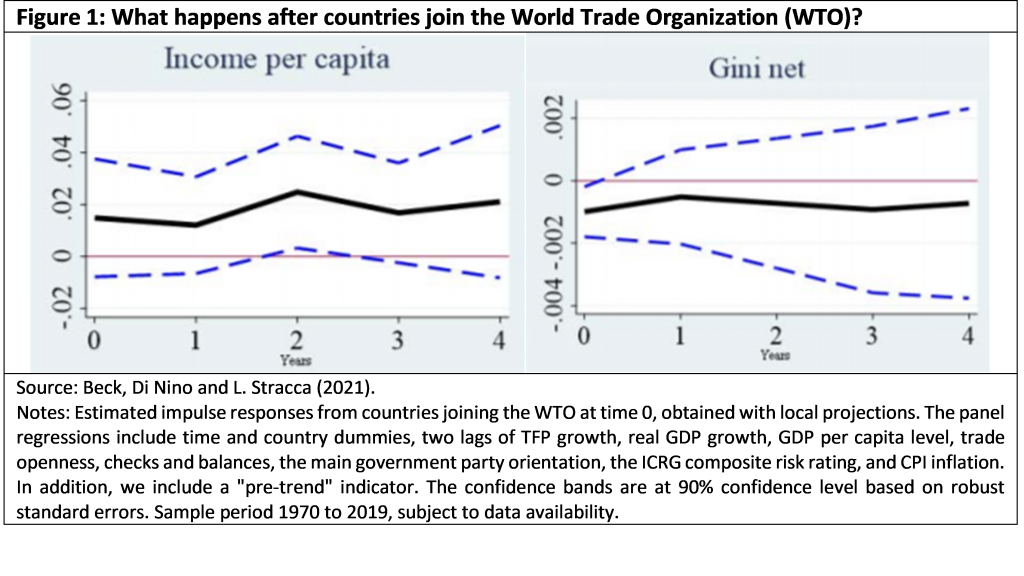

We find that most of our “globalisation shocks” lead to a significant increase in trade openness – a prerequisite for considering them as globalisation shocks in the first place. Second, the effects on per capita income are mixed according to our estimates. Most notably, we find little evidence that globalisation shocks lead to more inequality. The Gini coefficients pre- and post-redistribution tend not to change or even to fall in the wake of a globalisation shock (see Figure 1 for WTO accessions).

This finding also holds when considering alternative concepts of globalisation, when splitting our sample into advanced and emerging economies and when we limit it to the post-1995 era of “hyper-globalisation”. Taken together, our results point to mostly positive effects of globalisation shocks, and challenge the view that globalisation necessarily brings about an undesirable efficiency-equity trade-off.

References

Acemoglu, D., 2002, “Technical Change, Inequality, and the Labour Market”, Journal of Economic Literature, 40(1):7-72, March.

Beck, R. Di Nino, V. and L. Stracca, 2021, “Globalisation and the efficiency-equity trade-off”, ECB Working Paper No. 2546.

Chinn, M.D. and H. Ito, 2006, “What Matters for Financial Development? Capital Controls, Institutions, and Interactions”, Journal of Development Economics, 81(1):163-192, October.

Ebenstein, A., A. Harrison, M. McMillan, and S. Phillips, 2014, “Estimating the Impact of Trade and Offshoring on American Workers using the Current Population Surveys”, The Review of Economics and Statistics, 96(4):581-595.

Furceri D. and P. Loungani, 2015, “Capital Account Liberalization and Inequality”, IMF Working Papers, International Monetary Fund, November.

Furceri, D., P. Loungani, and J. D. Ostry, 2019, “The Aggregate and Distributional Effects of Financial Globalization: Evidence from Macro and Sectoral Data”, Discussion Paper 14001, CEPR, September.

Goldberg, P.K. and N. Pavcnik, 2007, “Distributional Effects of Globalization in Developing Countries”, Journal of Economic Literature, 45(1):39-82.

Rose, A. K., 2005, “Which International Institutions Promote International Trade?” Review of International Economics, 13(4):682-698.

Rose, A. K., 2004, “Do We Really Know That the WTO Increases Trade?”, The American Economic Review, 94(1):98-114.

Subramanian A. and S.-J. Wei, 2007, “The WTO Promotes Trade, Strongly but Unevenly”, Journal of International Economics, 72(1):151-175.

This post written by Roland Beck, Virginia di Nino and Livio Stracca.

Interesting post, Menzie, one related to matters I have actually published on, not to upset some commentators here too much.

So, looks like bottom line is not much change on means/medians for either income or Ginis over time as a result of joining T=WTO. But the variance on these, especially on the Gini, has increased. Would be useful to see the outcomes on the latter by nation, given patterns on this, if discernable look important.

Criticism against globalisation and European integration is often coined in terms of a trade-off between enhanced efficiency and social justice. According to this line of argument, globalisation tends to violate the Rawlsian principles of fairness as it raises incomes of a few while leaving parts of the society behind.

