The October Wall Street Journal survey of economists, now quarterly, is out. A substantial downshift in the forecasted level of GDP is apparent.

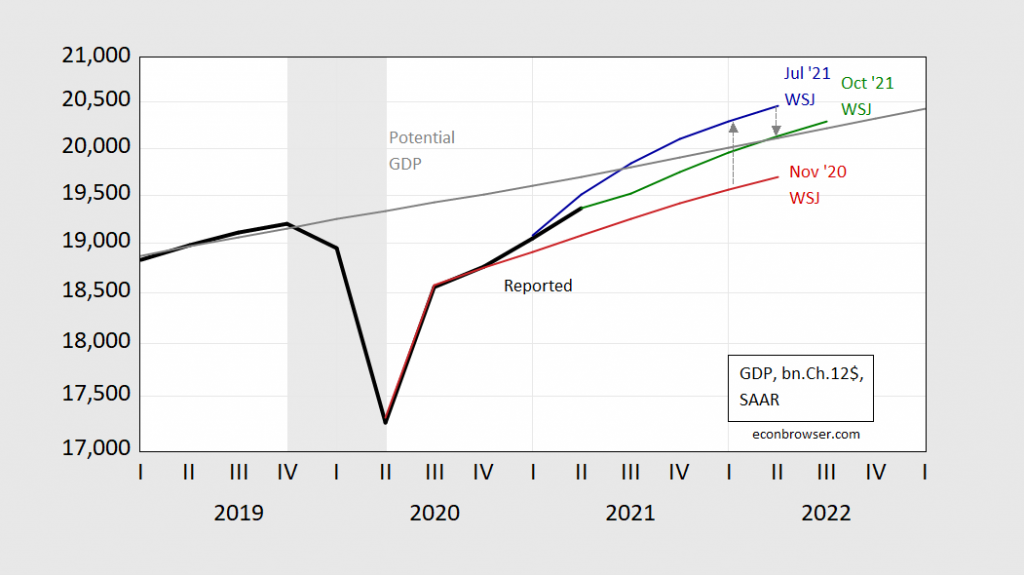

Figure 1: GDP (bold black), November 2020 WSJ survey mean (red), July 2021 survey mean (blue), and October 2021 survey mean (green). NBER defined recession dates shaded gray. Source: BEA, WSJ (various surveys), NBER, and author’s calculations.

In early November 2020, the average forecast was for a slow closing of the output gap (using potential GDP as estimated by the CBO in July of this year). By July, optimism had built, implying a zero output gap by mid-2021. As of the October survey, the closing of the output gap had been pushed back to mid-2022 (For an alternative view of the “output gap”, see this post).

