In order to judge the analytical abilities of an individual, it is sometimes useful to look back at their previous assessments. Consider this comment:

The fact is, this is the greatest economic boom in world history that has no end in sight.

Granted from the American position, we are not directly causing this event like in the 90’s expansion nor have we reached the capacity that we did by 2000, but it is getting there.

Simply a amazing world boom. Except [sic] it and enjoy the fruits.

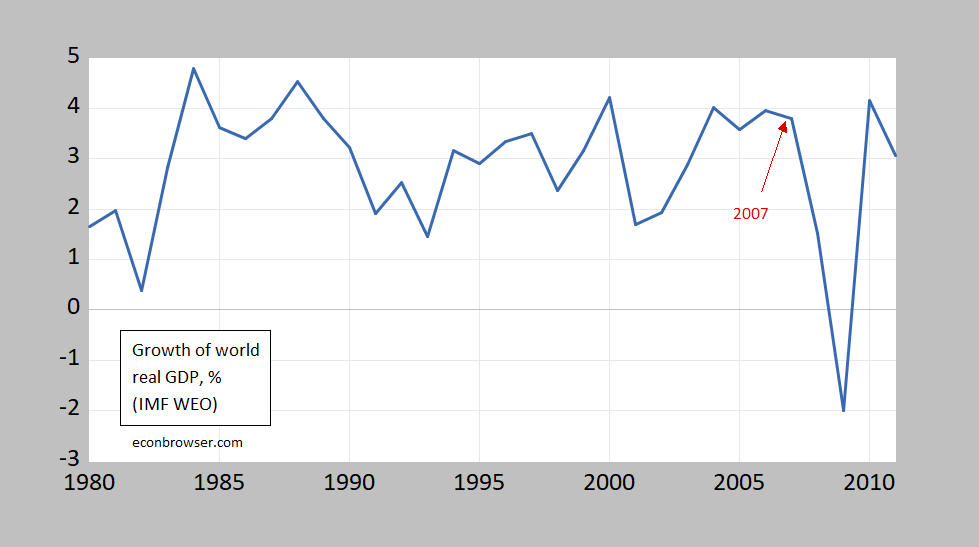

This comment is from reader Sammy in April 2007, eight months before the 2007-09 Great Recession/Global Financial Crisis. I provide a visual aid for readers to assess the accuracy of his prediction.

Figure 1: GDP growth in constant US$, at market exchange rates, % (blue). Source: IMF, World Economic Outlook, April 2021.

“this is the greatest economic boom in world history”

Sammy even got the history wrong. Average real GDP growth during Bush43’s first 7 years was a mere 2.5%. Not even close to the highest in post WWII US history. But hey Sammy likely was reading too much of Jerry Bowyer over at the National Review who wrote the side splitting book The Bush Boom. Yea had his misleading Buzz Charts which Mark Thoma labeled Fuzz Charts. Always a great source for a good laugh!

Now it was true that world real GDP was growing at a 4% rate back then but as your chart shows it was growing at a 5% rate in 1983. So Sammy through Saint Reagan under the bus. I would not be surprised if the true believers of supply-side economics disowned Sammy after that comment.

It might help if someone could provide the composition of that 4% world real GDP growth rate back in 2007. US growth was a mere 2.5%. I doubt EU growth was above 4%. So could it be that the drivers of world growth was Communist China back in 2007? It is good to see that Sammy was so in love with the virtues of the Chinese economic system!

“Roubini is one of few economists who predicted the housing bubble crash of 2007–2008. He warned about the crisis in an IMF position paper in 2006. Roubini’s predictions have earned him the nicknames “Dr. Doom” and “permabear” in the media.[2] In 2008, Fortune magazine wrote, “In 2005 Roubini said home prices were riding a speculative wave that would soon sink the economy. Back then the professor was called a Cassandra.“

https://en.wikipedia.org/wiki/Nouriel_Roubini

He’s baaaaaack…

“We are…left with the worst of both the stagflationary 1970s and the 2007-10 period. Debt ratios are much higher than in the 1970s, and a mix of loose economic policies and negative supply shocks threatens to fuel inflation rather than deflation, setting the stage for the mother of stagflationary debt crises over the next few years….

