The debt ceiling and implications of:

”We Republicans need to be willing to tolerate a temporary, partial government shutdown.”

and more recently

It is one of the oddities of current discourse in macroeconomic policy that there are concerns about the short term sustainability of the Federal government’s abilities to finance debt, despite the fact that the on the run ten year TIPS (maturing 1/15/2022) is -0.760% (1/11/13). I do believe there is reason for concern in the long term. However, should we encounter difficulties in raising the debt ceiling, the timetable could be greatly accelerated. To see this, consider the following expression:

(1) it10y = (it + Etit+1 + … + Etit+9)/10 + lpt10y + rpt10y

The long term nominal interest rate is the average of expected short term interest rates (the expectations hypothesis of the term structure), plus the term premium associated with liquidity effects (lp), and a premium associated with sovereign risk (rp). In general, for US Treasurys, we suppress the last term. But it is the last term that is relevant in the current debate; if the failure to resolve the debt ceiling manifests itself in a higher rp, then debt dynamics can become more problematic. To see this, consider this expression.

(2) dt-dt-1 = [(rt-gt)/(1+gt)]× dt-1 – pt

Where d is the debt to GDP ratio, r is the real (inflation adjusted) interest rate, g is the growth rate of real GDP, and p is the primary (noninterest) surplus to GDP ratio. In words, the debt to GDP ratio rises when the real interest rate-growth rate gap is sufficiently positive, or the primary deficit is sufficiently large. Notice that if the risk premium associated with a debt ceiling impasse rises, then ceteris paribus, the real interest rate rises, thereby accelerating the pace of debt accumulation. Moreover, if the debt crisis raises uncertainty that depresses growth, then that too accelerates the pace of debt accumulation (measured as a share of GDP). The logical conclusion: in ostensibly seeking to avert a debt crisis, certain parties could increase the likelihood of a debt crisis, or at least move it forward in time.

Let’s now examine the various channels by which a refusal to raise the debt ceiling could trigger an acceleration toward a debt crisis.

How Likely Are We to Default, and When?

The Bipartisan Policy Center has compiled data to make a guesstimate of the date at which the Treasury’s extraordinary measures will be exhausted. The resulting calculations are depicted below:

Figure 1: Bipartisan Policy Center, Debt Limit Analysis (January 2013).

Now what happens once extraordinary measures are exhausted? Then expenditures will be limited to daily revenue and cash on hand. Once those funds are exhausted, the Treasury according to BPC will default on financial obligations. The call for partial government shutdown, say paying our soldiers but not vendors, does not appear feasible.

First, the legal precedents for such an option –- that is to prioritize spending –- are unknown. [1], pp.8-9 Second, it is unclear whether it is technically feasible to do so, given Treasury’s computer systems (it is conceivable that debt payments could be prioritized over nondebt payments [2]). Hence, a partial shutdown, sparing essential services such as defense (or air traffic control, for those of us who fly a lot), would seem to face some obstacles. Here is BPC’s tabulation of the situation that would confront the USG on 2/15/2013:

Figure 2: Bipartisan Policy Center, Debt Limit Analysis (January 2013).

The astute observer will note that on this particular day, the $30 billion outflow for interest payments alone exceeds the $9 billion in revenue. Hence, regardless of the technical feasibility of prioritizing payments (it is unclear how the policymaker quoted above would like payments to be prioritized), on a day like this day, then, the USG would seem to be technically in default on US debt (not paying other creditors would also be default, just not a debt default). This is the logical implication of not raising the debt ceiling.

What Would Be the Domestic Financial Implications?

Since the US government has never defaulted, it is unclear what would happen. We have experience from the last time the intransigence drove us to the brink of default. From the Government Accountability Office’s (GAO’s) assessment of the 2011 event:

”Our results indicate that the 2011 debt limit event period led to a premium (which is represented by a decrease in the yield spread) ranging from 11 to 33 basis points on Treasury securities with maturities of 2 or more years. For 3-month and 6-month Treasury bills and cash management bills, which typically had a maturity of 56 days, the debt limit event period led to a 1 basis point decline in Treasury yields relative to private security yields during the period (which is represented by an increase in the yield spread), while there was no change in yields on 1-month and 1-year Treasury bills relative to private security yields. Overall, Treasury yields increased relative to comparable-maturity private securities during the 2011 debt limit event period.”

