Estimated and reported:

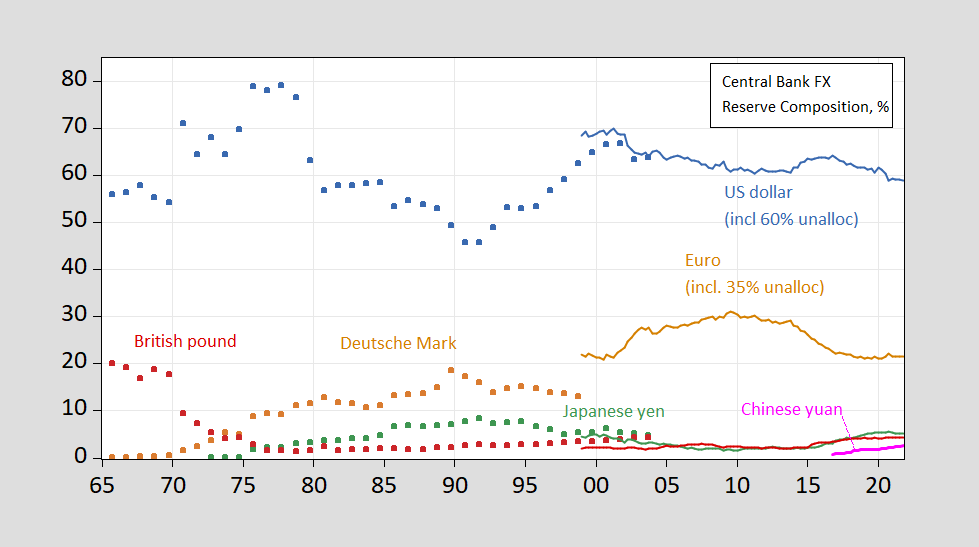

Figure 1: Share of central bank foreign exchange reserves in USD + 60% of unallocated reserves (dark blue), euro share + 35% of unallocated reserves (tan), Japanese yen share (green), British pound share (red), and Chinese yuan share (pink). Source: IMF annual reports as reported in Chinn-Frankel (2007), COFER and author’s calculations.

Notice that there are few decisive switches in ranking. The one noticeable is the British pound exchanging position with the German mark around 1973. The switchover lags the switch in GDP rankings, but also follows German capital account liberalization. That is suggestive for those that believe Chinese GDP exceeding US GDP is a necessary and sufficient condition for the rise of the renminbi (RMB).

Update, 6/1 8:00 am Pacific:

Serkan Arslanalp, Barry Eichengreen and Chima Simpson-Bell have an IMF blog post on the rise of nontraditional reserve currencies today.

https://fred.stlouisfed.org/graph/?g=PE07

January 15, 2018

Real Narrow Effective Exchange Rate for United States, Japan, United Kingdom and Germany, 1971-2022

(Indexed to 1971)

https://fred.stlouisfed.org/graph/?g=Q1jJ

August 4, 2014

Real per capita Gross Domestic Product for United States, Japan. United Kingdom and Germany, 1971-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=Q1jO

August 4, 2014

Real per capita Gross Domestic Product for United States, Japan. United Kingdom and Germany, 1971-2020

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2022

(Indexed to 1994)

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2022

(Indexed to 2007)

I pretty much agree with what Professor Chinn is saying here, but maybe, playing devil’s advocate, the sheer size of China’s economy says “this time is different”?? I don’t actually hold that belief myself, I’m just saying a semi-reasonable argument could be made. Look at how Russia is “muscling” its currency right now, with Germany and Italy and others. I think that kind of shows the argument I’m proffering here, a lot of factors trying to bash down the ruble here, and yet it’s holding up here probably better than most experts thought it would. Similar deal to China—the huge SIZE/amount of the things being traded.

On a related note, the New York Fed’s trading operation (officially called the System Open Market Account or SOMA) currently owns 38 percent of all outstanding U.S. Treasury Securities with 10 to 30 years remaining until maturity. It looks a lot like Japan…

https://wallstreetonparade.com/2022/05/new-york-fed-stuns-with-new-report-at-year-end-its-trading-desk-owned-38-percent-of-all-10-30-year-u-s-treasuries/

I wonder if the Fed has to mark its assets to market.

“I wonder if the Fed has to mark its assets to market.”

You may wonder but the rest of us know – they do. Try to keep up with the real world. DUH!

Link? If they actually do mark to market, the value of their assets should decline significantly with rising interest rates? Where is the Fed reporting losses?

Dude – we have been over this many times before. The FED does publish income statements and balance sheets which we have provided to you before. And stop being a lazy jerk and look them up for yourself.

https://www.federalreserve.gov/aboutthefed/files/combinedfinstmt2021.pdf

Even though it should be JohnH’s responsibility to find the financial accounts for the FED, we all know he is both lazy and a lying jerk. So to get ahead of his usual potty mouth debating tricks, I have decided to provide the 2021 Annual Report. Yea – I know, he will still whine that it is 2022. OK – by mid January 2023 the 2022 report will be released. And expect this lying troll to say once again the FED does not report its income. That is what he does. Ahem.

pgl couldn’t find anything to support his contention that the Fed marks the value of its assets to market…and then throws up some old Fed financials, because he couldn’t find anything in them to support him!

