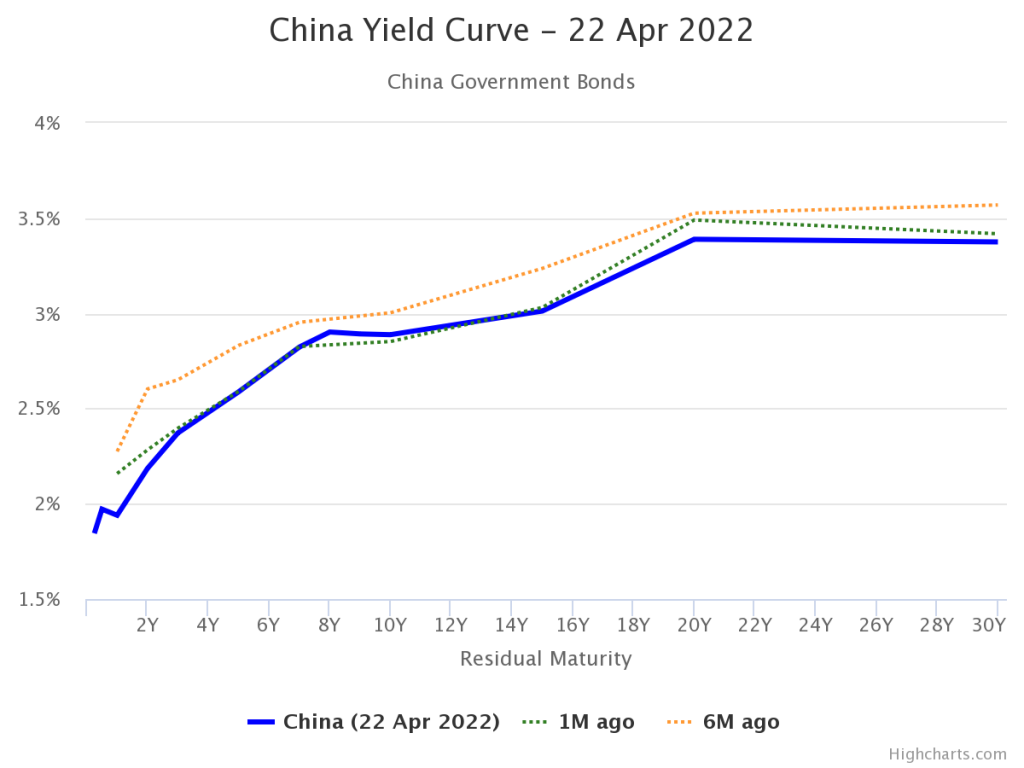

The WorldofGovernmentBonds website provides 2s10s, 2s5s and 1s2s spreads for a whole bunch of countries (missing unfortunately my favorite the 3m10s). Here’s the yield curve for China as of today:

Source: worldofgovernmentbonds.com.

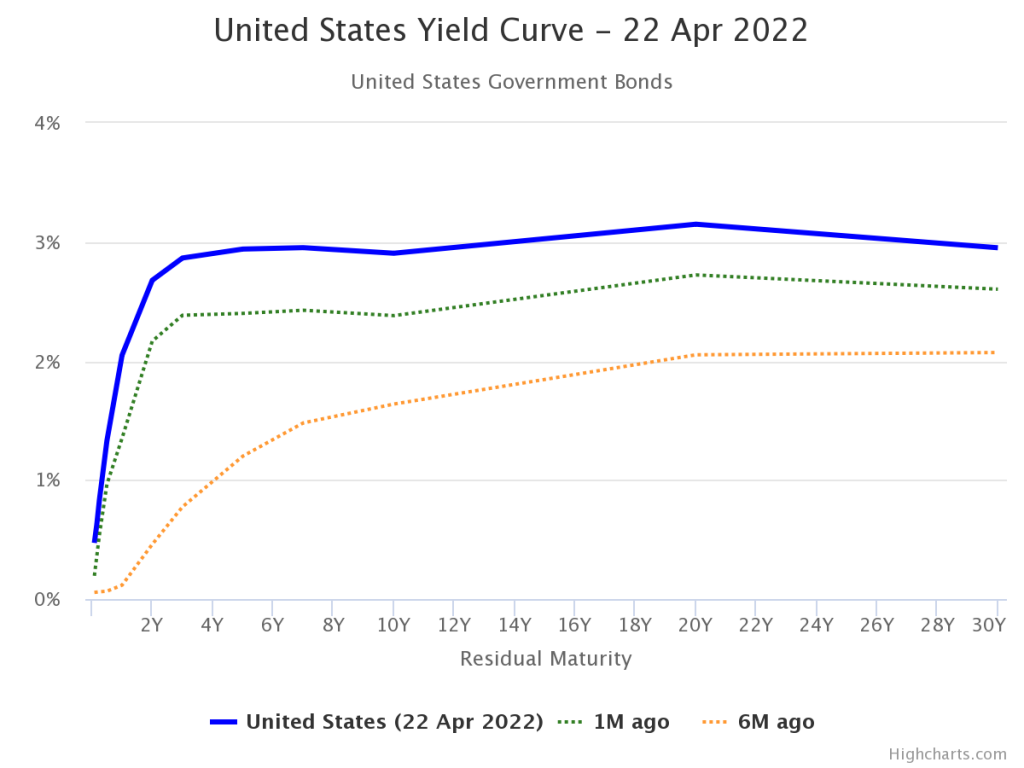

For contrast, here’s the US:

Source: worldofgovernmentbonds.com.