[ The development of China is showing dramatically that national integration and globalization in turn are necessary to meet Rawlsian principles of fairness and can quicken fairness in development. The ending of severe poverty in China required much enhanced efficiency and is by policy only a beginning of bettering living standards through China, and globalizing is intended to quicken accomplishing just this bettering. ]

https://news.cgtn.com/news/2021-06-16/We-don-t-need-the-G7-118PcjOsgTe/index.html

June 16, 2021

We don’t need the G7

By Jeffrey D. Sachs

The latest G7 summit was a waste of resources. If it had to be held at all, it should have been conducted online, saving time, logistical costs, and airplane emissions. But, more fundamentally, G7 summits are an anachronism. Political leaders need to stop devoting their energy to an exercise that is unrepresentative of today’s global economy and results in a near-complete disconnect between stated aims and the means adopted to achieve them.

There was absolutely nothing at the G7 summit that could not have been accomplished much more cheaply, easily, and routinely by Zoom. The most useful diplomatic meeting this year was President Joe Biden’s online meeting with 40 world leaders in April to discuss climate change. Routine online international meetings by politicians, parliamentarians, scientists, and activists are important. They normalize international discussions.

But why should those discussions occur within the G7, which has been superseded by the G20? When the G7 countries (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) began their annual summit meetings in the 1970s, they still dominated the world economy. In 1980, they constituted 51 percent of world GDP (measured at international prices), whereas the developing countries of Asia accounted for just 8.8 percent. In 2021, the G7 countries produce a mere 31 percent of world GDP, while the same Asian countries produce 32.9 percent.

The G20, by including China, India, Indonesia, and other large developing countries, represents around 81 percent of world output, and balances the interests of its high-income and developing economies. It is not perfect, as it leaves out smaller and poorer countries and should add the African Union (AU) as a member, but at least the G20 offers a fruitful format for discussing global topics covering most of the world economy. The annual EU-U.S. Summit can accomplish much that the G7 originally aimed to cover.

The G7 is particularly irrelevant because its leaders don’t deliver on their promises. They like making symbolic statements, not solving problems. Worse, they give the appearance of solving global problems, while really leaving them to fester. This year’s summit was no different.

Consider COVID-19 vaccines. The G7 leaders set the goal of vaccinating at least 60 percent of the global population. They also pledged to share 870 million doses directly over the next year, presumably meaning enough for 435 million fully immunized individuals (with two doses per person). But 60 percent of the global population comes to 4.7 billion people, or roughly ten times that number.

The G7 leaders offered no plan for achieving their stated aim of global coverage, and in fact, have not developed one, even though it would not be hard to do. Estimating the monthly production of every COVID-19 vaccine is straightforward, and allocating those doses fairly and efficiently to all countries is entirely feasible.

One reason such a plan has not yet been developed is that the U.S. government so far refuses to sit down with Russian and Chinese leaders to devise such a global allocation. Another reason is that the G7 governments let the vaccine manufacturers negotiate privately and secretly, rather than as part of a global plan. Perhaps a third reason is that the G7 looked at global targets without thinking hard enough about the needs of each recipient country.

Yet another example of the G7’s false promises is climate change. At the latest summit, G7 leaders rightly embraced the goal of global decarbonization by 2050, and called on developing countries to do so as well. Yet, rather than laying out a financing plan to enable developing countries to achieve that target, they reiterated a financial pledge first made in 2009 and never fulfilled. “We reaffirm the collective developed country goal,” they averred, “to jointly mobilize $100 billion per year from public and private sources, through to 2025 in the context of meaningful mitigation actions and transparency on implementation.”

It is hard to overstate the cynicism of this oft-repeated pledge….

https://www.imf.org/en/Publications/WEO/weo-database/2021/April/weo-report?c=223,924,132,134,532,534,536,158,546,922,112,111,&s=PPPGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2021

Gross Domestic Product based on purchasing-power-parity (PPP) valuation for Brazil, China, France, Germany, Hong Kong, India, Indonesia, Japan, Macao, Russia, United Kingdom and United States, 2007-2021

2021

China ( 27,191)

United States ( 22,675)

India ( 10,207)

Japan ( 5,586)

Germany ( 4,744)

Russia ( 4,328)

Indonesia ( 3,507)

Brazil ( 3,328)

France ( 3,232)

United Kingdom ( 3,175)

The nominal GDP list looks quite different, with the G7 much more noticeable near the top. So China moves to second, India moves to sixth, Russia moves to 11th, Brazil to 13th, and Indonesia to 16th. The three moving into the top ten in place of those moving out are Italy, Canada, and South Korea, according to 2021 IMF estimates.

ltr forgot to tell us that China’s population is 4X our population. I do not care about these comparisons unless they are expressed per capita.

pgl,

Well, aggregate GDP in some form is important in terms of global power relations. The US became in effect the world’s most important nation after WW I, if not sooner, basically because it had the world’s largest aggregated GDP, which became even more important and obvious in WW II and afterward. Charles Kindleberger argued that what really underlay the Great Depression was the refusal of the US to recognize its role and position in the world, with this manifesting itself in both the Smoot-Hawley tariff of 1930 and the really unfortunate monetary policy in the latter part of 1931 as the global financial crash coming out of the collapse of the Creditanstalt Bank in Austria arrived, with the combination of these irresponsible actions being what really turned what had been annoying recession into the Great Depression, which gave us Adolf Hitler in control in Germany in 1933.

It may be that for this global power ranking, it is nominal GDP that is more important than PPP, with nominal showing the ability of a nation to assert itself globally economically. PPP is certainly more about internal quality of life, although without question real per capita income is the much more important measure there. PRC is a middle income nation while the US is a high income nation, although there are several ahead of the US on the real per capita measure, along with even more ahead of the US (and certainly the PRC) on the UN’s Human Development Index, which also takes into account life expectancy and education and some other scattered stuff, as well as real per capita income. Big surprise, but some of those ahead of the US are ones with much more equal distributions of income, just to get back to a main theme of this thread.

