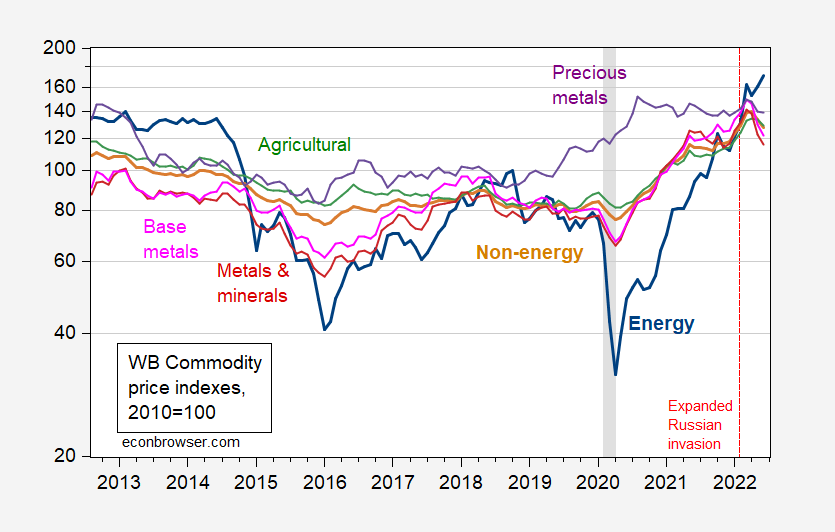

Commodity price indexes through June have turned down, excepting energy. Front month futures prices suggests a further abatement of upward commodity price pressure, including in energy.

Figure 1: Commodity price indexes for energy (bold blue), non-energy (bold tan), agricultural (green), metals and minerals (red), base metals (pink), precious metals (purple), all 2010=100, all on log scale. Last observation is June. NBER defined peak-to-trough recession dates shaded gray. Source: World Bank accessed 7/24/2022, and NBER.

Notice that through June, all indices are declining from March/April peaks, save energy (these are averages of daily data). Front month futures indicate downward movement in July, as shown in these graphs (all sourced from Macrotrends).

Crude oil – Brent

Natural gas- Henry Hub

Wheat

Corn

Soybean

Lumber

Platinum

Palladium

Obviously, some futures prices are not following these patters; for instance natural gas in Europe:

Natural Gas – TTF Dutch (not on log scale)

Of course, this is conditioning on market’s expectations regarding, for instance, Russian actions on natural gas supplies to Europe, the impact of sanctions on Russian oil exports, what happens in China regarding energy demand and/or production in the face of lockdowns.

https://news.cgtn.com/news/2022-07-24/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bVb5eP8RC8/index.html

July 24, 2022

Chinese mainland records 129 new confirmed COVID-19 cases

The Chinese mainland recorded 129 confirmed COVID-19 cases on Saturday, with 87 attributed to local transmissions and 42 from overseas, data from the National Health Commission showed on Sunday.

A total of 853 asymptomatic cases were also recorded on Saturday, and 6,288 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 228,648, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-07-24/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bVb5eP8RC8/img/96810d6464204868b0b579e7aaa40057/96810d6464204868b0b579e7aaa40057.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-24/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bVb5eP8RC8/img/b008136386274d1eb112023493d0a22d/b008136386274d1eb112023493d0a22d.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-24/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bVb5eP8RC8/img/c1cb66f99e7543898f9b6a04417df16d/c1cb66f99e7543898f9b6a04417df16d.jpeg

https://www.worldometers.info/coronavirus/

July 23, 2022

Coronavirus

United States

Cases ( 92,172,336)

Deaths ( 1,051,979)

Deaths per million ( 3,165)

China

Cases ( 228,519)

Deaths ( 5,226)

Deaths per million ( 4)

Of course, this is conditioning on…what happens in China regarding energy demand and/or production in the face of lockdowns.

[ The coronavirus is being controlled in China, safeguards are in place, and there is no reason to expect production limits from here. Inflation has been controlled, energy supply is ample and increasing. Economic growth is being supported through the country and should increase significantly from here. ]

As for food, China is food secure. Harvests this year have been ample, and reserves are ample. Agricultural research has markedly increased, technology applications are increasing, productivity is growing. China is readying more dedicated-agricultural land.