As matters stand, this slow-motion train wreck looks unavoidable. The Fed’s recent pivot from an ultra-dovish to a mostly dovish stance changes nothing. The Fed has been in a debt trap at least since December 2018, when a stock- and credit-market crash forced it to reverse its policy tightening a full year before Covid-19 struck. With inflation rising and stagflationary shocks looming, it is now even more ensnared.

So, too, are the European Central Bank, the Bank of Japan and the Bank of England. The stagflation of the 1970s will soon meet the debt crises of the post-2008 period. The question is not if but when.“ https://www.theguardian.com/business/2021/jul/02/1970s-stagflation-2008-debt-crisis-global-economy

Are there scenarios published that talk about how to get the Fed out of its debt trap and how to return the economy to some semblance of normalcy…without a crash?

You forgot to give proper quote attribution to Heather O’Rourke. Since this was an innocent omission we’ll let it slide just this once:

https://www.latimes.com/archives/la-xpm-1988-02-03-mn-27226-story.html

Gee – you are sounding a lot like Princeton Chicken Little Steve.

So… higher ‘debt ratio’, but at much lower carrying costs due to ultra-low rates. Supply shock, but clearly due to the short-term Covid situation. So it isn’t quite the same, is it?

The silence is deafening. At least Dr. Doom is not afraid to give it to you straight.

You had two counters here that of course you ignored. Oh wait – maybe you did not understand the counters.

Well, wonder what sammy has to tell us about “W” Bush now?? You know a lot of people still think President Obama was on duty when the derivatives/swaps mess hit the fan. Certainly we couldn’t be terribly surprised if sammy got the timing on that wrong. So many people time in the actual suffering with who is president when they actually feel that pain, rather than connecting it with the leader who enacted the policies which created the suffering. And there’s usually a lag there. I view that as one of the biggest problems with how people vote in this nation.

Menzie – I can’t seem to find anything in the archives, but I was wondering if you have posted about quotes from FOMC minutes just prior to the financial crisis. I recall quite a few quotes from governors that could make one question their “analytical abilities”. Plus it seems much more meaningful to assess the quotes of policymakers than random blog commenters (I should note that when I say “meaningful” I’m referring to “[a]nalysis of current economic conditions and policy” and not “meaningful” as it relates to ego-boosting via calling out random anonymous blog commenters). LMK

@ EConned

Maybe you can save Professor Chinn the time and share with us which person in the FOMC meetings circa 2007–2008 said: “this is the greatest economic boom in world history that has no end in sight.” Or any other FOMC meeting quotes that you found outlandish. Did your ego superimpose on Menzie’s numerous other duties that he was your personal RA??

We already know you are a jack*ss EConned, you now want people to do your homework to prove your contention?? Lay all these FOMC meeting quotes on us genius boy.

This is not now Jeopardy is played. Now wish Econned luck replacing Aaron Rodgers as the host.

Moses Herzog –

How on earth do you come up with these replies? I never asked Menzie to do any work – I simply asked if he has created posts on FOMC transcripts to scrutinize quotes from actual policymakers and professional economists instead of trying to boost his ego by publishing posts in an attempt to troll anonymous commenters. I don’t understand why that upset you so much.

Maybe you’re just new to the game, but your comment shows exactly how ignorant you are. Anyone who remotely follows central banking is aware of what was revealed after the release of the 2007/2008 transcripts. And, you’re (yet again) clueless if you don’t think I’ve done my homework.

