Since the pandemic struck, 0.4 percentage points (headline), 0.7 percentage points (core) [with additional results/graphs, 4/24]

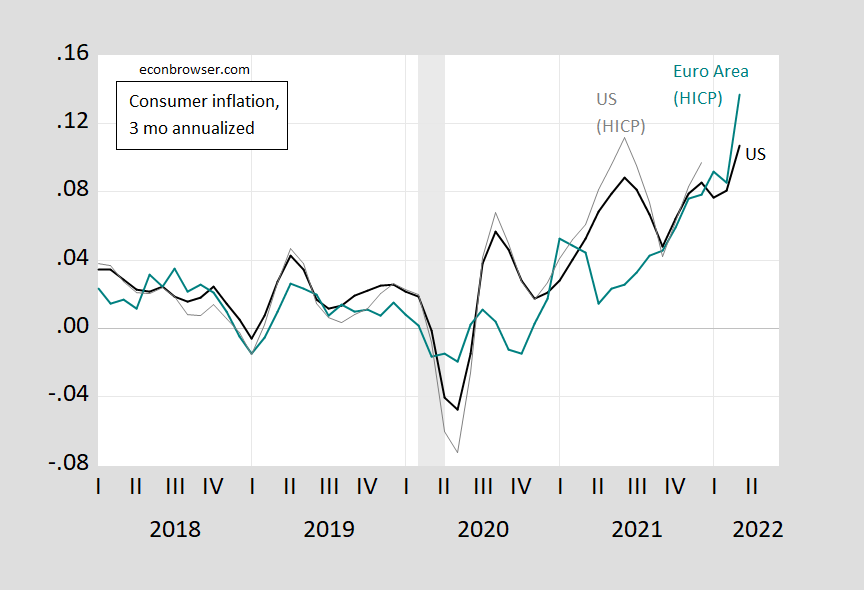

Here’s 3 month headline inflation annualized.

Figure 1: Three month annualized inflation rates for US CPI (black), US HICP (gray), Euro Area HICP (teal). Euro Area and US HICP seasonally adjusted by author using geometric X-12 before calculating inflation rates using log differences. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Eurostat, NBER, and author’s calculations.

Euro area inflation has recently moved ahead (3 month changes) relative to US. One could ascribe this to the sharp movements in energy prices, particularly for natural gas, experienced by Europe as compared to the US.

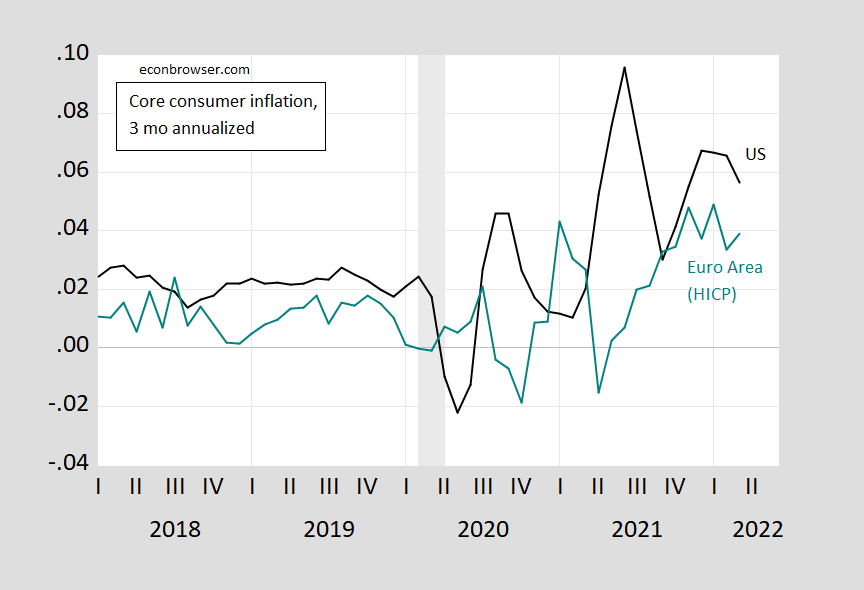

For evaluating the proposition that domestic factors — in particular demand pull vs. aggregate supply — were more important in the US, one could look at the core measures (Jason Furman argues inflation is more driven by demand pull). These figures are shown in Figure 2.

Figure 2: Three month annualized inflation rates for US Core CPI (black), Euro Area Core HICP (teal). Euro Area seasonally adjusted by author using geometric X-12 before calculating inflation rates using log differences. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Eurostat, NBER, and author’s calculations.

Headline and core inflation in the US are higher than corresponding Euro Area series. Are the differences statistically significant? Recalling that the US measures differ from the Euro Area measures (see this on HICP), it makes sense to compare the differentials between US and Euro Area series before, and after the onset of the pandemic (and the implementation of differing fiscal and monetary measures).

Specifically, I examine the time difference in the difference between US and Euro Area inflation, going from pre- to post-covid periods. This is an application of the differences-in-differences approach.

