Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

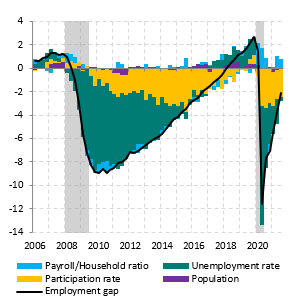

Back in July 2021, when How far to full employment? was posted on Econbrowser, nonfarm payroll employment, as of June 2021, was 4.4% below pre-pandemic peak level. Since that time the U.S. economy added nearly 1.8 million jobs (including revisions), however the employment shortfall relative to February 2020 level was still -3.3% as of September 2021. This was among others due to the Delta surge that slowed hiring especially in August and September. So, how far is the labor market behind full employment state as of the third quarter of 2021? Calculating the deviation of employment from trend, according to the approach proposed by Aaronson et al. (2016), revealed back in July that in the second quarter of 2021 the employment gap was -2.8% (-4.3 million jobs). The same exercise with currently available data vintages and the same July projections from CBO, leads to the outcome of -1.4% (-2.1 million jobs) in the third quarter of 2021, of which roughly -2.4 million results from the labor force participation rate decline below potential level and around -0.4 million from unemployment rate being above natural level (Figure 1). The remaining +0.7 million deviation results from the population and ratio contributions combined (Figure 1). At the same time second quarter gap was revised up to -3.7 million jobs.

Figure 1. Employment gap decomposition (millions of jobs)

Source: own calculations based on BLS, BEA and CBO data.

So, when can one expect this gap to close? If one assumes that the pace of job creation is 500k per month (in the third quarter the average pace was 550k jobs per month) the gap would already reach +906k jobs in the first quarter of 2022. Cut that pace in half and you get a +150k jobs gap in the second quarter of 2022. Let’s hope the first option is more likely.

References

Aaronson D., Brave S. A., Kelly D., 2016, Is there still slack in the labor market?, Chicago Fed Letter 359, Federal Reserve Bank of Chicago.

An Update to the Budget and Economic Outlook: 2021 to 2031, Congressional Budget Office, July 2021.

The post written by Paweł Skrzypczyński.

https://fred.stlouisfed.org/graph/?g=ykB5

January 4, 2018

United States labor force participation rate, * 2017-2021

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=yWG2

January 4, 2018

United States Labor Force Participation Rates for men and women, * 2017-2021

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=y2bh

January 4, 2018

United States Labor Force Participation Rates for men and women, * 2017-2021

* Employment age 25-54

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=FaSh

January 4, 2018

Labor Force Participation Rates, * 2017-2021

* Employment ages 25-54 and 55 & over

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=sxNb

January 4, 2018

Employment-Population Ratios for White, Black and Hispanic, * 2017-2021

* Employment age 16 and over

https://fred.stlouisfed.org/graph/?g=sxz6

January 4, 2018

Employment-Population Ratios, * 2017-2021

* Bachelor’s Degree and Higher, Some College or Associate Degree, High School Graduates, No College; Employment age 25 and over

Long overdue. Now if Congress can impose the same sensible ethics rules to its members:

https://nypost.com/2021/10/21/federal-reserve-bans-stock-trading-by-top-officials/

even with $1 to $2 million in cash accounts, Powell felt the need to sell stock ‘to cover family expenses’ when he feared the market was tanking…

A Forensic Look at Jerome Powell’s “Pants on Fire” Explanation for His $1 Million to $5 Million Stock Sale – Pam Martens – On Monday, October 18, the fearless Robert Kuttner at theAmerican Prospect, broke the news that Fed Chairman Jerome Powell had sold between $1 million and $5 million of the Vanguard Total Stock Market Index Fund on October 1, 2020, the same day that Powell had been on four phone calls with Treasury Secretary Steve Mnuchin, who was coordinating the White House response to the financial crisis resulting from the pandemic.

