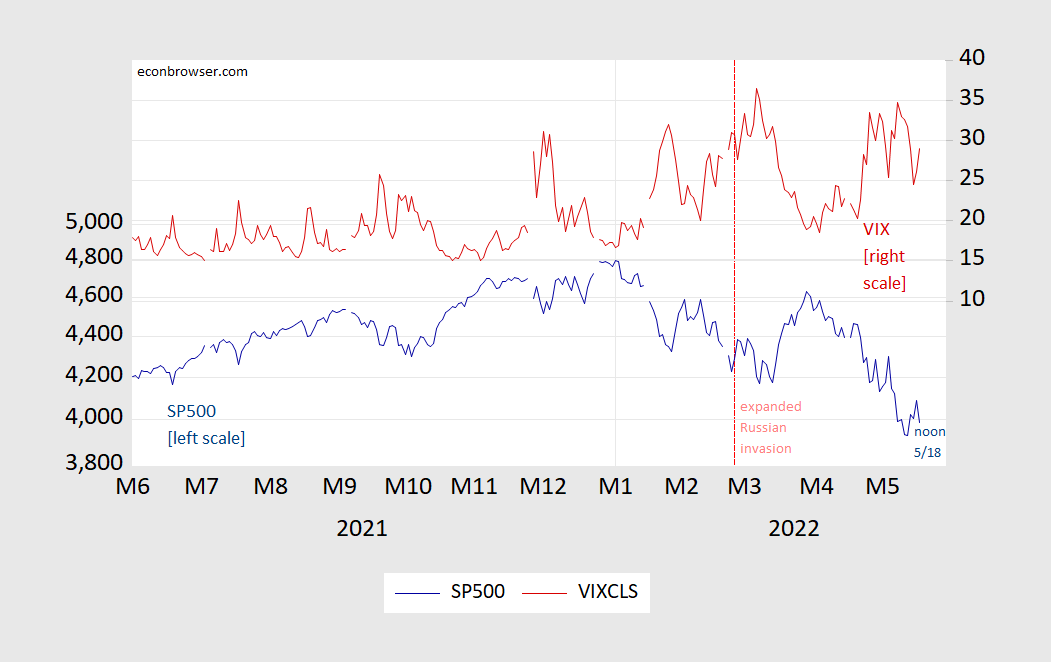

Over the last 9 months, the S&P500 has seemingly peaked and is now declining. Risk, discounting or something else?

Figure 1: S&P 500 index (blue, left log scale), and VIX (red, right scale). 5/18 observation as of noon, ET. Source: FRED.

How much further to go? Who knows, but an asset pricing framework can help think about the important factors. Stock prices should be the present discounted value of the stream of dividends expected over the future. Of course, most of the things of interest are unobservable — what’s the market’s expectations of dividends, what’s the rate to discount by (which is composed of the risk free rate and the equity risk premium), and are there bubbles. Assume no bubbles – then the making another assumption about dividends and earnings, one gets the price earnings ratio as an interesting variable.