Recall when ltr polluted this comment section with daily claims about how many Covid vaccines China had provided the world?

From an article in “The Diplomat”;

“Today, as Southeast Asia learns to live with COVID-19, some of the gloss has come off Chinese pandemic diplomacy. The lower effectiveness of Chinese vaccines is now clear, as it the fact that over 90 percent of Chinese vaccines to the region were sold rather than donated. The U.S. has overtaken China in providing vaccine donations. And China’s “zero-COVID” policy has hindered both trade and in-person diplomacy and exchanges.”

And that’s from an article which some to make the case that China gained diplomatic ground during the pandemic.

So when ltr claims that China is just the best place since forever and we should trust, trust, trust that China isn’t doing badly or doing bad things, remember how untrustworthy ltr’s propaganda has been in the past.

Zero Covid will continue to screw the Chinese people and their economy. Sooner or later they will be forced to do like Australia and New Zealand did after their very successful zero-Covid and vaccine campaigns – just let it rip. The new Omicron B5 variant is just not amenable to the current Chinese policies. It is unfortunate for China that their current dictator is a germaphobe, so they will suffer a lot on damage before they give in to scientific facts. Their real estate and banking system is also on very rocky grounds – remember the real estate is 30% of their GDP because that has traditionally been the only safe place to put savings. China is facing both short- and long-term headwinds no matter how many happy-happy-la-la-happy songs ltr sings.

https://www.msn.com/en-us/money/markets/yellen-says-signs-of-us-recession-aren-t-in-sight-for-now/ar-AAZUWA5?ocid=msedgntp&cvid=ec1b02f88af648b6a4f62b86451b88e8

Treasury Secretary Janet Yellen expressed confidence in the Federal Reserve’s fight against inflation and said she doesn’t see any sign that the US economy is in a broad recession. “We’re likely to see some slowing of job creation,” Yellen said on NBC’s “Meet the Press” on Sunday. “I don’t think that that’s a recession. A recession is broad-based weakness in the economy. We’re not seeing that now.”

Wait – Dr, Yellen is not convinced by the rants on Fox and Friends from their chief economist Princeton Steve? I presume Stevie will now declare that Dr. Yellen is an incompetent economist!

“Commodity price indexes for energy (bold blue), non-energy (bold tan), agricultural (green), metals and minerals (red), base metals (pink), precious metals (purple), all 2010=100, all on log scale. Last observation is June. NBER defined peak-to-trough recession dates shaded gray. Source: World Bank accessed 7/24/2022, and NBER.”

Interesting chart but I have a contest for the gang. What will Princeton Steve’s first complaint?

(a) he does not understand the data sources;

(b) he objects to the use of logs;

(c) he has trouble reading it as there are too many series; or

(d) all of the above!

https://www.msn.com/en-us/news/politics/republican-rep-adam-kinzinger-says-the-jan-6-committee-has-proven-a-criminal-case-against-trump/ar-AAZUVDF?ocid=msedgdhp&pc=U531&cvid=3c819e390f8549e9b5f36cb0d96b606c

Rep. Adam Kinzinger said he believes the Jan. 6 panel has proven a criminal case against Trump.

He “certainly has criminal exposure,” Kinzinger, one of two Republicans on the panel, said Friday.

The committee can send a criminal referral to the DOJ.

Rep. Adam Kinzinger, one of two Republicans sitting on the Jan. 6 committee tasked with investigating the Capitol riot, said the panel has proven a criminal case against former President Donald Trump. “I think, taken in totality, this represents the greatest effort to overturn the will of the people, to conspire against the will of the people, and to conspire against American democracy that we’ve ever had, frankly since the Civil War,” he said Friday during an interview with CNN. “I think we’ve proven that.”

One would think this is obvious. Then again you never know in this weird world. After all CoRev assures us he has never lied. And Princeton Steve has “numerous sources” – none of which he can identify – that says real GDP fell by 11% even if FRED says otherwise. And I thought 1984 was a fictional novel.

Daniel Yergin, a consummate indutryinsider, thinks that this energy crisis could be worse than the 1970s:

“So, yes, this energy crisis is as serious. In fact, today’s crisis is potentially worse. In the 1970s, only oil was involved, whereas this crisis encompasses natural gas, coal, and even the nuclear-fuel cycle.