The GAO’s assessment of the public finance implications of this event are as follows:

On the basis of our analysis, we estimated that delays in raising the debt limit in 2011 led to an increase in Treasury’s borrowing costs of about $1.3 billion in fiscal year 2011. We derived this estimate by multiplying the amount of Treasury securities issued at each maturity during the event period by regression-based estimates of the relevant yield spread change attributable to the debt limit event and weighting the result by the portion of fiscal year 2011 during which the security was outstanding. Many of the Treasury securities issued during the 2011 debt limit event will remain outstanding for years to come. Accordingly, the multiyear increase in borrowing costs arising from the event is greater than the additional borrowing costs during fiscal year 2011 alone.

Macro Implications for the US

GAO indicates that interest rates would rise in the wake of an event where we come close to defaulting. What happens if the USG stops paying vendors is unknown, although it would seem reasonable to conclude the impact on yields would be noticeably higher than that experienced in 2011 (so rp rises in equation (1)). Ceteris paribus, r in equation (2) rises, accelerating the rate of debt-to-GDP increases.

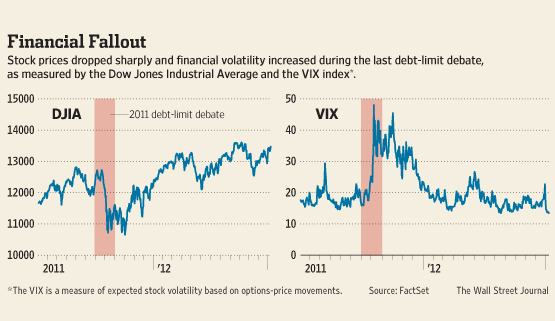

To the extent that rates are higher, it would not be surprising that other asset prices (including stock prices) decline precipitously. Uncertainty itself would depress stock prices as well, if it led to higher equity risk premia (I think that a highly uncontroversial conjecture). The WSJ documents the movements in the SP500 and VIX in 2011.

Figure 3: Source: Paletta and Hilsenrath, “Ugly Choices Loom over Debt Ceiling,” WSJ, 14 January 2013.

Further, many commentators have argued that uncertainty depresses output, as discussed previously. Baker, Bloom and Davis (2013) have attempted to measure economic policy uncertainty and the impacts on economic output. Figure 4 depicts the evolution of the Baker-Bloom-Davis index:

Figure 4: Economic Policy Uncertainty index (new version). NBER defined recession dates shaded gray. Source: Baker, Bloom and Davis, at Policy Uncertainty, accessed 1/12/2013.

Notice the spike at 11/08; that spike is associated with going to, but not over, the precipice. Baker, Bloom and Davis (2013) estimate that a 112 point innovation in the index leads to a 2.3% reduction in GDP after 4 quarters (peak response). The jump in uncertainty associated with the previous debt ceiling impasse was about 120 basis points (bps) (which is not quite the same as an “innovation”, but I’m pretty certain the difference is inessential in this calculation). Suppose for instance we have a default which pushes the index up 240 bps, so a back of the envelope calculation, assuming a similar elevation of uncertainty, suggests a 4.6% reduction in GDP after 4 quarters.

(I find it one of those supreme ironies that those who argue uncertainty impedes growth are often the ones that hold positions that would increase uncertainty.)

Now, consider equation (2). Notice that g enters into the calculations. The slower GDP growth, the faster the rate debt-to-GDP rises. Hence, a debt ceiling crisis which is not resolved, or is acrimoniously resolved with only minimal impact on the deficit, might very well exacerbate debt issues.

Isn’t Default Inevitable? Why Not Get It over With?

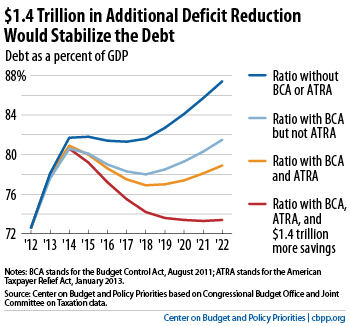

The oddity of the ongoing debate is the pervasive misconception that the US is fast becoming Greece. In addition to the obvious fact that the US borrows in dollars (i.e., in its own currency), and conducts its own monetary policy, the amount of fiscal restraint (spending cuts and tax revenue increases) is not sufficiently large so as to resort to desperate measures now. As the Center for Budget and Policy Priorities has observed, $1.4 trillion is sufficient to stabilize the debt-to-GDP ratio over the next ten years ($1.2 trillion reduction in the primary budget deficit).