This doesn’t pass the smell test: after China PNTR labor share of income dropped precipitously while corporate profits skyrocketed.

https://fred.stlouisfed.org/series/LABSHPUSA156NRUG

https://fred.stlouisfed.org/series/A053RC1Q027SBEA

A tremendous redistribution of income followed immediately in the wake of China PNTR. No doubt about it.

You know if you are so sure you have this right and their research is bunk, then why not write a paper and submit it to a referred journal? Or do you not care enough about this issue to do the hard work?

Stiglitz has already written plenty on this…including books.

Good stuff – I’ve read his writings. But unlike you – I have read a lot of other excellent pieces such as the one how host provided above. Stop your stupid chirping and start reading.

Question for our host. This Share of Labour Compensation in GDP at Current National Prices for United States is lower than it was a generation ago. This is a rather known fact and I’m sure there is a lot of economic literature on this issue. Is the ONLY explanatory factor free trade with China? I seriously doubt it as there have been lots of other explanations put forth by economists.

Then again – we have to forgive JohnH for not knowing this as he insists no economist cares about this issue not to put their research on the front page of the NYTimes.

pgl: Intro to this paper https://academic.oup.com/qje/article/135/2/645/5721266?login=true cites some of the hypotheses.

Thanks.

“The Fall of the Labor Share and the Rise of Superstar Firms”

David Autor, David Dorn, Lawrence F Katz, Christina Patterson, John Van Reenen

The Quarterly Journal of Economics, Volume 135, Issue 2, May 2020

https://scholar.harvard.edu/files/lkatz/files/adkpv-superstars-qje-manuscript-final-20200123.pdf

Between you and Uncle Moses – we now have two working links to their QJE paper. Now had Econned replied – he would give us zero links as well as not telling us the title of the paper or the authors’ names. After it is beneath him to provide such information to the obviously unworthy readers of this blog. So thanks to you and Moses.

This is exactly what Harvard Business School’s Michael Porter and others were preaching in the late1970s and early 1980s when strategic planning was all the rage. The mantra was: dominate your industry or get out of it. GE’s Jack Welch was the poster boy. And, naturally, it led precisely to the monopoly capitalism and profiteering of today. Well, not quite. Some firms are still happy to follow along under the price umbrella of the dominant firm, encouraged by the dominant firm so as to avoid the slim risk of a DOJ anti-trust action.

Porter mentioned labor only once in his book Competitive Advantage. But it was on everyone’s mind as Japan, Inc decimated many US industries. It led quite naturally to corporate designed, managed trade agreements that opened the way for major US industries to invest securely abroad, cut labor costs (along with costs associated with compliance to regulation), maintain access to US markets, and cement enormous barriers to entry via complex, integrated supply chains and, of course, lower costs.

Economists were generally on board even though the agreements, by managing trade, distorted it rather than freeing it and even though they led to all sorts of problems, including redistribution from labor to capital income, corporate offshoring of profits, etc. Curiously these managed trade agreements (Stiglitz’ characterisation) are still staunchly defended by economists under the misnomer of “free trade.”

It makes you wonder if much of today’s economic theory, like communism, will one day be repudiated and denigrated, not because the theories were necessarily wrong, but because of the abusive practices that were carried out in their name.

Harvard Business School’s Michael Porter? This is your idea of economics? About as brain dead is the fluff from Thomas Friedman.

Sorry dude but I refuse to read junk science.

Obviously pgl is an economist who fails to understand that business behavior drives much of what happens in the economy. And HBS’ Michael Porter was revered as a guru of good corporate strategy, which (not so coincidently) helps explain the rise of today’s monopoly capitalism.

Of course, pgl’s guru would appear to be Uncle Millie, an economics guru, who simultaneously encouraged corporations to sacrifice everything for maximum profit.

The two gurus worked their Mephistophelian magic in tandem, one from economic, the other from Business School. If, rather than disdaining current business theory, pgl tried to understand it, he might have a better idea of what is happening.

Congress and President Obama in April 2011 prevented China from working with the US on space exploration. The result in June 2021 is a China rover on Mars, a China rover on the moon, a Chinese retrieval of rocks and dust from the moon, and an orbiting Chinese “international” space station that has just been manned.

China has an advanced global positioning system and makes and sets in space its own robotically constructed satellites. A Chinese deep space telescope will soon be set in orbit alongside the new space station.

https://www.cgtn.com/special/Shenzhou-12-China-s-crewed-spaceflight.html

June 17, 2021

Shenzhou-12 astronauts become first Chinese to enter a space station

By Gong Zhe and Wang Yizi

Gee – we have JohnH who hates China and we have anne who serves as the chief spinmeister. I’d call this fair and balanced in a Fox News sense.

I have no idea why pgl would leap to the erroneous conclusion that I hate China. But it does amuse me that the foreign policy establishment howls in outrage at Chinese practices, such of foreign lending, that seem to have taken pages out of US books that were written decades ago. I mean, how dare they imitate the US’ own abusive practices???

You now love the Chinese? I guess you applaud the tremendous increase in real wages trade has fostered. Oh wait – as usual you are incapable of connecting the dots. Which is cool since your mentor Peter Navarro is also economically illiterate.