Define the annualized month/month inflation difference US vs. country i:

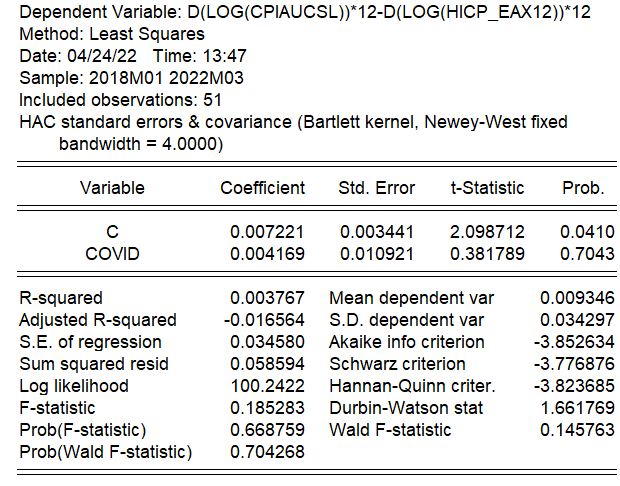

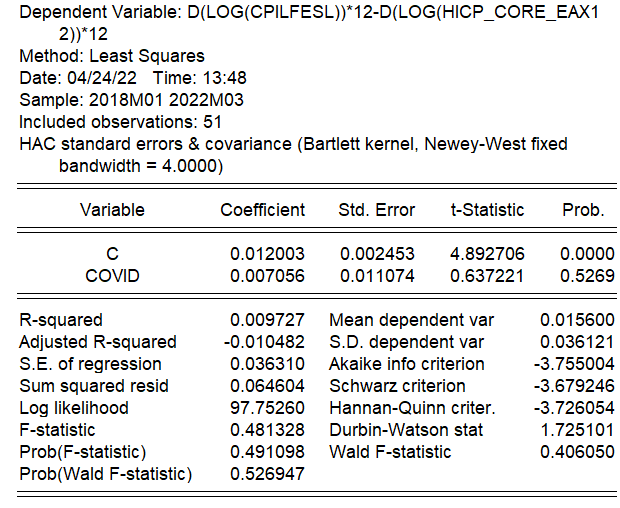

Take this variable and run the following regression over the 2018-2022M03 period:

Where covidt is a dummy variable taking a value of 1 from 2020M02 onward.

The α coefficient is the pre-covid inflation differential between the US and country i; the β coefficient is the change in the inflation differential post-covid.

Using HAC robust standard errors, I find that the estimated β coefficient is 0.0042 for US-Euro Area (HAC robust standard error 0.011), for headline inflation. For core inflation, the estimated β coefficient is 0.0071 for US-Euro Area (HAC robust standard error 0.011). In neither case does the t-statistic for the null of zero on the β coefficient approach statistical significance at conventional levels.

The ECB discusses some of the reasons (mechanically) for the differences in inflation behavior.

So, while it’s true US headline (core) inflation accelerated 0.4 percentage points (0.7 percentage points) more than that of the Euro Area, the difference is not statistically significant in either case.

Update, 4/24, 12noon Pacific:

There’s been some confusion about the results shown above, so I’m adding some documentation and the source data.

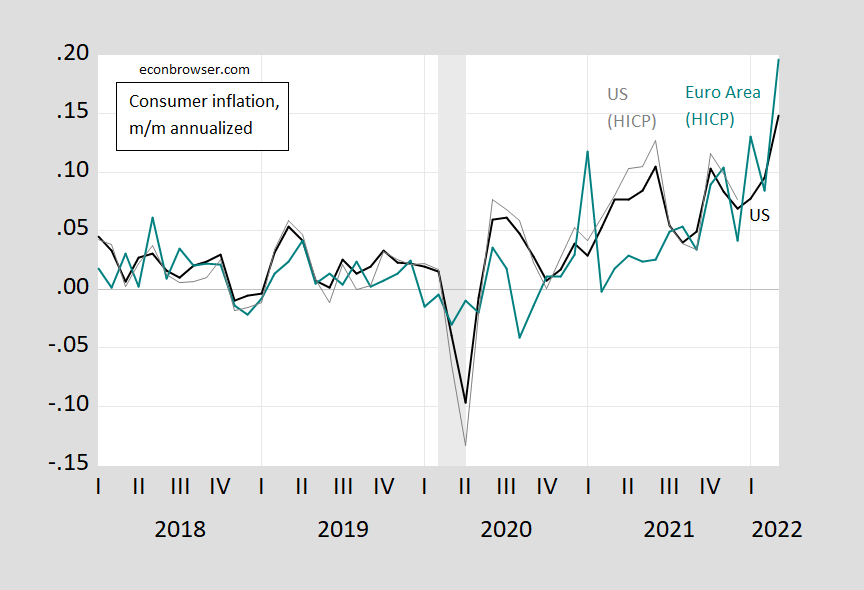

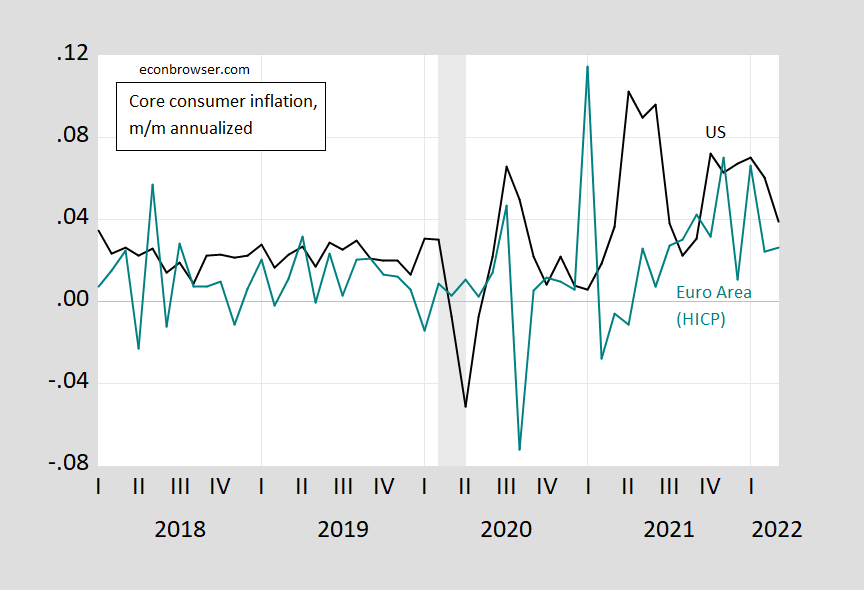

First, Figures 1 and 2 show 3 month changes — to better show the changes — but the analysis is done using m/m annualized inflation rates. Here’s the corresponding m/m figures.

