Weekly data through June 18th, and through June 25th, and Google/big data through July 2nd, on the US economy (follow up on Part I, Part II, Part III and Part IV).

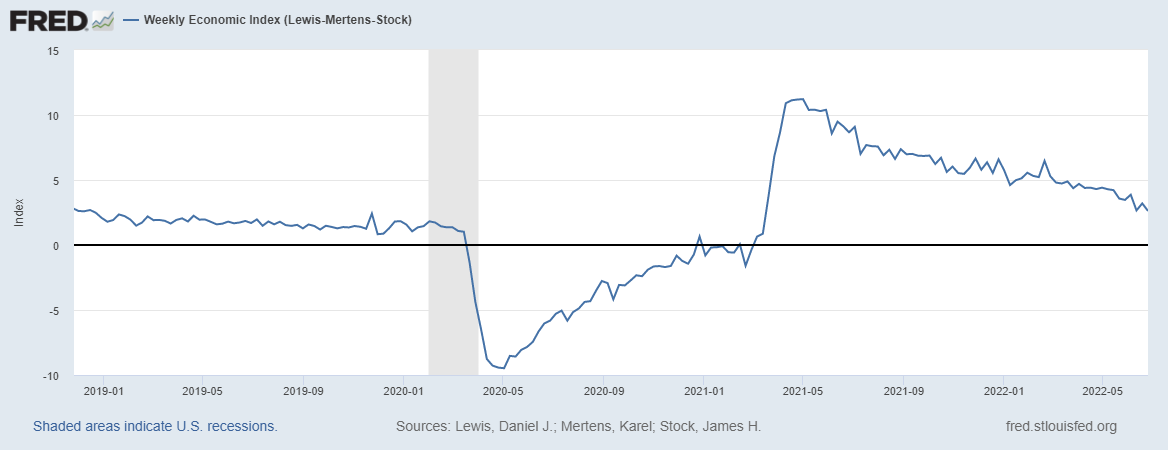

Source: Lewis-Mertens-Stock WEI, NY Fed via FRED, accessed 7/7/2022.

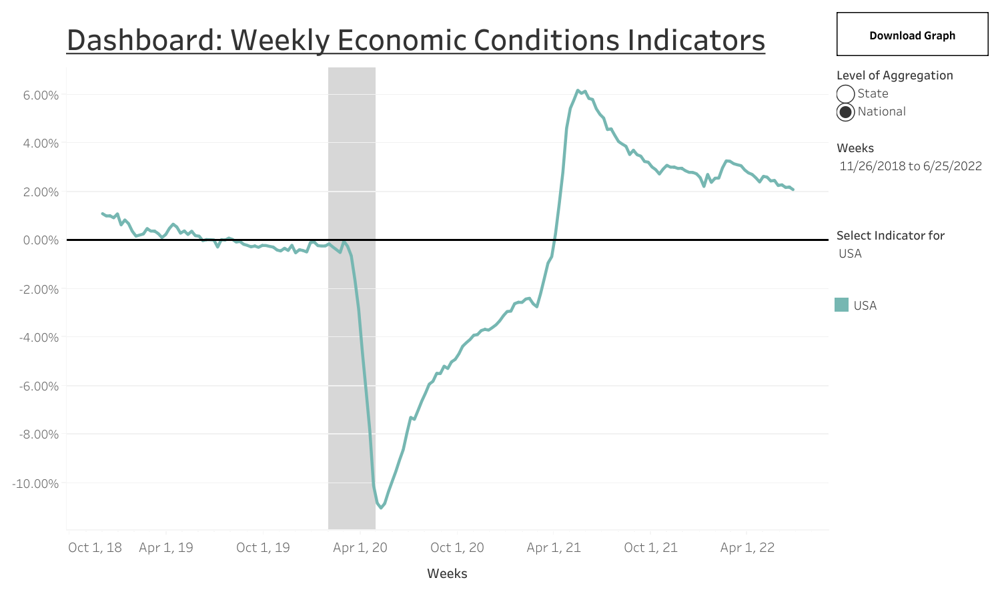

Source: Baumeister, Leiva-Leon and Sims Weekly State Economic Conditions Indicator, through 6/25/2022, accessed 7/7/2022.