@ pgl

When a commenter says he/she doesn’t like how trade with China lowers American wages, it doesn’t mean he/she “hates China”. If they attack Beijing leaders” decisions it doesn’t even mean that that person “hates China”. Which is one of the problems you have when you have a commenter who feels the need to fly off the deep end after differing views are offered, manufacture opposing views that were never stated, and act like a general lunatic in bad need of attention.

You often suggest people start their own blog. I just wish you would quit muddying the waters of what people say, because you have an inability to conduct a straight up honest debate on the “merits” of your own argument.

Frankly I don’t pay much attention to media reports on China. Negativity rules because China is regarded as a strategic challenge.

Rather than join those carping about Chinese government behavior, I’ll focus on the US. When we no longer live in a glass house, we can throw stones at others.

http://www.xinhuanet.com/english/2021-06/17/c_1310013397.htm

June 17, 2021

Over 945 mln doses of COVID-19 vaccines administered in China

BEIJING — More than 945.1 million doses of COVID-19 vaccines have been administered in China as of Wednesday, the National Health Commission said on Thursday.

[ Domestically, 7 Chinese vaccines are being administered at a rate of 20 million doses daily. ]

“We find that most of our “globalisation shocks” lead to a significant increase in trade openness – a prerequisite for considering them as globalisation shocks in the first place. Second, the effects on per capita income are mixed according to our estimates. Most notably, we find little evidence that globalisation shocks lead to more inequality. The Gini coefficients pre- and post-redistribution tend not to change or even to fall in the wake of a globalisation shock (see Figure 1 for WTO accessions).”

Any student of international trade since we got past Ricardo’s little model – that is anyone who got Hecksher-Ohlin-Samuelson – understood that the distributional aspects of globalisation is a key but difficult issue. Yes there were losers from free trade but who the losers v. winners happen to be requires a lot of actual research which this paper plays a role. This paper by itself does not settle the issue but can we not have the usual troll nonsense that economists do not care about this issue?

Who was the Coke moron that put bottles of their product in front of Ronaldo. He is a fitness freak and his disdain for Coca Cola was already well known. Oh well $4 billion in lost market value is no big deal I guess!

https://www.msn.com/en-us/sports/soccer/coca-colas-market-value-drops-244-billion-after-ronaldos-snub/ar-AAL77Vu?ocid=uxbndlbing

Yeah, I saw that in the Euro2020 highlights show I watched. How should we annotate that? Maybe under the Water team’s goals: Coca-Cola 1st minute (own goal)

Ice Trae is not quite on the level of KD but this come back was epic.

https://www.msn.com/en-us/sports/nba/trae-young-hawks-erase-26-point-deficit-to-stun-76ers-in-game-5/ar-AAL7Sw7?ocid=uxbndlbing

The Nets on the road to take on the Bucs. 76ers have to go to the ATL tomorrow. If it is Atlanta v. Brooklyn in the conference finals, I’ll need to buy tickets for the Barkley Center!

Anyone with a brain watching knows Game 5 of Hawks-Sixers was not an “epic comeback”, but an implosion by the Sixers. Add in the fact about 75% of Trae Young’s scoring was flopping for fouls James Harden-esque style and you’ll maybe (with your spoon-fed Stephen “Women Provoke Violence Against Themselves” Smith type garbage) figure out why no one wanted to see Trae Young flop for fouls at the NBA all-star game. Which is why Trae Young wasn’t invited to the NBA all-star game. It doesn’t take “ice” to flop for fouls on shots aimed at the stands. And no one wants to watch that in important games~~~NBA players who spend half the game flopping for free throw points.

Thanks for providing a link to a paper that Menzie already provided a link too but sorry I enjoy game of basketball and will not reply to another hate filled rant from someone who clearly does not get the game.

Criticism against globalisation and European integration is often coined in terms of a trade-off between enhanced efficiency and social justice. According to this line of argument, globalisation tends to violate the Rawlsian principles of fairness as it raises incomes of a few while leaving parts of the society behind….

[ There is simply no reason why such a criticism should be correct. Assisting Irish development was not done with a loss of German development. Assisting East German development was not done at the expense of West German development. Assisting the development of the South during the 1930s, with the likes of TVA infrastructure projects was not developmentally harmful for New York or Connecticut or Massachusetts. Trading fairly with Mexico will not be a necessary expense of California. ]

I’m not sure you understand the Rawlsian criterion, otherwise known as the “difference principle” (i.e., the second principle in Rawls’ Theory of Justice). The difference principle states that policies that introduce more inequality are only justified if those policies actually improve the economic position of those at the bottom. An increase in welfare for those at the top that leaves the bottom unaffected (not simply no worse off!!!) is not justified under the Rawlsian “difference principle.” You can agree or disagree with Rawls on this point, and Rawls himself isn’t clear about a policy that improves the bottom quintile but makes the next highest quintile worse off; however, the authors do correctly understand the Rawlsian difference principle.

FWIW, I doubt that Rawls would support the CCP because Xi clearly violates Rawls’ first principle regarding liberty.