In addition to stoking inflation, today’s crisis is transforming a previously global market into one that is fragmented and more vulnerable to disruption, crimping economic growth. And, together with the geopolitical crisis arising from the war in Ukraine, it is further deepening the world’s great-power rivalries.“

https://www.irishexaminer.com/opinion/commentanalysis/arid-40921490.html

But what’s Yergin’s decades of experience worth compared to a trend line on a graph?

Johnny, Johnny, Johnny,

You’ve once again used a silly rhetorical trick, based on emotion and a question mark, to pretend to make a point. But you haven’t made a point.

The trend line (sorry, which trendline?) doesn’t have anything to do with the possibility of future bad news. The lines (still trying to find a trend line) are a record of things that have happened. Yergin’s comments have to do with a possible future. Not, by the way, the only possible future.

So, here’s an idea; why don’t you make an actual point. Are you saying Menzie’s charts are wrong? Are you saying Menzie made a predictions that contradicts a predictions which Yergin made? Cause Yergin didn’t.

Come on, kid, form a complete idea for once. Do you a world of good.

https://www.prweb.com/releases/2006/03/prweb358175.htm#:~:text=The%20uranium%20price%20first%20climbed%20to%20%2440%20per,begs%20the%20question%3A%20Is%20today%E2%80%99s%20%2440%20price%20sustainable%3F

Johnny cites someone who claims uranium prices back in the 1970’s were not that high. Of course Johnny boy is incapable of checking the actual data so permit me. This is an interesting story that notes that the nominal price of uranium was $40 a pound back in 1976. Inflation adjusted this price in today’s dollars would be over $200 a pound. Yea we had a boom in the price of uranium a little over a decade ago but even then the inflation adjusted price was never that high.

OK Johnny finds some rather claims that he touts as wisdom because he is too lazy or too stupid to check basic facts.

https://www.researchgate.net/figure/Coal-prices-in-constant-dollars-1970-2000_fig2_24087732

The relative price of coal was quite high back in the 1970’s as well.

https://markets.businessinsider.com/commodities/lumber-price?utm_medium=ingest&utm_source=markets

Remember when lumber prices past $1450 per thousand board feet and Johnny boy got on his soap box and declared those pesky oligopolists would keep it there? Well these prices plummeted, Of course Johnny boy just a couple of weeks ago assured us that lumber prices never fell even though they had – a lot.

Update – this price is now below $600 thousand board feet.

Yes – Johnny boy can’t even do current commodity prices so why do we expect this clueless wonder to get prices from the 1970’s?

Yeah, lumber prices are a great example of why a brief downturn in a commodity’s price is no reason to declare victory over inflation…as Team Transientdid exactly a year ago.

pgl quickly forgets that lumber prices, after a brief drop, spiked again, just as someone that I linked to and who knew the industry had predicted. But Team Transient is very adept at wiping the egg off their faces as soon as it hits…and pgl would be the last to notice. But trust pal to keep unapologetically dishing out the BS no matter what.

“pgl quickly forgets that lumber prices, after a brief drop, spiked again”

I forgot nothing. I did provide that graph of lumber prices for you many times. When you said they had not declined yet you were lying. Which is something you do a lot. Get back to us when you decide to have an honest conversation. We will not miss your stupidity in the meantime.

“Yeah, lumber prices are a great example of why a brief downturn in a commodity’s price is no reason to declare victory over inflation…as Team Transient did exactly a year ago. pgl quickly forgets that lumber prices, after a brief drop, spiked again”

Look at the graph and you will notice what a liar JohnH is. A year ago lumber prices were only $620. The spike came early this year. The comment of his I was mocking was a few weeks ago. Yes there were some ups and downs over this year but none of what this lying troll writes has a damn thing to do with the conversation. But hey – nice try.

What a liar pgl is…and someone who apparently still hasn’t learned to read a graph: Most of the second lumber price spike had occurred by the end of 2021, though pgl claims that it was all this year.