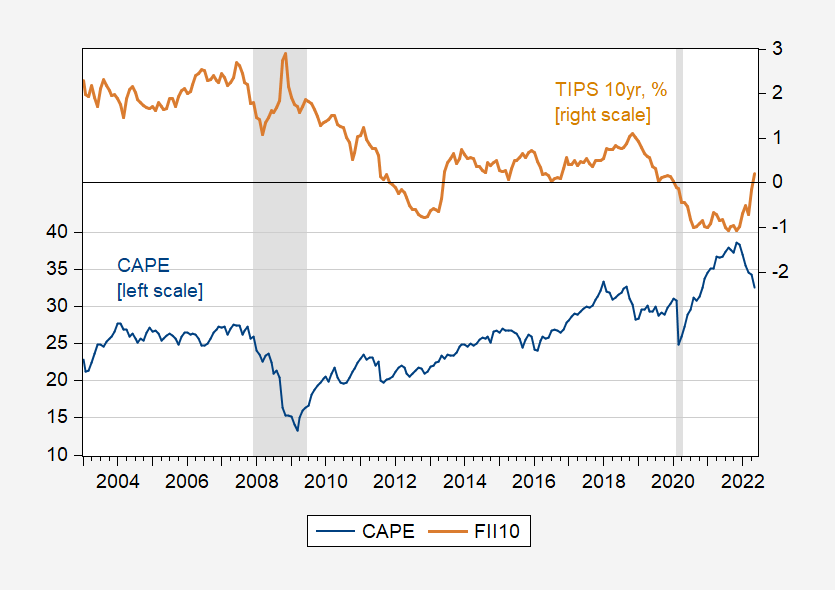

Here’s Shiller’s cyclically adjusted price-earnings ratio, plotted against the real 10 year yield (TIPS):

Figure 2: Shiller cyclically adjusted price-earnings ratio (CAPE) (blue, left scale), TIPS 10 year, % (brown, right scale). NBER defined recession dates peak-to-trough shaded gray. Source: Shiller, Treasury via FRED, NBER.

As long as the trajectory of expected real rates continue to move upwards, then CAPE is likely to continue to fall, even holding risk appetite and the path of expected earnings constant. (Note CAPE is still high, but much lower than the value of 43.8 recorded in January 2000.)

“Stock prices should be the present discounted value of the stream of dividends expected over the future. Of course, most of the things of interest are unobservable — what’s the market’s expectations of dividends, what’s the rate to discount by (which is composed of the risk free rate and the equity risk premium)”

Remember that 1999 prediction about the DOW reaching 36000 any day now by Glassman and Hassett? Where did they go wrong? We first of all they assumed a zero equity risk premium which is sort of extreme. But they also assumed dividends = earnings even for companies that were going which would require investment in new capital. Now that is a fundamental mistake which no one who remotely understands the valuation of assets would make. And yet their silly book was published. Go figure! And one of the authors of this incredibly dumb argument was the head of the CEA under Trump.

You’re giving them way too much credit. Those guys were just selling a book. Hassett is as cynical as they come.

Stock prices should be the present discounted value of the stream of dividends expected over the future. Of course, most of the things of interest are unobservable — what’s the market’s expectations of dividends, what’s the rate to discount by (which is composed of the risk free rate and the equity risk premium)

Housing valuations also reflect the market expectations of rent and the discount rate. A while back the former was quite high and mortgage rates were less than 3%, Princeton Steve insisted housing was in some sort of value. It is clear that Princeton Steve never learned even the most basic premises of financial economics.

When I was a youngster, and very excited about equities and maybe participating in it a a lot as an adult, I remember when 10–15 P/E was a pretty healthy range of number. 20+ P/E was starting to get high, and if it was under 10 or certainly under 7–8 you might start to wonder what was the “negative factor” or “not surface obvious” negative that was making the P/E so low. If you did your other balance sheet, 10-k, 10-q etc. homework you could do pretty well as in individual investor (a dead breed now) and the ground was fertile with great pickings.

Oh, for the simple days…… [ the exhausted and drained middle age man bemoaned ]

Symbol Last Price Change % Change

TGT

Target Corporation 157.28 -58.00 -26.94%

COST

Costco Wholesale Corporation 429.59 -60.88 -12.41%

^DJI

Dow Jones Industrial Average 31,711.08 -943.51 -2.89%

^IXIC

NASDAQ Composite 11,479.03 -505.50 -4.23%

Market betting against retail right now.

Diesel costs too high; shortage of long haul truckers. What could go wrong with supply chain from that?

Funny you forgot about Wal-Mart. Oh wait – their market valuation even now is $337 billion. Now have you ever looked at the 10-K filings for any retail giant? Oh wait you have no clue what that is. Never minds.

For 2021, Wal-Mart’s sales = $568.8 billion and its operating profits = $25.9 billion so I doubt anyone is worried that their shareholders are doing poorly.

I’m a little surprised that you forget to tell us what Donald Luskin has been saying. As they say – people who listen to him are poor because he is stupid.

