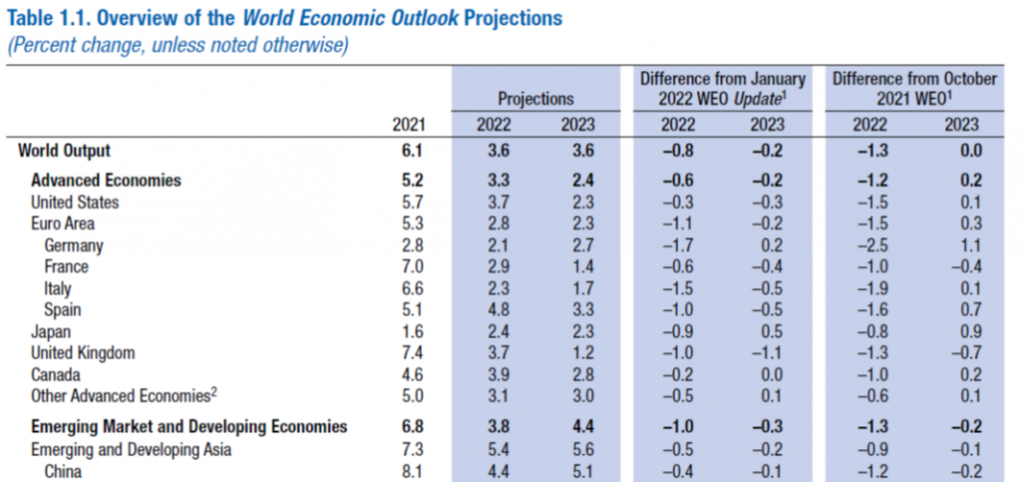

The entire IMF April WEO is out, with analytical chapters on private debt/global recovery, greener labor markets, and global trade and value chains. The forecasts are revised downward, at global and at national levels, for certain countries:

Since the January forecast, 2022 global growth has been revised town by 0.8 ppts (y/y), and revised down by 1.3 ppts since the October 2021 forecast. Pretty much, one could chalk the bulk of the downward revision to ongoing Russian military action in the Ukraine. So… “Thanks, Putin!”

Russia can thank Putin too; the downward revision in 2022 Russian GDP growth going from the January to April forecast is 11.3 ppts (to -8.5%). (Not shown in table, but can be seen by going to the WEO document itself).

The downward revision in Chinese GDP going from January to April is 0.4 ppts.

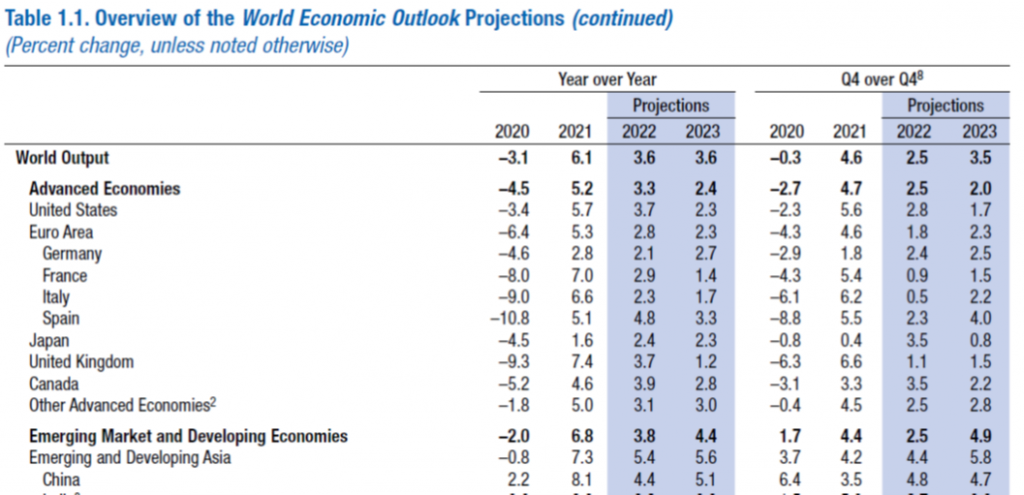

Q4/Q4 growth rates are more informative for figuring out the current pace of growth (at least to me), so here’s the relevant table.

Interestingly, advanced economy and EMDE Q4/Q4 growth in 2022 are slated to be the same — 2.5%. Of course, since EMDE growth trends are higher than that for advanced economies, this is a considerable slowdown for the EMDEs.