But more importantly, pgl is obscuring the real issue: a year ago Team Transient was celebrating a brief decline in lumber prices as vindication of their wishful thinking–not based on economics–that inflation was transitory. But then their wishful thinking got overtaken by events. (oh, but let’s not mention that!!!}

Same thing could happen with wishful thinking about current declines in commodities prices . Yergin provided a well reasoned rationale for doubting that energy price declines are anything but temporary. And Yves Smith explains why the decline in grain prices may be only temporary…caused mostly by US sanctions on Russia, not from Russia withholding grain exports to feed the third world.

https://www.nakedcapitalism.com/2022/07/some-implications-of-the-uns-ukraine-grain-and-russia-fertilizer-food-agreements.html

But let everyone engage in more wishful thinking–Democrats will need all they can get. And maybe Pelosi will stay in Taiwan…their gain would be our gain!

“In the 1970s, only oil was involved, whereas this crisis encompasses natural gas, coal, and even the nuclear-fuel cycle.”

I’m sorry but this statement is false. Yes we had a commodity boom starting nearly 20 years ago but we also had a commodity boom in the 1970’s. I guess your new guru has never looked at the relative price of uranium.

Daniel Yergin, vice-chairman of S&P Global, is the author of The New Map: Energy, Climate, and the Clash of Nations (Penguin, 2021) and The Prize (Free Press, 2008), for which he won the Pulitzer Prize. He received the first James R Schlesinger Medal for Energy Security from the US Department of Energy

I have a ton of respect for Yergin but this notion that the relative prices of coal and uranium were not high in the 1970’s is just false. It took me a little while to find reliable sources on both prices back then but I do know that S&P Global houses a lot of useful data on commodity prices. Yergin could have consulted with the folks who manage this data but I guess he did not. And we know you never bother to check the data before writing some fact free rant.

I was merely answering a question: “Will Commodity Prices Continue to Sustain Inflation?” with another question…raised by the interview with a consummate insider.

Seriously dude? Taking a page out of the CoRev/Bruce Hall playbook?

The “consumate insider.” JohnH has appropriated a description common to ESPN. (Dan, what are you hearing about the Giants’ QB situation?)

BTW, John, are you still waiting for that Pentagon report on Russian atrocities that you’ve insisted never happened?

And you actually dismiss others for “dishing out bs”?

You’re a riot, Alice, a regular riot.

The US never committed atrocities? How about the droning of funeral processions and wedding parties in Afghanistan?

Isn’t it strange how the human rights crowd here never insists that the US be held accountable before going on to criticize the behavior of it enemies?

“Isn’t it strange how the human rights crowd here never insists that the US be held accountable before going on to criticize the behavior of it enemies?”

Another one of your patented blatant lies. Of course the US should be responsible if it committed war crimes. Our problem with you is that you are celebrating Putin’s massive war crimes. Then again you have always be both dishonest and disgusting to the core.

And where exactly has the uproar over US atrocities been? There has probably been more outrage expressed here about Russia’s

atrocities in the past five months than about all the atrocities committed by the US over the last 20 years.

It is so bad, in fact, that the braveshistleblowers who exposed US atrocities have been routinely ignored as the government hunted them down and jailed them while the perpetrators and their bosses went free.

Basically the limousine liberals here are content to hear no evil, see no evil when it concerns US behavior and quite eager to scold most anything done by countries that don’t submit to US hegemony.

BTW the US is not a party to the International Criminal Court, precisely to avoid being tried for war crimes. If it were truly a human rights champion it would welcome being subject to the scrutiny of others.

it’s unbelievable how ignorant pgl is.

JohnH

July 26, 2022 at 10:44 am

And where exactly has the uproar over US atrocities been?

Let’s see back in 2003 when my daughter was a mere 14 years old she protested against the upward invasion of Iraq in Bush43 country literally risking her life daily. Her mother was so scared she asked me to stop her. I did not because I agreed with her. She may be a little woman but she has 1000 times more courage and 10,000 more integrity than a lying chicken little weasel like you can ever imagine.

“In the 1970s, only oil was involved, whereas this crisis encompasses natural gas, coal, and even the nuclear-fuel cycle.”

so what this is really sayings is that for nearly 50 years we have known about the problem with fossil fuels, and have not acted on it for a solution. why do we still deal with the same problems 50 years later? some of our greatest periods of inflation have been caused by fossil fuels. and the solution? use more fossil fuels. how silly.

