The CPI surprised on the upside by 10 bps relative to Bloomberg consensus (also higher vs. Cleveland Fed nowcasts). How did financial markets respond?

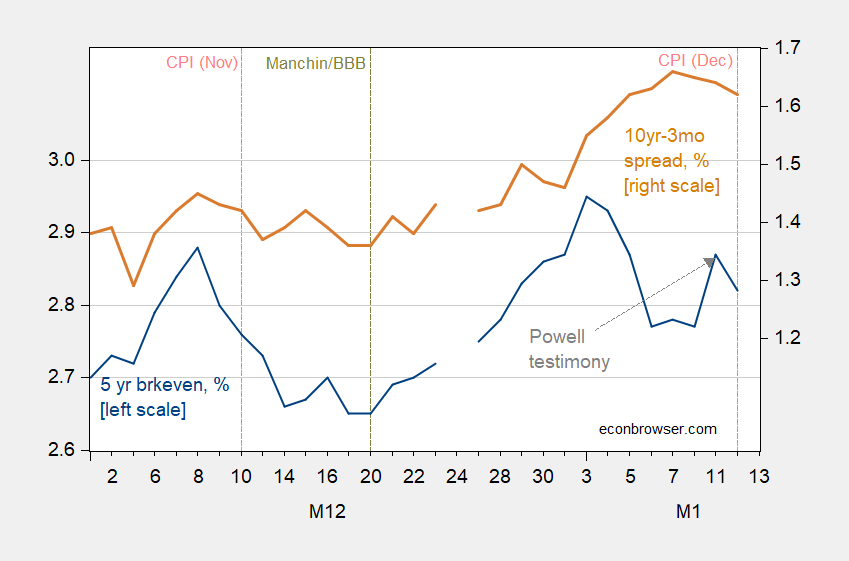

The 5 year breakeven (unadjusted for inflation risk, liquidity premia) fell 5 bps.

Figure 1: Five year inflation breakeven calculated as 5 year Treasury yield minus TIPS yield (blue, left scale), and Ten year-three month term spread (brown, right scale), both in %. Source: Federal Reserve Board via FRED, and author’s calculations.

Not much of an effect on the term spread. The 5 year 5 year forward expected inflation fell as well.

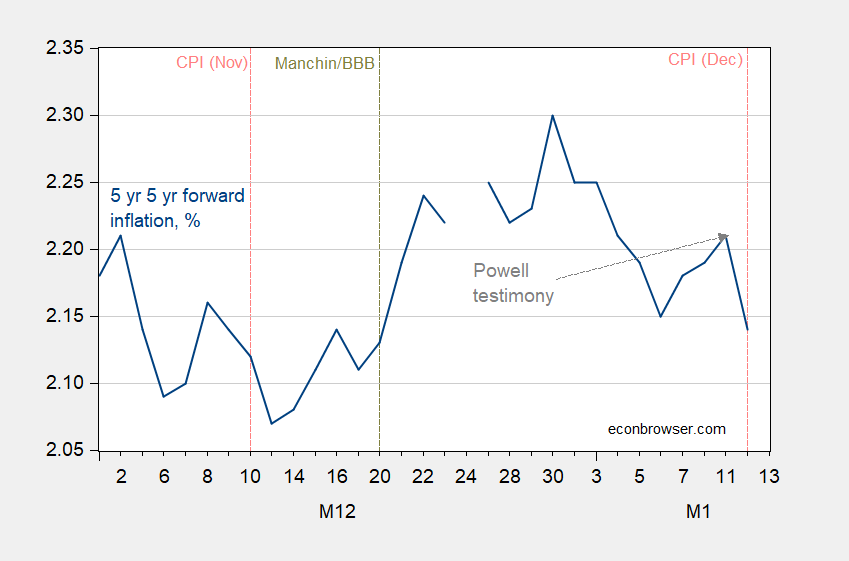

Figure 2: Five year five year inflation forward in % (blue). Source: Federal Reserve Board via FRED, author’s calculations.

Longer term inflation expectations seem well anchored, pretty much the same as mid-January 2021.

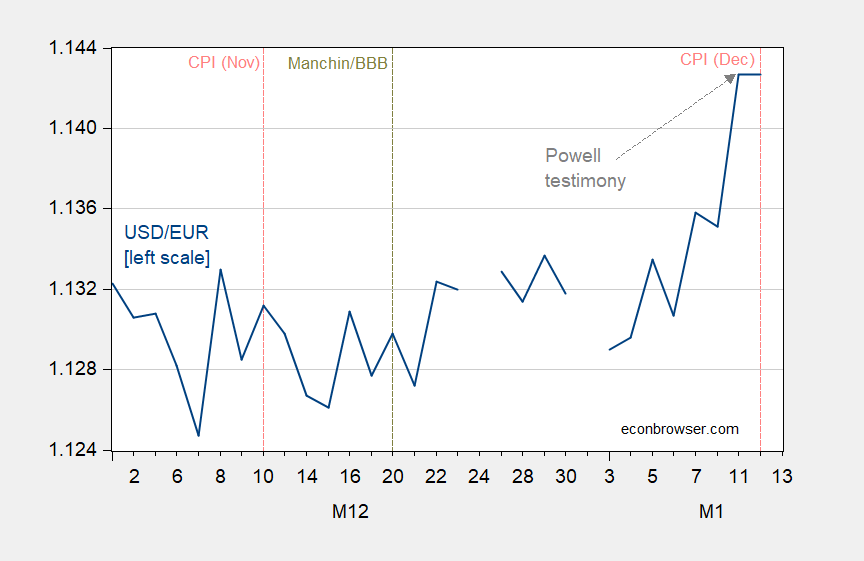

Finally, in a sticky price world where there’s a Taylor rule in place, one would’ve expected a dollar appreciation on the inflation surprise (as in Clarida (2007)). Instead, the dollar stayed flat.

Figure 3: US dollar/euro exchange rate (blue), up is dollar depreciation. Source: Federal Reserve Board via FRED, Pacific Exchange Services.

To me, this means the market was not particularly surprised by the CPI number, notwithstanding the headlines about record y/y inflation. That makes sense to me as soon as one realizes that month-on-month inflation continued to fall in December.

I agree that the market was not surprised. That doesn’t mean there’s anything wrong with the headlines.

I don’t see it as a surprise that CPI was 7% for the year. This is just confirmation, for people to read. That the dismissals last spring were off and that inflation was more than just a stray bad month at 4%+ in the beginning of the year. But markets have it priced in.

FWIW, I also think it’s reasonable to expect inflation to moderate going forward. Not because of the stray month at 5%– after all, last month annualized was at 9%. Did the prior change so radically? 😉 But more just general reversion to the mean. After all long term money isn’t getting 7%.

David P. Goldman has a slightly different take. Of course, he is not an economics professor, so we have to take his views with a grain of salt.

https://asiatimes.com/2022/01/worst-us-inflation-since-82-is-huge-underestimate/

But my “wet finger in the wind” forecast is that the Fed will put a damper on home price increases through higher interest rates (although the net results to consumers may still be higher mortgage costs), but the rental market prices will remain strong. Energy prices will continue to climb due to the forced march toward renewables which will lose some of those government subsidies as renewables increase market share because of preferential treatment by the government which will increasingly be reluctant to pony up big bucks to keep those subsidies flowing. Reducing subsidies means higher energy costs to the consumer..

This is a bit old, but shows the scope of the issue:

A study by the University of Texas projected that U.S. energy subsidies per megawatt hour in 2019 would be $0.5 for coal, $1- $2 for oil and natural gas, $15- $57 for wind and $43- $320 for solar. Many of the renewable energy subsidies come in the form of a Production Tax Credit (PTC) of 2.3 cents per kilowatt hour. Wholesale prices for electricity in 2017 were between approximately 2.9 cents to 5.6 cents per kilowatt hour. Therefore the wind production tax credit covers 30% to 60% of wholesale electricity prices. — Forbes; 3/23/18 There may be more current data, but I’m not interested in spending a lot of time looking for it when I’m sure some of the other readers keep it on a 3×5 card or their iPhone.