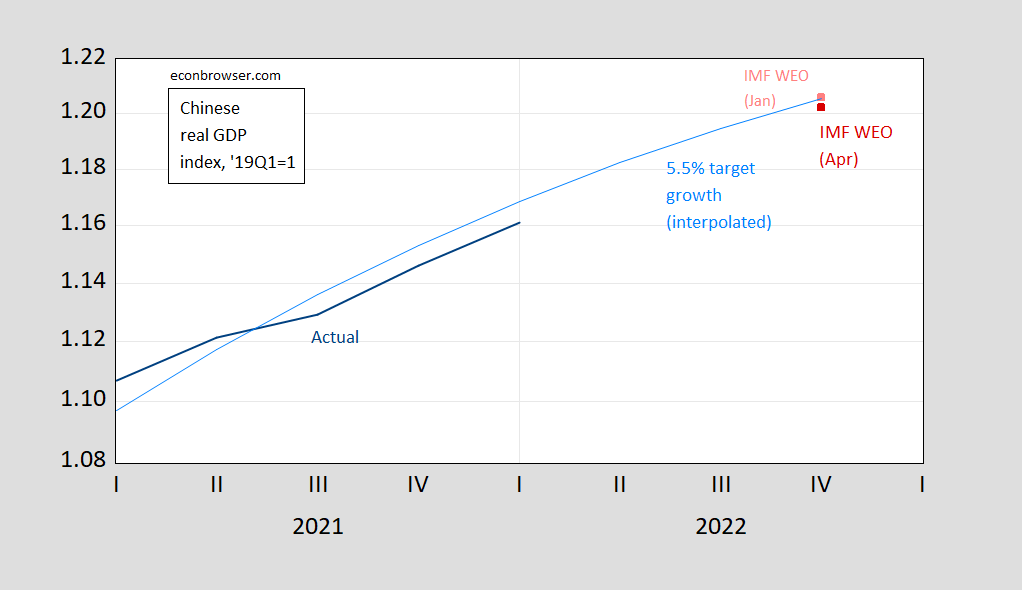

Chinese Q4/Q4 growth is slated to be 4.8%. In levels, this looks like the following picture.

Figure 1: Chinese real GDP index, s.a., 2019Q1=1 (blue), 5.5% y/y 2022 target interpolated (light blue), IMF January WEO (pink square), and IMF April WEO (red square). Index based on cumulated growth rates as reported by NBS. Source: NBS, IMF WEO (various issues), and author’s calculations.

When reports indicate that it will be difficult to hit the 5.5% target given Q1 growth, that is reflected in the position of the red square relative to light blue line.

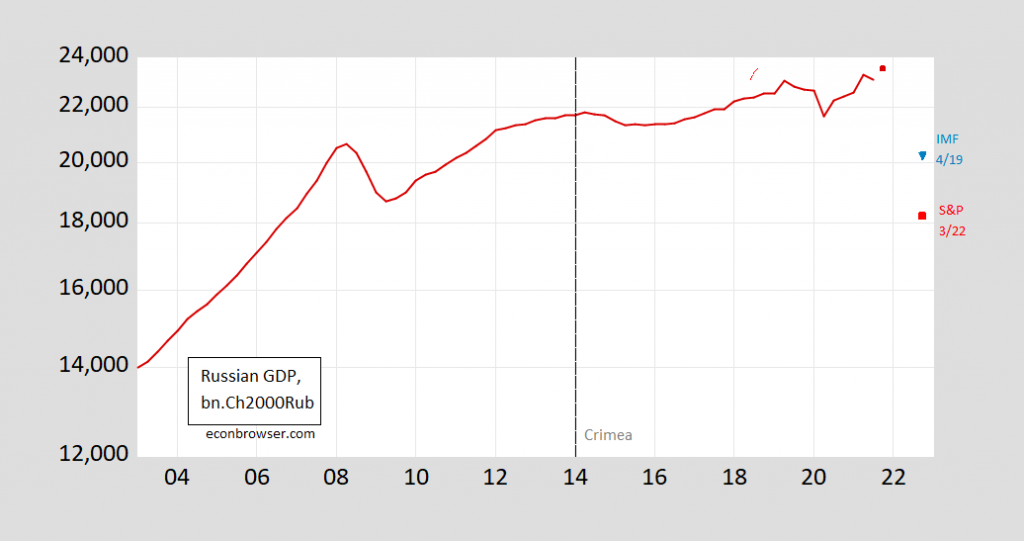

As for Russia, this is the IMF forecast of -14.1% Q4/Q4 growth in context.

Figure 1: Russian GDP in billions Ch.2000Rubles (red), IMF April 2022 forecast (light blue triangle), S&P Global forecast of 3/22 (red square), all on a log scale. Level for 2021Q4 calculated using growth rates from WEO. Source: OECD via FRED, IMF WEO, S&P Global, and author’s calculations.

The 14.1% Q4/Q4 decline forecasted by the IMF is smaller than the S&P forecast from a month ago. Still, it’s a pretty large decline.

Not a big deal, but do not get why France supposedly taking a bigger hit than Germany. They have nuclear power and much less reliant on Russian natural gas or anything else for that matter. Does this portend a Marine Le Pen victory this coming Sunday in the presidential election? It is going to be close.

Where did you read that France will take a bigger hit than Germany as it relates to the Ukraine War?? Haven’t seen that in anything I was reading, other than maybe French banks because of credit risks.

That first table. But I would say, it looks like Germany’s (nominal) growth was lackluster anyway.

Q4 to Q4 numbers, which may not be due to the war. But Germany projected to grow at 2.4% while France is to grow only 0.9%.

