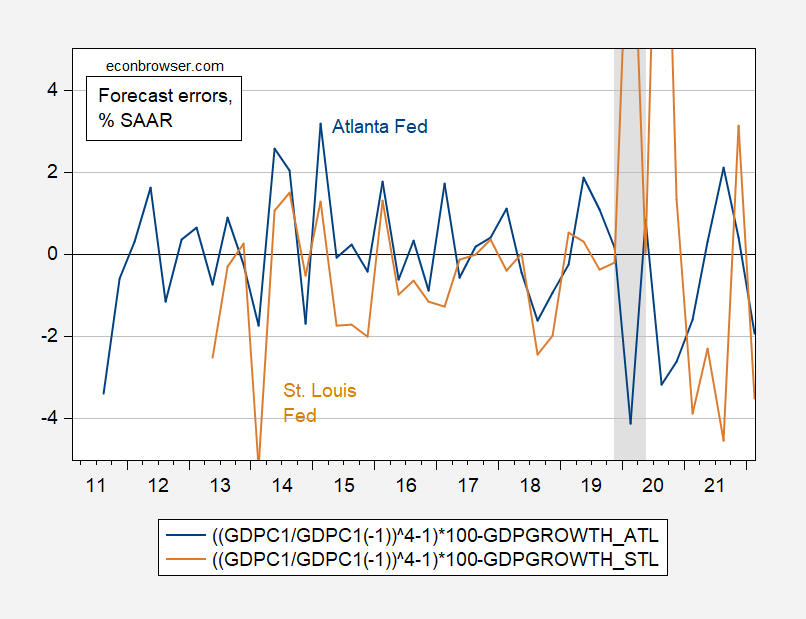

Reader Steven Kopits seems to think the Atlanta Fed’s GDPNow is the only nowcast of relevance. There are actually quite a few, from the tracking GDPs from consulting firms (e.g., IHS Markit formerly Macroeconomic Advisers) to Goldman Sachs, Deutsche Bank, etc. However, for illustrative purposes, here is an easy to do comparison (since the data are at FRED) for nowcasts just before the advance release.

Taking out the thee quarters of growth associated with the pandemic’s onset (Q1, Q2, Q3), the GDPNow and St. Louis mean errors for a common sample of 33 observations are 0.12 and -0.82 ppts respectively (SAAR). The RMSFE’s are 1.4 and 1.8 ppts respectively. In other words, GDPNow underpredicts slightly, while the St. Louis index overpredicts a bit. Adjusting by the bias means that the implied Q2 growth rate for GDPNow is -1.7 ppts, and +3.2 ppts for St. Louis Fed.

Note that I’ve taken final revised growth rates, instead of advance growth rates in my calculations (because otherwise I’d have to calculate all of the advance growth rates in the ALFRED spreadsheet), so consider this a quick and dirty analysis. And there is a more fundamental issue of whether pre-pandemic data is useful in this comparison of forecasting ability (which is why I used last three year’s in a previous post).

There you go.

Steven Kopits: My guess is that you couldn’t understand the numbers (and the calculation of the prediction interval), so you asked me to do it.

So if we drop 2020Q1-Q3, then the RMSFE of GDPNow is 1.5. And you’re saying that translates into a 0.1 pp decline in the expected value of the BEA advance estimate for Q2 GDP, that is, from -1.6 to -1.7% using the Atlanta Fed numbers. Do I have that right?

Steven Kopits: No. Try again.

I want to make sure I understand what you are asserting. It seems to me that a RMSFE of 1.5 would suggest an anticipated advance estimate well below -1.7%. So what does the RMSFE of 1.5 translate into in terms of advance estimate per GDPNow?

Steven Kopits: If you want my point estimate for GDP release for Q2 advance, then add the mean error to GDPNow nowcast. RMSFE is for figuring out the prediction intervals.

It sounds like you are fishing again. Your integrity has always been zero so hey – fish away.

Steven Kopits

July 25, 2022 at 9:19 am

Anyone who does not know the difference between the mean error and RMSFE has no business discussing forecasting or statistics. Of course Princeton Steve has no business discussing even basic macroeconomics.

“Reader Steven Kopits seems to think the Atlanta Fed’s GDPNow is the only nowcast of relevance.”

Actually Steve thinks whatever agrees with his babbling is the only thing of relevance.

Make your prediction. I have been on the record for weeks. What do you expect on Thursday, peege? It’s only three days from now. Surely you must have a view, given your vast expertise on the topic.

On the record? Your need a new vocabulary as your arrogance is flaring. BTW – arrogance is rarely combined with utter stupidity but you are champion at both.

As usual, I am sure you can make your forecast after the event. You have big talk, but no substance.

I do not run around claiming I’m a world class forecaster. I will leave that to you – even if you are always wrong.

I do know how to read historical data as in real GDP did not fall by 11% in 1947. Only a complete moron would make that claim even once. But you keep making it over and over.

You have no view. But it is deeply felt.