As long as domestic oil production remains below 2019 levels and the Saudis are disinclined to raise output significantly (why should they make less profit per barrel?), we can expect gasoline prices to remain in the $3.00 to $3.50 range (except for California). EVs haven’t grabbed a big enough share to dampen gasoline demand, but EVs are costing manufacturers and arm and leg to convert their product lines so don’t expect big price drops, even if the supply of vehicles improves.

Food? That’s a crap shoot. With all of the drought, fires, floods, and pestilence due to climate change, well there are whole regions of the country that are going to have to use up their life savings just to by stale bread. As Menzie Chinn pointed out in an earlier post, farmers are earning higher incomes now that they can sell their soybeans to China, but that hasn’t improved meat prices for American consumers and probably won’t until both supply and processing return to 2019 conditions.

So, in conclusion, while we may not see the 7% or 10% or whatever the actual inflation was in 2021, whatever increases we do see will still be a strain on consumers because it’s coming off a base they are presently struggling with.

My wet finger in the wind? Bruce’s idea of an expert

I see you’ve never been outside. Tough living in the basement in front of four screens, eh?

Went for the 5am run in the park as always. Even in the cold. You should try it but wear a coat.

“So, in conclusion, while we may not see the 7% or 10% or whatever the actual inflation was in 2021, whatever increases we do see will still be a strain on consumers because it’s coming off a base they are presently struggling with.”

let’s put it in writing. at what level of inflation will it be a problem, and at what level will it not be a problem? your statement says even 0% inflation is problematic for 2022. care to be more specific, or is this accurate?

Apologies for repeating myself, but –

Unless there is a reacceleration of inflation in coming months, the y/y inflation reading will come down pretty sharply in the April to July period. It’s already built into the math. The “largest 12-month increase since the period ending June 1982” is driven in large measure b what happened in April to July of last year.

There is a reasonable chance the Fed will begin hiking rates just as y/y inflation readings are about to cool. If so, then there is a good chance the press and casual observers will mostly misinterpret the connection between Fed policy action and inflation.

This is another one macroduck where we are seeing eye-to-eye nearly 100%, if that doesn’t frighten you too much.

You wanna know how my deranged mind works?? What I would do if I was Lael Brainard and head of the Fed right now?? (I know Brainard is not currently head of the Fed Res, but psychologically it’s too nauseating to imagine myself as Jerome “The Walking Joke” Powell). I would go full steam ahead with tapering plans, and leave rates alone for the moment—-that’s the wise move here.

: )

It may not help you sleep at night, but I cannot imagine Powell Ignoring Brainard when it come to economcs. Bank regulation? Dunno. But Powell is reportedly going to nominate Raskin to the financial oversight vice-chair job and has tried to put Saule Omarova in the Comptroller’s job. Pretty serious effort.

Interesting…….. I thought I had read Brainard would be the “#2” (I assume this is the same thing as Vice-Chair). I have nothing against Raskin, but I think Brainard would be the better “#2”. I’m not going to “hate on” Raskin just because I think Brainard would be the better choice. I do still believe though Brainard would be better. Will try to read up on Omarova, new name for me.

You get a twofer. Brainard as VC, Raskin VC for oversight. And yeah, I was confused, but I’m better now.

@ Macroduck

BTW, based on what you said on Raskin (who again I think would be a solid choice, just not the BEST choice) you may have been confused by something I said in a prior thread. I said “Never heard of her”. I was attempting one of my cute haha jokes thinking you would know I was referencing Brainard. based on my Asperger’s-like obsession with her over at the Fed and the things she says/writes. Obviously if Raskin was/is a stronger candidate based on your keeping up on it better than me, you would have been very naturally confused by my joke.

Oh, I had forgot about Omarova, I liked her a lot, I was super impressed with her but had somehow managed to already forget her name. Yeah, she dropped out. I was actually pretty angry about that:

https://www.wsj.com/articles/saule-omarova-withdraws-comptroller-of-the-currency-biden-elizabeth-warren-11638919303

Some people reading this are probably going “If you were so angry about it, couldn’t you just remember her name?” but anyway…… I just I was very impressed with her writings and her background. But I was just now trying to figure out who is the next candidate for Comptroller now that Omarova is out?? I checked “Politico” for theories on “next up” for Comptroller and didn’t find much on a quick skim read. There have to be rumors floating around on that already.

Moses,

It will be Neera Tanden, done just to specifically annoy and upset you personally. When it is publicly announced she will punch somebody while eating some fancy ice cream and saying bad things about Bernie, :-).

Hey, if they want to pat Tanden on the head for raising money, that’s fine. Just give her something appropriate to her skill set. Make her sign a legal form stating she’ll stay off social media for the duration of the job and give her Jen Psaki’s job when Psaki steps down. Jacking her jaw is the one thing Tanden can do prolifically. Maybe she can make shit up and tell us she’s another little girl who was riding on that school bus with Harris. I’m up for the entertainment. You think I wasn’t rolling around on the floor when I saw Hillary’s “I’m With Me” podium decorations??

Junior, your favorite gal in 2020 has also been a comedic sensation:

https://www.latimes.com/politics/newsletter/2021-06-23/kamala-harris-voting-senate-essential-politics

https://www.politico.eu/article/kamala-harris-paris-peace-forum/

Let us know in 3 years if Copmala visited the southern border or Paris more often, and in which locale she proved most useless.

“I would go full steam ahead with tapering plans, and leave rates alone for the moment—-that’s the wise move here.”

I am in the same boat here. there seems to be a chorus of folks, and I think it is political, trying to push the fed into more rate hikes quickly. in an effort to slow the economy. the fed has been pretty patient until now. I hope they can hold off a little while longer.

https://fred.stlouisfed.org/graph/?g=sVz7

January 15, 2020

Consumer Price Index and Consumer Price Index less Food & Energy, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=FmWS

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=ECQX

January 15, 2020

Consumer Price Indexes for New and Used Cars & Trucks, 2020-2021

(Percent change)

Menzie Chinn: “Finally, in a sticky price world where there’s a Taylor rule in place, one would’ve expected a dollar appreciation on the inflation surprise (as in Clarida (2007)). Instead, the dollar stayed flat.”

Oh, that was clever. Professional courtesy, I assume. Member of the tribe.

joseph: I wasn’t trying to be clever. Clarida made many big contributions to international finance before going into policy. If you check google scholar, he has close to 25000 cites. The paper I cited is well known in international finance.

Just because I don’t agree on one matter or the other doesn’t mean I won’t cite someone’s work. After all, Fama is cited numerous times in my academic work, despite my having big disagreements about his writings, both policy and professional.

I don’t think Menzie is that fraternal. I might have some minor gripes here and there, but that’s probably more due to my own general crotchetiness. Both Professor Hamilton and Menzie have allowed the strong criticisms of the economics profession (sometimes even directly to themselves which takes both tolerance and strong self-esteem to stomach). Joseph, have you ever had a comment filtered based on that particular score?? Honestly?? I doubt it, because I never have, and I have made borderline rude comments here aimed at Economics. I have been filtered, but I gotta tell you, it was more to save me from myself (which I’m actually kinda grateful for) than anything that would have protected the economics profession from constructive criticism.

Moses,

Why is one of our hosts “Professor Hamilton” while the other one is “Menzie”?

Same reason you are Junior.

BTW, I was originally thinking to call you “Junior the Instigator” but that sounded too much like a cool comic book villain in comparison to your drab and boring personality, so then I thought just plain Junior fit you better.

Actually, Moses, this is a serious question, and while you may find your answer amusing since I am the one who asked, it does not cut it. This is actually not just directed at you. Others do the same thing. Is it that Menzie is a good pal while Jim is off and away and distant and almost never here, so one must approach him only during his office hours and address him by a formal title?

I think some things are better left to “read in between the lines”.

I call Menzie by his first name as I interact with him more on the blog than I do Professor Hamilton. Politically, whatever rankles Menzie about my attitudes on gender, I think I’m much closer to Menzie politically, and have more of an “affinity” towards Menzie (whatever affinity one can have to another person solely through interactions online). I call him by his first name more as a gesture of warmth than anything having to do with his PhD or his career, calling him “professor” or Doctor feels too formal and cold for me. Maybe I am being selfish and not regarding Menzie’s feelings on the matter who put a lot of personal energy and no doubt forfeited things along the way to attain his PhD. But I don’t “sense” he is offended by it, so I go with what I view and the more friendly/warm first name addressing. Even though in my mind I “mispronounce his name “Muhn-zie” rather than what I think is the actual correct “short e” sound, because when I first read his name I read it using pinyin pronunciation rules, and got into the longterm habit of thinking of it as “Muhn-zie” in my mind.