@ Professor Rosser

Just to kinda show you I’m not quite the A$$ you think I am, I had also read in a bank report that the FUTURE had looked like the inflation might be rougher for France than Germany. I tend to believe that “take” on the inflation, but really don’t have much of an idea.

https://fred.stlouisfed.org/graph/?g=Hosz

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, Germany, France and Japan, 2007-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=HosB

August 4, 2014

Real per capita Gross Domestic Product for United States, United Kingdom, Germany, France and Japan, 2007-2020

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=NVN3

November 1, 2014

Total Factor Productivity at Constant National Prices for United States, United Kingdom, Germany, France and Japan, 2007-2019

(Indexed to 2007)

If Putin causes prices and output forecasts to shift, what does that say about the fundamentally irrational nature of all prices?

If the IMF didn’t predict Putin, and Putin-like irrational shocks keep happening over and over, wouldn’t it be prudent to include wide error margins on all forecasts?

Why has our blogger Mozerrella here not learned that lesson?

Of what use are economic forecasts, if they cannot predict irrational actors having huge effects on prices and output?

Well, one well-established pedagogical tactic is to assign the student the task of coming up with an answer to her own question. Answers to the question you asked are so obvious that even you should be able to find at least one answer.

Let us know when you figure it out.

“Russia can thank Putin too; the downward revision in 2022 Russian GDP growth going from the January to April forecast is 11.3 ppts (to -8.5%).”

But Putin claims the sanctions are not hurting Russia’s economy. Princeton Steve is saying the same thing as Princeton Steve argues that the only thing that matters is oil prices. It seems the economists at the WEO disagree with these two peas in a pod.

pgl,

I think this has been reported here that the Mayorof Moscow has been forecasting a loss of 200,000 jobs. Less publicized has been Naibullina the central bank governor also forecasting an economic hit, although I have not seen anything as specific as a 200,000 job loss prediction. But apparently she is also going against Putin’s pollyanna story. As it is, she already apparently wanted to resign, but Putin forced her to stay on. Her husband is the Rector of the Higher Economic School, which has had several faculty members openly critical of the war, with some students ending up in jail from protesting it.

I’m paraphrasing, but I think JerseySteve told us that Russia had “all the leverage” in their relationship with Biden. Not sure how he’s figurin’ that.

Do people do much figurin’ in Cape Cod?? Or are they more into pondering??

Cape Cod residents are known for whining that the bagels are too expensive and not that good. Awww!

Now, pgl i’ve given you sh*t, or I’ve given you “stuff” in the past, but you’ve proven your memory today. Well, bagels are “Jewish thing” we “get it” you and me, That mean we two Goyinms, will take a Ice FRESH bagel, any way we can. I like to give you and old man in Virginia a lot of guff. but I respect you guys, SSSSSHHHH!!! Goyims can’t give our resect to them away, QUIET!!! TWO “Russian Jews” here, “Lewis and Dean”

https://www.youtube.com/watch?v=zkoG-wI9_2g

Jerry Lewis on Letterman! What a treat!

BTW – the best bagels I know of are made by a Park Slope shop called Bagels World. 4th Avenue and 4th Street. Often long lines but worth the wait!

You took my comment as I intended it—in half humor. Now most of my life–I’m gonna admit it here–was spent in OKlahoma–aside from my 7 years in China when some girl accidentallly tore my heart out and kinda slammed it on the floor and stepped on my heart in heels (unintentionally( That other guy in Virginia took my half-comedic comments seriouselty —- But us two goyims love bagels and whatever problems you and me had before—were settled by the fact you love bagels, from now on you and me are to be known as the average goyim (you) and the dumb Goyim (me) “average goyim and dumb goyim” <<—- that's us

Every Monday, or most anyway, I go to Mr. J.’s Deli in Harrisonburg, VA to have lox and bagel. There is a senior discount, which I as an Old Man in Virginia appreciate taking advantage of.

https://www.imf.org/en/Publications/WEO/weo-database/2022/April/weo-report?c=223,924,132,134,532,534,536,158,546,922,112,111,&s=PPPGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2021

Gross Domestic Product based on purchasing-power-parity (PPP) valuation * for Brazil, China, France, Germany, Hong Kong, India, Indonesia, Japan, Macao, Russia, United Kingdom and United States, 2007-2021

2021

Brazil ( 3,436)

China ( 27,744)

France ( 3,362)

Germany ( 4,857)

India ( 10,219)

Indonesia ( 3,566)

Japan ( 5,615)

Russia ( 4,490)

United Kingdom ( 3,403)

United States ( 22,998)

* Data are expressed in US dollars adjusted for purchasing power parities (PPPs), which provide a means of comparing spending between countries on a common base. PPPs are the rates of currency conversion that equalise the cost of a given “basket” of goods and services in different countries.

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=924,134,534,158,111,&s=NID_NGDP,NGSD_NGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2022

Total Investment & Gross National Savings as a Percent of GDP for China, Germany, India, Japan and United States, 2007-2021

2021

China

Total Investment ( 41.6)

Gross National Savings ( 43.5)

Germany

Total Investment ( 22.7)

Gross National Savings ( 30.1)

India

Total Investment ( 31.2)

Gross National Savings ( 29.6)

Japan

Total Investment ( 25.2)

Gross National Savings ( 28.1)

United States

Total Investment ( 21.4)

Gross National Savings ( 20.0)

https://news.cgtn.com/news/2022-04-20/Chinese-mainland-records-2-761-new-confirmed-COVID-19-cases-19nvNY7fMRO/index.html

April 20, 2022

Chinese mainland reports 2,761 new COVID-19 cases

The Chinese mainland recorded 2,761 new confirmed COVID-19 cases on Tuesday, with 2,753 linked to local transmissions and 8 from overseas, according to data from the National Health Commission on Wednesday.