Figure 1a: Month-on-month annualized inflation rates for US CPI (black), US HICP (gray), Euro Area HICP (teal). Euro Area and US HICP seasonally adjusted by author using geometric X-12 before calculating inflation rates using log differences. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Eurostat, NBER, and author’s calculations. [graph corrected 4pm]

Figure 2a: Month-on-month annualized inflation rates for US Core CPI (black), Euro Area Core HICP (teal). Euro Area seasonally adjusted by author using geometric X-12 before calculating inflation rates using log differences. NBER defined recession dates peak-to-trough shaded gray. Source: BLS, Eurostat, NBER, and author’s calculations.

Second, the calculations are done comparing 2018-2020M01 (pre-pandemic) to 2020M02-2022M03 (pandemic and fiscal/monetary responses). Here are the actual regression results.

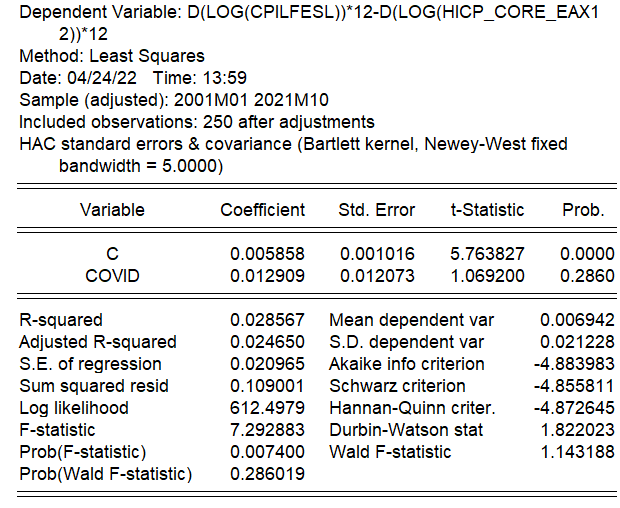

Since matters are somewhat obscured by the rapid rise in European energy prices just before and during the expanded Russian invasion of Ukraine (for clarification, the invasion’s been going on since 2014), I truncate the sample at 2021M10.

The acceleration of US headline inflation relative to Euro area is now borderline significant (13% msl), but core is nowhere near.

One could investigate at further length, using different seasonal adjustment measures, different inflation horizons (3 month, 12 month, etc.), and different subsamples. I provide the data (plus my ad hoc seasonally adjusted series), here [xls].

From inflation alone, one cannot determine the relative sources of inflation acceleration. However, to the extent that core inflation is faster in the US than in the Euro area, one can surmise that part of it is the growth of aggregate demand relative to aggregate supply (proxied by full employment output). But the fact headline was not that much faster suggests to me that as of March 2023, cost-push shocks were important. (For a graphical framework for interpretation, see this post).

(Always a caveat – statistical significance is not the same as economic significance.)

https://fred.stlouisfed.org/graph/?g=IXud

January 30, 2018

Consumer Prices and Consumer Prices less food & energy for Euro Area and United States, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=IXuE

January 30, 2020

Consumer Prices and Consumer Prices less food & energy for Euro Area and United States, 2020-2022

(Percent change)

Menzie,

The (not statistically significant) differnece in inflation between the Eorozone and the U.S. argues for faster monetary policy tightening from the Fed than the ECB. And that’s what policy guidance from both banks suggests.

In a funny bit of timing, a Bloomberg article got me interested in looking at exchange rates as an inflation driver. The article opines (it’s written by an Opinion columnist) that the Eurozone may face a “currency crisis” if the ECB fails to keep up with the Fed in tightening monetary policy. Japan comes in for criticism, too:

https://www.bloomberg.com/opinion/articles/2022-04-20/euro-weakness-may-lead-to-a-currency-crisis-if-the-ecb-doesn-t-act-soon

So I took a look at broad effective exchange rates for the euro:

https://fred.stlouisfed.org/series/NBXMBIS

And for the dollar:

https://fred.stlouisfed.org/series/DTWEXBGS#0

Really? A crisis? Just eye-balling, currency rates don’t seem to be a large contributor to inflation differentials.

Now, I understand that writers and editors are paid for SEO these days, but even ignoring that, do any non-troll commenters see major-currency exchange rates as the big issue for central banks right now? Menzie?

Maybe this is just a guy with a currency hammer looking for a currency nail.

i used to see $1.12 per euro was a good number to visit paris.

last night it is $1.09 per euro.

i am revising down!

Why not admit inflation is as arbitrary as Chintzy’s moderation?

Because no such admission is warranted. Because you are the only buffoon who holds such views. Because you are nothing more than a sad little attention seeker.