Maybe it’s Professor Hamilton’s influence of having a military Dad, he just seems more formal or “stuffy” (if that’s not too derogatory) so I figure he has a bigger fetish with formal titles than Menzie might. Maybe I am very wrong on both counts. It’s just something I “Sense”. I may be 180 degrees wrong about both men. If I am wrong, I mean no offense to either, because I respect them both.

Fair enough, Moses.

I think a lot of this is that Jim posts so infrequently these days. He has himself suggested that he does not like the personalistic bashing that goes on here so much, which you and I are among the guilty on.

As someone who knows him, indeed I knew him well before I ever met Menzie, he is actually a mellow nice guy. I get that this does not get seen in the occasional posts he makes here these days. And, of course, somebody with such a boring personality as mine is probably not qualified to make comments on any of this.

Last JUN, there was a post here headlined “Kevin Hassett Prediction: 7% y/y Inflation by December 2021” (and reflecting skepticism on achieving this).

https://econbrowser.com/archives/2021/06/kevin-hassett-prediction-7-y-y-inflation-by-december-2021

From the front page of the government CPI home page:

“In December, the Consumer Price Index for All Urban Consumers rose 0.5 percent, seasonally adjusted, and rose 7.0 percent over the last 12 months, not seasonally adjusted.”

https://www.bls.gov/cpi/

So, of course it’s good to look at the monthly datum. Although noisy, it is your new information. But it’s also good to look at the trailing twelve months. Especially in the context of discussions about what full year 2021 would do. The guy probably just got lucky. Still. We did 7% for the year. Throw the dog a bone. 🙂

And from the last JUN blog post, Hacket’s prediction mathematically necessitated a high CPI in 2H21: “This implies that month-on-month inflation June through December will average at least 7.3%, substantially higher than the 4% the University of Michigan’s June survey implied for the next year (through June 2022).” But, I guess that happened.

Hacket’s prediction? Well some say Kevin Hassett is a right wing hack but … OK – Kevin got lucky on this one. Menzie back then noted how far off Kevin was re COVID. And of course there was his 1999 forecast that the DOW would soon hit 36000. How did that work out?

https://english.news.cn/20220113/b252603b4c2a44a1b9dc999e57986fac/c.html

January 13, 2022

China FDI inflows hit record high in 2021

BEIJING — In a year when the pandemic continued to wreak havoc on the world economy, global investors have cast more votes of confidence on investing in China as the foreign direct investment (FDI) into the country hit a record high.

The FDI into the Chinese mainland, in actual use, expanded 14.9 percent year on year to a record high of 1.15 trillion yuan in 2021, the Ministry of Commerce said Thursday.

In U.S. dollar terms, the inflow went up 20.2 percent year on year to 173.48 billion dollars.

High-tech industries saw FDI inflows jump 17.1 percent from a year earlier, ministry spokesperson Shu Jueting told a press briefing.

Foreign investment in China’s high-tech manufacturing and high-tech services industries rose 10.7 percent and 19.2 percent, year on year, respectively….

Eamon McKinney: In China “ There are projections … that within the next six months to a year pricing on some export goods will increase up to 20%. In the past, goodwill between Chinese suppliers and U.S. customers would tend to dampen this upward pressure. Today, that goodwill is much reduced, and the Chinese are being more financially pragmatic. Consequently, there can be little doubt that product being ordered from China for delivery next year will increase in price, further contributing to this country’s inflationary pressure.”

https://www.industryweek.com/the-economy/trade/article/21183056/the-fallout-from-frayed-goodwill-with-china-will-be-swift-and-intense

TSMC, the leading-edge semiconductor company already announced price increases of 20% in 2022.

I hate to rain on anyone’s parade, but I have my doubts about inflation dropping to anywhere near the levels of the 2010s.

“TSMC, the leading-edge semiconductor company already announced price increases of 20% in 2022.”

You have now made this claim twice and neither time gave any credible source. BTW – TSMC is selling its services to companies like Samsung and Intel. I guess you have become their corporate cheerleader even if it is clear you know less about this sector than even the village idiot Bruce Hall. Now get your dictionary and do try to learn WTF contract manufacturer means. DUH!

Since pgl is too lazy too look up readily available data, here’s a link:

https://www.nasdaq.com/articles/tsmc-to-raise-prices-of-chips-wsj-2021-08-26-0

TSMCstock price surging…the benefits of having a near-monopoly in a market with shortages! But,of course, economists deny that monopolies play any part in inflation!!!!

‘Semiconductor Manufacturing Co 2330.TW, the world’s largest contract chip manufacturer’

I guess you did not read the opening line in your own link? TSMC is a contract manufacturer. Oh you have no clue what this means. Once again – it does not design the chips to manufacturers for their customers who happen to be Samsung, Intel, and the like. I guess the actual market structure is something you have no ability to comprehend.

Since pgl is too lazy too look up readily available data, here’s a link:

https://www.nasdaq.com/articles/tsmc-to-raise-prices-of-chips-wsj-2021-08-26-0

TSMCstock price surging…the benefits of having a near-monopoly in a market with shortages! But,of course, economists deny that monopolies play any part in inflation!!!!

They are far from a monopolistic but Samsung and zingers monopsony power appears to be weak. Yea you do not get any of this as you have no clue who does what in this sector

“In the past, goodwill between Chinese suppliers and U.S. customers would tend to dampen this upward pressure. Today, that goodwill is much reduced, and the Chinese are being more financially pragmatic. Consequently, there can be little doubt that product being ordered from China for delivery next year will increase in price, further contributing to this country’s inflationary pressure.”

Does JohnH not realize that TSMC is in Taiwan not China. Now if this lazy know nothing had read its Annual Report (he has not) he could tell us that 2 of their factories are in China but 17 of their factories are in Taiwan with one factor even in Arizona. Could someone buy this moron a damn map? GEESH!

Yep. Not just Chinese companies are raising prices, too. That should tell Team Transitory something

Another allegation without one shred of actual evidence. Are you an international tax attorney? Like them – you just make stuff up out of thin air. Or was that out of hot air?

Dr. Chinn has a new post with actual data which undercuts this claim of yours badly. Not that you will understand the data.

Having read the latest bombast from your new guru I was struck by what was not in his latest rant. Not one piece of actual data. No discussion of what goods the Chinese will be raising their prices to us. Of course if they raise the price of things like apparel, we can buy these goods from other suppliers. Some applies to toys, electronics, etc.

I see why you like reading this self promoting clown. His writings are even more absurd than your usual rants. People are actually paying to listen to him babble on during some conference? Utter fools I guess.

But seriously – you have a real talent from finding some of the most bizarre sources. Really truly bizarre!

I “was struck by what was not in pgl’s latest rant. Not one piece of actual data.” Typical of the overwhelming majority of his posts.

The informed opinion of an old China hand with hundreds of business contacts in China has to count for something…but pgl would prefer to believe the propaganda that passes for a lot of what’s called news in the United States.

When you worked for that Fortune 200 company (never named as it is probably bankrupt) did your presentation also fail to present a single shred of actual information? Oh that’s right – your job was to bring the sandwiches for lunch. Never mind!

Eamon McKinney’s only claim to fame seems to be that he calls himself a Sinophile. Huh – Princeton Steve calls himself a Sinophile. And we know how utterly competent Stevie is at actual analysis!

pgl: check him out on google scholar!

pgl complains that there is no hard data on how much Chinese companies plan to increase prices on exports…but in his bombast it apparently never occurred to him that no one bothers to ask American companies how much they plan to raise their company’s prices to their retail customers. Well, nobody but macroduck, who claims to have the data but ain’t sharing it.

Since data on planned corporate price increases is something of a black hole, probably intentionally, people have to rely on informed opinion, here and in China.

Menzie,

Who is pgl supposed to check on google scholar? I could find no such account for Eamon McKinney. Steve Kopits has one, but he has only 29 recorded citations in it, not exactly knocking it out of the park.

Barkley Rosser: yes, that’s the point. He has zero presence on google scholar, which in and of itself is not fully disqualifying, but is suggestive.

