Little changed from July, at least from the Wall Street Journal’s survey of economists:

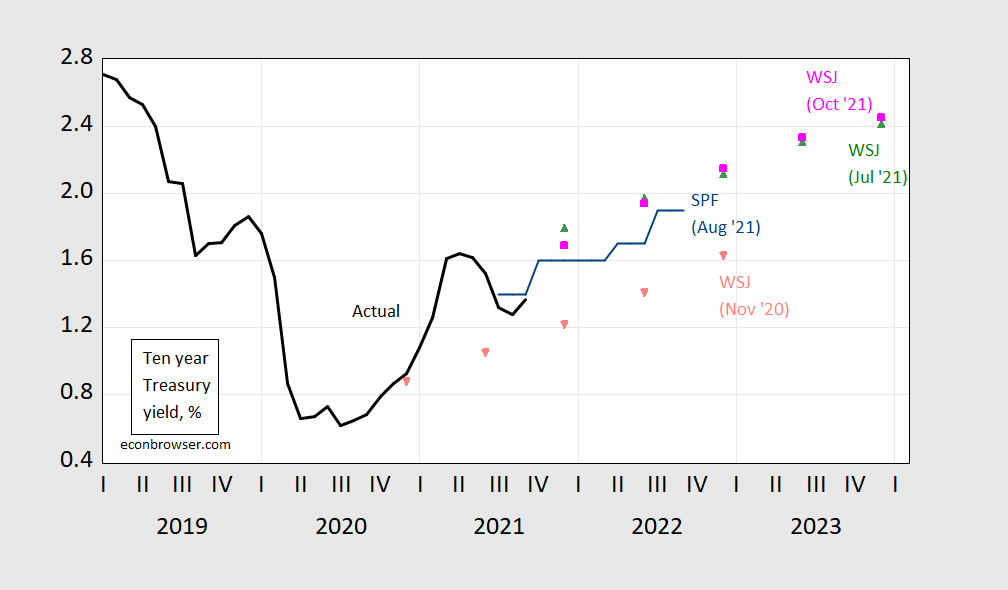

Figure 1: Interest rate on 10 year Treasury bond actual (black), mean forecast from November 2020 WSJ survey (salmon inverted triangle), from July 2021 (green triangle), from October 2021 (pink square), and August 2021 Survey of Professional Forecasters. Source: Federal Reserve Board via FRED, WSJ (various surveys), and Philadelphia Fed.

Unlike the forecasts of the GDP level (see this post), interest rate rate trajectories shifted upward from November 2020 to July 2021, and have ended up roughly the same by October. Of course, we don’t know how to apportion between interest rates and expected inflation the upward shift relative to November for the July and October forecasts.

