It’s belaboring the obvious that gasoline (and energy prices) had a big impact on headline inflation [BLS release]. M/m inflation was at Bloomberg consensus of 1.2%, while core was below, at 0.3% vs. consensus 0.5%. However, it’s useful to see how over time exactly how much headline and core diverged.

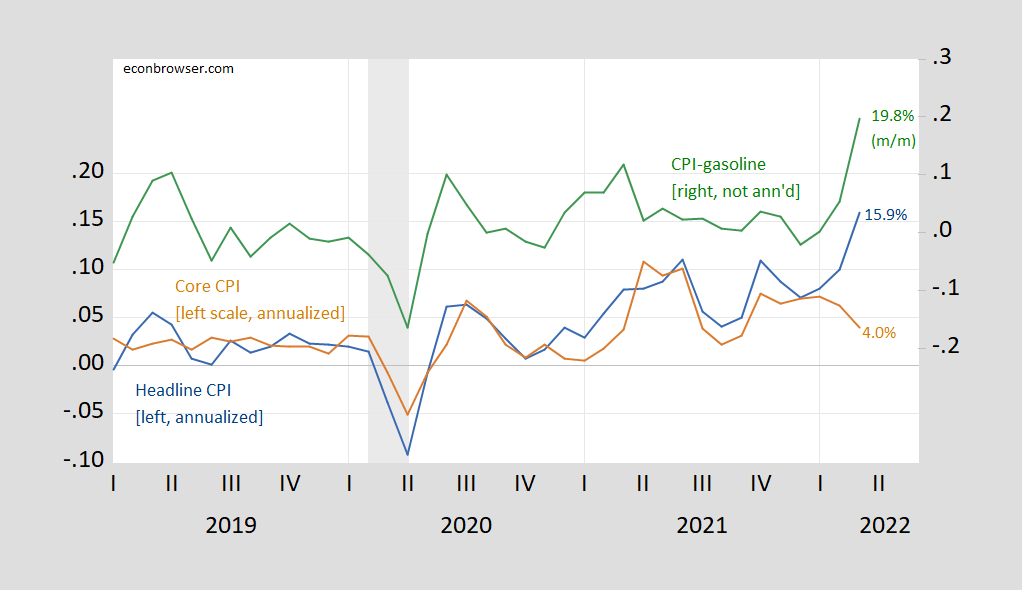

Figure 1: Month-on-month annualized CPI inflation (blue, left scale), Core CPI inflation (brown, left scale), and CPI gasoline component inflation, not annualized (green, right scale). NBER defined recession dates peak-to-trough shaded gray. Source: BLS, NBER, and author’s calculations.

Core inflation fell, while gasoline prices rose nearly 20% (m/m not annualized).

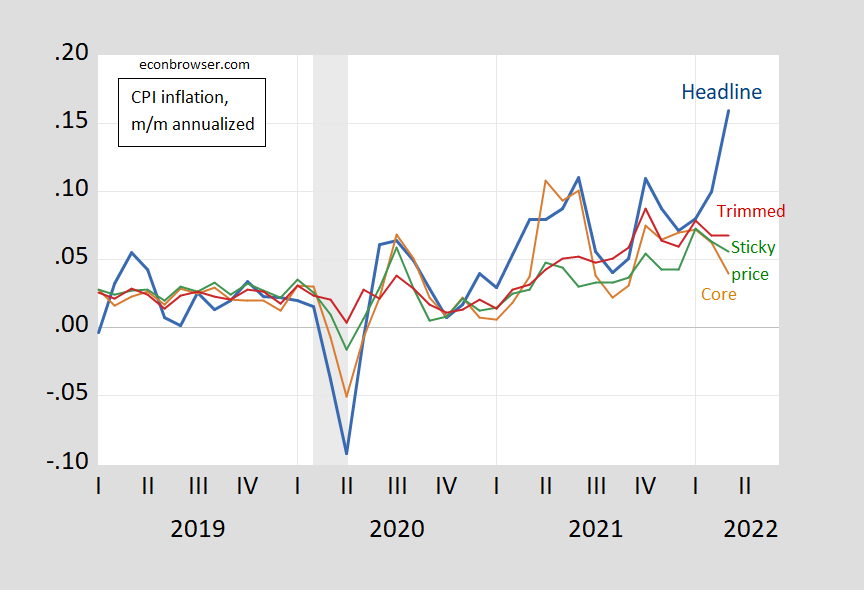

As shown in Figure 2, Trimmed CPI inflation fell, indicating the broadness of price inflation was reduced. Sticky price CPI inflation also fell, indicating that infrequently changed prices were also increased as a slower pace.

