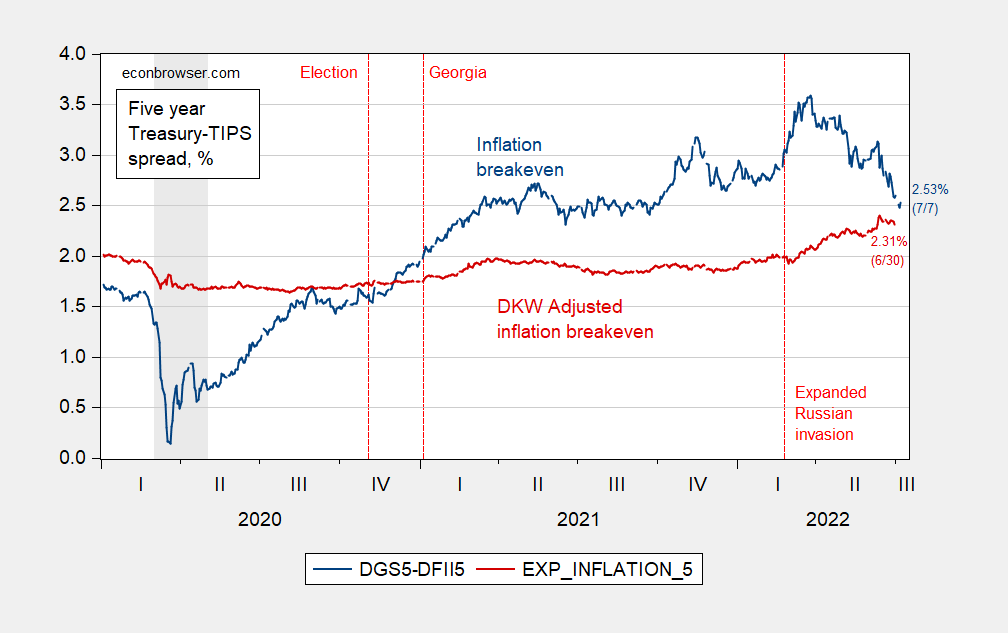

Treasury-TIPS 5 year breakeven down to 2.53%, but expected 5 year inflation after adjusting for premia at 2.31% as of 6/30.

Figure 1: Five year inflation breakeven calculated using 5 year Treasury minus 5 year TIPS yields (blue), five year expected inflation (red). Source: Treasury via FRED, Kim, Walsh and Wei (2019) following D’amico, Kim and Wei (DKW) accessed 7/7/2022, and author’s calculations.

As of 6/30, the conventional calculation implies 27 bps higher inflation than the adjusted series. The adjusted series implies that inflationary expectations have indeed risen, by about 50 bps since 1/20/2021 (the standard breakeven implies about 43 bps through 6/30.

This entire series has been terrific.

Yeah, gasoline prices are falling; lockdowns in China are over mostly,; last year’s fiscal stimulus is over, and the Fed is now sharply raising interest rates.

So, we do not know the near term, with such things as the massive food shortage induced by Putin’s invasion of Ukraine and blocking export of grain from Ukraine, something that none of the local disgusting Putin trolls here: JohnH, Anonymous, Bruce Hall, CoRev, and a few others, disgusting people who support people starving for a bunch of lies. You guys will burn in hell, if there is such a place. Have you a-holes just figured out how deeply evil you are in what you are supporting? You are evil, deeply evil. You are in there with those supporting Hitler in WW II. If you are so stupid that you cannot figure this out, sorry, you are damned. Really

Dear professor Chinn, how would you reconcile the liquidity adjustment shown in this series versus the work recently published by the San Francisco Fed ?https://www.frbsf.org/economic-research/publications/economic-letter/2022/july/increase-in-inflation-compensation-whats-up/

The SanFran Fed paper seems to show a positive liquidity premium in TIPS that biases the inflation expectation downwards, while this series seem to show a liquidity discount in TIPS prices which biases inflation expectation upwards.