The usual pgl balderdash and baseless allegations….

Apparently the Fed does mark to market for its pension, and foreign exchange holdings…but nothing else. At the current rate of inflation they could vaporise half the real value of their assets in nine years. Who needs QT?

JohnH

June 2, 2022 at 3:25 pm

pgl couldn’t find anything to support his contention that the Fed marks the value of its assets to market

Seriously dude – now you just lie because you are too stupid to read an income statement? No wonder Putin has hired you as his pet poodle.

“JohnH

June 2, 2022 at 3:31 pm

Apparently the Fed does mark to market for its pension, and foreign exchange holdings…but nothing else.”

Gotta love this. JohnH gets around to admitting he was wrong 2 out of 3 times. No moron – you were wrong on the 3rd issue. Sort of like the loser baseball player who swings and misses twice and then take a fast ball right down the middle and argues when the ump calls his out.

Yes – JohnH. Dumb as a rock, a liar, and a total loser too!

‘Treasury securities, net

Federal agency and government-sponsored enterprise mortgage-backed securities, net

Government-sponsored enterprise debt securities, net

Foreign currency denominated investments, net’

Four items on the FED’s income statement.

JohnH writes “Apparently the Fed does mark to market for its pension, and foreign exchange holdings…but nothing else.”

I guess this worthless troll does not get what “net” means for the first three items. Like I said – JohnH is too stupid to read even a simple income statement. Yes – he is THAT STUPID.

JohnH,

But the US’s Phillips Curve does not look like the US, :-).

Reserves are held as financial assets. China needs more than an open capital account in order for the RMB to become a large share of international reserve holdings. It needs a large stock of Chinese assets held outside China. Easiest way to accomplish tthat is to run current account deficits.

If some advantage is gained by being the country which prints “the” international reserve currency, that advantage has to be earned. The reserve currency must produce lots of assets (liabilities to the reserve-currency country) which reserve authorities are eager to hold.

It is simple-minded to think that GDP ranking is the sole qualification for reserve currency status. Lots and lots of high-quality, highly liquid assets a(liabilities) are essential to reserve currency status. China is nowhere near qualifying.

As of the end of 2021, the U.S. international investment position was a deficit in the amount of $14.3 trillion. China’s position was a surplus of $2.1 trillion. Where are the reserve RMB assets going to come from?

As of the most recent BIS FX survey, the US$ was one side of 88% of all FX transactions. The RMB was one side of 4.3% of transactions. And turnover in RMB is not growing much faster than turnover in the market as a whole. The RMB is not liquid enough to serve as a reserve currency.

https://www.bis.org/statistics/rpfx19_fx.htm

As to the question of asset quality, Chinese assets are held outside China mostly in emerging market portfolios. And after last year’s performance, some EM portfolio managers are considering dumping China from their portfolios:

https://www.bloomberg.com/news/articles/2022-01-27/wall-street-s-new-craze-is-splitting-china-from-emerging-markets

Becoming the reserve currency country is not the result of a command decision. It’s the result circumstance, and of many other decisions, public and private. It is the result of engaging in the world, from Hamilton onward, not central planning or hiding behind a wall of capital controls.

Reserve currency status is not something that treaties or belt-and-road deals, or daily chest-thumping in the comments section of Econbrouser, can accomplish. It’s not something Xi can reasonably demand from his technocrats.

“As of the end of 2021, the U.S. international investment position was a deficit in the amount of $14.3 trillion. China’s position was a surplus of $2.1 trillion. ”

And yet the US has a positive net income from abroad which is often called “Dark Matter”. China has a negative net income from abroad position – over at Econospeak I once dubbed the latter Dark Anti-Matter.

“The reserve currency must produce lots of assets (liabilities to the reserve-currency country) which reserve authorities are eager to hold.”

I think it’s not just about size (as you say) but also about trust. And it’s hard to believe the Chinese government is willing to play nice with the international community in the way that other emerging markets can and do. This is especially true given the turn in Beijing to the old ways of economic thinking.

In any case, who says being the world’s reserve currency is all that good? When there’s an international incident, there’s a flight to safety and US exporters take a hit with a higher, not lower, dollar. Otherwise, it just means that Ted Cruz isn’t president yet.

