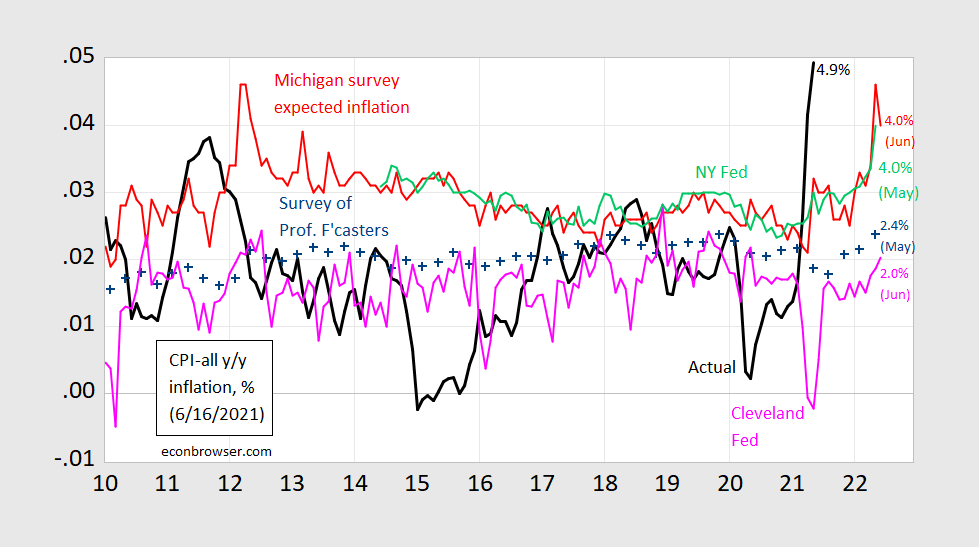

The FOMC has upped its expectations of PCE inflation [Politico] [CR]. Here’s latest available CPI inflation expectations.

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink). Source: BLS, University of Michigan via FRED, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, and Cleveland Fed.

The NY Fed’s measure rose from 3.36% in April to 3.4% in May – lower than the Michigan May reading of 4.6%.

It’s important to recall that household surveys of inflation (Michigan, NY Fed) register typically higher expected rates than economist surveys (e.g., SPF), and recently have been higher than hybrid market based/survey based surveys (Cleveland). Looking at the changes in expected inflation going from November 2020 to May, the NY Fed and Michigan rates have risen by 1.04 and 1.8 percentage points, contrasting strongly with the rise in the SPF of only 30 basis points.

The Fed targets the PCE deflator. Over the last 20 years, the PCE deflator has grown about 30 bps faster than the CPI. This is true since the pandemic struck (2020M03 to 2021M04).

You know, I’m always confessing to “catching on” to some things here. I probably shouldn’t tell on myself so much, aye?? But I noticed there’s a separate measure for gasoline price on “trading economics”. I had seen AAA’s measure, and “Gasbuddy”, but honestly locally I’ve found Gasbuddy very undependable. It can give me a hint who the cheaper stations are, but often times the price is still off by 3 cents. Anyway, the fascinating thing to me is, roughly the same time you see oil prices still rising up to $71, they have the gas prices dropping. Now I knew for a long time there was a time lag between oil and gasoline. But I gotta say I didn’t know that it was this much untethered. BTW, I got gas for around $2.43 on Monday, when the average price here is roughly 2.57. If I can believe Gasbuddy it’s still dropping, there was one station they quoted late afternoon today at $2.37.

Things going this way and that.

So I had somebody in the local real estate market tell me that lumber prices are now falling sharply. Do not know if this is corrrect,.

OTOH, SK is now being backed by sources that= oil prices may hit $100 by end of year. I note while I was and remain skeptical,, I nnever ruled this oout, with Goldman Sacks predictino$80 before end of year.

it is , whhecvr oil prices end u p as, I continue to accept Fed inflation is temporary.

