From Blanchflower and Bryson:

It seems to us that there is every likelihood that the US is entered recession at the end of 2021. The most compelling evidence is from the Conference Board expectations data for the eight biggest states.

Well, that’s certainly provocative. Here’s the abstract:

Economic shocks are notoriously difficult to predict but recent research suggests qualitative metrics about economic actors’ expectations are predictive of downturns. We show consumer expectations indices from both the Conference Board and the University of Michigan predict economic downturns up to 18 months in advance in the United States, both at national and at state-level. All the recessions since the 1980s have been predicted by at least 10 and sometimes many more point drops in these expectations indices. A single monthly rise of at least 0.3 percentage points in the unemployment rate also predicts recession, as does two consecutive months of employment rate declines. The economic situation in 2021 is exceptional, however, since unprecedented direct government intervention in the labor market through furlough-type arrangements has enabled employment rates to recover quickly from the huge downturn in 2020. However, downward movements in consumer expectations in the last six months suggest the economy in the United States is entering recession now (Autumn 2021) even though employment and wage growth figures suggest otherwise.

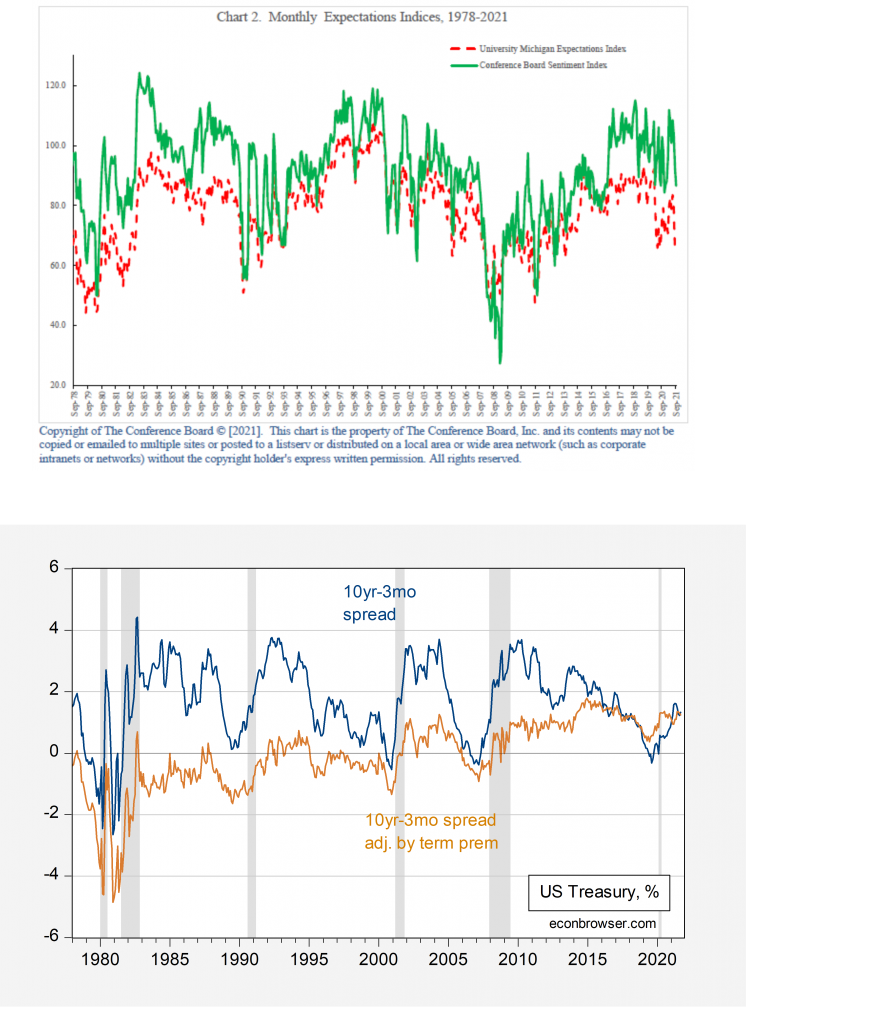

The figure below combines Blanchflower and Bryson’s Chart 2 (on top) with my plot (over the same sample period) of the 10yr-3mo term spread and spread adjusted by the NY Fed’s 10 year term premium (at bottom).

Figure 1: Top -Blanchflower and Bryson (2021) Chart 2, of Univ. of Mich. Expectations Index (red dashed line) and Conference Board Sentiment Index (green line); Bottom – 10yr-3mo US Treasury term spread, % (blue line), and term spread adjusted by estimated term premium (brown line); NBER defined recession dates shaded gray. Source: Blanchflower and Bryson (2021), and Federal Reserve Board, NBER, and author’s calculations.

There is indeed a sharp drop in the two sentiment indexes. On the other hand, the term spread does not signal an incipient recession. To formalize this point, let’s examine the predictions of each indicator, individually and combined, using a 12 month horizon, over the 1978-2019 period (so excludes recession information for 2020). I only test the Michigan sentiment index as I don’t have access to the time series for the Conference Board measure.

P(recessiont+12=1) = 0.11 – 0.015 sentimentt

McFadden R2 = 0.02

P(recessiont+12=1) = -0.317 – 0.693 spreadt

McFadden R2 = 0.29

P(recessiont+12=1) = 1.125 – 0.686 spreadt – 0.017 sentimentt

McFadden R2 = 0.31

bold face denotes statistical significance at 5% msl.

On its own, sentiment doesn’t show up as explaining a lot of the movements in the recession indicator, perhaps due to the fixed lag length of 12 months. The conventional 10yr-3mo Treasury spread explains a lot more of the recession indicator; the incremental information added by the sentiment indicator is small.