It is this flattening of the US yield curve that has sparked so much commentary (see here).

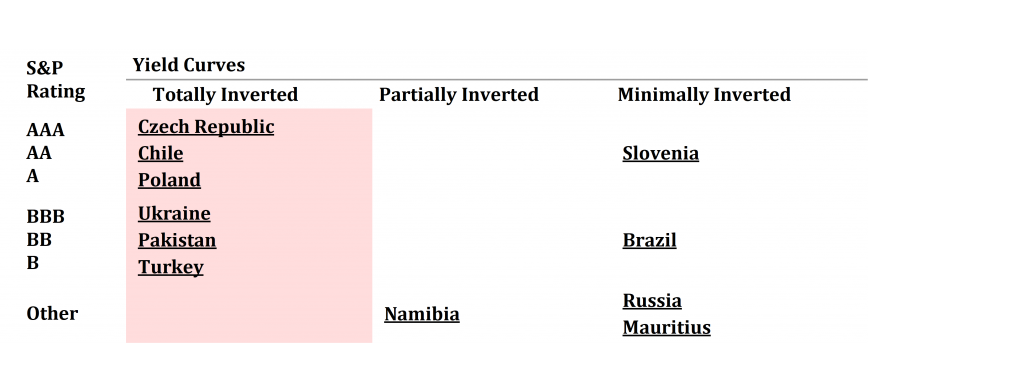

Despite the fact that this site tabulates these spreads such as the 10yr-2yr (aka 2s10s), do we know much about what this means for the countries that have inversions?

Source: worldofgovernmentbonds.com.

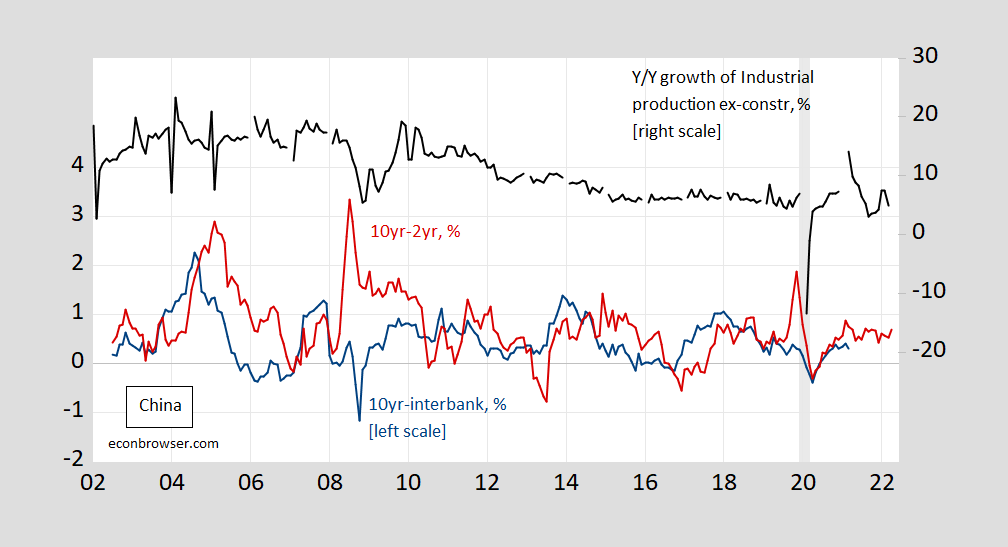

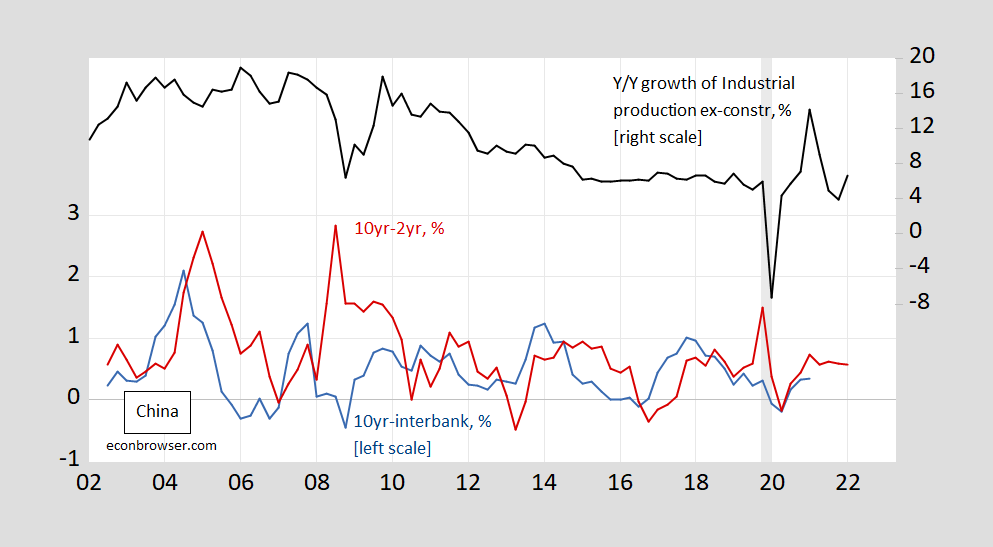

Well here’s a time series plot of spreads and year-on-year industrial production growth.

