As noted in the post by Rashad Ahmed, foreign yield curve developments helped predict US growth. What did those spreads do? And, turning the question on its head, what does the US spread mean for those economies’ recession prospects?

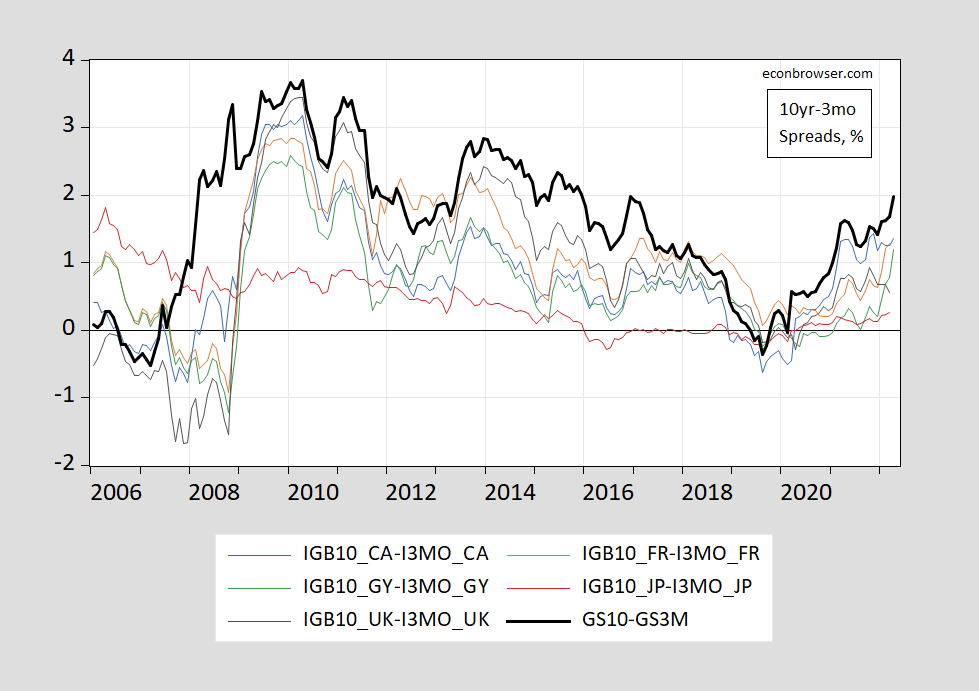

Figure 1 depicts 10yr-3m sovereign spreads over time — so before the 2007 recession and during the run-up to the 2020 pandemic.

Figure 1: 10yr-3mo Treasury spread (bold black), 10yr-3mo government bond – 3 month interbank spread for Canada (blue), for France (brown), for Germany (green), for Japan (red), for UK (dark gray). Source: Treasury via FRED, OECD Main Economic Indicators via FRED, and author’s calculations.

A cleaner measure for the foreign countries would’ve used sovereign yields for the short rate, to make comparable to the US spread (and to control for default risk), but I couldn’t get that easily.

While Chinn and Kucko (2015) examined cross-country evidence for own 10yr-3mo term spreads predicting recessions, we did not examine whether US term spreads had predictive power for foreign recessions. Mehl (2009) examined the usefulness of US spreads for predicting other-country economic activity and inflation rates — but using the 5yr-3mo spread. See the (brief) review of predicting recessions cross-country in this post.

A quick and dirty look at the data shows that the US term spread does not help much in adding to the 12 month predictive power of own-term spread for recessions during the 1970-2022M05 period for the countries shown above (recession peak-to-trough dates from ECRI). The probit regression involves the local economy recession indicator on the LHS, and the local term spread on the RHS, alone and augmented with the US term spread, along with a constant. (Of course, results might change with the addition of other covariates like oil price, equity prices and some measure of financial conditions).

In line with Mehl’s analysis, he uses instrumental variables to check whether the local term spread is being affected by the US term spread (i.e., spillovers). I didn’t do this myself, so that’s something to check.

Interestingly, I checked Korea, to move to outside of the group of usual suspects. Here neither the local term spread == nor the US term spread — was useful in prediction.

Note that I only examined recessions; I didn’t examine growth or inflation. More for later.

Here is the “ungated” on the Mehl paper. Happy Perusals!!!

https://www.econstor.eu/bitstream/10419/153125/1/ecbwp0691.pdf

Great follow-up. Helps satisfy a lazy man’s curiosity.

https://news.yahoo.com/manchin-spars-gop-senator-over-184455387.html

Manchin is criticizing the Trump tax cuts for the rich. He is right BTW so can we count on him for pushing Biden’s tax reform?

One of those lines, after you read it you wished you had said it first:

https://twitter.com/paulkrugman/status/1528015434179612672

Not only did a conservative concede, but a commodity exporting country voted for greenees. Well, tealees, anyhow.

https://www.nytimes.com/2022/05/23/business/economy/china-trade-tariffs-biden.html

May 23, 2022

Debate Over Tariffs Reveals Biden’s Difficulties on China Trade

Sixteen months into the Biden presidency, U.S. officials are still divided over what to do about a trade legacy left by President Donald J. Trump.

By Ana Swanson, Edward Wong and Alan Rappeport

WASHINGTON — President Biden’s decision on Monday to try to align with Asian partners to form an economic bloc against China comes at a moment of frustration over his administration’s economic approach to Beijing, with some White House advisers pushing the president to move away from the Trump-era policies he criticized and others arguing that Mr. Biden risks being seen as weak on China if he relents….

https://www.nytimes.com/2022/05/23/business/economy/china-trade-tariffs-biden.html

May 23, 2022

President Biden’s decision on Monday to try to align with Asian partners to form an economic bloc against China comes at a moment of frustration over his administration’s economic approach to Beijing, with some White House advisers pushing the president to move away from the Trump-era policies he criticized and others arguing that Mr. Biden risks being seen as weak on China if he relents….

[ What a remarkably revealing passage. Remarkable, the way in which prejudice can push White House advisers to work against American interests. ]

ltr,

There is also the simple electoral matter that Biden wants support of organized US labor movement, especially in swing Rust Belt states, and even though the tariffs are not all that great for their interests in reality, e.g. steel tariffs on autoworkers, organized labor and a lot of workers in those industries in those swing states support the tariffs, which Biden is acutely aware of. He is in a political bind as cutting the tariffs would help slow inflation, which is hurting him a lot politically.

Those tariffs are irrelevant. Supported by China and created from bogus marketing gimmicks, they mean nothing. Ignore them. Replace them with actual capital regulations. There is no legacy there.

Related to the issue of term spread is the overall performance of the bond market. Here’s a recent headline that I missed:

https://www.wsj.com/articles/its-the-worst-bond-market-since-1842-thats-the-good-news-11651849380

Setting aside the effort to blow sunshine up our skirts, the bond markets performance this year through April is the worst in 180 years. There is a great deal more wealth in bonds than in stocks. We were recently assured by the all-knowing Mr. Bott that all is well in the world of credit. I have my doubts.

If we look at the performance of term spread as an economic indicator, it tells us one thing – a steep curve is a sign of health. If we look at borrowing costs and wealth held in bonds as economic factors in their own right, there are signs of trouble.

Interesting development today that may not hold further is that stock market and crypto market may have become detaches. Stock markets rose in US pretty solidly while crypot markets fell pretty hard. They had been moving together, especially NASDAQ and main crypto currencies.

But where’s the trouble? We should expect a sharp downturn in assets with such a huge swing in monetary policy and forward guidance. Most of the time, real trouble is due to things we can’t foresee (assets that are surprisingly bad, not expectedly bad).