I got a new phone which has been a real challenge to learn. Maybe you borrowed my phone and its absurdity at correcting my spelling to its own liking!

Did you see the WSJ cartoon?? A couple are sitting together on a loveseat. The man looks mildly upset and perplexed, looking fixedly down at the coffee table. The woman has her arms crossed and looking over at the man says “Maybe if you apologize, Siri will talk to you again.”

I knew GS was forecasting $65/barrel oil last fall so I had to check and yea – they think we may get to $80/barrel.

https://www.thisdaylive.com/index.php/2021/06/15/goldman-sachs-maintains-80-brent-crude-forecast/

Temporary small inflation is no biggie. Temporary. large inflation, well, that may be another issue.

As for $100 oil: I was making the case that OPEC would ordinarily follow a price-led, not volume-led, strategy. The Saudis have made it clear that they have now transitioned to a price-led strategy: “Show us some demand, and we’ll supply more oil.” The Saudis said something to that effect recently, and that’s the essence of a price-led strategy.

I would expect oil prices to drift up from here, but timing matters. There’s still about 6 mbpd of spare capacity sitting around. If US shales start looking more lively, then OPEC could switch back to a volume-led strategy, ie, add barrels to protect overall volumes levels. So it’s a race between recovering demand, improvements to US supply, and OPEC’s beliefs about those two things.

I note that in trying to post my last comment, I had massive problems of letters and words. I apologize for mess, and I see no such problems with this comment so far. In any case, hopefully you all can figure out what I meant to say in that garbled comment.

“The NY Fed’s measure rose from 3.36% in April to 3.4% in May – lower than the Michigan May reading of 4.6%. It’s important to recall that household surveys of inflation (Michigan, NY Fed) register typically higher expected rates than economist surveys (e.g., SPF), and recently have been higher than hybrid market based/survey based surveys (Cleveland).”

Remember how Princeton Steve twisted what Menzie wrote about monetarist crack pot only to suggest Menzie was saying inflation would exceed 4%. OK Menzie said that but I bet the ranch that the chief economist for Fox and Friends will cite the first sentence here ignoring the next sentence. Like the world comes to an end if inflation passes 4%. MAGA.

Copy/pasted from Menzie’s favorite source for Russian news, the ZH blog (that’s a good-natured rib/joke people, designed to make Menzie grumble in his sleep)

https://www.freightwaves.com/news/broken-records-historic-cargo-surge-still-making-waves-at-us-ports

My house value is up 42% in eleven months. This is pure insanity.

You could sell the house and buy a bagel bakery!!!! Wow, this is exciting!!!! Hire some brown people to work for you in the bakery, and if they die on work time hide them under a bush in Marquand Park!!! Under MAGA law a brown person’s identity never existed and is considered ant food. Is that cool or what!?!?!?!?!

I’d add that I would not be surprised to see a downward readjustment of 15-20% when the tide turns at the Fed. But the Fed is of course trapped in its own strategy, as a meaningful rise in interest rates would crash the economy in all likelihood. So the Fed is going to struggle to take away the punch bowl. I’d add that I suspect there is a significant bias towards the Democrats there, so there will be an incentive to keep the arrows pointing up until the elections sixteen months from now.

Personally, I think these hopes will be dashed as the Fed has to pull in its horns, perhaps in Q4 21 or Q1 22. I think the inflation numbers are going to be substantially bad and will force the Fed’s hands.

I wrote in a note a couple of months ago that ‘whatever the Fed does, it will be from the crucifix’, and I don’t see any reason to change that view at this point.

Steven Kopits: This comment would have meaningful content if you defined “meaningful rise” in interest rates, and whether you mean real or nominal interest rates.

