Some do; some don’t. Revised paper by me, Hiro Ito, and Robert McCauley. From the abstract:

Do central banks rebalance their currency shares? The answer matters because the dollar’s predominant role in large official reserve holdings means that widespread rebalancing requires central banks to buy (sell) a depreciating (appreciating) dollar, stabilizing its value against other major currencies. We hypothesize that larger reserve holdings have led central banks to approach their investment more systematically and to make rebalancing in the face of exchange rate changes the norm. We illustrate the choice with two polar case studies: the US clearly does not rebalance its small FX reserves; Switzerland does rebalance its very large reserves, so that changes in exchange rates do not move its currency allocation. Our hypothesis finds partial support in global aggregated data. They reject both no rebalancing and full rebalancing and point to emerging market economies as the source of the aggregate result. We also test for rebalancing with panel data and find that our sample economies on average again behave in intermediate fashion, partially but not fully rebalancing. However, when observations are weighted by the size of reserves, the panel analysis finds full rebalancing. A variety of control variables and splits of the panel sample do not alter the thrust of these findings. Central banks rebalance their FX reserves extensively but not uniformly.

The most substantive innovation is the use of panel data with observations on how individual central banks and government agencies that hold foreign exchange reserves manage reserve composition. This is a unique data set, and represents an expansion of the data set compiled and examined in Ito and McCauley (2020), discussed in this post (the expansion is from 58 to 74 countries, 1999-2018 to 1998-2020).

Third, panel analysis of more than 70 economies also finds that in aggregate central banks partially rebalance. When advanced and emerging markets are separately analysed, their behavior does not differ substantially.

Fourth, when we weight the panel observations by the scale of reserves, full rebalancing is the result. From this perspective the Swiss approach is more typical of big reserve holders than the US approach. This finding is consistent with large reserve holders making reserve management more like private portfolio management.

Fifth, rapidly growing reserves are associated with a higher dollar share. We interpret this as reflecting the dollar as dominant (“vehicle”) currency in the FX market: most central banks buy dollars and then diversify into their target currencies with a lag. By contrast, there is little evidence that financial market volatility affects rebalancing.

Taking these altogether, the strong suggestion is the association of reserve size and rebalancing. In the case studies, the Swiss have large reserves and rebalance; the US, modest reserves and do not rebalance. In the aggregate data, rebalancing seems more characteristic of [Emerging Market Economies] EMEs, some of whom hold very large reserves. In the panel data, rebalancing is the norm when observations are weighted by reserve size in relation to GDP.

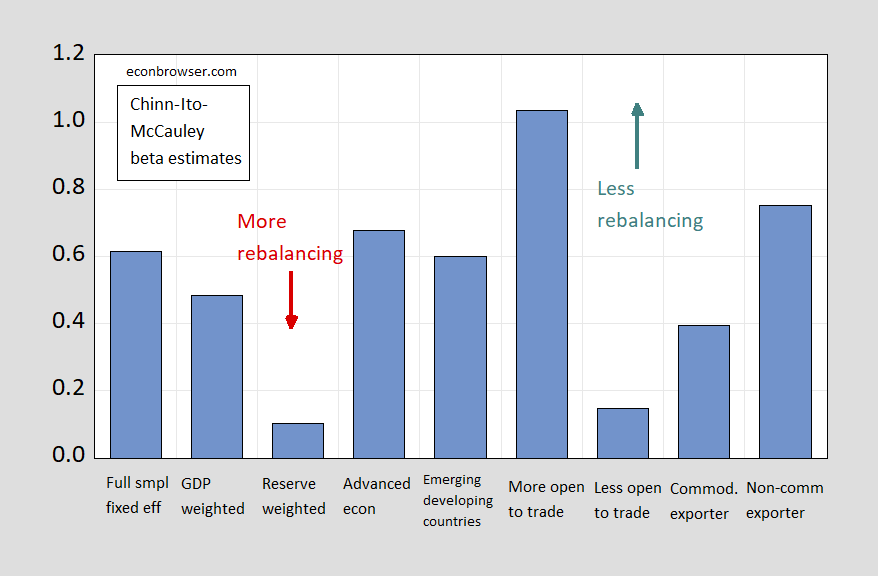

Stratifying the sample, we also find that closed-to-trade economies rebalance, while open-to-trade do not; commodity exporters tend to rebalance more than non-commodity exporters (the difference is not statistically significant in the latter case).

Some of these estimates are summarized in Figure 1 (higher values mean no rebalancing, lower values mean rebalancing).

Figure 1: Regression coefficient of change in dollar share response to valuation change in dollar share. Source: Chinn, Ito, and McCauley (2021), Tables 4, 5.