Figure 2: Month on month annualized CPI inflation (blue bold), core CPI inflation (orange), 16% trimmed CPI inflation (red), and sticky price CPI inflation (green). NBER defined recession dates peak-to-trough shaded gray. Source: BLS, NBER, Cleveland Fed, Atlanta Fed, and author’s calculations.

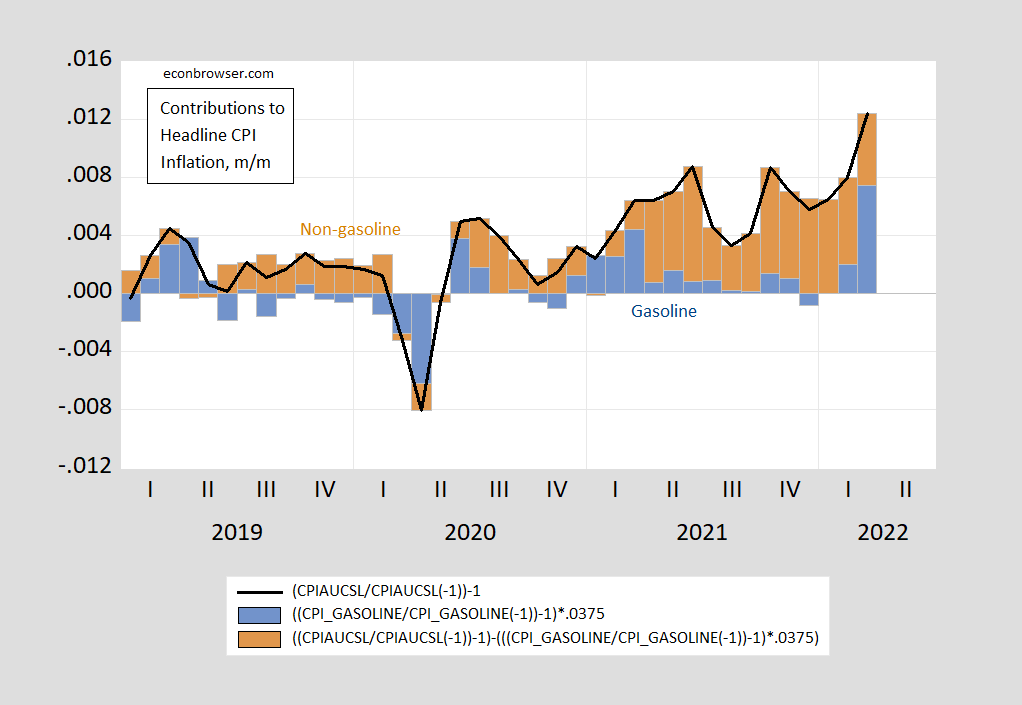

To isolate the contribution of gasoline prices to the CPI rise, I mechanically decompose the CPI into gasoline and non-gasoline components (using 3.75% weight for gasoline in the CPI).

Figure 3: Month-on-month headline CPI inflation (black line), gasoline contribution (blue bar), non-gasoline contribution (brown bar). Source: BLS and author’s calculations.

0.74 percentage points of the 1.24 percentage point month on month inflation rate was accounted for by gasoline alone.