Here’s a flavor from the resident jack*ss, you jack*ss…

“We’re not seeing anything out of the ordinary or a persistent pattern, and that gives me more confidence that nothing really bad is going to happen here.” Jan2007

“I’m much less worried about the housing market as a serious downside risk.” Mar2007

“First of all, this market is a fairly small part of the overall mortgage market. Also, there are ways for people to work out their situations. So the subprime market has really been overplayed in the media, and I do not see it as that big a downside risk. I am comfortable with the fact that we have lowered our forecast on housing a bit, but the numbers that just came in recently were actually ones that indicate some stabilization there—in terms of housing demand, in particular.” Mar2007

“ The central scenario that housing will stabilize sometime during the middle of the year remains intact” Mar2007

“I’ve marked down my growth expectations only a bit” Mar2007

“My own bet is that the financial market upset is not going to change fundamentally what’s going on in the real economy.” Aug2007

“The odds are that the market will stabilize.” Aug2007

“We have no indication that the major, more diversified institutions are facing any funding pressure. In fact, some of them report what we classically see in a context like this, which is that money is flowing to them.” Aug2007

“ my forecast is basically similar to my forecast at the last FOMC meeting and is consistent with the Greenbook forecast—that we would have a return to trend growth a bit later than we had expected but by mid-2008 and 2009” Aug2007

“I do not expect insolvency or near insolvency among major financial institutions.” Dec2007

“ Governor Mishkin is not here. He is aware of this meeting, but he is on the slopes—I think in Idaho somewhere.” Jan2008

“I think that our policy is looking actually pretty good… Overall I believe that our current funds rate setting is appropriate, and I don’t really see any reason to change.” Sep2008 – the day after Lehman collapsed and just three months before the fed funds rate hit ZLB

@ EConned

Let’s assume for the moment what you are saying is true, I assume you’re talking about Menzie, but it’s interesting to me you once again provide no links to these statements. I was only spot reading this blog at that time, if at all, I probably started reading this blog late 2008.

First of all Menzie was never on the FOMC board that I am aware of. Those statements you listed may look pretty bad in hindsight. You can probably find somewhat similar comments from Bernanke at that time without trying too hard. But they are much more moderate than say the following statement:

“this is the greatest economic boom in world history that has no end in sight.”

You’re also losing sight of the fact that much of the swaps and derivatives trading which is really the match flame that set off the natural gas explosion of 2007–2008, was “off balance sheet” or in the shadow-banking system. It’s a little hard for even credential economists to measure risk that is “off-balance sheet”. I believe it’s also sometimes referred to as “notional value risk” related to derivatives. Those numbers get into the billions. The rules on financial clearing houses have become more strict since that time.

Point being, even the best economist in the world cannot measure risk that isn’t being measured through mainstream channels or “inside the system” due to lack of proper regulations. That’s very different than some simpleton describing slightly better than average economic growth as some kind of Utopia.

I honestly don’t know why I acknowledge Moses Herzog. What on earth is he replying to? He is certainly one of the most “out there” commenters I’ve ever experienced in the blogosphere. No small feat.

I’ve finally achieved true success, bewildering Nobel Laureate “EConned”. Prepare my tomb.

Oh no, you’ve bewildered me numerous times prior.

The funniest thing is the obfuscation from Moses and PaGLiacci. They never want to discuss the actual topics at hand. Never! It’s always changing the subject or rendering the topic into obscurity. Never. Fails. Ever.

I somehow forgot this one from May 2007:

“I think that the notion of moderate growth with some uncertainty with return toward potential later in the year or early next year is still probably about right.”

I’m certainly not suggesting the Committee was/is full of fools but it seems more genuine to “look back at their previous assessments” than to troll decades old lines from anonymous blog commenters. Is that seriously a lot to ask?

Gee – it seems our host has been allowed a lot of rent free space in your empty brain!

anonymous blog commenters. Got ya Dr. Econned. That is your real name – right? I just want to make sure I properly cite all of your incredible AER publications.

Again, pgl is showing difficulty with reading comprehension. I’m not lamenting anonymous blog posters. I’m lamenting Menzie going back decades to troll anonymous blog posters “ In order to judge the analytical abilities of an individual, it is sometimes useful to look back at their previous assessments.” Whereas it seems much more prudent look back at the statements of FOMC officials if we are truly interested in “ Analysis of current economic conditions and policy” as opposed to the Menzie Chinn ego hour.

