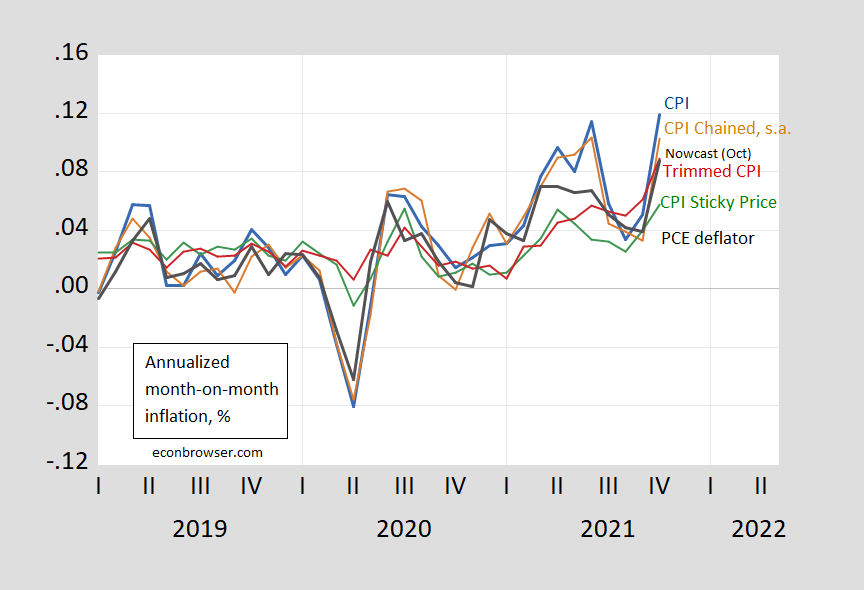

Chained, and particularly Trimmed, and Sticky Price CPI are less than headline.

Figure 1: Month-on-month inflation of CPI (blue), chained CPI (brown), 16% trimmed CPI inflation (red), personal consumption expenditure deflator (black). Chained CPI seasonally adjusted using X-12/ARIMA X-11 (brown). PCE deflator October observation is nowcast as of 11/10. NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, Cleveland Fed, NBER, and author’s calculations.

So other measures are lower than headline m/m — but they are all higher than recent highs (but not highs in the 70’s, see this post).

Morning Joe went off on the alleged hyperinflation this morning. 21% interest rates! WIN buttons! I had to change the channel as it was worse than listening to Faux News.

My Dunkin’ Donuts coffee wasn’t talking to me at all this morning. Strange………

https://money.cnn.com/2016/02/22/media/donald-trump-joe-scarborough-hot-mic/

What seem to be hard to understand for people like Morning Joe is that inflation (and hyperinflation) is not a natural default state – it has to be driven by something. In the old times when Unions were strong it could be driven by a wage-price spiral – but not these days.

If the screaming heads can show me a credible and sustainable driver of inflation, then we can talk. Until then, they are just part of the hyperbolic noice machine – never in doubt and never right.

couldn’t agree more, and have been saying the same for a while. perhaps we have inflation for the next year. so what? there is nothing to indicate that it will continue. there has been some wage growth, but it needs to be consistent for a couple of years before it becomes problematic. i see an economy that will continue to grow, but i do not see an economy that will overheat for years and cause inflationary problems.

There has been a quick divergence between the ten-year TIPS breakeven and the ten-year constant-maturity yield over the past few days. Curious to see the adjusted breakeven if you have the time, Menzie.

I don’t know of a way to formalize it, but I try to keep in mind that unadjusted TIPS yields represent what Treasury is paying as recompense for inflaion, not strictly what is expected of future inflation. The game is to guess whether TIPS will pay more or less in the coming period than is priced in today.

macroduck: DKW only publish updated adjusted inflation breakevens once a month, and it’s much too complex a calculation to do myself.

We can predict the weather by looking at the sky. But, we cannot interpret the signs concerning these times.

Trimmed mean is the only game in town as our Central Bank says.

It rose 4.1% at an annual rate which is the only way to look at it.

not good.

The Fed must be getting nervous

And, to repeat part of a comment I just posted on the newest thread, October result led strongly by energy and gasoline, with me noting sharply rising gasoline prices last month helping Youngkin in VA.

Funny thing is that have not risen at all since the election, with me even seeing some going down, not that there has been any comment on that by people ranting about inflation. Crude oil prices were down again. The gasoline price part of this may be over. Look for a lower inflation rate report next month.

“Morning Joe went off on the alleged hyperinflation this morning.”

Phillip Cagan literally wrote the book on hyperinflation and defines it as inflation of 50% per month. So Joe is only off by a factor of 50 or so — not bad for wingnut work.

It’s crazy the way everyone starts screaming “hyperinflation” any time it ticks up over 2%.

Another “it’s not as bad as it looks/feels article”!?.

High inflation is not hyperinflation. Only those trying to hide the pain from current inflation are making this comparison.

Your president and your policies in action.

i think you are hard pressed to identify it as high inflation. it is inflation. and not unexpected. millions of mortgages are benefitting as we speak. 7% savings bond rates are not bad for the savers in this world.

Baffled proves the point: ““it’s not as bad as it looks/feels article”!?. ” with his: “millions of mortgages are benefitting as we speak. 7% savings bond rates are not bad for the savers in this world.” Yup! There are some positive temporary side effects of increased inflation.

But he ignores the cause: “Your president and your policies in action.”

well, a major cause is supply chain issues. and those formed prior to biden coming to office. you do know who was in office at that time, right? supply chain problems have been around for over a year now, they are not new. of course, the biden policy of getting jabs in arms resulted in a lot more economic activity, which also pushed up inflation. you would prefer we did not have that increased activity? the economy would not be humming now if we still had no protection from the virus.

corev, seems to me you simply post to complain rather than contribute to a discussion.

I was looking around and it seems like there is inflation in all kinds of places not called the United States. Its hard for me to believe that all of that is due to Biden’s policies (which, btw, you haven’t actually specified). Others who study inflation more than I can comment, but blaming all of this on Biden and the Democrats seems terribly myopic.