I guess Dr. Chinn’s latest post is propaganda even though it is actual data from reliable sources.

Here’s an old post, discussing the high monthly inflation number in JUN:

https://econbrowser.com/archives/2021/07/inflation

Seems like if yesterday’s lower than trailing twelve month (and moving down from NOV) DEC number is indicative of future trends (with a noise caveat), than also the higher than TTM number of JUN (and moving up from MAY) should have been indicative of future trends (with a noise caveat).

Personally, I like the TTM since it gives some self-averaging of the noise. Yes, new data are new data. But they shouldn’t radically swing your priors. Forcing them to get diluted by TTM (or some other smoothing function, but it’s a convenient one) is a convenient way to do this.

Of course, mathematically, we could imagine extreme gyrations in initial months, so that what we really see in TTM is more a reflection of change in old beginning point, not even the new datum. I don’t see that as the case here. But it’s certainly possible (have seen it happen with other time series in oil production, prices). That’s why I just see TTM as a crude, convenient filter. Not Euclidean truth.

https://news.cgtn.com/news/2022-01-12/Chinese-mainland-records-221-confirmed-COVID-19-cases-16KPRB6xUQg/index.html

January 13, 2022

Chinese mainland reports 190 new COVID-19 cases

The Chinese mainland recorded 190 confirmed COVID-19 cases on Wednesday, with 124 linked to local transmissions and 66 from overseas, data from the National Health Commission showed on Thursday.

A total of 31 new asymptomatic cases were also recorded, and 726 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 104,379, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-13/Chinese-mainland-records-190-confirmed-COVID-19-cases-16MvSFTPp7O/img/a9f5c01d8e744edca076721f946aabdd/a9f5c01d8e744edca076721f946aabdd.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-13/Chinese-mainland-records-190-confirmed-COVID-19-cases-16MvSFTPp7O/img/4e08544d9aa04ce9b970deae91fb0e00/4e08544d9aa04ce9b970deae91fb0e00.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-13/Chinese-mainland-records-190-confirmed-COVID-19-cases-16MvSFTPp7O/img/c7daa74fb4f2498db4f5660773676882/c7daa74fb4f2498db4f5660773676882.jpeg

http://www.xinhuanet.com/english/20220113/f1e86092af3d4f52a08f7f70b0acdf6f/c.html

January 13, 2022

Nearly 2.92 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Nearly 2.92 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Wednesday, data from the National Health Commission showed Thursday.

[ More than 1.21 billion or 86.25% of Chinese mainland residents have been fully vaccinated. ]

https://www.worldometers.info/coronavirus/

January 12, 2022

Coronavirus

United States

Cases ( 64,359,409)

Deaths ( 866,891)

Deaths per million ( 2,596)

China

Cases ( 104,189)

Deaths ( 4,636)

Deaths per million ( 3)

Another JUN21 post:

https://econbrowser.com/archives/2021/06/a-sugar-high

“However, my view is that the 7% y/y inflation forecasted by for instance former CEA Chair Kevin Hassett is not particularly plausible.”

So, um…7% is what happened. 2021 done. What did people miss who predicted less? Anything to learn? Not asking for any radical change to priors or mechanisms. But some after action to explain why the not-particularly-plausible happened.

What a good memory you have, for a man with no name.

Just goes to show that we are terrible at forecasting inflation. Not limited to Menzie, but graph after graph shows that none of experts, markets or the public can anticipate inflation rates with any accuracy. Well, except Kevin Hassett.

Getting one forecast right does not make one an expert. It is sort of like betting on rolls of the dice. If you bet each die would come up as one – then you might get lucky on the first roll. Try that strategy all night and you would end up bankrupt. Sort of like your clients who bet on your forecasts of oil prices.

Should one remind you of DOW 36000 (1999)?

Did I call DOW 36,000? Don’t think so.

As for WTI, marching on towards $84.

Yeah prices are up last few days. [Yikes! WTI is in the 84+!] But strip is still backwardated. Bayesian better markets (a redundant term) have oil selling for lower prices later on.

WTI (CME, time of this post):

——————

FEB22 (prompt): 84.27

AUG22: drops below 80

OCT23: drops below 70

AUG27: drops below 60

Personally, I hope it drops much faster. Give me 700 rigs and I’ll threaten 2MM bopd/yr (C&C, not “liquids”). Remember 2018? That’ll make the Gulf states open the taps. Remember 1986?

P.s. Um, and team Kemp is still looking better than team Hamilton (“hundred dollars here to stay”) and Kopits (“Hamilton has it right on oil”) . Less than 3 years to go for a full decade of full decade below $100.

https://raylong.co/blog/2014/7/26/the-changing-face-of-world-oil-markets

So maybe hold your horses on those $100 calls, on the shale naysaying. Peak oilers are already getting frisky again. But they’ve been wrong for decades now.

The point was about forecasting – a point that the world’s worst consultant clearly did not understand.

“Jim is the pre-eminent macroeconomist covering oil markets. That’s why the International Energy Economists Association singled Jim out for his contributions to the field just a few weeks ago. There are others in this top group: Lutz Killian, Michael Kumhof of the IMF (vastly under-appreciated), Dermot Gately (now retired) and probably me (although I am not a professional economist). These are economists, not commodity analysts. Neither the IEA nor EIA has anyone at this level; nor do the oil companies. Nor does CERA (IHS) or PIRA.”

Well Dr. Hamilton is certainly an excellent analyst when it comes to the oil sector. But that is not MACROeconomics. Of course, Dr. Chinn has pointed out many times you have no clue what macroeconomics even is.

pgl,

I am assuming that quote is by S. Kopits from some time in the past as it does not appear on this thread. I think you need to be a bit careful here when characterizing Jim Hamilton’s work and identity.

He is most prominently identified as an econometrician. Of his 79,000 plus google scholar citeations, 26,999 of them (almost as many as Menzie’s total) are for his definitive grad textbook, Time Series Analysis. His second most at 11,000 (more than my total) is for a paper from 1989 in Econometrica whete he introduced the regime switching method widely used in macto time seties analysis (I have used it in several papers), although it can also be used in micro time series as well.

His third most cited from 1983 in the JPOE at about 4500 citation is “Oil and the macroeconomy since World War II,” which looked at the impact on the macroeconomy of oil price shocks, and he has since publiished other highly cited papers on that topic. So, while he has been an analyst of the oil industry itself in its various manifestation, what he is most renowned for in that regard is actually his studies of the impact of the oil sector on the macroeconomy, which combines being both an oil industry economist and a macroeconomist.

Needless to say, Kopits’s 29 total gs citations are far behind Jim’s many thousands on the subject of the oil industry and the macroeconomy. Heck, although these are down the list of mine, I have more citations for my scattered papers on the oil industry than does Steve have in total.

Correction: I meant to type 26,000 (plus) JIm’s book citations, and his influential 1983 paper that basicallyi made his initial reputation was in the JPE, not the JPOE (whatever that might be). Apology all around.

Not memory. I hit keyword inflation on the side and looked at a few of the previous articles from CY21. (Are too many, so I skimmed.) Honestly, hadn’t followed this at the time. I guess I tune things out. Didn’t even know it was a thing to beat Biden up (or defend him) for CPI. But I’m macro stupid and also don’t watch/read general news.

Going back to that post – it was all contingent on how real GDP might transpire. Let’s check back when BEA releases the information on real GDP for 2021QIV,

If we ignore what I would term as short term “spikes” in the price of sugar, if my math is correct, sugar is DOWN a little over 4% from the date of that post (June 13) to now. Now that’s not out to the decimal point, but if I’m way off there I’m happy to be corrected. Some of you people are just funny. If I was Menzie, VPNs and all, I’d be curious where it shows that comment came from.

OK, my math is horrible, it would be a rise of roughly 4%, 17.29 to 18.04 would have been the change not accounting for dollar value. Still not really horrific during a “supply shock” (if you buy that narrative) caused by a pandemic.

You are likely talking about the retail price of the sugar you buy and not this series:

https://fred.stlouisfed.org/series/PSUGAUSAUSDM

I do not know why this series has not been updated since October 2021 but this particular measure had been showing increases during last summer. Of course I’m no expert on sugar as I have not purchased any for about 15 years.