Of course anyone who checked the data would have known uranium prices and coal prices were both very high in the late 1970’s. But not JohnH who never bothers to check the data before spouting off his usual BS.

MD, we know this comment’s point: “So, yes, this energy crisis is as serious. In fact, today’s crisis is potentially worse. In the 1970s, only oil was involved, whereas this crisis encompasses natural gas, coal, and even the nuclear-fuel cycle.

In addition to stoking inflation, today’s crisis is transforming a previously global market into one that is fragmented and more vulnerable to disruption, crimping economic growth. And, together with the geopolitical crisis arising from the war in Ukraine, it is further deepening the world’s great-power rivalries.“ is terrifying to you, but stop with the deflection.

Using another description he is saying what I have pointed out for weeks: The “war on Fossil Fuels” is causing many of today’s social and economic problems. It’s the result of your approved and supported bad, bad policies.

“So, yes, this energy crisis is as serious. In fact, today’s crisis is potentially worse. In the 1970s, only oil was involved, whereas this crisis encompasses natural gas, coal, and even the nuclear-fuel cycle.”

Of course as I documented the relative price of coal and uranium was also very high in the 1970’s. I see JohnH is your new BFF as he is as stupid when it comes to the facts as you are!

The Fed predictions of inflation in 2022 and 2023 would seem to have priced in a substantial fall in the price of commodities. With the predicted 75bp this week they will almost certainly have overshot by the time they stop the rate increases.

Oil prices falling. Copper prices falling. Heck even lumber prices are dropping like a stone. And on my grocery shopping yesterday I got some great deals on my favorite items.

Gotta love pgl…wrong-headed and totally unrepentant!

“Short sellers are closing out short positions against oil-focused exchange traded funds, while money managers have modestly increased their holdings of crude oil futures over the latest reporting week. These trades suggest that speculators, traders, and hedge fund managers may have started to believe that the 20% crash in oil prices since the middle of June could be over, and prices are set to go higher from here.”

https://oilprice.com/Energy/Crude-Oil/Traders-Are-Betting-On-The-End-Of-The-Oil-Price-Slump.html

But pgl is absolutely, positively certain that the recent of oil price declines won’t reverse. Of course, if they do reverse, he will unabashedly argue that he was right all along…as “right” as he was on declining lumber prices which did drop late last summer but then spike higher by the end of the year. Sadly, pgl’s “never admit you’re wrong” attitude seems to endemic to his profession.

You are nothing more than a two year whiney little boy. Others have suggested you grow up but I doubt that is even in you.

Anyone who even remotely understands commodity prices gets the fact that their volatility makes forecasting future prices difficult. Yea some speculators might be thinking oil prices will rise. Heck Village Idiot Princeton Steve keeps telling us that oil prices will top $200. But we all know he is a bloviating fool. Now there are futures markets that let us know what the mean forecasts are. Did Johnny boy bother to check future prices? Of course he did not so permit me to provide these quotes:

https://www.barchart.com/futures/quotes/CL*0/futures-prices

Oh wait – there are people who disagree with our resident Village Idiots – Princeton Steve and JohnH. Go figure!

“But pgl is absolutely, positively certain that the recent of oil price declines won’t reverse.”

I have never said anything of the sort. But of course, Johnny is a mad little boy so he hurls these stupid comments out as his little feelings got hurt.

Why use 2010 as your baseline?

What do you mean in the opening paragraph that “Front month futures prices suggests a further abatement of upward commodity price pressure, including in energy.” Brent futures are down from very high levels provoked by the Russians. Pointing to a two to three week trend and claiming it indicates that prices are bearish or less bullish is a weak argument in itself, and I don’t see much other meat to the argument. I don’t know what the opposite of a “Dead Cat Bounce” is, but this might be one of those. The real answer is that No One Knows.

Using natgas prices in these analyses is complicated. US natgas behaved counter to the general trend (printing, pumping, inflation) because of shale gas. European natgas prices remained higher than what a “natgas” market would have determined because of the pricing systems in place in Europe (oil-linked though that is shifting to gas for gas pricing).