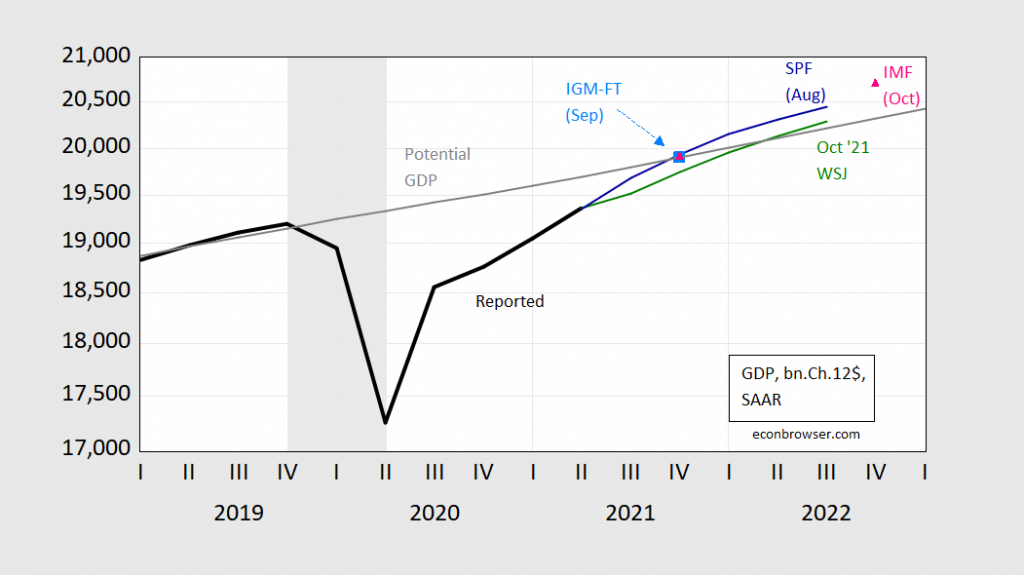

Figure 2: GDP (bold black), October 2021 WSJ survey mean (green), Survey of Professional Forecasters August survey mean (blue). FT-IGM September survey median (sky blue square), IMF World Economic Outlook October forecast (pink triangle). NBER defined recession dates shaded gray. Source: BEA, Philadelphia Fed, FT-IGM survey, IMF, WSJ (various surveys), NBER, and author’s calculations.

Certainly, the short term outlook does seem a bit lackluster, as indicated by monthly metrics (e.g., industrial production, in this post), and by GDP nowcasts (as of today, IHS-MarkIt is at 1.4% q/q SAAR for Q3).

The IMF remains noticeably more optimistic than the average WSJ survey respondent, looking more like the Survey of Professional Forecasters prediction.

Speaking of optimism, Amazon stock value is near $1.75 trillion. OK – sales surged last year to around $350 billion but a value to sales ratio near 5 is kind of steep for a company whose operating margin is generally near 5%. Value/earnings near 100 is off the chart unless one believed that 1999 book by Glassman and Hassett. So is Amazon overvalued?

Amazon is hiring 150,000 seasonal workers right now. How many is Walmart hiring?

Amazon’s business is very good.

So what? In 2019, Amazon’s holiday hiring target was 200,000. I’m not saying Amazon isn’t having a good run. I just don’t see that tossing out a single “big number” factoid tells us anything useful.

One of my favorite clarifying tricks with young analysts is to ask, when they toss out a number they clearly think is somehow important, “Is that a big number?” Or sometimes “Is $5 billion a lot?” They have swallowed the trick used by politicians and journalists of citing “big numbers” without context and end up fluustered confronted with a request for context. The follow-up is something like “What’s the total budget?” or “What’s daily turnover?” They usually don’t know and have to look it up.

That 150,000 seasonal hiring target? That’s 11% of Amazon’s workforce. In 2019, Amazon’s holiday-season hiring target was 25% of its workforce. This year’s target is much less ambitious.

“Big number”??~~Captain Kirk expenses weighing heavily on profit margins. B-acting upon desert touchdown is more expensive than ever. Melodramatic bad acting hasn’t been this expensive since Charlton Heston in “Soylent Green”.

I also asked how many Walmart is hiring. The answer is 20,000. Amazon is doing much better which explains its high stock valuation which was the initial question.

But go ahead and ignore the context while pontificating about “big numbers.” Here’s a big number for you: Amazon’s market cap is $1.75 trillion, while Walmart’s is $403 billion.

I guess pontificating is when you don’t like the answer.

What you are arguing, whether you know it or not, is that Amazon is big. Amazon is big – that’s not in question. Big, in itself, doesn’t even explain capitalization and it certainly doesn’t explain share price. Which is also to say, you are missing context. You’re still just saying ” big number”.

amazon has a p/e ration of around 60 today. it was 4 or 5 times that value a few years ago. so over time, its multiple has gotten cheaper (this is by no means cheap, however). a company that has done as well as it has over recent years while dropping its multiple is rather eye opening. from that perspective, it is hard to argue that the stock is over valued. amazon is a tech company that is growing while simultaneously dropping its multiple AND increasing its stock price. hard not to like this kind of stock and company.

Not sure what this has to do with manufacturing.

But, it’s not only AMZN. Chipotle’s P/E was 89; Treminix was 74; Chevron was 59 last Friday. .

It’s likely higher now.

From late August 2021 Barron’s – Aggregate value of the ‘big five’ tech companies is $9 trillion (AAPL – $2.4T, MSFT – $2.2T, GOOG – $1.8T, AMZN – $1.6T, FB – $ 1.0T), or 23.3% of S&P 500 aggregate value – up from 7.3% in 2012.