“You are likely talking about the retail price of the sugar you buy and not this series”

It’s arrogant prick comments like this that make it clear to everyone on this blog why you and Barkley Junior fit each other so well. I was using ICE traded sugar futures.

So much pretentious a$$-hole attitude, so little time.

And BTW narcissist, no one gives a flying F–K when the last time you bought sugar was.

Gee – touchy today. I guess “Of course I’m no expert on sugar” was being arrogant too. I was trying to interject some market data here and for some reason you get all offended? Dude – have some wine and chill. GEESH!

I think I posted this link before which explains why US sugar (No. 16) often trades on commodity markets at a price twice that of sugar on the world market (No. 11):

https://www.theice.com/publicdocs/ICE_Sugar_Brochure.pdf#:~:text=The%20U.S.%20domestic%20sugar%20price%20represented%20by%20the,trades%2035-50%25%20over%20the%20Sugar%20No.%2011%20price.

Domestic sugar producers are getting a yuuuge benefit from our trade restrictions which is why we pay a lot more for sugar than people in other nations.

Here’s another thing that’s funny to me about this inflation argument. We have been told for years now that silver and gold are major protectors against inflation. Now those things, if purchased correctly (which is actually harder to do now than ever because of shysters like Sprott and all these outfits over at ZH blog, Alex Jones, and all of your “conservative” Republican am radio favorites) can be held to perpetuity. So does anyone see a run on those things now?? If Republicans and the QAnon, ZH blog nutjob crew are sincerely worried about inflation, they’d be purchasing those two metals in droves right now. Of course, they’ve been selling that precious metals horse$hit for so many decades now, even the southern U.S. mason-dixie illiterate crew doesn’t even buy that anymore. So then now that same group is going with crypto currencies to fool the “Princeton”Kopits church choir. Because once you’ve scammed the entire town of Yates Center Kansas, then it’s time for “Professor” Harold Hill to move on to the next town.

“We have been told for years now that silver and gold are major protectors against inflation.”

Told by whom? Stephen Moore? Gold is even more volatile than oil in terms of prices. Now when I was in graduate school we were told gold had a low if not negative real return but imposed a lot of volatility to anyone dumb enough to hold such a risky asset. Of course one young finance professor speculated that it might be a negative beta asset. He was encouraged to do the research and write up the results as a potential publication. I don’t think he got very far with this weird idea.

Everyone on this blog knows that the word “plausible” has various definitions. But the ‘real’ definition is NOT and CANNOT be a definition that would potentially paint someone who Menzie doesn’t like in a remotely favorable light.

Lexicographers be damned!!!

Gee – your preK teacher is getting you to learn a few words that have more than 4 letters!

The resident tragic clown PaGLiacci has yet another phenomenal response to one of their most adored fellow-commenters. This comment section is sure to be bursting with great discussion after this one-of-a-kind (albeit ever so dreadfully mundane and rote) contribution to discourse. Here we are again laughing at the tragic clown. Honk away, PaGLiacci, honk away you creature of the stage!!!

You are the most adored? Is your real name Donald J. Trump?

Again PaGLiacci showing that they can’t read or that they don’t care to be honest in their commenting. This is par. Here’s the phrase in its entirety… “one of their most adored”. Yes, we all know that this blog’s comment section has difficulty with understanding the meaning of words but the meaning of words do matter. And PaGLiacci thinks “one of their most” means “the most”. Or maybe it’s a Pavlovian slip? In any case, yet another failed PaGLiacci post. HonkHonkHonkHonkHonkHonkHonkHonkHonkHonkHonk

Oh gag, Econned. You are the one who messed up here. The problem is that it is quite unclear to whom you are referring when you said “most adored.” I have a suspicion you meant Menxie, although this string of comments is part of a bunch bashing Menzie. But the way you wrote it made it look like you were referring to yourself.

I know you have a high opinion of yourself, but surely you understand that about the last thing you are here is “most adored.” Indeed, you are probably the leading candidate for being the exact extreme opposite of that here. Can you seriously name a single commenter here who is less reviled than you are? Maybe you can do that after you tell us about a single serious substantive and original post on economics you have put up here.

We are waiting.

Oh gag, Barkley Rosser. You are an absolute fool who has proved yet again to be incapable of reading in context. The egg on your face is very runny. You’d serve yourself well if you adopted a moniker. You sad, sad old man.

Weekly jobless claims up a bit – which should surprise few:

https://www.msn.com/en-ca/money/topstories/us-weekly-jobless-claims-unexpectedly-rise-as-covid-19-cases-soar/ar-AASJQMa

Credit to Reuters for reporting inflation in terms of what happened month to month.

https://fred.stlouisfed.org/graph/?g=KQm8

January 30, 2018

Global and United States Prices for Sugar, * 2017-2018

(Percent change)

* The difference in world and United States sugar, is that US sugar is tariff protected.

What is it with your reporting percent changes all the time? Thanks for linking to FRED data on commodity prices but people are more interested in how their levels move over time. We have been over this. Please pay attention.

https://english.news.cn/20220112/3896fecacf6f430fbe7911f2e0197412/c.html

January 12, 2022

China’s inflation tame in 2021 amid stable economy

BEIJING — With a mild retreat last month, China’s inflation largely remained tame throughout 2021 against the backdrop of sustained economic recovery, while soaring prices emerged as a massive threat in many parts of the world.

China’s consumer price index (CPI), a main gauge of inflation, rose 1.5 percent year on year in December, down from the 2.3-percent increase a month ago, the National Bureau of Statistics (NBS) said Wednesday.

Inflation climbed 0.9 percent in 2021, well below the country’s annual target of approximately 3 percent….

[ Importantly, the Chinese use of surplus commodity stores, protection against keeping products from market in expectation of price increases, national negotiation over critical prices such as medicines, were effective in limiting CPI increases. ]

How bizarre. The rise in inflation is a notable feature of this recovery. The causes are debated and the debate has been politicized. What are comments focused on? Reputation.

Economics is boring, so let’s gossip.

I thought it was interesting some researchers use S&P GSCI Sugar index to study the prices. If you go to the website, by just clicking you can see any range from month-to-date to 10 year. The index price on June 14 ’21 was 183.05. The index price right now is 193.05. Now, I guess that’s more a world market number. But here again, if we’re looking exclusively at domestic markets, I don’t know how a person blames Biden for tariffs enacted by the orange abomination. And as I stated above that’s roughly a 4% (using ICE sugar futures) increase from the time of Menzie’s June post on inflation.

Here is the link:

https://www.spglobal.com/spdji/en/indices/commodities/sp-gsci-sugar/#overview

OK – this is an interesting source of data on sugar prices. Now had ltr and I knew you were talking about this – we would not have wasted everyone’s time with what FRED provides. I will say it is surprising that S&P provides this for free. They usually charge huge bucks for their data.

Now an index can show changes over time – the 10-year window for example indicates that sugar today is not much more expensive than it was 10 years ago. I just wish there was a way to convert the index to the price of sugar per pound. But something tells me that S&P will not that only for their paying customers. At least FRED data is free to use.

I was curious what was going on with the high price of sugar 10 years ago. Maybe this is off the deep end but I found this history of sugar prices that goes back about 8 centuries:

https://www.winton.com/longer-view/the-sweet-and-sour-history-of-sugar-prices

Was sad to hear about Ronnie Spector passing away. What a unique talent. Was a great inspiration for Eddie Money (make your own judgements whether that musical “branch off” was good or bad). And what a knockout she was in her younger years (if it’s not punishable by death to comment on women’s appearances nowadays) Just strikingly beautiful in the face, and other areas. And how many movie soundtracks were taken up a notch with her singles included?? Her music will outlast her earthly existence by decades but her sparkly personality will still be missed,

I’m pretty certain if I had seen these eyes and face in person “IRL” my heart would have skipped 2–3 beats:

https://bit.ly/3FrYUVB

The usual suspects on the Supreme Court write: “The Solicitor General does not dispute that OSHA is limited to regulating “work related hazards … Although COVID-19 is a risk that occurs in many workplaces, it is not an occupational hazard in most.”

This is the very same Supreme Court that has worked remotely for over a year out of concern for their own worthless white a**es due to the hazards of COVID-19 in the workplace. Disgusting.

It is a hazard to go into a factory right now but these legal bozos had to find a way to support the MAGA cause. Unbelievable!

