Atlanta Fed upped its nowcast for Q3 from 0.3%, on the basis of advanced international data, and annual benchmark GDP numbers:

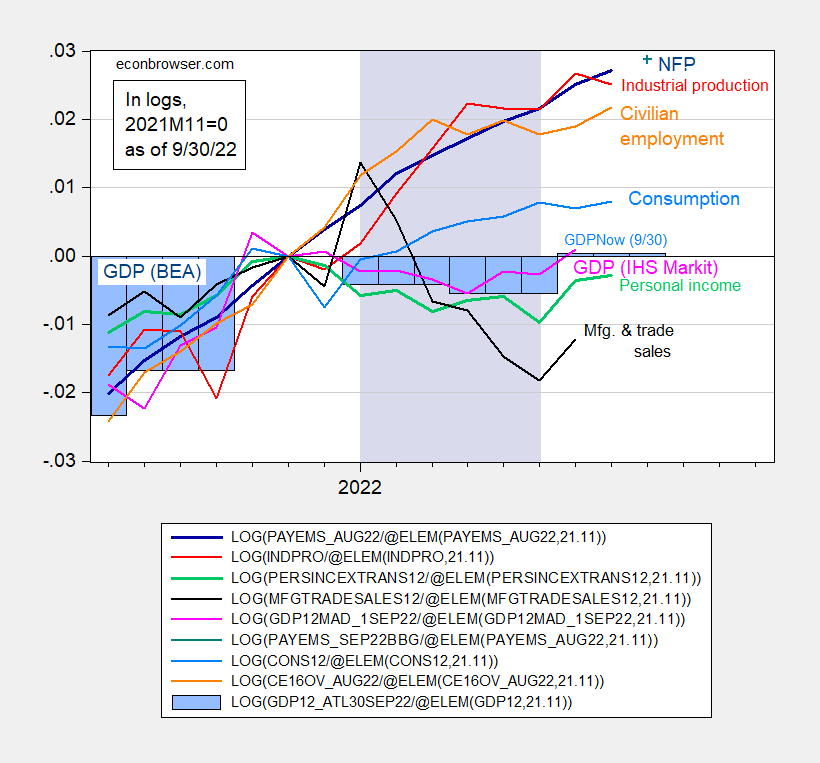

If Q3 turns out to be 2.4% as nowcasted, then the picture of business cycle indicators looks like this:

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 9/30 for NFP (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP with Q3 observation implied by GDNowcast of 9/30 (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (9/1/2022 release), Atlanta Fed (accessed 9/30), and author’s calculations.

RECESSION CHEERLEADER JohnH had lectured Barkley that GDPNow Q3 forecasts were more reliable indicators of real income than even measures like real GDI or real GDP. Forecasts better than actual reporting – really?

Of course now JohnH and his BFF Princeton Steve will have to go fishing for something else.

Misrepresent what I said much? Maybe pgl could find the quote where I said that…

No – I accurately represented what you wrote. Of course your writing is so all over the map and poorly articulated, maybe you have no clue what you said.

Of course you misrepresent what others have said 24/7. So listen troll – you really need to shut up and go far far away.

JohnH

‘September 21, 2022 at 5:13 am

Yeah, people like Rosser cherry pick the numbers to try to convince us “don’t worry, be happy.”

But the GDPNow numbers are what they are. And it’s very entertaining to watch “impartial scientists” constantly spin the numbers.’

This was JohnH’s reply to Barkley noting that actual real GDI rose even if actual reported real GDP did not. Yea he did elevate the Atlanta FED forecasting tricks over reported actual results. But in JohnH’s defense, it may be unfair to say he is lying as we all know he has to be the dumbest troll ever with the world’s worst writing skills.

Wow! You can really see pgl’s misrepresentations at work…a real stretch of the imagination! Rosser talked about employment but not GDI or income. Pgl lied to cover his previous lie! And he dissed the Atlanta Fed and “their forecasting tricks” in the process.

Now that GDPNow has come out with an estimate more to pgl’s liking, you would think they would be back in his good graces. Apparently not!

I must say that it has been quite amusing watching people trot out all manner of numbers to cast doubt on the heretofore sacrosanct GDP numbers that suggested a recession just before the mid-terms. The lengths people will go to shift public perception of the meaning of a few tenths of a percent of GDP!

I don’t see a misrepresentation at work from pgl. No surprise, since few people want to compete with you in your particular area of specialty. Well, one of your areas of specialty, the other being getting economics wrong. Oh, and getting math wrong. And getting facts wrong, I suppose. Come to think of it, you’re sort of a polymath when it comes to being wrong. And at misrepresentation.

Take, for instance, your claim that GDP is “sacrosanct”. Most everyone not in your troll choir has been arguing that GDP should not be the big focus of attention, while you seem mesmerized by it. Menzie updates NBER indicators as they come out. Lots of us have noted the strength of employment gains. Here you are, after making a hash of employment and income issues pretty much since the first comment you posted, pretending the rest of us hold GDP out to be hallowed. Now there’s misrepresentation.

Nice try, Johnny. At least you’re consistent.

Almost forgot. You’re pretty bad at international relations, too.

MacroDuck is apparently pgl’s double—Rosser and I never discussed GDI or income in that exchange. Pgl made it up. And MacroDuck endorsed pgl’s lie.

As noted here, 2022 GDP growth was not revised while GDI and GDO were revised down. However, it was the GDP numbers that were the ones that had been questioned, not the ones that got revised. Why would that be? For one, the GDP numbers have special importance, as they are widely used to assess whether the economy is in recession, pending the NBER pronouncement to be released at some point in the distant future. And second, the 2022 GDP numbers have not been good, which seems to be politically inconvenient, needing to be spun away.