Vanguard Total Stock Market Index Fund – huh. The new ethic rules bans selling specific stocks but not overall index funds.

something tells me the people in charge of moving markets should have limitations on their ability to trade that market.

in re your initial concern:

43 members of Congress have violated a law designed to stop insider trading and prevent conflicts-of-interest Insider and several other news organizations have this year identified 43 members of Congress who’ve failed to properly report their financial trades as mandated by the Stop Trading on Congressional Knowledge Act of 2012, also known as the STOCK Act.

[…]

Here are the lawmakers who have this year violated the STOCK Act — to one extent or another — during 2021:

“Congress passed the law in 2012 to combat insider trading and conflicts of interest among their own members and force lawmakers to be more transparent about their personal financial dealings. A key provision of the law mandates that lawmakers publicly — and quickly — disclose any stock trade made by themselves, a spouse, or a dependent child. But many members of Congress have not fully complied with the law. They offer excuses including ignorance of the law, clerical errors, and mistakes by an accountant.”

Ignorance of a law they passed just a few years ago? Give me a break.

Was any Fed official shorting mortgage derivatives in June 2008?

Here’s a modest proposal. Allow top Fed officers to trade at will, only require them to disclose all trades in official press releases. You guys may learn what they really are ‘thinking.’

Interesting information. His first option will be more likely if Congress gets off its duff and passes Build Back Better – especially if the proposal is not bled to death by those two Blue Dog Senators.

https://news.cgtn.com/news/2021-10-22/The-inflation-catch-up-game-14yRwaNxyda/index.html

October 22, 2021

The inflation catch-up game

By Mohamed A. El-Erian

Inflation is now on the front page of newspapers around the world, and for good reason. Prices of more and more goods and services are increasing in a manner not seen for decades. This inflationary spike, accompanied by actual and feared supply shortages, is fueling both consumer and producer anxiety. By also threatening to worsen inequality and derail a much-needed sustained and inclusive economic recovery from the COVID-19 pandemic, it is also becoming a hot political issue.

For their part, policymakers at central banks in the United Kingdom and the United States have started to move away from the narrative of “transitory” inflation. (The cognitive transition at the European Central Bank is less pronounced, which makes sense, given that the inflation dynamics there are less pronounced.) But the pivot is far from complete and not nearly quick enough, particularly at the U.S. Federal Reserve, the world’s most powerful and systemically important monetary institution. Delays in Congress approving measures to increase productivity and enhance labor-force participation are not helping, either.

The reasons for the rise in inflation are well known. Buoyant demand is encountering inadequate supply – a result of disrupted transportation and supply chains, labor shortages, and an energy squeeze….

Mohamed A. El-Erian is president of Queens’ College, University of Cambridge.

Why do economists get away with ignoring the standard error? Why don’t intellectually honest statisticians call them out?

rsm: Consider: Chang and Li (EI, 2018), wp version.

Serious economists understand this issue of uncertainty – but I agree standard errors or Mean Absolute Errors should be reported in journalistic accounts.

: ) it’s so hard sometimes

“I don’t drink” “Yah, I forgot” “Not one of you is worth a single hair on her head!!!!”:

Menzie is being gentle in his response. Allow me to pile on.

You don’t know what you’re talking about. First, if you read any empirical economic research, you’ll find that summary statistics are the conventional method of reporting results and the summary statistics go beyond just standard errors. Second, economists ARE statisticians by training. They just don’t brag about it.

Menzie mentioned journalists because it is journalists who extract point estimates from economic research and ignore other summary statistics. While we’re at it, many other users of economics also rely on point estimates and so increase the focus on those estimates.

Even if this blog is your only contact with unfiltered economics, you should have realized that economists don’t ignore the likely range of outcomes around the central estimate. Just look through the charts Menzie publishes.

Kindness is a type of “sin” sometimes, Don’t ask me how I know this or anyone associated with the kindness,

Opportunity insights tracks the distribution of employment. Low wage employment is doing worse than flat lining.

https://www.tracktherecovery.org/

JohnH,

You do not like it that job opportunities are now offering higher wages?