I try not to think of things like that as much as I can Joseph, because I just RAGE if I think about it a long enough (like anything greater than 20+ seconds of that thought). RAGE…….. It’s interesting to note Joseph SIX of our nine Supreme Court Justices right now are Catholic. Remember Joseph “Catholics ‘treasure’ life”. Please remember that Joseph, ok???~~”Catholics ‘treasure’ life”. Life is “very precious” to Catholics Joseph. Don’t forget, ok??

Gasoline prices just dropped another 2 cents per gallon here in Harrisonburg. What are others of you seeing where you are? Moses?

I note that Anonymous noted latest EIA report that seemed to indicate substantial gasoline supplies in US, so maybe not surprising, and maybe gasoline prices will not be contributing to whatever inflation occurs this month.

Crude prices rose quite a bit, but have been down the last two days, although WTI still over $81.

Paid $2.71 within the last 2 days. But I’m a cheapo so you know as the Jews say “Only an idiot pays retail”. But seriously, I would say the price in my city locale is probably closer to $2.79 and holding pretty steady there over….the last week maybe?? That’s not exact but I would say a close enough “feel” for this area. I just looked right now at one of those “apps” that is usually correct, it’s 8 cents higher than about 36 hours ago. So I would say on a very short term time frame gasoline price at the station is rising here.

Hospital visits are rising very fast in this state and I would say about 7/8ths of the people I see in public are sans surgical mask. So I don’t know what to make of it. Traffic seems to be lowering lately…… hard to gauge.

Just went out to the gas station [edited – MDC] to pick up a newspaper (not the one I usually go to for gas). Weirdly (or not since I just filled up) I didn’t take note of the price. What I did notice, not a single person other than the clerks was wearing a mask. Not one person, and another guy almost seemed to be working at getting in my face as I exited the station.

It’s a great feeling to be surrounded by morons clear through every day. Most of them really nice people. Just they have that Ronald Reagan dead/vacant look in their eyes.

http://www.aparchive.com/metadata/youtube/8a1cd374f0d3fa67b17b373bba18528b

Moses,

Since you are inappropriately dragging my wife into this, I note that I have been writing “gasoline prices” because YOU gave me heck some time ago when I wrote “gas prices,” which is of course what most people do and also say. But I did not wish to bring down your wrath that somebody might think I was writing about natural gas. So, Moses, this had nothing to do with my wife and everything to do with YOU. But, clearly there is no pleasing you. I do as you ask and you start mocking my wife. What a jerk.

All: Since it there is endless confusion between people of different nationalities about what “gas” actually refers to, I suggest not giving grief to people for their terminology. Heck, I make mistakes about “gas” and “gasoline” all the time.

When the Barney Fife of PhD professors plays coy when I discuss “gas prices” at the station and phonily wants to know if I’m talking about natural gas (i.e. “Dad, he started it”), Fife will get what’s coming to him.

Moses,

Are you claiming that I gave you a hard time about natural gas or gas? If you want to pull that, you are going to have to document it. It was you , not me, who made a fuss about this silly stuff. Sheesh.

Oh, and as for my wife and her knowledge of English, I am sure hers is better than yours. For three decades she was accurately correcting the English of college students at JMU before she retired. Back in the USSR she was involved in translating negotiations at very high levels, ambassadors and major business leaders. She was a major translater of economics books from English into Russian, including the works of Schumpeter. She is essentially fluent in several more than the five languages listed on her cv. You got in way over your head on that wise crack of yours, Moses, making a total fool of yourself, and a messed-up obnoxious one at that. .

Oh, and she has math too. She was given a gold medal for math achievement personally by Andrei N. Kolmogorov, although I suspect that you do not know who he was, again way in over your head..

Casually, I wonder what percentage of the American working population has COLAs?

All right, for starters, I may be wrong, but unless there have been some major changes, almost all government employees from Federal down to State, to major muni’s have that built into their wages.

Pardon the impression – this is purely back of the mental envelope for me – but I think between the companies that still have a cola built into their employee benefits plans, government workers (including military), and non-government unionized works… say about 25% of total employed?

https://www.nber.org/sites/default/files/2020-11/NB20-13%20Fitzpatrick%2C%20Goda.pdf

“In this study, we examine the prevalence of COLA adjustments in public sector retirement plans through original data collection for 49 plans in 30 states, which cover approximately 52 percent of public sector workers overall. Among this sample, on average 45 percent of workers each year experienced some change in COLAs between 2005 and 2018, with more than half of these workers experiencing negative changes.”

……..

“Approximately 13.8 percent of the U.S. workforce is comprised of state and local

employees who are eligible for retirement benefits from one of 299 state-administered or 5,977

locally-administered plans.”

……..

“Recent market losses and increased budget pressures related to the COVID-19 pandemic are likely to reduce the funding levels for state and local pension plans even further.”

@ SecondLook I think the exact number is going to be hard to get, because the data is just not available. But I’m sure someone who studies this stuff can give you a better answer than I just attempted..

Thanks.

I can add anecdotally that the military has a system based on BLS’s Employment Cost Index – subject to frequent Congressional tweaks – that gives a cola for active-duty personnel; which actually has variables dependent on where you are stationed in the States (i.e, high-cost locations), and whether you are overseas.

Military retirement pensions are cola’d. Again with some tweaking.

This Supreme Court that claims that the Biden executive branch is exceeding its authority in the face of a national health emergency is the same Supreme Court that authorized Trump to defy the will of Congress and build his wall because of a national immigration emergency.

You know Amy Barrett and Brett Kavanaugh had to pay off that trump IOU somehow. Getting your record expunged of three separate college frat boy attempted rapes has to count for something.

https://jacobinmag.com/2021/12/lobbying-supreme-court-corruption-gop-trump

I guess Amy Comey Barrett will continue to not recuse herself from cases where she has a clear conflict of interest:

https://www.forbes.com/sites/alisondurkee/2021/04/26/amy-coney-barrett-rebuffs-demands-to-recuse-from-dark-money-case-involving-group-that-supported-her-confirmation/?sh=8d7586e3171a

Recusal in such cases after all is what professional ethics would clearly require but I guess the Federalists are above professional ethics.

Why pretend there is no inflation, instead of proposing inflation-adjustment policies such as indexation?

rsm,

Indexation tends to entrench inflation, making it harder to lower it, and indexation tends to be, that word you used about prices,,,,arbitrary.

@ rsm

There was a lady, who got a Masters degree in Economics, who was very pro-COLA. A person could make a very strong argument, this woman, who attained her Master’s Degree in Economics, is the person most effective at bringing about the COLAs many Americans benefit from today.

https://exhibitions.library.columbia.edu/exhibits/show/perkins

https://www.nbcnews.com/id/wbna51512861

Not sure if Frances Perkins is included amongst the group of people with Master’s degrees in Economics that you strongly dislike.

To rsm,

It actually depends on what is being indexed. So if one indexes transfer payments to individuals such as Social Security, this does not reinforce inflation particularly. It becomes more of a deal if one automatically indexes wages, and especially if one indexes various prices. We have seen these latter sorts of indexation appear in hyperinflationary situations, and they indeed helped entrench it.

Is a retarded monkey using your computer to type such stupid comments? After all – I never imagined anyone can be this obnoxiously dumb.

rsm: If relative prices need to change, then indexation of all wages prevents relative price changes. Should the typesetters who know how to use linotype machines still be paid the same real wage relative to computer programmers as 30 years ago? That’s in addition to inflationary impact through wage-price spiral.

I swore Menzie to secrecy on my darkest secret, but there’s no fighting it anymore:

https://www.theguardian.com/world/2022/jan/13/face-masks-make-people-look-more-attractive-study-finds

None of us should be surprised at this video of Rand Paul, based on the many lies Rand has told related to Covid-19, vaccinations, and Dr. Fauci:

https://twitter.com/DrEricDing/status/1481178860779671552?s=20

The video of Rand Paul, advising young people to go around telling people lies, brings recall of the famous Maya Angelou quote:

“When someone shows you who they are, believe them the first time.”

Maya Angelou

moe,

state one of r. paul’s lies about vaccines

would like to study the data.

Generally, I don’t answer insincere questions. It’s just another form of “gaslighting”. I have enough things to fume about, thanks. If you want an explanation of what type of gas comes from the pump at 7-11 or Casey’s General Stores you can ask Barkley. He’s not sure if the stuff at the station is used to heat people’s homes or not.