One factor to review is how much of their shares these corporations buy in the market.

By end September 2021, $72 billion in junk-rated loans funded dividends, a high since 2000 [Barron’s].

In general, the markets are awash in liquidity.

Real personal disposable income fell 0.3% in August. With the end of enhanced jobless benefits and slowing job growth, a rebound in September may not be in the cards. A number of short-term economic indicators have cooled in recent weeks: https://www.calculatedriskblog.com/2021/10/seven-high-frequency-indicators-for_18.html?m=1

There is a tendency for forecasts to revert toward the mean, which may account for excess optimism heading into September. Once actual data become available, reversion to the mean is replaced by reality. It ain’t the end of the world, but the Fed may reconsider the timig of asset purchase tapering in light of reduced growth expectations.

Why don’t economists include standard error on GDP estimates? Because the confidence intervals would be so wide, you could tell any story and support it with the data?

When you scale another estimate by GDP, shouldn’t intellectually honest statisticians also multiply the errors, thus again yielding error bars so wide, any story becomes plausible?

In short, why are we still using GDP when making public policy?

rsm: BEA does report the size of revisions (mean error, std deviation, something like mean absolute error). (BLS does a similar thing for its main series as well.) Serious researchers have examined this issue of revisions, as discussed in this Econbrowser post. So I’m not as pessimistic as you, particularly insofar as the level of GDP is concerned.

In addition, I’m not sure how I would do what you specifically suggest. GDP is calculated using a large number individually, seasonally adjusted, series. These series are themselves not uncorrelated – so a “confidence interval” in the sense of classical statistics would be *really* hard to calculate.

If not GDP, what aggregate indicator of economic activity would you use?

Measurements increase/decrease of human capital?? Amount of wasted human capital?? Negative externalities created by coal/oil/meatpackers etc. manufacturing byproducts?? Lost potential GDP paying interest on government debt to pay for wealthiest Americans’ tax cuts??

https://ftp.iza.org/dp13494.pdf

Moses Herzog: If you’re saying we need something like a Nordhaus-Tobin Measure of Economic Welfare, I’m all behind you. But if you think you can estimate with any greater precision than GDP the variables you mentioned, well I beg to differ.

That’s fair enough. You are 100% correct on the measurement difficulties. I felt the point still deemed being made. And yes, I am aware many professional/credentialed economists have also made a clarion call on this, and I am stating nothing original in thought. For some reason this first book always pops into mind on this specific topic, though I have only read segments of it:

https://thenewpress.com/books/mismeasuring-our-lives

https://www.oecd.org/social/beyond-gdp-9789264307292-en.htm <<—-this 2nd publication link is free for those interested, click on the pdf version

@ Menzie

BTW, I bought some old school tiny (halogen??) brake lights for a 2007 model Toyota at lunchtime today. One of the original burnt out on me. A set of two cost be about $11.50. The mechanically clueless, uncoordinated, awkward Uncle Moses (my hands are probably more steady when drinking, and that has nothing to do with withdrawals either, just how bad my regular dexterity is) is going to try and install these $11.50 brake lights by himself. Can you tell me what it costs at a dealership for mechanics to install brake lights, so I know how much I robbed from GDP this week~~~giving a free comedy show to my neighbors as I attempt to install these???

Possibly the most shocking thing about all of this??~~ besides the fact Uncle Moses mustered up the courage to try out this sh*t show self-install with the brake lights?? After I left the store I noticed the lights were made in Japan and not, uh, other Asian nations “do south” of there. I nearly fainted.

i had an old honda crv with crappy headlights that needed replaced frequently. little halogen types. they were impossible to replace, especially in the cold of winter. i would gladly pay a dealer high multiples rather than go through such an ordeal again. the engineer who came up with that headlight design should have been placed in front of a firing squad.

