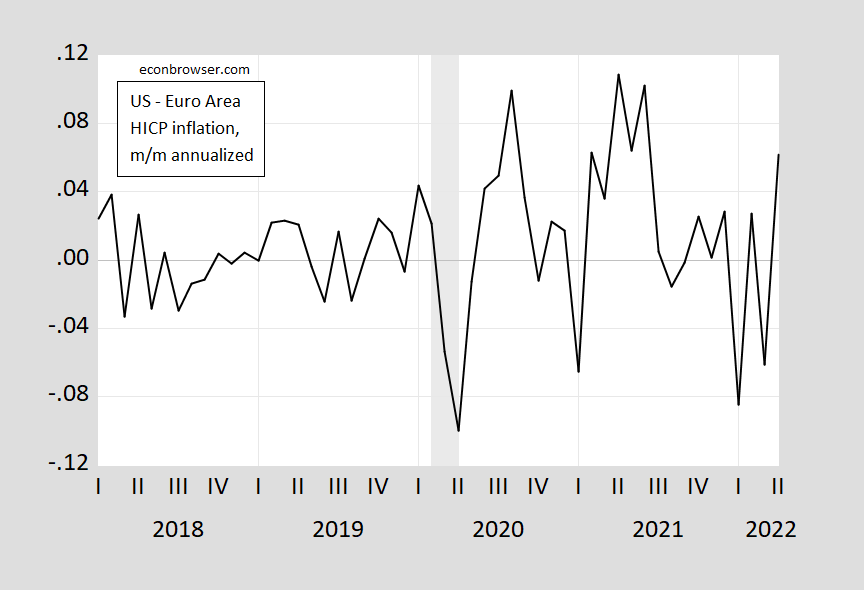

Since the Covid pandemic struck in the US in 2020M02, 1.1 percentage points; since 2021M03, 1.6 percentage points, using HICPs (0.4 ppts and 0.7 ppts, respectively using CPI for US, HICP for Euro Area).

Figure 1: Month-on-month annualized inflation differential for US-Euro Area (black), calculated using log differences. HICPs seasonally adjusted by author using geometric Census X-12. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat via FRED, NBER, and author’s calculations.

Given the variability in m/m inflation, it’s not surprising that in no case is the measured acceleration statistically significant.

The La Follette Forum was uploaded to YT today, in case anyone is interested. I hope to watch it later tonight.

I watched the Prosperity Session. Very well done. Of course I’ve always been a Chinn and Rampell fan, regular readers only get one guess who my favorite speaker of the 4 was. The great thing about this is Menzie had slides, and I can go back and digest some of those latter slides a little better. Really great stuff. I hope the students and the general audience knew how lucky they were to get this group.

I think in this kind of depressing world we find ourselves in, Menzie spotlighted what I personally view as kind of a “cheerful” aspect. That if Russia and China want to move away from the dollar, they can do that to a degree but it’s going to cost them. And my viewing that extra cost of capital and efficiencies to Russia and China as “cheerful” has nothing to do with my “love/hate” feelings towards China I have talked about before who had personal issues there for some of those seven years. It has to do with a war…… costing human lives and those who have chosen to be on the wrong side of that conflict. So if that immoral choice costs them more, yeah, to me, that’s “cheerful”.

Ehhhh…. I’m with Jason Furman on this one.

I wasn’t aware their opinions were that demarcated.

Sometimes, I too like to throw a grenade from the bushes and then watch participants react. But you have to either be more subtle or find targets more easily triggered. Nice try though. I advise attending the next MAGA rally. You’re not that skilled at this and you need a really dumb mark.

1)https://twitter.com/jasonfurman/status/1518643904463077376?s=20&t=olbGad1jnWt0IvvVFAdPHQ

2) Explain the MAGA comment. I don’t see how it’s applicable to the discussion and/or me.

Well you almost provide a link – but we have to cut and paste into a new window to use it as you apparently are not getting at this either.