Figure 1: 10yr-2yr Chinese government bond spread (red, left scale), 10yr-overnight interbank spread (blue, left scale) both in %, and year-on-year industrial production growth, % (black, right scale). ECRI defined recession dates peak-to-trough shaded gray. Source: investing.com, OECD via FRED, ECRI, and author’s calculations.

The spikes at the beginning of the sample in the y/y IP growth are due to the lunar new year holiday moving around between January to February.

If you were hard pressed to visually find a relationship between lagged term spreads and 12 month IP growth, you could be excused. A simple regression yields:

Δipt+12 = 8.73 + 2.62spread10yr-2yrt

Adj-R2 = 0.12, SER = 4.80, DW = 0.29, N = 212, where bold denotes significance at 5% using HAC robust standard errors.

However, the result is not robust to inclusion of a trend (which is apparent in industrial production growth).

Δipt+12 = 152.68 + 0.43spread10yr-2yrt – 0.06timet

Adj-R2 = 0.68, SER = 2.88, DW = 0.74, N = 212, where bold denotes significance at 5% msl using HAC robust standard errors.

Nor is the result robust to truncating the sample at 2014 (where IP growth stabilizes somewhat).

Δipt+12?sub> = 6.10 + -0.51spread10yr-2yrt

Adj-R2 = -0.01, SER = 2.76, DW = 0.51, N = 79, where bold denotes significance at 5% msl using HAC robust standard errors.

There’s a lot of reason to believe that the predictive power of the term spread in the case of the US would not transfer to China, given the segmented nature of the Chinese government bond market. As discussed in Chen et al. (2019), the market is highly segmented, with little liquidity until recently at longer maturities like10 years. Most of the transactions were at maturities of 3 years. To my knowledge, no studies assessed the predictive power of long spreads;

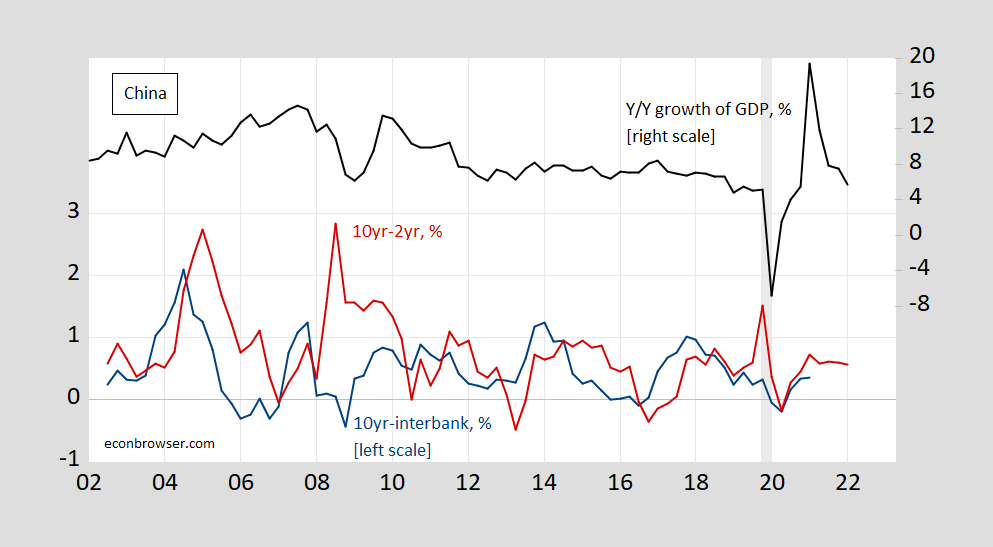

Moving to quarterly data:

Figure 2: 10yr-2yr Chinese government bond spread (red, left scale), 10yr-overnight interbank spread (blue, left scale) both in %, and year-on-year industrial production growth, % (black, right scale). ECRI defined recession dates peak-to-trough shaded gray. Source: investing.com, OECD via FRED, ECRI, and author’s calculations.

Figure 3: 10yr-2yr Chinese government bond spread (red, left scale), 10yr-overnight interbank spread (blue, left scale) both in %, and year-on-year GDP growth, % (black, right scale). Nominal GDP deflated by deflator interpolated from annual series from WEO ECRI defined recession dates peak-to-trough shaded gray. Source: investing.com, NBS, IMF WEO (April 2022), ECRI, and author’s calculations.

Similar fragility of results are obtained using either industrial production or GDP; the results are very sensitive to the inclusion of time trend. The most positive results (in terms of finding a role for the term spread) is:

Δyt+4t = 7.60 + 1.43spread10yr-2yrt

Adj-R2 = 0.06, SER = 3.40, DW = 0.78, N = 75, where bold denotes significance at 5% msl using HAC robust standard errors.