Ah, yes, you’re the guy who said that Goldman was the gold standard at 1.5% for Q2. That was your prediction. Well, they’re at 0.5% now. Guess where’ll they be on Thursday.

“Steven Kopits

July 25, 2022 at 3:32 pm

Ah, yes, you’re the guy who said that Goldman was the gold standard at 1.5% for Q2. That was your prediction.”

Such a liar. I never said they were the gold standard nor did I say they were my prediction. Looking forward to you whining about GDPPlus. BTW – try reading the underlying research paper before your usual bloviating.

Let’s go through the thread, shall we?

It started with Menzie:

Menzie Chinn Post author

June 30, 2022 at 2:03 pm

Steven Kopits: You neglected Goldman Sachs at +1.9%

Steven Kopits

July 1, 2022 at 6:27 am

And you included Atlanta and IHS.

I am going to guess that Goldman Sachs does not use as articulated a forecasting system as does either the Atlanta Fed or IHS.

pgl

July 1, 2022 at 9:04 am

Jan Hatzius (born December 17, 1968) is the chief economist of investment bank Goldman Sachs. Notable for his bearish forecasts prior to the Financial crisis of 2007–2008, he is a two-time winner of the Lawrence R. Klein Award for the most accurate US economic forecast over the prior four years. He has also won a number of other forecasting awards, including the Wall Street Journal, Bloomberg, and Institutional Investor annual forecaster rankings.

Yet Know Nothing Princeton Steve writes:

“I am going to guess that Goldman Sachs does not use as articulated a forecasting system”

Seriously Steve. I know some of the folks at Goldman Sachs. I plan to let Hatzius know you think he is not that good at forecasting. Given the lawyers at GS, expect a lawsuit.

Well, that fabulously articulated Goldman Sachs system pulled in its horns pretty quickly. GS July 1 forecast of 1.9% for Q2 was quickly pared back to only 0.7%.

Let’s see what Thursday brings.

Despite thorough discussion of the number, size and direction of revisions, and of the NBER’s method of determining the occurrence and timing of recession, CoRev recently implied that we’ll find out whether we’re in recession when the advance Q2 GDP data are released in the coming week.

So we already know his game. He intends to announce that the U.S. is in recession if GDP is reported to have contracted even if by only 0.1% SAAR in the advance release. Or even, I suspect, if the dollar value of GDP falls too little to register as a 0.1% decline. (Uh, oh. I may just have given CoRev an idea he couldn’t have come up with on his own.)

If no change or modest growth is reported, he’ll no doubt get religion and start carrying on about the previously irrelevant revision process.

What goes for CoRev also goes for faux news and all the other lying liars.

Your comments on the Usual Suspects are always spot on but are you saying Princeton Steve and CoRev are the same person?

I think one could skate through Q2 as a non-recession if growth came in at, say, -0.3% or higher. But if it comes in at -1.5% or lower, well, that looks like a recession to me.

Hey – keep just making up figures. As in your blatantly false claim that real GDP fell by 11% in 1947.

What if GDI is positive, and actually grows by more than 1.5 percent, Steve? In first quarter they differed by more than 3 percent, and their average, so-called Gross Domestic Output, which some think is maybe the best measure of aggregate output, exhibited positive growth. Could easily happen again in Q2, even if GDP goes down by 1.5 percent.

BTW, I appreciate that as a consultant you are paid to make point estimate predictions. But, this matter of demanding that others who are not produce their own point estimates is a third rate macho game. Moses Herzog likes to do this too, and we know he has serious masculinity issues.

The gang at George Mason centered on Bryan Caplan like to challenge people to bet on various point forecasts. Caplan is constantly doing it and bragging about how often he is right. But this frankly looks like, as I just said, a third rate petty macho game.

I mostly make fun of rsm with all his whining about noise in the data, but there is a lot of noise in the data, especially now with GDI and GDP esitmates seeming to be so at variance, with them in theory supposedly equal, not to mention all these disjunctures between payroll and houslehold measures of unemployment.

Heck, on your specialty, the oil industry, I am glad that recently Menzie posted the EIA 95% confidence interval on WTI six months from now, which ranges from under $40 per barrel to over $200 per barrel. As for Q2, I do not know what the numbers will be, although I suspect GDI will look better than GDP, and I continue to suspect that many forecasters do not have a handle on what has been happening with inventory changes, although I am also not forecasting a bottom line on those.

“a third rate macho game”.

Stevie has been playing Mr. Macho a lot of late which is funny as he would probably be running even before Josh Hawley did.

Feel free to criticize, but whenever I push you to make a statement or take a stand, you fold like an umbrella, Barkley. I am sure there are many quarterbacks out there who wish they could have had the benefit of your insight on the playing field the prior Sunday.

Regarding growth: If the WH felt that Q2 was going to be favorable, I sincerely doubt the CEA would have written the ‘Recession is not a Recession” piece.