Source: OECD, accessed 7/7/2022.

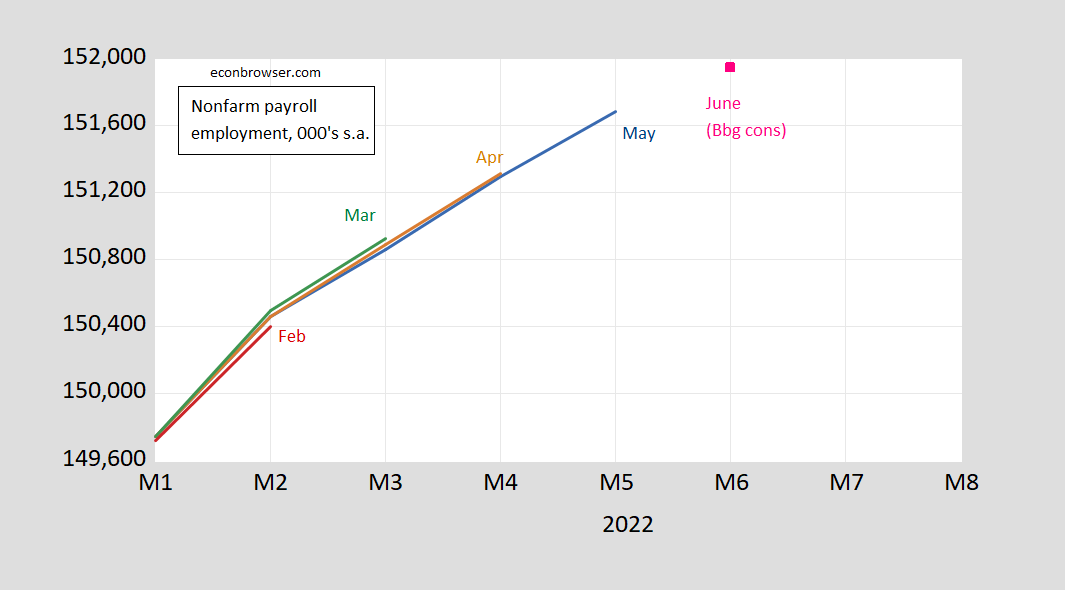

First reading on conventional monthly indicators tomorrow – from the employment situation release for June. Bloomberg consensus at +268 for NFP, +240K for private NFP. Assuming no revision to May numbers, this is the trajectory of NFP.

Figure 1: Nonfarm payroll employment, May release (blue), April release (tan), March release (green), February release (red), and Bloomberg consensus as of 7/7, assuming no revision to May release (pink square), all in 000’s, s.a., on log scale. Source: BLS via FRED, Bloomberg, author’s calculations.

Through June, it seems that what data we have does not indicate a recession in place (while consensus is for a recession in 2023, even possibly 2022H2).

Anyone familiar with Brian Wesbury, First Trust Advisors? He’s a bit of a righty, “American Spectator” and all that. Here’s a recent bit of his writing on the recession debate:

“But the debate about whether we’re in a recession should be about real economic pain, not academic-style semantics or whether we fit some technical definition. That’s the reason the official arbiter of recessions, the National Bureau of Economic Research, weighs jobs, manufacturing, and real incomes, when assessing whether we’re in a recession, not just real GDP.

“We suspect that some of this debate is political, with some champing at the bit to claim there’s a recession because they know it hurts the party of the incumbent president in a mid-term election year.”

https://www.realclearmarkets.com/articles/2022/06/28/were_not_already_in_a_recession_839675.html

Manchin and Schumer agree on Medicare drug-price negotiation authority:

https://www.msn.com/en-us/news/politics/democrats-schumer-and-manchin-strike-deal-to-cut-drug-costs-for-seniors/ar-AAZhEhp?li=BBnb7Kz

Disinflationary.