In both sources the liquidity-adj inflation expectation measures seem to be increasing though, but the level is very different.

“You guys will burn in hell”.

I hear on good authority that even the Devil does not want to deal with these disgustingly stupid trolls.

I was a bit over the top on that, but, really, these people justifying Putin’s invasion and the many innocent people being killed by artillery or starvation is not remotely justifiable.

Barkley, I thought you said Biden had a good foreign policy?

BTW, what do we say about the deaths die to the “War on Fossil Fuels”? For instance the 200-700 deaths in from the Texas power failure, or the probable increase this Winter in Europe, especially Germany? Energy starvation is real, and exacerbated by the “War on Fossil Fuels”.

Oh my Putin’s pet poodle sees an opportunity to go full blown partisan. Somehow I see you getting all excited when Russian soldiers rape elderly Ukrainian women. You are indeed THAT DISGUSTING.

Barking Bierka – the disgusting NYC Jerk says: ” Somehow I see you getting all excited when Russian soldiers rape elderly Ukrainian women.” I can’t even perceive or imagine anything that cruel and crude. What kind of disgusting, demented and socially deranged mind can even go to there? You are indeed DISGUSTING.

The deaths from the Texas power failure was a direct result of natural gas interruptions. Natural gas is a fossil fuel. It failed not because of a war in natural gas, but because the natural gas transmission system froze.

Speaking of sophistry: “The deaths from the Texas power failure was a direct result of natural gas interruptions. Natural gas is a fossil fuel. It failed not because of a war in natural gas, but because the natural gas transmission system froze.”

This from someone who says Texas need more unreliable & intermittent electricity sources to make the Texas grid reliable. Even more sophistry.

My statement was completely accurate, ghostbuster.

Baffled, show us the report that confirms your claim.

I shared that report in a previous post. My guess is you chose to ignore it.

“ghostbuster” hahahaha. Backreading missed comments can actually pay off once in 20 times.

Actually it doesn’t make me “look down on” someone if they have these kind of beliefs. I think the Bible mentions Moses and Elijah talking to Jesus. Were those two men Ghosts?? They talked with Jesus after “dying”. I just looked it up because I forgot which Bible figures it was, I think Saul “conjured up” King Samuel with help from a “medium”??~~ even though the Bible speaks strictly against using mediums or “talking to the dead”. There is a talking donkey in the Bible. There’s a “demon” that infests a pig (although I guess demons aren’t ghosts)~~~My point is many Christians will laugh at concept of “ghosts”, but then will turn right around and tell you they take every word in the Bible literally. You can’t have it both ways folks.

I saw some weird weird weird shit from street performers in China. I’m very perceptive about people (OK I was wrong about Tulsi Gabbard, give me some slack here people). I saw things I never saw before or have seen since, street performers creating large hard objects seemingly out of thin our with dozens of people watching just as amazed as I was. Was it visual tricks and I was drinking too much?? You be the judge. I been drunk too many times to count in my life~~~I only ever saw things like that with the Chinese street performers. LARGE metallic objects, seemingly emanating from their hand. I could go on here. I’m not gonna laugh at people if I think they believe something in a genuine way. I might tease them about it good naturedly, but not deride their contentions.

Do I believe in Ghosts?? I guess I’d term myself agnostic (bot not “atheist” as it relates to ghosts. I think there’s A LOT of unexplained Sh– in this world. and until I see the answers I’m leaving those chapters unlabeled.

Baffled, another post? Then show it. Lying is so common. Are you one? Here’s your quote: “The deaths from the Texas power failure was a direct result of natural gas interruptions.”

My point all along has been if renewables weren’t unreliable then the other sources needed to BACK THEM UP can not be blamed for the results from their lost reliability. The corollary to that is that adding unreliable renewables to the electric grid always adds costs (and risks lives).

Your belief and comment is just more proof.