A total of 17,166 new asymptomatic cases were also recorded on Tuesday, and 266,288 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 191,112, with the death toll at 4,655.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-04-20/Chinese-mainland-records-2-761-new-confirmed-COVID-19-cases-19nvNY7fMRO/img/70bae38a4a724e6fa3a4e93a2b8aee55/70bae38a4a724e6fa3a4e93a2b8aee55.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-04-20/Chinese-mainland-records-2-761-new-confirmed-COVID-19-cases-19nvNY7fMRO/img/d51a6b218cf84b3f9740b0cea2f28108/d51a6b218cf84b3f9740b0cea2f28108.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-04-20/Chinese-mainland-records-2-761-new-confirmed-COVID-19-cases-19nvNY7fMRO/img/c3367ab2e2564171bb6061e91d05b68e/c3367ab2e2564171bb6061e91d05b68e.jpeg

https://www.worldometers.info/coronavirus/

April 19, 2022

Coronavirus

United States

Cases ( 82,416,687)

Deaths ( 1,016,159)

Deaths per million ( 3,038)

China

Cases ( 188,351)

Deaths ( 4,648)

Deaths per million ( 3)

your report is misleading. yesterday china reported 2761+17166=19,927 new cases of coronavirus infection.

“ltr” gives you the Fox “news” from China. Technically not lying (if you allow for a certain freedom to redefine the meaning of words) – but grossly misrepresenting reality by downplaying or leaving out important information.

The reality of Covid in China is not that bad from a public health perspective. The problem is that their approach to deal with Omicron 2 will have severe detrimental effects on their economy for years to come. It appears they got the outbreak in Shanghai under control – but at a huge cost. Given the infectiousness of that variant and the limited success of vaccinations to prevent its spread, I would expect to see megacity outbreaks in China every 2 weeks.

One factor here is China’s demonization of foreign vaccines (ones that actually work against omicron) in favor of their home-grown version. Economic nationalism is stupid in many, many ways.

Are prices as arbitrary as Chintzy’s decisions on what pistd to disappear, amirite?

api and eia reported stock draws this report.

usa became a net petroleum (crude and product) exporter (reversing fox news complaining) on 11 mar 2022 rising to 2.9 million barrel/day week ending 15 apr report.

usa remained a net crude importer, less so last week.

spr releases not so much for reducing price at pump.

Ah, our local Putin-hugger is back, pretending to know stuff about the oil market.

Here’s what anyone with a bit of honest curiosity and access to the internet can find out about oil prices and the decision to release oil from the SPR. It takes less than 5 minutes.

WTI spot peaked at $123.64 (closing) on March 8. Also on March 8, the White House announced it would tap the SPR. The patest price reported by FRED (delayed 1 day) is $108.24, a 12.5% decline. In the interim, WTI has been as low as $94.85, a 23.3% drop. But anonymous claims, without evidence, that the SPR release hasn’t mattered to prices.

Oh, but anonymous left himself some wiggle-room by specifying prices at the pump. All grades conventional average price peaked

in the week ended March 14 (which includes March 8) at $4.315 and as of the week ended yesterday (April 18), had fallen to 4.066, a 5.8% decline. As has been discussed here repeatedly, gasoline rises quickly but fall gradually in response to crude oil price swings.

anonymous, who prances around pretending to be an oil market specialist, is really a Putin disinformation lackey. Nothing he writes is ever to be trusted. His pretended to interest in oil markets is really just a way of lowering readers defenses so he can slip lies in under the radar.

After WWII, the French shaved the heads of French women known to have crawled into bed with Nazis during the occupation. Wonder what’s in store for those who snuggle up to Putin?

https://www.detroitnews.com/story/news/politics/2022/04/20/michigan-senator-gains-spotlight-denouncing-hateful-garbage/7380771001/

Michigan Senator Mallory McMorrow calls out the hate exhibited by Lana Theis.

Senator Lana Theis accused me by name of grooming and sexualizing children in an attempt to marginalize me for standing up against her marginalizing the LGBTQ community…in a fundraising email, for herself. Hate wins when people like me stand by and let it happen. I won’t.

Hmm Bruce Hall is one of those MAGA hat wearing types in Michigan. So does he endorse this garbage from Lana Theis?

Alas Russia is still officially part of G20 but it seems a lot of people including Yellen and Powell walked out when their representative started speaking:

https://www.axios.com/janet-yellen-jerome-powell-walkout-russia-g20-b78b1f27-a608-46c0-8c51-432698560a63.html

It’s only symbolic, but it must have looked hella cool. I’d walk out too, Treas. secretary or not. Whether they like it or not, any officials in a totalitarian state/war machine are complicit.

the usa is not required to work with the illegitimate government in russia. when russia produces a legitimate government, we will be happy to interact with them. until then, treat the russian state as the pariah state they have become. russia interfered with our regime change. time to return the favor. time for russia to install a legitimate government.