As for the “EIA 95% confidence interval on WTI six months from now, which ranges from under $40 per barrel to over $200 per barrel.” What is that worth? At $40, the global economy has imploded. So a $40 forecast is the same as predicting something on the scale of a new covid pandemic. A $200 forecast, by contrast, is the same as — well, I am not even sure the global economy could sustain $200 oil. Not for very long. So that’s calling for a kind of mother-of-all-oil-shocks. So the EIA’s CI encompasses everything from the end of demand to the end of supply. What do you want to do with that? What’s your action item? That CI is absolutely useless in the real world.

Steven,

As I said, you are a consultant and get paid to make point estimates. As you said, “what is it worth” those 95% confidence intervals? Yeah, nothing for a paying client. So, as someone who is not A Real Man, I “fold like an umbrella.” But, I am not a consultant, so I can get away with being a folding umbrella.

I prefer the truth, and right now the truth is that there is an enormous amount of noise and disjunctures in the data, along the lines I have pointed out. We have rarely, almost never seen such large disjunctures, and I do not know where they are coming from. Why are GDI and GDP differing so much? I do not know. Do you, Mr. Real Man Steven? No, I do not think you do, although maybe if a client asks you, you will mske up some fake explanation and then thump your chest to show you are A Real Man.

Got what a pile of lying crap this is you are indulging in?

BTW, I do sometimes make some pretty specific calls, and sometimes I have been right when a lot of others were not. I called details of the housing crash and the timing of the beginning of the Great Recession a lot more precisely than a lot of other people, including people like Dean Baker and Nouriel Roubini. and, for that matter here you and Jim Hamilton, who was very slow to accept that the housing bubble was a bubble., Roubine and Baker got more attention than I did, but I was more accurate than they were, which Baker has admitted publicly.

.But, I also like to think I know when to be cautious about making specific calls, and the events of the last two plus years have really messed a lot of things up both structurally in the economy as well as what various data mean, and I am at least honest to face this and admit that I am now too cautious about making a bunch of point estimates for a bunch of things because the uncertainties are just so high, even if it means I am some kind of pathetic wuss, poor me.

“Feel free to criticize, but whenever I push you to make a statement or take a stand, you fold like an umbrella, Barkley.”

We need the Village People right now. Macho Macho Man – Stevie boy thinks he is Macho Man.

Steven, and thereafter will come the Q3 estimate and revisions to Q1 and Q2. I predict that at least one of those revisions will be downward.

https://www.nytimes.com/2022/07/24/world/africa/congo-oil-gas-auction.html

July 24, 2022

Congo to Auction Land to Oil Companies: ‘Our Priority Is Not to Save the Planet’

Peatlands and rainforests in the Congo Basin protect the planet by storing carbon. Now, in a giant leap backward for the climate, they’re being auctioned off for drilling.

By Ruth Maclean and Dionne Searcey

DAKAR, Senegal — The Democratic Republic of Congo, home to one of the largest old-growth rainforests on earth, is auctioning off vast amounts of land in a push to become “the new destination for oil investments,” part of a global shift as the world retreats on fighting climate change in a scramble for fossil fuels.

The oil and gas blocks, which will be auctioned in late July, extend into Virunga National Park, the world’s most important gorilla sanctuary, as well as tropical peatlands that store vast amounts of carbon, keeping it out of the atmosphere and from contributing to global warming.

“If oil exploitation takes place in these areas, we must expect a global climate catastrophe, and we will all just have to watch helplessly,” said Irene Wabiwa, who oversees the Congo Basin forest campaign for Greenpeace in Kinshasa.

Congo’s about-face in allowing new oil drilling in environmentally sensitive areas comes eight months after its president, Félix Tshisekedi, stood alongside world leaders at the global climate summit in Glasgow and endorsed a 10-year agreement to protect its rainforest, part of the vast Congo Basin, which is second in size only to the Amazon.

The deal included international pledges of $500 million for Congo, one of the world’s poorest nations, over the first five years.

But since then, the world’s immediate priorities have shifted….

https://fred.stlouisfed.org/graph/?g=S7mr

August 4, 2014

Real per capita Gross Domestic Product for Democratic Republic of the Congo, South Africa and China, 1971-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=S7mB

August 4, 2014

Real per capita Gross Domestic Product for Democratic Republic of the Congo, South Africa and China, 1971-2021

(Indexed to 1971)

“Congo’s about-face in allowing new oil drilling in environmentally sensitive areas comes eight months after its president, Félix Tshisekedi, stood alongside world leaders at the global climate summit in Glasgow and endorsed a 10-year agreement to protect its rainforest, part of the vast Congo Basin, which is second in size only to the Amazon. The deal included international pledges of $500 million for Congo, one of the world’s poorest nations, over the first five years But since then, the world’s immediate priorities have shifted.”