This is from the troll who writes quotes without telling us who said that or when or where. This is why I suggested you want to host Jeopardy. But you are so effing stupid – you did not get the joke (which is on you).

Alex – I’ll take Economics for $400.

Econned – dumbest troll ever!

As stated previously, I continued this trend because it upsets you so much. I’m clowning the clown. pgl – the clowniest clown ever! Also, is pgl an abbreviation for PaGLiacci? Be honest… honk honk

And you’re not anonymous??

This is one of the tell-tale signs you and Barkley are full of cr*p. Because he harangues people who disagree with him about being anonymous on blogs (an actual tradition of blog hosts themselves) and never has one word to say about his B–tbuddy in NYC’s choice to be anonymous.

Huh – now you want to be Econned new BFF. Or maybe you want to date him. A match made in heaven!

You wanna talk about forecasting and the difficulties of it, there’s a story in the June 28 WSJ about a guy named Maninder Singh Grewal, and his work for AB InBev and the work he does helping them meet demand and problem solving during the Covid-19. While it does not get into the more technical difficulties (numbers crunching and parameters thereof) of Forecasting, it provides interesting anecdotal stuff related to forecasting and walking and chewing gum at the same time. Pretty good read.

https://www.wsj.com/articles/how-a-beer-giant-manages-through-waves-of-covid-around-the-world-11624830297

http://krugman.blogs.nytimes.com/2006/08/25/the-bubble-bursts/

August 25, 2006

The Bubble Bursts

By Paul Krugman

Just a wonkish note about how bad the macroeconomics of all this * could be:

If you look at the most leading of the indicators on housing, stuff like new home sales and applications for permits, they’re off more than 20 percent from a year ago. If that translates into an equivalent fall in residential investment, we’re talking about a fall from 6 percent of the G.D.P. to 4.8 percent. And this may be only the beginning; I wouldn’t be surprised to see housing investment drop below its pre-bubble norm of 4 percent of G.D.P. at least for a while.

Add to this the likely effect of a housing bust on consumer spending and you’ve got a direct hit to G.D.P. of, say, 2.5 percent or more. That’s bigger than the slump in business investment that led to the 2001 recession. And the main reason the 2001 recession wasn’t as deep as some feared was that the Federal Reserve was able to engineer… a housing boom. What will the Fed do this time?

Maybe rising business investment and a declining trade deficit will soften the blow. But it’s remarkably easy, playing with the numbers, to come up with scenarios in which the unemployment rate rises above 6 percent by the end of 2007. That’s not a prediction, but it’s well within the range of possibility.

* http://www.nytimes.com/2006/08/25/opinion/25krugman.html

http://www.nytimes.com/2005/08/08/opinion/that-hissing-sound.html

August 8, 2005

That Hissing Sound

By Paul Krugman

This is the way the bubble ends: not with a pop, but with a hiss.

Housing prices move much more slowly than stock prices. There are no Black Mondays, when prices fall 23 percent in a day. In fact, prices often keep rising for a while even after a housing boom goes bust.

So the news that the U.S. housing bubble is over won’t come in the form of plunging prices; it will come in the form of falling sales and rising inventory, as sellers try to get prices that buyers are no longer willing to pay. And the process may already have started.

Of course, some people still deny that there’s a housing bubble. Let me explain how we know that they’re wrong.

https://fred.stlouisfed.org/graph/?g=x2fE

January 30, 2018

Case-Shiller Composite 10-City Home Price Index / Owners’ Equivalent Rent of residences, 1992-2021

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=oCkD

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2000-2021

(Indexed to 2000)

http://www.nytimes.com/2006/08/25/opinion/25krugman.html

August 25, 2006

Housing Gets Ugly

By Paul Krugman

Bubble, bubble, Toll’s in trouble. This week, Toll Brothers, the nation’s premier builder of McMansions, announced that sales were way off, profits were down, and the company was walking away from already-purchased options on land for future development.