Off topic —

The debate over sanctions on Russia includes frequent claims that sanctions haven’t caused Russia to withdraw or that threats of sanctions didn’t prevent Russia’s invasion. The other side of the debate takes the view that these narrow criticisms miss the point, that foreign policy requires a view to the long term. (Think Kennan’s long telegram.)

Well, here’s an argument for sanctions that looks to the long term, based in game theory analysis:

https://www.politico.com/news/magazine/2022/04/21/russia-sanctions-game-theory-00026566

It looks to me to be based on tit-for-tat strategy, the bug winner in a game theory competition some years ago. Those better versed in game theory may want to weigh in.

there is no moral foundation for game theory as applied to war. people die!

glad i had no coffee in my mouth:

‘That’s all really bad, but it’s not as bad as a future where national sovereignty is not respected.’

when the biggest sanctioner ‘respects’ national sovereignty maybe the sanction could seem legit.

legit is a far lesser standard than moral.

Nice job moving the goalposts!

You have been one of the biggest peddlers of the every pro-Russia story line that comes along. Now, when I point out an argument that sanctions can be effective, you no longer want to argue otherwise. Nope, you’d rather claim economic sanctions against an violent aggressor are immoral. Good luck defending that one.

Oh, but you don’t need to make sense of your claim that sanctions in a murderous regime are immoral. You’re more of a hit-and-run propagandist.

Remember when I linked to a story about a hundred Myanmar villages burned to the ground by Myanmar’s military, and your answer was “what about Afghanistan?” When you aren’t moving the goalposts or changing the subject, you go for whataboutism. Well, allow me to join you: What about Russia killing thousands of Ukrainians in an effort to put an end to Ukrainian sovereignty? What about Russian soldiers raping and executing Ukrainian civilians? What about Russian soldiers executing Ukrainians in cars marked “children”?

You think sanctions are immoral? What about war?

whataboutism!

You are an idiot. Full stop. Learn to take criticism given that you endorse war crimes 24/7.

“there is no moral foundation for game theory as applied to war. people die!”

Glad I had no coffee in my mouth.

ever heard of the critiques of game theory behind “mutual assured destruction”.

Ever heard of anything else even remotely connected to game theory?

Anonymous,

You are right. It is especially bad to have a future where national sovereignty is not respected. Glad to see that you agree with most of us here that therefore V.V. Putin is the very bad actor on the world stage here, given how he is showing total disrespect for the national sovereignty of Ukraine. Nobody is violating the sovereignty of Russia.

here to please…..

and i won’t mention the putin paradigms set by clinton, bush, obama, and trump in the post modern era

A.,

If by “Putin paradigms” you mean allowing nations to join NATO that were once dominated by the USSR or ever were once part of the no-longer-existing USSR and are not part of Russia you think that these actions were violations of Russian “national socereignty,” you are sorely mistaken. Claims of “spheres of influence,” wishful thinking by Putin, are not the same as claims of “national sovereignty,” which only apply to a nation itself, such as Ukraine, whose national sovereignty Putin is currently massively violating.

Speaking of sanctions, there has been a good bit of back-and-forth in comments about Russian oil exports, some of it of quite low quality. It has been pointed out already that Russian crude shipments fell 25% in the week ended April 15. We may not know which countries account for the drop for a few more weeks – China will release April import data in May

We already know tha China’s oil imports from Russia were down, y/y, in March. Same for Saudi Arabia. A boost in imports from Iran and some facilities closures seem to account for a good bit of that. It turns out, Chinese oil imports in March were mostly contracted for prior to sanctions bein imposed, with the effects of sanctions unlikely to show up until April, to be reflected in May data:

https://www.channelnewsasia.com/business/china-imports-13-less-crude-oil-saudi-march-14-less-russia-customs-2635631

So maybe China’s shift to Iranian oil is due to sanctions on Russia. It is worth remembering that private firms with real payment concerns make the first-round decisions about China’s purchases of oil imports. They face payment risks due to sanctions, just like everyone else.

Similarly, Chinese imports of Russian coal were down 30%, y/y, in March. Though overall Chinese imports of coal were off 40%, this article makes clear that payment risk is a big factor in lower Chunese demand for Russian coal:

https://www.hellenicshippingnews.com/chinas-march-coal-imports-from-russia-plunge-30-yr-yr/

But, of course, sanctions aren’t working. Of course, sanctions can’t work because China’s government makes all the decisions and China’s government has decided to help Russia. Of course. That is, of course, until we look at the evidence.

I think Steve K’s points about the oil sanctions specifically were fair. He did *not* say they were useless, only that up to that point there was little evidence they had an effect.

In any case, Russia’s own central bank seems to be saying that it’s not the oil sanctions, but everything else that’s really doing the heavy lifting. Who knew that a country would need imports to run their economy! But isn’t this just Making Russia Great Again?

Yep. It’s financial sanctions that are apparently doing the most to screw up Russia’s energy exports.

The problem with Steve K’s view is that it leans heavily in one direction. There is no (“limited” would have been a more accurate choice) evidence so far in either direction, but Steve always goes for “no evidence sanctions work”. And given what we know about the effect of sanctions on Russia’s economy since 2014, as well as the effect of sanctions on Iran, it is reasonable to expect sanctions will work, and unreasonable to preted the odds aren’t heavily in favor of sanctions having a substantial effect.

Steve’s views are never fair nor balanced, except in the Fox News meaning of those words.

Steve actually brags about getting invited to tell the Fox and Friends crowd his views on things such as immigration. Go figure.