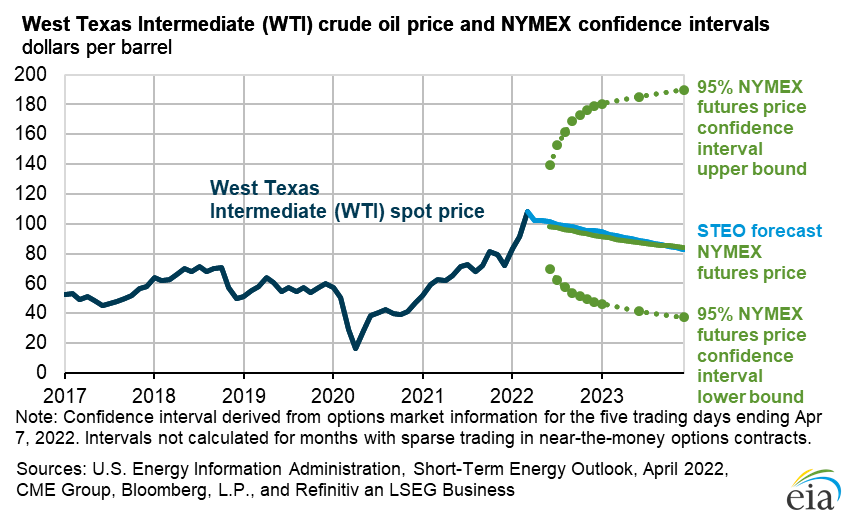

Clearly, as noted in yesterday’s post, the course of gasoline prices — which is linked to oil prices — will determine inflation’s trajectory in the short term. Here, the forecast is for a decrease — but with a very wide confidence interval (I’m assuming Brent has the same forecast and uncertainty attributes).

Source: DOE EIA.

If oil prices do decline in April, then gasoline prices should deduct from headline inflation. But given geopolitical conditions, I wouldn’t bet on that occurring.

See more from CEA, especially on how vehicles added to CPI inflation.

https://www.nytimes.com/2022/04/12/opinion/inflation-consumer-prices.html

April 12, 2022

Inflation is about to come down — but don’t get too excited

By Paul Krugman

The inflation report for March came in hot, as expected: Consumer prices are up 8.5 percent over the past year. But more than two years into the pandemic, we’re still living on Covid time, where things can change very fast — so fast that official data, even about the recent past, can give a misleading picture of what’s happening now.

In this case, the Consumer Price Index — which roughly speaking measures average prices over the month — probably missed a downward turn that began in late March and is accelerating as you read this. Inflation will probably fall significantly over the next few months.

But don’t get too excited. The better numbers we’re about to see won’t mean that the inflation problem is over.

Why expect inflation to come down? Surging gasoline prices accounted for half of March’s price rise, but it now appears that the world oil market overshot in response to Russia’s invasion of Ukraine. A lot of Russian oil is probably still reaching world markets, and President Biden’s million-barrel-a-day release from the Strategic Petroleum Reserve makes up for much of the shortfall. As of this morning, crude oil prices were barely above their pre-Ukraine level, and the wholesale price of gasoline was down about 60 cents a gallon from its peak last month.

Beyond that, there are growing indications that the bullwhip is about to flick back.

What? The bullwhip effect is a familiar issue for products that are at the end of long supply chains: Changes at the consumer end can lead to greatly exaggerated changes farther up the chain. Suppose, to take a non-random example, that a shift to working from home — then, coronavirus panic — leads to increased purchases of supermarket toilet paper (which is a somewhat different product from the stuff used in offices). Consumers, seeing a shortage, rush to stock up; supermarkets, trying to meet the demand, overorder; distributors who supply the supermarkets overorder even more; and suddenly there are no rolls to be had.

I presume, by the way, that the term “bullwhip effect” comes from the fact that when Indiana Jones swings his arm, the tip of his whip moves much faster than his wrist.

Bullwhip effects probably played a significant role in the bottlenecks that have bedeviled the economy since we emerged from the pandemic recession. Consumers, unable or unwilling to consume face-to-face services, bought lots of manufactured goods instead — and in some cases, overbought out of fear that goods wouldn’t be available. Wholesalers and shippers, in turn, rushed to buy to be able to meet consumer demand; and suddenly, there weren’t enough shipping containers or port capacity, sending costs soaring.