What are the macroeconomic implications? If enough central banks with enough reserves adjust in response to exchange rate changes, then there’s a possibility of effects on dollar asset values, like bond yields and the dollar itself. A back of the envelope calculation:

A 10% depreciation of the dollar could give rise to $150-$200 billion in dollar purchases. The implication for the foreign demand for US Treasury securities follows immediately.

The paper is also available as NBER working paper no. 29190. It can also be downloaded from the Global Development Policy Center at BU, here.

I guess I’ve read about this, and probably forgotten, but one random thought I have kinda related to this topic. I wonder what Turkey’s “strategy” is on balancing/rebalancing currency reserves?? The reason I ask is, their country seems to have a recurring issue with devaluations. And I’m wondering if they were a little better on how they handled their reserves if it would change/ semi-alleviate the problem?? Or in some country’s case (Turkey would probably qualify) if once you meet a certain amount of political risk tied to the currency makes it where it wouldn’t make any difference what the hell you did with the balance of your currency shares??

In a sense, devaluation is necessary for reserve accumulation in cases like Turkey’s. There’s a tight connection. Managing reserves in a routine fashion requires having sufficient reserves to deal with economic fluctuations. Turkey is stuck playing catch-up, so has to devalue to stem reserve outflows. Which can lead to pre-emptive outflows.

Part of the work Krugman didn’t get his Nobel for (not specifically, anyhow,) included some stuff about exchange-rate management and credibility. Turkey lacks credibility, so exchange-rate management is expensive.

This raises the usual issues of stocks and flows. As of 2019, which is (I think, but I could be wrong) the most recent BIS triennial survey, official transactions accounted for roughly one half of 1% of daily turnover in FX markets: https://www.bis.org/statistics/rpfx19_fx.htm

Total official reserves amount to something like $11.7 trillion : https://en.m.wikipedia.org/wiki/List_of_countries_by_foreign-exchange_reserves

Daily turnover is around $6.6 trillion (BIS again).

So with official reserve and other official transactions accounting for only about half of 1% of daily turnover and reserve stocks less than two day’s turnover, how powerful is the influence of reserve adjustment on the value of the dollar relative to other currencies?

I have no clue.

I would guess very little. Certainly as reserve rebalancing/adjustment being a “root cause” (and not as a byproduct of a different factor changing value of USD). But in fact, I have no idea either. I think exports and imports flow and dollar invoicing would be more apt to dictate that, or a larger factor than the rebalancing of currency reserves in and of itself.

The Wall Street Journal publishes a comparison of job growth in states that ended unemployment insurance benefits early v. those that maintained these benefits.

Forget the title – the comparison shows virtually no difference between states that terminated benefits v. those that maintained benefits.

https://www.wsj.com/market-data/quotes/fx/EURUSD?mod=mdstrip

Which raises the question – when did Socialists take over the Wall Street Journal?

The WSJ has always been socialist. It just doesn’t like the socialism to benefit individuals.

https://www.wsj.com/articles/states-that-cut-unemployment-benefits-saw-limited-impact-on-job-growth-11630488601?st=xl7h1wxsen3vwly&reflink=desktopwebshare_permalink

I think the WSJ screwed up my link so here it is again.

Barry has a reference to it over at the Big Picture

https://ritholtz.com/2021/09/cutting-ui/

Job creation was a hair better in states that retained the inflow of federal dollars a little longer – nobody could have predicted?

Thanks for this. Great title. Even bettre discussion.

think about hospitality, in particular bars and restaurants. in many large cities, such as nyc and la, the people working these gigs, even full time, are not doing it as a main job. they are students, actors, etc who are doing it to get a paycheck until their “career” hits. now the numbers may not be huge, but think about all the out of work actors, bartending until their next “work” gig comes through. during the pandemic, those dreams ended. there were no “acting gigs” for these folks. my guess is many of them finally realized the dream was up, and started to look for another career. this did not require them to work as a waiter or bartender any longer. on the margin, losing this part of the workforce probably played a pretty big role in the lack of workers hospitality is seeing today.

I think something like 1.5 million new small businesses have been started. It could be where that disappearing workforce has gone. People finding that sufficient amounts of income could be replaced by switching that underpaid unsatisfactory job with something that they enjoy (even if the income was somewhat less). If they can save on expenses for child care and transportation, it may even put them in a better financial situation.

“my guess is many of them finally realized the dream was up, and started to look for another career.”

