From Marketplace yesterday, “The debt ceiling explained” (Dylan Miettinen):

To default, however, would be “seriously damaging,” Irving said. The U.S. Treasury website prefers the term “catastrophic,” saying that if the U.S. did in fact default on its obligations, it would precipitate a financial crisis.

“In concrete terms, you could see the price or the valuation of U.S. Treasury debt going down, which is the same as saying interest rates are going to rise for U.S. government borrowing. What that’s going to do is it’s going to tend to blow up our deficit faster than it otherwise would,” said Menzie Chinn, a professor of public affairs and economics at the University of Wisconsin – Madison.

Its impact on everyday life would be felt immediately, Chinn said. For example, if the government is unable to pay its bills, that would mean it would be unable to make payments to those who work in the military, federal government workers or those who depend on Social Security. Food assistance benefits could be stopped for millions of Americans, too.

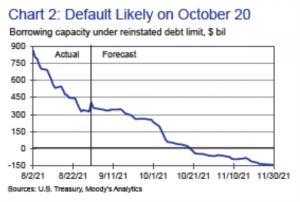

Zandi and Yaros and Moody’s Analytics have a report outlining some of the damages to the US economy if the US defaulted to any significant degree (a two week delay in payments induces a 4% peak to trough decline in GDP (GDP would contract for 2 quarters before starting to grow again), and 6 million jobs lost.

Two figures from the report are useful for evaluating the timing, and impact.

Figure 3 shows how Treasury yields rose as the last crisis unfolded. The yields reverted back to pre-crisis levels fairly quickly then, but Zandi and Yaros note:

…a 1979 episode when Treasury inadvertently missed payments on Treasury bills maturing that spring. The mishap was caused in part by fallout from a delay in raising the debt limit, but also by problems with word processing equipment the Treasury used at the time to pay investors. Even though investors received their payments with only a small delay, T-bill yields initially jumped by 60 basis points and remained elevated for several months thereafter. The cost to taxpayers was ultimately in the tens of billions of dollars.

What are the implications just for debt accumulation? Here is what I wrote back when we had the last round of contentious debt ceiling negotiations (Democratic President, Republican Congressional opposition, January 2013):

It is one of the oddities of current discourse in macroeconomic policy that there are concerns about the short term sustainability of the Federal government’s abilities to finance debt, despite the fact that the on the run ten year TIPS (maturing 1/15/2022) is -0.760% (1/11/13). I do believe there is reason for concern in the long term. However, should we encounter difficulties in raising the debt ceiling, the timetable could be greatly accelerated. To see this, consider the following expression:

(1) it10y = (it + Etit+1 + … + Etit+9)/10 + lpt10y + rpt10y

The long term nominal interest rate is the average of expected short term interest rates (the expectations hypothesis of the term structure), plus the term premium associated with liquidity effects [and inflation premium] (lp), and a premium associated with sovereign risk (rp). In general, for US Treasurys, we suppress the last term. But it is the last term that is relevant in the current debate; if the failure to resolve the debt ceiling manifests itself in a higher rp, then debt dynamics can become more problematic. To see this, consider this expression.

(2) dt-dt-1 = [(rt-gt)/(1+gt)]× dt-1 – pt

Where d is the debt to GDP ratio, r is the real (inflation adjusted) interest rate, g is the growth rate of real GDP, and p is the primary (noninterest) surplus to GDP ratio. In words, the debt to GDP ratio rises when the real interest rate-growth rate gap is sufficiently positive, or the primary deficit is sufficiently large. Notice that if the risk premium associated with a debt ceiling impasse rises, then ceteris paribus, the real interest rate rises, thereby accelerating the pace of debt accumulation. Moreover, if the debt crisis raises uncertainty that depresses growth, then that too accelerates the pace of debt accumulation (measured as a share of GDP). The logical conclusion: in ostensibly seeking to avert a debt crisis, certain parties could increase the likelihood of a debt crisis, or at least move it forward in time.

Let’s now examine the various channels by which a refusal to raise the debt ceiling could trigger an acceleration toward a debt crisis.