When was the last time Russia had a legitimate government. Not Putin, not Yeltsin, not any of those Soviet tsars, and not many of the actual tsars.

Preaching to the choir! And it’s high time to call out certain Western “leaders” for being Putin’s puppets. To paraphrase what a certain someone said just today, “When they speak of Russia, they speak of their banker.”

Also, time to call out Pope Francis for being mealy-mouthed about the whole affair. Enough of the both-sides-do-it nonsense. Bernie Sanders gets it, Francis should too.

There seems to have been some complacency developing about oil supplies as oil price has stabilized between $100-105/barrel. In the following, the Dallas Fed points outs some potential clouds on the horizon. While complying with a recent court ruling to open up federal oil leases, the Biden Administration appears to been making some effort to subtly undermine that:

>The royalty rate for new leases will increase to 18.75% from 12.5%. That’s a 50% jump and marks the first increase to royalties for the federal government since they were imposed in the 1920s.

…

Leases for 225 square miles (580 square kilometers) of federal lands primarily in the West will be offered for sale in a notice to be posted on Monday, officials said. The parcels represent about 30% less land than officials had proposed for sale in November and 80% less than what was originally nominated by the industry.

https://www.npr.org/2022/04/16/1093195479/biden-federal-oil-leases-royalties

Lucy, direct your comments to the Dallas Fed.

—–

Capacity Constraints Drive the OPEC+ Supply Gap

By Lutz Kilian, Michael D. Plante and Kunal Patel

Dallas Federal Reserve Bank

April 19, 2022

https://www.dallasfed.org/research/economics/2022/0419

The growing gap between OPEC+ production quotas and actual oil production has drawn increased attention in recent months because of its implications for crude oil prices. Production capacity constraints in several OPEC+ countries are driving much of this gap. These constraints will only become more binding through the year.

OPEC+ Slowly Unwinding Supply Cuts

OPEC+, a group of 23 oil-producing countries, enacted a massive supply cut in April 2020 to accommodate the drop in global oil demand associated with the coronavirus pandemic. The move effectively ended a price war in global oil markets. Since mid-2021, the group has been unwinding these cuts, typically raising production quotas each month by a combined 400,000 barrels per day (b/d).

Every OPEC+ member’s individual quota increases by an amount related to how much it contributed to the total cut in 2020. For example, the group’s quota in January 2022 was 400,000 b/d higher than in the prior month. Saudi Arabia, which made up 26 percent of the initial cut, saw its January quota increase by 104,000 b/d. Eventually, each country’s quota will return to its “baseline” production level, which in most cases corresponds to what the country produced in October 2018.

Importantly, if a country cannot meet its individual quota for a given month, there is no written agreement for other members to make up for that shortfall.

This has certain advantages. For example, each country is given a fair chance to increase its production every month using an agreed-upon formula; at the same time, there is no need to undertake potentially thorny discussions surrounding which member may increase production should another member fail to meet its monthly quota. Additionally, OPEC+ has a compensation mechanism in which countries are given time to adjust when their compliance falls below 100 percent.

The downside of this arrangement is that it becomes challenging for the group to target a specific production level because no country can step in if another falls short of its target.

How to Measure OPEC+ Production

Measuring OPEC+ production is a necessary first step when quantifying the supply gap. While this task may seem straightforward, there are at least six different sources for production data that do not always align with one other. Here we rely on International Energy Agency (IEA) data from its monthly Oil Market Report released in March 2022. Supply gaps calculated using other sources may vary from those we report.

It is important to note that three OPEC members — Iran, Venezuela and Libya — are currently excluded from the production quotas. Additionally, while some observers include Mexico among the larger group of OPEC+ countries, it is not bound by any official quota. We therefore exclude these four countries from our supply-gap calculations and focus on the remaining 19 members of OPEC+ that have official quotas.

This distinction can be important in some months. For example, in January 2022, the 19 countries we consider increased their production collectively by 370,000 b/d, which was about 92.5 percent of the 400,000 b/d quota increase for that month.

The production increase after including Iran, Venezuela, Libya and Mexico was 230,000 b/d, or just 57.5 percent of the quota increase. This makes the shortfall look larger in January. However, since none of these four countries have official targets, it seems more appropriate to focus on the 19 that do.

Growing Supply Gap Garners Attention

Various commentators have noted a gap between OPEC+ quotas and actual production levels. There are several ways of presenting this gap. Some report a monthly gap between the total quota and total production, considering only those countries participating in the agreement. This gap stood at almost 1.1 million barrels per day (mb/d) in February, the most recent month for which there are official production data (Chart 1).

Chart 1

https://www.dallasfed.org/research/economics/2022/~/media/Images/research/economics/2022/0419/dfe0419c1.png

Others report the cumulative losses in supply over some period. By this measure, there was a large and growing production shortfall in the group, with the total reaching more than 300 million barrels by the end of 2021 and increasing into 2022 (Chart 2). A closer look shows that this shortfall is largely attributable to three countries: Angola, Nigeria and Saudi Arabia.