Interesting that both Paul Krugman and Jason Furman took note of what Menzie Chinn posted without firing off the type of insults you excel at.

“Since the Covid pandemic struck in the US in 2020M02, 1.1 percentage points; since 2021M03, 1.6 percentage points” – Dr. Chinn’s post.

Gee Dr. Furman had this difference at 1.3 percentage points so they agree at the numbers. Of course Dr. Furman has to add the qualitative statement that a mere 1.3% difference is a large difference. Not sure I would use that language but I do expect another one of your patented childish rants.

You’re literally the only one ranting here. Consecutive posts of you ranting – b*thing about a weblink and now this. All I said is “I’m with Jason Furman on this one”. Keep honking, PaGLiacci.

given the variability on monthly data it is not surprising no-one else uses annualised figures. they are next to useless to discern a trend. I would be interested in wwhat the annual figures are.

If you are so het up about annualised figures then maybe use the three month annualised figures. Much easier to discern a trend.

Not Trampis: But then a statistical test for difference in means would yield misleading inferences. Consider a Brownian motion in monthly data; looking at a 3 month change then induces a moving average process of order k-1=2. Then you would have a misleadingly precise estimate of standard errors if you ignore this fact. You can use HAC robust standard errors, but when the serial correlation is very high, then for instance Newey-West will have poor small-sample properties. So, I see what you mean, but there’s a reason why I’m doing what I’m doing.

Jason Furman has said a lot of things on US inflation. Now Econned may say he agrees with Dr. Furman but of course he is too lazy to bother to link to a single thing Dr. Furman has written, tweeted, or said. Maybe this interview might prove interesting to the many folks here that want to have informed discussions (which of course excludes little brat Econned):

https://news.harvard.edu/gazette/story/2022/03/harvard-economist-weighs-in-on-new-inflation-data/

It isn’t my fault you’re too ignorant/lazy to be abreast of topical conversation(s). I’m not your babysitter.

More angry from the dumbest troll ever! I’m up to date on what Dr. Furman said even if you are too stupid to note which of his many statements you allegedly agree with. Your needed parents to teach you how to deal with others but it is not my fault your parents were utter failures in this regard.

What’s angry? You’re very emotional. Shallow yet emotional. You cannot be “up to date” and make the comments you’ve made. Unless you’re willfully ignorant. A willfully ignorant clown is certainly a possibility.

You remind me of the 2 year old who runs around screaming. When mommy asks little baby what’s the matter – he whines it is too loud here. BWAAAAAAAAAAAAA!!!!

I think I’ve had enough of your lack of… literally everything. You never reply to anything in a meaningful or logical fashion. From this point on, the PaGLiacci clown show is no longer something I’m interested in entertaining.

I’m sorry, PaGLiacci. I understand that your shallow retorts to my comments are, in many respects, your lifeblood. But I’ve become disinterested in your emptiness. I tried.

All the best!

I suppose.

Whatever.

Meh.

https://news.cgtn.com/news/2022-04-21/This-inflation-is-demand-driven-and-persistent-19pdQZn4sCI/index.html

April 21, 2022

This inflation is demand-driven and persistent

By Jason Furman

Commentators have generally offered two arguments about advanced economies’ performance since COVID-19 struck, only one of which can be true. The first is that the economic rebound has been surprisingly rapid, outpacing what forecasters expected and setting this recovery apart from the aftermath of previous recessions.

The second argument is that inflation has reached its recent heights because of unexpected supply-side developments, including supply-chain issues like semiconductor shortages, an unexpectedly persistent shift from services to goods consumption, a lag in people’s return to the workforce, and the persistence of the virus.

The first argument is more likely to be true than the second. Strong real (inflation-adjusted) GDP growth suggests that economic activity has not been significantly hampered by supply issues and that the recent inflation is mostly driven by demand. Moreover, there is reason to expect demand to remain very strong, which means that inflation will persist.