Off-topic

Pretty good reading if you can get past the paywall. I have to say this rings pretty true to me on the bureaucracy over there, though my personal experience on SARS around 2002 was much better than this (if you consider being separated from someone you love for weeks “better” treatment). But I can’t say my personal movement was restricted at all, just my GF’s

https://www.wsj.com/articles/testing-positive-in-zero-covid-china-11653710461

Off topic –

The issue of monopoly rents often comes up here in comments. A recent WSJ opinion piece, actually an excerpt from a book, notes that boring millionaires – not finance or tech – are often beneficiaries of territorial or market restrictions that create local monopolies. Car dealers and beverage distributors are cited as common examples

https://www.nytimes.com/2022/05/14/opinion/sunday/rich-happiness-big-data.html

Glamour small businesses – music stores, toy stores, clothing store, flower shops – don’t have government-mandated monopoly positions and don’t generally survive very long.

The author notes that business owners are far more likely to become millionaires (though “millionaire” is not the standard the author uses) than high-earning professionals. This may not strictly contradict Dean Baker’s position that it’s doctors, lawyers, executives and immigration law which are the crux of income inequality, but it certainly makes Baker look a bit one-sided in his view. It takes all kinds to make an plutocracy.

Another good share. It takes all kinds of local frictions. But I’m surprised there wasn’t much mention of land ownership, particularly in big cities on the coast. Another unsexy business likely making a handful of people rich. Also impacted by government restrictions (though that’s probably not necessary for this story).

Another thing not mentioned in the article: I don’t have the reference and I don’t want to look it up right now but there was some chatter in the data journalism world in the aftermath of the 2016 election that made the point that many of Trump’s relatively low education, relatively high income supporters are the people mentioned here (unsexy local business owners; the businesses are unsexy, not the owners).

Baker’s half of the story is important, though: Doctors are highly protected in the US and have a big superstar effect (think: top surgeons), lawyers have an extreme superstar effect, and executives have both a superstar effect and corrupted boards deciding their incomes.

And then there’s inequality of education, which is another big driver of inequality, but of the 70th percentile vs. 30th percentile variety, not the top 1% vs 99%. Even getting their foot on a college campus is impossible for so many – and not because of the cost, but because they had terrible preparation.

“Doctors are highly protected in the US and have a big superstar effect (think: top surgeons)”

Have you ever seen the TV series Dr. Death? A friend of mine is one of the writers and I’m trying to see if I can score the first couple of episodes. The real world surgeon was one sick human being.

Thanks for giving me nightmares, pgl. :-S

When I moved to Manhattan I was appalled at the high prices for low quality groceries. Then again there were only three grocery chains with two of them owned by the very rich fat cat (and on my is he really fat). Not exactly a place known for real competition – alas.

Menzie,

When did the USD come to exceed the British pound in this?

Barkley Rosser: Hard to say since the world didn’t hold reserves in the way they do now. Probably sometime between WW I and WW II…but Barry Eichengreen would be the expert here.

Well, you know my memory or war chest of knowledge isn’t that broad so it wouldn’t shock anyone to know I had to Google this, but it appears some shy boy from the state of Washington has implied it was after World War II. Eichengreen seems to say mid-1920s. To be fair, these opinions may be “dated” in the authors’s themselves eyes.

I swear I typed “authors’ “. There’s a gremlin in the internet that hates me. I know he’s in the ethernet cord somewhere. He’s like Lubdan the Leprechaun. I know he’s there somewhere.

About sterling after WWII: It’s been argued convincingly that for whatever reason, the UK tried hard and failed at keeping the sterling bloc together, but the writing was on the wall and it was never going to recover as an international reserve currency:

https://www.semanticscholar.org/paper/Zombie-International-Currency%3A-The-Pound-Sterling-Avaro/88fbe94522770d9a9b471c3c2ff0f6acfc037a6b

https://fondation.banque-france.fr/sites/default/files/media/2021/06/10/gdre_avaro.pdf

I don’t know where the final version is going to be published but it’s a good read.

Now you are the one with the great share. The question is, was the author looking for any excuse to include Zombie in the title (horror fan??) ?

Menzie et al,

So I did a bit of checking on my own. Yeah, it is true that the whole reserves thing was handled differently with the upshot that it is probably impossible to really meaningfully determine. Clearly from WW I to the immediate aftermath of WW II saw a huge shift by the end of which for sure the USD was ahead, although there was a lot of inertia with so many pounds out there.

One moment when there was a particularly large shift appears to have been 1929. I got that from a paper by yet another leading expert, maybe the only one more knowledgeable than Eichengreen, the late Charlie Kindleberger. He reports that the Bank of France, certainly one of the major players, made a major shift from pounds to dollars in 1929. It is possible that is the precise moment the overall balance shifted too.

https://www.economicsnetwork.ac.uk/archive/keynes_persuasion/The_Economic_Consequences_of_Mr._Churchill.htm

1925

The Economic Consequences of Mr. Churchill

By John Maynard Keynes

The Misleading of Mr. Churchill

The policy of improving the foreign-exchange value of sterling up to its pre-war value in gold from being about 10 per cent below it, means that, whenever we sell anything abroad, either the foreign buyer has to pay 10 per cent more in his money or we have to accept 10 per cent less in our money. That is to say, we have to reduce our sterling prices, for coal or iron or shipping freights or whatever it may be, by 10 per cent in order to be on a competitive level, unless prices rise elsewhere. Thus the policy of improving the exchange by 10 per cent involves a reduction of 10 per cent in the sterling receipts of our export industries….