Then again Luskin is a lot smarter than you could ever be.

The combined Walton family net worth is down to around $212 Billion. Two day losses of close to $34 Billion, or about 14%.

I would feel bad for them, but my own market setbacks total about 16%.

Somehow, we’ll all survive.

Costco stock may have recently declined but I guess the Village Idiot Bruce Hall did not know it was enjoying a Biden boom!

https://finance.yahoo.com/quote/COST/

This is getting too easy as Bruce is incapable of doing any real research so making fun of this Village Idiot may just be cruel. But hey – he sets himself up 24./7!

Lucy, you are quite the dogmatic apologist for a decrepit “leader”.

The pain is just beginning.

Mary, Mary, yiou just can’t keep your diapers on, can you?

For all the declining going on right now, the DJI and S&P are still higher than when Biden took office, although the NASDAQ is now lower, and a lot higher than when when the 2020 election happened, which your guy said would lead to an immediate and massive stock market meltdown.

We are waiting to see if you can stop stinking the place up with your name calling infantilism.

Shame on you for confusing Brucie boy aka Mary girl with reality!

Barkley, yes, higher now. But some of the gain was simply a rebound from the artificially induced crash in 2020 when most states shut down their economies to “stop COVID”. Yeah, that didn’t work out. Come back to this in a few months. The economic and stock market pain is just beginning.

https://www.yahoo.com/finance/news/chicken-wings-34-pent-inflation-140006054.html

https://www.nytimes.com/2022/05/16/business/dealbook/bernanke-stagflation.html

No, it’s not about chicken wings, it’s about the ability of sellers to absorb the higher levels of inflation they have been experiencing rather than passing that on to customers.

Okay, out of respect for your sensibilities, I will stop referring to pgl as that primitive hominid.

‘But some of the gain was simply a rebound from the artificially induced crash in 2020 when most states shut down their economies to “stop COVID”. Yeah, that didn’t work out.’

Bruce Hall takes a victory lap along with Donald Trump as their 2020 disinformation campaign did indeed make the damage from the virus much worse than it needed to be. Bruce is so proud that he managed to let a lot of non-white people die needlessly. Doing his MAGA part to counter “Replacement”.

sad response

fall 2020!

then we had in spring 2021 another stimulus spree, and more $90B a month of asset purchases, and zipr!!

the fed is > year behind the curve.

i suspect that is trump’s fault!

if no one blimnks…..

manchin is a saint!

OK, Bruce, I had forgotten that you actually did explain the name you were using, a suggestion that pgl is actually an Australopithecus. Oh well, I forgot as I suspect everybody else also forgot. Anyway, time to move on.

Barkley Rosser: I guess I was not paying attention either; I thought it was an allusion to Lucy in Peanuts…

Bruce Hall is upset that he cannot buy a 40-pound box of chicken wings cheaply? Damn – how fat is this dude anyway? His medical bills must be through the roof with such an unhealthy diet. Oh wait – he is living off the government dole so you and I are paying his medical bills.

And I accused CoRev of writing gibberish. You need to spend less time surfing young boys on the internet and pay attention to your preK teacher.

https://finance.yahoo.com/m/8b2943f1-621f-3545-b217-1e2966567c58/it-was-already-a-terrible.html

What has Old Uncle Joe done lately?

Biden is younger than you and a whole lot smarter. Then again the rocks in my backyard are smarter than you are.

https://www.nytimes.com/2022/05/17/opinion/crypto-crash-bitcoin.html

May 17, 2022

Crashing Crypto: Is This Time Different?

By Paul Krugman

Last week TerraUSD, a stablecoin — a system that was supposed to perform a lot like a conventional bank account but was backed only by a cryptocurrency called Luna — collapsed. Luna lost 97 percent of its value over the course of just 24 hours, apparently destroying some investors’ life savings.

The event shook the crypto world in general, but the truth is that this world was looking pretty shaky even before the Terra disaster. Bitcoin, the original cryptocurrency, peaked last November and has since declined by more than 50 percent.