Well it’s also that they can’t import important intermediate goods, which hurts their own production. Proving Nehru wrong is tough going.

I don’t want to defend Steve too much here. We’re not on the same side on many issues. I just wanted to point out that one narrow thing.

That was a nice defense of Steve’s comment until you wrote this wise statement:

Russia’s own central bank seems to be saying that it’s not the oil sanctions, but everything else that’s really doing the heavy lifting.

True but be aware that Steve has dismissed this too claiming only oil matters.

I spoke to someone who knows this stuff very well and they said the stuff about subgame perfection was completely unnecessary in the example given.

In any case, I think the real takeaway is this:

“This theoretical result lines up with how our intuitions about norms and vengeance actually work. It’s what Hitler expected after Chamberlain failed to defend Czechoslovakia, and it’s probably what Putin expected after the West failed to sufficiently punish his 2014 foray into Crimea.”

@ Macroduck

Yanis Varoufakis is a Game Theory guy. I’d be very interest to hear his full reply to your very cerebral proposal.

https://english.news.cn/20220421/13c52b29b0ec406587afee07c89bfe31/c.html

April 21, 2022

China’s non-financial outbound direct investment up 6.3 pct in Q1

BEIJING — China’s non-financial outbound direct investment (ODI) reached 170.95 billion yuan in the first three months of the year, up 6.3 percent year on year, official data showed Thursday.

In U.S. dollar terms, the non-financial ODI rose 8.5 percent from a year ago to 26.92 billion dollars, according to the Ministry of Commerce.

In the first quarter, non-financial direct investment into countries along the Belt and Road increased 19 percent year on year to 5.26 billion dollars, the data showed….

https://english.news.cn/20220414/c3f66b4ed1a74b2187e3cada7ecc1d91/c.html

April 14, 2022

China’s FDI inflow up 25.6 pct in Q1

BEIJING — Foreign direct investment (FDI) into the Chinese mainland, in actual use, expanded 25.6 percent year on year to 379.87 billion yuan in the first quarter of the year, the Ministry of Commerce (MOC) said Thursday.

In U.S. dollar terms, the inflow went up 31.7 percent year on year to 59.09 billion U.S. dollars….

Regarding China, I see in The Economist from two weeks ago a story that the CCP is presenting to many of its cadres a “documentary” that praises Stalin without reservation. Putin is compared favorably to him with both of them compared favorably to Khrushchev and Gorbachev, especially given the latter letting the USSR fall apart. It looks that the most historically outrageous lie in this documentary involves the famine of the early 1930s, which is blamed on wealthy peasants hording grain, a claim Stalin made when he called for class struggle against the kulaks (wealthy peasants), most of whom ended up dead one way or another, especially in Ukraine.

You note that the graphs are 3-month annualized inflation rates and your regression are m/m annualized. Why the difference?

Nice link to the Furman piece – I hadn’t seen that one yet.

I recall a few days ago Scott Sumner comparing inflation between US and Japan in a blog post about what’s driving inflation. Anyone who knows Summer can likely guess his conclusion.

Sumner (not “Summer”) is one of the most overrated commentators on macroeconomics there is. Some people at Mason, notably Tyler Cowen, think he walks on water. But mostly he seems to me to either say things that are boringly obvious or just sinks into the water as he tries to walk on it.

Yes, thanks for the “boringly obvious” correction of my 2nd mention of Scott Sumner’s name. It’s comical that you felt the need to ‘correct’ that and yet completely ignore my initial mention of Sumner’s name which was spelled correctly. It’s impressive that you’re able to do all of this while simultaneously “sinking into the water as you try to walk on it.”

Econned,

Oh, I both walk on water and sink in it, a truly amazing simultaneity. I also have this spring hosted both Menzie Chinn and Nobel Prize winner Vernon Smith for seminars at JMU, both of which you were invited to participate in. You could have exposed him and me for all our errors and sins, if you had shown up. But, no, you were too much of a chickenscheiss to do so. I have had Tyler Cowen in as well, several times. Not only do I sink in the water and walk on it simultaneously, but sometimes I choose to fly above it as well, a lot of fun, :-).

Barkley,

You’re a joke and oblivious at how ridiculous you present yourself. The constant name dropping to make yourself feel important is absolutely hilarious. You’re quite possibly the only entity on this blog who can assert another economist will “say things that are boringly obvious” while you say something that is boringly obvious in the very same paragraph. And in the same exact paragraph you will also assert another economist “sinks into the water as he tries to walk on it” all while sinking into the water as you try to walk on it. One thing you have over Sumner is your uncanny ability to accidentally make yourself into the class clown. I do honestly wonder if sometimes there’s someone writing under the “Barkley Rosser” moniker just as a joke. I do know one thing, you’re the coward who wouldn’t say those things to Sumner’s face, or anyone’s face… talk about “ chickenscheiss”. You fraud.

Econned,

Nice try, chickenscheiss. You were the one who was invited to participare in a seminar with Menzie Chinn and also to one with Nobel Prize winner Vernon Smith. Name dropping? I am a friend of both of them and was the one who invited both of them to present seminars, which they did, and very well so, thank you, with no presence from you, unless you were there hiding. Espeially with the Smith seminar there was a large audience, not all of whose names I recognized (it was on zoom).

As for all the water stuff, that was me making a joke about myself. So, if I am the class clown it is a matter of choosing to be so.

Regarding Sumner, I have not met the guy, but I have many times openly on Marginal Revolution where he hangs out say he is overrated. That is a matter of public record. You can check that out. And he is overrated. Why were you wasting our time here by bringing up such a loser?