To be sure, inflationary pressures reflect both supply and demand factors, the exact combination of which is unknowable. But when considering the economy as a whole, it is implausible that all the individual supply stories would add up to the generalized inflation we have seen. It is far more likely that the increase in demand exceeds what the economy can produce, leading to higher prices.

By definition, price growth equals the growth of nominal output minus the growth of real output (with a small difference due to compounding). Over the course of 2021, U.S. real GDP grew by 5.5 percent, nominal GDP grew by around 11.5 percent and GDP price growth thus came in at around 5.9 percent. For the OECD as a whole, real GDP growth was slightly lower, at 4.9 percent, and nominal GDP growth was 10.4 percent, yielding 5.2 percent GDP price inflation.

Recall that policymakers largely protected or increased disposable personal income at a time when consumption possibilities were constrained (through most of 2020). If one considers these excess savings alongside the persistence of low interest rates through most of 2021, a rising stock market, pent-up demand, and additional fiscal support, the magnitude of the increase in nominal GDP is not particularly surprising. In the United States, discretionary fiscal stimulus totaled $2 trillion in the 2021 calendar year, but nominal GDP was only $1.6 trillion higher than it was in 2019. If anything, the surprise is that nominal spending was so constrained, and that saving rates remained so elevated.

What about real GDP? Here, we need to remember that all the supply-side stories are different ways of saying that real output was constrained. According to one common story, consumption shifted from services to goods, and, because goods production is less responsive to market changes (more “inelastic”), it could not expand quickly enough. Another story is that labor supply was constrained by the pandemic and the policy response (owing to weaknesses in labor supply in the U.S. and to reductions in hours worked in Europe). And still other stories focus on particular markets, like the reduction in microchip production or the snarling of U.S. ports….

Jason Furman is Professor of the Practice of Economic Policy at Harvard University’s John F. Kennedy School of Government.

It’s not clear to me what Furman is arguing. If all he wants to say is that supply and demand factors are at work driving inflation, well OK. Is anybody smart really arguing otherwise? I that’s his point, it is nt really controversial.

We know that Russian oil supply has been reduced. We know that OPEC has been slow in boosting production in respose to high oil prices. We know that Ukrainian grain harvest and exports have been hindered by Russia’s attack on Ukraine. We know that labor supply has been reduced around the world by Covid. We know that drought is a problem in many grain-producing areas. And so on.

Demand swings from services to goods – check.. Resumption of demand for services got ahead of the return of labor to service firms – check. Those are demand-side issues. Don’t hear anyone disagreeing.

We also know that global effects are more powerful now than they were some decades ago in determining domestic inflation – a factor which seems to be more supply side than demand side.

If Furman’s point is that demand needs to be constrained, the Fed is doing that and has signaled that it will do more. So is Furman quibbling with Powell when Powell said the Fed is using demand management to deal with supply shocks? ‘Cause that’s pretty clearly true. Is he quibbling with DeLong saying that adjustment to the various shocks the world has suffered will be faster in the absence of recession? That’s a question of priorities – adjustment vs inflation.

Either Furman is mostly restating the consensus view while employing a tone meant to sound like he’s correcting an error, or he’s quibbling. Academics quibble all the time, so that’s OK, but we groundlings could use some clarification.

By he way, I’m assuming Furman is not responsible for the title of the article. The title is simplistic and dumb.

I wonder if the editors asked Econned to write that stupid title. Econned did say he agreed with Furman even if this arrogant troll cannot be bothered which of Furman’s many statements he agreed with.

“If Furman’s point is that demand needs to be constrained, the Fed is doing that and has signaled that it will do more.”

The timing is off, but if said a few months ago, when Powell and some liberals not at the Fed argued that it’s all about short term supply shocks so we should just wait it out, then it’s spot on. The supply constraints argument was a cop-out.

Ah – someone knows how to provide what Dr. Furman wrote. I would suggest you have Econned pay you for doing his work for him but then I would not wish upon any person the task of working for the biggest jerk either.