I don’t want to get gang-banged like Johnny (for whatever past transgressions he may have committed) but this entire post has me baffled.

JohnH is still incensed over the US role in the Siege of Vicksburg. He wants to know why Grant and his adjutants have never been charged with war crimes and why the House has yet to move on Grant’s impeachment.

OTOH, Jon has cautioned us not to believe anything written or recorded by the hundreds of correspondents now in Ukraine . Because, well, we all know they can’t be trusted and, of course, they’re happily colluding against Putin.

He was adamant that little proof existed of Russian atrocities, certainly nothing like the proof of the damages that occurred at Vicksburg. See, nobody but John knows the real story. When others refuse to face the truth, John will be there to uphold the virtues of struggling underdogs like V. Putin.

There is so much misrepresentation in this comment that it’s hilarious!!! Thanks for the laughs.

But noneconomist still can’t address why no one—maybe starting with O’Bomber, who personally approved the hits—has been charged with war crimes for droning funeral processions and wedding parties in Afghanistan.

Apparently all is forgiven and forgotten with regard to US behavior…and the righteous indignation all bottled up and directed at Russia

Well, who would direct righteous indignation at Russia? Certainly not you. You’ve got enough righteous indignation for everyone else.

BTW, are you still waiting for the Pentagon to verify any “alleged” Russian atrocities at Mariupol?

If we didn’t charge Lincoln with war crimes, why would we bother with Putin?

But you are a great humanitarian, JohnH. In your own mind,anyway.

The US is not charged with war crimes because we have all the guns and all the money. We refuse to submit to anyone’s courts, especially the ICC. The US military applies overt or defacto extraterratoriality to all its Status of Forces treaties for the 150 countries it presently occupies. America is the most feared nation on the planet and widely hated for its military and social policies, but you can’t fight City Hall and you can’t sue someone with air craft carriers and Reapers.

Which leads JohnH —and you?—to believe therefore in NO two wrongs and only one right.

That the US is always wrong simply because it is a stronger nation. In JohnWorld, that excuses massive human rights violations by the likes of Putin because, well golly, no one has punished the US, so why should Russia have to suffer?

Sure, Putin may poison a few opponents and bomb a few Ukrainian schools and kill a few hundred kids , but unless we punish any country that acts similarly—especially the US—why sweat the results?

That’s junior high thinking. At best.

@Noneconomist. I think you have read too much into what I wrote or you are just spoiling for a flame war. As I said, don’t gang up on me just because you don’t like JohnH and don’t put words in my mouth. Your question mark does not absolve you and doesn’t mean your pseudo question is not an accusation. I never said the US is always right. I don’t excuse US behavior or condone it. I am merely stating facts.

The US is bathed in blood and atrocities from its inception. When America ran out of domestic Native Americans to slaughter, it moved the game abroad. America has invaded more countries than any other in history. America occupies over 100 countries (imagine if Japan, Germany, France or China set up military bases in NY, California and Texas!). The US has carried out countless terrorist attacks on foreign soil, overthrown legitimate governments, assassinated rightfully elected leaders, and tortured and executed numerous civilians without any due process. The US has massacred millions of civilians in Vietnam, Cambodia, Laos, Afghanistan, Iraq, Libya, Yemen, Costa Rica, Venezuela, and so on.

I believe that every elected official in US history should be hung for crimes against humanity. They are all mass murderers and torturers. I believe that Russia should be punished for invading the Ukraine and committing atrocities. I think there are far too many people on the planet and culling 50% of the assholes would not cause me to shed a single tear. But how am I or anyone supposed to achieve that.

So, when I say you can’t sue America, I mean it. It is legally possible but pointless. You can’t threaten America either. The same applies to Russia, though given Russia’s weak economy, fragile infrastructure and ineffective military, they are more vulnerable. But they still have lots of tanks, lots of oil, lots of gas…and…wait for it…. a shitload of nuclear tipped ICBM’s, short range missiles and artillery shells.

So whine all you want about the US and Russia. Whine about China while you are at it. Whine about the Mob shaking down restaurants in your neighborhood while uniformed cops make the cash pick-ups for the mobsters! Good luck doing anything about it. That is all I am saying.

If you have any ideas, I am all ears but stop lumping me with random targets you hate and conflating our views.