Figure 5: Source: CBPP.

The question policymakers need to ask themselves is whether it is necessary to chance a self-inflicted wound in order to try to balance the budget via spending cuts.

See also Klein and CFR for discussion.

Global Financial Implications

Note that the previously cited financial impacts are based upon cases where we have come close to, but not actually, defaulted. If one were to contemplate what would actually happen, my answer would be “who knows?”.

That is because a default on US debt has ramifications above and beyond those that would occur for a default on debt issued by other sovereigns. Treasurys by far account for the largest single market for sovereign debt (in a convertible currency). A large number of other asset prices are linked to Treasurys either directly or indirectly (e.g., as benchmarks in derivative prices). As Steven Englander from Citi has noted (via Wiesenthal/BI):

So it is possible that we will get a technical default for a few days, but more likely that Congress will give in, vote the debt ceiling up temporarily, and let the automatic sequesters kick in. Mounting risk of a technical default was USD positive in 2011 because it led to cutting of long-risk positions and the USD/Treasury market remained safe havens. However, it also occurred in an environment of slowing EM growth and intensifying euro zone sovereign risk pressure, so the USD support came from external forces as well. Given that investors are now somewhat long risk again, the position cutting is again likely to be USD positive, however, unattractive US assets were. As was the case in 2011, it is very unlikely that the Treasury will not pay its bills, although even a technical default could have very unforeseen consequences, given the multiple functions that Treasuries play in global financial markets. The more likely scenario of sequester plus grudging debt ceiling rise is USD negative. It will put more pressure on the Fed to keep pumping liquidity into the US economy without giving any reassurance to investors that long-term fiscal issues are close to resolution.

[emphasis added — MDC]

My worry is that the consequences of throwing sand (or bolders) into the wheels of global finance are insufficiently comprehended in by some of our policymakers in key veto positions within the legislative branch. Those who have faith that actors in the financial system can mitigate any damage arising from technical default by means of careful positioning and hedging should remember back to September 2008, when it was believed the financial institutions were prepared for the bankruptcy of a relatively small investment bank.

Update, 9:35AM Pacific, 1/16: Jeff Frankel provides some views on the debt ceiling debate and possible remedies.

Read about Toomey:

“Toomey disagreed with Obama’s argument that the debt ceiling is about paying past debts.

“It’s to enable him to engage in the future spending that he wants,” he said.”

One would expect him to understand what the Constitution says.

The president proposes and congress disposes. What a tool.

I just reviewed my retirement allocation and realized that I was overweighted in equities after a very good 2012. Looking for fixed income alternatives I considered investment quality bonds, TIPS and money market funds. I was initially surprised by the negative real yield on TIPS, but it made sense because of the fear of inflation, rather than a prediction of inflation. When you are looking for inflation protection, aside from investing in real property or equities, where else to go? I put some in TIPS and some in short duration (2.4 years) investment grade bonds.

I am skeptical of inflation “predictions” based on the spread between TIPS and corresponding nominal bonds. Generally people expect current conditions to continue and do not predict a sudden change in inflation. It’s been a while since our last bout with inflation, but on the way up and down, it caught most by surprise.

Rich Berger: OK. Welcome to the anti-efficient markets hypothesis gang. I take it you believe in adaptive expectations? Recursive (least squares) learning? Either is okay with me (I’m agnostic, and not particularly wedded to any given approach), but I am curious how you make judgments based on data.

The budget is authorized each year. If the Democrats do not submit a budget then the Republicans should fund only essential services and let the other services do without. There is no obligation to fund all the employees in the Commerce Department, Department of Education, Department of Energy, HHS. We could easily defund the EEC and not feel a thing.

Rather than funding all of the spending that the President commits to the Republicans should only fund spending that is essential: interest on the debt, committed contracts to suppliers, wages to defense. Rather than a massive continuing resolution the House should specifically fund essential services.