Where the spread coefficient drops to statistical non-significance with the inclusion of a time trend. Putting in a shift term for 2014-2022:

Δyt+4t = 9.35 + 0.71spread10yr-2yrt – 3.11dummy2014-2022t

Adj-R2 = 0.22, SER = 3.09, DW = 0.90, N = 75, where bold denotes significance at 5% using HAC robust standard errors, and italic_underscore denotes significance at 17% msl using HAC robust standard errors.

The failure to find a systematic relationship similar to those found for the advanced countries (recalling that Chinn and Kucko (Int.Fin., 2015) failed to find it for advanced economies Canada, France, Italy, Japan, UK) is not surprising, given the extant literature (as far as I can find; Mehl (OER, 2009) investigates 5yr-3mo for emerging markets, while Haubrich (Ann.Rev., 2021) [ungated 2020 wp version] reviews some of the more recent evidence). While Sowmya and Prasanna (IREF, 2018) find a relationship between slope and subsequent output, it’s a negative relationship. Chang, Mattson and Tang (IJFS, 2019) find a larger adjusted one year-interbank spread predicts slower output growth. Interestingly, Jiang, Guo and Zhang (Econ.Mod., 2017) don’t find a spread as one of the useful predictors for growth.

So, bottom line: you can calculate spreads, but the big question is whether they mean anything (for growth).

This website is quite informative. Notice how low German government bond rates are:

http://www.worldgovernmentbonds.com/country/germany/

https://english.news.cn/20220412/06c94fd63d834d81bbdb287fce210f03/c.html

April 12, 2022

China accelerates issuance of local-gov’t special bonds

BEIJING — The issuance of local-government special bonds in China has progressed much faster and is more advanced this year than in previous years, an official said Tuesday.

The country has allocated all special bond quotas for project construction, Vice Minister of Finance Xu Hongcai told a press conference.

By the end of March, the country had front-loaded about 1.25 trillion yuan (about 195.9 billion U.S. dollars) worth of the 2022 bond quota, or 86 percent of the total.

According to this year’s government work report, the country plans to issue a total of 3.65 trillion yuan of special-purpose bonds for local governments in 2022.

Xu also pledged measures including bigger tax and fee cuts and transfer payments in key fields to offset the loss in fiscal revenue brought about by tax refunds.

http://www.xinhuanet.com/english/2021-04/24/c_139902860.htm

April 24, 2022

China issues 895.1 bln yuan in local gov’t bonds in Q1

BEIJING — China’s local governments have issued 895.1 billion yuan (about 137.85 billion U.S. dollars) worth of bonds in the first quarter of this year, official data showed.

Of the total, special bond issuance came in at 374.1 billion yuan in the first three months while the issuance of general bonds amounted to 521 billion yuan, according to the Ministry of Finance (MOF).

In March alone, local government bond issuance reached 477.1 billion yuan, with the issuance of special bonds hitting 198.3 billion yuan.

MOF data also showed local government bonds were issued at an average issuance term of 7.7 years in March and at an average interest rate of 3.44 percent.

By the end of March, China’s outstanding local government debt stood at around 26.2 trillion yuan, within the official limit of 33.28 trillion yuan for this year, the ministry said.

https://news.cgtn.com/news/2022-04-25/China-to-cut-reserve-requirement-ratio-for-foreign-currency-deposits-19wwMt6vNqE/index.html

April 25, 2022

China to cut reserve requirement ratio for foreign currency deposits

China’s central bank announced Monday that it will cut the reserve requirement ratio (RRR) for foreign currency deposits by one percentage point beginning May 15.

https://fred.stlouisfed.org/graph/?g=yCkY

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=F7qB

January 15, 2018

Total Reserves excluding Gold for China, 2017-2022

https://english.news.cn/20220420/9a6cfeb031ff45a589bfb52a2a848a59/c.html

April 20, 2022

Reasons to stay optimistic on Chinese economy

* China’s gross domestic product grew by 4.8 percent year on year in Q1, quickening from a 4-percent increase in the previous quarter.

* This positive start to the year has defied uncertainties stemming from the Russia-Ukraine conflict and a resurgence of domestic COVID-19 infections.

* The long-term economic fundamentals remain sound and the continued momentum of economic recovery has not changed.

BEIJING — With several economic indicators showing slower increases in the first quarter (Q1) of the year, some analysts are concerned that China is falling into a further slowdown, or even a slump. But is this actually the case?

A closer look at the economic performance would prove that such concerns are overblown as the world’s second largest economy remains resilient with a super-large market, complete industrial and supply chains and huge domestic demand.

China’s gross domestic product (GDP) grew by 4.8 percent year on year in Q1, quickening from a 4-percent increase in the previous quarter, data from the National Bureau of Statistics (NBS) showed on Monday. This positive start to the year has defied uncertainties stemming from the Russia-Ukraine conflict and a resurgence of domestic COVID-19 infections.

Though lower than the 5.5-percent annual growth target set by policymakers in March, the Q1 growth will not “drag down” China’s economic development in 2022, which mainly depends on economic operations in Q3 and Q4, according to Li Daokui, an economist with Tsinghua University.

Overall, China has shown solid economic performance in Q1 and a 4.8-percent GDP expansion represents fairly rapid growth, Li told Xinhua.