Moses,

Again, this is your bs, Moses, not mine. I had and have no problem with this. You got all in a fit because I referred to “gas” prices and you were sure people here could not tell whether I was talking about natural gas or gasoline. So I did your bidding and stick to using “gasoline” for what comes out of gas stations, since you are so unable to figure these things out. But you are still going on about this.

Is this going to become another one of these memes where you think you have caught me out with something when you blatantly have not, but you keep bringing it up? At least you finally figured it out that you were just making yourself look like an ignorant idiot with all your going on about how andeven distribution over a gene implies an even distribution over a population.

https://news.cgtn.com/news/2022-01-14/China-s-foreign-trade-volume-exceeds-6-trillion-in-2021-16OeLZ3dr6U/index.html

January 14, 2022

China’s foreign trade volume hits record high of $6.05 trillion in 2021

China’s foreign trade volume reached $6.05 trillion in 2021, surpassing the $6 trillion mark for the first time, data from the General Administration of Customs (GAC) showed on Friday.

Calculated in Chinese yuan, China’s foreign trade volume reached a record high of 39.1 trillion yuan last year, up 21.4 percent from 2020. Exports came in at 21.73 trillion yuan, a 21.2-percent increase from a year earlier, while imports totalled 17.37 trillion yuan, up 21.5 percent, according to the GAC data.

GAC spokesperson Li Kuiwen said the resilience of China’s economy and the recovery of the global economy helped the country to maintain strong growth momentum in trade.

The country’s exports and imports grew more slowly in December compared to the previous month as overseas demand for goods eased after the holiday season, and high costs pressured exporters.

Exports rose by 20.9 percent year-on-year last December after increasing by 22 percent in November, slightly beating a Reuters forecast of 20 percent.

https://news.cgtn.com/news/2022-01-14/China-s-foreign-trade-volume-exceeds-6-trillion-in-2021-16OeLZ3dr6U/img/0bbf31b225e24e9fa6e0f903a2c737f8/0bbf31b225e24e9fa6e0f903a2c737f8.jpeg

https://news.cgtn.com/news/2022-01-14/China-s-foreign-trade-volume-exceeds-6-trillion-in-2021-16OeLZ3dr6U/img/f9e4b605bb0648cb80cdd297934dc2e5/f9e4b605bb0648cb80cdd297934dc2e5.jpeg ….

https://news.cgtn.com/news/2022-01-14/China-s-5G-phone-shipments-soar-63-5-in-2021-16OGkeaGCAw/index.html

January 14, 2022

China’s 5G phone shipments soar 63.5% in 2021

Shipments of 5G phones in China skyrocketed by 63.5 percent year on year to reach 266 million units in 2021, data from the China Academy of Information and Communications Technology (CAICT) showed on Friday.

The figure accounted for 75.9 percent of the total shipments during the same period, much higher than the global average of 40.7 percent, said the CAICT, a research institute under the Ministry of Industry and Information Technology.

The number of 5G terminals increased rapidly last year. As of the end of December, a total of 671 types of 5G terminals obtained a network access license, including 491 types of 5G mobile phones, 161 types of wireless data terminals and 19 types of vehicle wireless terminals.

Declining phone prices have injected impetus to the boom in 5G’s popularity, as the price of 5G mobile phones dipped below 1,000 yuan (about $157.4), the institute noted.

In addition, the country continued to promote the construction of 5G networks and expand 5G coverage in major cities. As of the end of November last year, China built a total of 1.4 million 5G base stations, covering all cities above the prefecture level, more than 97 percent of counties and 50 percent of townships in the country, said the CAICT….

So, wait. We are supposed to believe that you picked a 15 year old paper by Clarida out of your hat just hours after Clarida resigned in disgrace from the Fed and it was totally a coincidence. His paper was the first to pop to mind?

That’s as believable as Clarida’s claim that his reversal of stock sales three days previous and his stock purchases just hours before Powell’s announcement to the press about his extraordinary measures to support corporation was totally a coincidence.

Coincidences abound.

And then you compare him to Fama. Fama is a dope about macroeconomics but he isn’t a liar and a crook. But, never mind, Clarida is a distinguished member of the tribe — even though he is a liar and a crook and should be in jail.

Joseph,

Are you familiar with this PhD thing that some people have? So the idea is, they develop a systematic, encyclopedic knowledge of a subject area. Hard to imagine anyone doing that, but that’s actually what one is expected to do, along with some original research, in order to get one of these PhD things.

Hard to imagine anyone actually going to all that bother, but over 3 million people in the U.S. alone have done it! (Don’t get me started on Canada!) Even weirder, many of the keep gathering and systematized data AFTER THEY ALREADY HAVE THE PhD!!! And doing research! Who would do that?

And Menzie is one of them. Cracks me up.

So here’s another crazy thing. Some commenters here – me among them – try to drag the conversation in comments toward Fed stuff. Menzie hardly ever takes the bait. It’s like he has other things on his mind sometimes. Probably that systematic, encyclopedic knowledge he’s always fussing with.

Now here’s the oddest bit of all. Richard Clarida publishes research in the same subject area as Menzie. And I don’t mean “same subject area” as in freshman econ. I mean the same area as in their research is discussed in the same graduate seminars. It’s ridiculous, right? What are the odds?

So if someone were to jump in front of Menzie and say “What’s the first thing that comes to mind when I say Richard Clarida?”, it’s pretty likely Menzie would say “The Factor Content of Equilibrium Exchange Rates” or some such blather.

I swear, these PhD guys are so odd.

It could have made the paper “fresh” in his head (recalling it recently when going over the recent headlines), without necessarily “defending” his recently discovered actions. That’s a very plausible scenario.

BTW, you can think Edison was an A-hole, but how do you discuss lightbulbs and not bring up his name?? I think Elon Musk has many sociopathic behavior traits, but how would I discuss recent space travel and not mention his name?? You know I “get it” Joseph, I don’t like Clarida either, If I had my way, Clarida would be sitting in a jail cell (and not a country club style prison) for 8–10 months and pay a hefty fine on his investments. But I think you’re drawing false conclusions here.

https://rigcount.bakerhughes.com/na-rig-count/

Weekly rig count out. +11 oil, +2 gas. Very nice.

We won’t do that much every week. For one thing it’s a noisy variable. For another, that might have some new year’s programs baked into it.

Given current prices, even forward looking, with the backwardation, we should keep adding rigs in the new year. I’m hopeful we do about +5 oil, +1 gas (~half of this week), for the next several weeks.

We are close to 500 oil-directed rigs now (and growing slowly). I figure about 600 rigs would enable 1 MM bopd/yr growth, which would start affecting OPEC market control. 700 rigs would be even better. 😉 There’s some lag behind rig addition and growth (at least 6 months). Plus frac spreads need to get added too (but not as bad, we were depleting DUC [drilled but uncompleted] previously.)

You’re probably looking at 20-40 weeks before the industry is really back on its feet, ready to drill baby drill in a way that scares OPEC. That’s assuming we get the rig rate addition, posited above. But increased US production is a key factor in reducing prices. (world oil prices, regional natural gas prices).

Crude did seem to react to the rig count. If you look at the chart, we dropped right at 1300 EST (when the rig count is released). Dropped about $0.50 or a little less, but very noticeable, sharp reaction in a minute.

Still, that is on a level that is really extremely high. WTI is north of $83 and Brent is north of $85. Almost dangerously close to the “$100 here to stay” that James Hamilton posted on, a couple months before prices dropped below that and stayed below for the next 7 years. [But I don’t think we are heading to $100 and neither does the futures market.]

https://www.cmegroup.com/markets/energy/crude-oil/light-sweet-crude.quotes.html (click on bar chart icon for FEB contract)

A.,

Crude dropped for two days, but indeed it is up again, with Brent now oever $86, higher than in all of 2021.

OTOH, I heard on the radio this morning that it is not only Harrisonburg, but retail gasoline prices fell this week in Virginia as a whole. I gather nationally the average is still sitting at $3.30, not all that inflationary.

BTW, whilie $86 may be higher than all of last year, we have seen extended periods in the past when the price was indeed over $100, and the economy grew reasonably well without inflation during some of those periods, e.g. during much of the early teens this century, not too long ago.