So your explanation is low wage people are getting high wage offers? Me? I’m waiting for someone to write a well researched and thought off empirical paper that covers the various possible explanations for this data point.

It might help if you told folks who these people are:

https://opportunityinsights.org/team/

A team led by Raj Chetty commands some real credibility. Now I’m hoping this team goes beyond the data and explores who low wage employment has not recovered. Lots of potential explanations. Is it a decline in the demand for these types of jobs? Or is it people leaving low wage jobs either because of COVID-19 or opportunities to make higher wages in other jobs?

I’m not criticizing as I do not know the answer to these questions. But I’m sure Chetty and his team have the intellectual chops to let us know.

More related research from Chetty and his team:

https://opportunityinsights.org/paper/tracker/

does a full employment target even have a meaning any more, with a near record of more than 2 job openings for each of the unemployed, and a record high for job quitting?

rjs,

But but, Blanchflower and Bryson are telling us that we are already in a recession! These are just out of date lagging numbers you are posting here, clearly!

The title “Do Employers Exploit Workers with Low Wages” caught my eye but damn – this was from the right wing nutcases at the American Institute of Economic Research. Anthony Gill wrote it and apparently this cowboy hat wearing has spent too much time in the plains teaching the economics of religion – whatever that is.

I read his dumb rants about being an old bartender willing to work for $5 an hour. I guess the bar lets him have free drinks, which he must have consumed before writing this Econ 101 fairy tale that pretends markets are perfectly competitive and low wage people love their jobs.

Read it for laughs as the economics of this rant are what you expect from some drunk cowboy writing on a Saturday night just before midnight:

https://www.aier.org/article/do-employers-exploit-workers-with-low-wages/

https://www.nytimes.com/2021/10/21/opinion/corporate-taxes-deficit-spending.html

October 21, 2021

How Not to Let Corporations Kill Biden’s Agenda

By Paul Krugman

I’m not one of those liberals who believe that corporate greed is the root of all evil. It’s the root of only some evil; there are other dark forces, especially white nationalism, stalking the U.S. body politic.

But corporate money is surely the villain behind the latest roadblock to President Biden’s agenda: Senator Kyrsten Sinema’s opposition to any rollback to Donald Trump’s big 2017 corporate tax cut.

After all, Sinema, who was in the House of Representatives at the time, voted against that tax cut. And she attacked the tax cut the next year during her run for the Senate. Given that raising taxes on corporations has overwhelming public support, it’s hard to see any reason for her flip other than the corporate lobbying blitz against Build Back Better.

It’s a distressing story. But here’s what you need to know: While the Trump tax cut was bad and should be reversed, reclaiming the lost revenue isn’t essential right now. If the key elements of the Biden agenda — investing in children and in protecting the planet against climate change — have to be paid for in part by borrowing, that’s OK. It would certainly be better than not making those investments at all.

About that tax cut: The Tax Cuts and Jobs Act was sold with claims that a lower corporate tax rate would induce U.S. businesses to bring back money they had invested overseas, leading to a surge in business investment that would increase productivity and wages. This was a slightly more plausible story than the usual justification for tax cuts, the claim that they will give already rich people an incentive to work harder. But none of it happened….

Marjorie Taylor Greene’s attempt to intimidate Liz Cheney sort of backfired:

https://ijr.com/cheney-fires-back-greene-house-floor/

Greene needs to focus on her anti-Semitic space lasers? Dick Cheney taught his daughter well!

https://cepr.net/between-1989-and-2020-spending-on-prescription-drugs-rose-from-0-6-percent-of-gdp-to-2-4-percent-of-gdp/

October 21, 2021

Between 1989 and 2020, Spending on Prescription Drugs Rose from 0.6 Percent of GDP to 2.4 Percent of GDP

By DEAN BAKER

That simple point might have been worth mentioning in an article * reporting on efforts by Democrats to rein in prescription drug costs since 1989. The current level of spending of roughly $500 billion a year comes to more than $1,500 for every person in the country. Annual spending on prescription drugs is roughly one and a half times as much as the proposed spending in President Biden’s Build Back Better proposal.