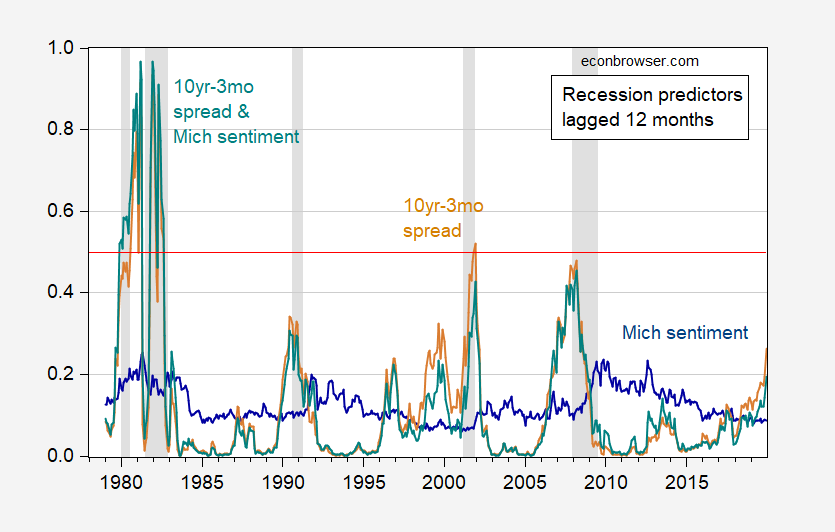

For predictions of recessions, one can see the comparative performance in Figure 2.

Figure 2: Probability of recession predicted from Michigan sentiment index (blue), from 10yr-3mo Treasury spread (brown), and from sentiment index and Treasury spread (teal). Red line at 50% threshold. NBER defined recession dates shaded gray. Source: Univ. Michigan, Federal Reserve via FRED, NBER, and author’s calculations.

The Michigan sentiment indicator certainly covaries and precedes recession dates, although the probit model does not do a particularly good job at detecting big changes in probability (average is about 10%, rising to about 20% at actual recession times). Note that Blanchflower and Bryson focus in on big changes of 10 percentage points are more, pointing to a nonlinearity I’ve not incorporated (although I did try changes in sentiment as an indicator, yielding similarly lackluster results.)

Note that the term spread does a better job, but not altogether great. The candidate reasons for this result are manifold, as discussed most recently in this post. Using both variables improves the fit slightly, but does not yield a specification that is appreciably better at predicting recessions.

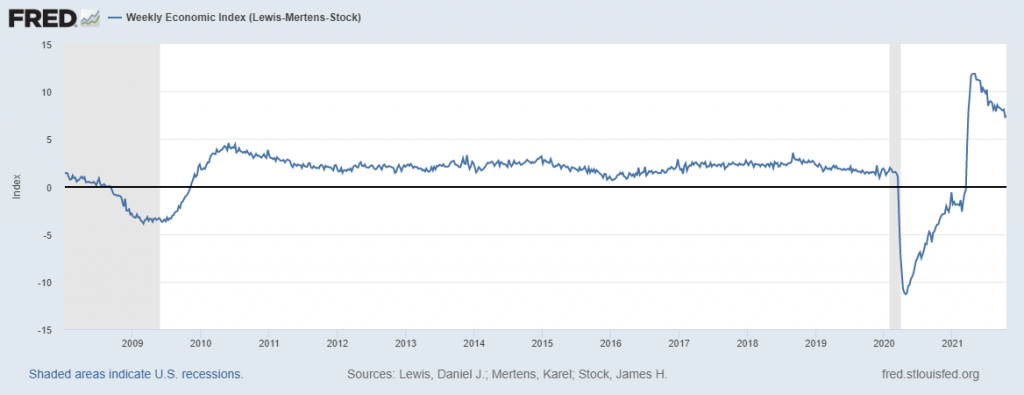

As for whether we’ve already entered into recession, I’m agnostic. My recollection of a discussion between myself and another CEA person in April 2001 was that we were assuredly not in a recession at that time. Of course, we only had data up to February, maybe a bit of March; and all that data was subsequently revised. NBER eventually dated the peak at March 2001. However, to the extent we have high frequency indicators we didn’t have back then, it doesn’t appear we were in a recession as of early-mid October.

Source: Lewis-Mertens-Stock Weekly Economic Index, via FRED, accessed 10/19/21 (for week ending 10/16/2021). https://fred.stlouisfed.org/series/WEI

The Globe had an article on a Dartmouth prof who sees the US already in recession. It said the state of economy is skewed by massive Federal transfer payments.

Americans have $18.5 trillion in bank [mostly FDIC-insured] deposits – a mitigation. The fact that so much money is earning [comparative] zero and not being invested or spent while inflation is 5%+ says something – fear, uncertainty.

Americans are having trouble paying utility bills. It seems President Biden’s about to make it worse.

T.Shaw: You do know the Dartmouth professor who is cited in the Globe article is the same Blanchflower who co-authored the article which is the subject of this post? It might behoove you to read either (i) the Globe article in its entirety, or (ii) read the Econbrowser post in its entirety.

With $18.5 trillion in the bank how can they have problems paying utility bills?

With $18.5 trillion in the bank why would they need to stop their record breaking spending spree, just because the government stopped sending stimulus checks? The stock markets have provided trillions of more spending dollars since the insurrection; we don’t need government to create new money when Wall Street does. That is what stimulus is all about (compensating for the private sectors failure).

…is entering…

Well, this is an interesting piece.

A housing crash appears to be about on us, as I had suggested (as pgl discounted) a couple of months back. The primary evidence here is from Zillow completely exiting its home buying program, even though this represented about 60% of revenues.

https://www.youtube.com/watch?v=BdCK9RKng1Q&list=LL&index=1

https://www.youtube.com/watch?v=Vh50ErhG8lY

So: no taper, and lots of inflation.

You still do not get that higher rents and lower discount rates affect housing valuations? You win the crown from dumbest consultant ever. And in my life – I have met a lot of really dumb consultants. Congrats!

What did Mr. Kopits ever do to you?

“Zillow completely exiting its home buying program”

They exited temporarily as they cannot get the construction materials to execute this business strategy. Oh wait – did your friends at Fox and Friends forget to tell you what this Zillow play was? Damn – you are one dumb consultant!

Brandon from Reventure Consulting? (your youtube). Folks – do not bother listening to this 12 minute waste of time because Brandon may be dumber than Princeton Steve. Loud but really stupid.

Come on Steve – please do not insult this blog with such utter garbage.

Before you claim that Zillows exit of the house buying and selling business is “evidence” of an impending “housing crash” maybe you should figure out what their business model is – and why they are have been forced to temporarily exit.

https://www.cnn.com/2021/10/18/homes/zillow-halting-home-buying/index.html

The quick flip money machine doesn’t work if you can’t do the quick fixing up. Prices don’t crash when there are supply chain problems – they usually go up.