What Would Be the Domestic Financial Implications?

Since the US government has never defaulted, it is unclear what would happen. We have experience from the last time the intransigence drove us to the brink of default. From the Government Accountability Office’s (GAO’s) assessment of the 2011 event:

”Our results indicate that the 2011 debt limit event period led to a premium (which is represented by a decrease in the yield spread) ranging from 11 to 33 basis points on Treasury securities with maturities of 2 or more years. For 3-month and 6-month Treasury bills and cash management bills, which typically had a maturity of 56 days, the debt limit event period led to a 1 basis point decline in Treasury yields relative to private security yields during the period (which is represented by an increase in the yield spread), while there was no change in yields on 1-month and 1-year Treasury bills relative to private security yields. Overall, Treasury yields increased relative to comparable-maturity private securities during the 2011 debt limit event period.”

The GAO’s assessment of the public finance implications of this event are as follows:

On the basis of our analysis, we estimated that delays in raising the debt limit in 2011 led to an increase in Treasury’s borrowing costs of about $1.3 billion in fiscal year 2011. We derived this estimate by multiplying the amount of Treasury securities issued at each maturity during the event period by regression-based estimates of the relevant yield spread change attributable to the debt limit event and weighting the result by the portion of fiscal year 2011 during which the security was outstanding. Many of the Treasury securities issued during the 2011 debt limit event will remain outstanding for years to come. Accordingly, the multiyear increase in borrowing costs arising from the event is greater than the additional borrowing costs during fiscal year 2011 alone.

…

Macro Implications for the US

GAO indicates that interest rates would rise in the wake of an event where we come close to defaulting. What happens if the USG stops paying vendors is unknown, although it would seem reasonable to conclude the impact on yields would be noticeably higher than that experienced in 2011 (so rp rises in equation (1)). Ceteris paribus, r in equation (2) rises, accelerating the rate of debt-to-GDP increases.

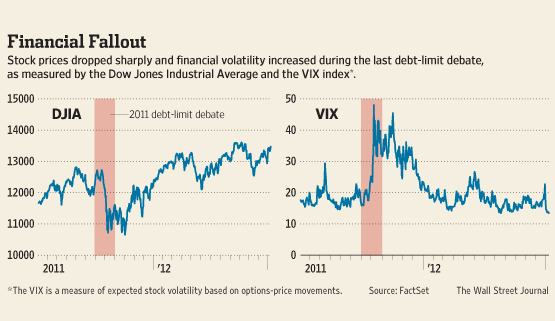

To the extent that rates are higher, it would not be surprising that other asset prices (including stock prices) decline precipitously. Uncertainty itself would depress stock prices as well, if it led to higher equity risk premia (I think that a highly uncontroversial conjecture). The WSJ documents the movements in the SP500 and VIX in 2011.

Figure 3: Source: Paletta and Hilsenrath, “Ugly Choices Loom over Debt Ceiling,” WSJ, 14 January 2013.

Further, many commentators have argued that uncertainty depresses output, as discussed previously. Baker, Bloom and Davis (2013) have attempted to measure economic policy uncertainty and the impacts on economic output. Figure 4 depicts the evolution of the Baker-Bloom-Davis index:

Figure 4: Economic Policy Uncertainty index (new version). NBER defined recession dates shaded gray. Source: Baker, Bloom and Davis, at Policy Uncertainty, accessed 1/12/2013.

Notice the spike at 11/08; that spike is associated with going to, but not over, the precipice. Baker, Bloom and Davis (2013) estimate that a 112 point innovation in the index leads to a 2.3% reduction in GDP after 4 quarters (peak response). The jump in uncertainty associated with the previous debt ceiling impasse was about 120 basis points (bps) (which is not quite the same as an “innovation”, but I’m pretty certain the difference is inessential in this calculation). Suppose for instance we have a default which pushes the index up 240 bps, so a back of the envelope calculation, assuming a similar elevation of uncertainty, suggests a 4.6% reduction in GDP after 4 quarters.

(I find it one of those supreme ironies that those who argue uncertainty impedes growth are often the ones that hold positions that would increase uncertainty.)