Chart 2

https://www.dallasfed.org/research/economics/2022/~/media/Images/research/economics/2022/0419/dfe0419c2.png

Capacity Constraints Drive Supply Gap

There are a number of reasons this supply gap has emerged. One important explanation — and one that continues to play a role in 2022 — is the inability of some OPEC+ members to increase production to take advantage of their growing quotas. These countries are bumping into capacity constraints for several reasons, including infrastructure issues and the difficulty of attracting sufficient investment to offset production declines at existing wells.

Angola is an example. Its quota in February 2022 was 1.42 mb/d. However, Angola’s maximum capacity is 1.19 mb/d, according to IEA estimates. This supply gap will only worsen in coming months, as Angola’s quota will eventually reach 1.53 mb/d, the country’s October 2018 output according to OPEC.

Capacity constraints also affect Nigeria, whose February target was 1.70 mb/d but whose sustainable capacity was 1.54 mb/d, according to the IEA. Even reaching the sustainable capacity level has been difficult for the country — it has not produced at that level since mid-2020.

Saudi Arabia’s shortfall in the first half of 2021 was unrelated to capacity constraints, on the other hand. The country enacted a voluntary production cut from February 2021 to June 2021, with the goal of bringing down global inventory levels.

Increasing Attention on OPEC+ Supply Role

Dwindling OPEC+ spare capacity looms large, given expectations of continued strong global demand in 2022 and 2023 — concerns that have been elevated by Russia’s invasion of Ukraine.

Assuming that the group increases production at the same pace it has in recent months, only a handful of countries in OPEC+ will have spare capacity left by the start of the summer, a number that will dwindle as year-end approaches. Thus, the supply gap is expected to continue growing this year with many OPEC+ countries unable to take advantage of the higher production quotas they will receive under the group’s agreement.

This says it all:

Others report the cumulative losses in supply over some period. By this measure, there was a large and growing production shortfall in the group, with the total reaching more than 300 million barrels by the end of 2021 and increasing into 2022 (Chart 2). A closer look shows that this shortfall is largely attributable to three countries: Angola, Nigeria and Saudi Arabia.

The Dallas FED nowhere mention your little obsession with the Biden Administration. So Brucie – are you just lying again? Or did you not understand what your own link said. Ah yes – you do this all the time. Provide some link to a good discussion and then just make up garbage to bash Biden. A pattern of serial lying!

Lucy,

Time for you to get new reading glasses. Right at the beginning of the comment is the quote from NPR:

Leases for 225 square miles (580 square kilometers) of federal lands primarily in the West will be offered for sale in a notice to be posted on Monday, officials said. >b>The parcels represent about 30% less land than officials had proposed for sale in November and 80% less than what was originally nominated by the industry.

So, reduce the amount of land available for leases and raise the royalty fees by 50%. Yeah, great incentives to produce more oil.

Damn – you are a MORON. Yes there was that mention of that single factoid but even a person with an IQ in the teens could tell the entire point of the story involved the royalty rate. Your disdain for raising the royalty rate to a more appropriate level shows you are completely ignorant of the economics of oil production. But we all already knew that.

Here is a hint troll – READ the entire discussion. You might learn something (but I doubt it).

Lucy,

Never met a tax you didn’t like, eh? Well, how did you arrive at the “fact” that 18.75% was an “appropriate” rate? Let’s not beat around the bush. Biden & Co. are all about climate change and equity. Oil production is an inconvenience and an evil in their ideology, so anything from stopping pipelines to increasing the cost to American producers (the market price of oil doesn’t increase simply because the government siphons off more of the money) is simply meant to disincentivize American oil production. It’s all about protecting little Greta.

But hypocritically, Biden goes around to rogue states asking pretty please pump more oil. It’s the same hypocrisy that European nations are guilty of. Ban production at home; buy it from Russia.

So, Lucy, you moron, the royalty rate is just one piece of the picture that you want to obfuscate to protect your daddy, Joe.

just to be clear, if Europe had more reliance on renewables, they would have less reliance on uncertain Russian energy. that would be a good thing during this war. why do we continue to try to run the world with oil and gas? it has lead to multiple wars through the years. time for a change that encourages peace rather than war. anybody who promotes the continued reliance on oil and gas are simply in the pro war movement.

@baffling It’s worse when you consider that Germany is decommissioning its nuclear power plants …

AndrewG: “It’s worse when you consider that Germany is decommissioning its nuclear power plants …”

OMG. Get correct data on power plants and energy, then come back. NG for electricity generation is not the issue, process heat and space heating is, in these sectors NPPs do not help. It is always funny that proponents of nuclaer power are often too stupid to get the basics straight.

Nah, this says it all:

Dwindling OPEC+ spare capacity looms large, given expectations of continued strong global demand in 2022 and 2023 — concerns that have been elevated by Russia’s invasion of Ukraine.

Assuming that the group increases production at the same pace it has in recent months, only a handful of countries in OPEC+ will have spare capacity left by the start of the summer, a number that will dwindle as year-end approaches. Thus, the supply gap is expected to continue growing this year with many OPEC+ countries unable to take advantage of the higher production quotas they will receive under the group’s agreement.

Now combine that with Biden’s restrictive leases and punitive royalties and… we’ve got a loser!

punitive royalties?