Princeton Steve tries to convince us that 60% of Zillow’s business is from Zillow Offers. Either this troll is lying or he has no clue what Zillow’s financials show. Over the 2019 to 2020 period, total revenues averaged $3.04 billion a year with Zillow Offers revenue average $1.54 billion a year or just over 50% of total revenue.

But revenue is a terrible measure of value added when one is flipping houses. Consider a simple example where Zillow paid $450,000 for your house and then decided to put $50,000 into repairs before selling it for $500,000. Revenue may be $500,000 but value-added is a mere $50,000. And note profits on this hypothetical transaction was zero.

If Princeton Steve had bothered to check the Zillow 10-K, he might have noticed cost of revenue average $1.59 billion a year which reflects the cost of buying houses and fixing them up. Which is consistent with how Zillow noted this program has been running operating losses.

Look – I would expect a consultant to get basic accounting. But Princeton Steve clearly flunked Accounting 101 the same way he flunked Finance 101.

That was an informative story. Permit me to quote one part of it:

“Home purchases by iBuyers now account for about 1% of the market, according to a report from Zillow. The share is still a tiny part of the whole market”

Princeton Steve’s hair is on fire about some alleged crash because a housing flipper that represents a mere 1% of the market has paused its efforts? Seriously?

Princeton Steve has been known to lie to us before and he is doing it again. Zillow did not suspend its Zillow Offers program fearing a housing crash as Princeton Steve implied. No – it was shortages in the construction sector as this account notes:

https://news.wfsu.org/all-npr-news/2021-10-19/heres-why-zillow-wont-be-buying-any-more-homes-to-renovate-and-resell-this-year

Come on Stevie – we are not stupid enough to fall for your lies so stop it.

not sure if i see both a housing crash and high inflation occurring at the same time, today or in the near future. how does one square that? wouldn’t a housing crash tamp down inflation? if not in the official inflation calculations, but for the fact people would quit extracting money from their house to spend?

“The primary evidence here is from Zillow completely exiting its home buying program, even though this represented about 60% of revenues.”

my understanding is this has less to do with a housing crash, and more to do with zillow mismanaging their buy and sell business. apparently their high tech algorithms were unable to handle the uncertainty of contractor schedules and supplies. anybody who had ever needed a contractor for work certainly understands the proposed schedule and the actual schedule are about a year apart. the current supply chain issues meant the AI technology deployed had never been trained to work in such a disruptive environment.

As the Reventure guy points out, this would be a reason to scale back the business, not exit it. In a rising market, Zillow can essentially front run the market, hold the house for a bit and sell it for a higher price. This is pure financial speculation, most likely short term. If Zillow is exiting, it suggests this strategy is no longer viable, ie, house prices have probably peaked.

As the Reventure guy points out?? This guy is a loud mouth moron. I guess he did not check their 10-K filing. Did you? You might have noticed that this line of business has been a loss leader even before the pandemic. Maybe they should not just suspend this loss leader but exited it after all.

It suggests zillows business model is very flawed. It suggests that they cannot easily identify cheap properties that can be flipped for a profit. It suggests zillow is overvalued more than it suggests a housing crash. If a housing crash were imminent, the home builders would also be pulling out of the market. They are not. I would have more confidence in the actions of established home builders than the technology folks at zillow who recently decided to enter the housing market.

I agree. Now had little Brandon and his BFF Princeton Steve bothered to check the 10-K filings of Zillow, they show Zillow recorded an operating loss in excess of $300 million a year in 2019 and 2020.

Brandon wants us to believe the Zillow folks are the experts on the housing market. They clearly are not. But at least they are not as loud and stupid as Brandon or his BFF.

“If Zillow is exiting, it suggests this strategy is no longer viable, ie, house prices have probably peaked.”

or it means they no longer have access to cheap capital that allows them to hold a property. and if they must hold the property during renovation, which will now have an unknown timeline, that will be problematic. and i will note, house prices which have peaked does not mean the next step is a crash. that is the basis of your analysis, because we have peaked we will now see a crash.

at one time, i considered investing in zillow stock. i like interesting tech companies. i chose not to invest. did not think their new business model was sustainable or well thought out. they were a great innovator in the online housing presence a few years ago. but when they arbitrarily tried to purchase my house more recently, i was not impressed. it would not have been a profitable venture for the firm. i can understand why they would/should begin to exit the home buying strategy at this time. my guess is they are already overextended on properties that cannot be completed soon. funding has dried up.

“at one time, i considered investing in zillow stock. i like interesting tech companies. i chose not to invest. did not think their new business model was sustainable or well thought out.”

Smart! Tech companies can be great if their tech is used for smart purposes. But Zillow seems to be run by charlatans who would only impress dimwits like Princeton Steve and his new BFF Brandon. Look – a lot of people in Manhattan babble about flipping houses but none of them have the IQ to spot a market inefficiency if it ran over them.

Two business models.

1. Purchase houses, quickly fix up and sell within 60 days.

2. Purchase houses, fix up slowly and sell within 180 days.

First model require that you can identify cheep houses (great price compared to cost of fixing and sales price). Second model also require access to a lot of cheep capital and a solid ability to predict house prices half a year forward (beyond drawing a straight line through two datapoint). Zillow wanted to do model 1 and it makes sense that investors thought they might succeed. However, they were forced to do model 2 for which they were not qualified and investors refused to lend them enough money to do. Model 1 is not realistic if you hire contractors. You have to hire roofers, plumbers, electricians, painters and carpenters – then carefully calibrate the purchasing volume according to the workforce that you hired. That is very difficult.

I made the mistake of listening to some more of Brandon’s youtubes. I swear this dude is so incredibly dishonest and utterly stupid that he makes the National Review look smart in comparison. But I think we have figured out where you get your hair brained ideas. Brandon is a charlatan and you decided to pollute this blog with his intellectual garbage?

https://reventureconsulting.com/

Steven,

So you have been roasted pretty hard by pgl and others here. I have to agree that Zillow is a questionable source. However, not only are rents rising to the point of being a major driver of the recent inflation, although with some of that driven by various supply shortages that may dissipate, but the price to rent ratio has gone up, rising over 20% during the last year, with how high it has gotten depending on the data source one uses. But it has clearly gotten quite high in historical terms. This would have been a stronger argument than this stuff from Zillow.

Have you listened to any of those youtubes by Brandon (Steve’s new housing guru)? Brandon is loud, proud, and beyond dishonest. Sort of the Sean Hannity version of a housing economist.