I posted a link. it is there. if I do it again, you will simply ignore it and when the subject comes up again, play the same game. this is what I mean when I call you dishonest. you accuse me of lying. but the post and link are there. it is not my fault you are either unwilling or unable to read the report. or comprehend the analysis. the report and link are not ghosts. they are real.

https://markets.businessinsider.com/news/stocks/paul-krugman-economist-runaway-inflation-stagflation-bill-ackman-gas-prices-2022-7#:~:text=Paul%20Krugman%20dismissed%20the%20idea%20that%20inflation%20expectations,Listen%20to%20The%20Refresh%3A%20Insider%27s%20real-time%20news%20podcast.

Nobel Prize-winning economist Paul Krugman says fears of runaway inflation are hugely overblown – and dismisses the risk of stagflation

But what does he know? Our Fox and Friends chief economist Princeton Steve says we are already in a recession with double digit inflation so that settles it – right?

https://www.nytimes.com/2022/07/07/opinion/inflation-recession-the-fed.html

July 7, 2022

That Was the Stagflation That Was

By Paul Krugman

On Wednesday the five-year breakeven inflation rate fell to 2.48 percent. If that doesn’t mean anything to you — which is completely forgivable if you aren’t a professional economy-watcher — try this: The wholesale price of gasoline has fallen about 80 cents a gallon since its peak a month ago. Only a little of this plunge has been passed on to consumers so far, but over the weeks ahead we’re likely to see a broad decline in prices at the pump.

Incidentally, what are the odds that falling gas prices will get even a small fraction of the media coverage devoted to rising prices?

What these numbers and a growing accumulation of other data, from rents to shipping costs, suggest is that the risk of stagflation is receding. That’s good news. But I’m worried that policymakers, especially at the Federal Reserve, may be slow to adapt to the new information. They were clearly too complacent in the face of rising inflation (as was I!); but now they may be clinging too long to a hard-money stance and creating a gratuitous recession.

Let’s talk about what the Fed is afraid of.

Obviously we’ve had serious inflation problems over the past year and a half. Much, probably most, of this inflation reflected presumably temporary disruptions of supply ranging from supply-chain problems to Russia’s invasion of Ukraine. But part of the inflation surge also surely reflected an overheated domestic economy. Even those of us who are usually monetary doves agreed that the Fed needed to hike interest rates to cool the economy down — which it has. The Fed’s rate hikes, plus the anticipation of more hikes to come, have caused the interest rates that matter for the real economy — notably mortgage rates — to soar, which will reduce overall spending.

Indeed, there are early indications of a significant economic slowdown.

But the just-released minutes of last month’s meeting of the Fed’s Open Market Committee, which sets interest rates, suggest considerable fear that just cooling the economy off won’t be enough, that expectations of future inflation are becoming “unanchored” and that inflation “could become entrenched.”

This isn’t a foolish concern in principle. Over the course of the 1970s just about everyone came to expect persistent high inflation, and this expectation got built into wage- and price-setting — for example, employers were willing to lock in 10-percent-a-year wage increases because they expected all their competitors to be doing the same. Purging the economy of those entrenched expectations required an extended period of very high unemployment — stagflation.

But why did the Fed believe that something like this might be happening now? …

Menzie says: “The adjusted series implies that inflationary expectations have indeed risen, by about 50 bps since 1/20/2021 (the standard breakeven implies about 43 bps through 6/30.” Inflationary expectations have indeed risen, by about 50 bps since 1/20/2021. Why not show actual inflation after an article caused by this statement: “I estimate (don’t kinda think) that a large portion of today’s inflation is due to environmental policies, in particular the war on fossil fuels.”?

Instead of inflation what risk may the TIPS factoring in? Anyone?

“Instead of inflation what risk may the TIPS factoring in? Anyone?”

This obviously has become your latest cheap debating trick. Guess what troll – no one is taking your pathetic little bait. So be a real man (cough, cough) and answer your own stupid question.