Here’s one way to think about that decline. Almost everyone is concerned about the rising cost of living; the Consumer Price Index — the cost of a representative basket of goods and services — has gone up about 4 percent over the past six months. But the cost of the same basket in Bitcoin has risen around 120 percent, which means inflation at an annualized rate of about 380 percent.

And other cryptocurrencies have performed far worse. Two cities — Miami and New York — have introduced their own cryptocurrencies, with enthusiastic support from their mayors. MiamiCoin is down more than 90 percent from its peak, and NewYorkCityCoin is down more than 80 percent.

By now, we’ve all heard of them, but what exactly are cryptocurrencies? Many people — including, I fear, many people who have invested in them — probably still don’t fully understand them. Saying that they’re digital assets doesn’t really get at it. My bank account, which I mainly reach online, is also a digital asset, for all practical purposes.

What’s distinctive about cryptocurrencies is how ownership is established. I own the money in my bank account because the law says I do, and the bank enforces that legal claim by requiring, one way or another, that I prove that I am, in fact, me. Ownership of a crypto asset is established through what’s known as the blockchain, an encrypted (hence the name) digital record of all previous transfers of ownership that supposedly obviates the need for an external party, such as a bank, to validate a claim.

What’s the point of this kind of decentralized finance, and what purpose does it serve? Well, I’ll get to all that.

Though cryptocurrencies are currently way down, boosters — and as anyone who’s played in this space can tell you, there are few boosters quite as boosterish — will reassure you that this has happened before. Bitcoin, in particular, has always bounced back from previous dips, and investors who HODLed (held on for dear life to their coins, despite falling prices) have ended up with huge capital gains. But there are reasons to believe that this time may be different….

ltr,

I have not read the rest of Ktugman’s argument, but one reason why the giant runup may be over is that previously there were all these people who had not invested in it and did not know about it. They could be brought in. But now basically everybody knows about it, and now grandmas are buying in, with all those celebs doing ads all over the place, although I read some of them are a bit embarrassed now. They have run out of new people to get to buy it, even as some outfits like Fidelityare now prepared to let people put up to 20% of their retirement portfolios into bitcoin. If we do not see that turning it around, all the grandmas get scared, that will be it, although we csn certainly expect plenty of volatility, so probably some short term dramatic up movements for at least short periods.

“They have run out of new people to get to buy”

Another way to say crypto is mostly a scam.

One means of delivering returns which is left out of most stock valuation models is buy-backs. A number of explanations have been offered for the price effect of buy-backs. Two popular explanations are that reducing shares outstanding improves EPS and that taxes are avoided:

https://www.wallstreetprep.com/knowledge/share-buyback/

McKinsey argued that manipulating EPS was an inadequate explanation and that the right answer is tax avoidance:

https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/

A few years ago, I read some efforts to account for the effects of the premium over market that is paid in many buy-backs. Generally, including that premium improved the explanatory power of the model. As I recall, these fell into the tax avoidance camp, though that was not explicit in the explanation. Can’t find them now – sorry.

Buy-backs are funded with debt and driven by interest rates. Rising rates imply fewer buy-backs, helping to deflate stock valuations.

Buy-backs have been viewed as not violating regulation prohibiting stock price manipulation. The result is a windfall to share holders at taxpayers expense and more indebted firms, so an increase in risk for the economy from two directions. If buy-back for no other reason than to boost stock prices were viewed by regulators as stock manipulation, firms and the economy in general would be less indebted, stock valuations would be less rate sensitive and I wouldn’t be left wondering how Senator Warren missed this one.

