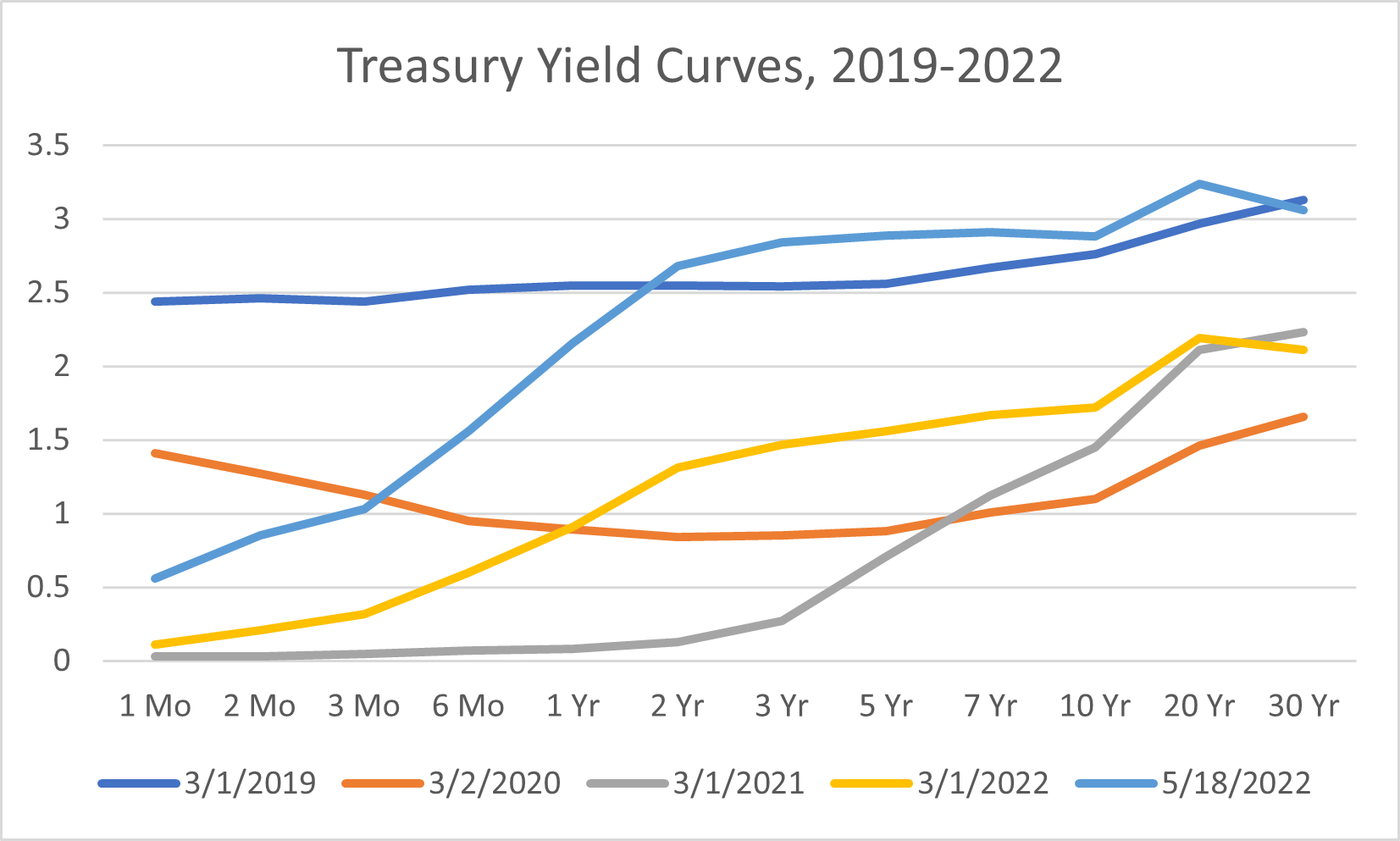

Here is a snapshot of yield curves at the beginning of March of four years, and as of today.

Figure 1: Treasury yield curves, %. Source: US Treasury.

There is (nominally) a yield inversion for the 10s5s, and 30s20s.

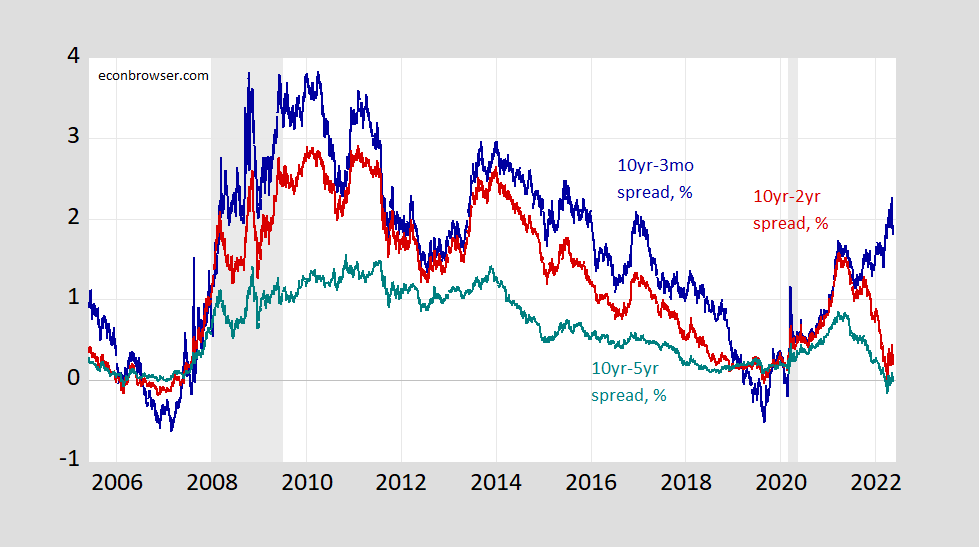

A longer span of data for the 10yr-3mo, 10yr-2yr, 10yr-5yr spreads.

Figure 2: Treasury 10yr-3mo spread (blue), 10yr-2yr (red), 10yr-5yr (teal), all in %. NBER defined recession dates shaded gray. Source: Treasury via FRED, NBER, and author’s calculations.

What this graph reveals is that the inversion is at the longer end of the maturity spectrum. Interestingly, the McFadden R2 from a probit regression using the 10yr-5yr spread is lower than that from that using a 10yr-2yr, which is yet lower than that using a 10yr-3mo.

Considering we have zero clue of the actual model being referenced, I don’t find it all interesting that the pseudo R2 is is lower using the 10yr-5yr spread is lower than that from that using a 10yr-2yr, which is yet lower than that using a 10yr-3mo. Or anything else.

Econned,

Yeah, facts are not interesting unless they are tied to models. How right you are.

You must be a fan of the late Axel Leijonhufvud who just passed away, especially his famous article “Life Among the Econ.” he noted how their high priests were much taken with “modls,” the most important thing in their society. Who needs facts without “modls”?

One simple explanation for the divergence of the 3m/10y spread from the 2y/10y spread is “not yet”. Within the duration o a 2-year note, the fed funds rate is expected to rise substantially. Within the duration of a 3-month note, the funds rate is expected to rise very little.

Futures are pricing in a funds rate of roughly 300 basis points at the February 2023 FOMC meeting. If the ten-year Treasury yield is then what it was at yesterday’s close, the curve will be slightly inverted. But not yet.