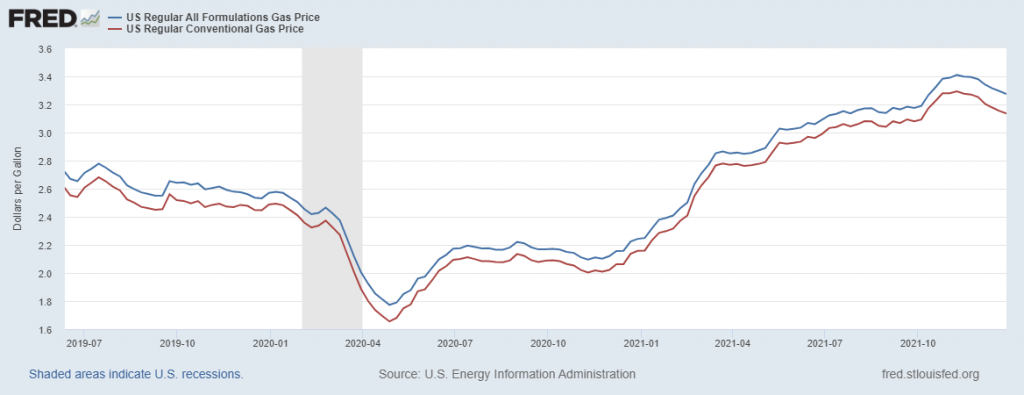

As of Monday, 12/27, from EIA via FRED:

Source: Energy Information Administration via FRED, accessed 12/28/2021.

Gasoline prices (all formulations) are now down about 4% since November 8th reading.

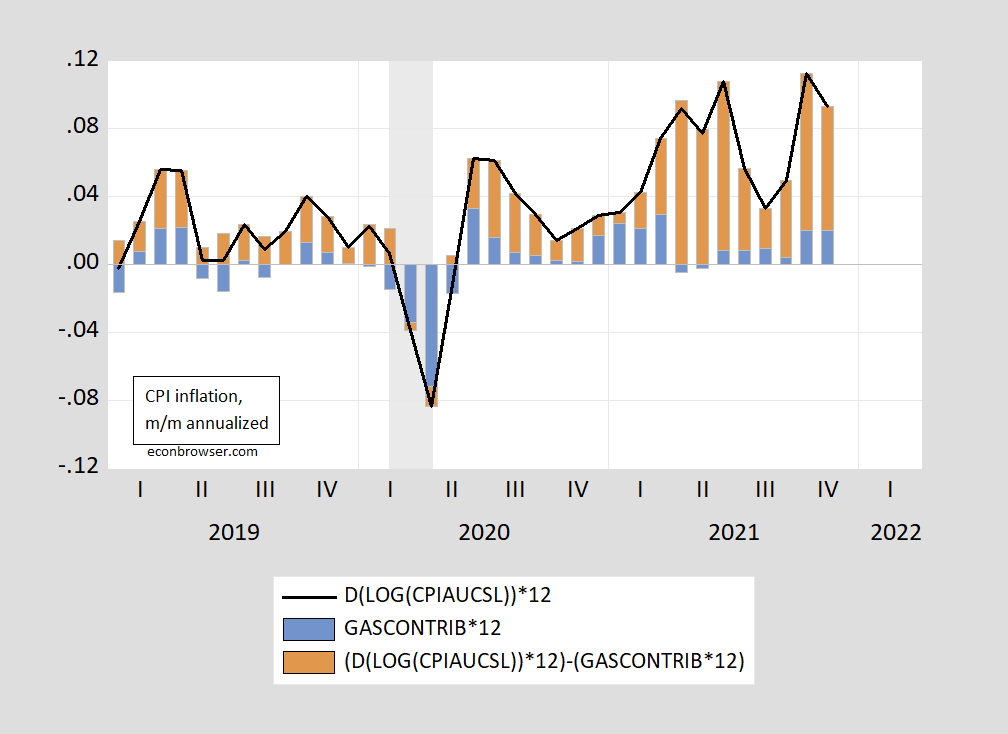

What’s the impact on the CPI-all urban? Below I show a mechanical decomposition of the direct impact on the CPI (using log approximations, and the December 2020 weights). Notice that fuel costs embodied in goods prices are not included.

Figure 1: CPI-all urban month-on-month annualized inflation rate (black line), direct contribution from gasoline prices (blue bar), contribution from all other sources (brown bar), all seasonally adjusted. Rates calculated using log differences, and December 2020 weights. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, NBER, and author’s calculations.

Going forward into December’s numbers, gasoline prices should account for a declining share of total inflation.

Gasoline futures prices as of 12/28 are in backwardation. Chinn and Coibion (2014) note that gasoline futures are unbiased predictors of future gasoline prices out to the 6 month horizon, and outpredict a random walk (and outpredict a simple ARIMA(1,1,1).

Some excellent work. Of course rsm is going to whine about confidence intervals. And your use of log approximations is going to drive Princeton Steve nuts. I have a different question – one that probably does not have a clear cut answer yet. Is the use of December weights somehow biasing the estimated impact on CPI?

pgl: Bigger biases probably introduced by using *any* fixed weights. See Cavallo’s work, cited here.

I think by “December 2020 weights”, it’s the weights used in the December 2020 vintage of CPI. I think the weights correspond to 2017-18…

Two comments

1 The EIA calculates a statistic denoted crack spread which is the value of a refinery output less the cost of the input.

2 If the price of gasoline falls, this does not bode well for climate change, a carbon tax, or electrification. Positive comments about higher gasoline prices are short sighted. Higher prices to reduce the emissions have a lasting impact. Don’t we want to force these SUVs and huge pickups off of the roads?

Transportation 15.161%

Public transportation 1.105%

Private transportation 14.056%

I guess I should not be surprised that public transportation is a mere 1.1% of our overall budgets while private transportation’s weight exceeded 14% (as of December 2020) but it might be nice if the new infrastructure investment drive got more of us to rely on public transportation. Just saying.

This is consistent with Moses Herzog boasting about paying $2.55 a gallon just this week. I did read something about a refinery fire in Texas recently but I’m guessing that won’t impact inventory until a few months from now.

Menzie,

So, you do not give a bottom line on what the December inflation rate might look like taking this into account, with it hard to know what other sectors will be doing what, but it looks to me that if the other sectors behave about the same as in November, this might put the month to month rate back down to about the neighborhood of the September rare. Is that about right, or am I miscalculating here?

Barkley Rosser:

Thinking about Marina, and extending strength and wellness.

Thank you, ltr.

Ron Klain was just asked about the lack of COVID-19 testing. He put this spin on it – we are having 9 million tests per day. YEA BUT – we have 330 million people.