It’s really hard to know where to start on this one. I mean, you’ve gotten to the core there I’m sure, but the contradictions with what “Princeton”Kopits has already stated are nearly endless. What is really going on here is “we’re” (“we’re” here read as numb-nutz Kopits) leaving ourselves an “out” for when oil doesn’t go up to $100 and gas at the pump doesn’t reach $4 and when it becomes more and more obvious that this is at the most transitory inflation, and me being the mule-like stubborn that I am still saying this really is more like reflation which the sheep are now buying from corporate media is “inflation”, so like the illiterate MAGA sheep that they are, they will accept higher prices on consumer goods etc, which they have no Earthly reason to pay.

The market already cr*pped its pants late in the week when they discussed a rate hike before end 2022, so we already know the Fed can put the hard air-brakes on these prices ANY time they want. And the biggest cryers in the market/media will be the “Princeton”Kopits of the world, because they want their cake and eat it too. They want to b*tch out the left side of their mouth on hyper-inflation and then yell about “Fed politics” out of the right side of their mouth. Which is it??? The multiple personalities Sybil of “policy consultants” cannot decide—because he knows inside his own self he has no F-ing idea.

@ Menzie

Did you notice “Princeton”Kopits didn’t even blink after I satirically referenced his Hurricane Maria Puerto Rican death count for brown people of 3 (counting Grandma Sanchez’s dog)?? I’m gonna tell you something you won’t believe—ZERO surprise for me there.

Finger to the wind, high 4’s to mid-5’s on the 30 year mortgage.

That would knock 10-15% of current house prices.

The fed mandate is inflation and employment, not asset prices. If banks are doing their job, mortgages will have proper collateral and a 10% drop will not do damage like a decade ago. Steven, you misunderstand the purpose of the fed. Asset bubbles are simply a feature of a capitalist marketplace. Right now there is simply no justification for a 5% mortgage rate. 10 year treasuries have actually dropped in yield recently.

So you think my house is really worth 42% more than one year ago? You think that’s going to end well?

“So you think my house is really worth 42% more than one year ago? You think that’s going to end well?”

no, i do not think your house is worth 42% more. what measure are you using? if you indeed sold it at that value, we can have a different conversation. zillow estimated values jump all over the place. they are not reliable. you want fed policy to be based on your monthly zillow house estimate? silly.

by the way, you think somebody can get a mortgage for your house at a 42% increase? not likely. now if a cash buyer wants to pay out, fine. they take on the risk. but i am not hearing that the mortgages are getting out of control like during the last housing bubble-yet. seems it is cash buyers taking on the risk this time. less leverage in the system, which is a good thing if it crashes.

The entire problem of bubbles, Baffs, is that people leverage up against those values. This is exactly what we saw in ship finance in 2007, when tankers and bulkers were trading at three times long term replacement cost, and banks were issuing loans at 70% of market value. Loan-to-value is an important concept in banking, and ‘value’ is ordinarily determined by the market. There will be bankers who resist following bubbles up, but generally that will mean exiting the business for a while, at least. Their offer will not be competitive for those seeking to maximize the value of a loan (rather than just attain the lowest interest rate). Ex-post, we will inevitably criticize the greed of bankers, but in truth, if you’re a banker, you’re pretty much providing a commodity service in a highly competitive marketplace. Crashes are not created by bankers. They are created by monetary conditions, often and possibly typically created by central banking policies — as is the case today.

steven, you are making the same argument our old buddy peak trader used to make on this site. during the financial crisis, in his view, it was not the bankers fault that they forgot all about risk. it was the fed’s fault they had to forget the risk. baloney. these folks know exactly what they are doing when they leverage up. they make that choice. they simply don’t think they should be held accountable.

“There will be bankers who resist following bubbles up, but generally that will mean exiting the business for a while, at least.”

maybe they should find a new job? they are not entitled to that money. some people actually have to work for a living, steven. just because everybody else is doing it, doesn’t mean you are all of a sudden permitted to take bad actions. are you a teenager? the situation you are describing simply implies we have an oversupply of bankers.

You’ve obviously never run a group or a profit-center, have you, Baffs?