Toll’s announcement was one of many indications that the long-feared housing bust has arrived. Home sales are down sharply; home prices, which rose 57 percent over the past five years (and much more than that along the coasts), are now falling in much of the country. The inventory of unsold existing homes is at a 13-year high; builders’ confidence is at a 15-year low.

A year ago, Robert Toll, who runs Toll Brothers, was euphoric about the housing boom, declaring: “We’ve got the supply, and the market has got the demand. So it’s a match made in heaven.” In a New York Times profile of his company published last October, he dismissed worries about a possible bust. “Why can’t real estate just have a boom like every other industry?” he asked. “Why do we have to have a bubble and then a pop?”

The current downturn, Mr. Toll now says, is unlike anything he’s seen: sales are slumping despite the absence of any “macroeconomic nasty condition” taking housing down along with the rest of the economy. He suggests that unease about the direction of the country and the war in Iraq is undermining confidence. All I have to say is: pop! …

https://fred.stlouisfed.org/graph/?g=npX1

January 4, 2018

Interest rates on 10-Year Treasury Bond minus 3-Month Treasury Bill, 2000-2021

It’s Morning in Joe Biden’s America

https://www.nytimes.com/2021/07/05/opinion/joe-biden-economy.html

Of course Mitch McConnell chalks the economic boom to that 2017 tax cut for the rich. Dr. Sammy on the other hand will probably tell us it is due to the 1981 tax cut for the rich!

Dear Menzie,

Just an interesting comment. This chart has me thinking of my own professional work career and how every time I was screwed by Republican administrations. I remember looking for my first job in early 90s – George H.W. Bush recession and being told, “we can’t pay you much – there is a recession going on!” And then losing my job during the George W.Bush Great Recession – “business is slow – we need to “right-size” our middle management by getting rid of you!” Fortunately, during the Trump Recession – I was working at a well managed company that has been hiring workers and expanding. Otherwise – I can imagine being told – “You are getting old – we have to right the ship by getting rid of managers like you!”

I’m not complaining – we all have to make our way in life. However, there is a generation of workers – who have a generation of lived experience that rejects that GOP/conservative B.S. that Republicans admins are better for the economy.

Of course, this doesn’t stop the GOP from spouting off their B.S. I saw Sen Grassley claiming on Twitter that the 850,000 jobs added in June, 2021 were somehow because of the Trump Tax Cuts of 2017?! Sen Grassley will go to his grave believing he is a great man because he got some farm subsidies for corn and hog farmers of Iowa to generate manure that is making the Iowa water undrinkable. And, operating on some B.S. he heard under Reagan about tax cuts grow the economy. Unless you are a hog/corn farmer hoping for more govt handouts – why would you vote for the GOP?

(BTW – from farmers in Midwest – I am hearing – markets go up and down – don’t you know and Trump set this all up – and why do I want to do cover crops to sequester carbon – when climate change is just something that just really impacts the West etc etc)

http://www.xinhuanet.com/english/2021-07/06/c_1310045557.htm

July 6, 2021

Over 1.31 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 1.31 billion doses of COVID-19 vaccines had been administered in China as of Monday, the National Health Commission announced on Tuesday.

[ Internationally, more than 480 million doses of Chinese coronavirus vaccines have been distributed. ]

Sammy made his comment in April 2007, and indeed, at the time, the world economy was booming. I do think that period could be characterized as the greatest economic boom in history — not necessarily in the US, but on a global and principally Asian scale, for sure. All booms end in eventual downturns, but I don’t recall Econbrowser calling for a depression in April of 2007, or indeed, a year later.

At that point, I believe Bill McBride was warning of a housing bubble. I am pretty sure I was.

I did not know at the time that the difference between a recession and a depression is a durable drop in home values, leading to material negative equity requiring 7-10 years to resolve in turn implying weak aggregate demand. But don’t we have that same bubble now? Of course we do. So the question is really how much leverage will be taken on to capitalize on current valuations. The longer the bubble lasts, the greater the amount of debt taken on, and the harder the subsequent crash.