He then noted the number of tests being done a year ago was 1.5 million tests per day. But of course President Trump did declare we should slow the testing down. I guess he succeeded in that policy “goal”.

we received 4 each home tests on the stoop today………

why do you test w/o a medical input?

paddy,

You do if somebody in your family has already tested positive.

i do understand

Crude is back up to $75 (WTI prompt). So gasoline prices should be heading back up, too. Are some lags in the reporting and the wiggles and such. But if we stay at $75, will be higher gasoline prices than when crude was in mid-60s, few days a go.

So you are assuming gasoline price = oil price/40 plus some fixed constant that must exceed $1 to make the numbers work out in your thesis.

Actually this alleged constant is the additional cost from excise taxes, refinery margins, and distribution margins which often sum to only $1 a gallon or even less. Of course taxes vary by state and these margins are somewhat volatile.

I’m not relying on any particular observed regression of observed variables. It’s basic micro-economics and business intuition. In a competitive market, a major factor increase (or decrease) will be carried on into prices. And crude is a massive part of the cost of retail gasoline. Sure there are some costs in refining, distribution, and taxes. But those are semi-fixed.

EIA used to report on the refinery and distribution margins on a monthly basis (they may still do so but I have not figured out their new website design). These margins were quite volatile. Biden was suggesting that refinery margins had recently increased – which should be no real surprise. I’m just saying there is hope that these margins will retreat.

Oil refining, in some ways like oil production, is a heavy fixed cost business (if for refining, you take crude cost and product prices out of the equation and just think in terms of “crack spread”). It’s hard to bring new capacity online or take it off. Those facilities run relatively all-out, 24-7, Christmas and Easter. Yes, there can be debottlenecking projects that are smaller than whole facility construction and also some opportunistic maintenance, but in general capacity is pretty fixed.

So when volume declines, refiners get squeezed and then the converse. If the demand CURVE is static, increased crude prices will lead to increased retail prices, will lead to lowered demand, will lead to refiners getting squeezed. The opposite happens when crude prices drop. (There is an international trade component in products also, of course, but the ideal refiner is the local refiner, he at least has a transport price advantage. Anyhow, not considering that in idealized scenario.) All of this assumes crude prices rose because of the supply curve rising, with demand curve fixed. E.g. because of OPEC+ policy , outlook for shale, etc. But of course prices can move because of demand shifts also. So if crude prices go up because of demand curve shift (fixed supply curve), the impact on refiners is different…as what really matters to them is volume. And a demand driven price increase implies higher volume and a supply driven price increase implies the opposite.

My overall impression is that the economy is getting back on its feet, the Zoom class is returning to work, boys are taking girls out on car dates, etc. So, I think volume runs should be pretty healthy, which would imply refiners having higher crack spreads, not lower. Both from value capture (just timing in the commodity cycle, same thing you see in any heavy fixed cost industry with slow changes in capacity) as well as a small amount of higher utilization, debottlenecking, etc. (which implies costlier refining).

http://www.news.cn/english/2021-12/03/c_1310349895.htm

December 3, 2021

China to cut gasoline, diesel retail prices

BEIJING — China will cut the retail prices of gasoline and diesel starting Saturday, the country’s top economic planner said Friday.

The prices of gasoline and diesel will go down by 430 yuan (about 67.46 U.S. dollars) per tonne and 415 yuan per tonne, respectively, according to the National Development and Reform Commission.

Under the current pricing mechanism, if international crude oil prices change by more than 50 yuan per tonne and remain at that level for 10 working days, the prices of refined oil products such as gasoline and diesel in China will be adjusted accordingly….

https://fred.stlouisfed.org/graph/?g=KjOJ

January 15, 2020

Prices of Oil and Natural Gas, 2020-2021

(Indexed to 2020)

https://news.cgtn.com/news/2021-12-27/Japan-to-auction-600-000-barrels-of-national-reserve-oil-in-February-16kUztX1PLa/

December 27, 2021

Japan to auction 600,000 barrels of national reserve oil in February

Japan’s industry ministry said on Monday it will hold an auction on February 9 to sell about 100,000 kilolitres, or 628,980 barrels, of crude oil from its national reserve as part of a U.S.-led coordinated release of oil reserves aimed at cooling rising prices.

The supply, to be taken from its Shibushi tank in southwestern Japan, will become available to the winning bidder on March 20 or later, it said in a statement.

The last time you reported gasoline prices per ton – we asked you to do this in terms of dollars per gallon. Is that too much to request? It would actually make those numbers somewhat meaningful.

“The prices of gasoline and diesel will go down by 430 yuan (about 67.46 U.S. dollars) per tonne and 415 yuan per tonne”

I looked up the conversions since you seem incapable of doing so. One ton equates to about 310 gallons so this alleged price decrease is about $0.22 per gallon.

Just saying your spinning for the PRC could be vastly improved if you bothered to quote these things in dimensions most people relate to.

waiting for tomorrow’s eia inventory report.

last week observations: gasoline stocks up a bit, crude oil stocks down a bits……

no indication of large release from crude stocks in the “rserve”.

Professor Chinn,

Not being conversant with the futures market, how do the futures look today related to future gas prices.

Any chance to share data and a regression model in EViews showing a forecast?

Would be a great learning experience and maybe make it easier for amateurs to follow your paper.

CME lists WTI (and Brent) prompt/strip for free. Also Henry Hub gas.

https://letmegooglethat.com/?q=CME+Henry+Hub

😉

What an incredible lady. Germans should have (born in Germany or not) an innate shame for the crimes Germany committed, against Jews and others, in the first half of the 20th century.

https://www.pbs.org/video/angela-merkel-3blqg0/

To have a leader who recognizes those crimes and shows genuine contrition and sorrow for those crimes, can make Germans feel some current sense of pride. I think the German character has a kind of “darkness” to it, even to this day. If you prefer you can call it “stoicism” rather than darkness. I say this as someone with a portion of German blood. But they also have good things they can offer the world, when in the right mindset.

Noise, analyzed with jibber-jabber, right?

Aren’t prices largely formed in options markets?

Are you looking at the shadows in Plato’s cave?

rsm: What prices are you speaking of?

I think he’s just throwing small stones at whatever moves really, but my wild guess would be commodities in general. I give you a lot of credit for trying to reach out to a person here, but……

Moses,

So, since you did not do so on the most recent thread, would you care to tell everybody on this one whether that $2.55 per gallon price you paid was higher, lower, or the same as the previous price you paid?

I note that your answer may be of yet more interest here as we have this peculiar situation where it looks that retail gasoline prices have been declining as Menzie has reported, while indeed crude prices have been riising again, Brent now at $79.17 per barrel, and with debates going on here about the timing and relations between crude prices and retail prices. Would be helpful to know what you actually ecperienced beyond informing people about how isolated stations charge more than ones with others nearby, an observation I think everybody here has probably known for a very long time.