Some reading for our resident “Russian expert”. I won’t be able to comment on this today because I can’t get around the paywall. But I will read it tomorrow sometime.

https://www.wsj.com/articles/documents-reveal-hundreds-of-russian-troops-broke-ranks-over-ukraine-orders-11654094212?mod=trending_now_news_4

sounds like the us army, etc around 1972…

have the russian kids been rolling grenades under officers’ cots??

Moses,

Not sure why you are invoking me on this one. For one thing I am also blocked by the WSJ paywall so will not read the link. I also have not commented on this matter and have no inside information on it. I have seen various reports of bad morale in among Russian troops, but those have been in various standard western media sources.

Actually (that word you do not like me using) I think my only comment on this matter came as a result of something you consider to be a great failing of mine, my report of Putin’s claims that the troops in Belarus would be going home after their exercises were done. You ridiculed me for taking that report seriously, but it was not only taken seriously by Ukrainian President Zelenskyy, but also reportedly by many of those troops who thought they were going home to Russia, and so were unprepared and lacking morale when instead they were ordered into Ukraine. I think I did comment on that last matter, that their morale was damaged by this fake claim by Putin.

Is that what you had in mind since you have been so obsessed with reminding people that I reported Putin’s claims here seriously?

@ Barkley Junior

I’m surprised your university doesn’t provide you with free access to WSJ. I know even at many small universities most business students can access it for free. I thought I remembered Menzie saying his even has access to a Bloomberg terminal (which mildly impressed me). And your school doesn’t provide WSJ for profs?? Fascinating. That could explain a lot. Do you have internet at JMU??

Moses Herzog: I wish I had free electronic access to WSJ via UW. I don’t. Nor did I via UCSC… Older articles, month old or so, yes…

@ Menzie

Ohp…. I stand corrected Sir, my apologies. I do know some small universities (and therefor I would assume most D1 schools) offer it free to full-time students. Maybe that’s more a low-income thing or “let’s get them hooked while they’re young” thing and they feel profs can handle that? But I apologize for assuming too much there.

@ Prof Barkley

Regarding your query. I was mainly addressing you as I thought a new source of information on Russia might be very useful to you, since your “inside sources” in Russia have mostly managed to embarrass you on this blog. I thought you might be open to better quality sourcing at this point. I have quick-skimmed 80% of the WSJ article just now for whatever it’s worth. Being the naive man that I sometimes am, I thought some soldiers might be deserting the army for moral/ethical reasons. On this, Uncle Moses is being silly again…… It appears commenter “Anonymous” is pretty close to the truth, the main reason for Russian army desertion appears to be lack of motivation, and fear—-not as silly Uncle Moses was earlier conjecturing, moral repugnance. Damn my confounded and intermittent faith in humanity anyway……

Moses,

I think I know why you have your obsession with somehow trying to show that I do not know what I am talking about regarding this or that, and I have hinted at in the past, but simply will not revisit it. As it is, I do think it is a matter that really calls for you to get psychiatric assistance. If you have not been doing so, you really need to.

Do you not understand that on this particular topic you have made far more completely inaccurate and foolish remarks than I have? I am not embarrasses at all about anything I have posted here on Russia or Ukraine, including even my report on what Putin was saying shortly before the invasion. How many times does it need to be noted that Zelenskyy and even Russian troops themselves believed him? And if you want to trumpet your belief in the US intel prediction of the invasion, do you want to trumpet your belief that the invaders would take Kyiv in three days, something I accurately doubted?

As for the idea that the WSJ would be some “new source” for me that I either somehow are unaware of or that is better than the sources I have? Well, again, your brain has simply fallen out of your head onto the sidewalk where you have proceeded to step all over it in full view of everybody here. And you have to apologize to Mwnzie for making a total fool of yourself yet again.

Really, Moses, get some help. Your sickness has really gotten completely out of control.

@ Barkley Junior

Mostly I like showing that you don’t know what you’re talking about, because it’s so easy to show you don’t know what you are talking about. Which was why I knew days in advance you were going to make a fool of yourself on Ukraine. You’d been stating for 10 weeks solid that you didn’t think there would be war in Ukraine. And the Russian troops on the southern border of Belarus made it 98% that indeed war was going to happen. I knew your ego couldn’t “walk it back” after 10 weeks of comments and even a post on Naked Capitalism, in a very sad attempt to juxtapose your nanoscopic geopolitical knowledge with David Ignatius (who has truckloads better grasp on geopolitics than you, even though he is a CIA lapdog). So I knew if I so much as stepped on your little toe, you’d scream real loudly that there would be no Russian invasion of Ukraine, which is exactly what you ended up doing. The real humor of this, is that to this very day, you still have no self-awareness of how you and your ego are easier to read than your average 5 year old, alone in a room with a stopwatch and a large marshmallow.