We had this discussion when I advised a Hungarian bank back in 2005. The Hungarians were borrowing in Swiss francs for their mortgages, because the franc interest rate was much, much lower than the Hungarian forint rate (something like 3% versus 18% — I don’t know if that’s right, but that order of magnitude). Meanwhile, the forint was stable against the franc, with the Hungarian economy ostensibly growing faster than western Europe, including Switzerland. Therefore, on paper, a Hungarian borrower would not only have a lower interest rate, but also the prospects of the forint appreciating against the franc. The risk-return was irresistible from the borrower’s perspective. I would have done the same had I been a Hungarian shopping for a mortgage.

But of course, there was exchange rate risk. We had numerous discussions about this at the highest levels of the bank. But what could you do? It’s possible that the Hungarian forint could appreciate against the franc for twenty years. On the other hand, if the forint tanked, well, the entire portfolio would be in trouble, indeed, you’d have systemic risk across the entire Hungarian economy as the entire mortgage borrowing segment would be in immediate crisis up and down the line.

And then along came 2008, and well, I need hardly tell you what happened to the strength of the franc. The Orban government forced the banks, as I recall, to eat the foreign exchange losses (it was after my time).

But if you were a bank in Central Europe, what could you do? The dynamics were similar across the region — Poland, Slovakia, etc. So either you could withdraw from your entire Central European strategy, or you put your money on the table and hope for the best. Sure, there was some risk management, but you can’t manage that kind of systemic risk entirely. Perhaps not even materially.

You’re somehow assuming that you can be in a business and avoid the rough — sometimes brutal — patches. You can’t. Good management can help you ride out the storm, but you won’t be able to avoid hard weather.

Comes down to taxes and transactions costs, doesn’t it?

Did your property taxes increase 42%?

According to what measure?

Zillow. But it’s consistent with the actual transactions in the neighborhood.

zillow is notoriously inaccurate. it also “updates” its past prices when they become skewed wrong. my previous home had a price history curve that was refit over a period of time. so for example the value listed for june 2021 changed over time. using zillow to inform your views of fed fund rates is silly. as an aspiring consultant, steven, you should never, ever let it be known you are using zillow to inform your decision making process.

here’s the headline i have on the piece i wrote on the May producer price index: Producer Price Index YoY Records for Final Demand and Intermediate Services; 46 year High for Intermediate Goods, 48 year High for Raw Materials

it probably won’t be posted online until Sunday…

NB the final demand and services indices have short histories (2010)

the serious inflation in the pipeline is with intermediate goods and raw materials; see the year over year column here: https://www.bls.gov/news.release/ppi.t02.htm

for instance, the index for “Unprocessed nonfood materials except fuel’ ie, core raw materials, is up 80.6% year over year..

Confused……. you were for BLS?? I’m sure my faulty brain is missing something here, but would appreciate if you would clarify.

you’re right, Moses, that was a pretty crappy comment, like something i’d write in an email, but not appropriate for a public forum…i’ll try to be more to the point next time i have a similar observation…

@ rjs

The comment was fine, and informative. I was just mainly curious if you worked for BLS and didn’t edit my typing. Your comment was post related and ideal. I am the last person who would criticize someone for going off on tangents here on the blog, which is not what you were doing. I have no space to criticize as I violate this unwritten rule regularly.

not sure what you’re asking, Moses; the BLS website was down for maintenance most of today, but the link i posted is good now..

regards “the piece i wrote”, i post on my own blogs on Sundays, but sometimes i’ll get what i have ready for Angry Bear before that, and then Econintersect picks up my weekly synopsis for Monday morning…..i just used the headline i wrote for my PPI piece as a quick and dirty explanation of what PPI prices did in May, rather than copy & paste my six long paragraphs..

now go back and read what i wrote in my original comment, and see if it’s clearer now..

I miss-typed, I meant to ask if you worked for BLS, which would have surprised me, because I would assume writing on a blog would be frowned on by BLS.. But your 2nd comment largely answered my question. Thanks.