Against my better judgement, I’ll humor you. $2.53. I’ll note I didn’t pass by that station today. I’m using an internet source, which as it pertains to that particular station has been 98% reliable. So I do believe that is indeed the current price.

Thanks, Moses.

So actually your report showed an increase in price, not a decline, although not by much. Or is the $2.53 price one since the $2.55 one? If so, well then I guess prices have continued to decline. Your comment here is a bit unclear.

As I previously noted, prices have been still declining here up unto the last few days. But I fear that with the ongoing rise in crude prices this may be the end of that decline. We shall see.

My guess is the two major factors would be increase or decrease in gasoline inventories and omicron. The lesser-severity of Omicron seems to imply a picture of higher demand than gauged a month ago. Inventories imply lower prices, as those would most likely increase. The higher demand probably more than cancels out the increase in gasoline inventories. That implies higher gasoline prices to me going into late January. But that is not my bailiwick, so that is not a prediction, it is by definition a guess on my part.

$2.53 as I stated is the current price at that station as of 3pm U.S. central time Wednesday, when I made the comment. So if you can do simple math, that shouldn’t be too hard to figure out for a mathematical economist. 2 cents lower is a decrease from whenever I made the $2.55 comment.

Moses,

Thanks for clarifying the relative timing of those prices. So indeed prices have still been declining recently in your neck of the woods.

Crude has continued to rise, although only slightly today, with Brent now at $79.32. Stock and crypto markets also very quiet, perhaps a year end pulling back for the big partying tomorrow night.

BTW, off-topic, for anybody who does not know the big holiday in Russia is New Year’s (“Snovem Godem”), or especially New Year’s Eve. That is when Ded Moroz (“Grandfather Frost”) comes to give presents to good children, with him looking a lot like US santaClaus, and families gather and give presents and eat etc. The long Communist rule played down Christmas, for which there are effectively two anyway as the Russian orthodox celebrate it on Jan. 7 due to Julian calendar, but there are quite a few Catholics and other Christians there who do it on Dec. 25 for the Gregorian calendar. It is my suspicion that Putin wanted his phone call with Biden today so as to both look tough but also come out making peaceful noises for the big holiday coming up.

rsm:

There is an aspect of forward-looking in current RBOB (or crude, which is tightly linked) prices. This would happen regardless of the futures market (time arbitrage, the rational decision to store or sell, based on future expectations). But the futures market does allow seeing it clearly. However, in any case, futures are in backwardation, so current prices are being lowered by future expectation (of being even lower), not raised.

https://www.cmegroup.com/markets/energy/crude-oil/light-sweet-crude.quotes.html

However, I’ll say again, that Menzie is looking at lagged data. Crude spot/prompt are up last few dayand retail gasoline will/has follow/ed.

today’s eia inventory report:

distillate fuel stock is down 19.6% yoy, hope for continued mild heating season

gasoline stock down about 5% yoy

crude input to refineries up yoy w/economic rejuvenation

still no noticeable release from nat pet reserve.

crude imports up yoy but not huge.

domestic crude supply down slightly yoy.

i bought gasoline in boston metro up $.10 to 3.17 week over week.

The idea that prices are “formed” in the market for some derivative instrument and imposed on other derivatives and on spot prices is popular but wrong.

Some prices move faster than others. Some markets trade when others are closed. Arbitrage is powerful. Those facts can give the impression that Some instrument causes price changed in others. But in the sense of prices resulting from the interaction of supply and demand, it’s useful to think of one market with a bunch of instruments.

You seem obsessed with the idea that finance rules everything. So financial instruments must rule physical markets, I guess. You’re deceiving yourself.

Extremely sad to hear about Harry Reid. I had no idea until this very late afternoon:

https://www.nytimes.com/2021/12/28/us/politics/harry-reid-dead.html

I also thought the way he left the Senate was very eerie. something about a quarrel with his brother, than what looks like a bad eye injury, and if I remember correctly his family was very dysfunctional. Very strange circumstances and I think he deserved a better exit point (from the Senate).

*then what

Still no satisfying explanation for the well observed asymmetry in retail gasoline price changes. Retail gasoline prices increase much faster when the crude oil price rises than when they decline. This is an obvious market inefficiency.

One explanation that makes some sense is that retailers are very quick to respond to wholesale price increases to maintain their margins and stay in business. But once wholesale prices peak, they are slow to reduce their retail prices and instead seek higher margins abetted by imperfect competition.

I think this is exacerbated by the media. The media incessantly flogs increasing prices but miraculously loses all interest the moment prices start to come back down. This contributes to less motivated and price conscious consumers on the down slope, allowing retailers to collect their higher margins temporarily.

You can notice this yourself if you look at the number of news accounts about gas prices a month ago vs today. When consumers are not beat over the head every day about rising gas prices, they get lazy and stop shopping for the lowest priced gas station in town.

“Still no satisfying explanation for the well observed asymmetry in retail gasoline price changes. Retail gasoline prices increase much faster when the crude oil price rises than when they decline. This is an obvious market inefficiency.”

The EIA used to provide data on distribution margins by month. They probably still do but their new website design has me confused as to how to access this data.

The data also includes monthly observations with respect to the refinery margins. These margins are more volatile than the distribution margins.

I wish I knew of an analysis of how these margins evolve over time. I would imagine that these issues have been studies but I do not know of any such report,

Still no satisfying explanation for the well observed asymmetry in retail gasoline price changes….

[ Frank Wolak of Stanford explained the asymmetry in energy price movements near the beginning of the century, and the explanation was picked up by Paul Krugman and written about in the midst of early century California energy crises. The gasoline-diesel problem stemming from imitative actions by refiners, the energy grid problem from such actions by power generators:

http://www.pkarchive.org/economy/Wolak.html

May 27, 2002

Frank (Wolak) Thoughts On the California Crisis

By Paul Krugman ]

The Krugman piece was on the electricity market – not the gasoline market. Different set of economic factors.

Some National Review nutcase is making his case that the Federal debt is about to blow up by quoting National Review clown Brian Riedl a lot. His link however does not go to Riedl’s paper but rather to some of Rield’s NR discussions which run like this: (a) we must cut taxes even more; and (b) all spending is evil:

https://www.nationalreview.com/corner/numbers-that-cannot-be-wished-away-the-u-s-and-its-debt/

This nutcase actually wrote “math is math” but never once talked about the present value of future taxes or the present value of future spending. So I guess the nutcase does not understand the basic math at all. Did Riedl better explain this in his paper? It would have been nice if the nutcase provided a proper link but I guess competence is not the National Review’s forte.