Barking Bierka – the NYC Jerk, will not answer the obvious question. Which letter of the alphabet frightens liberals? Hint: that letter between Q & S (cough, cough)

Renewal? Resurgence? Recovery?

And I do not bother appearing on Sean Hannity either. You are nothing more than a lying troll who is so dumb that he thinks he is making a point. Nothing more.

CoRev Instead of inflation what risk may the TIPS factoring in?

Well, how about the risk of a GOP House and Senate? I’m pretty sure the financial markets would see that as a huge risk given the history of the Republicans in Congress whenever the debt ceiling needs to be raised.

2slugs regales us with another comment full of gibberish, but more importantly denial of the letter “R”. 😉

CoRev Not sure what you mean by the letter “R”. If you’re referring to “recession,” then I’ll note that there’s no evidence that we’re currently in a recession. I suppose it’s possible that we might be in a recession around election time, but that’s only four months away so the economy would have to get really bad really fast. OTOH, if what you mean by the letter “R” is Russia, then that very well could be an inflation risk. Of course, in that case you’d be implicitly putting the blame on your hero Putin and his immoral war.

I noticed that you didn’t really deny the likelihood that a GOP Congress would (once again) threaten to default on the debt, just as they did throughout the Obama years. Defaulting on the debt would cause a much deeper recession than anything the Fed might do to bring down inflation.

2slugs, more gibberish? “I suppose it’s possible that we might be in a recession around election time…” is IIRC is the 1st admission. I would think that another .75% increase by the Fed will have some effect.

BTW, you are and have been pushing the “War on Fossil Fuels” for years. Now we are all living with the economic results from this horrible virtue signalling policy. This Winter we will probably see an increase in deaths due to fuel starvation, and that can be laid directly at the feet of the virtue signalling following the horrid policy.

Where’s that list of Biden’s successful policies? I provided a list of classes/categories of policy. The “War on Fossil Fuels” is a policy within energy category, and is implemented via many, many avenues. You seemed unaware of this, another lack of fundamental knowledge. Remember your comment on limiting carbon?

CoRev So you still can’t answer the question. What policies, specifically, has Biden implemented that would justify a “war on fossil fuels” other than supporting Ukraine? When you say you have already provided specifics you are simply lying…an old CoRev pattern. I am saddened that Biden hasn’t pursued a war on fossil fuels, so if he’s been implementing policies that I’m not aware of, then please enlighten me. But I’m talking specific policies, not just vague motherhood and apple pie generalizations and aspirations.

What we’re living with are the results of not starting the war on fossil fuels sooner. If you think it’s bad now, just be glad you’ll be long dead when things get really bad for your grandchildren.

2slugs, can you not read at all? I said in the comment: ” The “War on Fossil Fuels” is a policy within energy category, and is implemented via many, many avenues. You seemed unaware of this, another lack of fundamental knowledge. Remember your comment on limiting carbon?”

You also said: ” I am saddened that Biden hasn’t pursued a war on fossil fuels, so if he’s been implementing policies that I’m not aware of, then please enlighten me.” You obviously don’t know the difference between policy and how they are implemented. Don’t confuse “the War on Fossil fuels Policy” with its implementations. Biden articulated the policy: “I want you to look at my eyes. I guarantee you, I guarantee you we’re going to end fossil fuels,” during the campaign. If you have questions of policy implementations then look at the laws, the Executive Agencies regulations and directives within the Executive Branch. Hint: the Supreme Court just ruled on on a set of EPA regulations.

You also claim: “What we’re living with are the results of not starting the war on fossil fuels sooner. ” What results? Inflation? Shortages? Fewer weather related deaths? Energy-related deaths? And even the Russo/Ukraine WAR? These are what I consider the results of the world-wide “War on fossil Fuels”, and they are not all bad. What’s your list of results that will get worse in the future?