OK I just gave you an excuse not to listen to Brandon but the fellow is quite the hoot.

pgl,

Asking me? No, I have not listened to Brandon and not about to. I prefer to keep track of serious sources.

The process to finally put Steve Bannon in jail starts tonight:

https://www.nbcnews.com/politics/donald-trump/jan-6-committee-move-forward-steve-bannon-contempt-charges-n1281843

More astounding news: Analysis of ancient poop reveals humans have always loved beer and cheese.

Based on what seems to be the general state of things, I doubt that we are in a recession. It is possible that shipping backlogs could cause one but at the the same time shortages of so many materials that do not require international shipping would seem to confirm that demand is robust. And those same shortages are a good indication of pent-up demand… they will be made up at some time.

Its my understanding that in many sectors sales are back above pre-Covid numbers. It’s just that demand for many products have gone considerably past that. If people cannot spend on entertainment they demand spending their money on something else, . So “just-in-time” supply chains have become “just-give-me-a-little-more-time” supply chains. It will wash out soon enough.

i listen to bloomberg radio a bit these days. in my view, bloomberg is now far and away the best at business news and analysis. at any rate, they have had several analysts on that have made a similar comment. while there are supply chain issues, at the end of the day it appears that demand is still robust. it is hard to see how a recession results with robust demand, in their views. companies like apple, with supply issues, will not lose their customers. people seem willing to wait for their apple product, rather than replace the item with an android. keeps apple with steady sales, even if not growing due to constraints.

Funny…. Blanchflower is no Trumpian trying to destroy whatever is left of the Biden Economy. No, he is a die hard Keynesian.

But any rate, we are not in a recession, things are going swimmingly, and are fantastic. How do we know? Well, several people in the Biden Administration tells us this, Jen Psaki, for one, said this; Pete Buttgieg said this, and then of course, President Ron Klain said that inflation is only a high class problem (via Jason Furman).

So no, Blanchflower is probably wrong, because the current administration tells us so.

Manfred,

Oh so snarkily cute. Well, if this is indeed a recession it will be the first one ever marked by the biggest surge in quit rates seen in US history. Yeah, workers are clearly a bunch of fools thinking they can quite their jobs for better ones when we are already in a recession that will, well, assuming this one looks like other recessions, lead to a rise in layoffs and job losses. Not a good time to be quitting a job to search for a better one, right, Manfred?

But, hey, please do not let some very hard facts spoil your delightful snark on what “the current administration tells us so.”

Thanks for the compliment, Barkley. Apparently, it is allowed to be snarky against a Republican president, but not against a catastrophic Democratic president.

Oh yes the quit rate. That is your only evidence? Pretty flimsy, I might say. Somehow, millions of workers disappearing from the labor force has nothing to do with it. Barkley, context matters.

But again, I know that one is not allowed to criticize the Ron Klain Administration. Merrick Garland may consider an undesirable, just like the parents criticizing school boards.

What a load of partisan rubbish. I guess you think Trump always told us the truth about COVID19.

You are so funny pgl. Really funny. “Partisan rubbish”, cannot stop laughing. As if you were never partisan, oh no.

Even if Trump is the Biggest Liar, does not mean that this Administration is a load of angels walking on water curing the poor.

No, they can be both the Biggest Liars. I understand, pgl, logic is not your forté. Never was, and never will be.

But again, I hope Merrick Garland let this pass again and does not put me on his black list, like those parents.

Manfred: Sorry, what of Biden’s statements compares to “the election was stolen”, “there was massive election fraud”, hydroxychloriquine works, “let in the sunlight”, “it’s like the flu” (especially what Peter Navarro knew back in January 2020), it’ll disappear in the spring, we’ll have 4% growth, etc. etc.?

Manfred

October 20, 2021 at 11:09 am

Wow – did I set off something in this troll or what? I would reply but our host beat me to it.

Manfred,

Are those “millions of workers disappeating from the labor force doing so because they are discouraged about getting a job after trying hard and failing to get one? I have seen no evidence of that. There does seem to be a problem of concern about lack of child care on the part of some workers and there is also fear about the pandemic in workplaces by some others, but maybe you can provide us with a source showing how many of these millions were trying and trying and trying to get a job, but just could not so left the labor force.

I don’t think you have anything here, not a darned thing at all. Just some snarky remarks about the admin, with you now throwing around some names from it. But what does Merrick Garland have to do with this? You want to defend people who are threatening the lives of school board members”? Those are the people Garland is concerned about, not just people “criticizing school boards.” Just how poorly informed are you anyway?

One more point that should be just plain obvious, Manfred. You are worried about these “million” of workers who have left the labor force and seem to be blaming various Biden admin figures who do not seem obviously to be involved in this at all? Well, last i checked most of those who “disappeared” from the labor force did so before Biden replaced you know who as president. Now this is a complicated matter with a lot of things going on, but if you want to make a big fuss about this labor force participation element, then what have you to say about the Tramp admin during which the majority of people pulled this disappearing act that you think people like current AG Garland should be by name called out over? Just which garbage Fox News show did you get this silliness from? Or did you somehow make this up on your own?

“Somehow, millions of workers disappearing from the labor force has nothing to do with it. Barkley, context matters.”

and those millions of workers disappeared under the trump administration. context matters manfred. why are democrats always cleaning up the mess of a previous republican administration? obama spent much of his administration cleaning the mess of the bush administration. by comparison, trump received a functioning economy that he still managed to derail.

It seems that 10 out of the last 10 recessions have been preceded by an inversion in the 2y/10y yield curve.

https://ritholtz.com/2021/10/10-wednesday-am-reads-260/

That is a very impressive predictor and easy to understand why such an event almost have to precede a recession. Someone explain to me why this time would be different?

Actually, the problem with inversion as an indicator ought to be false positives, not false negatives. Both the natural flattening of the curve (demographics, income and wealth distribution, whatever) and flattening due to policy (central bank asset purchases, banking regulation) lead to an increased risk of inversion.