It’s also worth noting that this piece repeatedly refers to Democrats efforts to “control” drug prices. This is inaccurate. The government already controls drug prices by granting companies patent monopolies and related protections. As a result, drug companies can charge prices that are often several thousand percent above the free market price. In the absence of these protections we would likely be spending less than $100 billion a year on drugs, for a saving of $400 billion annually.

The point is that it is not necessary to have the government intervene to bring prices down. We could have the government not intervene, or intervene less, to avoid allowing drug companies to charge such high prices.

* https://www.nytimes.com/2021/10/21/us/politics/drug-prices-democrats.html

https://www.nytimes.com/2021/10/21/us/politics/drug-prices-democrats.html

October 21, 2021

A 30-Year Campaign to Control Drug Prices Faces Yet Another Failure

Democrats have made giving government the power to negotiate drug prices a central campaign theme for decades. With the power to make it happen, they may fall short yet again.

By Jonathan Weisman

Yeah, apparently the drug companies have gotten to Kyrsten Sinema, and without her on board, Dems in Senate cannot get it past. Dems need bigger margin there, although in danger of losing both Houses next year.

As it is, I am worried about this year’s race in VA. Smells like 2010, with enthused GOP all worked up over fake issue, defending people threatening the lives of school board members who are supposedly being suppressed by Terry McAuliffe, and with Dems very complacent. Looks to me that Youngkin will win governor race, and while nobody is talking about it, likely GOP will take House of Delegates back also. Only good side is no race for State Senate, so Dems will remain in charge, there, just barely, but hopefully enough to block worst stuff Youngkin might push that would require Assembly approval.

Since I never watch Fox and Friends I did not realize that their early coverage of the passing of Colin Powell was to abuse his death to spin their nonsense that the vaccines do not protect us from COVID-19. Don Lemon watch this and gave his reaction to the disgusting clowns on Fox and Friends:

https://www.cnn.com/videos/media/2021/10/19/fox-news-colin-powell-death-dons-take-sot-dlt-vpx.cnn

https://www.wwno.org/news/2021-10-20/haunted-by-poor-football-season-and-title-ix-scandals-lsu-moves-on-from-ed-orgeron

LSU is parting company with coach Ed Orgeron in large part because his players are not wining every SEC game. That they may have been committing sexual assault without any real consequences – not high on the AD’s list.

Orgeron represents many of the old ways of football, and not in a good sense. He turned a blond eye to misdeeds. He represents how sports were played in the 80s. His philosophy seems to be might is right. Glad to see the bully leave.

https://research.stlouisfed.org/publications/economic-synopses/2021/10/15/the-covid-retirement-boom

October 15, 2021

The COVID Retirement Boom

By Miguel Faria e Castro

The labor force participation rate registered its largest drop on record in 2020, falling from 63.2 percent in the fourth quarter of 2019 to 60.8 percent in the second quarter of 2020. By the second quarter of 2021, the rate had recovered slightly, to 61.6 percent, but was still 1.6 percentage points below its pre-pandemic level—indicating that as of that quarter, roughly 5.25 million people had left the labor force.

People left the labor force during 2020 for many reasons. Some may have left due to cyclical factors: Labor force participation tends to fall when the unemployment rate is high, and in 2020 the COVID-19 crisis featured the highest post-Great Depression unemployment rate on record (14.8 percent in April 2020). Others may have left for factors specific to the COVID-19 crisis. For example, many people were forced to quit jobs to care for children or other family members because of the lockdown of schools and other institutions. Some people would have left the labor force anyway because of retirement. Retirees are a significant fraction of the population, as U.S. population growth has slowed and Baby Boomers (those born between 1946 through 1964) are currently retiring. Finally, a significant number of people who had not planned to retire in 2020 may have retired anyway because of the dangers to their health or due to rising asset values that made retirement feasible. This essay provides a back-of-the-envelope estimate of the number of “COVID-19 retirements.” …