Where’s that list of Biden’s successful policies? I provided a list of classes/categories of policy. The “War on Fossil Fuels” is a policy within energy category, and is implemented via many, many avenues. You seemed unaware of this, another lack of fundamental knowledge. Remember your comment on limiting carbon?

CoRev Saying The “War on Fossil Fuels” is a policy within energy category, and is implemented via many, many avenues. is not an itemized list of specific policies. Please learn the English language. Your comment was almost the definition of a highly general statement. Are you that stupid that you don’t know the difference between general statements and specific policy actions? Or are you simply that dishonest? I’ll let readers decide.

As to the results of not fighting a war on fossil fuels earlier, the war in Ukraine is a perfect example. If we weren’t so dependent on fossil fuels, then Russia wouldn’t have as much leverage on the West and our economies would be more resilient. Can you imagine how much worse things would be if Europe was even more dependent on Russian oil and gas that it already is? Oh wait, you approve of Putin’s war so maybe that’s why you’re so eager to keep the West addicted to fossil fuels. Fossil fuels are like an addiction to donuts. You don’t get healthier by eating more of them. People with the inability to defer instant gratification end up eating too many donuts and die fat and young. Or in your case having bypass surgery. Of course, you’re a selfish old man who will probably be checking out before too long, so I’m not surprised that you don’t care about what happens to future generations.

2slugs, your gibberish is getting worse. You obviously don’t know policy from a pumping oil hole in the ground.

You also claim: “As to the results of not fighting a war on fossil fuels earlier, the war in Ukraine is a perfect example.” Europe has been fighting fossil fuels for decades. It’s how they fought it that has given Russia its energy leverage. Instead of using local energy resources they preferred to to get it from Russia. It was people believing as you that promoted that decision. Thinking people warned them of the risks and COSTS.

Biden’s War on Fossil Fuels is part of his policy to fight climate change which is related to his policy to convert to clean energy: “Stand up to the abuse of power by polluters who disproportionately harm communities of color and low-income communities. (Bolding in original) Vulnerable communities are disproportionately impacted by the climate emergency and pollution. The Biden Administration will take action against fossil fuel companies and other polluters(my emphasis to aid your reading & comprehension) to who put profit over people and knowingly harm our environment and poison our communities’ air, land, and water, or conceal information regarding potential environmental and health risks….” https://joebiden.com/climate-plan/

You’re getting more desperate,and trying to save a future world have lost sight of today’s. 8.6% inflation actually disproportionately harm communities of color and low-income communities. A significant portion of that US inflation is due to Biden’s and apparently your War on Fossil Fuels. Europe has been fighting its own war for years, and is also disproportionately harming its communities of color and low-income communities.

There’s low information ORSAs and then there are those who just don’t think at all. If we good only bottle those unicorn farts for saving the future from climate change.

Rehabilitation? Resumption? Renaissance?

Since CoRev is a Putin pig, I bet R stands for rape as in what he wants Russian troops to do to elderly Ukrainian women.

Barkley, so far your word choices would probably result in + pricing instead of what is shown. Try again. You’ll find some word(s) that qualify for the – pricing.

CoRev,

So, you are the one challenging people here to deal with this big bad word that begins with a letter between O and S, obviously R. You thought you were scoring some big point by referring to “Recession.” which indeed you are right would tend to lower gasoline prices.

But, oh, here we have gasoline prices falling, which on another thread you identified as yet more evidence that things are getting worse, bad Biden Derangement Syndrome in progress with you, nothing that happens under him can be good,

Ah, but now you make it clear that anything that involves the economy possibly growing, the long list of words I came up with beginning with the letter R, as uh oh being bad because they must imply gasoline prices rising.

But, sorry you lose yet again, boy. The economy is and has been growing recently while gasoline prices have been falling, so, sorry, you are full of scheiss on this, all the way.

BTW, you continue to double down on yout “Barking Bierka” bs, but in case you have not figured it out, you are “Barking Bierka,” and every time you put this out you just remind us of that, not to mention that you are also clearly a total lying jerk, even if you do not live in NYC.