I’m not so sure that $100 oil was so great in the early teens. Or that the early teens were great overall. I sort of felt like we were still digging our way out of the financial crisis for years.

One of the things that mitigated the high oil prices was that at least US production grew dramatically (so at least that sector benefited). But if we have high prices, sans US activity, it may not be as mitigated. That’s why I’m unhappy about how low the US activity is under Biden than under either Trump (booster) or Obama (benign neglect).

https://twitter.com/RobertClarke_WM/status/1453017667137323010

All that said, sure $100 oil is not the end of the world. Not great. But it’s becoming a smaller and smaller part of the economy (meta trend over last 60+ years). So it’s not as bad as in the 70s, for instance.

Yes, A., we were coming out of deep recession in the early teens, and the high oil prices probably contributed to the slowness of the recovery. But your noting that US oil production rose then is not surprising given what the price was. You see it rising now at much lower prices than $100.

BR:

The chart I linked is already price-adjusted. Activity is low for the price level. I do hope we go back to “the blue band” as US oil is a powerful actor versus OPEC and as oil demand is pretty inelastic.

It should be reasonably easy to grow fast (if we get the activity) for next year or two. This is because shale oil wells are very prone to high decline early in life. This means the base decline (rate of decline with no drilling) gets worse when production has recently ramped up. And gets better after a period of production decline.

Overall level is important also (obviously need more rigs to maintain 10 MM bopd than to maintain 5 MM bopd). But what’s especially important is the number of recent wells. You get the Red Queen effect (have to race hard just for base decline) if you’ve recently grown a lot. But the converse is also true. After a decline in production, or even just holding it flat for a while, the base decline moderates. This is one of the reasons why we had such spectacular growth in 2H17 (1 MM bopd in six months) and in 2018 (2 MM bopd). Because it was coming on the tail of couple down years in 15, 16. But then in 2019 we moderated to “only” 1 MM bopd up. (Prices and rigs went down also, but the base decline was a big issue as well.)

We could be setting up for the same thing in 2022-2023. Shale has surprised people before. But…we do need another 100-200 oil rigs. (And spreads, but rigs are sort of easier to track and at the end of the day, DUC inventory works its way out…rigs will get the spreads needed to support them.)

inv report for week of 7 jan

usa imported ~1.3 mbbl/day net crude and petrol products.

product supplied was uniformly strong.

yoy inventory mostly drawn.

usa net crude import ~4.1mbbl/day

usa is selling a lot of product, kerosene too for the jets!

image of releases from usa reserve may dampen more crude opec+ and here.

https://news.cgtn.com/news/2022-01-14/Chinese-mainland-records-201-confirmed-COVID-19-cases-16OaTHeTUHK/index.html

January 14, 2022

Chinese mainland reports 201 new COVID-19 cases

The Chinese mainland recorded 201 confirmed COVID-19 cases on Thursday, with 143 linked to local transmissions and 58 from overseas, data from the National Health Commission showed on Friday.

A total of 42 new asymptomatic cases were also recorded, and 748 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 104,580, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-14/Chinese-mainland-records-201-confirmed-COVID-19-cases-16OaTHeTUHK/img/ef65574ba9604f6b8cceea9fae9efd70/ef65574ba9604f6b8cceea9fae9efd70.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-14/Chinese-mainland-records-201-confirmed-COVID-19-cases-16OaTHeTUHK/img/40447cf597254a449ab7e7bd1954dbf5/40447cf597254a449ab7e7bd1954dbf5.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-14/Chinese-mainland-records-201-confirmed-COVID-19-cases-16OaTHeTUHK/img/350790b5d2bd4d5b9cb5c26fc305b5c8/350790b5d2bd4d5b9cb5c26fc305b5c8.jpeg

https://www.xinhuanet.com/english/20220114/2e89e6106a4d449f9a266667b6c1128f/c.html

January 14, 2022

Over 2.92 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Over 2.92 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Thursday, data from the National Health Commission showed Friday.

[ January 8, 2022

More than 1.21 billion or 86.25% of the Chinese mainland population had been fully vaccinated. ]

January 13, 2022

Coronavirus

United States

Cases ( 65,236,475)

Deaths ( 869,212)

Deaths per million ( 2,603)

China

Cases ( 104,379)

Deaths ( 4,636)

Deaths per million ( 3)

https://www.nytimes.com/2022/01/14/opinion/france-economy-pandemic-socialism.html

January 14, 2021

Wonking Out: France’s economy is having a good pandemic

By Paul Krugman

Yesterday I wrote about America’s surprising success in limiting the economic damage from Covid-19. Compared to expectations and compared to our handling of the 2008 financial crisis, we’ve done remarkably well. But other countries have also done well, in some cases and by some measures better. In fact, among major advanced economies, the star performer of the pandemic era, arguably, is … France.

France? For as long as I can remember, U.S. media coverage of the French economy has been relentlessly negative.

Back in 1997, The Times’s Roger Cohen described France as “America’s favorite European basket case” (although he had the good grace to make fun of his own premature pessimism 16 years later.) Indeed, in the ’90s we were told that France was too culturally stagnant to keep up with modern technology; another 1997 article was titled “Why the French Hate the Internet.” (France currently has higher broadband penetration than we do.) During the 2010-13 euro crisis, I constantly read assertions that France was next in line to join the afflicted economies of Southern Europe — “France is in Free Fall,” asserted an editor at Fortune.

The data never actually supported this negativism. What was really going on, I believe, was that business and economic discourse in the United States is strongly shaped by conservative ideology — and given that ideology, France, with its huge social expenditure, high taxes and extensive economic regulation should have been a basket case. So reporting about France seized on every negative development as a sign that the long-awaited disaster was finally arriving.

But it never did show up. Instead, the French economy just kept on plugging along. True, gross domestic product per capita is about a quarter lower in France than it is here. But that mainly reflects a combination of earlier retirement and, above all, shorter working hours — because the French, unlike Americans, actually take vacations. That is, somewhat lower G.D.P. mainly reflects a choice rather than a problem.

And while the French work less than we do, they’re more likely than Americans to be employed during their prime working years. That’s probably not the story you’ve heard; my sense is that many Americans still imagine that France suffers from mass unemployment, a vision that had some truth to it 25 years ago but has long been out of date.

And prime-age employment is where France has done astonishingly well during the pandemic. Many economists use the employed percentage of adults ages 25 to 54 as a gauge of labor market conditions. This ratio plunged in the United States during the worst of the Covid-19 slump; it has since recovered strongly but is still below prepandemic levels, even though other indicators suggest a very tight labor market — one of the divergences that have economists talking about a Great Resignation of workers unwilling or unable to return to the labor force. France, however, not only managed to avoid a huge plunge in employment but has also surpassed its prepandemic level:

https://static01.nyt.com/images/2022/01/14/opinion/krugman140122_1/krugman140122_1-jumbo.png?quality=75&auto=webp

France is working.

How did it do that? When the pandemic forced economies into a temporary lockdown, Europe, France included, and the United States took divergent routes toward supporting workers’ incomes. We offered enhanced unemployment benefits; France offered subsidies to employers to keep furloughed workers on the payroll. At this point it seems clear that the European solution was better, because it kept workers connected to their employers and made it easier to bring them back once vaccines were available….

https://fred.stlouisfed.org/graph/?g=pqhd

January 15, 2018

United States and France Employment-Population Ratios, * 2007-2021

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=KSys

January 15, 2018

United States, Germany, France and Netherlands Employment-Population Ratios, * 2007-2021

* Employment age 25-54

https://www.nytimes.com/2022/01/13/opinion/pandemic-economic-recovery.html

January 13, 2022

The Secret Triumph of Economic Policy

By Paul Krugman

https://www.amazon.com/Monetary-Correction-Escalator-Inflation-Occasional/dp/0255360584

1974

Monetary Correction: A Proposal for Escalator Clauses to Reduce the Costs of Ending Inflation

By Milton Friedman

[ On indexing as a provisional means of coping with inflation, while moving away from inflationary policy. ]

Open access:

https://www.aei.org/wp-content/uploads/2017/02/Essays-on-Inflation-and-Indexation_text.pdf?x91208

1974

Monetary Correction

By Milton Friedman

[ On indexing as a provisional means of coping with inflation, while moving away from inflationary policy. ]