Maybe this payment of only $100 million per year could have been larger. Even if Congo sees the oil price boom as a better economic option, they need to be weary that the world’s oil multinationals such as Chevron do not play their usual transfer pricing games shifting much of the economic rents from oil production off to tax havens such as Switzerland.

the recession call is a political soccer ball until a political checklist is ticked off.

how about pce data coming day after prelim estimate of q2 gdp!

https://fred.stlouisfed.org/graph/?g=S7nc

August 4, 2014

Real per capita Gross Domestic Product for Democratic Republic of the Congo, South Africa and China, 1992-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=S7ng

August 4, 2014

Real per capita Gross Domestic Product for Democratic Republic of the Congo, South Africa and China, 1992-2021

(Indexed to 1992)

Off topic, relevant to another type of denialism –

From the MIT Technology Review:

https://www.technologyreview.com/2022/07/21/1056291/do-these-heatwaves-mean-climate-change-is-worse-than-we-thought/

Is climate change largely to blame for these extreme heat waves?

Yes. Global warming has established a hotter baseline for summer temperatures, which dramatically increases the odds of more frequent, more extreme, and longer-lasting heat waves, as study after study after study has clearly shown.

Is climate change unfolding faster than scientists expected?

The answer, at least in the broad sense, is no. In fact, the linked rise in greenhouse gas levels and global average temperatures has tracked tightly within the spread of model predictions, even dating back to cruder climate simulations from the 1970s.*

Several researchers and studies, including the latest UN climate report, have highlighted just how closely observed temperatures have followed predicted increases. The resemblance is uncanny (almost as if the world should have heeded the warnings of climate scientists decades ago).

In response to the question “Why didn’t anyone warn us?”, Chris Field, director of the Stanford Woods Institute for the Environment, is quoted:

“The problem has not been that the scientists got it wrong. It has been that despite clear warnings consistent with the evidence available, scientists dedicated to informing the public have struggled to get their voices heard in an atmosphere filled with false charges of alarmism and political motivation.”

Recall the recent link to some really bad math aimed at claiming that atmospheric CO2 and global average temperatures aren’t correlated? And carping about the inference of causation amounting to religion? That’s where the be performance of models comes in. If an assumption of causation is built into a model and the model makes accurate predictions, that’s points in favor of the assumption.

*Recall the recent link to some really bad math aimed at claiming that atmospheric CO2 and global average temperatures aren’t correlated? And …

Forgot my asterisk.

Bad math? Do you remember anyone refuting the article’s conclusion? I remember much dialogue claiming they wouldn’t do it the same way, but never actually following through.

Reminds me of the failure to refute the claim that solar sourced electricity will never fulfill daily demand peak. Or for that matter how 4 hours batteries will fill in the lost solar hours of solar.

There’s also bad logic. For instance that warming is only bad. Or that more CO2 is bad because — climate change and not more crop growth. Even worse, that adding destabilizing renewables electricity sources to the grid is beneficial to grid stability and lowers end user prices. The we get to that horrid example of how that “War on Fossil Fuels” policy doesn’t add to inflation.

There are ideas and policy implementations that add to social benefits and costs. To which side of that equation is your/Biden’s adding? Not in the future but today is being impacted.

Take your meds as this chasing your own tail stuff is getting really old.

Sorry, CoRev, we get it that like Big Brother in 1984 you think that if you simply ignore what anybody says and just keep repeating your lies, somehow eventually people will start agreeing that 2+2=5 or that zero divided by zero is zero as you twice claimed here.

So, sorry, at least a half dozen people, including me, but especially Menzie and 2slugbaits, have completely torn to shreds that incredibly stupid article that you are somehow now claiming nobody here “refuted.”

This is almost as stupid as your refusal to realize that your idiotic claims about solar power in Texas causing problems due to the several hours discrepancy within a day between peak solar production and peak energy demand have also been torn to shreds in various ways by various people. You just ignore what anybody says and just keep repeating your idiotic mantras like “War On Fossil Fuels!”

Menzie and 2slugbaits, have completely torn to shreds that incredibly stupid article that you are somehow now claiming nobody here “refuted.”

Can we give credit to 2slugbaits for the best description of CoRev ever – policy wank!

Barkley, then actually refute either. Saying you would do the statistics differently doesn’t refute anything unless you actually do the math ans show different results. The funny part of that effort is that you would actually refute Dr Bohde, which is what that article was actually doing. Did you read any of the references? You don’t appear to from the depth of your commenting.

As for the solar claim, if they are so idiotic refute them. No one has yet.

CoRev,

I read the handful of references, and they sucked. Go back and read what both Menzie and 2slug said about the statistical analysis. It is just worthless garbage. I am not going to repeat what they said as obviously you will just ignore it all again as you do, running off to try and set up some yet new fake goal post.

The point I made, which Macroduck also made, is that there is simply an enormous literature decades old now based on hard science that establishes scientifically that indeed CO2 and methane are greenhouse gases, that increasing accumulations of them in the atmosphere should be expected to heat up the lower atmosphere. We know scientifically what the causal mechanism is. So when we observe a correlation, which we do, this is completely unsurprising. This is not some dumb correlation that has no causation like the rooster maybe causing the sun to rise because it crows as the sun rises. There is a real, scientifically established causal connection, but this idiot Andy May, not a climatologist, and you, and apparently this Bohde guy also, who is also an effing nobody, do not get it and make fools of yourselves pretending there is no such known causal connection when there most certainly is.