Barkley Rosser,

And you’re invited every.single.day. to reply on Sumner’s blogs and let him know you think he is “boringly obvious”. You can reply to Sumner on MoneyIllusion and on EconLog that you feel he “just sinks into the water as he tries to walk on it.”. You won’t do it because you’re a fraud. You don’t have the integrity to call him a “loser” on his blogs and ensure you use your email. That is “chickenscheiss” at its very worst. You disgraceful hypocrite. You’re an absolute fraud.

As to why I am “wasting our time here by bringing up such a loser?” Why are you wasting your time replying? Because you’re a scum. You bring nothing valuable other than your typical sophomoric attempt with zero substance at refuting someone’s comment. I brought up Sumner because his post that I mentioned was somewhat similar to Menzie’s. Please try to keep up – it’s becoming quite boring to reply to this faux “Barkley Rosser”. I literally do not believe I am replying to the economist at George Mason. These incoherent and nonsensical babblings can’t be from any remotely sane individual. Why not even try to have a discussion? That’s what comment sections are for. But you can’t even imagine having a fruitful discussion up here. You initiate the sh*t-posting for no reason and without any provocation. You rarely have the slightest bit of substance to provide and then you get mad when you get called out on your b.s. replies.

And yes, please lookup “name dropping” – use any dictionary of your choosing. You name drop for no reason and do so often. Your inviting people to a seminar is irrelevant. Your being invited to a seminar is irrelevant. Your being “friends” is irrelevant. You name drop and I can’t imagine that you’re so lost that you have to be told these things. The level of unawareness from your comments are unbelievable.

Once you make these all of these comments to Sumner himself, you might regain a slight amount of integrity. But your track record on this forum as a feeble, despicable, faux intellect isn’t easily reversed.

The continual and constant name-dropping is a strong indication of personal insecurity more than anything. Though I really have no idea how to profile Barkley’s major issues. I imagine Roy Baumeister and Mark Leary maybe could explain it, if you gave them roughly a decade to focus on Barkley alone. I feel certain Barkley will inform us in this thread he meets with Baumeister and Leary for tea every weekend. Titillating……..

Econned,

I am “invited every day” to respond to Sumner on this or that blog? I do not think so, but even if I am why should I bother? I think he is an overrated joke not worth bothering with. There are lots of blogs out there, and I do not waste my time on ones run by people I think are not worth bothering with, which includes him big time. You brought him up here and did not even bother to say what the point of doing so was. He said something “similar” to Menzie? What was it and so what? You are the one wasting our time by dragging in this overrated character and added nothing of any substance from him. What a joke.

And again, I am sure he has seen me call him “overrated” on Marginal Revolution. He hangs out there, and I make the comment there because Tyler is one of those doing the overrating. I am addressing Tyler when doing so, with Sumner watching. Fine with me. Why bother wasting time going to Sumner’s own blog to bother with this? I comment on Marginal Revolution because I respect Tyler Cowen and take him seriously, something not the case with Sumner.

As for the name dropping of Vernon Smith in this case, it is a matter of you and Moses both going on at length about how I am supposedly “senile” and how people should be informed of this where I work. So I pointed out that I run a seminar where I work, which happens to be at James Madison University, not George Mason (sorry, Econned, there is no “Barkley Rosser” at Mason, although I have given lots of talks there). I invited both of you to show up at one of the seminars I host so you could reveal to all there how senile I am or otherwise just no good. I even provided times when you could, once when Menzie was speaking and once when Nobel Prize winner Vernon Smith was doing so. You could have revealed to them how senile or otherwise awful I truly am. I mean, obviously I have been somehow pulling the wool over the eyes of Menzie and Vernon, not to mention all those other names I drop of people I know. You both had the opportunity to reveal to people where I work my supreme awfulness, but neither of you dared to do so. Chickenscheiss is exactly what both of you are, only good for firing off slime mold here under your phony names.

And, Econned, for the umpteenth time, what substantial point have you made here? All you do is attack people, most annoyingly Menzie. That is what gets me ticked off. At least Moses does talk about substantial matters much of the time, even if a lot of them are way off topic and sometimes he makes a fool of himself when he does so. But you just trollishly slime people all the time, nothing else.

Let’s do another point-by-point take down of the academic “Barkley Rosser”…

“Barkley Rosser” comments: “I am “invited every day” to respond to Sumner on this or that blog? I do not think so, but even if I am why should I bother? “

First, yes, of course you’re invited everyday because the blogs he posts on are open for anyone to comment. And you should bother because you’re the one making numerous disparaging comments about Sumner on other blogs. You’re a coward.

“Barkley Rosser” comments: “I think he is an overrated joke not worth bothering with. There are lots of blogs out there, and I do not waste my time on ones run by people I think are not worth bothering with, which includes him big time.”

Your revealed preferences suggest you are lying or you would have just STFU in the first place and ignore my comment.

“Barkley Rosser” states “You brought him up here and did not even bother to say what the point of doing so was. He said something “similar” to Menzie? What was it and so what?”

I clearly said this in my original comment. There’s no way I’m to believe you’re an accomplished academic economist if you don’t see this in my original reply to Menzie’s post. You’re lying or disingenuous. Or probably both.

“Barkley Rosser” comments: “You are the one wasting our time by dragging in this overrated character and added nothing of any substance from him.”

You are not the arbiter of these matters. If you don’t think his comments (which are related to this post) are of substance, you should be able to elucidate what that is the case. That or be an adults and just shut up.