The rest of the government should be shut down until we begin to get our spending under control.

Note, the House could do this even if they extend the debt ceiling.

So, Friday, Feb. 13th, with a $43 bn deficit is an indicative day?

There are 20 workdays in February. Does that imply a monthly deficit of $860 bn?

Is there some clarification you’d like to make about the nature of that day?

There are costs and risks from the default. There are also future gains from having the Republicans think twice about playing these cards again, even on other issues.

The opposition could just point to the republicans and say “There they go again… the republicans are putting us at risk once again just like in the default.”

Ricardo: Excellent proposal. And if services should be cut (say that morphine drip) for a Medicare patient, so be it! Clearly it’s inessential. I have also wondered if air traffic control can be self-organized. Why can’t pilots just look out the window, check the radars, and see if the runways are clear? Looking forward to the natural experiment the Ricardo-world would present.

Steve Kopits: Actually, the date I examined is Friday, February (corrected from Jan to Feb, 4:40pm) 15. Other days are illustrated in the presentation, should you care to click through (sometimes I wonder why I bother adding the URLs and documentation). The point that I wished to highlight is that there are some days in which prioritization, even if feasible, would not prevent debt default. I hope that is now clear.

Days? Good thing you don’t extrapolate your home budget based on the day you pay your mortgage. Then again, if its the same day as payday thing might be very good!

Good lord Menzie, that graph of projected Debt/GDP is pure propaganda. Under no plausible assumptions could this ever come to pass.

I just read their methodology. Their assumptions are absurd. You’ve got to read through things before you post them.

Anonymous: Would you care to be more specific? And should I accept characterizations of propaganda from people who write (in this case “Anonymous” on 11/09/2012, at 10:55am):

Personally, I wonder about people who use all-caps.

Menzie, you looked at 2/15. You said above it was 1/15. Typo in your comment not in the post.

If anyone took the time to scroll through the link, they’d see February is listed in really big type as “a “bad” month for the federal government’s finances”. (p.11)

To make a comment, it’s pretty obvious you’re talking over people’s heads. You’re talking about default, about failing to pay bonds and bills that have been sold to investors. Even though most of that money is owed to ourselves – some to the government, some to US citizens – much is owed overseas. Actually choosing not to pay money we owe is not a good thing. How much bad happens is unknown and I thought you did a nice job talking about that.

I would say another point is it will hasten the end of the dollar as the world reserve currency. Imagine you’re China. You own a huge amount of US debt. You don’t get paid. You’ve already been calling for a switch away from the dollar as the reserve currency. This makes your case. If the idea of default is indeed as reported – in part as a way of showing the GOP base they’re doing something and of mollifying the hardcore reps – then I can’t imagine a scenario in which the risk of destroying our currency’s role is worth that.

I understand some people want this to force spending cuts. Let’s assume it happens. The actual spending cuts would be to Medicare, Medicaid and maybe Social Security because everything else amounts to not much money. Cut the EPA and you save a little over $8B a year. So Medicare gets cut. Then what happens? How exactly would the GOP win in the next election cycles when they’ve forced the nation into default to cut Medicare?

jonathan: Thanks for catching the typo. Obviously, I agree it’s a crazy thing to default in order to force measures that might potentially (to be charitable) have a positive effect on debt dynamics.

They would have to delay Social Security or other monthly benefits ahead of time to build up a buffer for the rest of the month to avoid default on the debt, but the advantage is it would put an end to the discussion really quickly.

My bet is, they will make a deal in time; go with McBride in this matter.

Even if there a are a lot of gun nuts, dommsday preppers, republicans and people who use all-caps out there, default would be political suicide and they know it.

Your risk assessment is right Menzie, putting sand in the machine by them will slow it down a bit, but call for responsibilty.

ps, off topic: the Lehman Bro. crash was masterminded by GS plus H. Paulson, was engineered.

Menzie wrote:

Ricardo: Excellent proposal. And if services should be cut (say that morphine drip) for a Medicare patient, so be it! Clearly it’s inessential. I have also wondered if air traffic control can be self-organized. Why can’t pilots just look out the window, check the radars, and see if the runways are clear? Looking forward to the natural experiment the Ricardo-world would present.

Curious that you actually believe that Medicare patients and air traffic control are not essential services that should be funded? I do not agree with you by the way.