But now there is growing buzz to the effect that the bullwhip is cracking back. The C.E.O. of FreightWaves, a company that specializes in supply-chain analysis, recently published an article titled “Will the bullwhip do the Fed’s job on inflation?” (Actually no, but I’ll get there.) He pointed out that retailers appear to have overbought and are sitting on unusually large inventory. Car lots are filling up; demand for trucking is falling quickly. International shipping rates seem to be coming down:

https://static01.nyt.com/images/2022/04/12/opinion/krugman120422_1/krugman120422_1-jumbo.png?quality=75&auto=webp

Shipping sinking….

https://fred.stlouisfed.org/graph/?g=G5Ya

January 4, 2020

Real Average Hourly Earnings of All Private Workers, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=KH4x

January 4, 2018

Real Average Hourly Earnings of All Employees in Manufacturing, 2017-2022

(Indexed to 2017)

Here’s the inventory picture:

https://fred.stlouisfed.org/graph/?g=OavV

Wholesalers are holding very large inventories. Retailers are holding only about what they had prior to the recession. Keep in mind, though, that retail ex-auto looks a bit different, with inventories fairly high.

“Core inflation fell, while gasoline prices rose nearly 20% (m/m not annualized).”

Gee – the press is so all a flutter over the spike in headline inflation that I did not know until now that core inflation fell. OK – I was dismayed that my weekly purchase of a dozen eggs might cost me $4.50 this time. I also get that gasoline prices are important to a lot of hard working people.

But wait – Princeton Steve is now being Mr. Doomsday now that he sees that spike in oil prices beginning to reverse itself. He even said this means those Russian sanctions are not working. Then again – he is Mr. Hyperbole.

Let’s hope food and gasoline prices moderate.

The CPI report has good news. Core inflation has declined for three months — 0.6 then 0.5 then 0.3. No signs of runaway spiraling inflation.

Gasoline is the biggest contributor to inflation, by far. Environmentalists have been warning for 40 years that an economy that depends on despotic regimes for fossil fuels is dangerous, but the usual suspects never learn no matter how many times they get kicked in the a** for the same mistakes.

Instead we get sociopathic demands for higher interest rates which don’t address the core issues at all. These demands boil down to “Hey, if we put millions of people out of work, there will be lots of cheap gas for me!”

“sociopathic demands for higher interest rates”

Uh, no, we get calls for tighter interest rates – from known “sociopaths” like Paul Krugman – because there are signs that the labor market is still overheated and it could get worse if the Fed is not vigilant.

Is Tesla stock overvalued. An interesting discussion from Kevin Drum:

https://jabberwocking.com/how-much-is-tesla-overvalued/

Value to earnings makes no sense for a start-up when the earnings/revenues ratio is going to rise in the future. So Kevin contrasts value to revenue where Tesla’s ratio is 20, which is incredibly high unless one expected the earnings/revenues ratio to be really, really high. Car companies generally make very modest earnings/revenues even in the best of time.

It would be nice if we could get a little more honesty from economists.

Just as the military uses the euphemism “collateral damage” when what they really mean is “bombing civilians”, economists use the euphemism “raise interest rates” when what the really mean is “put other people out of work and make them poorer so they they won’t buy so much of stuff I want to buy.”

Well some of us economists are not convinced that we need to repeat the mistakes of the early 1980’s.

“put other people out of work and make them poorer so they they won’t buy so much of stuff I want to buy.”

Monetary policy is not a conspiracy. And inflation often hurts people at the bottom the most.

Also, it’s possible that tighter policy will slow down inflation without causing a recession.

“Also, it’s possible that tighter policy will slow down inflation without causing a recession.”

if most of the inflation is caused by oil and gas-impacted by some global events-then perhaps tighter policy is not necessarily the best solution to the problem. one would think you are using a sledgehammer unnecessarily?

“if most of the inflation is caused by oil and gas-impacted by some global events”

Just because “most” of the inflation is being driven by energy now doesn’t mean there isn’t a significant component of inflation due to an overheated labor market, which we clearly have. Look at Figure 3 above. That’s hardly nothing. And the standstill in the core numbers comes AFTER the Fed pivoted towards hawkish policy. Where would it be if they had not signaled tightening?