@ baffling

I’ll tell you a little trick, and this is NOT a practical joke. Now this won’t help you if the headlights are actually broke, but it will help you if your car is old and your lights get dim. This is cheap Uncle Moses’ personal experience talking here. Buy you some high fluoride toothpaste. Standard Crest or Colgate will work. Get you an old used dishtowel or a rag that is clean. You could use an old ripped t-shirt also but a rag or ripped towel is slightly better. Maybe a small plastic pail of water. Smear about 5–8 times the amount of toothpaste you use on your teeth DIRECTLY onto the outside cover of your headlight (no need to disassemble anything). Take that rag, dip it in your small plastic pail of water and then squeeze out the excess water from the towel. Now, semi-vigorously run that toothpaste on the headlight for about 3–5 minutes. You want just enough water in the towel that it lathers up the light but doesn’t immediately rinse the toothpaste off. Do the other headlight the same. 3-5 minutes semi-vigorous wiping. Rinse off all that toothpaste from the cover of the headlights by pouring your pail of water over both lights and then dry it off with another old (but clean) rag.

If you have an old car and your headlights are dim, I promise you will notice a difference after doing this. If it’s still not bright enough then you need to fix your lights or replace them. But I can tell you, if your lights are dim on a very old car, this little stunt will work. The older lights can get dim from the carbon build up on the outside part. It’s a lifesaver if you drive at night.

@ baffling *rub the toothpaste, not “run” it. Hopefully that was understood anyway,

Domestic Demand:

The US is, first and foremost, a market.

Let Korea, Malaysia (et al) measure exports as a benefit to their economies, rather than a lack of adequate local demand.

Apparently there will be a semi-important IHS-Markit number coming out on Friday. Not sure if public media sources will be reporting that or not. Certain to get some attention.

Kuehne and Nagel is reporting that last week 584 container ships were stuck outside ports, twice the number as this year’s beginning. That would be an interesting number to keep track of if a person can get regular access to it.

this site is pretty neat!

https://www.marinetraffic.com/en/ais/home/centerx:-127.0/centery:35.5/zoom:4

@ Mr. Kivlin

It IS pretty cool. Thanks for the share. I think Menzie put this up a couple times in the semi-distant past or a very similar such. ZH sometimes has these type links. And I know you have to be very skeptical when using ZH materials, but there are some good ones. WSJ is also good. Amazingly I have semi- goodluck getting past the FT paywall, and they give data points on this stuff here and there which is where I got the 584 number from.

the interesting thing is that if trump had simply acknowledged the coronavirus was a problem, and emphasized that the vaccine was going to be strong deterrent for the virus along with masking and social distancing, he probably would have won the election. and if he had followed through on that plan, gdp would be going through the roof right now. but he did not. and so he was not reelected. and the economy continues to suffer from his positions. he probably lost the election when he got covid and almost died. that struck a chord with many voters, who would not have been lost had he never gotten sick. and the only way he does not get sick while campaigning is to social distance and mask.

Baffled’s comment represents what wrong with liberal logic. Still blaming Trump for the current political/economic conditions while implementing or at least talking about implementing his party’s and his chosen candidate’s “pie in the sky” policies.

Also indicative is the series of articles here and else where trying to convince us that it not as bad as we think it is. Remember the articles of the Trump years, which were trying to make us believe its worse than the data showed.

We are well into the 1st year of your chosen candidate’s policies, liberals best ideas for governing, and we can see just how poorly they are performing.

2022 is coming.

Sounds like the Republican snowflake is having a rough day. Here, CoRev, something to make you feel better, from the “Glory Days” of June 2020. Over 4 months before the orange creature lost the election 306 to 232:

https://www.politico.com/news/2020/06/27/trump-losing-2020-election-342326

Well, we all knew donald trump was a weak p**sy, with small hands. Then he went and proved it.