Hey, you might as well claim that the fact that we see objects falling to earth when dropped is merely a correlation, not a matter of gravity causing them to do so. That is how dumb your argument is.

Got it yet, moron?

BTW, CoRev, the understanding of the underlying science of how CO2 causes global warming dates all the way back to the mid-19th century. It was Fourier in particular, who first figured out that CO2 will absorb certain wavelengths of light that can lead to such cooling. The first person to put this understanding to its logical conclusion, that increasing CO2 in the atmosphere by human activity could lead to global average temperature was Sven Arrhenius of Sweden in 1896.

This is very old and very established scientific knowledge. That this “petrophysicist” Andy May does not know this stuff only shows what an ignorant moron he is, and you too that you do not seem to know it, CoRev, “Policy Wank.”

“lead to global average temperature RISING…”

Barkley insists: ” So when we observe a correlation, which we do, this is completely unsurprising.” Prove it by doing the additional statisitical tests both 2slugs and Menzie agree will be needed?

Prior to 1987, the authors conclusion, THERE IS NO CORRELATION PROVEN, is clearly supported. Saying additional tests may disprove that without doing them is proof only of bias and perhaps fear of the results.

Continuing to insist without doing the work, just proves the truth of what you said: “… even if it means I am some kind of pathetic wuss, poor me.”

I was in graduate school back in the 1970’s and we were told about climate change back then. Of course as a young lad I never realized that political spin would take the art form that the deniers have pulled.

https://www.msn.com/en-us/news/world/lavrov-says-russian-goal-to-oust-ukraine-s-president/ar-AAZWtl8?ocid=msedgntp&cvid=886d9c8f1f6c4d81a133e1b8eafadbb0

Lavrov claims Putin would be fine letting Ukraine exist as a nation as long as Putin gets to choose its leader. Zelensky out and some puppet of the Kremlin in? No thank you. Of course Putin thinks he can put his own main on our White House – Donald Trump.

The ‘are two quarters a recession?’ controversy.

https://twitter.com/PaulEDionneII/status/1551250286001344514

Paul E. Dinello (born November 28, 1962) is an American comedian, actor, and writer, best known for his collaborations with Stephen Colbert and Amy Sedaris.

You are consulting his twitter for economics? God – you are as dumb as a rock.

Here’s the White House, if you think that’s a better source:

https://www.whitehouse.gov/cea/written-materials/2022/07/21/how-do-economists-determine-whether-the-economy-is-in-a-recession/

Why does the White House feel a need to front-run the GDP numbers?

Steven Kopits: Well, gee, that was mentioned in a post 4 days ago, which you (apparently) read, since you commented on it. Or have you forgotten that’s where you saw it?

It was linked, not mentioned. I did not click through.

Me thinks he never read the entire discussion as he stopped at the first sentence.

It was mentioned? Do you ever read past the 1st sentence? This discussion debunked your intellectual garbage. Seriously dude – did you even pass preK reading? Damn!

Steven Kopits

July 25, 2022 at 2:39 pm

It was linked, not mentioned. I did not click through.

YEP – something else informative that you choose not to read. After all truth would interfere with your parade of bloviating BS.

Burry

https://twitter.com/michaeljburry/status/1551422801818505216

Steven Kopits: Wow. You should examine his other views, including on Ukraine (frankly, it’s despicable) and on free speech/abortion rights (frankly, that too is despicable).

Twitter allows just about anyone to post whatever they want to. But Princeton Steve seems to think everyone who posts whatever on macroeconomics must have a Nobel Prize in economics!

You want to do a discussion on Burry’s views on Ukraine?

I think the point is this: As we have discussed, the majority of the US public thinks we’re in recession. If the Q2 print is bad, and I am guessing it will be if the White House has decided to front-run the issue, then the plain vanilla interpretation will be, in the public’s mind, that we are in recession. Do you think the credibility of the White House, or the CEA, or NBER (later), Secy Yellen or the economics community will be burnished if they then stand up and say, “Well, you know, it’s two ugly quarters that would normally count as a recession, but it’s a not a recession! Everything’s fine!” I don’t think so. I think the public is going to think that these fine institutions and their professionals have screwed up — again! — and are lying to them.

Right now, Joe Biden’s net approval per 538 stands at an astounding -19.3 — worse even than Truman! It’s just above the lowest for Trump during his entire four years. It’s bad.

I think it’s time to stop the kumbaya stuff, and start getting people’s heads around what is to come. To wit: Janet Yellen could do with burning a little less of her credibility with each passing day. “Recession is not inevitable.” I think Q1 and Q2 are going to look like a recession to the average Joe, the same one who remembers the “transitory inflation” meme.