BRIGHT SPOTS

A breakdown of the NBS data shows that the performance of the industrial sector and investment beat market expectations.

In the first three months, China’s value-added industrial output went up 6.5 percent year on year, and fixed-asset investment jumped 9.3 percent. In particular, investment in infrastructure rose 8.5 percent.

As infrastructure projects usually last for longer periods, they are expected to maintain their momentum over the following quarters, according to Li….

It’s hard to take this analysis seriously when the word “housing” doesn’t appear once.

“Real estate” only appears in a graphic highlighting “China’s key actions for steady growth.” No hint of actual troubles in that sector.

ltr, aren’t you yourself concerned about the quality of information from these sources? Why not post analysis independent of the Chinese government?

No mention of housing or real estate. No mention of covid.

These aren’t news articles at all. They’re just repeated talking points.

You’re not helping us understand the Chinese economy.

It’s always a fun number/visual to look at. I remember when Forbes and Economist used to put it in the back of the magazine. I didn’t understand it as well as I do now, I just remember being fascinated by it at the time. Like seeing a shelf cloud in the sky or something. I don’t know about the other countries, but my theory on why the inversion doesn’t hold for recessions or growth in China is, they don’t really have a “market mechanism” in the true sense. So it just wouldn’t. I think it could change, but that would be decades into the future, and only probably after societal wide violence. It would take the type situation that Kopits fantasizes would happen in the next 5-10 years.

Very positive news:

https://www.theguardian.com/world/2022/apr/24/emmanuel-macron-wins-french-presidential-election-say-projected-results

Just like when the orange creature lost a democratic election, we can all sleep a little easier tonight.

Glad Macron won but the fact that Marine Le Pen got over 41% of the vote is troubling. Yea I know – we Americans actually put Trump in the White House for 4 years, which is deeply troubling.

Won by about 17pp, with low turnout. Good enough I guess. Better than winning by <50,000 votes (ignoring the popular vote) and huge turnout, as was the case with Heavy Hitler's ousting.

I don’t know how political scientists calculate that (and I’m not trying to be funny), but to me, I don’t know how you get “a 17% win” out of that. Yeah, ok I assume you’re saying 58 minus 41=17% or something. But to me, she only needs 10% more to win, so she in essence only lost by 10% of the vote. Now I am not a Le Pen fan. I am just saying “17%” win strikes me as a rather learning disabled way to look at the situation. If the wind was going north at 10mph yesterday, and today the wind is going south 10mph, we don’t say “wind speeds to the south increased by 20mph”. We don’t do that, because it misrepresents what is happening AND it’s dumb.

17pp is not 17%.

17% = 17 percent (117 is 17 percent larger than 100)

17pp = 17 percentage points (58 is 17 percentage points larger than 41)

Le Pen would need to *swing* 17/2 = 8.5 percent of the voters FROM Macron TO her to tie. She must gain that many votes AND Macro needs to lose that many. It’s certainly not “she lost by 10%”.

“If the wind was going north at 10mph yesterday, and today the wind is going south 10mph, we don’t say “wind speeds to the south increased by 20mph”

And yet it would be true.

It appears Larry David took a dip in a cold pool and he had some shrinkage:

https://newrepublic.com/article/165376/larry-david-crypto-super-bowl-commercial-pretty-pretty-pretty-bad

I guess Larry will have to eat come mackinaw peaches now. That or crow. The “liberal …..”, selling people down the river for a quick buck. Shocking……..

I think the extent to which crypto is a scam is often overstated. A lot of this is about pure stupidity and ideology. Fertile ground for scams, for sure, but also fertile ground for just more stupidity.

Kim Kardashian is a crypto scam artist. Larry David and Matt Damon are most likely just idiots out to make a quick buck. That doesn’t absolve them, but it is different.

The left’s critique of crypto is 1) hilarious given their conspiracy-driven skepticism of monetary policy, and 2) just another way to project their doom and gloom about young people’s prospects in the middle of the biggest labor market boom in generations and a housing boom driven by millennials. Among the many reasons I don’t read TNR.

@ AndrewG

Most of your contentions above I would call “reasonable”. That is to say, I may not subscribe to them, but they are very plausible assertions. These are mostly subjective statements and can be argued from either side.

But one I think you are pretty far off-base:

“The left’s critique of crypto is 1) hilarious given their conspiracy-driven skepticism of monetary policy,”

Are you honestly going to tell us that you think the left has more skepticism of monetary policy than the right?? If so, I don’t think you are paying attention at all. Do you have any idea how often Menzie and left-leaning economists such as Paul Krugman have come to the defense of the Fed vs the average number of hit jobs and false smears against the Fed nutjob sites like ZeroHedge, Heritage Foundation, Hoover, FOX, AEI, Epoch Times and on and on and on have made towards the Fed’s monetary policy?? I am honestly curious what celestial rock you have been visiting since Bernanke took over the job of Fed Chairman back in 2006, 16 years ago?? Were you visiting Saturn’s moon of Enceladus those 16 years and just came back to Earth the last few days??