Barkley is one of those people who likes ATTENTION, whether it is positive attention or negative attention. So let’s give junior the negative attention he craves so badly every waking moment of his life.:

Barkley Rosser said the following, about 1 week before war in Ukraine broke out: “Do keep in mind I am the one here with access to Russian media. That has now been blaring for several days that the troops [ in Belarus ] will go home after the exercises are done, and exercises are exactly what they are doing now. This has more recently been reinforced by statements from Putin in press conferences, such as the one just held after the visit of German Chancellor Scholze.

There is not going to be an invasion, even if some of the details of what Zelensky and Ukraine may agree to are not fully settled, and Victoria Nuland has been shooting her mouth off too much, somebody I wish was not part of this administration.”

https://econbrowser.com/archives/2022/02/risk-and-uncertainty-before-the-open#comment-268219

Folks, never let it ever be said, that Barkley Junior isn’t a master of Russian political events /sarc. I certainly would never say such a thing /sarc. I’m just happy if I can convince the Master of Russian events Moldova is west of Ukraine, not north.

Two things:

1. Back then, gold could be used as reserves (which you and MC imply when you say reserves were different back then – it was the gold *exchange* standard) and France had lots of gold; they and the US were the gold hoarding champions of the world. The Brits, however, before WWI were known to not need that much gold in order to ensure stable exchange rates – their reputation allowed them to run their monetary policy off a “thin film of gold” as they called it. But with major players hoarding gold, it made it much harder for others, including the Brits, to keep their currency pegged to gold after WWI. Combined with a gold valuation of sterling that was too high, it made it impossible for the UK to stay on the gold exchange standard. That’s probably why they were the first to abandon gold, in 1931.

2. The politics of empire were important to the Brits as well. Their empire (colonies + dominions), plus apparently a couple other countries, constituted a sterling bloc. There were certain trade and other inducements to remain in the bloc. But this unwieldy system was bound to fail as a) the advantages of being tied to Britain were fading – why not the US or Germany?, and b) the pound was harder and harder to maintain at parity in any case. And ultimately, the Brits were in no position to maintain their empire militarily anymore. It’s a wonder the bloc lasted as long as it did.

AndrewG,

Gold is still used as part of central bank reserves in many of them. The value of those simply fluctuates with market prices as there is no fixed peg between gold and any currency.

@Barkley Rosser

Yes, you’re right. I think even the Fed still has gold. What I meant to say was gold was the primary backing of most major economies’ currencies and therefore the main kind of reserve. Today, gold is not so important to currencies.

AndrewG,

Yes, the Fed has gold, a lot of it. I think in fact that the largest single pile of gold in the world is the one lying in the basement of the New York Fed, although I may stand to be corrected on that. Maybe super alert Moses can find a WSJ article that will refute it. But it is certainly a huge pile of gold, although some of it belongs to other nations.

As a matter of fact, one of the more amusing aspects of the final gasps of the remnant of the gold standard was in the early 60s when gold-obsessed Charles de Gaulle demanded that the US transfer gold to France at a time when France had a bilateral current account surplus with the US. So what happened was that some people went down into the basement of the New York Fed and went to one room containing piles of gold that belonged to the US, put it on some carts, and then trundled it down the hall to another room where there were piles of gold belonging to France. Hot stuff.

@BR

*INTRINSIC VALUUUUUEE*

Eichengreen is indeed the person to read, and he and others will tell you it was WWI that did it. The UK had to liquidate many of their overseas assets to pay for the war. Guess who ended up becoming the world’s biggest capital exporter? The US. But it’s more complicated than that, since after the war the British Empire (or at least the sterling bloc) turned inwards for reasons I’m not clear on – and as early as the 20’s. And when the Brits tried to go back to gold in1925, they arguably pegged the pound too high, resulting in a series of crises. Keynes famously blamed Churchill for Britain’s terrible economic state, and in a role reversal, the US had to act to prop up the pound.

After the war, the US also became the world’s biggest hoarder of gold, which certainly made it the most credible country in the gold exchange standard era, but made the rest of the world’s financial system more precarious.

https://news.cgtn.com/news/2022-06-01/Chinese-mainland-records-35-new-confirmed-COVID-19-cases-1avdwd8AQow/index.html

June 1, 2022

Chinese mainland records 35 new confirmed COVID-19 cases

The Chinese mainland recorded 50 confirmed COVID-19 cases on Monday, with 28 linked to local transmissions and 22 from overseas, data from the National Health Commission showed on Tuesday.

The Chinese mainland recorded 35 confirmed COVID-19 cases on Tuesday, with 22 linked to local transmissions and 13 from overseas, data from the National Health Commission showed on Wednesday.

