Or why Jason Furman and I get different answers.

- Is US core inflation faster than Euro Area, during the pandemic? Yes.

- Was US core inflation faster than Euro Area, before the pandemic? Yes.

- Is US core m/m inflation faster than Euro Area during the pandemic period, with statistical significance? Yes.

- Did US core m/m inflation accelerate relative to Euro Area during the pandemic period, with statistical significance? No.

A follow up to this post.

I examine US and Euro area inflation, month-on-month, using log differences of the price level. The Euro area HICP indices are seasonally adjusted using geometric X-12. Then define the annualized month/month inflation difference US vs. country i:

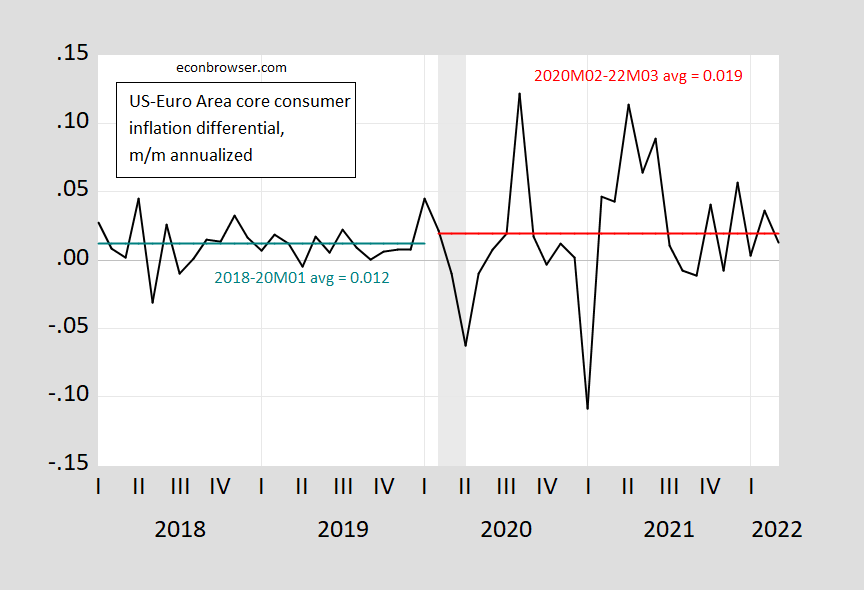

Take this variable and regress this object on a constant over the 2018M01-2020M01 period, and I obtain an estimate of 0.012, HAC standard error of 0.0025 (i.e., US core inflation exceeds Euro area core inflation by 1.2% on average). Then do the same regression on 2020M02-2022M03, to obtain an estimate of 0.019, HAC standard error of 0.0109. So, the difference between US and Euro area core inflation widens from 0.012 to 0.019, or 0.007 (0.7%).

How to calculate the difference in mean inflation differentials? One could do a t-test doing a manual calculation of the standard error (essentially a weighted average of the first and second standard errors). Or, I can just run the regression over the 2018-2022M03 period:

Where covidt is a dummy variable taking a value of 1 from 2020M02 onward.

The α coefficient is the pre-covid inflation differential between the US and country i; the β coefficient is the change in the inflation differential post-covid. (This diffs-in-diffs approach is to be preferred because the compositional aspects of the US series and the Euro Area HICP.)

Using HAC robust standard errors, I find that the estimated β coefficient is 0.007 for US-Euro Area (HAC robust standard error 0.011). The t-statistic for the null of zero on the β coefficient approach statistical significance at conventional levels. That’s partly because (in a mechanical sense), the variability of the differential in the pandemic period is so large.

Figure 1: Month-on-month core inflation differential between the US and Euro Area (black), calculated using log differences. Teal line is mean differential 2018-2020M1; red line is mean differential 2020M02-2022M03. Euro Area core HICP seasonally adjusted by author using geometric Census X-12. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat via FRED, NBER, and author’s calculations.