The interesting observation here in Eueope is that even many people for which the hospitality job was their only job do not return. And to be clear, the chosen alternatives were already available before covid. Obviously, many people have a very narrow field of sight when assessing their job situation and only change when forced.

there have been a number of articles written in the usa recently citing former hospitality workers changing to something with better career prospects. sales and banking have become popular in the articles. i don’t have any numbers to back it up, but the articles do make sense. a lowly teller does have some career prospects in finance, at least until automation completely shuts that down. a lot of it has to do with better and more stable working hours. working a minimum wage restaurant job half time, but with a boss expecting you to be on call 24 hours a day, is something many of these folks are happy to leave behind. i had an aunt who worked at walmart prior to covid, and the thing she hated the most was she only worked 30 hours per week, but they were irregular and changed almost weekly. she had less flexibility than her children, for whom she liked to babysit the grandkids. she eventually quit and retired, with similar income and nobody but the grandkids dictating her schedule. many folks hate this scheduling issue as much as the minimum wage.

I guess currency reserve totals is a different conversation than currency reserve balances or rebalances. I presume a huge chunk of Turkey’s reserves are U.S. dollars. But at one time I really thought there might be some kind of a local crisis happen here, and it hasn’t happened yet, but I’m still wondering where it goes, because the political part of it keeps guiding bad policy:

https://tradingeconomics.com/turkey/foreign-exchange-reserves

https://www.reuters.com/article/turkey-cenbank-reserves-int/turkeys-net-fx-reserves-lowest-in-18-years-at-10-68-billion-idUSKBN2BV1P6

Back in 2019-2020, Turkey engaged in heavy defense of the lira using swaps. Include outstanding swaps in the reserve balance and the balance is negative. Recognition of that fact drove a steady lira selling by private accounts in 2020.

Take a look at this anti-vaxxer [edited MDC] and tell me why she left her MAGA hat at home. If this cow even has a husband, I bet he is visiting the local KKK salon.

https://truthout.org/articles/georgia-vaccination-drive-shuts-down-after-anti-vaxxers-threaten-harass-staff/

Georgians need to step up getting vaccines like citizens of Alabama and other southern states. Look I hate violence and am anti-gun but could someone take out their rifles and please shoot these horrific excuses of human beings? Damn!

I was surprised this didn’t get a little more attention than it did and thought I would pass it a long for any who missed it:

https://www.seattletimes.com/business/sudoku-maker-maki-kaji-who-saw-lifes-joy-in-puzzles-dies/

When you think of crossword puzzles and the similarity there with Sudoko and hobbyists (I would presume bending towards a more older crowd) I think it’s hard to guess the thousands of people this man gave quiet joy to.

Today in Redneck Hillbilly Comedy Spotlight:

https://www.huffpost.com/entry/markwayne-mullin-threatened-embassy-staff-afghanistan_n_612f951be4b04778bfff6a8a

Menzie,

So it seems that rebalancing is done to maintain some given shares of total values of currencies in the reserves rather than maximizing the value of those reserves. If central banks were doing the latter, then they might be inclined to unload dollars when USD depreciates to get more of a rising value currency rather than buying more.

This is the messaging Biden does after Blacks in Georgia battled to get him into office?? Fascinating

https://twitter.com/RepAOC/status/1433059198305292296/photo/1

“Act like Blacks’ lives are not worthy of note, get a cushy job doing next to nothing”

After Jim Clyburn destroyed Nina Turner’s chances to be a U.S. legislator maybe he can use his muscle to get Rahm this nice cushy job. Sense Clyburn doesn’t want to upset any Ohio based racists, one assumes Clyburn is ready to get the pompoms out for Rahm.

*since.

rather than telling a sitting senator how to vote, i would rather see aoc get elected to the senate and do the job herself. there has been a lot of talk from aoc, however, i have not seen her accomplish much on the congressional floor. this is not a statement in support of clyburn or rahm. but we don’t need any more back benchers in congress. i would like to see more of them get shit done. that includes aoc.

I tend to agree with you but AOC is from my state (NY) where our two senators are not exactly closest Republicans. Then again with the Ida mess maybe AOC will move to WV!

Central banks can also hedge by using currency swaps.

Hedge for what purpose?

Central banks aren’t, as a rule, profit maximizers. Swap lines are widely used by central banks, but not, as far as I’m aware, for hedging.

Years ago, the BDF and Bank Negara had mandates to engage in FX activity to increase the value of reserves. No other large-economy central banks had such a mandate. Not sure either of them do any more.

Hmm. I put up a reply here about 24 hours ago, but not here. Maybe there will be a duplicate.

Anyway, my observation is that it looks from this finding that central banks are trying to maintain roughly constant shares by value of forex from given countries rather than maximizing the value of their reserves. If they were doing the latter they would probably sell declining currencies rather than buy them.

I don’t know where it all fits in terms of Covid-19 risk, but I have to confess, it sure does feel good to watch Minnesota playing Ohio State tonight. This Ibrahim kid, #24 is fun to watch, and so is Tanner Morgan.

Wisconsin better watch out November 27, the game is in Minnesota and these dudes are for real. They ain’t playin’

ohio state dispatched with the gophers, just as they will with any other big 10 school who shows up at their doorstep. their qb already has a million dollar nil contract. college sports as we used to know it will change dramatically with this nil situation.