A total of 96 asymptomatic cases were also recorded on Tuesday, and 10,638 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 224,134, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-06-01/Chinese-mainland-records-35-new-confirmed-COVID-19-cases-1avdwd8AQow/img/07c7ba8e075e44629ab02eb6fb595851/07c7ba8e075e44629ab02eb6fb595851.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-06-01/Chinese-mainland-records-35-new-confirmed-COVID-19-cases-1avdwd8AQow/img/2f66c4236f4040538f4ebc87b9c3404d/2f66c4236f4040538f4ebc87b9c3404d.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-06-01/Chinese-mainland-records-35-new-confirmed-COVID-19-cases-1avdwd8AQow/img/63f6263fd660465ebb991912fd915af8/63f6263fd660465ebb991912fd915af8.jpeg

https://www.worldometers.info/coronavirus/

May 31, 2022

Coronavirus

United States

Cases ( 85,901,797)

Deaths ( 1,031,613)

Deaths per million ( 3,082)

China

Cases ( 224,099)

Deaths ( 5,226)

Deaths per million ( 4)

https://www.nytimes.com/2022/05/31/health/omicron-deaths-age-65-elderly.html

May 31, 2022

During the Omicron Wave, Death Rates Soared for Older People

Last year, people 65 and older died from Covid at lower rates than in previous waves. But with Omicron and waning immunity, death rates rose again.

By Benjamin Mueller and Eleanor Lutz

Despite strong levels of vaccination among older people, Covid killed them at vastly higher rates during this winter’s Omicron wave than it did last year, preying on long delays since their last shots and the variant’s ability to skirt immune defenses….

https://www.worldometers.info/coronavirus/

May 31, 2022

Coronavirus

New York

Cases ( 5,601,528)

Deaths ( 69,473)

Deaths per million ( 3,571)

China

Cases ( 224,099)

Deaths ( 5,226)

Deaths per million ( 4)

https://news.cgtn.com/news/2022-05-30/Maternal-infant-mortality-rates-in-China-drop-to-historical-low-1asgHJRb2EM/index.html

May 30, 2022

Maternal, infant mortality rates in China drop to historical low

China’s maternal and infant mortality rates have both dropped to a historical low, the National Health Commission said Monday.

In 2021, China recorded a maternal mortality rate of 16.1 per 100,000, said Song Li, head of the Commission’s maternal and child health department. At the same time, the mortality rates of infants and children under five have decreased to 5 per thousand and 7.1 per thousand, respectively, both dropping to a record low.

Compared to 10 years ago, China’s maternal mortality rate and the mortality rates of infants and children under five have dropped by 38 percent, 58 percent and 54 percent, respectively, Song said.

Song said the country has made notable achievements in building healthcare mechanisms for women and children, improving related health services and ensuring equal access to these services.

There are 3,032 maternal and child healthcare institutions, 793 maternity hospitals and 151 children’s hospitals nationwide. The number of obstetrician-gynecologists and pediatricians in the country has grown to 373,000 and 206,000, respectively….

https://fred.stlouisfed.org/graph/?g=Q2wQ

January 15, 2018

Life Expectancy at Birth for China, United States, India, Japan, Germany, Indonesia and Brazil, 2007-2020

https://fred.stlouisfed.org/graph/?g=Q2wH

January 30, 2018

Infant Mortality Rate for China, United States, India, Japan, Germany, Indonesia and Brazil, 2007-2020

Gallup’s Economic Confidence Index suggests the US is in recession now, at a level comparable to Feb. 2008.

https://news.gallup.com/poll/393176/economic-pessimism-growing.aspx

The issue reflected here is inflation, not the measures being taken by the Fed to reduce it. None of the major indicators suggest a recession right now or even very soon.

Here’s an interview with Larry Summers on CNN.

https://www.cnn.com/videos/business/2022/06/01/larry-summers-inflation-janet-yellen-federal-reserve-newday-vpx.cnnbusiness/video/playlists/business-economy/

I have been largely in agreement with Summers on the stimulus and Fed policy. The stimulus was too big and Fed policy was too easy, the latter again because the Fed confused a recession with a suppression, which I have been saying all along, and which I think Janey Yellen now concedes at some level (still not sure she can differentiate the two).

I am not sure I agree with Summers on the need for more interest rate hikes. Summers notes the 1970s precedent, and I think that’s partially fair, but I think there are also several important differences.

First, the underlying interest rate is lower because the demographic context is much different, so current rates are high by comparison with the underlying ‘natural’ rate in 2022.

Second, we are speaking not only of a massive monetary stimulus, but also a whopping fiscal stimulus, and I think much of the inflation and bottlenecking is associated with fiscal policy, which had no equivalent in the 1970s. As the $1.5 trn stimulus rolls off, we would expect a stiff, if shortish recession as purchasing power of 7% of GDP goes missing from the economy. By simply ending the stimulus, the economy is already suffering massive contractionary fiscal policy, so raising interest rates is just piling on.