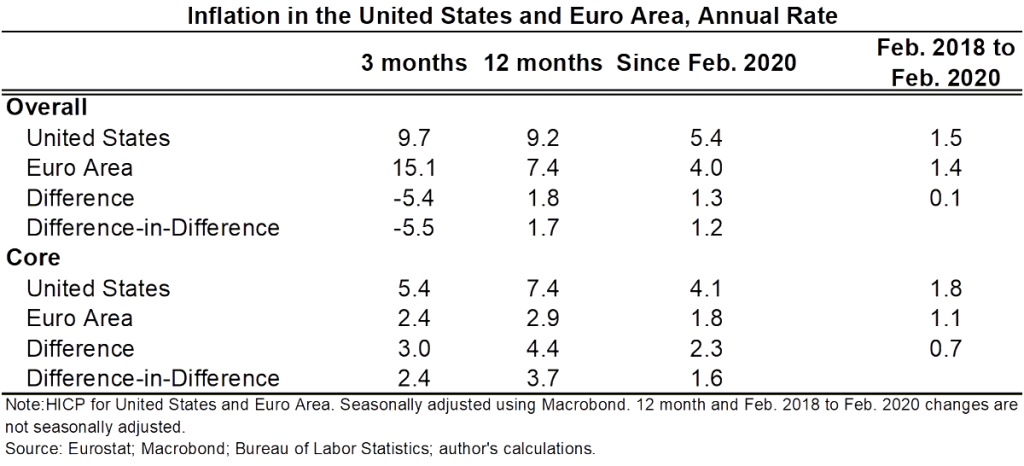

Now, why does Jason Furman get a big difference in his “Since Feb. 2020” category, vs “Feb. 2018 to Feb. 2020” in the Table below?

Source: Furman (2022).

After some number crunching, I think what’s going on is that Jason Furman calculates the growth rate before, and after, using the slopes of lines in Figure 2 below.

Figure 2: US core CPI, s.a. (black) and Euro Area HICP core seasonally adjusted (teal). Red arrows connect 2018M02-2020M02, 2020M03-2022M03 for US, green arrows for Euro Area. Euro Area core HICP seasonally adjusted by author using geometric Census X-12. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat via FRED, NBER, and author’s calculations.

As the slopes of the arrows steepen for both series, inflation rates are rising for both — but the US slope steepens more than the Euro Area slope.

Both approaches are “right”. If you want to focus on the last 3 months or last year, you should do what is done in Jason’s table. If you want to compare pre-pandemic and pandemic periods, you can do what is in the table (and implicitly Figure 2). But then you can’t do a statistical significance test, as I did.* Personally, I prefer the diffs-in-diffs in a regression context just because, well, that’s how I teach it in class.

* There may be some deep issue, about whether the slopes approach treats the CPI or HICP as a I(0) variable, while the regression of inflation rates approach treats inflation as I(0), but I don’t quite have the energy to think about that right now.

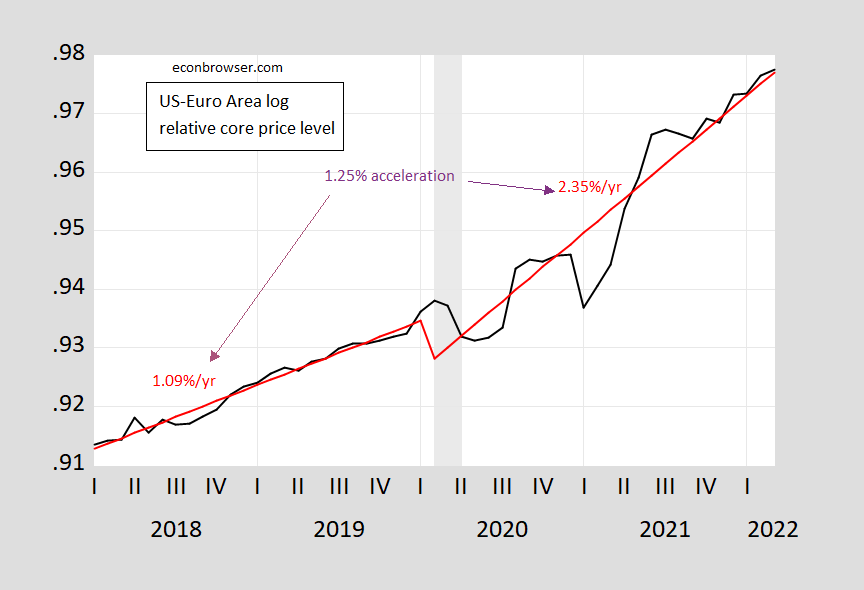

Update, 8pm Pacific: a formal estimate of differential trends in price level.

Define the dependent variable as the log relative US core CPI to Euro Area core HICP, and run the regression over the 2018-2022M03:

Which yields:

Adj-Rsq = 0.96, SER = 0.0040, N = 51, DW=0.71, bold denotes significance at 5% msl.

Using the estimates to fit the data, we get this picture.

Figure 3: Log ratio of US core CPI, s.a. to Euro Area HICP core seasonally adjusted (black). Fitted value using estimated equation (red). Euro Area core HICP seasonally adjusted by author using geometric Census X-12. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat via FRED, NBER, and author’s calculations.

The series (either from 2000M12 or from 2018M01 onward) fails to reject the null hypothesis of unit root using ADF test, or DF-GLS test of Elliott-Rothenberg-Stock, but does reject the Kwiatkowski-Phillips-Schmidt-Shin trend stationary null. The extreme serial correlation (DW < R2) is suggestive of spurious correlation.