Just an aside, Medicare is funded by its own tax isn’t it? Of course it has been expanded beyond its funding but that is another issue.

Ricardo: Just curious — where do you draw the line? NOAA? After all, hurricanes are now unlikely…USGS, since earthquakes will happen regardless. Why measure!

Very good, thorough overview of the situation. I agree with most of it, but one area I have a quibble with is:

”Our results indicate that the 2011 debt limit event period led to a premium (which is represented by a decrease in the yield spread) ranging from 11 to 33 basis points on Treasury securities with maturities of 2 or more years.”

Yields on 10-year and 30-year Treasuries were fairly flat through June and July 2011, and then tanked starting July 28. (Recall Congress got a deal done on July 31 ahead of the August 2 deadline). Yields continued to fall through S&P’s downgrade of the U.S. on August 5, and didn’t bottom until the end of September. I don’t understand the conclusion that borrowing costs went up when the flight-to-quality trade drove yields down. Perversely, one could conclude that the turmoil reduced borrowing costs.

Menzie,

A better question is where to you draw the line? Do we keep increasing SNAP until the government pays for the food of all citizens? Shouldn’t housing be an entitlement since people die without shelter? Shouldn’t we guarantee everyone a living wage whether they work or not?

Perhaps we could pay everyone to write papers on the mating habits salamanders, or manufacture perpetural motion machines run. Better yet, let’s send everyone to an economic conference all expenses paid. Everyone needs to understand economics.

Menzie,

Sorry, I was illustrating the absurd by being absurd. It dawned on me that you might actually be asking a serious question.

One of the best things Jimmy Carter did in his presidency was institute zero based budgeting in the executive branch. I would draw the line at the point where any government agency could not justify their existence. Make them do what the private sector does and compete for funds rather than pretend that government spending is a limitless source.

No congress can tie the hands of a future congress. As I said before if congress had any guts they would only authorize spending for essential services.

Ricardo: Based on your comments, and your previous comments both as Ricardo, RicardoZ, Dick, and as DickF, I take it you believe USGS, NOAA, are inessential, but Medicare is. Very interesting. Am curious about courts. Are they essential? Interesting choice of SNAP, by the way.

Menzie,

Why is it every time you get into a logical quandry at my questions you drag out the bait for my cyber-stalker? You don’t seem to understand why I use a pseudonym here. It is not to protect me but to protect others. My cyber-stalker took on others as well. I have him controlled. I don’t want him locking on to anyone else so I use a pseudonym. You might think you are being cute in identifying me but you are threatening others.

Back to the dicussion at hand, if you are not prepared to draw any limits on spending that is fine. You can join the other fantasy writers in believing in the Horn of Plenty.

After the following, it is your turn.

Tell us what percentage of people in the US should be covered by SNAP?

Where do you believe we should draw the line on spending as a percentage of GDP?

Where should we draw the line on the debt?

Here is a partial list of federal programs and departments that can be cut (notice this does not touch executive and congressional spending nor does it even address grants, foreign aid, or the military).

Personal Income Tax Division of the IRS

National Endowment for the Arts

National Wild Horse and Burro Program

Dept. of Education

Dept of Energy

FEMA

FDIC

Freddy Mac & Fannie Mae

Administration on Aging

Administration for Children and Families

Administration on Developmental Disabilities

Administration for Native Americans

Children’s Bureau

Family and Youth Services Bureau

Head Start Bureau

Healthy Marriage Initiative

Low Income Home Energy Assistance Program

Office of Child Support Enforcement

Office of Community Services Block Grant

Office of Family Assistance

Temporary Assistance for Needy Families

Office of Refugee Resettlement

President’s Committee for People with Intellectual Disabilities

Agency for Healthcare Research and Quality

Agency for Toxic Substances and Disease Registry

Health Resources and Services Administration

Indian Health Service

Office for Civil Rights

Office of Minority Health

Program Support Center

Substance Abuse and Mental Health Services Admin.