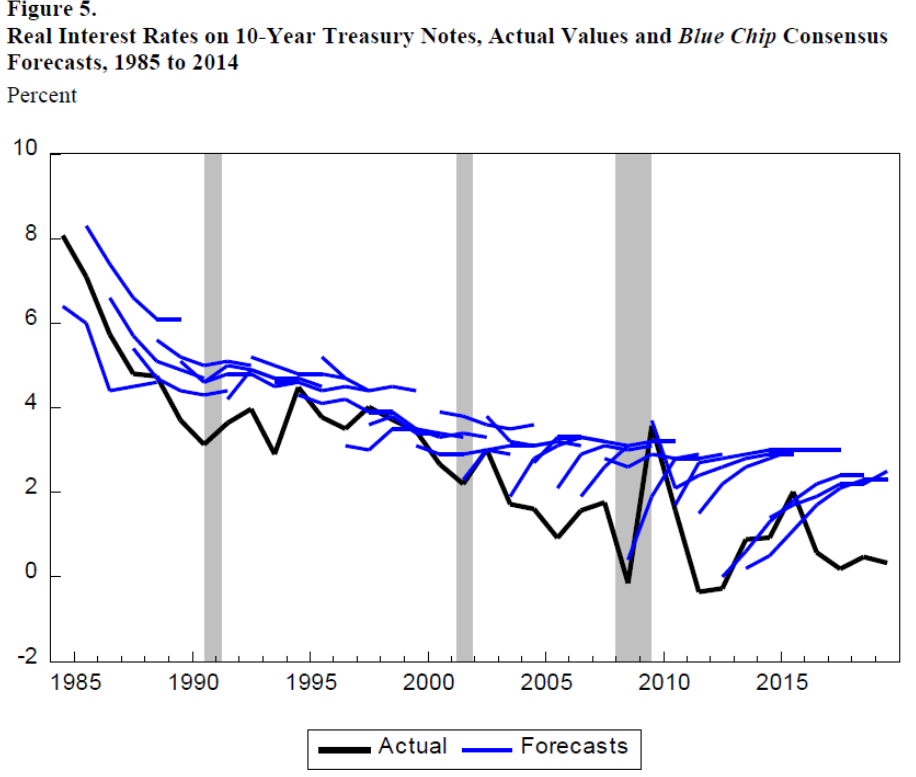

As remarked upon in a previous post, the trajectories are all upward. This is a characteristic of these consensus forecasts since 2003 (here’s the relevant figure):

Source: Gamber (2020).

“interest rate rate trajectories shifted upward from November 2020 to July 2021”

I think a small edit here is needed.

What would that “edit” be exactly??

Moses Herzog: I got “rate rate” in the sentence.

Damn…… I call that “pulling a Moses”. It doesn’t technically count as a syntax error.

Moses, Gita Gopinath is returning to Harvard from IMF at end of year.

Oh, that’s interesting. I always try to keep a peripheral eye on her work and activities but missed that. My guess is it’s for family reasons. Oh man, see I keep trying to forget she has a family and you had to remind me again. Damned socially well-adjusted people. Don’t they make you sick?? No, I mean in case you don’t get it I’m mostly jabbing at myself here. I think she can do great research (already has on currencies) and if she can get back to deep research and have more time with her family I applaud it and I’m happy for her. kind of….not really…… but…. confounded socially well-adjusted people!!!!

I’m not trying to be facetious or rude here, I appreciate you passing that along Sir. I think the IMF will miss her because there’s few economists with both her mathematics skill and empathy. It’s a rare combination IMO.

The end of the year will be the end of the leave Harvard gave her to go be at the IMF. So she faced a choice of either staying at IMF and losing her position at Harvard or going back to there. I know nothing about her family life.

I would think Harvard would give her an extension if she asked, but I have no idea the general policy on those things. If what I was just reading is correct the policy is two years at Harvard. I think that’s a mistake in Gopinath’s case, but I can see it both ways.

https://www.thecrimson.com/article/2018/4/13/fas-restricts-public-service/

I think if I was Harvard, with a woman attaining a position that hasn’t been open to many women in the past, exceptions could be made. And it seems to give the University added status as well.

The consistent wrongness of rate forecasts is very disturbing. It is simply not possible for economists to be this consistently wrong without motivated reasoning clouding their forecasts.

This consistent bias has profound implications, especially when it is incorporated into CBO forecasts because it upwardly biases the estimated cost of any government fiscal programs. The CBO is making forecasts biased against spending increases and biased to support spending cuts. We need better economists.

“It is simply not possible for economists to be this consistently wrong…”

The SPF forecast is economists, but trading and investment professionals are also surveyed about interest rate expectations and as a group have also mostly expected rates to be higher than they have turned out to be. So not just economists. Every group which has some claim to expertise in interest rates.

Motivated reasoning? What’s the motive? Investment professionals, as a group, have had a generation-long tailwind from falling yields. As have the rich.