Now, consider equation (2). Notice that g enters into the calculations. The slower GDP growth, the faster the rate debt-to-GDP rises. Hence, a debt ceiling crisis which is not resolved, or is acrimoniously resolved with only minimal impact on the deficit, might very well exacerbate debt issues.

Isn’t Default Inevitable? Why Not Get It over With?

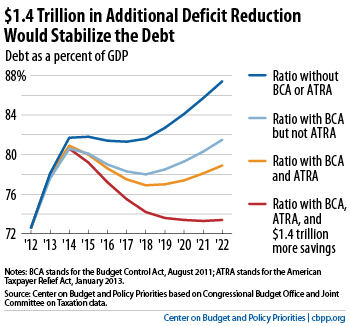

The oddity of the ongoing debate is the pervasive misconception that the US is fast becoming Greece. In addition to the obvious fact that the US borrows in dollars (i.e., in its own currency), and conducts its own monetary policy, the amount of fiscal restraint (spending cuts and tax revenue increases) is not sufficiently large so as to resort to desperate measures now. As the Center for Budget and Policy Priorities has observed, $1.4 trillion is sufficient to stabilize the debt-to-GDP ratio over the next ten years ($1.2 trillion reduction in the primary budget deficit).

Figure 5: Source: CBPP.

The question policymakers need to ask themselves is whether it is necessary to chance a self-inflicted wound in order to try to balance the budget via spending cuts.

See also Klein and CFR for discussion.

Global Financial Implications

Note that the previously cited financial impacts are based upon cases where we have come close to, but not actually, defaulted. If one were to contemplate what would actually happen, my answer would be “who knows?”.

That is because a default on US debt has ramifications above and beyond those that would occur for a default on debt issued by other sovereigns. Treasurys by far account for the largest single market for sovereign debt (in a convertible currency). A large number of other asset prices are linked to Treasurys either directly or indirectly (e.g., as benchmarks in derivative prices). As Steven Englander from Citi has noted (via Wiesenthal/BI):

So it is possible that we will get a technical default for a few days, but more likely that Congress will give in, vote the debt ceiling up temporarily, and let the automatic sequesters kick in. Mounting risk of a technical default was USD positive in 2011 because it led to cutting of long-risk positions and the USD/Treasury market remained safe havens. However, it also occurred in an environment of slowing EM growth and intensifying euro zone sovereign risk pressure, so the USD support came from external forces as well. Given that investors are now somewhat long risk again, the position cutting is again likely to be USD positive, however, unattractive US assets were. As was the case in 2011, it is very unlikely that the Treasury will not pay its bills, although even a technical default could have very unforeseen consequences, given the multiple functions that Treasuries play in global financial markets. The more likely scenario of sequester plus grudging debt ceiling rise is USD negative. It will put more pressure on the Fed to keep pumping liquidity into the US economy without giving any reassurance to investors that long-term fiscal issues are close to resolution.

[emphasis added — MDC]

My worry is that the consequences of throwing sand (or boulders) into the wheels of global finance are insufficiently comprehended in by some of our policymakers in key veto positions within the legislative branch. Those who have faith that actors in the financial system can mitigate any damage arising from technical default by means of careful positioning and hedging should remember back to September 2008, when it was believed the financial institutions were prepared for the bankruptcy of a relatively small investment bank.

Today, the 10 year Treasury yield is 1.47%, and the corresponding TIPS yield is -0.87. With these rates, we still have some considerable fiscal space. Now’s not the time to unnecessarily push up these rates.

You worked hard on all this information and excellent commentary but please correct the close:

“Today, the 10 year Treasury yield is -1.47%, and the corresponding TIPS yield is -0.87. With these rates, we still have some considerable fiscal space. Now’s not the time to unnecessarily push up these rates.”

Of course nominal rates are positive 1.47% which with expected inflation where it is means a real rate equal to negative 0.87%. The rest of the close is spot on.

pgl: Oops, fixed now. Thanks!