You’re a complete clown. I provided reference to Furman’s stance before you posted these ridiculous comments. Always ridiculousness coming from the resident tragic clown PaGLiacci.

Now you just lie to make up for your incompetence. Figures!

‘pgl

May 18, 2022 at 3:35 pm

Jason Furman has said a lot of things on US inflation. Now Econned may say he agrees with Dr. Furman but of course he is too lazy to bother to link to a single thing Dr. Furman has written, tweeted, or said.’

You provided that rather feebly done link at 5:29PM. So you are both a liar and an utter moron.

You dumb@$$. You can’t even grasp the concept of successive posting or of a timestap.

Econned

May 18, 2022 at 5:29 pm

1)https://twitter.com/jasonfurman/status/1518643904463077376?s=20&t=olbGad1jnWt0IvvVFAdPHQ

pgl

May 19, 2022 at 11:28 am

Ah – someone knows how to provide what Dr. Furman wrote. I would suggest you have Econned pay you for doing his work for him but then I would not wish upon any person the task of working for the biggest jerk either.

May 18 is before May 19

Energy costs are driving inflation in just about all sectors of the economy, but the Biden Administration has taken steps to ensure that our future energy needs will be met by the magic of windmills and seas of glass. Of course, that doesn’t address immediate needs. So, one has to wonder, as does Premier Jason Kenney, just why Old Uncle Joe has had so much antipathy toward Alberta while showing so much consideration for Saudi Arabia (and Iran and Venezuela)..

https://www.energy.senate.gov/services/files/C3125CEA-BBA6-4995-AC40-1F21ACB04CCE

Energy costs are the sole driver of inflation? Seriously Bruce – after all the references to Jason Furman’s discussion, we write such a simpleton statement? Oh wait – you are a simpleton. Never mind.

“but the Biden Administration has taken steps to ensure that our future energy needs will be met by the magic of windmills and seas of glass.”

The problem here is “but.” This has nothing to do with short term energy prices.

It may be that the increase in US inflation relative to EU inflation has not been statistically significant, but it is the case that the rate of inflation in the US has increased somewhat relative to that in the EU. What is also fairly reasonable is to say that the US and EU have experienced approximately similar supply chain disruptions, although they have not been exactly the same. That suggests that the not-statistically-significant rate of relative increase we have seen in the US may be more due to differences in demand side policies, which I think Furman has somewhat argued. Looking at graph presented by Menzie suggests that the period when this difference was the greatest both in magnitude and period was during the first half of last year. This also seems to coincide with what look to be the greatest differences in fiscal policy between the two areas.

This correct, re: demand.

Also Menzie seems to be focused on, to use Furman’s words, “whether any given month was individually statistically significantly different in the US & EA.” But I think Furman is correct on focusing on the collective.

Econned: I don’t think that’s quite right, much as I usually agree with Furman. What I did was a difference in means test — that is the mean inflation differential in period 1 statistically different from that in period 2. That *is* a test for the collective, not an individual.

Semantics. You did a diff in means of months, so sure, that’s a collective. But not the same as what Furman proposes. I thought Furman’s explanations were spot on. Statistically, that your approach ignores cumulative impacts as well as measurement error and serial correlation. Also, let’s not forget that statistical significance DNE practical significance. On the practical side, as noted by Furman, when comparing two nation’s growth over a decade, one wouldn’t likely ask if forty quarterly growth rate differences were statistically significant. Would they?

Econned: I did the cumulative approach — see this post. If I force a break at 21m03, assuming the trends are deterministic, then there’s a bump up in level, but *slower* inflation growth in second period. If I force there to be no level change, then there is *slower* inflation growth in the second period, but not statistically significant. In both cases DW < R2. In other words, if I came to this issue as an econometrician who cared about treating the data somewhat carefully, I’d be a little wary about making strong conclusions one way or the other.

Agreed. Also, I should’ve said initially I also agree with your comment that neither your approach nor Furman’s is “wrong”, just that Furman’s makes more sense.