Office of the National Coordinator for Health Information Technology

Center for Faith-Based and Community Initiatives

Employees’ Compensation Appeals Board

Employment Standards Administration

The Office of Labor-Management Standards

Office of Workers’ Compensation Programs

Wage and Hour Division

Employment and Training Administration

Employee Benefits Security Administration

Women’s Bureau

Job Corps

Bureau of East Asian and Pacific Affairs

Bureau of Economic and Business Affairs

Bureau of Educational and Cultural Affairs

Internet Access and Training Program

Bureau of European and Eurasian Affairs

Bureau of Human Resources

Bureau of Information Resource Management

Bureau of Intelligence and Research

Bureau for International Narcotics and Law Enforcement Affairs

Bureau of International Organization Affairs

Bureau of International Security and Nonproliferation

Bureau of Legislative Affairs

Bureau of Near Eastern Affairs

Bureau of Oceans and International Environmental and Scientific Affairs

Bureau of Overseas Buildings Operations

Bureau of Political-Military Affairs

Bureau of Population, Refugees, and Migration

Bureau of Public Affairs

Bureau of Resource Management

Bureau of South Asian Affairs

Bureau of Verification, Compliance, and Implementation

Bureau of Western Hemisphere Affairs

Counterterrorism Office

National Foreign Affairs Training Center

Office of International Information Programs

Office of the Legal Adviser

Office of Management Policy

Office of Protocol

Office of the Science and Technology Adviser

Office to Monitor and Combat Trafficking in Persons

Office of War Crimes Issues

Car Allowance Rebate System

Cash for Appliances Program

Bureau of the Public Debt

Community Development Financial Institution Fund

FHA

HUD

Then if you want I can also list 73 INDEPENDENT AGENCIES Of the U.S. GOVERNMENT.

Ricardo: Doesn’t DoE control nukes? FEMA is inessential? You want to cut the counterterrorism office?

By the way, the reason I use your past monikers is so you can be held accountable for your previous comments, so that readers can revel in the sheer [fill in the blank] of all your views.

Ricardo, how about you itemize and add up the budget for all of those items you listed? You might find it enlightening.

Have I not been paying attention, or is there a flare-up of crazy here in the comments section? Menzie seems to be dealing with a lot of efforts at distraction from the substance of the fiscal debate.

Joseph’s point needs to be raised at every opportunity. Offering a list of government offices is great crazy-bait, having almost nothing to do with the deficit today and in the future. Any discussion of the budget ought to involve some appreciation of the magnitudes represented by various revenue and spending items. Medicare, military and interest payments are large components of outlays. Indian Affairs, not so much.

Claims that the government is able to prioritize spending (because Heritage says so), pooh-poohing the notion that daily cash balances matter, cheering for blackmail and trickery to get things done in a democracy that can’t be accomplished through legislation – it all comes down to bombast, ignorance, deception or simply crazy. The government doesn’t run on magic thinking. It runs on cash, on computers, by the calendar – real constraints that can’t be made to go away by foot stomping or bombast.

Menzie,

I have answered your question now stop with the dodges and answer mine. Don’t be a typical Progressive and ignore the difficult questions hoping they will go away.

What percentage of the population should the government feed? Should the SNAP program have a cap? If so what?

Ricardo: Jawohl! Sofort! Now that you’ve told me guarding nukes is “not essential”, I’m heading to my bunker. I think I’ve made my point that your definition of essential is not the normal person’s definition (although might fit the tea partiers’)

No cap on SNAP!

In Ricardo’s world there are no food-insecure people, only people who prefer hunger to satiation.

Re Rich Berger’s comment on inflation estimation and TIPS. IMHO we’re looking at a classic median vs mean issue. The “runaway inflation” long tail is getting thicker even as people’s reasonable expectation of likely inflation levels remain fairly low. At current rates of inflation TIPS largely function as INSURANCE against an unlikely but potentially devastating rise in inflation.

A simplistic analysis of means and rates of return would tell one to NEVER buy insurance, but insurance still makes sense for unlikely events that will have severe negative consequences.

Menzie,

Great! I think this may be the first time you have taken a stand without attributing it to someone else. It is refreshing to know that you believe that it is the government’s role to feed 100% of the people. Folks talk about socialism!!

Now concerning controlling nukes, I believe that should be the responsibility of the Defense Department. You and your buddies have departments controlling departments controlling departments with all of them making huge salaries. That is why our budget is out of control. Where are the essentials? Well in truth no one in the government really knows.

Menzie, why don’t you want nukes controlled by the military?