The 18.75% royalty rates are still lower than the true value of being able to use Federal lands. Which is why oil companies are still enjoying yuuuge profits. Look Bruce – you have no clue what optimal pricing looks like and you never will as you really do not care about such pesky concepts. But chirp away as it is really funny watching the dumbest dog ever chase its own tail.

My God – Bruce Hall does not read his links as he missed the entire lead in this US lease issue:

The Interior Department on Friday said it’s moving forward with the first onshore sales of public oil and natural gas drilling leases under President Joe Biden, but will sharply increase royalty rates for companies as federal officials weigh efforts to fight climate change against pressure to bring down high gasoline prices. The royalty rate for new leases will increase to 18.75% from 12.5%. That’s a 50% jump and marks the first increase to royalties for the federal government since they were imposed in the 1920s.

Now anyone who remotely gets the pricing issue here would tell you that 12.5% was far too low allowing the economics rents from Federal lands to be siphoned off by the already profitable oil sector. So this increase was LONG overdue.

Of course giving Biden credit for doing the right thing is something Bruce Hall would never do. Then again – I suspect he has no effing clue what his own link was even talking about.

Lucy,

Keep trying to defend Old Uncle Joe’s dysfunctional energy policy. It’s good to see you trying to justify oil exploration disincentives under the current situation, Must be hard sliding down that pile of shit.

“Keep trying to defend Old Uncle Joe’s dysfunctional energy policy.”

Did your brain cells die 50 years ago or what? I guess you would let oil companies ignore all negative externalities as well as any rights to the economic rents for Federal owned property just so you could get gasoline for $2 a gallon. Oh wait – I’m talking about basic economic concepts which of course you could care less about. Ok Brucie boy – you win the gold medal for STUPIDEST MAN ALIVE!

Lucy, keep trying to defend a 50% increase in royalties when the current percentage has been perfectly acceptable to both Democratic and Republican administrations for a century. It has been a good balance between government revenue and exploration incentives.

Those San Francisco radical liberals would love to see landlords increase rents by 50% while offering only 20% of the space they wanted which is 30% less than the space the landlords had previously offered for a lower price. Eh? Make room for more tents on the sidewalks.

You might want to actually listen this time, pgl.

Actually this whole round of new leases looks like just a publicity show, irrespective of what royalties are being charged for them. The hard fact is that oil companies are sitting on something like 9,000 leases right now they are not using. Why are they not using them, some “dysfunctional” policy of Biden’s?

Most observers say that the companies have been holding back because of the high volatility of oil prices combined with stockholders demanding more steady returns. This has led to a great hesitancy to expand production in general out of fear that oil prices could suddenly drop again, leaving them losing money.

Bruce Hall loves to lead his pathetically dishonest and stupid comments with garbage like this:

‘There seems to have been some complacency developing about oil supplies as oil price has stabilized between $100-105/barrel.’

Some complacency? On whose part? What evidence do you have of this? NONE. But reality never stopped Bruce Hall from making really stupid LIES. Of course he did provide two interesting stories – neither of which he accurately summarized.

Most dishonest troll ever? Or just the dumbest?

Lucy,

How about complacency in Europe? Still not considering fracking and drilling despite a lot of oil and gas there and the North Sea. Don’t worry, there will be plenty of oil in a couple of months, eh?

How about complacency in the White House? Raise the cost and reduce the opportunity to find more oil, eh?

Isn’t that complacency enough for you?

‘Bruce Hall

April 21, 2022 at 12:18 pm

Lucy,

Never met a tax you didn’t like, eh?’

Macroduck tried to explain this to you. Royalties are claims to the property rights of the government which a corrupt MAGA hat type like you would just turn over to Exxon. And it seems you never learned the concept of negative externalties. Look Bruce – we know you are dumber than a rock so chill.

“How about complacency in Europe?”

I asked who was complacent and you mentioned a Continent? Don’t try to do even better as you have wasted too much space with your stupid dishonesty.

“Bruce Hall

April 21, 2022 at 12:24 pm

Lucy, keep trying to defend a 50% increase in royalties when the current percentage has been perfectly acceptable to both Democratic and Republican administrations for a century. It has been a good balance between government revenue and exploration incentives.”

That is the dumbest statement EVER. It is clearly a rip off of the property rights of the Federal government. But because the most corrupt minority leader ever favors it – you think it is optimal economic policy? Oh yea – President Trump thought it was fine and he is a very moral leader with great economic skills in the minds of MAGA hat morons like you.

Damn you are DUMB. I would ask you to provide an actual economic analysis of this but I know for a fact you have no clue what economic analysis even means.

The federal government has long been accused of charging too little for mineral leases, including for oil leases. The fact that lease fees have not risen in a century, while petroleum became a widely used resource in a growing economy while oil companies grew rich, suggests that the government has, indeed, reaped too little return for tax payers. The U.S. charges less in taxes and fees on petroleum than just about any developed country, another indication that the U.S under-taxes petroleum. Economists are in wide agreement that a carbon tax is an efficient approach to reducing carbon emmissions, and lease fees amount to a tax on carbon emissions.

Funny how you led off by criticizing a rise in lease fees.