So is Econbrowser warning of a new depression? Or are we going to live forever, as many thought in 2007?

“Sammy made his comment in April 2007, and indeed, at the time, the world economy was booming. I do think that period could be characterized as the greatest economic boom in history — not necessarily in the US, but on a global and principally Asian scale, for sure.”

4% is far from the greatest growth in world history. But yea – it was not from US growth. More from growth in China, which BTW is a Communist regime.

China is an authoritarian regime. North Korea and Cuba remain more or less communist regimes. I worked in Hungary under the communist system, so trust me, I know what that means in daily practicalities.

Yada, yada, yada. Your labeling does not change the fact that China’s high growth rate was what drove that 4% world growth rate. Basic arithmetic – something else Princeton Steve flunked.

“I worked in Hungary”

OK genius – what was its growth rate in 2007?

FRED is an incredible research tool. It is too bad Princeton Steve is totally incapable of using it as this series shows world real GDP per capita from 1960 to 2000:

https://fred.stlouisfed.org/series/NYGDPPCAPKDWLD

Since Princeton Steve is too research disabled to do the real work, permit me. From 2004 to 2008 real income per capita at an annual rate just under 3%. Now that is pretty good but from 1962 to 1969, this growth rate exceeded 3.6%.

Now just in case Princeton Steve flunked preK arithmetic as well as freshman finance, 3.6% is greater than 3%.

BTW – I see this college dropout is still claiming housing prices are way over valued even though real rents are up and the cost of capital is very low. Like I said – he flunked freshman finance.

This is doubling stoooopid:

“the difference between a recession and a depression is a durable drop in home values, leading to material negative equity requiring 7-10 years to resolve in turn implying weak aggregate demand.”

First of all anyone who passed freshman finance could take apart Stevie’s insistence that we have some sort of massive housing bubble. I have done so dozens of time but I guess this idiot never learned to read.

But let’s say residential investment slows down a bit and there is also some reduction in housing equity. Stock equity is way up as are other forms of household wealth. Plus we are seeing growth in other forms of aggregate demand including business investment and government infrastructure investment. But yea – Princeton Steve never learned freshman macroeconomics either.

You believe Bill McBride was saying there was a housing babble back then? I guess you do not know how to check his archives even though he makes this incredibly easy:

https://www.calculatedriskblog.com/2006/12/housing-in-2007.html

He reviewed a lot of data and concluded with a forecast that nominal housing prices would fall by 2% in 2007. Not exactly what you said there.

Come on Stevie – learn to do basic research. GEESH!

@ Kopits

Wait…… are you talking about sammy Hagar?? He was in Van Hagar, and few people liked that band, they had only 2-3 good songs compared to the prior incarnation of the band.

Except that wasn’t me.

I wasn’t commenting on this blog in 2007. It’s not my style either. And I use the lower-case s in my name. In fact in 2007 I was posting about the housing bubble on another blog,. So my analysis was actually prescient .

There are two Sammys out there?! That explains the incredible amount of incredible stupidity under your name!

you mean we have 2 stoooopid sammy’s in this world?

There was this fellow named JohnH saying a lot of absurd things over at Mark Thoma’s place. Our JohnH denies he wrote that idiocy but he certainly is making some of the same dumb gold bug statements here.

Typical pgl, the insult machine. He has no counter to Roubini’s analysis of the Fed’s debt trap, so he just calls me a gold bug!

Seriously dude? This is your defense for claiming Cameron’s fiscal austerity boosted UK real wages – even though they fell by 5%? I thought you were dumber than rocks but DAMN!

“in the meantime, the same loose policies that are feeding asset bubbles will continue to drive consumer price inflation, creating the conditions for stagflation whenever the next negative supply shocks arrive. Such shocks could follow from renewed protectionism; demographic ageing in advanced and emerging economies; immigration restrictions in advanced economies; the reshoring of manufacturing to high-cost regions; or the Balkanisation of global supply chains.”