But forget that. Take a look at the global PMIs. They look like absolute crap. And China. Good lord. Consumer confidence has fallen off a cliff there. With population decline looking like it’s setting in there, 30 years of real estate Ponzi schemes may be coming to an end, and if it does, it will end in a real ugly way. So I think Xi has two choices: start a war which will end civilization as we know it; or start polishing up the resume.

I suppose my slightly less hyperbolic view is that we’re now going to have an ugly correction in the US, but probably not worse than earlier downturns, if more acute. And it is starting now (in the sense that Q1 and Q2 could be considered a technical recession, that disliked term, but I think the plain ol’ recession is gathering steam right now).

But China? I think China is now going to have its first oil shock and popping of its real estate bubble. That’s where the big changes are coming. If I take an optimistic view of the Chinese people, then we will see a transition to democracy coming up in the medium term. The wheels are in motion.

Steven,

Do you know why it does not matter whether or not the public thinks we are in a recession or not? They do not know what one is. They know it is something that feels bad. And they feel bad, as those abysmally low consumer sentiment numbers show. But we know why they feel bad. It is because of inflation. That is making them feel bad, so they think we are also having a recession.

The sign is indeed the complete incoherence of idiots declaring that a “worker shortage” means there is a recession. Really stupid that.

Steven,

You are seriously quoting somebody who views a “labor shortage” as evidence we are in a recession? Really?

And your Q2 is what, Barkley?

Come on Barkley – Stevie does not know what any of these economic expressions even mean.

Steven,

I am not playing the third rate bs macho game of making a point estimate of Q2. You must do that because you are a paid consultant, but I am not.

As noted elsewhere, I see too much noise in the data to make a point estimate. I expect GDI to look better than GDP, but by how much? Do not know.

So, that makes me a wussy folding umbrella who is not A Real Man, poor me.

The title makes me think of baseball. Braves v. Cardinals!

https://www.msn.com/en-us/news/politics/trump-refused-to-call-on-the-justice-department-to-prosecute-capitol-rioters-to-the-fullest-extent-of-the-law-according-to-draft-remarks-obtained-by-jan-6-committee/ar-AAZW2Gx?ocid=msedgdhp&pc=U531&cvid=634190e6aa4749c49243a687fd9d800b

People on surprised that on 1/7/2021 President Trump declined to say the Justice Department should prosecute the 1/6 domestic terrorists? Why? They were following his orders. Now the Justice Department should prosecute the mob boss – Donald Trump.

Only slightly off topic, but clearly appropriate for recent discussions. This is a letter in response to an IMF working paper.

https://co2coalition.org/2022/07/21/the-great-carbon-arbitrage/

Rebutting the IMF’s Carbon Arbitrage Scheme

Some quotes:

Externalities: “OECD NEA 2018, p39 confirms “When VREs [variable “renewable” energy] increase the cost of the total system, … , they impose such technical externalities or social costs through increased balancing costs, more costly transport and distribution networks and the need for more costly residual systems to provide security of supply around the clock” (OECD NEA 2018, p39) and “From the point of view of economic theory, VREs should be taxed for these surplus costs [integration costs above] in order to achieve their economically optimal deployment.”

Estimating costs: “Your use of the variable cost measure LCOE is scientifically incorrect when comparing dispatchable with base load power. When you adjust your analysis for full costs (which you must for a logical economic argument), you will get different results….

and

Please include and detail the probability and costs of energy shortages (such as current energy crisis starting in 2021 prior the Russian/Ukrainian conflict) and energy starvation (Schernikau et al. 20221) which will directly result from moving away from conventional energy to variable “renewable” energy that is intermittent, energy inefficient, material inefficient, and requires 100% backup or storage to function.”

Problems Converting to Green Energy: “Please mention and clarify that the “green” energy transition will reduce global net energy efficiencies, because they require more complex energy systems and increased storage

IEA 2022[18] “Shifting away from centralized thermal power plants as the main providers of electricity makes power systems more complex. Multiple services are needed to maintain secure electricity supply.” And “In addition to supplying enough energy, these include meeting peak capacity requirements, keeping the power system stable during short-term disturbances, and having enough flexibility to ramp up and down in response to changes in supply or demand.”

Please clarify that to date no grid-scale environmentally and economically viable long duration energy storage system exists. If you believe otherwise, please clarify which solution is today available for long duration energy storage….”

Those are just a few of the highlights from this letter to the IMF

CoRev,

You really like to cite third rate blogs run by idiots.

Presumably those extra VRE costs will be borne by those paying bills to the utilities that put them in place. That will internalize them. They will not be externalities.

But then we know, you really do not know what an externality is, and it looks like these people do not either.

Barkley, if it were only true: “Presumably those extra VRE costs will be borne by those paying bills to the utilities that put them in place. That will internalize them. They will not be externalities.”

This is actually an attempt to internalize the VRE costs.

“From the point of view of economic theory, VREs should be taxed for these surplus costs [integration costs above] in order to achieve their economically optimal deployment.” Otherwise they remain hidden and only recovered through those providing backup, WHEN REGULATIONS ALLOW. Remember that issue of hidden costs.