Third, consumer sentiment suggests we are already in a recession — we were in Q1 — and ordinarily we would be easing interest rates, rather than raising them, once a recession had started.

Fourth, the EU has now delivered us an oil shock on a plate, and that’s going to take the global economy crashing down.

I personally would probably hold interest rates at their current level for a while and wait for some data to roll in.

https://www.epi.org/blog/wage-growth-has-been-dampening-inflation-all-along-and-has-slowed-even-more-recently/

I’ve nearly always been a friendly party to Menzie here on the blog, hope he considers me as such, but also have my own mind and have shown disagreement on some things. Brexit. Neera Tanden. I’m sure I could think of other divergences of opinion if I was up to making the effort. I think it’s fair to say Menzie has been a …… “tepid supporter” of Summers’ thoughts on inflation. I’m honestly curious what Menzie thinks about Summers’ recently talking out of both sides of his mouth on the CBO’s inflation numbers when I think Menzie generally respects the CBO’s manner of crunching the numbers.

Steven,

Well, Summers now looks wise to have warned that fiscal policy was too stimulative last year and probably fed policy was as well. But as I have noted US core inflation seems to be only about 2 percentage points higher than in EU, which is probably a measure of the excessively stimulative policies in the US. A huge amount of what is going on still reflects supply side issues, with two and a half rounds of new Covid variants since a year ago when people like Yellen and lots of us here were forecasting inaccurately inflation would be transitory, as well as, of course the war in Ukraine with all the disruptions of oil, natural gas, and food markets from the supply side that have come out of it. About the only good thing going on now is that it looks like the lockdown in Shanghai is over, which should help ease the supply side bottlenecks somewhat.

Consumer sentiment is not a measure of whether we are in a recession now or not. It is an important leading indicator, but not absolute. Consumer spending apparently is still holding up by and large in the US, with a few exceptions such as in the housing market. It may lead to reduced consumer spending and a recession, but we are not in one yet.

Oh, and it remains the case that nobody else out there is into your concept of “suppression.”

Summers looked wise last year, as I noted at the time.

As for suppression: Well, if you had bought into that concept, we wouldn’t have crippling inflation now, would we? I mean, you can pick it right off the graph with simply visual inspection.

Btw, Biden is now even less popular than Trump was during this time in his administration, with a net approval rating of -13.0 versus -11.1 for Trump. I can’t even conceive of how Biden pulled that off. (Okay, I can: Inflation.)

https://projects.fivethirtyeight.com/biden-approval-rating/?ex_cid=rrpromo

The Democrats are going to be slaughtered in November. That’s not necessarily a good thing, but that is what will happen, I think.

“As for suppression: Well, if you had bought into that concept, we wouldn’t have crippling inflation now, would we? I mean, you can pick it right off the graph with simply visual inspection.”

Larry Summers and Adam Posen and other hawks are relying on ideas about aggregate demand and supply, not “suppression.” I don’t recall Yellen talking about a depression; besides, she’s not on the Fed board anymore. I also don’t recall Powell or other board members talking about a “depression,” particularly in 2021, but I am happy to be corrected here.

To the best of my knowledge, I am the only analyst making distinctions among recessions, depressions and suppressions. It is clear that Powell felt the 2008-2009 stimulus was too small, and really cut loose with the easy money in 2020 and 2021. Monetary policy was set so loose because Powell thought that 2020 looked like 2008. But the comparison was incorrect, because the former was a depression — where collateral is impaired — and 2020 was a suppression, where the government was literally preventing people from leaving their homes. Very different animals. Thus, putting the FFR to zero in 2008 (2009?) had no impact on either asset prices or inflation for literally years, whereas the same policy in 2021 exploded asset values in a matter of months.

So, yes, you are correct. The profession, including Summers, Powell and Yellen, does not distinguish recessions, from depressions or suppressions. As a result, monetary policy from 2008 (post crisis) was largely ineffective. Massive QE had relatively little stimulative effect and absolutely blew up the Fed’s balance sheet. Meanwhile, similar policies in 2020/2021 blew up asset and housing values in months.

Yellen has said she misunderstood the situation. She could have done worse than use a recession / depression / suppression framework. The policy outcomes would have been better in both 2008+ and 2020-2021.

“As for suppression: Well, if you had bought into that concept, we wouldn’t have crippling inflation now, would we?”

Never mind suppression is a totally made up term on your part which no one including you knows what it means. Look dude – you do not know a damn thing about macroeconomics so could you have the decency of not writing such utter gibberish?

Yes, Steven, it looks that Biden is unpopular largely because of inflation, although the botched exit from Afghanistan also hurt. But really, I do not think only about 2% of that inflation can be laid at his feet, or his and the Fed’s. The rest is supply side stuff that was going to happen unless one decided to just let Putin have his way in Ukraine, which I do not think you support.

I am glad that you recognize that you are all by yourself with your cooked up concept of “suppression.” Sorry, but no: Janet Yellen would not have had better analysis of what has gone on if she had adopted it.