“Baffled’s comment represents what wrong with liberal logic.”

no. i am showing you that trump had a legitimate chance of reelection. but his decision making resulted in his failure. we are still dealing with that today. that said, the economy is chugging along. we are not in a recession. not sure what dire circumstances you think we are currently in, corev. but we could have been in even better condition. had trump addressed the coronavirus effectively, we would be vaccinated and spending like drunk sailors. and trump would still be president. all he had to do was do the right thing. but he could not bring himself to do so. so we have to deal with some wasted time as we recover from his administration.

https://fred.stlouisfed.org/graph/?g=txuj

January 30, 2020

GDPNow, 2020-2021

this site is pretty neat!

https://www.marinetraffic.com/en/ais/home/centerx:-127.0/centery:35.5/zoom:4

https://www.nytimes.com/2021/10/19/opinion/vaccine-mandates-us-ports-supply-chain.html

October 19, 2021

Of shots and supply-chain snarls

By Paul Krugman

It’s 7:38 a.m. on a Tuesday — specifically today, Oct. 19, 2021 — and you’re taking a taxi from Kennedy Airport to the New York Times building. If you’d taken that ride very early this morning, when there was no traffic, it would have taken less than half an hour. But during today’s morning commute it looked like this:

https://static01.nyt.com/images/2021/10/19/opinion/krugman181021_1/krugman181021_1-jumbo.png?quality=75&auto=webp

The joy of traffic.

What caused this snarled traffic? We could see major delays on the Long Island Expressway and at the Queens-Midtown Tunnel; I don’t know what they were about. It could have been accidents, or stalled cars, or just the kind of random traffic backups that always happen once highways are sufficiently congested. At a fundamental level, however, the specifics aren’t the point. The reason it takes much longer to make the Kennedy-New York Times trip during the morning commute than it takes off-peak is that this is what happens when more people are trying to use roads than the road network can easily handle.

And now you understand the basics of the supply-chain problems that are driving up many prices and may interfere with your Christmas shopping.

There has been excellent reporting on the details of the logistical mess that has created shortages of almost everything, with much coverage focusing in particular on the logjam at the Port of Los Angeles; that gateway and the adjoining Port of Long Beach are the entry points for 40 percent of U.S. seaborne imports. But it’s important not to let the details obscure the big picture.

You see, the supply chain hasn’t broken down — U.S. ports are actually unloading a record quantity of goods. The reason everything is delayed is that people are trying to buy more stuff than ever before, and their demands are outstripping the supply chain’s capacity — the same way that morning-commute traffic in New York outstrips the road network’s capacity. And once things are that stressed, small disruptions tend to snowball into large delays.

Here’s real spending on durable consumer goods — everything from cars to kitchen appliances to exercise equipment — expressed as an index with the start of the pandemic set to 100:

https://static01.nyt.com/images/2021/10/19/opinion/krugman181021_2/krugman181021_2-jumbo.png?quality=75&auto=webp

A surge in demand for stuff.

As you can see, there was a huge surge — a 34 percent rise over 13 months! — that has only partly receded. I’ve also sketched in the prepandemic trend, to show that this was really far outside previous experience.

What accounts for this surge? Overall consumer demand has been strong, boosted by stimulus checks. But that has happened during previous economic recoveries. What’s special this time is that demand has been skewed: Consumers are buying fewer services and more goods than usual. Or as we might put it, they’ve been forgoing experiences and acquiring stuff instead. Here’s consumption of durables and services since the beginning of the pandemic:

https://static01.nyt.com/images/2021/10/19/opinion/krugman181021_3/krugman181021_3-jumbo.png?quality=75&auto=webp

Buying stuff in lieu of experiences.

Why the skew? It’s not a mystery: We’ve been afraid to indulge in many of our usual experiences and bought stuff to compensate….

https://fred.stlouisfed.org/graph/?g=HVRe

January 15, 2020

Real Personal Consumption Expenditures for durable goods, 2020-2021

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=GyyX

January 15, 2018

Real Personal Consumption Expenditures for durable goods and services, 2017-2021

(Indexed to 2017)

I did not appreciate the volume of cargo ships in the ocean, until I started following it:

https://www.marinetraffic.com/en/ais/home/centerx:-134.3/centery:40.7/zoom:2

It’s easy to see how it could be disrupted.

https://www.atlantafed.org/-/media/images/cqer/research/gdpnow/gdpnow-forecast-evolution.gif?h=356&w=650&la=en

Not good.

it is pretty apparent when you get a coronavirus variant as infectious as delta, if you do not control its spread you will get a decrease in gdp activity. apparently all of those laws passed in texas and florida which resisted any efforts to slow the spread were not economically helpful. thanks for pointing this out bruce.