I would not argue against raising rates. just be moderate about it. you used the term “vigilant” to describe the fed. I think that is a biased argument that implies the fed must be very aggressive. if most of the inflation is caused by oil and gas global events, then the fed should not respond to that in an extreme fashion. if core is holding steady at 4%, and possibly threatening to go lower, why would you be aggressive with rates? I have found most people who are advocating for a more aggressive fed action are typically arguing for their book, not necessarily for the nation as a whole. slightly higher rates will lower housing inflation, and it already looks like the oil and gas aspect has leveled off, and may even start to slide down. overreacting and causing a recession is a bigger risk than underreacting and allowing inflation to remain elevated for an extra quarter.

“And inflation often hurts people at the bottom the most.”

Oh, please spare us your concern for the poors. Workers in the bottom 20% are getting wage increases faster than inflation. For the first time in decades they have the power to tell abusive employers to shove it.

The most egregious economic policies always come with the excuse that they are doing for the poor people. It might hurt but it’s for their own good even if they are too stupid to realize it. Curiously, they rich just get richer.

So exactly how do you think raising interest rates is going to relieve the gasoline shortage? If people lose their jobs, they won’t have to drive to work? They won’t have a job but at least gas will be cheaper. Whoopee!

“Oh, please spare us your concern for the poors. Workers in the bottom 20% are getting wage increases faster than inflation. ”

Not anymore they aren’t. Check the data – Chinn posted about that recently.

You have a very warped view of monetary policy.

it’s possible that tighter policy will slow down inflation without causing a recession.

That is the hope but pulling this off take a lot of dexterity.

https://fred.stlouisfed.org/graph/?g=IM1P

January 4, 2018

Real Average Hourly Earnings of Production & Nonsupervisory Employees in Retail Trade and Leisure & Hospitality, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=M3tH

January 4, 2018

Real Average Hourly Earnings of All Employees in Retail Trade and Transportation & Warehousing, 2017-2022

(Indexed to 2017)

“ Lower-income households are disproportionately burdened by high inflation — especially the rising costs of food, housing and energy — yet policymakers lack the right data to fully capture the disparity, according to remarks from one of the Federal Reserve’s top officials.”

https://thewashingtonpost.pressreader.com/article/281925956538250

It’s curious that economists prefer the inflation measure that disregards the particularly hard impact of energy and food inflation on a substantial portion of the population. Coincidence? Have they noticed it? To my knowledge, Brainard is the first to get the information into the Overton window, although it has probably been published before in some obscure academic journal.

JohnH: Since you are so often on this blog, suggest you consider what has been written on the topics you allege nobody pays attention do on this blog. For instance, whose consumption basket does the CPI measure, discussed first time in 2008 by me, more recently elsewhere on this blog.

Let’s see – JohnH routinely dismissing the premise that James Hamilton is a prominent economist when it comes to energy economics so why would one think he has bothered to read your incredibly insightful comments re macroeconomics.

So are you saying that you disagree with Lael Brainard?

So are you saying that you disagree with Lael Brainard’s assertions?

‘To my knowledge…”. Good one, John. (Maybe you can also weigh in on the shortcomings of 18th century economists. To your knowledge)

One of JohnH’s latest rants is a claim that mainstream economists have never suggested a tax on the economic rents of oil and natural gas suppliers. But it seems this idea dates back to Adam Smith (18th century economist).

Pgl appears to be unaware of the Overton window: “ The Overton window is the range of policies politically acceptable to the mainstream population at a given time.[1] It is also known as the window of discourse.” https://en.wikipedia.org/wiki/Overton_window

As Brainard noted, “ policymakers are “only beginning to understand” how inflation is experienced by different households, how that information relates to income and demographic data, and whether people’s experiences change over time.

Brainard said it would be useful to have inflation broken out by demographic groups, similar to what’s available for labor market and personal-income data. But statistical agencies don’t collect information that captures the household level

If the effect of inflation on lower income households had been within the Overton window, you can bet that federal agencies would collect data on it. Maybe now they’ll make an effort.

“It’s curious that economists prefer the inflation measure that disregards the particularly hard impact of energy and food inflation on a substantial portion of the population. Coincidence? ”

perhaps because that part of the measure can be pretty volatile, both up and down. you want policy to behave like a yo-yo?