Now, if you think about the formation of expectations, you might reach another conclusion from Menzie’s chart. If expectations are backward-looking, the a history of yield levels would generally lead to an expectation of a return to higher yields. If past yield levels carry more weight in people’s minds than does the downward trend, then it’s natural that they forecast a reversion to some prior, higher mean. We aren’t clever enough to hand first derivatives. We think in levels.

“Incompetence is a better explanation than conspiracy in most human activity.”

— Peter Bergen

Handle first derivatives. Not hand. Crud.

@ Joseph

Joseph, I like you, but with all due respect…… Going heavy with the Howard Beale schtick lately, aren’t we??

Consider also that a funds rate of 2.5% (which is what the Fed has kind of figured as the long-run equilibrium rate for some time) and a tens/funds spread of just 1% gives you a ten-year yield of 3.5%. That’s just about where a lot of those forecast lines ended up from 2005 to 2015. Now they end up even lower.

Just about the same number of people expected monetary policy tools to stop working as expected the Spanish Inquisition. That’s why forecasts have been too high. (Apologies to those not familiar with Monty Python.)

Felicitations. You know more about monetary policy in the 21st century than the Spanish Inquisition in the 15th. (Apologies to those familiar with History.)

From 2009 to December 2015, the fed funds rate target was 0% to 0.25%; prime rate was 3.25%.

In January 2019, the fed funds rate target was 2.25% – 2.50% [it was more or less steadily raised from 0.25% to 0.50% in December 2016]; Prime Rate was 5.50% and the 10 year rate ranged about 2.70% to 2.75% over the month.

Since March 2020, the FF target is 0% – 0.25% [it was 1.50% – 1.75% in December 2019]; prime rate is 3.25%; 10 year UST moving ‘about’ just below 1.70%. And, inflation is . . .

While a Fed taper [allow long rates to rise?] seems in the offing, it appears there is no plan to raise short rates.

“The CBO is making forecasts biased against spending increases and biased to support spending cuts.”

Not necessarily. The crudest approach would balance the 10y rate with long-term growth, say over a 10y horizon. If expected long-term growth surpasses the 10y rate and if they are shooting for 0 deficit their advice might still entail expansionary policy.

Off-topic

Related to politics. Thought some here might take an interest.

https://www.oklahoman.com/story/news/2021/10/19/second-candidate-defects-from-republican-party-amid-oklahoma-governors-race/8525553002/

Zuckerberg giving Americans another of many IQ tests, asking always the same Question: “Just how dumb are you??”

https://finance.yahoo.com/news/facebook-reportedly-changing-name-042958266.html

Americans’ answer always comes back the same: VERY

From one of the better small colleges in America (a great place to send your child if you or they are looking for a great “small campus” type atmosphere)

https://www.grinnell.edu/news/52-americans-believe-democracy-facing-major-threat

And more data on a plethora of topics.

https://dasil.sites.grinnell.edu/political-science/grinnell-college-national-poll/ ENJOY!!!!!

@ Menzie, Earnest Question

Do you know of any academic/credentialed economists that are accounting for this date, July 1, 2022 and the ramifications thereof in their forecasts?? “Asking for a friend.”

https://www.ilwu.org/west-coast-longshore-workers-ratify-contract-extensionnew-agreement-will-continue-until-july-2022/

Moses Herzog: No.

I suddenly feel like a fashion model not being taken seriously for her latest Hollywood film role.

Moses Herzog: You shouldn’t. The answer merely reflects the fact that I can’t keep track of everything going on, so there may very well be somebody out there following this issue.

You’re right it would be more than silly to put it into economic forecasts at the moment, but in all seriousness, I think it’s a date worth filing away in the memory banks. There was a longshoreman (OK, yeah, most of them aren’t candidates for jobs at NASA) who wrote an anonymous editorial for Business Insider. He seemed to be of the belief the date, July 1 2022, takes on added significance with the offshore buildup of shipping containers. Is that cleared out by June 2022?? I don’t know. But if you had a offshore container buildup still there, (and some crabby longshoremen guys due to 24 hour running of the docks) going into labor Union negotiations, it struck me as something that could be an “event”. Most of the transport people seem to think the 24hour LA dock operations only makes a tiny dent in that buildup~~that it DOES help, but it’s not a significant change in the flow of those goods.