OK I had to go back and actually read what he wrote. Let’s see – your first interpretation here was Princeton Steve’s housing bubble BS. Seriously dude – Steve flunked Finance 101. Oh wait you did too.

But debt trap? So you agree with Mitch McConnell that we cannot afford Biden’s spending proposal. No – you are a pathetic excuse for a progressive.

And yea – you are a gold bug as you fear current monetary policy will destroy us with INFLATION.

Look we get you are the most confused troll ever. Relax!

Exactly what interpretation did I give? I asked a question!!!

Typical pgl…full of insults, short on ability to read!

And, of course, he has absolutely no ability to answer the question I posed, so he covers his ignorance by hurling BS insults instead.

As I said, 90% of my initial comment was a quote from Roubini.”Only the question was mine. But pgl is too poor a reader to notice the clearly marked Roubini quote.

If pgl has a quarrel with Roubini, he should take it up with him, not me. But I doubt he will. Roubini would chew pgl up and spit him out before pgl could even hurl an insult.

And nobody has answered my question: how to avoid the train wreck that Roubini sees as inevitable. Apparently pgl is clueless. No surprise there!

JohnH

July 6, 2021 at 5:26 pm

In other words – you had no clue why you cited him. Got it. At least you identified the author and provided a link – something beyond the capabilities of troll Econned!

The thing about forecasting in economics is that it really is difficult to get it right. There are way too many parameters that influence the outcomes and often their influence can change in unpredictable ways, and with time. So any model build on observations from the past is at best somewhat flawed. The optimist fools saying “this time its different” are actually half right, but in the wrong direction – every time is different!. Sure there are some basic rules and correlations that hold out most times, but its when they fail or something completely new appears that the models fail.

Krugman is probably one of the best forecasters in the field and there are a couple of things that may have allowed him a way above average performance. Although he is very political, he leaves the politics out of his economic analysis. His predictions are based on facts not a desperate attempt to reach a predefined conclusion. When he is wrong he admits it to himself and try to find out and learn from why he didn’t get things right.

“When he is wrong he admits it to himself and try to find out and learn from why he didn’t get things right.

And even when he is right, a lot of trolls make $hit up that he allegedly said (but never did) in order to put him down. Most of these trolls are right wing lying idiots but a few come from the radical left.

Princeton Steve just pointed to Bill McBride as an authority on housing prices. He is and I often read his excellent discussions but it seems Princeton Steve has not bothered with this from just over two weeks ago. It is an interesting but rather long discussion so permit me to summarize a couple of key points Bill makes:

https://www.calculatedriskblog.com/2021/06/the-housing-conundrum.html

Real rents are up and the cost of capital is very low. Yea I have said that MANY times but Bill spends a little time explaining why real rents will stay high.

Now it is true that Bill worries are prices are a little high relative to the fundamentals. But he is not hair on fire shouting there is some massive housing bubble.

Of course Princeton Steve will continue with this nonsense as this clown THINKS he is smarter than Bill McBride. He is not but that never stopped the worst consultant ever from bloviating.

Bill is just fantastic. He lets the data drive his narratives rather than seeking out (only) data supporting his favorite narratives. One thing that many economists (and also Bill) seem to be missing is that the house pricing to income ratios should be adjusted for cost of borrowing. People are restricted by ratio of monthly income to monthly mortgage payment. So the actual price of a house is not that important if you can get a very low interest mortgage. I would love to see housing price data presented with monthly mortgage payments instead of $ cost of houses.

https://www.cnbc.com/2021/06/08/senate-passes-

bipartisan-tech-and-manufacturing-bill-aimed-at-china.html

‘The bipartisan bill passed the Senate a month ago:

The Senate on Tuesday passed the U.S. Innovation and Competition Act, a $250 billion bill aimed at countering China’s technological ambitions. The scope of the bill, the final product of at least six Senate committees and almost all members of the chamber, could be one of the last major bipartisan bills of 2021. Among its many provisions, the bill provides $52 billion to fund the semiconductor research, design, and manufacturing initiatives.’