“Are you honestly going to tell us that you think the left has more skepticism of monetary policy than the right?? ”

No. I didn’t say that anywhere. But I do recall Bernie Sanders openly calling for “auditing” the Fed, just like a certain racist former Texas congressman. And I see comments here from the left portraying rate hikes as a conspiracy of the rich. Today in the New York Times, there’s a piece about how stock valuations grow faster when there’s high unemployment, giving only scant attention to low interest rates’ well known effects on asset values (interest rates down, stocks up) – again, framing monetary policy as a conspiracy against the poor. (Unlike TNR, I still read the NYT. It’s still the world’s premier English-language paper, even if it misses sometimes.)

I mention the left because you cite TNR, which of late has been one of the homes of soft anticapitalism. The left (in this case by that I don’t include liberals like myself) correctly identifies crypto as scammy and bad, but their conspiracy theories about the Fed are in the same vein as those who think crypto is the solution to all monetary and currency policy problems. That’s why I laugh. It’s ironic.

https://www.msn.com/en-sg/news/world/live-updates-uk-russian-offensive-slowed-by-supply-issues/ar-AAWyfbA?ocid=uxbndlbing

This story notes the many problems Putin’s invasion is running into including “supply issues”. Now this is what one would expect when one puts Bruce Hall in charge of logistics.

Some of the severe issues in the north are a result of too optimistic assumptions and were BTW predicted :

https://warontherocks.com/2021/11/feeding-the-bear-a-closer-look-at-russian-army-logistics/

“While the Russian army definitely has the combat power to achieve these scenarios, does Russia have the logistics force structure to support these operations?”

Notice little chirpy bird Brucie is now admitting he was put in charge of these logistics. Bruce Hall – a failure at everything!

Furthermore,, the Ukrainians took out a fuel depot almost 100 miles inside Russia and a few days later took down radio towers in a Russian backed rebel area in Moldova. They sure know how to find a weak spot and make it weaker.

The fact that the Russians again are rattling the nuclear weapons threat is a clear indiction that they are not winning this new offensive. They are complaining that this is a proxy war, and it is, but who started it? Russia walked right into a trap, eyes open, and now they are complaining that they are trapped. Soon Russia will ask for a ceasefire and Ukraine will be the ones saying let’s wait another week or two. The next month will be extremely dangerous, because we don’t know for sure where the snapping point is for Putin. What level of degradation of Russias military will be needed before he takes it as an existential threat – and how do we get Ukraine to hold back, if they think they are about to destroy their enemy.

I read somewhere about the extensive help the US is giving Ukraine in terms of intelligence, but that can’t be the whole story. The Ukranian military just appears to have their ‘ish together, unlike a certain other large eastern-European country we know of.

The whole thing about the existential threat conspiracy theory is that a) one wonders if Putin really believes it (maybe he does) and b) if he does, why would Austin say something like “we need to wear down the Russian military” as he did? That says a lot about White House/Pentagon beliefs. Since the US intelligence has been pretty good in the past few months, I’m leaning towards Putin *not* actually believing his own propaganda and it being just a means of recreating the Russian Empire. Just my two cents of course.

who is being “worn down”?

nato countries have very limited war reserve stocks, sending any to ukraine is degrade a factor in “unit readiness”.

usa has a larger war reserve stocks, but not infinite.

a week or so ago the main suppliers were called in to the pentagon….. seems the stocks are an issue!

and some of these weapons have been out of production ling enough the restart will be slow and source components iffy due to technology advances.

lots of money going to be made and a lot of high profit expediting coming!

Putin lives in this racist right wing “lebensraum” universe where delusions of grandeur is mixed with paranoia. I have no doubt that he is convinced that the west would attack Russia directly and take over the country – if it could do so “safely”.

In that context, the words from Austin was not just stating the obvious, but also soothing the Russian paranoia. He did not say “our goal is the complete destruction of Russia/its military”, nor did he say “our goal is to throw Russia out of every inch of Ukrainian territory they have taken in the last decade”. So he actually told the Russians not to panic.

After having agreed to supply Ukraine with enough military help to ensure that Russia cannot take much more land without heavy loses, Austin told the Russian generals the obvious: “the longer this fight goes on, the weaker your military will be when it ends”. Russia has deployed all their combat ready forces and NATO has agreed to an endless supply of needed weapons for Ukraine. This would be a long struggle between a country whose GDP was the size of Spains before the sanctions, against a block of allies with a 20 times bigger GDP – its pretty obvious who would wear down to the bone first.

Thank God we have a competent leader, not an Orange disaster, in the White House during this crisis.

@Anonymous What’s for lunch at the troll farm? Borscht again?

@Ivan I totally agree with your rendering of the economics, but not where ideology and propaganda/messaging meet. I see Austin’s comments as being an escalation, which can easily be interpreted by Moscow propagandists as an inch closer to an invasion of Russia. Not reassuring to Russia at all. Hence the saber-rattling. In which case, if Putin actually believes his own nonsense, it risks serious escalation.

Which is why I *don’t* think Putin actually believes that stuff, just like the idiotic global gay conspiracy, etc. I suspect WH/Pentagon got it right. Or at least, I sure hope they did. Otherwise, the threat of escalation is real.

A.,

Oh, you are being hilarious here. Reports have that substantilal portions of cettain Russian weapons have been destroyed, e.g. tanks, but production facilities for them have been shut down in Russia due to sanctions blocking them receiving crucial parts from outside, such as computer chips. This is not happening to production facilities in any NATO nation.