I’m guessing Professor Chinn would roll his eyes to the back of his head on this, but I found this book to be very educational:

https://www.versobooks.com/books/1155-crisis-in-the-eurozone

https://twitter.com/DeanBaker13/status/1405291053209440257

Dean Baker @DeanBaker13

Unlike his predecessor, Biden can engage in serious discussions with world leaders, but that doesn’t mean that he necessarily is taking us in the right direction. A new Cold War with China is not a good idea

https://cepr.net/biden-china-and-the-new-cold-war/

Biden, China, and the New Cold War

After Donald Trump’s clown shows, it was nice to have a U.S. president who at least takes world issues seriously while representing the country at the various summits over the last week. But that is a low bar.

6:27 PM · Jun 16, 2021

https://fred.stlouisfed.org/graph/?g=ns5D

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 1980-2018

(Indexed to 1980)

Decline in labor share of income:

94.2 – 100 = – 5.8%

Increase in real profits:

382.0 – 100 = 282.0%

https://fred.stlouisfed.org/graph/?g=nrSP

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 1992-2018

(Indexed to 1992)

Decline in labor share of income:

94.1 – 100 = – 5.9%

Increase in real profits:

293.1 – 100 = 193.1%

This study aims to address whether globalization systematically leads to inequality (on average). But the systematic impact isn’t the only important question. Whether globalization has led to a significant loss in labor market power and associated increase in income inequality in specific country-cases is not addressed in this study, and remains of critical interest. For the U.S., open trade/liberal market/corporate-sponsored de-regulation left large numbers of people worse off (i.e., uncompensated for the associated loss) and, arguably, undermined social cohesion in the long-run.

A very fair critique.

Relevant here, and noted in my opening remark on this thread, is that while on average we do not see much change in Gini coefficients (income inequality) the variance of the outcomes clearly went up. This means that in some nations there were substantial increases in inequality, almost certainly tied to weakened power of labor, while in some others equality increased. There is no single simple (or even complicated) story here.

“For the U.S., open trade/liberal market/corporate-sponsored de-regulation left large numbers of people worse off”

You’ve lumped these together but they are discrete things which must be disaggregated to be analyzed. Plus, I don’t even know what you mean by ‘liberal market.’ I’ve never seen this term clearly or consistently defined, so you would have to do so in order to analyze its possible effects.

But I think you’ve gotten closest to what I think is the correct problem statement: where do (did) the gains and losses from trade initially accrue, and how does the existing taxation, expenditure, and regulatory system allocate those gains and losses to the eventual recipients? In other words, I don’t think that trade itself is the problem; there will be gains and losses, and gains will be larger. The problem is how our system allocates those gains and mitigates/compensates those losses, and how can/will we achieve a Pareto-optimal outcome?

http://glineq.blogspot.com/2016/07/time-to-ditch-rawls.html

July 31, 2016

Time to ditch Rawls?

The seminal work in political philosophy for the era of globalization is John Rawls’ “The law of peoples” (LoP). It was written in 1999. I was attracted to it in the early 2000s as I was then already working on global inequality which was a totally new topic, entirely ignored, in economics. The only thing that came remotely close to it in economics was the Heckschler-Ohlin-Samuelson trade theorem whereby wage inequality should go down in poor countries and up in rich countries when they engage in trade. But this was such a small part of globalizations: it dealt with wages only and left out other types of income; it left out capital flows, development aid, migration, outsourcing. None of that was discussed in economics (and mostly still is not) in a global framework as opposed to 2-country 2-goods very limiting framework. But political philosophers have thought more about it….

— Branko Milanovic

“I was attracted to it in the early 2000s as I was then already working on global inequality which was a totally new topic, entirely ignored, in economics.”

This is sort of sad. Yes he did do research on this issue but to suggest no one else ever considered it? Come on man.

I know I read on inequality, both domestic and international, starting as an undergrad in the 80s. I don’t remember which authors/papers because after undergrad I was pushed in and pursued different directions. It wasn’t ‘mainstream,’ but there was a literature on it before 1999.

The “law of peoples” thesis and Milanovic’s critique are irrelevant to what the authors of today’s post were talking about. The “law of peoples” is best understood as an extension of Rawls’ earlier (1993) book Political Liberalism. The “law of peoples” extended the argument from domestic politics to the international arena. In fact, one lecture in Political Liberalism is entitled “The Idea of Public Reason”, which informed a lot of the “law of peoples”. The authors in today’s post were clearly referring to Rawls’ “difference principle” in his much earlier (1971) book A Theory of Justice.

Do you think Branko Milanovic would approve of today’s CCP and President Xi?

It’s funny — and I don’t mean funny, ha,ha — in the early 2000’s when millions of blue collar manufacturing jobs were being lost, economists were all “Shut up, ignorant peons. Globalization good, protectionism bad.”

And jump ahead a couple of decades to the present and when high-paying white collar jobs are threatened suddenly there is a panicked call for billions in “competitiveness” and R&D welfare subsidies for U.S. corporations. “We need to protect our critical industries (and profits).”

Please tell us which economists said that 20 years ago. Not Paul Krugman. Not Paul Samuelson. Now if you Lawrence Kudlow – that Klown is not an economist.

joseph: 25 years ago, I first taught international trade. At the time, I had to summarize the profession’s views on globalization, particularly in the trade sphere. Not all said unambiguously “globalization good, protectionism bad”. I didn’t. People who knew trade theory basics (and what Pareto optimality meant) would not have been so un-nuanced.