“Barkley Rosser” asks: “Why bother wasting time going to Sumner’s own blog to bother with this?”

Because you’re openly disparaging him and are critical of his work. If you can’t see why you should t go to the source, you’re a lost cause. You’re a fraud if you won’t say these things directly to him. A phony.

“Barkley Rosser” comments: “As for the name dropping of Vernon Smith in this case, it is a matter of you and Moses both going on at length about how I am supposedly “senile” and how people should be informed of this where I work.”

I never mentioned your senility on this post.. You seem very paranoid about this. Strange. In any case, yay least you’re finally admitting to the name dropping. You apparently fail to see how it’s irrelevant but oh well.

“Barkley Rosser” comments: “ I invited both of you to show up at one of the seminars I host so you could reveal to all there how senile I am or otherwise just no good. I even provided times when you could, once when Menzie was speaking and once when Nobel Prize winner Vernon Smith was doing so. You could have revealed to them how senile or otherwise awful I truly am. I mean, obviously I have been somehow pulling the wool over the eyes of Menzie and Vernon, not to mention all those other names I drop of people I know. You both had the opportunity to reveal to people where I work my supreme awfulness, but neither of you dared to do so. Chickenscheiss is exactly what both of you are, only good for firing off slime mold here under your phony names.”

All the proof is in your actions here. Your seminars don’t mean anything to me. Your social ineptitude is quite literally baffling.

“Barkley Rosser” states: “And, Econned, for the umpteenth time, what substantial point have you made here? All you do is attack people, most annoyingly Menzie. That is what gets me ticked off. But you just trollishly slime people all the time, nothing else.”

I don’t think you can point to a single instance of me attacking a commenter without being previously provoked. But that’s what you did here. That’s what you do all the time and it’s somehow me who is in the wrong? That’s the issue. You should have either stayed quiet on this post or replied with something of substance. You’re incapable. You are the literal pot calling the kettle black and you’re completely unaware.

A very nice summary.

Bruce Hall’s latest stupid chirping involved the increase in the Federal oil lease royalty rates from 12.5% to 18.75%, which prompted another excellent comment from macroduck:

“macroduckApril 21, 2022 at 11:15 am

The federal government has long been accused of charging too little for mineral leases, including for oil leases. The fact that lease fees have not risen in a century, while petroleum became a widely used resource in a growing economy while oil companies grew rich, suggests that the government has, indeed, reaped too little return for tax payers. The U.S. charges less in taxes and fees on petroleum than just about any developed country, another indication that the U.S under-taxes petroleum. Economists are in wide agreement that a carbon tax is an efficient approach to reducing carbon emissions, and lease fees amount to a tax on carbon emissions. Funny how you led off by criticizing a rise in lease fees.”

Over an hour later Bruce Hall wrote what may be the dumbest comment in the history of the internet.

“Bruce Hall

April 21, 2022 at 12:24 pm

Lucy, keep trying to defend a 50% increase in royalties when the current percentage has been perfectly acceptable to both Democratic and Republican administrations for a century. It has been a good balance between government revenue and exploration incentives.”

Of course this incredibly dumb troll with a weird desire for hitting on guys with girls names provided nothing to support this absurd statement. So permit me to provide the reading challenged Bruce Hall with this reading assignment:

Report on the Federal Oil and Gas Leasing Program (doi.gov)

https://www.doi.gov/sites/doi.gov/files/report-on-the-federal-oil-and-gas-leasing-program-doi-eo-14008.pdf

OK Bruce is not going to read the whole thing so let me give the Cliff Notes version to the dumbest troll ever:

‘The review found a Federal oil and gas program that fails to provide a fair return to taxpayers, even before factoring in the resulting climate-related costs that must be borne by taxpayers; inadequately accounts for environmental harms to lands, waters, and other resources; fosters speculation by oil and gas companies to the detriment of competition and American consumers; extends leasing into low potential lands that may have competing higher value uses; and leaves communities out of important conversations about how they want their public lands and waters managed. The fiscal components of the onshore Federal oil and gas program are particularly outdated, with royalty rates that have not been raised for 100 years. States with leading oil and gas production apply royalty rates on State lands that are significantly higher than those assessed on Federal lands. The Texas royalty rate, for example, can be double the Federal rate. Likewise, bonding levels have not been raised for 50 years. Federal minimum bids and rents have been the same for over 30 years. These antiquated approaches hurt not only the Federal taxpayer but also State budgets because States receive a significant share of Federal oil and gas revenues.’

Texas of all places got it right by doubling the lease rate. Oh wait – Kelly Anne Conway forgot to tell Brucie this?

Footnote 25 of the report I linked to provides this reference:

https://www.taxpayer.net/wp-content/uploads/2020/02/TCS-Royally-Losing-2020.pdf

There is little evidence of industry’s claims that increasing the federal onshore royalty rate would drive developers away and reduce overall revenues. Oil and gas production occurs where fossil fuel reserves are located—be that state, private, or federal land. Further there is no evidence state production dropped in response to higher royalty rates adopted for leases on state lands.

See its footnote 3. Look Bruce Hall has been telling us a lot of blatant LIES on this topic. Maybe he is being fed these lies by Big Oil. But there is a LOT of literature that provides honest and excellent analyzes. Of course Bruce Hall will never READ such analyzes. It might jeopadize his role as chief chirper for Big Oil.