Barkley, as I’ve noted you’ve been making some big mistakes lately: “big bad word that begins with a letter between O and S, ” Not O and S, but Q and S. How did you get to R with that reading comprehension? Perhaps just a Freudian slip, and you weren’t being serious with your other comments???

You also claim: “bad Biden Derangement Syndrome in progress with you, nothing that happens under him can be good, ” No, I’ve been asking for weeks now for a list of successful Biden policies. You’ve come up with a list of mixed results, but without policy associated.

As to Barking Bierka – Disgusting NYC Jerk, those descriptive names are appropriate for the poor demented individual who can not help himself from making derogatory comments. They are derived from his own comments and the names he has called others.

You’ve been wrong a lot lately.

Gibberish is your domain. Maybe you should sue 2slug for patent infringement.

Oh my Putin’s pet poodle sees an opportunity to go full blown partisan. Somehow I see you getting all excited when Russian soldiers rape elderly Ukrainian women. You are indeed THAT DISGUSTING.

2slugs, this is what another economists has to say about the War on Fossil Fuels: https://johnhcochrane.blogspot.com/2022/04/inflation-and-end-of-illusions.html#more

“…The return of inflation and Russia’s war in Ukraine signal the end of stupendously counterproductive energy and climate policies. Our governments have been pursuing a dangerously myopic strategy of shutting down US and European fossil-fuel development before alternatives are available at scale, strangling nuclear energy, and subsidizing grossly inefficient (and often carbon-intensive) projects such as California’s high-speed train to nowhere.

The folly of this approach is now plain to see. After blocking the Keystone XL Pipeline and limiting oil and gas exploration, US President Joe Biden’s administration has now gone begging to Venezuela and Iran to make up for a shortfall in energy supply. Similarly, although cracks have appeared, the Germans still can’t bring themselves to allow nuclear power or fracking for natural gas. Efforts to strangle domestic fossil-fuel companies via financial regulation continue unabated. For example, on March 21, just as Russia’s attack on Ukraine was driving gas prices sharply higher, the US Securities and Exchange Commission decided to announce expansive new climate-related disclosure rules designed to discourage fossil-fuel investment.

For years, climate regulators have repeated the mantra that fossil-fuel companies would soon be bankrupt – stuck holding “stranded assets” – because of such regulation, and that this justified measures to force banks to stop lending to them. But reality must now remind everyone of a lesson from Economics 101: when supply is restricted, price (and profits) go up, not down. Those who have been insisting that climate change is the greatest risk to civilization, or to financial markets, surely must now acknowledge that there are other more likely near-term threats, such as pestilence, military aggression, and now possibly even nuclear war.

Yet the spin continues. One still hears that inflation comes from vulnerable supply chains, nefarious price gouging, profiteering, monopoly, and greed. The Biden administration’s latest effort to brand inflation “Putin’s Price Hike” is both comically inept and patently false. Inflation is widespread and has been surging for a year, while Russian President Vladimir Putin wants nothing more than to sell us lots of oil to finance his military. Such spin trivializes a war that is a fight for the soul of Europe and for the security of the world; it is not about Americans’ inconvenience at the gas pump.

The era of wishful thinking is over. Those who come to grips with that fact now will look a lot less foolish in the future.”

Remember, this policy is one which you say is less than you wish. Too little & too late? The craziness it burns!

https://www.nytimes.com/live/2022/07/08/business/jobs-report-june-2022/jobs-report-june-2022

July 8, 2022

U.S. economy added 372,000 jobs in June, a strong showing.

The economy added 372,000 jobs in June, a hotter-than-expected boost to the labor market that may ease worries of an impending recession, but that also complicates the job of the Federal Reserve as it seeks to quell inflation.

The unemployment rate was 3.6 percent, the same as a month earlier, the Labor Department reported Friday.

Employers have continued to compete for workers in recent months, with initial unemployment claims rising only slightly from their low point in March.