You’ve hit the nail on the head Joseph. And BTW, there were a lot of them, and credentialed. I suppose pgl will be telling us no economists were anti-regulation either, even though nearly every congressional testimony Greenspan gave he stated his disdain for even minimal financial regulation, and was considered “God” at the time by a large number of his colleagues. Nevermind Robert Rubin’s and Larry Summers’ attempted intimidation of Brooksley Born. It speaks to a lot of personal insecurity that certain economists cannot even stand the slightest constructive criticism of their profession. It mirrors TBTF banks’ defense of their overextending themselves and their depositors’ money with swaps and derivatives with the cliche’ “The public just isn’t ‘sophisticated’ enough to understand our genius in losing their bank savings for our gain”.

joseph I don’t think there’s any evidence that “high-paying white collar jobs” are anymore vulnerable today than they were in the past.

https://fred.stlouisfed.org/series/LNS14027662

One thing that is different is that in the old days economists were less concerned about inequality because there wasn’t a lot of evidence that inequality was bad for economic growth. Inequality was seen as a problem for sociologists, not economists. But I think that’s changed. Over the years economists have accumulated a fair amount of empirical data that supports the idea that inequality is not just a sociology problem, but is also bad for economic growth.

@ 2slugbaits

You don’t think Asian Indians (and other legal immigrants) are taking a lot of coveted tech jobs formerly reserved (say mid 1980s) for the MAGA and QAnon’s favorite native born race?? Not paying attention much are we?? Along with MDs and….. and….. and…….

“I don’t think there’s any evidence that “high-paying white collar jobs” are anymore vulnerable today than they were in the past.”

I wouldn’t be so sure yet. In your FRED chart, I see definite cyclicality, with a lot of noise between the peaks and troughs, but also an upward trend. Of course, a time series lends zero insight into the cause of the upward trend, so I think there’s an open question there.

I agree that, in the olden days of the 80s and 90s, many economists didn’t really view inequality as their concern. After all, H-O-S models and S-S Theorem both indicate that inequality that results from increased trade could be a problem IFF the population deems it to be.

My perception was that the prevailing attitude was that solving it was a political problem because any solutions would get into normative, not positive, economics. Problems like that are why we have a political system; economists and other social scientists can inform about the probable effects from different policies (solutions), but which one is better or best is a political question.

@ joseph

Ask “Academic Economist X” when he/she plans on writing his next research paper on University professor tenure impeding worker and job flows. You’ll find out who “the true faithful” of the Free Trade Church Congregation are pretty quickly. I doubt if the ECB is handing out grant money or salaried jobs on that question joseph.

Okay, so now we’re going with “Not All Economists.”

But I’m old enough to remember the bitter denunciations of labor leaders as being ignorant Luddites over arguments to admit China to the WTO when they warned about issues of human rights, labor union suppression and environmental laxity. There were all sorts of stories about how it would be great for Americans and result in China becoming more liberal because they were buying Big Macs. Folks like Hufbauer and Melitz. There were even those who accused protectionist Americans of wanting to keep poor Chinese poor. (Funny, today you don’t hear accusations of protectionist white collar workers trying to keep Chinese from entering the upper middle class.)

Of course a decade or two later, long after the fact and the damage was done, folks like Autor, Dorn, Hanson and even Krugman began to concede that things turned out a lot worse than they expected for blue collar workers.

“folks like Autor, Dorn, Hanson and even Krugman began to concede that things turned out a lot worse than they expected for blue collar workers.”

These folks were saying back then that a modest increase in trade would lead to a modest reduction in the incomes of blue collar workers. What Autor et al. noted that the massive increase in trade led to a higher reduction in the income of blue collar workers. Just getting right what their research has said over time.

https://fred.stlouisfed.org/graph/?g=sCbZ

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=sCc3

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2019

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=AkXA

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=AkXG

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 1977-2019

(Indexed to 1977)

[ There is a reason 158 countries are part of the Belt and Road Initiative. ]

http://glineq.blogspot.com/2016/07/time-to-ditch-rawls.html

July 31, 2016

Time to ditch Rawls?

In the late 1990s, John Rawls turned his attention from how a single nation-state should be organized (as in his Theory of Justice, ToJ) to how the world should be organized. Obviously, it had to be done at a very abstract level and, as will be seen, that abstract level comes very close to the situation Rawls (and the world) seemed to face in the 1990s. But, and it will be my key point here, that situation has dramatically changed in the past 20 years so that the abstract sketch of the world made by Rawls is no longer compatible with what we see today and thus the recommendations Rawls drew from that sketch are irrelevant.

In LoP, Rawls abandoned the metaphor of individuals meeting behind the veil of ignorance to agree on an a priori basis on the principles of justice in their societies. That rule still holds, according to Rawls, in individual societies but not in the world of nation-states whose representatives (but not individuals themselves) meet to agree on the principles that would guide their (inter-societal) relations.

Rawls has five types of societies: liberal (these are the same societies with which his ToJ is concerned), consultative hierarchical societies, “burdened” societies, outlaw states (notice: not societies) and benevolent absolutisms. We can drop the last because they never play a role in LoP (I never understood why; perhaps Rawls just did not know what to do with them). Both liberal and consultative hierarchical societies are well-ordered societies (meaning that within each of them the principle upon which they are based are reinforced by peoples’ daily actions); they respect each other and the (different) principles upon which each is based. Burdened societies cannot become liberal because they are held back by their poverty. Outlaw states just go to war (for basically no reason; they just, like in a Hollywood movie, seem to like being troublemakers).