Sorry, it is Russia that is in danger of running out of weapons, and pretty soon, not the NATO nations. Gag you are delusional. Do your masters in Moscow really think people on this blog ate that ignorant not to know this sort of thing? Or are you trying to distract people with rank nonsense? Given the blatantly extreme nature of the lies Putin is currently spouting, actually you look almost reasonable by comparison.

By the way, thank you for a great link. I did not realize that the Russian army had been structured in such a way that fighting more than 100 miles from a major supply depot is extremely hard for them. Fighting battalions are heavy on tanks and light on supply trucks. Now the risky attacks on supply depots inside the Russian borders makes a lot more sense. Russian build up supply depots in Izium (Ukraine) seemed such a risky move – but the Russian generals have no choice. Russian military simply doesn’t have the structure to fight the war Putin has put them into.

Lucy,

I hear you are now in charge of Russia’s economic policy. Maybe we can work together. I’ll set up a JIT system that doesn’t work and you can set up a trade system that doesn’t work.

Troll alert. It does seem you still think the plight of Ukrainians is nothing but a joke.

You have to admit, that one was funny.

Bruce is a dog chasing his own tail – always good for a laugh!

I guess Wall Street finally got to understand the risk of putting money into a country ruled by a dictator with territorial ambitions.

https://www.cnn.com/2022/04/25/investing/china-capital-outflows-covid-ukraine-war-intl-mic-hnk/index.html

Now they are also ditching China. Maybe we will get more re-shoring of manufacturing as another Biden win on something Trump failed to do.

To be fair, this largely has to do with Xi. He’s the hardliner who’s turning China backwards (as evidenced by the Stalinesque propaganda appearing in these comments) with more centralized control over politics and the economy, and with him personally firmly in charge. Reformers have been tossed aside. The investment environment is different than it was 10 years ago. Plus, 10 years ago, we didn’t know about the concentration camps.

“There’s a lot of reason to believe that the predictive power of the term spread in the case of the US would not transfer to China, given the segmented nature of the Chinese government bond market. As discussed in Chen et al. (2019), the market is highly segmented, with little liquidity until recently at longer maturities like10 years. Most of the transactions were at maturities of 3 years.”

Very interesting. Though not what would surprise you for a developing country.

It’s unfortunate that the yield curve isn’t predictive of China’s economic performance, given that China’s government churns out happy-happy propaganda about it’s economy (see lts’s comments above) rather than objective forecasts, while preventing international organizations from doing their own objective assessments.

China’s size and influence in commodity markets makes objective forecasts important. We’ll figure it out some day.

It seems from what MC wrote that China’s capital markets are still developing (segmented and not very liquid). Lots of mispricing. I’m no China expert though, and I don’t know how much of that is simply government regulation.

Covid is coming for Beijing – that could get ugly.

https://www.nytimes.com/live/2022/04/25/world/mandates-cases-vaccine-covid-19#covid-beijing-shanghai

The organization of the lockdown in Shanghai did not work out so well. People were left hungry. Now the lockdowns will be preceded by panic buying, as people would rather have 3 months supply of stuff at home than trust the authorities will provide if needed.

Going from bad to worse in Beijing

https://www.cnn.com/2022/04/26/china/china-beijing-covid-mass-testing-intl-hnk/index.html

things will probably go smoother in Beijing than in Shanghai. more government officials in Beijing demanding a competent response will help them. but it is such a massive city, the lockdown will be impactful.

What right does Donald Trump has to comment on the marriage of Prince Harry and Megan Markle?

https://www.huffpost.com/entry/donald-trump-prince-harry-whipped_n_62665a88e4b0d077486295ba

Of course a flaming racist like Trump does not like Megan. DUH! But Harry is “whipped”? Is that code for actually being loyal to one’s wife. I guess the only marriage worth having for the Donald is one where he cheats on the wife and treats her like garbage. Melanie would have left this fat turd years ago if she can take her share of the money.

https://www.msn.com/en-us/news/world/australian-pm-says-chinese-naval-base-in-solomon-islands-would-be-red-line/ar-AAWzqFY?ocid=msedgdhp&pc=U531&cvid=12671fb2124945aa8ed236ed1a404da8

China wants to set up a base in the Solomon Islands but Australia and the US strongly object. The war over the Pacific Ocean seems to be heating up.

Speaking of China and signs of trouble, the PBOC cut the FX reserve requirement today because of this:

https://www.tradingview.com/symbols/USDCNY/

Worry that Beijing is in line for a shutdown may have somethig to do with yuan volatility.

Fed rate hike expectations have also shifted in a bit as China’s outlook dims. Interesting, given that a widening China shutdown could have global inflation implications, as well as global growth implications.

Defense Sec. Lloyd Austin is certainly honest – one of our goals is to weaken Russia so they cannot unleash hell on other nations:

https://www.theguardian.com/world/2022/apr/25/russia-weakedend-lloyd-austin-ukraine

At some point – someone in the Kremlin needs to wake up and get that Putin is undermining his own nation. In the meantime, give Ukraine the weapons they need to battle off Putin’s pigs.