So yeah, a positively sloped curve, steepening since August, really, really doesn’t hint at recession.

https://www.atlantafed.org/cqer/research/gdpnow

October 19, 2021

After recent releases from the US Census Bureau and the Federal Reserve Board of Governors, the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth decreased from 0.9 percent and 10.6 percent, respectively, to 0.4 percent and 8.4 percent, respectively.

https://fred.stlouisfed.org/graph/?g=txuj

January 30, 2020

GDPNow, 2020

Off-topic

I thought the HNA story in FT was interesting. Written by Edward White. Posted on the 18th I believe. Worth a read for those still following the Evergrande story or just China in general. I’m not relating this to markets in any fashion, but I would say there is an extreme amount of anger simmering there. and probably a similar type of build up in anger can be expected with Evergrande. There’s a lot of platitudes from Chinese officials about protecting consumers and smaller investors. I’m very cynical on that last sentence. The smaller players might lose some skin on their next “haircut”.

This is something like the fourth time (?) since since 2009 that China’s government has tried to let some air out of the property market. The previous times, things got scary and the government rented. So the problem got worse each time. Rogoff (I think) puts construction at 29% of China’s output. And there is some suspicion he has underestimated because of bad data.

You know the problem – how do you move from investment to something else as the driver of the economy without falling over? Ain’t never been done.

Relented. Not rented.

Same problem as brewing in the US, no? Unsuccessfully trying to let air out of the property market without tanking the economy?

I guess you got that dumb comment from your new BFF – Brandon. He is quite the hoot!

“brewing”? Micro-brews doing pretty well across the US.

“Well, that’s certainly provocative”

An informal survey taken of economists working at Mercatus Center indicated 8 of 10 economists prefer the term “ballsy”.

Found this on FT. I tend to disagree with it, but thought it was interesting either way and wondered if Menzie or anyone else had and “takes” on it:

https://twitter.com/RobinBrooksIIF/status/1448288803886669830?s=20

i.e. Is it crazy to think of this as mainly a “demand shock”??

this is what krugman has recently argued. services activities were cut, and consumers replaced it with increased consumption of products. the expectation is this will even out as the virus gets under control, and supply chain issues will resolve because we will cut back a bit on consumption of products. i guess this means gdp won’t really grow, as it is constrained by limited supply. but the demand for that supply will not evaporate, so a significant drop in gdp is probably not expected. as people have been saying, somebody who wants an apple product will simply wait until the product appears, rather than not make the purchase. gdp could grow if more people got vaccinated and increased services activities, to compensate for the constraints on the product side. politically half the population would rather see gdp tank, unfortunately.

Blanchflower and Bryson are interested in identifying early recession warning methods, here trying to exploit the idea of an “economics of walking about” which recognizes that people know stuff. (Market participants know stuff that drives yield curve inversion.) What it doesn’t tell us, at least in this case, is what they know. That may matter. We are looking at the possibility of a supply-shock recession. The data record B&B are working from is mostly of demand and financial shock recessions (oil embargo the exception). Maybe what the public knows is about demand shocks. That seems likely to be a problem with other early warning systems, too.

Ed Leamer has identified a progression of economic indicators which, as they turn negative, signal recession. Housing first – looking bad. Then autos – also looking bad. Then factory output overall – tepid. But all of them are facing supply constraints, so may not be signaling what Leamer’s system suggests.

Questing after early warning methods is virtuous, but means accepting a higher risk of false positives. It is also a very popular pastime among economists (formally trained and otherwise). It turns out, all kinds of data series have been identified as changing course ahead of recessions. The Sahm rule, as B&B note in another paper, is pretty good for the U.S., not so good elsewhere (less flexible labor markets?). Many of those series change direction too often, too late, too something, to be of much use.

Given the payoff from knowing that a recession is coming, and the ability of computers to identify data patterns, I’m kinda suspicious that rigid early warning methods have mostly been tried and found lacking. Human judgment, relying on a whole pile of data, may be as good as it gets.

Anybody have a Chna recession predictor? Now would be a good time to tell us if you do.

I’m not trying to be funny, I think this is actually a VERY interesting question. The biggest problem being nearly all of China’s economic stats are incorrect, and even most SOEs balance sheets are terribly inaccurate. I desperately want to say something witty at this moment about a “rule of thumb”, like motor home sales, or pounds of soybean curd sold per month. My sad pathetic contribution here is “I don’t know” but it doesn’t mean that it’s not out there somewhere. Maybe one of Menzie’s Hong Kong bros has some idea. Do they have something similar to our yield inversion?? short answer, NO

I think the best answer I could give you, in lieu of no other, and focusing on the current context of 2021–2022, is the “recession indicator” would be a certain amount of credit extended to the construction industry, below which hypothetical credit amount would cause construction/ property markets to go bust. The more practical answer to this, is that Xi Jinping and Beijing are not going to let this hurt the higher socio-economic levels of China’s society/population.

https://www.elibrary.imf.org/view/journals/001/2018/002/article-A001-en.xml

Well, md, a serious and important question, and, no, I do not have such. All I know is what I read in various publicly available outlets.

So, it seems that for now PBOC is containing the Evergrande problem from spreading seriously outside China beyond damage already experienced by certain firms. Their problems are spreading to other property developers there, and indeed residential construction is taking a pretty substantial hit.

But official and not-so official forecasters seem to be saying that the upshot of all this will amount to a reduction of about a half percent for this year’s GDP growth, not all that big of a deal. But, as I have noted here several times, very few of these observers really know certain important aspects of this, especially what is going on in the shadow banking sector, which Evergrande has been reported to be deeply involved in. Most observers seem to be assuming that indeed the PBOC does know what is going on there with all this and will be able to keep it reasonably under control.

So far so good, more or less, but we shall have to wait and see.

it is probably not possible to have a good recession predictor for the chinese economy. it does not evolve as a free market capitalist system. all of our market models really assume that aspect to be true. the ccp can and does intervene in ways that our models cannot accurately account for. as macroduck said, human judgement is probably the best we can do at this point. when a nation’s leaders can unilaterally impose new rules on economic sectors, it becomes very hard to predict the future performance of those sectors. some of those actions will be effective, and others not. couple that with the opaqueness of business and economic data from china, and it is a difficult country to analyze and invest in.

We also have no conventional recessions in China (based on official data) in three or four decades, so no way to extract a conventional recession signal from data.

This absence of recessions also accounts for the confidence that Chinese officials can prevent recession – a kind of Chinese exceptionalism. Good luck to China with that.