Did you actually read this letter? More importantly did you read any of the references?

CoRev,

Oh gag, wasted my time reading the letter, including underlying sources. Sorry, these people do not understand what externalities are. There is zero argument `that the VREs will not end up being paid by those paying the utilities.

Their case is that there are costs associated with dealing with the VREs, some of which have in fact been discussed here, such as those storage costs. There is a question of how large those cosrs are. But if solar and wind are cheap enough, it can certainly be efficient to adopt them, and the costs will be paid for by those using the electricity provided by the utllity. These are not externalities, and the claims made in this letter that they are, are simply incorrect.

BArkley, so you admit that you commented without reading the letter and article. Your 1st comment made this point: “Presumably those extra VRE costs will be borne by those paying bills to the utilities that put them in place. That will internalize them.”

Now you admit: “There is zero argument `that the VREs will not end up being paid by those paying the utilities.” A wuss moving the goal posts doesn’t understand the issue of: renewables need backup, typically gas, and thermals do not need renewables. When accurately priced as with the FCOE, renewables costs are not even close to cheaper.

But that’s only one minor point made against the IMF preliminary release.

CoRev,

I read the stupid letter before I commented. Then I went and dug into the so-called source matetial, which simply got worse.

It is clear that this Lars Schernikau is not a real economist and does nor know what externalieies are. He has a 2009 PhD from the Technical University in Berlin with his dissertation becoming a book about the International Trade in Coal, which inaccurately forecast that coal would remain cheaper than alternatives. The guy has never held an academic or government position, and it shows. He claims to be an “independent economist” and a “commodities trader” and an “entrepreneur.” But he has no google scholar cited articles, and except for that book he just has junk like this dumb letter that is simply crawling with flaming errors. Again, none of his coauthors even remotely claim to be economists.

So, they are obsessed with what you are, the intermittency of some renewables. Yes, that does add some costs beyond just the direct cost of the renewables. But those costs are internal to the utility that is using the renewables. It may be that some utilities are incompetent and do not take account of them, but they are still internal to the firms in question. They are not borne externally outside the firms. Thus there is no case for taxation or any other government intervention to offset some externality. There are none.

We get it you really do not understand externalities. On the matter of fossil fuels having brought high standards of living, that is true. But there were no externalities involved, except negative ones due to pollution. The people getting the benefits paid for them. You may argue that the benefits exceeded the costs, but that is true of anything anybody buys. The gap between them is that basic micro concept of consumers’s surplus, which is not an externality. Period.

https://news.cgtn.com/news/2022-05-30/China-s-first-solar-tidal-photovoltaic-power-plant-fully-operational-1asqPv0xC2k/index.html

May 30, 2022

China’s first solar-tidal photovoltaic power plant fully operational

China’s first hybrid energy power station utilizing solar and tidal power to generate electricity became fully operational on Monday in Wenling City of east China’s Zhejiang Province.

The project marks the country’s latest approach toward harnessing two green energy sources in a complementary manner for power generation.

With an installed capacity of 100 megawatts, the power plant ensures more stability for the utilization of renewable energy. Since solar energy supply is intermittent and unavailable when the sun goes down, tidal waves could replace it by supplying power during the night. Moon’s gravity causes tides in the oceans.

“The project has created a new model of comprehensive utilization of new energy by coordinating tidal and photovoltaic power generation using both sunlight and water [tides],” Feng Shuchen, executive vice president of the China Energy Group, told China Media Group (CMG). “It has also effectively promoted innovation and development to accelerate structural energy reform and industrial upgrading.”

The power plant has been built on over 133 hectares with 185,000 installed photovoltaic modules. Its annual output will be over 100 million kWh to meet the annual electricity demand of about 30,000 urban households.

https://news.cgtn.com/news/2022-07-07/Two-new-pumped-storage-power-stations-help-boost-clean-energy-in-GBA-1btmYP4790Q/index.html

July 7, 2022

Two new pumped storage power stations help boost clean energy in GBA *

By Cao Chufeng

At the end of May, two pumped-storage power stations with a capacity of a million kilowatts was put into operation in south China’s Guangdong Province, one located in Meizhou city, and the other in Yangjiang city. Officials said they would promote clean energy and help ensure steady supplies of electricity.

Pumped storage power station functions like a power bank. When the demand for electricity is low, the station uses excess electricity to pump up water into the upper reservoir and store it. When the demand for electricity is at its peak, stored water is released to generate electricity.

It took just four years to build the Meizhou station, the shortest construction period for this kind of project in China, and the Yangjiang station has the largest single unit capacity of generators in China.

“The Yangjiang Pumped Storage Power Station has three 400,000 KW generating units, the largest single unit capacity in China. When the main spindle of the generator rotates clockwise, it is generating electricity. When it rotates counterclockwise, it is pumping water,” said Peng Qian, the Executive Director of Yangjiang Pumped Storage Power Station, which is under CSG (China Southern Power Grid) Power Generation.