Wow – someone actually gets this topic. Thank you!!! Reading the serial garbage from Village Idiot Bruce Hall was giving me a headache.

I hope you saw this utter nonsense:

“Bruce Hall

April 21, 2022 at 12:24 pm

Lucy, keep trying to defend a 50% increase in royalties when the current percentage has been perfectly acceptable to both Democratic and Republican administrations for a century. It has been a good balance between government revenue and exploration incentives.”

You are welcomed to fire away. But of course having a discussion with Village Idiot Bruce Hall may be a waste of your considerable talents so if you skip the dumbest comment ever, we will understand.

I believe oil and gas leases are sold via auction. If so, then the revenues are quite literally what the market thinks they are worth.

https://www.marketplace.org/2021/11/19/biden-administration-auctions-oil-and-gas-leases-on-1-7-million-acres-of-the-gulf-of-mexico/

Looks as if Germany is leading the way in Europe.

https://www.msn.com/en-us/money/markets/german-inflation-producer-price-rises-highest-since-1949/ar-AAWp9Cb

“German annual producer price inflation topped 30% in March, the country’s Federal Statistics Office said on Wednesday. That’s its highest level since the agency began collecting data 73 years ago. The biggest culprit? Energy prices, which rose nearly 84% from the same month last year.”

Of course your boss (Kelly Anne Conway) told you to blame Biden for Germany’s temporary spike in prices. Come on Brucie – be more careful to fully copy and paste her emails lest she cut off your rent checks.

Lucy,

So, you disagree with the data? Of course you do. Because Bruce Hall provided the link. And I’m still not paying rent for staying in your head.

“Because Bruce Hall provided the link.”

Referring to yourself in the 3rd person nowadays. Do you really think that is going to get you dates with guys with girls names. Brucie – you really do need professional help. Or a rubber doll.

Lucy,

Avoiding the question… as usual.

“Bruce Hall

April 21, 2022 at 12:29 pm

Lucy,

Avoiding the question… as usual.”

You had no question to address troll. But I understand why you avoid answering queries about your strange dating preferences.

https://www.msn.com/en-us/money/markets/a-growing-amount-of-russian-oil-is-being-sent-destination-unknown-as-wary-buyers-try-to-avoid-affiliation-with-the-sanctioned-nation/ar-AAWsivj?ocid=msedgdhp&pc=U531&cvid=06877b86e1844f428057da2b4aed5c22

It seems the major importer of Russian oil may be “destination unknown”!

https://fred.stlouisfed.org/graph/?g=Or6Q

January 15, 2018

Consumer and Producer Prices for Germany, 2017-2022

(Percent change)

https://news.cgtn.com/news/2022-04-21/This-inflation-is-demand-driven-and-persistent-19pdQZn4sCI/index.html

April 21, 2022

This inflation is demand-driven and persistent

By Jason Furman

Commentators have generally offered two arguments about advanced economies’ performance since COVID-19 struck, only one of which can be true. The first is that the economic rebound has been surprisingly rapid, outpacing what forecasters expected and setting this recovery apart from the aftermath of previous recessions.

The second argument is that inflation has reached its recent heights because of unexpected supply-side developments, including supply-chain issues like semiconductor shortages, an unexpectedly persistent shift from services to goods consumption, a lag in people’s return to the workforce, and the persistence of the virus.

The first argument is more likely to be true than the second. Strong real (inflation-adjusted) GDP growth suggests that economic activity has not been significantly hampered by supply issues and that the recent inflation is mostly driven by demand. Moreover, there is reason to expect demand to remain very strong, which means that inflation will persist.

To be sure, inflationary pressures reflect both supply and demand factors, the exact combination of which is unknowable. But when considering the economy as a whole, it is implausible that all the individual supply stories would add up to the generalized inflation we have seen. It is far more likely that the increase in demand exceeds what the economy can produce, leading to higher prices.

By definition, price growth equals the growth of nominal output minus the growth of real output (with a small difference due to compounding). Over the course of 2021, U.S. real GDP grew by 5.5 percent, nominal GDP grew by around 11.5 percent and GDP price growth thus came in at around 5.9 percent. For the OECD as a whole, real GDP growth was slightly lower, at 4.9 percent, and nominal GDP growth was 10.4 percent, yielding 5.2 percent GDP price inflation.

Recall that policymakers largely protected or increased disposable personal income at a time when consumption possibilities were constrained (through most of 2020). If one considers these excess savings alongside the persistence of low interest rates through most of 2021, a rising stock market, pent-up demand, and additional fiscal support, the magnitude of the increase in nominal GDP is not particularly surprising. In the United States, discretionary fiscal stimulus totaled $2 trillion in the 2021 calendar year, but nominal GDP was only $1.6 trillion higher than it was in 2019. If anything, the surprise is that nominal spending was so constrained, and that saving rates remained so elevated.

What about real GDP? Here, we need to remember that all the supply-side stories are different ways of saying that real output was constrained….

Jason Furman is Professor of the Practice of Economic Policy at Harvard University’s John F. Kennedy School of Government.

Looks like pgl is looking for a new job now that his perspective on the world has met the response of the free market.

https://babylonbee.com/news/cnn-exceeds-all-expectations-by-lasting-nearly-3-weeks/