There is a bit of an oddity in the relative performance of core and headline inflation, I think. Headline inflation can lead core in the near term because higher energy prices leak into core prices. Core prices are, however, a better predictor of headline inflation in the medium to long-term than vice versa. Underlying inflation dynamics are more clearly presented in core measures, and core inflation trends are also more persistent than volatile headline measures.

All of this is a recitation of the reason economists follow core measures despite the howl from the cheap seats about how everybody has to eat and heat. In the present context, this means Joseph’s point about the recent slowing in core inflation is quite important.

Trimmed mean which is the onw to watch is a tad over 6%. your Fed should have been at the neutral rate well before now. Most central banks have been too lax.

one option floated by president biden today (?) is to increase the ethanol content, which would volumetrically reduce the refined crude in a gallon, of gasoline say 10% to 15% (e15).

https://www.forbes.com/sites/rrapier/2021/07/04/a-setback-for-the-ethanol-industry/?sh=bf39c9b49a4c

increased ethanol was addressed in 2019 and court found raising the ethanol content violated law.

it increases the evaporation (higher rvp, more evaporation) and emission spectrum toward more smog.

e15 is on the farm lobby agenda.

Boogeyman lobbyists aren’t the story here. Tempering short-term gas prices is.

Instead of giving us quaint old just-so stories about inflation, why not give us a) trades to hedge inflation and/or b) inflation insurance in the form of interest that equals inflation?

Why can’t we keep real purchasing power stable even if prices rise without bound?

Old Uncle Joe has decided that farmers need to produce more corn for the production of E15 gasoline this year to try to bring the price of gasoline down and save some seats in the House of Representatives. But Thomas J. Vilsack, Secretary of the Department of Agriculture turned down a request from Mike Seyfert, President and Chief Executive Officer, National Grain and Feed Association, to expand acreage from the “Conservation Reserve Program (CRP) as potential solutions to address commodity supply constraints and focus on prime farmland in particular” to be made available for planting more corn. This request was denied.

Rationale: Importantly, it is critical to point out that if we allow the tillage of CRP acres, the marginal at best benefit to crop production will be coupled with a significant and detrimental impact on producers’ efforts to mitigate climate change and maintain the long-term health of their land.

Another win for ideology.

However…

Increasing corn ethanol production would be a big mistake, says Jason Hill, a biofuels expert at the University of Minnesota. “The science has long pointed out that this is not where we want to go,” he says. “In the long run corn, ethanol has done almost nothing for our energy independence, and it has a large, disproportionately negative impact on the environment and food security.”

https://www.wired.co.uk/article/biofuels-gasoline-russia?mbid=social_twitter

Huh you are actually attempting to understand science and economics. But wait – you have consistently mocked anyone who rightfully expressed concerns about “the large, disproportionately negative impact on the environment and food security.”

And you decide to mock Biden for adopting the Bruce Hall view of this issue? Excuse me but what happened to the real Bruce Hall. Oh wait – there isn’t a real Bruce Hall – just a Kelly Anne Conway bot.

I’m sorry – you WERE mocking the smart people in the room. I missed your little mock: “Another win for ideology.”

No dumbass – it is a win for long-term solutions as opposed to short-term considerations. But my apologies – we know these distinctions are things you will never grasp. So mock on troll.

Figure 3 is most interesting. Thanks.

It will interesting to see if the core basket inflation rate turns up driven by increased inflation expectations.

According to ABC News, the price of E15 gasoline is about 10-cents per gallon less than typical E10 regular or about a 2-1/2% savings at $4.00 per gallon for E10. However, E15 gasoline is less fuel efficient. If you have a large SUV getting 20mpg on E10 and it gets 19mpg with E15, you’ve lost money getting the E15. At the same time, in order to plant the additional corn needed to make the ethanol for the E15 mixture, some other crop is going to be displaced or the corn normally used for human and animal consumption will be less available possibly driving up the cost of corn.

Somehow, Joe Biden’s E15 strategy seems much ado about nothing … or less than nothing. Wouldn’t it just be simpler to stop summer blends and make standard E10 all year long? It would be the most efficient approach to producing the fuel and lower the summer driving costs as well.