During the construction, cost-efficiency was also taken into consideration.

“Our upper reservoir has a total storage capacity of 28 million cubic meters, which allows our three units to generate power for nearly 30 hours at full load. The upper and lower reservoirs are connected by a 3.6-kilometer channel with reinforced concrete lining. We saved nearly $30 million on the construction of the channel alone,” added Peng….

* Guangdong–Hong Kong–Macau

Natural gas news from Europe:

https://abcnews.go.com/International/wireStory/gazprom-raises-questions-energy-standoff-europe-87367900

BERLIN — Russia’s Gazprom said Monday that it would further reduce natural gas flows through a major pipeline to Europe to 20% of capacity, citing equipment repairs. The move escalates tensions over energy supplies that are dwindling just as the continent is trying to shore up its storage for winter. The Russian state-owned company tweeted that it would reduce “the daily throughput” of the Nord Stream 1 pipeline to Germany to 33 million cubic meters as of Wednesday, saying it was shutting down a second turbine for repairs. The head of Germany’s network regulator confirmed the reduction. “The halving of the nomination of NordStream1 was announced for the day after tomorrow,” tweeted Klaus Mueller. Deliveries on Monday were at 40% of full capacity when Nord Stream 1 reopened after 10 days of scheduled maintenance last week. The German government said it rejected the notion that technical reasons would lead to further gas reductions.

Gazprom is saying these cuts were due to their own incompetence. Germany thinks it is more Putin playing games. Either way – an opportunity for the US to sell the EU more natural gas.

How did we miss this hack team?

https://americafirstpolicy.com/latest/mcmahon-kudlow-rollins-launch-america-first-policy-institute/

Arlington, VA – Linda McMahon, Larry Kudlow, and Brooke Rollins, along with other key Trump Administration leaders and officials, today announced the launch of the America First Policy Institute (AFPI), a 501©(3) organization formed to accelerate the transformative, positive changes in American life driven by America First policies. AFPI will provide sound research and carefully crafted policy recommendations to advance the America First agenda.

Linda McMahon’s big accomplishment was promoting fake wrestling.

Rollins was president and CEO of the Texas Public Policy Foundation, an Austin-based free-market think tank.

Kudlow is a lying coke head whose claim to fame was writing the dumbest rants ever for the National Review.

OK – one might note that Rollins and Kudlow used to be free trade. But then they worked for Trump and decided a trade war with China was a grand idea.

I used to call Kudlow, Moore, and Art Laffer the 3 stooges. I guess the show now features Kudlow, Rollins, and the wresting lady.

Brooks Rollins may be dumber than Kudlow. I went to their website what pearls of economic reasoning they offer.

Washington, D.C. – Today, the America First Policy Institute (AFPI) released the following statement from Brooke Rollins, AFPI’s President and CEO, on the wasteful CHIPS-Plus Bill:

“It’s no wonder that our national debt is over 30 trillion dollars with policy proposals like this. The CHIPS-Plus Bill is a massive 250-billion-dollar government spending spree that favors special interests at the expense of American taxpayers. This bill wastes billions of dollars on an already bloated bureaucracy and hands out corporate welfare to companies who don’t need it – all with money we don’t have. Worst of all, this ‘watered-down’ version does not ensure that vital chip manufacturing supply chains will be returned to the United States from China. Instead of more wasteful spending and corporate welfare, Congress should increase U.S. manufacturing competitiveness through the successful pro-growth policies of the Trump Administration that helped all businesses thrive.”

That is the extent of her analysis? The Federal debt is high! OK? Subsidizing a learning by doing sector such as semiconductors is “wasteful”. Just wow. Of course how did Trump favor the coal sector – subsidies and other forms of corporate welfare.

If this is the best Rollins has – she is dumber than even CoRev and Bruce Hall, MAGA!

Atlanta Fed has issues in that it doesn’t take exports or inventory as GDP. It leads a tendency when these issues crop up in “missing exports” or “missing inventory” for lower projected GDP. Its why I use it more for GDI, even then, nothing is perfect. Quarterly revisions take years of processes to work out. If GDI grew 1.8 first quarter and -1.5 2nd quarter with 2nd quarter inventory/exports “surging” creating positive growth overall real GDP, then GDI grew 2 in quarter 3, looks like a microrecession from the crypto bust and some from the artificial rise in gas prices, which was fraud basically. Of course then revisions come with mean trimming, raising Q1 GDP and lowering Q2.

The crypto bust looks over fwiw. 2 trillion of capital liquidated in the 2nd quarter.

Gregory Bott: I’m confused. In the documentation https://www.atlantafed.org/-/media/documents/research/publications/wp/2014/wp1407.pdf, net exports (and inventories) are described as difficult to nowcast, not excluded. And for the input data, I see trade data show up (July 7th into current nowcast). So do you mean that it’s just hard for GDPNow’s authors to nowcast these components?