BTW, even if Biden remains unpopular this fall, the Dems may yet avoid disaster electorally. We have seen voters separate a party from a president in the past. And the Dems will be able to run on things like abortion and guns against bonkers GOPs pushing very unpopular policies.

It may also get to be realized that even though people are mad at Biden about inflation (which might be somewhat better by then, although I am not forecasting that particularly), they may also notice that the GOPs have no policies other than calling for attempting to increase oil production in the US, which will not have an impact for some time in the future.

Steven Kopits

June 2, 2022 at 12:08 pm

To the best of my knowledge, I am the only analyst making distinctions among recessions, depressions and suppressions.

OMG. You are not an analyst. The reason no one else is talking about your little trio as the term suppression is your made up BS and your definitions of the other two terms shows that you have no clue what the terms mean. Word salad is not analysis. Stop babbling this BS as you are clearly a clueless moron.

“To the best of my knowledge, I am the only analyst making distinctions among recessions, depressions and suppressions.”

No offense, Steve, but … from one non-macroeconomist to another, I don’t see the value of your framework. At least, not as applied here.

So then how do you think about those lines on the graph, Andrew?

In the garden variety recessions, FFR never went to zero and the economy typically recovered within three years. In 2007, the FFR went to zero for seven years, asset prices were all but unmoved, and the economy did not fully recover by some measures for 10 years. In 2020, the FFR went to zero and blew out asset prices in a matter of months.

So tell me, Andrew, if all these phenomena are the same, how do you explain the different policy outcomes? What framework do you use to make sense of it all?

Btw, Menzie, I would ask you to weigh in on the expected GDP effects of a reduction in government spending of 7% of GDP. In your opinion, is this likely to result in a recession? If so, what kind?

This might be a model to consider:

February to October 1945: End of WWII

World War II was an economic boon for the U.S. economy as the government infused tens of billions of dollars into manufacturing and other industries to meet wartime needs. But with the surrender of both Germany and Japan in 1945, military contracts were slashed and soldiers started coming home, competing with civilians for jobs.

As government spending dried up, the economy dipped into a serious recession with GDP contracting by a whopping 11 percent. But the manufacturing sector adapted to peacetime conditions faster than expected and the economy righted itself in a tidy eight months. At its worst, the unemployment rate was only 1.9 percent.

This suggests a short, sharp technical ‘jobby’ recession (as opposed to a jobless recovery). Of course, this does not consider monetary policy, but perhaps a post-war recession is a good model for what may happen to year end.

Thoughts?

https://www.history.com/news/us-economic-recessions-timeline#:~:text=February%20to%20October%201945%3A%20End%20of%20WWII&text=As%20government%20spending%20dried%20up,in%20a%20tidy%20eight%20months.

Deficits are endogenous. Tax receipts will go up as the economy grows. And the American Rescue Plan’s spending doesn’t just appear one month then disappear some time later. Much of the focus was on the unemployed, and there are far fewer of them with an unemployment rate well below 4%. A lot of other spending was about plugging holes in state and local government budgets that would recover, again because of recovering tax revenue. And not only will the spending naturally taper, but their real value has been falling due to inflation. So I don’t think we should expect a 7% real contraction in annual GDP due to fiscal contraction as you seem to be implying. I am still interested in what Menzie thinks though.

Probably not 7%. But 4% wouldn’t surprise me.

If you are a Keynesian and believe in stimulative deficit spending, then by extension you must believe in contractionary effects of a reduction in government outlays, no? And the amount of money is material this time around.

@Steve,

“If you are a Keynesian and believe in stimulative deficit spending, then by extension you must believe in contractionary effects of a reduction in government outlays, no?”

You don’t have to be a “Keynesian.” Even in RBC terms, there’s an argument for stimulus, based on consumption/tax smoothing. (By the way, does that make you a Keynesian now?)

And you’ve missed my point about timing. Timing matters a lot here. Much of the spending was front-loaded, and it peters out. And last I checked (happy to be corrected) we are already in the fiscal-drag part of the stimulus cycle, and yet we just added more than 300,000 jobs in May. The Fed being more hawkish seems pretty reasonable to me.

“Btw, Menzie, I would ask you to weigh in on the expected GDP effects of a reduction in government spending of 7% of GDP”

Government purchases are not going to decline by even 1% of GDP. This claim of yours was stupid the first time. Stop repeating your usual really dumb garbage.

“Steven Kopits

June 2, 2022 at 12:14 pm

If you are a Keynesian and believe in stimulative deficit spending, then by extension you must believe in contractionary effects of a reduction in government outlays, no?”

No moron. You are talking about the freshman version of macro where interest rates and exchange rates are fixed. Now had you bothered to actually read what Dr. Chinn has posted on this topic (as opposed to your habit of just babbling BS all day long) you might have realized how incredibly DUMB this statement is.

Look – stop talking and start listening for once in your worthless life. You might learn something.

…Janet Yellen…