So the rules then become relatively simple—and some would even say simplistic. The well-ordered societies, though different in their internal structure, can coexist at peace because they respect each other, and liberal societies do not try to impose their norms on consultative hierarchies. They do not try to export democracy.

Second, liberal societies have a duty to help the burdened societies but only as far as they require to become liberal, which, in Rawls’ view, takes place at a very low average level of income. After that point, even huge differences in incomes within the group of well-ordered societies are no ground for continuation of international aid. In other words, there is no reason for Norway to help Bangladesh because they are both well-ordered.

Finally, Rawls is against migration as a right or against migration as a way to alleviate global poverty and inequality. Countries (that is, organized peoples) have control of their territory and they alone decide whom they want to accept. They can accept refugees that flee persecution but not economic migrants (which is by the way consistent with Rawls’ general underplaying of the importance of income for our happiness).

So, this is the sketch: liberal societies reaffirm their liberal principles daily, they live in peace with hierarchical societies, they do not export democracy, they help only the poorest countries and this very moderately, and they do not allow economic migration.

As you can see, this is why I was attracted to Rawls: unlike economists he does present a coherent sketch of the world and economic rules.

So why do I have a problem with Rawls’ taxonomy now?

…

— Branko Milanovic

Simply reposting the same thing doesn’t make it anymore relevant. Whether or not you agree with Rawls is irrelevant to what the authors said. You simply didn’t understand that the authors were referring to Rawls’ “difference principle” and not the “law of peoples.” It’s pretty clear to me that you have no idea what the “difference principle” means; otherwise you wouldn’t have made this comment:

[ There is simply no reason why such a criticism should be correct. Assisting Irish development was not done with a loss of German development. Assisting East German development was not done at the expense of West German development. Assisting the development of the South during the 1930s, with the likes of TVA infrastructure projects was not developmentally harmful for New York or Connecticut or Massachusetts. Trading fairly with Mexico will not be a necessary expense of California. ]

“I don’t think there’s any evidence that “high-paying white collar jobs” are anymore vulnerable today than they were in the past.”

Well, only because white collar jobs are protected by trade agreements while blue collar ones are not. How much do you think those $250,000 a year programmers at Google and Facebook and Apple would be making if they weren’t protected by intellectual property rent seeking in trade agreements? Why don’t you see the same sort of protections for unions or minimum wages in the trade agreements? I think it is clear why. Trade agreements are designed to put U.S. blue collar workers in direct competition for workers without any protections in China and other countries. Trade agreements are designed to sweeten the jobs of white collar workers in the U.S. with intellectual property protections.

“those $250,000 a year programmers at Google and Facebook and Apple would be making if they weren’t protected by intellectual property rent seeking in trade agreements”

Or those $300K a year doctors protected by all sorts of games pulled by the AMA. There has never been any debate about this by actual economists. Let me repeat – Lawrence Kudlow is not an economist.

joseph You seem to be all over the ballpark. Your post drips with unfocused rage. Is you gripe with academic economists? Or “high-paying white collar” workers? Or owners of intellectual property? You do know that these are three distinct groups with different interests, right? For example, while intellectual property protections clearly benefit the owners of those properties, those same protections probably hurt programmers. Why? Because it’s in the economic interests of superstar programmers to live in the wild, wild west where their skills are more valuable. Rigid and binding property protections discourage innovation, which is good news if you’re a property owner but bad news if you’re a programmer.

If you haven’t already read it, let me recommend Good Economics for Hard Times by Nobel winners Banerjee and Duflo. I think you’ll find that they’re quite sympathetic with downscale workers and the victims of economic inequality.

Joseph is channeling his inner JohnH. Both should read Good Economics for Hard Times by Banerjee and Duflo. Then again there are a lot of economics who remind me of parrots who declare over and over that free markets are wonderful. They too should read their piece.

Also highly recommended is their Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty written in 2011. The two scholars married in 2015.

He’s contradicting himself somewhat, but he still has some valid points. People get angry about these things because they have good reason. And it doesn’t have to be “first person” experienced job loss, if you see family and friends go through this.

Unions can solve many of these problems:

https://www.salon.com/2019/04/30/software-engineers-at-prominent-tech-firm-say-they-were-fired-for-trying-to-unionize-report/

https://www.bloomberg.com/news/articles/2021-06-15/mapbox-workers-announce-union-drive-in-latest-tech-labor-push

https://www.bloomberg.com/news/articles/2018-02-26/coders-want-to-unionize-with-help-from-trump

https://www.bloomberg.com/news/articles/2015-04-30/microsoft-contract-workers-are-organizing

https://www.bloomberg.com/news/articles/2021-01-21/alphabet-workers-union-leader-parul-koul-takes-on-google-googl

https://www.wired.com/story/apple-app-developers-union/

Not to nitpick but that last story was not about Apple employees but about contractors wishing to sell their creations on Apple’s little monopoly:

“The Developers Union says it will attempt to tackle is revenue sharing. Apple’s longstanding policy gives App Store developers 70 percent of the money made from most apps, while Apple takes 30 percent. Back in 2016, Apple changed this split to 85/15 percent for developers who are able to maintain long-term subscription customers. Google soon followed suit, offering the same revenue split for subscription apps sold through the Google Play Store.”