It passed the Senate 68-32 even though the China bashers at FreedomWorks opposed the bill because it did not bash China enough.

A lot of incentives for the US semiconductor sector. One would think Bruce “no relationship to Robert” Hall would support these ideas since he thinks the semiconductor shortage is going to be the end of the world as we know it. But the last time he commented on Biden’s efforts at encouraging our semiconductor sector, he flipped and criticized these efforts.

https://www.cnbc.com/2021/06/08/senate-passes-bipartisan-tech-and-manufacturing-bill-aimed-at-china.html

In case my link screwed up!

Dean Baker thought that a bubble was forming in the housing market by summer 2002. Paul Krugman credited the writing of Baker in August 2002, and both tracked the market from then on. Krugman by summer 2007 also understood there were credit market problems stemming from speculation in mortgage-backed securities. Baker and Krugman wrote about the matters regularly from 2005 on, but interestingly even Krugman’s former “academic boss” then at the Federal Reserve, Ben Bernanke, never publicly responded to the writings.

http://krugman.blogs.nytimes.com/2009/01/03/economists-behaving-badly/

January 3, 2009

Economists Behaving Badly

By Paul Krugman

Ouch. The Wall Street Journal’s Real Time Economics blog has a post * linking to Raghuram Rajan’s prophetic 2005 paper ** on the risks posed by securitization — basically, Rajan said that what did happen, could happen — and to the discussion at the Jackson Hole conference by Federal Reserve vice-chairman Don Kohn *** and others. **** The economics profession does not come off very well.

Two things are really striking here. First is the obsequiousness toward Alan Greenspan. To be fair, the 2005 Jackson Hole event was a sort of Greenspan celebration; still, it does come across as excessive — dangerously close to saying that if the Great Greenspan says something, it must be so. Second is the extreme condescension toward Rajan — a pretty serious guy — for having the temerity to suggest that maybe markets don’t always work to our advantage. Larry Summers, I’m sorry to say, comes off particularly badly. Only my colleague Alan Blinder, defending Rajan “against the unremitting attack he is getting here for not being a sufficiently good Chicago economist,” emerges with honor.

* http://blogs.wsj.com/economics/2009/01/01/ignoring-the-oracles/

** http://www.kc.frb.org/publicat/sympos/2005/PDF/Rajan2005.pdf

*** http://www.kc.frb.org/publicat/sympos/2005/PDF/Kohn2005.pdf

**** https://www.kansascityfed.org/publicat/sympos/2005/PDF/GD5_2005.pdf

Kevin Drum reads the Washington Post so we do not have to. Apparently WaPo went all China bashing declaring the PRC of being a big threat:

https://jabberwocking.com/theres-no-need-to-panic-over-china/

ltr might be happy that Kevin told everyone to RELAX. But ltr needs to read on as Kevin also calls out the PRC for a lot of things that ltr continually pooh poohs here.

Interest on the 10-year T-Bond has fallen 22% since March which seems to me to be evidence of a recession forthcoming. Does the bond market think that fiscal stimulus is over and the Fed is incapable of preventing a downturn? Certainly McConnell and the GOP want to slow the economy and job creation in order to have an economic agenda to run on in 2022 and beyond. If the Dems fight among themselves, as appears to be happening, then infrastructure spending will fail. Shumer and Pelosi need to get their act together and get an infrastructure bill done.

https://www.huffpost.com/entry/nikole-hannah-jones-unc-tenure-howard-university_n_60e35e85e4b094dd268ebb3f

Howard University has granted tenure to Nikole Hannah Jones who turned down a position at UNC Chapel Hill because of some stupid people at the latter institution who let Trumpian morons create a horrible environment for this distinguished journalist.

There was a day I had a lot of respect for UNC but letting racist idiots dictate who gets to teach there is pathetic.