One thing is clear – the nutcase and the clown both assume interest rates in the future will be much higher than they are now. Their basis for this? WTF knows.

https://www.manhattan-institute.org/riedl-higher-interests-push-washington-toward-federal-debt-crisis#:~:text=Indeed%2C%20several%20realistic%20economic%20scenarios%20could%20easily%20push,doves%20have%20no%20backup%20plan%20for%20this%20possibility.

OK – here is a link to Riedl’s doomsday paper. Two things are clear – he rules out the possibility of using higher taxes entirely. He is also insisting that the nominal interest rate will increase to 5% or so. The one thing that caught my eye about his comparison of interest rates in 1990 v. today was his insistence of using the nominal interest rate. But Riedl does know how to at least approximate real v. nominal interest rates and his charts indicate that one of the reasons why nominal rates fell by 7% over this period was that expected inflation declined.

But wait – the appropriate “math” would have us use real interest rates not nominal interest rates. If Riedl knows this – then why does he abuse the nominal rate? If he does not know this – then he is completely unqualified to be write on this topic.

Full disclosure – I learned about these National Review nutcases fretting over the US Federal debt from a Kevin Drum post that provided very little except his noting how the Japan gross debt/GDP ratio had passed 200%. Knowing this was a bit of a canard, I was hoping one of his readers would call him on this. One did and provided this interesting discussion:

https://medium.com/@JapanDetail/explain-with-charts-why-japans-huge-national-debt-is-not-a-problem-at-all-5b1994293915

46% of Japan’s gross debt is held by its Central Bank. And back to Riedl, Japan has seen a dramatic decline in interest rates as has the EU nations, the UK, and several other developed nations. I wonder if the readers of the National Review have ever been told about this fact.

WTI is back up to near $77, up $12 from its early December lows.

Last report I saw had WTI between $75 and $76 but cheer up as Brent prices are above $78. Now before you start your little celebration – it seems the Saudis are about to allow Dubai prices (oil sold to Asia) to fall:

https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabia-May-Cut-Oil-Prices-For-Asia.html

Oh I’m sorry. I did not mean to spoil your New Years celebration.

You think my New Year’s is predicated on whether oil is $75 or $77?

Maybe not if your neighborhood passes out free bagels but you do seem to jump up and down with glee whenever oil prices rise. It is rather disgusting on your part but yea we get it – you are lobbying for another appearance on Fox and Friends.

Natural gas in Europe is “down” to $36/mmbtu.

https://www.naturalgasintel.com/european-natural-gas-prices-continue-to-slide-eroding-premium-to-asian-markets/

Euros should go ahead and approve Nordstream 2. This is very silly that they are paying these kinds of insane 10x prices and shutting down commodity industries that use natural gas for fuel.

https://twitter.com/StreetBomber/status/1475134372801957892

Nordstream 2 would benefit both European buyers as well as Putin’s business buddies. Now if Putin would back off on his insane idea of annexing Ukraine, this efficiency benefit could quickly materialize.

Euros should go ahead and approve Nordstream 2….

[ The United States sought to stop the Russian pipeline, relenting finally at the insistence of Angela Merkel, however Merkel is retired and Olaf Scholz, leading a split government, seemingly has less influence even in Germany. ]

And WHY did the US do this? Oh yea – your master Putin wants to invade Ukraine.

pgl and ltr,

I have been taking what looks like a tough on Russia line here, but in fact I think Biden is right not to work to block it. An obvious reason is that indeed allowing it will increase the supply of natural gas, thus helping to reduce inflationary pressure. Indeed, while Biden was partly motivated by trying to keep a door open to Putin and Russia (relationship operates on multipole levels and is complicated between the top two nuclear weapons powers), the main motive for Biden was to please Merkel, who was angry at Trump moving to block it.

OTOH, as of right now the deal is being held up by a German regulator. We shall see what happens with that.

BTW, my wife has long argued that indeed Russia should have Crimea in the long run, for complicated reasons (can tell not well-known tales on all that). The problem is how this was done. My bottom line is that indeed Russia will never give up Crimea again, even Navalny supports keeping it. What needs to be done is to make sure that Putin pays for violating the Budapest Accord. So the acceptance of this fait accompli should be held back until after Putin is out of power.

Was this what your “Not well known tale” was??

https://ewjus.com/index.php/ewjus/article/view/Andriewsky/24

https://www.wilsoncenter.org/event/the-1919-pogroms-ukraine-and-poland-one-hundred-years-later

Bet when Jews were slaughtered in Crimea by the Nazis they appreciated all the help Stalin gave them. Russian citizens’ “Love” of Crimea is heart-warming.

Wondering how much state TV Russian expats watch when they travel back there??

@ Barkley JUnior

You really make me laugh at your absurdity sometimes, and the absurd statements you make, conning yourself into thinking it is something very cerebral. Your support of a Russian pipeline, Nord Stream 2, which would supply a significant portion of energy to Europe, which they no doubt will provide almost no “Plan B” for as time goes on and they become dependent on it and assume it will always operate without interruption, makes me think you are a man “born after your time”. You would have been a very useful man as a jubilant witness signature for the Munich Agreement.

Moses,

Curious you provide contradictory links in terms of the current propaganda about the possible Russian invasion of Ukraine. One deals with the Holodmor, the famine in Ukraine. This is a leading trope of Ukrainian nationalists who declare Putin seeks to commit genocide yet again in Ukraine. But then you have link about pogroms against Jews a century ago in Poland, Ukraine, and other places. Not clear at all what that has to do with anything here, but I note that on the Russian side Putin and some of his supporters regularly claim that this is an extension of WW II, with the Ukrainian government neo-fascist. It happens not be so, although there are neo-fascists in Ukraine, and some previous governments have had their support. But Ukrainian President Zelensky is half-Jewish and his government is not supported by those people.

So, whose propaganda did you wish to support here? Or did you somehow not figure out that you were massively contradicting yourself with these links?

Oh, an oddity that this brings out is that the part of Ukraine where the neo-fascists are strongest is western Ukraine, also the center of super Ukrainian nationalism. This is the part of Ukraine Russia never ruled. It was for hundreds of years ruled by either Poland or Austria, and only was conquered by the USSR during WW II.