Until now, demographics have minimized the appearance of economic recessions in china. That tailwind is now turning into a bit of a headwind.

all that about sentiment indexes. employment indicators, and spreads is just confusing me; are they talking about a recession as per the usual 2 negative GDP quarters, or some other definition, akin to “it feels like a recession”?

speaking of provocative, Bill McBride has a good catch: Most Housing Units Under Construction Since 1974 bottom line, housing starts are not leading to housing completions because of component shortages and related delays…with automotive, that’s two big sectors being crippled by supply chain problems…

r.j. sigmund: Well, I for one am using 1’s and 0’s defined using NBER peak/trough dates.

You Puh-huds and yur damnded durned mathsez.

All degenerates’ style joking aside. If headline quarterly GDP was at +10% (not coming out of an abutted recession with odd May consumption numbers) and in that same exact time period the unemployment rate increased 8% and LFPR dropped 10%, would the La Follette School of Public Affairs faculty members be telling us this is “good news” or “bad news”?? Remember…… this hypothetical world I have based this question on is MY world, and I dictate reality on the ground.

Bill McBride as always has a lot of informative insights on the housing sector. McBride’s latest undermines the housing crash insanity we saw above with those complete misrepresentations of happenings at Zillow.

Princeton Steve once admitted as such but of late he has not been following the insights of Bill McBride. No Princeton Steve has been listening the youtubes by Brandon of Reventure Consulting who is clearly the dumbest charlatan ever.

you gotta give Steve a little credit, pgl; he called $100 oil before Putin did…

Well, rjs, in the last month and a half Brent crude has risen over $15 per barrel. If it keeps rising at that rate, it will hit $100 per barrel not too long after Thanksgiving. I know that several people here ridiculed SK for this forecast and also got on my case for saying it was quite possible even though I was not forecasting it, although I was still then allowing that we might also see a sharp decline, which has not happened. But while I still think there are some serious counterevailing forces out there, the old forecast of $100 per barrel by the end of the year does not look nearly as ridiculous as did some several months ago when various folks thought it was great to make great fun of such a forecast.

I as someone who called the massive OPEC- price boost of nearly a half century ago am not surprised that OPEC is back to its old tricks and apparently strongly behind this price boost, even as they might yet decide to hold it back before it hits $100 before the end of the year. But as of the last month and a half the trend has it going there, with no mumbling out of the key players there of them slowing it down all that much.

We may have an oil price boom but that pales in comparison to what is happening to copper prices. Folks – raise you hand if you predicted that!

pgl,

Also, natural gas prices, especially in Europe have shot up a lot more than has oil and quite suddenly. I am not aware of anybody calling that one either, including me or Steven Kl, although perhaps he will weigh in that he did to his clients. I do not know.

A lot of weird stuff going on.

October 27th is a good day for U-W Madison students to call in sick, or spend the evening off campus. Trust me kids, you’ll thank Uncle Moses later. Just the smell alone from Shannon Hall will be unbearable.

Aren’t recessions choices? If the Fed bailed out Lehman’s would the 2008 recession have even happened? If governments had not shut down society would the 2020 recession have happened? Isn’t GDP too ergodic to have any relevance to my life anyway, except through psychological channels?

Are you all just telling a groupthink story based on data so noisy, you could easily settle on some other story and sell that by cherry-picking from the noisy data?

Aren’t recessions choices? No. That’s the implicit foundation of this hunt for early warning indicators. We want to have a choice, but don’t have because we don’t know enough to use countermeasures.

NBER doesn’t rely entirely on GDP for calling recessions. Other measures employed are directly linked to welfare. So again, not made up stuff. Real stuff.

How accurate is their data? Why don’t they include error margins?

If NBER had different personalities, would their call have been different?

‘If the Fed bailed out Lehman’s would the 2008 recession have even happened?’

Lehman’s collapse was on 9/15/2008. Now we know Donald Luskin said on 9/14/2008 there would be no recession, NBER dates the beginning of the Great Recession as of Dec. 2007. Now the financial crisis was made worse by the collapse of Lehman’s but it was already on the way before hand.

《The committee views the payroll employment measure, which is based on a large survey of employers, as the most reliable comprehensive estimate of employment. This series reached a peak in December 2007 and has declined every month since then.》

(From https://www.nber.org/news/business-cycle-dating-committee-announcement-december-1-2008 )

Did they consider the standard error? Same question for the rest of their criteria, too?

rsm: The committee places greater weights on those series that are both timely, and experience smaller revisions. Have you ever talked to anybody on the NBER BCDC?

The good news is no “superspreader” events at all of the college football games. Football is officially out of a recession. Definitely reached “herd” immunity at Marshall University.

One might attribute this allegedly goods news to the college kids being a lot smarter than you – as in wearing masks and getting vaccinated.

Of course anyone with a brain would know the college football season is not over. Except for programs in Michigan!

observation of populations that do not mask does not support masks work….

maybe states that do not run medico tyranny have a lot of volunteers.

do you turn the telly on and see any masks in those crowds?

the vax increases myocarditis and pericarditis rates in young males (lesser but present in females) 6 to 8 times.

Is your real name Tucker Carlson? So many lies, so little time.

“the vax increases myocarditis and pericarditis rates in young males (lesser but present in females) 6 to 8 times.”

lets give this a more proper analysis paddy.

“HEART inflammation triggered by some covid-19 vaccines has been a concern, especially in younger people, but a preliminary study suggests that in those most affected, it is six times more likely to occur after a coronavirus infection than after vaccination.”

Read more: https://www.newscientist.com/article/mg25133462-800-myocarditis-is-more-common-after-covid-19-infection-than-vaccination/#ixzz79wOcK9t4

Michigan, where a rose never grows.

West Virginia is 24th ranked state in case rates. Data up the 18th of October. But this is at a point in time when America has the highest level of vaccine rates since the start of early 2020. This proves the effectiveness of the 2020 shutdowns and onward, it does NOT disprove the lives saved by shutdowns.

https://www.marshall.edu/coronavirus/2021/06/24/update-on-fall-2021-covid-19-protocols/

“Unvaccinated individuals should be prepared to wear masks in all areas, including outdoors.

Students are required to submit their current vaccine status in an online registry to help us gauge whether or not we have reached herd immunity on campus. The registry offers several possible responses, including an option to not disclose vaccine status.

Our student vaccine incentive program currently includes a weekly raffle for $250 gift cards for the campus bookstore and $300 packages of Herd Points. We will announce the raffle winners on Instagram every Friday beginning tomorrow, June 25, and running until Aug. 20.”