Can I hedge a Treasury index like TLT by selling these forecasters Treasury futures?

Directly? No. Their firm? Yes.

And they’d have prospered all the way from 1985 to now. Falling yields mean rising prices. Great trade for them.

It always kills me the things people choose to criticize. Just who in the hell did they think had nailed rates forecasts over the last 40 years?? I’d like to meet this person. Oh sure, it’s a given, the segment of village idiots on the comment section of this blog has every term rate from money markets to perpetuity nailed in their personal journals under their mattress, but…… other than that.

Isn’t the point that you can easily hedge any rate forecast by selling it and taking an opposite position in the underlying? If yields go up as forecast, the underlying (not TLT as I mistakenly posted, but direct bond purchases) makes you money; if forecasts are wrong, the futures you sold the forecasters (or whoever believed them) make money? You just need institutional access, and optimal proportions?

In other words, Goldman Sachs is going to make profits no matter what forecasts say or rates do, and economists should be studying and reporting to us how this is done, because GS has solved the economic problem and we would all benefit from knowing exactly how it can be done?

There is a “greater fool” assumption in you model somewhere. Somebody has to take on the risk the hedger sheds. Nobody does that for nothing.

Goldman wishes Goldman were that smart. GS often reports long runs of uninterrupted profits from trading which makes them look like evidence against efficient markets. In reality, those profits represent bid-ask spreads and fees.

viggish

Isn’t the Fed the backstop?

Doesn’t the Fed ensure the outside spread doesn’t move too much too fast?

Wasn’t AIG bailed out so GS would get face value on the insurance it bought, but AIG was in danger of defaulting on?

Florida is the land of housing flippers so I thought I might take a look at what this organization had to say about Zillow temporarily suspending its iBuyer program:

https://www.floridarealtors.org/news-media/news-articles/2021/10/zillow-puts-its-ibuyer-program-hiatus-until-2022

Not to give any credence to this crew but at least they consulted with an economist at Georgia State instead of Princeton Steve’s charlatan Brandon. And some of this discussion makes sense even if it directly contradicts the housing crash thesis ala Brandon and Steve.

If sellers are still demanding a premium price for their houses, it is hard for a new flipper to turn a buck in this market. And Zillow’s record so far has been awful as evident from the segmented financials presented in their own 10-K.

Of course charlatans like Brandon and their puppy dog followers (bark for us Steve) cannot be bothered to check a 10K filing!

It must be fun “working” in the Senate when drug companies and other big money donors have already been promised how you’ll vote on issues that hurt working families and the retired. The same retired people who fund her campaign.

https://www.opensecrets.org/news/2021/09/sinema-leveraging-slim-majority-powerhouse-fundraising-hardball-spending/

https://www.washingtonpost.com/politics/sinema-biden-domestic-policy-veterans/2021/10/21/f441b8f0-3278-11ec-93e2-dba2c2c11851_story.html

The fact that old retirees in Arizona fund Sinema and vote for her in droves proves that functional illiteracy is nothing new in America. Functional illiteracy has been weighing down American democracy long before the first Atari, Nintendo, or Sony Playstation ever appeared.

In other news, warmonger and “W” Bush BFF Condoleeza Rice thinks we should all forget about the insurrection of January 6th. Because Condoleeza knows “that’s what healthy democracies do”, ignore violent attacks and death threats on their nation’s capitol made by a traitorous “president” and illiterate schizoid right-wing KKK mobs.

Funny thing. Sinema began her political career as a member of the Arizona Green Party and is now considered by GovTrack to be the most conservative Democrat in the Senate: https://www.govtrack.us/congress/members/kyrsten_sinema/412509

Whatever butters yer biscuit, I guess.

if democrats could miraculously pick up a couple of seats, then sinema and manchin are cooked. they are making bitter enemies by the day.