Yes but increasing royalties is about getting prices up, not down. In that limited sense I think Hall had a point. It’s at odds with stated policy to keep prices down for the time being. I think it’s reasonable to suggest that climate change policy should take a back seat right now due to the unusual circumstances. (I know that’s not Hall’s point of view, but it is mine.)

Nice defense of Bruce Hall but read enough of his MAGA dogma and you will realize that you are cheering for the fact that the dog can chase its own tail.

Another report Bruce Hall was not allowed to read:

https://crsreports.congress.gov/product/pdf/R/R43891/3

Mineral Royalties on Federal Lands: Issues for Congress, Congressional Research Service, January 2015.

Lots of great discussions with this one cracking me up:

There is precedent for raising federal oil and gas lease royalty rates (which the Secretary of the Interior has the authority to do). Under the Bush Administration in 2008, Interior Secretary Dirk Kempthorne raised the deepwater rate for new leases from 12.5% to 16.67%. Then, in March 2009, Secretary Ken Salazar of the Obama Administration increased the royalty rates for new offshore leases to 18.75%. The 12.5% rate for federal onshore oil and gas leases appears low when compared to the state rate and the private sector rate, but there are upfront costs such as bonus bids involved in the purchase of a federal lease that increase the government’s overall revenue stream. Most states have a statutory minimum rate of 12.5%, but actual state royalty rates are more likely 16.67% or 18.75% and can be as high as 25%. Private sector rates are typically around 18.75%

Wait, wait – the private sector charges 18.75% but Bruce Hall without a shred of economic analysis thinks 12.5% is optimal? Gee Bruce – the private sector is charging too much? And you pretend to be a free marketer. Go figure.

https://news.cgtn.com/news/2022-04-22/Chinese-mainland-records-2-133-new-confirmed-COVID-19-cases-19qOwwNeY1O/index.html

April 22, 2022

Chinese mainland records 2,133 new confirmed COVID-19 cases

The Chinese mainland recorded 2,133 new confirmed COVID-19 cases on Thursday, with 2,119 linked to local transmissions and 14 from overseas, according to data from the National Health Commission on Friday.

A total of 16,465 new asymptomatic cases were also recorded on Thursday, and 249,507 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 196,086 with the death toll at 4,674.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-04-22/Chinese-mainland-records-2-133-new-confirmed-COVID-19-cases-19qOwwNeY1O/img/be2d7f13d97641589bdb3cbb92138aec/be2d7f13d97641589bdb3cbb92138aec.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-04-22/Chinese-mainland-records-2-133-new-confirmed-COVID-19-cases-19qOwwNeY1O/img/03aac179fcbb4e7990865443b51a9bbf/03aac179fcbb4e7990865443b51a9bbf.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-04-22/Chinese-mainland-records-2-133-new-confirmed-COVID-19-cases-19qOwwNeY1O/img/f16be5f37419415c8455dacc6add916f/f16be5f37419415c8455dacc6add916f.jpeg

https://www.worldometers.info/coronavirus/

April 21, 2022

Coronavirus

United States

Cases ( 82,553,058)

Deaths ( 1,017,609)

Deaths per million ( 3,042)

China

Cases ( 193,953)

Deaths ( 4,663)

Deaths per million ( 3)

The thing is that now (“Really, Andrew? Now??”) I’m worried official stats from China about Covid aren’t real. There was an article in the NYT about how the death numbers appeared to be manipulated. No reason why other numbers could get the DeSantis treatment.

In any case your repeated data-driven comments are appreciated.

CGTN is “data driven”?!?!?!?! Wow, that’s a new one for me. Would you feel the same if someone put 20 RT links up shotgun style??

This should be fun!

https://www.msn.com/en-us/news/politics/marjorie-taylor-greene-testifying-at-reelection-disqualification-hearing/ar-AAWtl45?ocid=msedgdhp&pc=U531&cvid=86d8b389276445e1ad61111446fe8add

A potentially precedent-setting disqualification hearing is underway Friday in an Atlanta courtroom, aimed at determining if Republican Rep. Marjorie Taylor Greene of Georgia is constitutionally barred from running for reelection because of her role in the January 6 insurrection. Greene is testifying as a witness during the marathon hearing — making her the first lawmaker to testify under oath about their involvement in the insurrection. She is currently on the stand, was sworn in and is being questioned by lawyers for the voter who challenged her candidacy. At the disqualification hearing, Greene said under oath that she “had no knowledge of any attempt” to illegally interfere with the counting of the electoral votes on January 6. Greene also testified that she believes President Joe Biden lost the election to Trump. “We saw a tremendous amount of voter fraud,” Greene said, repeating a debunked claim that has become a rallying cry among Trump supporters.

I knew this ugly witch with a B would perjure herself. They should throw her in jail for this perjury.

Some (ostensibly conservative-leaning) legal scholars in the NYT said that because the 14th is federal law, it requires enforcement in federal court. I’m no legal scholar, but I call BS. Since when is the 14th amendment limited to federal enforcement?

Section 3: “No person shall be a Senator or Representative in Congress, or elector of President and Vice-President, or hold any office, civil or military, under the United States, or under any State, who, having previously taken an oath, as a member of Congress, or as an officer of the United States, or as a member of any State legislature, or as an executive or judicial officer of any State, to support the Constitution of the United States, shall have engaged in insurrection or rebellion against the same, or given aid or comfort to the enemies thereof. But Congress may by a vote of two-thirds of each House, remove such disability.”

I’m no legal scholar but your interpretation of this issue strikes me as point on! Taylor Greene has zero respect for our Constitution or for the voters of NE Georgia.