And the two SEC teams (ALABAMA and georgia) destroyed those two ACC giants – Clemson and Miami.

If folks wanted to avoid having two SEC teams in the playoff rounds, yesterday was a bad day.

Dean Baker has emailed his latest on today’s BLS report and I’ve reproduced only the beginning of it here (maybe someone will post a link to the whole thing):

“Economy Adds 235,000 Jobs in August; Unemployment Falls to 5.2 Percent

The average hourly wage for production and nonsupervisory workers in leisure and hospitality grew at a 23.7 percent annual rate in the last three months compared with the prior three.

The August job gains were somewhat weaker than expected; although it is not clear that it should be viewed as a seriously negative report. The 235,000 figure is less than half of what most forecasters had been predicting, but it was still associated with a 0.2 percentage point drop in the unemployment rate to 5.2 percent. The unemployment rate had not fallen to 5.2 percent following the Great Recession until July of 2015. It is also important to note that in the prior two months jobs gains were revised up 134,000, bringing the three-month average to 750,000.”

Not as much as expected so folks promoting the Biden fiscal stimulus could use this to tell Manchin to go suck an egg with his inflation mania.

The recent increase in nominal wages for leisure and hospitality workers is interesting. I bet its above the inflation rate for the same period but you never known what Princeton Steve and JohnH can cook up.

Look like a lot of people have left the workforce. They have not taken back their old jobs and also are not looking for a new job. They may have retired, started a business or just decided that it was worth losing that income for whatever gains came with not working.

https://news.cgtn.com/news/2021-09-03/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13fpeO7oXni/index.html

September 3, 2021

Chinese mainland reports 28 new COVID-19 cases

The Chinese mainland recorded 28 new confirmed COVID-19 cases on Thursday – all from overseas, the latest data from the National Health Commission showed on Friday.

In addition, 22 new asymptomatic cases were recorded, while 433 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 94,954, with the death toll unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-09-03/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13fpeO7oXni/img/cb0647f56fc64e07813ec1a82bfc371b/cb0647f56fc64e07813ec1a82bfc371b.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-09-03/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13fpeO7oXni/img/5512a40b3f3b4687afc7399b36d6dc87/5512a40b3f3b4687afc7399b36d6dc87.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-09-03/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13fpeO7oXni/img/7f56dd163ed34e25bdbb16ef93899c90/7f56dd163ed34e25bdbb16ef93899c90.jpeg

http://www.news.cn/english/2021-09/03/c_1310166361.htm

September 3, 2021

Over 2.08 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 2.08 billion doses of COVID-19 vaccines had been administered in China as of Thursday, data from the National Health Commission showed Friday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 2.084 billion doses of Chinese vaccines administered domestically, another 990 million doses have been distributed to 105 countries internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

September 3, 2021

Coronavirus

United Kingdom

Cases ( 6,904,969)

Deaths ( 133,041)

Deaths per million ( 1,948)

China

Cases ( 94,954)

Deaths ( 4,636)

Deaths per million ( 3)

Average hourly earnings as reported by the BLS was $30.73, which represented a 9.13% increase over the past 2 years. Consumer prices over the past 2 years have risen by 6.38%. I’m using 2 year comparisons given all the noise since the start of the pandemic.

Overall real wages are increasing but this is not exactly the overheated labor market that Joe Manchin thinks we are in.

IDA death count reaches 63 with 49 reported deaths in the Northeast. We were not prepared despite Cuomo’s blather about Build Back Better. Yea – Manhattan was OK but not Brooklyn and Queens. The new governor is promising to do better. Let’s hope so.

And to all you Climate Change deniers – please shut up.

pgl:

You suffer from confirmation bias (Confirmation bias is the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one’s prior beliefs or values. People display this bias when they select information that supports their views, ignoring contrary information, or when they interpret ambiguous evidence as supporting their existing attitudes.) compounded by recency bias

Here is a list of the worst hurricanes to hit the US: https://www.msn.com/en-us/weather/topstories/10-worst-hurricanes-in-united-states/ss-AAj2HQP#interstitial=2

The years 1900, 1926, 1928, 1935, 1957, 1960, 1969, 1992, 2005.

Come on Sammy – I did not say this was one of the worst Hurricanes ever. I did say the Northeast was not prepared. Now if you want to make light of the suffering that occurred come to Brooklyn and I will introduce you to some of affected homeowners with no apologies for the types of things that will tell you.

sammy, you suffer from out of dateness. that article was from 2016. since then, we have had harvey, ida, michael, maria, etc. many other major hurricanes struck throughout the Caribbean. even a tropical storm, imelda, came ashore in 2019 and caused over $5 billion with record flooding. there is no recency bias, that is simply when the storms have struck.