Bruce…… I don’t wanna call you dumb. That’s self-evident.

no need to cause and effect study the lack of difference between masked and un masked populations!

there is no statistic difference.

the state ranking……

ny and nj remain the top death states.

All right – you repeated your dangerous lies. So what do you have in store for tonight’s show Tucker?

https://www.nytimes.com/interactive/2021/us/covid-cases.html <<—-also has each of the 50 U.S. states' death rates.

Not too big on reading are we paddy?? Do you think you might want to account for the base populations and rate of cases/deaths when doing these things?? Or do you prescribe the idea that the total number of women suffering from breast cancer is higher in Florida than it is in West Virginia is due to West Virginia women’s better health choices??? paddy, was your name “CoRev” in a prior life??

My non-technical cloudy plastic ball says no recession and none soon. The magic dowsing stick agrees.

https://www.nytimes.com/2021/10/18/us/politics/sanctions-cryptocurrency-treasury.html

October 18, 2021

Treasury Warns That Digital Currencies Could Weaken U.S. Sanctions

A review found that the sanctions program must be modernized to maintain its effectiveness.

By Alan Rappeport

WASHINGTON — The Biden administration warned on Monday that digital currencies posed a threat to America’s sanctions program and said in a new report that the United States needed to modernize how sanctions were deployed so that they remained an effective national security tool.

The warning was included in a six-month Treasury Department review of the nation’s sanctions program, which has been used more aggressively in recent years as a lever in international diplomacy. The focus on digital currencies coincides with an administration-wide effort to determine how to regulate new financial technology without stifling innovation.

“Technological innovations such as digital currencies, alternative payment platforms and new ways of hiding cross-border transactions all potentially reduce the efficacy of American sanctions,” the Treasury report said. “These technologies offer malign actors opportunities to hold and transfer funds outside the traditional dollar-based financial system.”

The Treasury Department also raised concern that America’s adversaries have been taking steps to reduce their reliance on the U.S. dollar and said new digital payments systems could exacerbate this trend and could erode the power of American sanctions.

The United States has more than 9,000 sanctions in place, largely to punish countries such as North Korea, Iran and Venezuela for facilitating terrorism, violating human rights or committing other illicit behavior. The strength of the U.S. dollar and its role as the world’s reserve currency means that the United States can cut off countries, groups or individuals from much of the global financial system at its discretion. That has intensified efforts to find new ways to evade America’s sanctions, including by using digital currencies that do not flow through the traditional banking system.

The use of sanctions surged to record levels during the Trump administration, which averaged more than 1,000 new designations per year, according to the law firm Gibson, Dunn & Crutcher. This year, the Biden administration is on a pace to impose 900 sanctions, which would tie for the third-highest total on record….

http://www.news.cn/english/2021-10/20/c_1310257421.htm

October 20, 2021

China’s FDI inflow up 19.6 percent in first 9 months

BEIJING — Foreign direct investment (FDI) into the Chinese mainland, in actual use, rose 19.6 percent year on year in the first nine months of the year, the Ministry of Commerce said Wednesday.

During the Jan.-Sept. period, non-financial FDI into the country totaled 859.5 billion yuan. In U.S. dollar terms, FDI into the Chinese mainland totaled 129.3 billion U.S. dollars, up 25.2 percent year on year.

FDI into the service sector increased 22.5 percent in yuan terms, while high-tech industries saw FDI inflow jumping 29.1 percent year on year, data from the ministry showed.

Foreign investments from the Association of Southeast Asian Nations and countries along the Belt and Road into the Chinese mainland jumped 31.4 percent and 31.9 percent, respectively.

Stephen Miller last year cooked up some scheme to send half of the US Army to the border with Mexico:

https://www.sandiegouniontribune.com/news/border-baja-california/story/2021-10-19/trumps-pentagon-chief-quashed-idea-to-send-250-000-troops-to-the-u-s-mexico-border

What a guy – maybe he wanted to start a war with Mexico so he could lead a slaughter of those Brown People.

https://news.cgtn.com/news/2021-10-20/Chinese-mainland-reports-30-confirmed-COVID-19-cases-14vrOGSP71u/index.html

October 20, 2021

Chinese mainland reports 30 new COVID-19 cases

The Chinese mainland recorded 30 new confirmed COVID-19 cases on Tuesday, with 17 cases of local transmission and 13 from overseas, data from the National Health Commission showed on Wednesday.

In addition, 22 new asymptomatic cases were recorded, 4 of which were locally transmitted, while 356 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 96,601, with the death toll remaining unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-10-20/Chinese-mainland-reports-30-confirmed-COVID-19-cases-14vrOGSP71u/img/748f684a1d2844e8b3833d27bc56809e/748f684a1d2844e8b3833d27bc56809e.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-10-20/Chinese-mainland-reports-30-confirmed-COVID-19-cases-14vrOGSP71u/img/ffb1e9f232274458b386731c917d3850/ffb1e9f232274458b386731c917d3850.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-10-20/Chinese-mainland-reports-30-confirmed-COVID-19-cases-14vrOGSP71u/img/9441ec7d069145babf9c7c56b03e6a66/9441ec7d069145babf9c7c56b03e6a66.jpeg

http://www.news.cn/english/2021-10/20/c_1310257619.htm

October 20, 2021

Over 2.236 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — More than 2.236 billion doses of COVID-19 vaccines had been administered on the Chinese mainland as of Tuesday, data from the National Health Commission showed Wednesday.

An astonishing and distressing failing for British public health:

https://www.worldometers.info/coronavirus/

October 20, 2021

Coronavirus

United Kingdom

Cases ( 8,589,737)

Deaths ( 139,031)

Deaths per million ( 2,034)

China

Cases ( 96,601)

Deaths ( 4,636)

Deaths per million ( 3)

Hi ltr,

Assuming your Covid data is correct, it begs the question why has China been so less affected than other countries?

Scientists believe the virus may have been engineered. If so, why would you said engineering not include, if possible, disparate impact on the genetic profile of the home country?

Here is a list of the highest death rates by country:

https://www.bbc.com/news/world-51235105

Here are death rates per 100,000 population

https://www.bbc.com/news/world-51235105

Death rates per capita in the US are relatively high but not the highest in the world. Of course ours is really high in light of the fact that we are doing pretty good at getting our population vaccinated.

Now if we stopped listening to COVID19 liars like you we would see even more vaccinations as well as more social distancing, which would have given us less deaths per capita.