A superb analytical post.

i didn’t expect to see this:

Russian rouble hits near 2-year high vs euro – (Reuters) – The Russian rouble strengthened on Monday, firming past 77 against the euro to a near two-year high, helped by tax payments that companies are due to make this week and as the market looked ahead to a central bank rate decision on Friday. By 1453 GMT, the rouble had gained 3.6% to trade at 77.25 versus the euro , earlier clipping 76.96, its strongest mark since June 2020. The rouble was 3% stronger against the dollar at 73.17, hovering around levels seen before Feb. 24, when Russia sent tens of thousands of troops to Ukraine.

The story did note the Central Bank will speak on Friday. Its policies of letting interest rates go sky high is one explanation for the recovery of the rouble. So Russia 2022 is a lot like the US in 1982 under Volcker. Not exactly a pretty macroeconomic picture.

They’re fighting a currency crisis, mostly to save face. The means of keeping up the currency this high are disastrous.

A significant portion of the mathematics of this is above my head. The only attempt at a contribution to this running conversation I can make is, in a better world, this is the manner in which people would disagree with one another.

https://fred.stlouisfed.org/graph/?g=OyJm

January 30, 2018

Consumer Prices and Consumer Prices less food & energy for United Kingdom and United States, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=IXud

January 30, 2018

Consumer Prices and Consumer Prices less food & energy for Euro Area and United States, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=OyKz

January 30, 2020

Consumer Prices and Consumer Prices less food & energy for United Kingdom and United States, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=IXuE

January 30, 2020

Consumer Prices and Consumer Prices less food & energy for Euro Area and United States, 2020-2022

(Percent change)

https://news.cgtn.com/news/2022-04-26/Chinese-mainland-records-1-923-new-confirmed-COVID-19-cases-19xsMje9bna/index.html

April 26, 2022

Chinese mainland records 1,923 new confirmed COVID-19 cases

The Chinese mainland recorded 1,923 new confirmed COVID-19 cases on Monday, with 1,908 linked to local transmissions and 15 from overseas, according to data from the National Health Commission on Tuesday.

A total of 15,889 new asymptomatic cases were also recorded on Monday, and 246,139 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 205,257 with the death toll at 4,828.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-04-26/Chinese-mainland-records-1-923-new-confirmed-COVID-19-cases-19xsMje9bna/img/453cc9ebcc3740c48781fad58e835ad7/453cc9ebcc3740c48781fad58e835ad7.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-04-26/Chinese-mainland-records-1-923-new-confirmed-COVID-19-cases-19xsMje9bna/img/44e5ddbe66dd444aa3f58f3005e51899/44e5ddbe66dd444aa3f58f3005e51899.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-04-26/Chinese-mainland-records-1-923-new-confirmed-COVID-19-cases-19xsMje9bna/img/f1fa4dbfaf024fea81c8ed2b35a8e592/f1fa4dbfaf024fea81c8ed2b35a8e592.jpeg

https://www.worldometers.info/coronavirus/

April 25, 2022

Coronavirus

United States

Cases ( 82,733,763)

Deaths ( 1,018,582)

Deaths per million ( 3,045)

China

Cases ( 203,334)

Deaths ( 4,776)

Deaths per million ( 3)

Great post. I learned a lot.

There has been a lot of talk about Europe going back to nuclear power to lower its dependency on Russian oil and natural gas. This got me curious what is up with uranium prices. Alas FRED’s reporting has not been updated since Dec. 15, 2021 but this source is helpful.

https://tradingeconomics.com/commodity/uranium

Before Putin invasion of Ukraine, the price was around $40 a pound but did jump to almost $65 a pound after the invasion. This price has moderated somewhat but is still rather high.

“There has been a lot of talk about Europe going back to nuclear power to lower its dependency on Russian oil and natural gas.”

No, that does not make sense for two reasons:

1) Cost of new NPPs is prohibitively high, you get a kWh for less than 50% with onshore wind or PV even in Europe, offshore wind is around 70% of the NPP costs.

2) Only 20% of the NG is used for electricity generation and most of it could be replaced with available coal power plants. 80% of the NG goes into industrial process heat or space heating. Here NPPs do nort help.

I’ve been wondering how CoRev, Ed Hanson, and Peaktrader have been spending their time since they no longer descend on this blog. Mystery solved:

https://twitter.com/francska1/status/1518916591299309569?cxt=HHwWgsC9vfOlo5QqAAAA

Does anyone know when QAnon is sending troops to Mariupol and help Putin murder non-existent “gay and lesbian cults”?? Or are Republicans too busy trying to “cancel” Disney in a “business friendly” fashion?? I’m assuming since Republicans have defunded public education over the last 40 years, three-fourths of white trash Americans already have their AK-47 over their shoulder, a Russian flag patch on the upper arm of their camouflage jacket, and a ticket to the nearest open airport to Ukraine. Or are the “tough” Republicans only willing to shoot at the unarmed in American department stores and restaurants??