A 30% commission rate is highway robbery. And I’m sure hi tech companies pay their workers far below the value of their marginal product. But note Joseph’s complaint is not that they are underpaid. His complaint is that workers in other sectors face even stiffer downward pressures on wages.

“Rigid and binding property protections discourage innovation, which is good news if you’re a property owner but bad news if you’re a programmer.”

Which explains why Microsoft’s valuation is so high even though its computer programs today are basically the same garbage they were selling 20 years ago.

“Your post drips with unfocused rage.”

Ah, yes. The old “you’re being shrill” trope.

Obviously, you know nothing about the field if you don’t think that the white collar folks at Apple and Google are not invested in the idea of protecting their intellectual property. They know that’s where their big salaries are coming from. Really, are you stupid enough to believe that intellectual property rents accrue only to the literal owners of the property?

They were okay when China was just taking over blue collar jobs in their sweatshops assembling their iPhones to which they could attach their intellectual property rents. But they are in a panic now that China is making a move to take over the high tech jobs they thought they had a lock on. Things like chip design and production. Airliner design and manufacturing. Biotech.

So we have this push for a new Cold War with China. Billions in government welfare for “competitiveness” when they belatedly realize that their intellectual property rents might be at risk.

Remember all the folks saying that inequality was just about an education gap? Now they are realizing that the educated are vulnerable too and they really don’t like it.

Please read Good Economics for Hard Times and Poor Economics: A Radical Rethinking of the Way to Fight Global Poverty.

Both at decent prices over at Amazon.com

Heck 2slug and I might even offer to pay for you to buy these two excellent books.

Of course you can pretend like JohnH that the only two books on this were written by Michael Porter and Joe Stiglitz.

“Now they are realizing that the educated are vulnerable too and they really don’t like it.”

You are right about this. The AMA is nothing but a doctor’s cartel. And I’m sure the ABA is trying to find all sorts of ways for lawyers to rip us off even more. Folks may want fierce competition for sectors that sell them stuff but damn it – competing for what I sell is not something anyone likes.

“But they are in a panic now that China is making a move to take over the high tech jobs they thought they had a lock on. Things like chip design and production.”

A bit of an update – which I never could get across to Bruce Hall. We may still be in the game when it comes to semiconductors but those pesky South Koreans and Taiwanese have been kicking our a$$es since the 1990’s. And yea – Micron Technologies hates this while Intel has been shifting their production to Malaysia for a while.

Now they are realizing that the educated are vulnerable too

Remember back in the late 1960s and early 1970s when engineers couldn’t find jobs? Remember when teachers couldn’t find jobs? My dad was an experimental physicist and there were times (before Sputnik) when he had a rough time in the job market. College educated workers have never been immune from tough times, but it’s always been true that things are much easier if you’ve got a sheepskin. The non-cyclical recession unemployment rate for college educated workers has held pretty steady over the last 30 years at around 2 or 3 percent.

are you stupid enough to believe that intellectual property rents accrue only to the literal owners of the property?

Are you asking me if I believe corporate management executives believe and act as though they are the literal owners of the property? To that question the answer is yes. But your earlier comment was about superstar programmers, not corporate managers. Not all white collar workers, even within the same company, have the same economic interests. If I’m a CEO, then I want to restrict competition. If I’m a superstar programmer, then I want a wild, wild west. It’s no different with sports teams. NFL owners want to restrict competition while superstar players want more owners competing for their talents.

The reason I referred to your post as unfocused was because you seem to have shifted your anger. Initially you were blaming academic economists for the plight of lowly workers. That pretty much fell apart so you went on to blame “high-paying white collar” workers such as highly paid programmers. Now it’s executives who accrue rents from intellectual property. This isn’t the first post in which you’ve adopted a “blame the academic economists” posture.

‘This isn’t the first post in which you’ve adopted a “blame the academic economists” posture.’

Like I said – he is channeling his inner JohnH. But unlike JohnH – he makes a decent point here and there.

On this matter of white versus blue collar workers and trade disputes, Dean Baker has long pounded on this point. At the time of the Great Recession he regularly denounced doctors, lawyers, and academic economists for their alleged protectionist practices in their professions and thus their supposed hypocrisy.

I debated vigorously with him at the time that while he was clearly correct about the AMA and ABA having gotten policies in place to keep our foreign physicians and attorneys, there was no such thing in place for academic economists, with foreign economists entering the US academic job market fairly freely. My own department has a substantial minority of people who are immigrants with at least some of their higher education abroad. It took awhile, but I eventually got Dean to agree with me, and dropped the academic economists from his screeds on this matter.

I shall repeat a story I have told here before about the AMA in particular, that involves U of Wisconsin, and for that matter Milton Friedman, whose PhD dissertation showed the monopolistic power and its impact of the AMA. The late Donald Nichols, whom Menzie kinew well and was at the LaFollette Center, once had his tenure threatened by a demand that went before the governing Board of Regents. He had told this story about the power of the AMA in a class, which happened to have in it the son of the head of the Wisconsin branch of the AMA, with this also being closer in time to the days of Joe McCarthy. This father then went all the way to the Board of Regents to demand that Don Nichols be fired for spouting communist propaganda. Really.

“Milton Friedman, whose PhD dissertation showed the monopolistic power and its impact of the AMA.”

I often note Occupational Licensing (1962). That was based on his PhD dissertation? A classic argument even if we do need to have some standards for becoming a doctor.