That region actually shows the profound complexity of that region and all of this stuff that so many people ignorantly shoot their mouths off about here. So the largest city of that region was ruled by Austria just before WW I, and its name was the German :”Lemberg,” meaning city of Lions, a name dating back to when Genghis Khan’s invasion of Europe was stopped at the eastern slopes of the Carpathian Mountains where this city is. I note most of the population of the city was either Austrian/German or Jewish, although the surrounding countryside was populated by ethnic Ukrainians. After WW I, it fell under the control of Poland, who renamed the city Lwow, pronounced “W-vov..” Then in WW II it was conquered for awhile by Germany who renamed it “Lemberg,” and killed all the Jews who failed to get out (I knew one of those who got out, the famous statistician, Mark Kac, the only member of his family to survive, whom Jim and Menzie may have heard of as he is the father of the underlying theory of stochastic discrete choice models). By the end of WW II it was conquered by the USSR who threw out the German population who ended up in what was Breslau in the former Germany, but they were also thrown out when it was given to Poland and became Wroclaw), with mostly Ukrainians moving in as it was placed in the Ukrainian SSR. However it was given the Russian name “Lvov,” pronounced about the way it looks. Finally, in 1991, when Ukraine became independent, it was given a Ukrainian name, “L’viv,” which is actually pronounced by people who live there, “L-view.” Really.

Moses,

Oh, I probably should not have mentioned a “not well-known tale,” but since you seem all worked up about it, I guess I should tell it. The inside part has to do with inside Moscow gossip from several decades ago involving Nikita Khrushchev and Yekaterina Furtseva, whom the insiders believe was his mistress, still widely believed among Moscow elites. He did appoint her to be the first woman on the Soviet Politburo, although they fell out later. But more is needed before we get to that juicy gossip, which one can only finds hints of by googling, rumors reported in US diplomatic messages.

So we need to deal with the complicated history of Crimea, which has always had a mixed ethnic population that has changed over time. The earliest groups we know of there in about 1000-500 BCE, were Cimmerians and Scythians, both related to Persians. There is no current separate remnant of those people there. The first group of which there are separate remnants were Greeks who began moving in after 500 BCE, with most of the municipalities on the east side of Crimea named by them (most on the west side have Turkic Tatar names). My wife’s great grandmother on her father’s side was of this Crimean Greek population and she used to spend time in summers there as a girl visiting this woman, whom she strongly resembles (when we visited Greece, they all thought she is Greek). The Romans would rule if for hundreds of years, but the Greeks ran the local show during that period. But other groups moved in over the centuries, including Jews, Armenians, and several Turkic groups, including Kipchak Polovstians and especially the Tatars, more numerous than any of those others. Ethnic Russians and Ukrainians came in much later, although they are now the most numerous there.

It was briefly ruled by the Kievan Rus around 1000 CE, but they did not populate it and it was soon conquered by the Turkic Kipchaks. For a period of time the Genoese actually controlled its major ports in the 1200-1300s. From 1441-1783 it was an independent khanate ruled by the Tatars, who then became the most numerous and still a major group there. Catherine the Great conquered it in 1783 after when Russians and Ukrainians moved in, also a time when there was no separation between Russian and Ukraine. In WW II Germany conquered it for awhile. When Stalin got it back he expelled the Tatars and killed many of them, accusing them of collaborating with the Nazis (some did, as did some Ukrainians also). After Stalin’s death and especially after 1991 when the USSR broke up, many Tatars returned. They would and still largely support Ukrainian control of Crimea.

So now we need to turn to Ukraine. It was ruled by various powers over time. It came under Russian control in 1654 with a treaty signed by the tsar and Cossacks, who tended to be mixtures of ethnic Russians and Ukrainians. This led to the Poles and Lithuanians being thrown out who had been ruling it before then for some time. When the USSR was established in the 1920s, Stalin played the crucial role in assigning Crimea to be part of the Russian SSR rather than the Ukrainian SSR.

Then there is that episode you provided a link about, the Holodmar famine of the early 1930s in Ukraine, in which millions died. An important player in that was none other than Nikita Khrushchev, then a mid-tier party official. He was himself born just over the border between the republics on the Russian side, and mostly Russian, although supposedly with some Ukrainian ancestry. Supposedly he felt guilt about his role in the Holodmar, especially given that he himself was partly Ukrainian. As I think most here know, but just in case you do not, Khrushchev would eventually become the successor to Stalin as the Soviet leader, after several years of political competition in the mid-1950s.

So, now we must bring in Yekaterina Furtseva, born northwest of Moscow. Under Stalin she would serve as a mid-tier Party official in, yes, Crimea. She managed to get to Moscow in the early 50s before Stalin died and became involved in the Moscow city Party. This is when she and Khrushchev got to know each other, and whether or not she really was his mistress, they became close and allies. I note she lived in a building just off Pushkin Square next to where my wife’s maternal grandparents lived, and Marina would actually see her up close in person many years later. So, this is very inside and local gossip.

Anyway, after Stalin died, Khrushchev made the crucial move of shifting Crimea from being a part of the Russian SSR to being a part of the Ukrainian one in 1954, which is the basis for arguing that Ukrainian ownership was shaky. The official justification was that this was the 300th anniversary of the treaty that brought Ukraine under Russian control (officially as “allies”). As noted many think he also was inclined to reward Ukraine out of his guilt trip for his role in the Holodmar. But the inside gossip is that it was urged on him by Furtseva who felt a connection there, and that he did it at least partly as a “gift” to her, his then mistress. No way to know whether or not that is true or not.

Regarding Furtseva, also in 1954 Khrushchev made her the leader of the Moscow branch of the Soviet Communist Party, a powerful position. In 1957 he put her on the Politburo, the top ruling body of the nation, again, the first woman put there. She supported him at that time in his de-Stalinization campaign. However, later they would fall out. She had an affair with the Soviet ambassador to Yugoslavia, whom she eventually married. In 1960 she was named Minister of Culture before she was removed from the Politburo in 1962. However, she was notorious for micromanaging and banning many theater productions and other activities in her position as Minister of Culture, which she held until her death in 1974. She apparently became an alcoholic, which was obvious when Marina saw her up close. It remains in dispute the nature of Furtseva’s death, with most thinking it was due to her alcoholism, although there have long been rumors she committed suicide as she was supposedly being investigated for massive corruption. Yet another loose end.

So there you go, Moses. Did you enjoy that?

Market Watch put out this array of recent market data:

https://www.marketwatch.com/story/u-s-oil-retreats-poised-to-snap-5-day-streak-of-gains-ahead-u-s-inventory-report-11640783317?siteid=yhoof2&yptr=yahoo

Yes WTI and Brent prices are up for now. But note at the end, their noting that gasoline future prices signal more price relief at the pump by next Monday.

It’s normal that the prompt moves much more radically than the strip. So if prompt goes up 10, year out goes up only 5 and so on. (Not exact numbers but roughly so.) Same thing happens when the price crashes. So after a recent strong rise, we should have a strongly backwardated strip and after a big crash, a strongly contango one. It;’s not that the further out doesn’t move (usually it does), but that it doesn’t move as much.