Nyc just saw what houston has been seeing on a near yearly basis. We have been getting 100 year weather events almost yearly. Time to update our probabilistic models, and better understand fat tails on many of our natural hazards. The other day i got stranded by 2 feet of water in the roads for a couple hours. Pulled into a strangers dry driveway, happy the 5g was still working. We need a big, big, big push in infrastructure improvements. New orleans was just protected by the recent hurricane upgrades developed after katrina.

Thanks for the adult comment (unlike Sammy and his heartless denial). You are right. We need as a nation to “build back better”. Of course this is the slogan Biden got from Cuomo. Alas with Cuomo it was only a slogan beyond protecting the privileged in Manhattan. This this Brooklyn and Queens are once again underserved. But the mess we went through pales in comparison to what happened in Louisiana or even New Jersey.

build nuke plants!

So a storm can cause a nuclear meltdown? Lord – you are an idiot!

They are a small part of the solution. They have long term issues we as a nation refuse to address.

Couple of things about the August jobs report which has led to the spilling of so much electronic ink.

The “local government education” hiring category showed a loss of 5,700 jobs in August following a gain of 224,900 jobs in July. July’s gain was the largest on record, following on a hefty gain of 133,800 jobs in June. That big fluctuation is all about timing, not labor demand. Smooth it out and August payroll hiring looks more like 353,000, not 235,000.

Residential building employment was flat, residential building specialty trades areas 17,000 jobs. Make of that what you will.

Neither the hiring of teachers or residential building folk is clearly attributable to the Covid spike. The plunge in accommodation and food service jobs clearly is. Instead of a hiring swing of three quarters of a million from July to August, it’s more realistically half a million once teachers are accounted for. ISM data also show cooling, but from very rapid growth to somewhat less rapid, other than pretty soft ISM employment data.

Not saying this isn’t worrying; I’ve been wringing my hands over a September slow-down for some time, but so what? — I’m just another guy on a barstool. Point is, the swing in hiring between June and July vs August is exaggerated.

There are, of course, lots of folks saying the Fed must now delay tapering asset purchases, but the output gap narrowed in August and that’s normally enough to keep the Fed from an immediate about-face. The narrowing was not as fast as in other recent months and certainly not a happy thing, but a little agnosticism about the future and future Fed policy wouldn’t do any harm right now.

The policy screw-up in the making is on the fiscal side (says the occupant of this barstool). Fed tapering is a financial asset event before it is a real economy event. Fiscal policy is mostly the other way around. People who are fixated on asset prices (including most of the press) are glued to the Fed, but Manchin’s latest power grab looks a lot more consequential from this barstool.

Oh, and the auto-sector supply problem? Vehicle and parts making jobs were up 24k follow a 10k rise in July. Model-year change-over is more spread out than in he past, but it’s still a thing. Strong auto-sector hiring.

We’ll probably see a couple of months of rising new vehicles prices because there is no need for inventory clearance this year. Seasonals anticipate discounting and will push up vehicle prices. More scary inflation talk.

The problem is how “media” reports it. August is known as a “clean out” month with NFP and NFP is not meant to be like household data. Next month NFP could easily be million+ again. However, based on household growth, the US recession will be over by the end of the year. With 2022 beginning the path back to peak 2019 conditions. NFP will simply lag that. Its built that way. The nature of the “contraction” and “recovery” is very fast this time.

Not only is tapering due, but interest rate hikes are due. Mishandling of data is why media needs regulation. Less noise.

this is another comment that simply makes no sense. it is a giant incoherent complaint.

macro,

on your barstool i hope you consume inbev products, i am modest long on that stock. it is a brand loyalty thing from my youth!

“The plunge in accommodation and food service jobs clearly is.”

au contraire… i stayed in a chain hotel more than usual for a retired person in august, and in one of the hardest hit counties in the usa.

i patronize food service retailers weekly an issue is: menu prices are getting too high!

don’t blame a virus when inflation, or end of intervention largesse may be closing pocketbooks.

that said i see all kind of help wanted signs in front of food service venues.

Forgive me for saying this but this comment reminds me of the usual self serving yuk from old Uncle Moses. Like anyone cares what your ordered from dinner.

https://www.cepr.net/jobs-2021-09/

September 3, 2021

Economy Adds 235,000 Jobs in August; Unemployment Falls to 5.2 Percent

By DEAN BAKER

The average hourly wage for production and nonsupervisory workers in leisure and hospitality grew at a 23.7 percent annual rate in the last three months compared with the prior three.