Take a bow Newt Gingrich, Kevin McCarthy, and Mitch McConnell~~not much longer before your intentional ruination of America will be complete. Take a bow.

mo,

talk about guns!!

the us army selected (10 year contract) a sig sauer (usa off spring of german gun maker) for the new squad infantry rifle.

good news it is using a new, larger ammunition 6.8mm x 51 mm (roughly .270 cal). the ammunition has more energy to make the round more accurate firing through a shorter barrel. a bit technical for mo.

this will make it better rifle for shooting deer and bear than the ar 15, which shoots .223 cal (5.56x 51 mm nato) ……

and shooting a 130 gr bullet is better ‘impact’ than much the smaller .223!

In related news, “people familiar with” ECB discussions say the ECB means to end asset purchases and begin rate hikes soon. That news has not strengthened EurUsd.

The BOE begins asset sales next week.

The PBOC decided to forego easing at mid-month. Yuan weakness has helped lift DXY to its highest level in a couple of years, which should ease inflationary pressures a bit. However, it’s an inflation-related problem – China’s new Covid struggles – that have sunk the yuan. China’s share of global exports is up since 2020, making the shutdown problem a wee bit worse for global inflation.

Everybody else adopting tighter (or less loose than expected) policy without weakening the dollar is a help to the Fed. Meanwhile, U.S. credit spreads are looking sketchy. The last time BBB spreads were this wide, the Fed ended rate hikes and soon reversed them:

https://fred.stlouisfed.org/graph/?g=OzsD

I don’t know if they’re coordinating (maybe they are in this day and age – that’s nothing new historically) but smooth exchange rates are good. That or it’s just expectations. Sudden movements = already baked in.

And aren’t those “effective” BBB rates nominal? This probably isn’t about risk premia but inflation.

inflation is the bear!

worth watching: euro, pound and yen all off toward low against the us$ recently. yuan went down monday am their time.

2.5% fed funds rate or 4.5% before the ‘stabilization’ is achieved? equity markets seem to be looking at the higher?

maybe ecb has bigger problem than the us federal reserve, who has been jaw boning, and ecb member national bank strategies may be like herding cats……

unexplored territory in usa will be handling $90B a month unwind of the balance sheet…… only usa recent experience was jan 2018 to sep 2019 $.7T roughly 35B per month! fed rate also rose but that was low inflation time and did not seem so bad, iirc!

Anonymous,

No no. Russia is the bear. As a certified Putin bot troll, don’t you know that?

I’m curious what European leaders think it bodes for the future, that Germany still happily pays for Russian natural gas in Euros (as I understand it) and Russia cuts off both Poland and Bulgaria’s natural gas supplies?? Do they think this means Putin is going to yell out “Olly Olly Oxen Free!!!!” any day now?? Or does it mean something else entirely??

https://www.reuters.com/world/europe/russian-gas-supplies-poland-halted-polish-media-reports-2022-04-26/

And two radio towers in Moldova struck:

https://www.reuters.com/world/europe/blasts-hit-soviet-era-radio-antennae-breakaway-moldovan-region-authorities-say-2022-04-26/

As Germany keeps funding Russia with natural gas purchases, and America watches as Poland loses its energy supplies and says “Oh, we can’t give Ukraine jets!!! That would be incendiary!!!” How do they think this is going to change Putin’s behavior. WOW, none of the leaders in Germany have been this “courageous” in standing up to an authoritarian madman since Paulus sent German troops into South Russia to starve to death.

Germany’s behavior has been ridiculous. At least they say now they’ll send some heavy weapons.

I bet those two radio towers were taken down by Ukraine, not Russia, as a pre-emptive strike against a possible new Russian front. The Ukranian military has shown great deft at this stuff (says the armchair military expert!).

“Germany’s behavior has been ridiculous. At least they say now they’ll send some heavy weapons. ”

The behaviour is only partially ridiculous:

1) To send heavy weapons for which the Ukraine has no support infra structure is not useful within the next 3-6 months. If we want to create a short-term impact, only ex-SU systems make sense, Germany does not have many left.

2) Even in a longt term scenario some of the heavy German weapons do not really make sense. The exception would be modern artillery (PzH2000 or similar) for which the training of Ukraininan soldier will happen in Germany (for the Dutch systems).

3) The issue with the German government, better SPD coalition partner, is that they do not clearly voice alternatives that actually make sense, i.e. buying US systems and provide these to NATO countries which could transfer all their SU-stuff to Ukraine.

4) In a longer war (2 or more years) the only useful approach is to tranfer regular NATO equipment to the Ukraine, for this production has to be increased or storages have to be emptied, in case of tanks only the USA has larger numbers in depots….

A very good discussion of the military economic implications is found here:

https://www.youtube.com/channel/UCC3ehuUksTyQ7bbjGntmx3Q