As I type this, the WTI prompt is $76.45. NOV22 is at $71.50. So, if all happens as market predicts (and of course huge uncertainties about what really happens, but still the betting market is the e betting market), then we’ll be down $5 by midterms. Not great, not $55 WTI. Not even the $65 prompt we had a few days ago. Or the $62.25 NOV22 contract of 01DEC21. But still moderately better for the Donks than the current prices.

24 dec 21 eia report most every stock is down wow and yoy.

idk what marketwatch was expecting….

I’ve known since basically “the handover” that this is where it was all going. Knowing what’s going to happen before it happens doesn’t make it any easier to watch

https://www.reuters.com/business/media-telecom/hong-kong-police-arrest-6-current-or-former-staff-online-media-outlet-2021-12-28/

Those people being arrested are heroes in my book, and should be honored with awards by western (or Democratic Asian nations’) journalistic institutions.

“Hong Kong pro-democracy media outlet Stand News shut down on Wednesday after police raided its office, froze its assets and arrested senior staff on suspected “seditious publication” offences in the latest crackdown on the city’s media. The raid raises more concerns about press freedom in the former British colony, which returned to Chinese rule in 1997 with the promise that its freedoms, including a free press, would be protected.”

Another promise broken. If we ever are stupid enough to give Trump access to the White House again, this will happen to our own reporters.

https://foreignpolicy.com/2021/12/28/ethiopia-tigray-abiy-tplf-war-biden-needs-to-correct-course/

December 28, 2021

To End Ethiopia’s War, Biden Needs to Correct Course

A one-sided U.S. approach provided political cover to the TPLF insurgency. Washington now has an opportunity to create the conditions for peace.

By Bronwyn Bruton and Ann Fitz-Gerald

Four years ago, escalating protests threatened to unleash a civil war in Ethiopia, as repressed and miserable crowds of various ethnic backgrounds across the nation sought to escape the yoke of the Tigray People’s Liberation Front (TPLF), a former rebel group that had enjoyed near-dictatorial powers in Ethiopia for 27 years.

Then—as now—Ethiopia appeared to many to be on the brink of implosion. But it was pulled back from the edge in March 2018, when the TPLF agreed to surrender leadership of the nation to a new prime minister, Abiy Ahmed.

Abiy launched a series of frantic reforms to placate the protesting population. But ethnic violence suppressed by the TPLF during its reign boiled over and—having petulantly withdrawn to its northern enclave in Tigray and rejected engagement with Abiy’s new political party—the TPLF continued to use its immense patronage networks, domination of the economy and military, and billions of dollars of looted resources to frustrate meaningful change throughout the country.

While most Western analysts then reveled in the seemingly peaceful transition of power, astute observers feared a military confrontation with the TPLF was unavoidable. Abiy’s celebrated peace with Eritrea—for which he was awarded a Nobel Peace Prize in 2019—pressured the TPLF to surrender to Eritrea territory that Ethiopia, under TPLF rule, had illegally annexed. The TPLF had refused to surrender that territory for almost two decades, creating a tempestuous “no peace, no war” situation throughout the Horn of Africa that fueled destructive proxy conflicts.

Despite Abiy’s peace agreement with Eritrea, the TPLF refused to demilitarize the contested border or pull its troops back onto Ethiopian soil—and it was militarily strong enough to flout Abiy’s demands. The TPLF’s ongoing ability to obstruct the peace deal…

Ann Fitz-Gerald is director of the Balsillie School of International Affairs and a professor of international security at Wilfrid Laurier University.

“A one-sided U.S. approach provided political cover to the TPLF insurgency.”

Followed by an incredibly one-sided editorial as if the government has done nothing wrong during this Civil War. PLEASE!

The Africa Group at the United Nations, representing 54 African nations and 1.3 billion Africans has been supporting the Ethiopian government led by Prime Minister Abiy Ahmed, * while all are working for peace in Ethiopia. Possibly American economic sanctions against Ethiopia are unwarranted. **

* Awarded the Nobel Peace prize in 2019

** https://www.whitehouse.gov/briefing-room/statements-releases/2021/11/02/a-message-to-the-congress-on-the-termination-of-the-designation-of-the-federal-democratic-republic-of-ethiopia-ethiopia-the-republic-of-guinea-guinea-and-the-republic-of-mali-mali-as-beneficia/

Evading the real issues as usual.

“I am taking this step as Ethiopia, Guinea, and Mali are not in compliance with the eligibility requirements of section 104 of the AGOA — in Ethiopia, for gross violations of internationally recognized human rights”

These violations of human rights are being committed by the government you applaud. You not only have zero integrity – you have no soul.

https://news.cgtn.com/news/2021-12-29/Chinese-mainland-records-197-confirmed-COVID-19-cases-16nDAEB8rFm/index.html

December 29, 2021

Chinese mainland reports 197 new COVID-19 cases

The Chinese mainland recorded 197 confirmed COVID-19 cases on Tuesday, with 152 linked to local transmissions and 45 from overseas, data from the National Health Commission showed on Wednesday.

A total of 15 new asymptomatic cases were also recorded, and 496 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 101,683, with the death toll remaining unchanged at 4,636 since January.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-12-29/Chinese-mainland-records-197-confirmed-COVID-19-cases-16nDAEB8rFm/img/912d01ba83f24f56a821005bf8ddc6a7/912d01ba83f24f56a821005bf8ddc6a7.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-12-29/Chinese-mainland-records-197-confirmed-COVID-19-cases-16nDAEB8rFm/img/f79894aa608a4cf18ca77e33a1867857/f79894aa608a4cf18ca77e33a1867857.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-12-29/Chinese-mainland-records-197-confirmed-COVID-19-cases-16nDAEB8rFm/img/866cc5b9f9e6400882792376d4aa8d6b/866cc5b9f9e6400882792376d4aa8d6b.jpeg

http://www.chinadaily.com.cn/a/202112/28/WS61cbc6b3a310cdd39bc7e101.html

December 28, 2021

Over 2.78 bln COVID-19 vaccine doses administered on Chinese mainland

More than 2.78 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Monday, data from the National Health Commission showed Tuesday.

[ Chinese coronavirus vaccine yearly production capacity is more than 7 billion doses. Along with over 2.78 billion doses of Chinese vaccines administered domestically, more than 1.85 billion doses have already been distributed to more than 120 countries internationally. Nineteen countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

December 28, 2021

Coronavirus

United States

Cases ( 54,148,544)

Deaths ( 842,161)

Deaths per million ( 2,522)

China

Cases ( 101,486)

Deaths ( 4,636)

Deaths per million ( 3)

Weekly EIA petroleum report is out:

https://www.eia.gov/petroleum/supply/weekly/

Decent draw on inventories (crude and products). Good demand.

Not sure what next week (this week) will be like. Maybe a holiday slowdown? Less commute and family travel. But then hit it hard in new year. (Just a guess.)