I’m trying to think of a real world analogy to being stupid enough to default on the credit cards when the family is financially well off. Let’s consider some couple on the Uppity East Side living on 5th Avenue just south of Central Park. We will call them Donald and Ivanka and pretend it is the roaring late 80’s. Plenty of income, loads of good credit, life is good.

But wait Ivanka catches Donald banging some girl named Marla and files for divorce. All hell breaks out. So Donald decided to not pay the bills so the grumpy wife and whiny kids cannot even buy groceries. I wonder what ever happened to this cheating fool?

Never heard of him. Native Georgian??

PGL scores an own goal again! “But wait Ivanka catches Donald banging some girl named Marla and files for divorce. All hell breaks out. So Donald decided to not pay the bills so the grumpy wife and whiny kids cannot even buy groceries. I wonder what ever happened to this cheating fool?” Ivanka, their daughter, was only 8 at the time, and probably didn’t have a credit card in the early 90s. Ivana, the mother and Donald’s wife, got $650,000/year in child support for 3 kids, ~$14M settlement, a Greenwich, Connecticut mansion, an apartment in Trump Plaza and use of the Mar-a-Lago mansion in Florida for one month out of the year.

Only in PGL’s hate filled world is a ” a real world analogy” so stupid and so wrong to totally miss the point.

Ivana. Ivanka. Trump did tell Howard Stern he has the hots for his own daughter. Thanks for the reminder CoRev.

In Georgia circles it’s probably not uncommon for women to marry their father as a minor, that’s probably pgl’s main confusion. Heck, it may even be “a New York thing” pgl has latched onto to fit in with “the locals”.

Although, this is even bad by pgl’s “standards” as he made the same mistake twice in the same comment, so it’s hard to label it a “typo”. Maybe pgl is drawing from his “feminist” predisposition when he writes these things. It has to be that.

The initial sociological research has unveiled an alarming Manhattan trend here.

https://people.com/movies/mia-farrow-encouraged-woody-allen-to-bond-with-daughter-soon-yi-previn/

There are two broad types of harm assessed here and in qouted articles – direct harm which can be estimated with reasonable accuracy, and indirect harm which is much harder to estimate. The second type is, I suspect, the greater problem. Moody’s raises it:

Some-time in mid-October, there would likely be a TARP moment, hearkening back to that dark day in autumn 2008 when Congress initially failed to pass the Troubled Asset Relief Program, and the stock market and other financial markets cratered. A similar crisis, characterized by spiking interest rates and plunging equity prices, would be ignited. Short-term funding markets, which are essential to the flow of credit that helps finance the economy’s day-to-day activities, likely would shut down as well. The economic recovery would quickly be in jeopardy.

“In jeapordy”? That’s how you use understatement , boys and girls. Default would change the risk profile of every asset portfolio in the whole big world. It would change the value of collateral in ways that would be difficult and perhaps impossible to calculate in a timely manner. These problems may sound small relative to people not being paid the wages owed them, but these are powerful mechanisms of financial contagion. As ever, Mcconnell is willing to let the world burn if he gains political advantage.

And by the way, “technical default” is default. The adjective is superfluous. I’m not sure Newt Gingich coined the term, but he and his goons dragged it into our political parlance to suggest that default would be good for us because…well, because the threat might give them leverage. Just like Mcconnell. Technical default is default.

As to this: “The oddity of the ongoing debate is the pervasive misconception that the US is fast becoming Greece.

Kalecki identified the real problem decades ago: “…obstinate ignorance is usually a manifestation of underlying political motives.”

One difference between the TARP episode and default – there was a second vote on TARP and we continued on our rocky way. You can make up lost payments on Treasuries, but you can’t undefault them. The foundational safe asset would not be safe any more.

@ macroduck

Professor Chinn astutely and wisely says “My worry is that the consequences of throwing sand (or boulders) into the wheels of global finance are insufficiently comprehended in by some of our policymakers in key veto positions within the legislative branch.”

Or as commenter “Not Trampis’ ” fellow countrymen are known to sometimes say: “Some people have to piss on the electric fence to find out for themselves.”