Random question related to probabilities:

Anyone know what the Vegas odds are that if Kyrsten Sinema was having a press conference on a watered down and castrated version of a “infrastructure, investment and jobs” Act/legislative bill, that Lisa Murkowski and Susan Collins would be standing in the immediate vicinity behind her??

https://images.app.goo.gl/yjg61mkWTmV1u5aN9

No chance this is connected to Hillary Clintons’s “I’m With Me” fight for gender equality is there??

Covid outbreaks seem to be driving 10 year yields. If normal nominal rates are 2-4%, then the forecast is pretty typical.

Evergrande’s angel buyer pulled out of the deal. Evergrande has gotten another extension on its missed payment on an offshore bond. The latest sales data show almost no new sales, and new sales contracts have been a major source of credit to this Ponzi.

The renminbi has been jumpy, too. Coincidence?

So the government’s effort to avoid an Evergrande shock has taken a turn for the worse.

my guess is the local buyers will be made whole, but it will take some time. the firm and its management will suffer significantly, possibly with jail time. payment to mainland bond investors will be delayed, and perhaps reduced a bit with a government bailout. this will keep the problem from spreading within china. the government will let the stock value drop. but if you are an international bondholder, look out. i think you will get pennies on the dollar. the message china will send out is that they will not easily permit contagion to spread in the mainland, but foreigners will not be protected by government funds.

the longer this situation is permitted to drag on, the worse i anticipate the outcome to be for all involved.

Just heard evergrande will make its dollar denominated bond payout today, last day before default. Still have a couple more payouts to make in next couple weeks. Beijing seems to be pushing firms to make the payments. Have not heard beijing indicate government bailout if payment not made.

I saw the headline in FT but was having a hard time finding the bypass around the paywall this morning. Maybe tomorrow morning’s hardcopy WSJ will fill me in. I’m sticking to my guns on the prediction of not very much contagion at least on world markets, and even, really, in China. The seas will get a little bumpy for markets inside China, but I don’t think Xi Jinping has “Putin-like control” to risk allowing a true blood-letting here. He’ll do his best to make the pain felt by parties who convey no political threat to him.

If anyone wants my “confidence level” on the above prediction, I would say I’m 80% on that one.

trump new social media site hacked?

https://www.msn.com/en-us/news/politics/pranksters-have-already-defaced-trump-e2-80-99s-new-social-media-network/ar-AAPNovh?ocid=uxbndlbing

i told you so! this is what is called a target rich environment.

“But within hours, pranksters found what appeared to be an unreleased test version and posted a picture of a defecating pig to the “donaldjtrump” account.”

Sort of what Trump did to the nation for 4 years. The sheer technical incompetence of the crew that put this up is so Trumpian!

and the story gets more interesting

https://www.cnbc.com/2021/10/22/trump-social-media-spac-digital-world-acquisition-corp-surges-another-100percent.html

at one time, the trump spac was up over 200%. it seems to have become a meme stock on reddit. now if the stock grows, good for trump. but if it collapses, how does that impact the trump brand? i for one am happy to see the stock rise. i don’t believe the social platform they are pushing has a chance to be successful, financially. this will result in a lot of empty maga wallets in the future. i don’t mind seeing trump get rich at the expense of his minions. that profit eventually gets redistributed to the economy anyways, due to his poor business decisions. he is a good con man who can collect money, but he loses it just as easily.

and the guy running the trump spac also runs a business in wuhan. ironic, no?

The House voted to hold Steve Bannon in contempt. All 220 Democrats were joined by 9 Republicans. I guess the other 200 Republicans have decided the House should have no investigatory powers in the age of King Donald I.