“Assuming your Covid data is correct, it begs the question why has China been so less affected than other countries?”

Come on Sammy – we have done this many times before. Now go write on your chalk board 500 times:

Social distancing/masks/test and trace

Maybe some day these simple concepts will enter your very diseased brain.

pgl,

what happened in sweden where they do none of your sacred npi’s? or in many red states!

the null hypothesis for why the pac rim suffers lesser impact from covid19 is “prior exposure to corona viruses has durable, cross immune effects”.

immensely superior to leaky, dangerous shoddily tested western vaccines.

that null hypo thesis is superior to the hypothesis “npi’s work”.

two things about ur covid religion: inferential statistics/experiment design are anathema, and population data is heresy.

or china is hiding the fact not much is getting exported bc covid is more than they say. the ships off long beach are less dense than ships off mainland china port.

paddy kivlin: Maybe compare Sweden to neighbors Norway, and Denmark. What do you see? Hint: go to this site for cumulative fatalities per capita numbers: https://ig.ft.com/coronavirus-chart/?areas=swe&areas=nor&areas=dnk&areasRegional=usny&areasRegional=usla&areasRegional=usnd&areasRegional=usak&areasRegional=usfl&areasRegional=ustn&cumulative=1&logScale=0&per100K=1&startDate=2020-09-01&values=deaths

Random question: do you have some sort weird aversion to capitalization and proper grammar?

Tucker! How did your show go last night?

Coronaviruses are notoriously known for their inability to create lasting immunity. Infections protect somewhat for 3-9 months depending on how bad the infection was.

menzie,

you had no replay button for your oct 20 7:17pm

i can compare sweden to netherlands and Belgiium limited to the headline covid period, as well.

there are many ways to look at population data and many measures, as well as time periods to select and hypothesize. lately i like to use all cause deaths, as they rid counting and testing biases.

prior to mar 2020 numerous studies, many public health “experts” agreed npi’s should not be applied to populations in pandemic.

no sense in dueling. this debate has been going on since may 2020.

If you want to make the prior exposure argument, you need to at least provide some adequate data and explanation of what and how that exposure occurred. Otherwise you are simply promoting conspiracy theories paddy.

https://mainly macro.blogspot.com/2021/10/who-is-really-to-blame-for-uks-terrible.html *

October 19, 2021

Who is really to blame for the UK’s terrible pandemic performance?

In September the right wing press began a campaign to get GPs to see more patients face to face. All the right wing papers joined in, with the Mail having a five-point manifesto for GPs which included calls for the Government to “act to ensure a greater proportion of GP appointments are in person”. It might seem odd that the Mail should launch this campaign at a time that COVID is still widespread in the population, and GPs are already overworked from both this and also vaccinating a large number of their patients.

In mid October, the new Health minister Sajid Javid offered GPs new money, but only if they increased the number of patients they saw face to face. League tables giving data on how many people have seen their GP face to face will be published. The 2 metre rule in surgeries will be scrapped to allow more patients to attend surgery. Javid clearly thinks, like the rest of the government, that the pandemic in England is over, even though the data thinks otherwise.

Although over time the number of GPs has grown faster than the population, the demand for GP services has grown faster still. As the pandemic began the UK had 2.8 doctors per 1,000 people, compared with an average of 3.5 doctors across the OECD, so the UK has one of the lowest number of GPs among similar countries in Europe. Furthermore the number of GP appointments has increased, not fallen: practices in England delivered 31.1 million appointments in June 2021, of which 4.2 million were for covid vaccinations, which was 7.3 million more appointments than in June 2019 (23.8)….

— Simon Wren-Lewis

* Reference link purposely broken in order to post

https://www.nytimes.com/2021/10/12/world/europe/uk-covid-deaths-inquiry.html

October 12, 2021

Britain’s Covid Missteps Cost Thousands of Lives, Inquiry Finds

Prime Minister Boris Johnson’s slowness last year to impose a lockdown and institute widespread testing had tragic results, according to a parliamentary report.

By Shashank Bengali

LONDON — Britain’s initial response to the Covid-19 pandemic “ranks as one of the most important public health failures the United Kingdom has ever experienced,” a parliamentary inquiry reported on Tuesday, blaming the government for “many thousands of deaths which could have been avoided.”

In a highly critical, 151-page report, two committees of lawmakers wrote that the government’s failure to carry out widespread testing or swiftly impose lockdowns and other restrictions amounted to a pursuit of “herd immunity by infection” — accepting that many people would get the coronavirus and that the only option was to try to manage its spread.

“It is now clear that this was the wrong policy, and that it led to a higher initial death toll than would have resulted from a more emphatic early policy,” the report concluded.

Although many of its findings were already known, the report grew out of the first authoritative investigation of Britain’s pandemic response. The inquiry, led by lawmakers from Prime Minister Boris Johnson’s own Conservative Party, described a litany of failures by his government in the months after the first coronavirus cases were detected in Britain in January 2020….

https://www.worldometers.info/coronavirus/

October 20, 2021

Coronavirus

Sweden

Cases ( 1,164,402)

Deaths ( 14,945)

Deaths per million ( 1,468)

Denmark

Cases ( 371,286)

Deaths ( 2,694)

Deaths per million ( 463)

https://www.worldometers.info/coronavirus/

October 20, 2021

Coronavirus

Norway

Cases ( 198,161)

Deaths ( 893)

Deaths per million ( 163)

ltr,

You keep making my point. Covid death rate in China = .3 per 100,000

US death rate = 220 per 100,000

Peru death rate 614 per 100,000

Brazil =285 per

Italy = 218

UK = 207

The highest asian nation I could find is Philippines at 37 per 100,000

Japan = 14 per 100,000

South Korea = 5.2 per

Taiwan = 3.6 per

Singapore = 4.1

China = .3

https://www.bbc.com/news/world-51235105

Sort by “Death Rate” and scroll the list.

Every Thursday morning, the US Employment and Training Administration (part of the Department of Labor) reports on new unemployment insurance filings, and the number who continue to collect unemployment insurance. The weekly figures are very quick, but subject to immediate revision the following week.

Now that the major revisions are done, we know that in the first nine months of the year, initial weekly unemployment claims are down 65.5% from a year earlier, but up 150.1% from Jan-Sept 2019. Continuing claims are down 68.7%, or up 114.5%, depending on your perspective.

https://www.dol.gov/agencies/eta/feature-numbers