I recently noted Democrats have gained substantial support in “generic candidate” polls since the Dobbs decision. Here’s the link again:

https://view.newsletters.cnn.com/messages/1656369087597e7689b8b9103/raw?utm_term=1656369087597e7689b8b9103&utm_source=cnn_The+Point+-+Monday%2C+June+27%2C+2022&utm_medium=email&bt_ee=5nHEvbB4P5ir5ucpbl1jnltt%2FbsJ6DuiwO4orh6%2F4IVVrDyzZEabJK1wOM6jrKjw&bt_ts=1656369087599

Apparently, historians are among those who may not be voting for Republicans. The American Historical Association wrote an amicus brief for the Supremes, noting a long history in the U.S. of tolerating termination of pregnancy. The Supremes ignored it, and Alito lied about history in his opinion. Historians are not happy:

https://www.historians.org/news-and-advocacy/aha-advocacy/history-the-supreme-court-and-dobbs-v-jackson-joint-statement-from-the-aha-and-the-oah-(july-2022)

Good news for the US economy but the downside is we should expect one tirade after another from Princeton Steve.

Off topic, but on a familiar topic –

Shareholder Power and the Decline of Labor:

https://www.nber.org/papers/w30203

Turns out, concentrated ownership of shares leads to lower employment and wages, even when that concentration is institutional rather than individual. Unionization and monopsony power (localized labor markets) both matter. Productivity is not improved by concentration of ownership. It purely a distributional issue.

Related – Kevin Drum notes how much higher GDI is than GDP:

https://jabberwocking.com/how-big-is-the-us-economy-anyway/

And notes the thoughts of James Bullard:

https://www.reuters.com/article/usa-fed-bullard-idTRNIKBN2OI1LT

The U.S. economy is expected to continue to grow this year even as the Federal Reserve raises interest rates sharply to bring down unacceptably high inflation, St. Louis Fed President James Bullard said on Thursday. The U.S. central bank’s monetary policy tightening, along with inflation running at more than three times the Fed’s 2% target, has stoked fears of a recession, and many economists estimate the most widely cited measure of U.S. economic output, gross domestic product, may have shrunk for a second straight quarter in the April-June period. Bullard, in slides prepared for a speech at the Little Rock Regional Chamber in Arkansas, pushed back on that narrative, pointing to an alternative measure, known as gross domestic income, that shows the economy is actually expanding. “At this point, it appears that the GDI measure is more consistent with observed labor markets, suggesting the economy continues to grow,” Bullard said in remarks accompanying the slides, noting that labor markets are “robust” and by a broad swathe of measures stronger than they have been in more than 20 years.

So who to trust Bullard and the chief economist for Fox and Friends (Princeton Steve)?

Bullard is calling for a “soft landing.” Would be nice if it can be pulled off, a tough line.

https://fred.stlouisfed.org/graph/?g=RwFl

January 30, 2018

Gross Domestic Product and Gross Domestic Income, 2000-2022

Gross domestic income is an alternative way of measuring the nation’s economy, by counting the incomes earned and costs incurred in production. In theory, GDI should equal gross domestic product, but the different source data yield different results. The difference between the two measures is known as the “statistical discrepancy.” BEA considers GDP more reliable because it’s based on timelier, more expansive data.

https://fred.stlouisfed.org/graph/?g=RwFF

January 30, 2018

Gross Domestic Product and Gross Domestic Income, 1948-2022

https://fred.stlouisfed.org/graph/?g=RwFW

January 30, 2018

Gross Domestic Product and Gross Domestic Income, 1980-2022

https://fred.stlouisfed.org/graph/?g=RwGj

January 30, 2018

Gross Domestic Product and Gross Domestic Income, 2007-2022

https://www.nytimes.com/2022/07/06/business/economy/fed-rate-increase-inflation.html

July 6, 2022

Fed Moves Toward Another Big Rate Increase as Inflation Lingers

As the Federal Reserve battles rapid inflation, officials are likely to stay on an aggressive path even as signs of economic cooling emerge.

By Jeanna Smialek

WASHINGTON — The Federal Reserve, determined to choke off rapid inflation before it becomes a permanent feature of the American economy, is steering toward another three-quarter-point interest rate increase later this month even as the economy shows early signs of slowing and recession fears mount.

Economic data suggest that the United States could be headed for a rough road: Consumer confidence has plummeted, the economy could post two straight quarters of negative growth, new factory orders have sagged and oil and gas commodity prices have dipped sharply lower this week as investors fear an impending downturn.

But that weakening is unlikely to dissuade central bankers….