Domestic production is up in the report, but wouldn’t read much into it. The production numbers are modeled (mostly from rig counts). We don’t get real production numbers from a survey until the 914 report (which is lagged two months). The inventory numbers have their issues (e.g. tanker delivery timing), but are a true survey…real data.

Here is my report summary of the EIA’s PSR of this week:

The report this week was about as good as we’ve seen since the beginning of the pandemic. Product supplied (consumption) was strong, with total product supplied (all refined products) 1.1 mbpd above normal for the week, and gasoline and distillate (diesel) both above normal and posting their best showing since the start of the pandemic on a 4 wma basis.

Inventories accordingly fell, in absolute terms, 2.7 mbpd, which is a big draw. Seasonally adjusted for demand, excess crude inventories fell slightly, but taken together, excess crude, gasoline and distillate (CGD) stocks fell 13 mb to 23 mb. In other words, considered in aggregate, there are practically no excess crude or refined products inventories in the US.

This no doubt reflects some year-end dumping of inventories to book revenues in 2021, but still, the numbers are solid even on a four-week moving average (4 wma) basis, which should smooth out some of the gamesmanship here. Expect a couple of tepid weeks in early January as this process reverses. In all though, good, solid numbers for consumption and inventories.

Lower 48 (the contiguous 48 states, including the Gulf of Mexico) crude and condensate production came in at 11.8 mbpd, up 0.2 mbpd from last week and reaching a nineteen-month high. The previous high of 13.1 mbpd was set in March 2020. We are still some ways from the level, but the shales – by which I mean the Permian – are still alive and kicking.

The most impressive oil statistic is the number of new subscribers to my notes, which has been on a tear for the last two months. This says nothing about oil fundamentals, but it does say a great deal about interest in investing in oil and related equities. Such demand for these reports suggests that oil prices and equities have upside, to judge by my readers’ enthusiasm for the topic.

For the technical investors among you, oil has been quite humpy this past year, with new and rising peaks every four months. If this pattern holds up — and I have no reason to believe that it will, but if it did — we might expect to see a new peak for WTI this coming March in the $90-92 / barrel range. Invest at your own risk, but Happy New Year in the meanwhile.”

If you are interested, you can sign up at info@prienga.com

I’ll skip the obvious – you are again once engaged in shameless self promotion. No – this line caught my eye:

‘product supplied (consumption) was strong’

Product supplied is not the same thing as consumption. DUH! Yea – I get that in normal periods quantity demand is thought to be the same as quantity supplied but actual economists try to be more precise in their language.

If more people are actually wasting their funds for the summaries of someone cannot get get basic concepts right – Trump should run in 2024 as their are a lot of really dumb people out there.

Well, since you asked.

The EIA publishes US oil and refined products consumption numbers monthly, typically one week after the close of the prior month. However, the EIA in the PSR also reports product supplied on a weekly basis. While this is not consumption, it is the closest proxy we have on a short-term basis, and therefore it is used as a stand-in for consumption. Both other analysts and I use product supplied as a short-term consumption proxy, but tend to compensate by using a 4 wma, which tends to smooth weekly product supplied numbers and hopefully track closer to consumption.

I have 900 subscribers, and many of them are retail investors unfamiliar with oil terminology. Therefore, I sometimes explain the terms in greater detail, in this case, signaling that product supplied is a proxy for consumption.

As for the change in subscriber numbers: The EIA data speaks to oil market fundamentals. However, the demand for oil sector equities and commodities futures are also determined by the interest of the investing community. Such interest is pro-cyclical and shows up in more subscribers when the oil market is hot. Continued interest in my reports suggests investors are looking to place bets on the industry in one form or another, and that is actually news to investors. That is, if investors are showing interest, it suggests that commodities and equities may have an upward bias, ceteris paribus.

This can also show up in the futures curve. If oil fundamentals change, the term structure of the futures curve can also change. Thus, if demand is strong and supply is lagging, we would expect to see greater backwardation in the futures curve as well as increasing oil prices. However, if the demand is purely financial, then we can see rising prices across the curve with no change in the term structure. This suggests that prices are driven by investor sentiment, rather than oil market fundamentals. In recent times, we have seen the entire curve move up and down in tandem, suggesting that a substantial share of price movements may be the result of interest from investors, rather than changing fundamentals. This interest will also show up, I think, as interest in reports concerning oil markets. Thus, an unusual increase in subscriber numbers may reflect greater investor interest in the sector, which investors may want to know.

“The most impressive oil statistic is the number of new subscribers to my notes”

My Lord – this shameless self promotion is beyond disgusting. If this were my blog I would either ban such shameless self promotion or in the alternative demand a royalty fee whenever some shameless person tries to get a little free promotion.

The United States sought to stop the Russian pipeline, Nord Stream 2, relenting finally at the insistence of Angela Merkel, however Merkel is retired and Olaf Scholz, leading a split government, seemingly has less influence even in Germany:

https://news.cgtn.com/news/2021-12-05/Why-isn-t-U-S-defence-budget-approved-Again-because-of-Nord-Stream-2-15KfzJlR8HK/index.html

December 5, 2021

Why isn’t U.S. defence budget approved? Again because of Nord Stream 2

By Djoomart Otorbaev

There is a fascinating process going on in the U.S. Congress right now. For a long time and behind closed doors, Congress members have been unable to approve the Pentagon’s defence budget of $770 billion. The stumbling block, like last year, was the construction of the Nord Stream 2 gas pipeline from Russia to Germany, which runs along the bottom of the Baltic and North Seas….

https://news.cgtn.com/news/2021-12-16/The-world-energy-balance-is-changing-before-our-eyes-1617CX3jXsk/index.html

December 16, 2021

The world energy balance is changing before our eyes

By Djoomart Otorbaev

On winter’s eve, Europe found itself in an unprecedented energy crisis. The oversupply of fuel observed over the past two years, leading to lower prices, was quickly replaced by an unparalleled shortage which shocked the continent’s electricity production and hit the lives of ordinary citizens. The energy crisis that gripped Europe in early autumn was no less unexpected than the fall in oil prices to negative values in the spring of 2020. However, the consequences of the gas collapse will be much more significant and long-term than the temporary overflow of oil storage facilities.

Gas prices in Europe began a steep rise in April 2021. For example, on April 2, gas futures were traded on TTF (a virtual point of sale for natural gas in the Netherlands) at €19.17 ($21.61) per MWh but have since grown eightfold. At one end, the quotes rose above €160 ($180.37) per 1 MWh, which corresponds to about $2,000 per 1,000 cubic meters. From May 2020, when prices sank against the backdrop of the pandemic and a fall in demand for energy, quotations have grown 30 times….