The August job gains were somewhat weaker than expected; although it is not clear that it should be viewed as a seriously negative report. The 235,000 figure is less than half of what most forecasters had been predicting, but it was still associated with a 0.2 percentage point drop in the unemployment rate to 5.2 percent. The unemployment rate had not fallen to 5.2 percent following the Great Recession until July of 2015. It is also important to note that in the prior two months jobs gains were revised up 134,000, bringing the three-month average to 750,000.

State and Local Government Lost 11,000 Jobs in August

The state and local sectors, which are still down 815,000 jobs from their pre-pandemic level, lost 11,000 jobs after adding 246,000 in July. This is likely a question of timing, with some jobs that would be added back in the fall showing up in July and some still to appear in September. It may be some time before state and local governments gain back all the jobs lost in the pandemic, but with most schools back to in-person instruction and most of these governments’ budgets in reasonably good shape, it seems likely most jobs will be coming back soon.

Restaurants Shed 41,500 Jobs in August

By far the biggest single factor in the slowdown from July to August was the loss of 41,500 restaurant jobs after a gain of 290,000 in July. There are several different factors at play in this. Clearly the spread of the Delta variant played a role, but that can be exaggerated. The arts and entertainment sector, which is also dependent on in-person gatherings, added 35,000 jobs in the month.

Restaurant owners have complained that they can’t find workers. They had been blaming the $300 unemployment insurance (UI) supplements, but with almost half the states ending their pandemic UI programs, this cannot be the explanation. But wages are rising very rapidly in the lowest paying sectors. Over the last year, the average hourly pay for production and nonsupervisory workers in leisure and hospitality has risen by 12.8 percent. In the last three months (June, July, and August) compared with the prior three months (March, April, and May), the average hourly wage in the sector has risen at a 23.7 percent annual rate.

These sorts of rapid wage gains are consistent with a story where employers really are unable to find workers. In some cases, employers may not be able to afford to offer higher wages. That will mean they will go out of business, but that is the way a healthy capitalist economy works, with workers moving from lower-paying, lower-productivity sectors to higher-paying, higher-productivity sectors.

Home Health Care and Nursing Homes Both Lose Workers in August

The home health care sector lost 11,600 jobs in August, while nursing homes lost 7,100 jobs. Both of these are among the lowest-paying sectors in the economy. The job loss is consistent with a story where workers feel they are in a position to turn down jobs with low pay and bad working conditions.

Share of Unemployment Due to Quits Fell to 9.9 Percent

The share of unemployment due to voluntary quits fell 0.9 percentage points to 9.9 percent, reversing the July increase. This goes in the opposite direction of a story where workers feel comfortable quitting a job without a new one lined up.

One factor keeping down the quit share of unemployment is the continued high share of long-term unemployed (more than 26 weeks). This fell slightly to 37.4 percent, but is still unusually high.

[Graph]

The Number of Unincorporated Self-Employed is More than 700,000 Above the 2019 Average

There was a small drop in the people reported as being unincorporated self-employed (more than 60 percent of the self-employed), but it is still more than 700,000 above the average for 2019. The monthly data are erratic, but seeing a high number month after month indicates that the rise in this category of self-employment (more than 7 percent) is real….

I said earlier that someone should post a link to the latest from Dean. Thanks for doing so.

tl/dr

i see more than a virus…..

https://www.nytimes.com/2021/09/03/opinion/covid-recession-austrian-school-hayek.html

September 3, 2021

Wonking Out: A very Austrian pandemic

By Paul Krugman

Remember Austrian economics? In the aftermath of the 2008 financial crisis, a number of conservatives rejected Keynesian economic prescriptions and claimed instead to be devotees of the Austrian School, especially Friedrich Hayek.

It’s questionable how many of these self-proclaimed “Austrians” actually knew what they were endorsing. In general, when right-wingers talk about intellectual history, you want to fire up your fact-checking. For example, Mark Levin of Fox News has a best-selling book claiming not just that the current American left is in the thrall of European Marxists but more specifically that they’re followers of Herbert Marcuse and the Frankfurt School — except that he keeps calling it the “Franklin School.”

And the idea that there was a titanic intellectual battle in the 1930s between Hayek and John Maynard Keynes is basically fan fiction; Hayek’s views on the Great Depression didn’t get much intellectual traction at the time, and his fame came later, with the publication of his 1944 political tract “The Road to Serfdom.”

Nonetheless, there was an identifiable Austrian analysis of the Depression, shared by Hayek and other economists, including Joseph Schumpeter. Where Keynes argued that the Depression was caused by a general shortfall in demand, Hayek and Schumpeter argued that we were looking at the inevitable difficulties of adjusting to the aftermath of a boom. In their view, excessive optimism had led to the allocation of too much labor and other resources to the production of investment goods, and a depression was just the economy’s way of getting those resources back where they belonged.