Speaking of name-drops, some guy we know got a nice name-drop today:

https://twitter.com/paulkrugman/status/1518196455936344064

Being recognized by peers (receiving rather than giving name-drops) is a nice feeling (not that I would know). It’s something earned, and not used to fluff one’s self image.

The irony here is, as much time as I play online, I spend very little time on Twitter in recent years. But I thought IF our good man Professor Chinn hasn’t already seen it, he might especially enjoy this tweet:

https://twitter.com/petersagal/status/1518361423042260993

https://english.news.cn/20220415/a5762ee5b39d4ed18ca2152a4c2e86cf/c.html

April 15, 2022

China’s home prices generally stable in March

BEIJING — China continued to see a generally stable housing market in March, with the month-on-month growth of home prices in first-tier cities declining, official data showed Friday.

New home prices in four first-tier cities — Beijing, Shanghai, Shenzhen and Guangzhou — rose 0.3 percent month on month in March, compared with a 0.5 percent increase in February, according to the National Bureau of Statistics.

Prices of second-hand homes in the four cities gained 0.4 percent in March, easing from the 0.5 percent month-on-month increase in February.

New home prices in second-tier cities remained flat compared with that in February, while those in third-tier cities witnessed a month-on-month decrease of 0.2 percent last month.

“In March, home prices in the 70 major cities displayed a stable trend on a monthly basis,” said the bureau’s senior statistician Sheng Guoqing, adding that on a year-on-year basis, these cities saw their housing prices decline or register slower growth.

New home prices in first-tier cities rose 4.3 percent year on year in March, narrowing from 4.4 percent in February. New home prices in second-tier cities went up 1.6 percent, while those in third-tier cities decreased 0.6 percent compared with the same period last year….

‘In this year’s government work report, China reiterated the principle of “housing is for living in, not for speculation,” vowing to keep land prices, housing prices and market expectations stable.’

The Chinese real estate-housing market is being structurally reorganized to limit speculation, and there is every reason to think the reorganization will be successful. As for rural China in particular a large scale subsidized home construction program has been ongoing.

@ ltr

I’m sorry, I got a lot of wax build-up in my ears. Did the Chinese government say “housing was for living in”, or that “housing was for starving in”?? Please enunciate clearly.

https://nypost.com/2022/04/26/shanghai-residents-scream-at-authorities-amid-covid-lockdown/

“The Chinese real estate-housing market is being structurally reorganized to limit speculation”

Again, propaganda. Blaming evil capitalist speculators, rather than governments who have incentives to build big, juice local GDP numbers, then get promoted. As with other places in other times, it’s the government’s fault you have a housing crisis.

China wants to set up a base in the Solomon Islands…

[ This is false. ]

https://news.cgtn.com/news/2022-04-19/China-Solomon-Islands-sign-security-cooperation-framework-19mkjbmENMs/index.html

April 19, 2022

China: Security pact with Solomon Islands does not target third party

China said on Tuesday that its security cooperation with Solomon Islands does not target any third party, following the signing of a security cooperation pact between the two countries.

Chinese State Councilor and Foreign Minister Wang Yi and Solomon Islands Minister of Foreign Affairs and External Trade Jeremiah Manele recently signed a China-Solomon Islands intergovernmental framework agreement on security cooperation, Chinese Foreign Ministry spokesperson Wang Wenbin said at a regular press briefing.

The spokesperson stressed that security cooperation between China and Solomon Islands is part of normal exchanges and cooperation between two sovereign and independent countries.

Wang said the cooperation is based on equality and shared benefits and is conducted on the premise of respecting Solomon Islands’ will and actual needs.

The two sides will conduct cooperation in fields such as maintaining social order, protecting people’s lives and properties, providing humanitarian assistance, and tackling natural disasters, so as to help Solomon Islands strengthen its capabilities in safeguarding national security, he added.

The cooperation is intended to promote social stability and lasting security of Solomon Islands and is in line with the common interests of the country and the South Pacific, he said.

Describing China-Solomon Islands security cooperation as “transparent, open and inclusive,” he said it does not target any third country , does not contradict the cooperation between Solomon Islands and other countries, and can complement the existing cooperation mechanisms in the region….

“The two sides will conduct cooperation in fields such as maintaining social order”

We know what “maintain social order” looks like in China. It’s not pretty, ltr.

The rest of this article is just begging the reader to believe this is all innocuous.

China’s government also told us SARS started in Hong Kong, not Guangdong province. Why would anyone think China’s government is lying to us?? Also those are not slaves in Xinjiang , they are all volunteering to make lollipops for Han people because of the Han’s benevolence to them of allowing Uighurs to breathe, as long as Uighurs breathe acquiescently. Isn’t Beijing kindly??

Oh come on. They even signed a deal to let this happen.

https://fred.stlouisfed.org/graph/?g=Np5S

August 4, 2014

Real per capita Gross Domestic Product for China and Solomon Islands, 1981-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=Np5Z

August 4, 2014

Real per capita Gross Domestic Product for China and Solomon Islands, 1981-2020

(Indexed to 1981)

Also those are not slaves in Xinjiang , they are all volunteering to make lollipops for Han people because of the Han’s benevolence to them of allowing Uighurs to breathe, as long as Uighurs breathe acquiescently….

[ This is false. This is profoundly racist. ]