Now – Justice Department. Do your job and throw this loser in jail.

https://cepr.net/between-1989-and-2020-spending-on-prescription-drugs-rose-from-0-6-percent-of-gdp-to-2-4-percent-of-gdp/

October 21, 2021

Between 1989 and 2020, Spending on Prescription Drugs Rose from 0.6 Percent of GDP to 2.4 Percent of GDP

By DEAN BAKER

That simple point might have been worth mentioning in an article * reporting on efforts by Democrats to rein in prescription drug costs since 1989. The current level of spending of roughly $500 billion a year comes to more than $1,500 for every person in the country. Annual spending on prescription drugs is roughly one and a half times as much as the proposed spending in President Biden’s Build Back Better proposal.

It’s also worth noting that this piece repeatedly refers to Democrats efforts to “control” drug prices. This is inaccurate. The government already controls drug prices by granting companies patent monopolies and related protections. As a result, drug companies can charge prices that are often several thousand percent above the free market price. In the absence of these protections we would likely be spending less than $100 billion a year on drugs, for a saving of $400 billion annually.

The point is that it is not necessary to have the government intervene to bring prices down. We could have the government not intervene, or intervene less, to avoid allowing drug companies to charge such high prices.

* https://www.nytimes.com/2021/10/21/us/politics/drug-prices-democrats.html

https://www.nytimes.com/2021/10/21/us/politics/drug-prices-democrats.html

October 21, 2021

A 30-Year Campaign to Control Drug Prices Faces Yet Another Failure

Democrats have made giving government the power to negotiate drug prices a central campaign theme for decades. With the power to make it happen, they may fall short yet again.

By Jonathan Weisman

WASHINGTON — When a powerful Democratic Senate chairman assembled his Special Committee on Aging to confront what he called a “crisis of affordability” for prescription drugs, he proposed a novel solution: allow the government to negotiate better deals for critical medications.

The year was 1989, and the idea from that chairman, former Senator David Pryor of Arkansas, touched off a drive for government drug-price negotiations that has been embraced by two generations of Democrats and one Republican president, Donald J. Trump — but now appears at risk of being left out of a sprawling domestic policy bill taking shape in Congress.

Senior Democrats insist that they have not given up the push to grant Medicare broad powers to negotiate lower drug prices as part of a once-ambitious climate change and social safety net bill that is slowly shrinking in scope. They know that the loss of the provision, promoted by President Biden on the campaign trail and in the White House, could be a particularly embarrassing defeat for the package, since it has been central to Democratic congressional campaigns for nearly three decades.

“Senate Democrats understand that after all the pledges, you’ve got to deliver,” said Senator Ron Wyden of Oregon, the chairman of the Finance Committee.

“It’s not dead,” declared Representative Richard E. Neal of Massachusetts, the chairman of the Ways and Means Committee.

But with at least three House Democrats opposing the toughest version of the measure, and at least one Senate Democrat, Kyrsten Sinema of Arizona, against it, government negotiating power appears almost certain to be curtailed, if not jettisoned. The loss would be akin to Republicans’ failure under Mr. Trump to repeal the Affordable Care Act, after solemn pledges for eight years to dismantle the health law “root and branch.”

And after so many campaign-trail promises, Democrats could be left next year with a lot of explaining to do….

2.6% gdp is not far from what was spent in dod.

the pharma industry congress complex where is an Ike to warn…?

I do not usually do this, but some unrelated things people might find of interest. One is that leading economist of transitrion, Janos Kornai, who discovered the soft budget constraint, died in Budapest at 94 two days ago. He should have won the Nobel. I have blogged on this on Econospeak.

The other, not in the news yet somehow, is that Russia, or at least Moscow, is going on a major lockdown starting Monday, oct. 25 to last until Feb. 22. This messed up my wife, Marina, who was supposed to fly there on Sunday to visit her 93 year old mother. Not happening now.