This view had logical problems: If transferring resources out of investment goods causes mass unemployment, why didn’t the same thing happen when resources were being transferred in and away from other industries? It was also clearly at odds with experience: During the Depression and, for that matter after the 2008 crisis, there was excess capacity and unemployment in just about every industry — not slack in some and shortages in others.

This time, however, is different. Although we aren’t hearing much about Austrian economics these days, the pandemic really did produce an Austrian-style reallocation shock, with demand for some things surging while demand for other things slumped. You can see this even at a macro level: There was a huge increase in purchases of durable goods even as services struggled. (Think people buying stationary bikes because they can’t go to the gym. Hey, I did.)

https://static01.nyt.com/images/2021/09/03/opinion/krugman030921_1/krugman030921_1-articleLarge.png

A very weird slump.

You can see it even more clearly in the details: Record vacancies in the market for office space, a crippling shortage of shipping containers.

So we’re finally having the kind of economic crisis that people like Hayek and Schumpeter wrongly believed we were having in the 1930s. Does this mean that we should follow the policy advice they gave back then?

No….

https://fred.stlouisfed.org/graph/?g=FMwl

January 15, 2020

Real Personal Consumption Expenditures for durable goods and services, 2020-2021

(Indexed to 2020)

https://www.nytimes.com/2021/09/05/us/politics/cryptocurrency-banking-regulation.html

September 5, 2021

Crypto’s Rapid Move Into Banking Elicits Alarm in Washington

The boom in companies offering cryptocurrency loans and high-yield deposit accounts is disrupting the banking industry and leaving regulators scrambling to catch up.

By Eric Lipton and Ephrat Livni

BlockFi, a fast-growing financial start-up whose headquarters in Jersey City are across the Hudson River from Wall Street, aspires to be the JPMorgan Chase of cryptocurrency.

It offers credit cards, loans and interest-generating accounts. But rather than dealing primarily in dollars, BlockFi operates in the rapidly expanding world of digital currencies, one of a new generation of institutions effectively creating an alternative banking system on the frontiers of technology.

“We are just at the beginning of this story,” said Flori Marquez, 30, a founder of BlockFi, which was created in 2017 and claims to have more than $10 billion in assets, 850 employees and more than 450,000 retail clients who can obtain loans in minutes, without credit checks….

https://www.nytimes.com/2021/09/02/opinion/corporate-taxes-biden-spending-bill.html

September 2, 2021

Corporate America Is Lobbying for Climate Disaster

By Paul Krugman

Why does Mickey Mouse want to destroy civilization?

OK, that’s probably not what Disney executives think they’re doing. But the Walt Disney Company, along with other corporate titans, including ExxonMobil and Pfizer, is reportedly gearing up to support a major lobbying effort against President Biden’s $3.5 trillion investment plan — a plan that may well be our last chance to take serious action against global warming before it becomes catastrophic.

To say what should be obvious, the dangers of climate change are no longer hypothetical. The extreme weather events we’ve recently seen around the globe — severe drought and forest fires in the American West; intensified hurricanes, catastrophic flooding in Europe; heat waves pushing temperatures in the Middle East above 120 degrees — are exactly the kinds of thing climate scientists warned us to expect as the planet warms.

And this is just the beginning of the nightmare — the leading edge of a wave of disasters, and a harbinger of the crisis heading our way if we don’t act quickly and forcefully to limit greenhouse gas emissions.

What can be done to avoid catastrophe? Many economists favor broad-based incentives to limit emissions, such as a carbon tax. There’s an interesting, serious economic debate over whether that’s really the best policy, or at any rate whether emissions taxes would be a sufficient policy on their own. As a practical matter, however, that debate is moot: Carbon taxes, or anything like them, won’t be politically feasible any time soon.

What might be politically feasible — just — is a set of more targeted measures, in particular an effort to decarbonize electricity generation. Generation is, in economic terms, a relatively soft target, because near-miraculous declines in the cost of renewable energy mean that we already have the technology needed to move away from fossil fuels fairly cheaply. And electricity generation isn’t just directly responsible for about a quarter of U.S. greenhouse gas emissions; if electricity becomes a clean power source, that would open the door to large reductions in emissions from vehicles, buildings and industry via widespread electrification.

The good news is that Biden’s proposals would provide a big push toward decarbonization. As the climate journalist David Roberts points out, there are two major climate-related elements in these proposals: a set of fines and subsidies that would give power companies strong incentives to stop burning fossil fuels, and expanded tax credits for various forms of clean energy. These policies would fill only part of environmentalists’ wish lists, but they would be a very big deal.

The bad news is that if these proposals aren’t enacted, it will probably be a very long time — quite possibly a decade or more — before we get another chance at significant climate policy.