Djoomart Otorbaev is the former Prime Minister of the Kyrgyz Republic, a distinguished professor of the Belt and Road School of Beijing Normal University.

You are once again evading the real issues. Look – your credibility here is already less than zero. Keep this up and it will go lower.

ltr,

US defense budget has been passed without an insistence on blocking Nord Stream 2. The leader of trying to block it has been Cruz, who held up many ambassadorial nominations over this.

BTW, the real potential sanction out there if Putin actually invades Ukraine, which as I have noted nobody in Ukraine thinks will happen, there remains cutting them off from SWIFT. I know Rick S. dismissed this as either mere rumor or no big deal, but in fact it is a very big deal. It would hit the Russian economy hard, as well as more specifically Putin himself and his closest cronies financially. No, they do not want that.

Kyrgyzstany is this oped almost 2 weeks old and outdated, notice who wrote it. He was Prime Minister of Kyrgyzstan for a brief period of time but has been rather pro-Putin for quite a long time. Of course ltr fails to tell us about his political biases.

Djoomart Otorbaev has been opining on something called the Organization of Turkish States and the role Russia might play:

https://www.project-syndicate.org/commentary/organization-of-turkic-states-great-power-reaction-by-djoomart-otorbaev-2021-12

“The United States sought to stop the Russian pipeline, Nord Stream 2, relenting finally at the insistence of Angela Merkel, however Merkel is retired and Olaf Scholz, leading a split government, seemingly has less influence even in Germany”

Please. Propaganda requires a certain level of intelligence and knowledge you obviously do not have in case of Germany. 🙂

I bet the Soviet Union had a similar excuse for their invasions of other nations. Hey – energy prices will be high this winter. Time to let the Russians annex another nation! Wait – food prices in South Korea went up. Time to let the PRC roll in! ltr is advocating World War III as a means of keeping down the price of basic goods. What a lady!

It is very strange, how a person who claims to be German, with a generic German pseudonym, always seems to be much more concerned about Russia’s interests than those of the country he claims to hail from. I wonder why that could possibly be?? Hmmmmm……. It’ll come to me eventually……

https://english.spbu.ru/education/undergraduate/bachelor/85-program-bac/2518-german

https://www.daad.ru/ru/ucheba-i-nauka-v-germanii/izuchenie-nemetskogo/izuchenie-nemetskogo-v-rossii/

https://www.languageinternational.com/german-schools-russia

@ ULenspiegel,

Were you the anonymous source for how the IRA worked??

https://www.wired.com/story/russia-ira-propaganda-senate-report/

That’s awesome brother. Pays the bills and beats being a used car salesman. You’re CoRev’s and Bruce Hall’s favorite source for “news” now. Maybe you can sell them an air-fryer made of 100% polystyrene for three easy payments of $199 and 99cents. Finding out you are a “German” who salutes the Russian Federation flag every morning is the biggest rush of adrenaline I’ve had since finding that half-way unwrapped Andes mint on the sidewalk.

The Africa Group at the United Nations, representing 54 African nations and 1.3 billion Africans has been supporting the Ethiopian government led by Prime Minister Abiy Ahmed, while all are working for peace in Ethiopia. Possibly American economic sanctions against Ethiopia are unwarranted.

[ Apparently, Africans are not to be permitted by Americans to distinguish African human rights. This, to me, is startling and distressing. This will likely prove self-defeating to accomplishing American foreign policy objectives. ]

Your dishonesty here is beyond belief. You are talking about praise for him back in 2019. This horrific civil war started in 2020. Come on – your lies have become incredibly transparent.

Before you peddle your lies about how people at the UN are supporting Ethiopia’s human rights abuses in this civil war that started just over a year ago, address these findings by a UN investigation into those human rights abuses you try to deny:

https://apnews.com/article/africa-united-nations-kenya-ethiopia-abiy-ahmed-ccf2665d453f6af0d08e3bdf8db81b96

Your are excusing some incredible horrific abuses of people with your serial lies. Disgusting.

Over/under on the EIA-914 crude production number, coming out noon tomorrow? By train with the FCOJ weather report. 😉

In SEP, we were at 10.8 MM bopd. See below:

https://www.eia.gov/petroleum/production/ (if you look after noon tomorrow, the new one will be out.)

But that 10.8 involved a huge temp drop in FGOM oil from a hurricane. I’m assuming most of that comes back and we get back to 1.8 MM bopd versus 1.1i, but don’t know how fast it comes back. Probably have some small jumps in NM and TX (Permian). ND should be flat. Other states a mix of up/down. LA has a bit of state water hurricane to recover, but only say 20,000 bopd. AK might go up also (still coming out of maintenance downtime). Other states a mix of gradual decline (CA) and possible small increases (OK, CO, WY).

Looking at the EIA weekly numbers (from their STEO model), something like 11.35 makes sense.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

I’m hopeful that we have a more dramatic jump. Getting 0.7 in FGOM and .05 each in TX and NM would get us to about 11.6 MM bopd. I usually lean high, and FGOM may take more time to get platforms running after the storms. But…it’s possible.

https://www.eia.gov/petroleum/production/

914 report is out. OCT crude production was up about almost 0.7 MM bopd. Now sitting at just under 11.5 MM bopd. FGOM recovered 0.7 MM bopd (maybe has another 100,000 bopd left to recover). NM and TX were strangely down. Rest of US mostly a wash.

I haven’t dug through the monthly EIA API gravity spreadsheet yet, but would assume there’s a big jump in medium grade oil, given the FGOM recovery.

Natty was up 2 BCF/d, with most states contributing. Maybe WV was most noteworthy with a 0.5 BCF/d jump. It’s now the number 5 state after TX, PA, LA, AK. I would even call it the number 4 state given that AK gas is 90% reinjected and should be disregarded in national production (no pipeline to lower 48).

Both crude and natty hit post-COVID records. But are still short of pre-COVID production records, short of 2019 levels.

Henry Hub prompt is down to 3.5+. Been a mild winter so far in the population centers. [Of course that can change. Weather models are near useless after 10 days or so.]

https://www.cmegroup.com/markets/energy/natural-gas/natural-gas.quotes.html

Ethane has been tracking NG for a while now, but would not be surprised to see them diverge a bit (ethane not following NG lower). Economics for rejecting ehtane into natural gas getting weaker and petrochemical demand for ethane providing a floor.

https://www.cmegroup.com/markets/energy/petrochemicals/mont-belvieu-ethane-opis-5-decimals-swap.html

Weekly rig count out. No change for US. (Canadians have a holiday emphasis that US does not.)

https://rigcount.bakerhughes.com/na-rig-count/

Hoping rig count growth resumes in JAN. US production has historically helped destabilize OPEC and lower world prices.