I’ll have to look up Kornal and read about him. I’d lecture you on visits to Moscow?Russia, but you can’t tell people not to visit their families. And I’m certain she knows the deal, so……. There’s nothing you can do to stop people from doing those things. But you know she’s gonna get stuck again if she goes.

Moses,

I just checked on the Wikipedia entry on Kornai, and it is seriously incomplete and even misleading. It fails to mention the concept he was most likely to get the Nobel Prize for: the soft budget constraint, introduced in his 1980 book, The Economics of Shortage, which the entry does recognize was his most important work. This noted that a state-owned firm will not be efficient because it counts on the state to bail it out if it loses too much money, so not facing a hard budget constraint. Of course, this concept has relevance in market capitalist economies as well, when large and powerful firms are able to get financial support from political leaders.

The entry also fails to note that he was actually jailed after the 1956 Hungarian Revolution. Marina and I talked about this with him in the interview we did with him that appeared in the 2009 book by me, Colander, and Holt, European Economics at a Crossroads. The entry hints at it, but he also barely survived the worst phase of Nazi rule in Hungary, having to hide under a pile of straw at one point.

Also not in the entry, and in fact not widely known, is why he did not get the Nobel Prize. At the end of the 90s he was on track to get it for the soft budget constraint. All the preliminaries had been carried out. But the dominant figure on the Nobel committee at that time was Jurgen Weibull. He was married to a daughter of Kornai, and they had an ugly divorce, which was basically his fault. This led him to turn against Kornai and blocked him getting the prize.

You may think this is some kind of cruel joke. But I am being earnest here. I will pray for you, your wife, and her family as it relates to their safety/health and travel constraints. I honestly believe prayer does work. If you are Christian I encourage you to set aside a time of the day and also pray. I feel that it’s beneficial when hitting obstructions, of even before hitting those obstructions, God bless you and your family.

Moses,

I accept your kind thoughts, prayers, and intentions. Thank you.

Moses,

Moses,

Again, thank you for your benevolent words. I shall take advantage of this moment of friendliness, which I hope continues, but will understand if it does not.

So, my wife and her mother, now 92, are both very upset about not getting to see each other in the near future. While WaPo says this is all over on Nov, 7, Marina tells me from official Russian sources that for those over 60, which means her and her mother, the lockdown will last until Feb. 22. I have no idea what will happen with this, but they are both very upset.

I shall now do something Marina would not approve of (she does not follow this blog), but I shall do so for the historical record, although still suffering from long paranoia based on bad past experiences, I shall not provide the name of my wife’s mother, although even her actual name is an issue, and I shall stick to basics here.

Just a few days ago, Oct. 16 actually, my wife noted to me that this was he 80th anniversary of her mother being sent to Siberia during WW II. What was that like? Well the movie “Dr. Zhivago,” has sort of an image of it in its depiction of the family traveling by train to their old estate.

Her father, who remsains unnamed here, was a high level Bolshevik, but too close to N. Bukharin. A chess grandmeister with a massive library, became a Deputy Minister of Agriculture afrer WW II, but got into a debate with Molotov’s wife, and that very night he was gone, along with his massive library. His daughter suffered very badly at that time. He survived to be released by Khrushchvw in 1956, but was a total tortured wreck, no teeth and not much else, although he was officially “rehabilitated,” hah!

So, his daughter, who suffered in many ways for his purge and other things, nevertheless overcame all this and became both an MD and a serious researcher on dermatology, eventually inventing an excellent skin creme, that back in the 1980s when Marina came to the US and brought some of it here, my then teenage daughters from my first marriage said it was great for acne. If she had been in the US she would have become wealthy, probably giving us money, rather than the reverse. As it was, for this creme, produced in Poland, she got some small flat fee from the old Soviet govt, and we help her out financially, rather than vice versa, although she is way more worthy than either of us.

Barkley Rosser

The Moscow lockdown is only lasting until Nov. 7, at least according to Reuters and CNN, although not the Mayor of Moscow.