Let’s face it: There’s a good chance that Republicans will control one or both houses of Congress after the midterm elections. And at this point climate denialism has a deathlike grip on the G.O.P. — a grip unlikely to loosen until complete catastrophe is upon us, and maybe not even then. Look at the way anti-mask-mandate, anti-vaccine-mandate Republican governors are doubling down in the face of soaring Covid-19 hospitalizations and deaths.

So the Democratic reconciliation bill that will either succeed or fail in the next few weeks may well be, in effect, our last chance to do something meaningful to limit climate change.

Why, then, is corporate America mobilizing against the bill? Because Democrats are proposing to offset new spending partly with higher taxes on corporate profits, and to a lesser extent by using the government’s bargaining power to negotiate lower prices for prescription drugs. This approach is necessary as a political matter: If taxes must be raised, the public wants to see them raised on corporations. But corporations, not surprisingly, don’t want to pay.

So corporate opposition to the Biden plan is understandable. It’s also unforgivable….

http://umich.edu/~thecore/doc/Friedman.pdf

September 13, 1970

The Social Responsibility of Business is to Increase its Profits

By Milton Friedman – New York Times

When I hear businessmen speak eloquently about the “social responsibilities of business in a free-enterprise system,” I am reminded of the wonderful line about the Frenchman who discovered at the age of 70 that he had been speaking prose all his life. The businessmen believe that they are defending free enterprise when they declaim that business is not concerned “merely” with profit but also with promoting desirable “social” ends; that business has a “social conscience” and takes seriously its responsibilities for providing employment, eliminating discrimination, avoiding pollution and whatever else may be the catchwords of the contemporary crop of reformers. In fact they are–or would be if they or anyone else took them seriously–preaching pure and unadulterated socialism. Businessmen who talk this way are unwitting puppets of the intellectual forces that have been undermining the basis of a free society these past decades.

The discussions of the “social responsibilities of business” are notable for their analytical looseness and lack of rigor. What does it mean to say that “business” has responsibilities? Only people can have responsibilities. A corporation is an artificial person and in this sense may have artificial responsibilities, but “business” as a whole cannot be said to have responsibilities, even in this vague sense. The first step toward clarity in examining the doctrine of the social responsibility of business is to ask precisely what it implies for whom.

Presumably, the individuals who are to be responsible are businessmen, which means individual proprietors or corporate executives. Most of the discussion of social responsibility is directed at corporations, so in what follows I shall mostly neglect the individual proprietors and speak of corporate executives.

In a free-enterprise, private-property system, a corporate executive is an employee of the owners of the business. He has direct responsibility to his employers. That responsibility is to conduct the business in accordance with their desires, which generally will be to make as much money as possible while conforming to the basic rules of the society, both those embodied in law and those embodied in ethical custom. Of course, in some cases his employers may have a different objective. A group of persons might establish a corporation for an eleemosynary purpose–for example, a hospital or a school. The manager of such a corporation will not have money profit as his objective but the rendering of certain services.

In either case, the key point is that, in his capacity as a corporate executive, the manager is the agent of the individuals who own the corporation or establish the eleemosynary institution, and his primary responsibility is to them.

Needless to say, this does not mean that it is easy to judge how well he is performing his task. But at least the criterion of performance is straightforward, and the persons among whom a voluntary contractual arrangement exists are clearly defined….

https://news.cgtn.com/news/2021-09-05/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13iJR9u8IBq/index.html

September 5, 2021

Chinese mainland reports 28 new COVID-19 cases

The Chinese mainland recorded 28 new confirmed COVID-19 cases on Saturday, all from overseas, the latest data from the National Health Commission showed on Sunday.

In addition, 23 new asymptomatic cases were recorded, while 421 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 95,010, with the death toll unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-09-05/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13iJR9u8IBq/img/f72810f652d74732992cc5b2068d7ec7/f72810f652d74732992cc5b2068d7ec7.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-09-05/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13iJR9u8IBq/img/fb191376446d49479cb63dba5dab6881/fb191376446d49479cb63dba5dab6881.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-09-05/Chinese-mainland-reports-28-new-confirmed-COVID-19-cases-13iJR9u8IBq/img/cc8a866bcd8a4cf9883f07749c9660c0/cc8a866bcd8a4cf9883f07749c9660c0.jpeg

http://www.news.cn/english/2021-09/05/c_1310169422.htm

September 5, 2021

Over 2.1 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 2.1 billion doses of COVID-19 vaccines had been administered in China as of Saturday, data from the National Health Commission showed Sunday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 2.1 billion doses of Chinese vaccines administered domestically, another 990 million doses have been distributed to 105 countries internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

September 5, 2021

Coronavirus

United Kingdom

Cases ( 6,978,126)

Deaths ( 133,229)

Deaths per million ( 1,950)

China

Cases ( 95,010)

Deaths ( 4,636)

Deaths per million ( 3)