The debt limit simply should be ended, period. Somehow this idea is greeted with horror by so many politicians, but no other nation has anything like it. Some have variations, but not like ours with specific numbers that must keep being raised by legislation.

As it is, it looks like the GOP really wants to tank the economy. They figure they can get away with doing it and blame the outcome on Biden and the Dems. Really.

As I said before, Schumer blundered by not putting the debt ceiling increase into the Reconciliation package and somehow thinking he could guilt trip McConnell and trhe GOP into being reasonable and responsible. Big mistake.

no one worried about ‘harms’ in march 2020….

why worry about it now?

and the terms reasonable and responsible are nothing i would ascribe to any democrat hiding behind the security fences and militarized capitol police up on the ‘hill’.

paddy,

Once again you seem to want to make our Moses look like Mr. Sober here. What on earth Dems “hiding behind security forces” on the Hill has to do with the threat of a default on US securities being brought about by an irresponsible GOP refusal to raise the debt ceiling is totally unclear. There is the problem I have noted repeatedly now of Schumer having blundered by letting them have that power when they have clearly become utterly irresponsible on this, which is another matter, even if your rival for lack of sobriety somehow thinks it is Nancy Pelosi who runs the Dems in the Senate.

Do please note that when Trump was prez, the Dems went along with several (three? not sure quite how many) debt ceiling increases engendered by his deficit enhancing tax cuts without even a whisper of a fuss. That was a throwback to the responsible conduct that was standard decades ago, in contrast to what MeConnell et al seem to be up to now, which is to tank the US economy with the expectation that the US public is so stupid they will not realize that it was the GOP that did it and punish Biden and the Dems for it and return the GOP to power.

That be good sh*t you smoke’n.

Although I don’t pretend to grasp every part of the equations (yet), I LOVE LOVE LOVE LOVE LOVE these types of posts. And I greatly appreciate the Zandi link as well. Great post Menzie, although there a lot to unpack and digest here still for me, great post. Outstanding. Thanks for the time/work involved here on this blog post.

Maybe I missed it – but it always seems like the most obvious solution to the problem – never gets discussed much: tax increase – I would prefer an increase on the top 10%. But, frankly, even at my modest working class income level – I would not mind a few dollars more in federal taxes. (Stands back – as all the old oligarchs and media villagers have a fainting spell.) Also I have always liked the idea of a tax on stock transactions. Have no idea how that works – but wouldn’t that make people more careful in their stock trading? Also – why do people still think of the GOP as the party of business/helping the economy? After suffering through two recessions caused by the GOP in my working career and constantly being concerned that the U.S. will default on its obligations since Newt Gingrich – the GOP brand does not say pro-business to me. Thanks for allowing me to comment and – thanks as always Menzie for excellent post.

james,

A tax increase is temporaty and always haed in the US Congress, with the GOP pretty much always hysterically opposing any and all. So not at all simple.

The clear and permanent solution is to simply join the rest of the world and permanenty abolish the bloody debt ceiling, but somehow the politicians seem to be too scared to do it and chase after all these other half-baked temporary fixes. Of course in the further past, prior to the early 90s, it was never a problem as both parties went along with routinely raising the ceiling, with at worst some mild grumbling if the other party was in the White House. But now all that is gone and we have full dyscuionality coming from the GOP. Time to just put a permanent end to this.

No I think James is right here. We do need to raise revenues to cover spending eventually. The question becomes do we follow the McConnell route and tax the little guy or do we have a little common sense and tax the ultrawealthy. We know where Greg Mankiw stands – raise sales taxes on the little guy to pay for eliminating any taxes on capital income.

But, pgl, there is this immediate problem of the debt ceiling. A failure to either raise it or eliminate it might tank not only the Us but the world economy. The question of ultimately paying for our spending is not exactly immediately pressing. If it was, we would see real interest rates soaring, and they are not exactly.

I am still a fan of the $1 trillion coin to be minted by the government and sold to the Fed. That would once and for all get rid of the absurdity of the whole concept. I think the GOP has moved from the “lets use the debt sealing to blackmail the democratic president to a “lets use the default to show how incompetent the democratic president is” tactic.