There is no guarantee that swift growth will continue indefinitely, however, as sky-high prices weigh on consumer spending. The labor force remains constrained by aging demographics, low levels of immigration, and barriers to work that keep many people on the sidelines.

“We weren’t going to keep up the employment growth that we had been seeing — it needed to stop,” said Julian Richers, the vice president of global economics research at Morgan Stanley. He said it would take a while, however, to exhaust America’s appetite for labor.

“There’s still a lot of pent-up demand for workers,” Dr. Richers said. “It does make sense that as the economy slows, employment should slow as well, once we’ve worked through the backlog of labor demand.”

That backlog is evident in the 11.3 million jobs that employers had open in May, a number that remains close to record highs and leaves nearly two jobs available for every person looking for work. In that equation, any workers laid off as certain sectors come under strain will most likely find new jobs quickly — for a time, at least.

— Lydia DePillis

“The unemployment rate was 3.6 percent, the same as a month earlier”

Since this is from the Household Survey, we should note that both the employment to population ratio and the labor force participation rate fell.

Good news from the Payroll Survey:

https://www.bls.gov/news.release/empsit.nr0.htm

Total nonfarm payroll employment rose by 372,000 in June, and the unemployment rate remained at 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in professional and business services, leisure and hospitality, and health care.

I could say that this rather explodes the recession forecasts from our Usual Suspects. But I am also more honest than lying incompetent ‘consultants’ like Princeton Steve so we should note the household survey indicated a fall in employment.

https://www.nytimes.com/2022/07/08/business/wages-climbed-5-1-percent-a-still-rapid-pace-as-fed-awaits-slowdown.html

July 5, 2022

Wages climbed 5.1 percent, a still-rapid pace as Fed awaits slowdown.

By Jeanna Smialek

Wages continued to climb rapidly last month, offering little encouragement to the Federal Reserve as policymakers hope for a slowdown in pay gains that might allow inflation to moderate.

Average hourly earnings picked up by 5.1 percent in the year through June, moderating slightly from 5.3 percent in the year through May. Economists in a Bloomberg survey had expected a slightly bigger cool-down, to 5 percent.

Fed officials spent the years before the pandemic cheering every strong wage number, but recent pay gains have been fast enough that they would make it difficult for rapid inflation to slow toward the central bank’s 2 percent annual goal. That is because as companies pay more, they typically try to cover their costs by raising prices….

“Wages climbed 5.1 percent, a still-rapid pace as Fed awaits slowdown.”

I would think anyone who writes for the NYTimes knows this is the increase in nominal wages – not real wages. Inflation adjusted wages – hello?

Bill McBride shows how to report the details of the latest from BLS!

https://www.calculatedriskblog.com/2022/07/comments-on-june-employment-report.html?m=1

I was alerted to his basic positive take reading some confusion from the usually excellent Kevin Drum. Could someone let Kevin know that the Household Survey is different from the Payroll Survey?

This is a horrible law:

https://www.theguardian.com/us-news/2022/jul/08/arizona-law-bans-people-from-filming-police-within-8ft

A new law in Arizona bans people from taking close-range recordings of police, ostensibly to prevent them getting dangerously close to potentially violent encounters, though some critics have described it as a threat to the first amendment. The new law prohibits anyone within 8ft of law enforcement officers from recording police activity. Violators will face a misdemeanor charge and up to 30 days in jail, though only after ignoring a verbal warning.

I see – the police do not want us filming them as they gun down young black men for jogging or paying for an Arizona tea and Skiddles.

Dean Baker’s latest email opens with this interesting data:

The June employment report showed the economy created 372,000 jobs last month, with the private sector adding 381,000. Private sector employment is now 140,000 jobs above its pre-pandemic level. Total employment is still down 524,000, as local government employment is 599,000 below pre-pandemic levels, and state government employment is 57,000 below pre-pandemic levels.

He also notes how nominal wage growth has moderated.