I have occasionally mentioned the volatility switch driven by options strategies – options strategies reinforce low volatility when volatility is low, but reinforce high volatility when volatility is high. Here is a clearer explanation than I have ever bothered to write:

https://www.nakedcapitalism.com/2022/05/how-the-options-tail-has-come-to-wag-the-market-dog.html

Gamma trading is not directly related to the impact of interest rate movements on stock valuations, but there is a strong indirect effect. Options positions have to be financed. Repo and other short-term financing vehicles account for most of that financing. The big rise in options trade described by Linden is yet another result of the low cost of finance. So while options strategy are adding to volatility now, higher borrowed rates may cut into options trade in the future. Warren Buffet would be pleased.

https://fred.stlouisfed.org/graph/?g=r4vw

January 15, 2018

Wilshire 5000 Total Market Index, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=PAbp

January 15, 2018

Real Wilshire 5000 Total Market Index, 2017-2022

(Indexed to 2017)

Wilshire 5000 Total Market Index, 2017-2022

I get the fact MAGA hat liars such as Bruce Hall tell us Trump was GREAT for the stock market while socialist Biden is destroying market valuations but your chart shows how dishonest this spin is.

(a) yes market valuations rose by 50% from the time Trump took office to the start of the pandemic;

(b) the pandemic which was made much worse by Trump’s incompetence (cheered on by the lies of Bruce Hall) wiped out all of those gains; and

(c) since then market valuations have more than doubled.

But no Bruce Hall is trying to tell us two lies – market valuations have collapsed and had we followed his advice of taking bleach this virus would have washed away by Easter Day of 2020.

I ask you – can someone really be THIS DUMB?

https://english.news.cn/20220514/9ef799ee58ff47c18fe8ff01b92b68f2/c.html

May 14, 2022

Listed firms on STAR board report striking profit growth

BEIJING — Companies listed on China’s Nasdaq-style sci-tech innovation board, known as the STAR Market, reported staggering profit growth for 2021 and the first quarter of the year.

Despite multiple challenges, the companies saw their combined net profits soar 75.89 percent year on year in 2021, and surge 62.42 percent in the first three months.

Combined revenues jumped 36.86 percent from a year ago in 2021, and climbed 45.6 percent in the first quarter.

Listed companies in biomedicine, new chemical materials and new energy sectors performed more strongly than others in the first quarter, said Wang Jun, an analyst with the BOC International (China) Co., Ltd.

China launched the STAR Market on July 22, 2019, kicking off a trailblazing leg of the country’s innovation drive and capital market reform.

https://english.news.cn/20220515/7fa92dd8b07d4a4fbdd144f17bc4b19c/c.html

May 15, 2022

China’s sci-tech innovation board more attractive to foreign investors

BEIJING — Shanghai Stock Exchange’s sci-tech innovation board, also known as the STAR market, has become increasingly appealing to foreign investors, data from the board shows.

So far, nearly 90 percent of the board’s stocks that are under the STAR market connectivity mechanism have been included in MSCI, FTSE Russell and S&P Dow Jones, and the number keeps rising, statistics from the board showed….

vix is getting to be a trailing indicator!

“Over the last 9 months, the S&P500 has seemingly peaked and is now declining.”

This is a strange comment. We know what the peak was “[o]ver the last 9 months” because it is history. As such, are you asserting the S&P500’s recent high is one that isn’t likely to be eclipsed anytime soon? Or ever? Maybe you could clarify what you meant by “seemingly peaked”. And the importance of such a comment.

More much ado about nothing again. His statement was clear and it never suggested that the recent “peak” was never to be seen again.

One has to wonder why you insist on writing insulting gibberish. Did your supply of ED pills run out and the local government refuses to pay for any more of them for you? Look if you truly need to get yourself excited – the rest of us will take up a collection so as to fund more pills for you.

So clear it up. Don’t write gibberish. Clear it up. What on earth was “seemingly”?

You asking someone to write clearly? Seriously?

ClownTime

this is a strange comment. could you please clarify what you mean by “strange”? and the importance of such a comment? I saw nothing “strange” in the statement by prof. chinn.

Econned seems to have one purpose in life – to be the biggest jacka$$ on the internet. On that – he certainly excels!

And you live for it. You love it. You don’t exist without it (or with it). The clown.

I find it strange to say something “seemingly” happened when we have evidence of occurring. It’s nonsensical.

You are truly the biggest waste of time ever.

So why are do you “waste” your time on replying to my comments? And do so with ZERO substance? The PaGLiacci clown show never ends.