Now if MacroDuck is simply interested in the truth, he can acknowledge that it was the “bad” 2022 GDP growth numbers that held up in the recent revision.

It will be very interesting to see how the H1 GDP numbers get spun here now.

JohnH: As Figure 2 in this post shows, GDP was revised up. Growth rates were not.

“Rosser talked about employment but not GDI or income.”

Everyone can go back and see that Barkley did talk about GDI. Pretty amusing that you accuse others of lying since that is what you do each and every comment. Look Johnny – everyone here knows you are full of malarky but do keep remining us.

‘Barkley Rosser

September 21, 2022 at 1:08 pm

JohnH,

Gross domestic output has been growing strongly. I think you are the on “cherry picking” numbers that are not all that important. People vote on employment, not inventory changes.’

And yet JohnH claims Barkley did not talk about GDI or GDP as Barkley allegedly only talked about employment? I dunno – maybe JohnH is not a liar as something tells me he never learned to READ.

Johnny? Johnny, GDP is wdely used to assess recession, in large partbecause recession cheerleaders like you run around saying it’s so. Kinda like Republicans who claim the election was stolen, then say the legitimacy of the election needs to be investigated because people need to be able to trust that the election wasn’t stolen.

“Recession” isn’t something that you or I or Congress or the Fed can do anything about – not anything usefull, anyhow. Inflation? Yes. Unemployment? Yes. Fiscal deficit? Yes. Trade deficit? Kinda maybe. Recession? It’s an historical artifact, used as a convenience for discussion and research. Until MAGA minions and Putin poodle decide they know before the NBER, better than he NBER, when there has been a recession. And here you are again, making noise for political reasons. Putin must be so proud.

I believe that I also talked about GDI at another time as well, not the time pgl cites, but, sorry, I am not Moses Herzog who loves to dredge through ancient posts here. It does seem that JohnH has been mischaracterizing my exchanges on this with him, although, frankly, I have lost track of all the ins and outs of it. Sorry, my incipient senility kicking in, of course, :-).

Oh, JohnH is right that I made a big deal about employment, which we know is something the NBER makes a really big deal about in their considerations, a point I have made more than once, I believe, although I am not going to digging around to count how many times exactly. But the job market has been hot hot hot all year and continues to be, which is one of the reasons with inflation continuing to hold up that policymakers and many others are freaking out, with likely further Fed policy tightening, and the stock market getting very unhappy.

Actually, this is one of those old saws that I have told students in macro classes about for many decades. It is the paradox of the stock market often reacting badly to “good economic news,” such as an unexpected decline in the unemployment rate. Now if the economy is in a really unequivocal recession, such good news may help the stock market. But otherwise, it often hurts the market precisely because it leads market participants to expect greater tightening of monetary policy with higher interest rates, which the stock markets in particular, as well as many other financial markets Ialthough not necessarily the forex market( do not like. Pretty obvious once one thinks about it, but something not obvious to students until it has been pointed out to them.

“Atlanta Fed upped its nowcast for Q3 from 0.3%”.

0.3%! You insisted the other day that the average annual growth rate for real GDP has been only 0.3% since 2000, which would mean real GDP today would be only 6.5% higher than it was in 2000. BEA says real GDP today is 49% higher than it was in 2000.

I suggested you call Bill Gates as you have a very defective version of Excel.

https://news.cgtn.com/news/2022-09-30/India-s-central-bank-delivers-half-point-rate-hike-1dKhl6AgrV6/index.html

September 30, 2022

Indian central bank raises interests by 50 basis points to 5.90%

The Reserve Bank of India raised its benchmark repo rate by 50 basis points to 5.9 percent on Friday, after the rupee plunged to a record low this month.

The rate hike was the fourth straight increase in the current cycle. The standing deposit facility rate and the marginal standing facility rate were also increased by the same quantum to 5.65 percent and 6.15 percent, respectively.

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2022

(Indexed to 1994)

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2022

(Indexed to 2007)

I was actually surprised this interest rate had declined below 6% but then I have not checked India’s data since Obama was still President:

https://fred.stlouisfed.org/series/INTDSRINM193N

https://fred.stlouisfed.org/graph/?g=NVGh

January 15, 2018

Interest Rate on 10-Year Indian Government Bonds and Consumer Price Index, 2012-2022

(Percent and Percent change)

https://fred.stlouisfed.org/graph/?g=O535

January 15, 2018

Interest Rate at Discount Window for India and Consumer Price Index, 2007-2022

(Percent and Percent change)

Final domestic demand looks weak, maybe negative, while inventories (!) and trade are not drags. Trade looks pretty massive as a contribution. Softer domestic demand and a less negative (positive in terms of GDP contribution) showing from trade go hand in hand.

Residential investment is likely to remain a drag for some quarters to come, though perhaps with some exceptions. Government spending isn’t, on average, looking like an add to growth.

Seriously, with domestic demand softening from housing, household spending and government, the Fed can really afford to take a breather. The effects of monetary policy lag. The PCE deflator for August doesn’t show the entire effect of hikes so far.

The Fed could afford to, but it seems hell-bent on punishment; Jerome (“Dominatrix”) Powell is in charge.

https://english.news.cn/20220930/113fccff751140c8a55d135a981ccf54/c.html

September 30, 2022

Chinese mainland rises to 11th place on WIPO’s innovation rankings

BEIJING — The Chinese mainland has climbed to 11th place on the Global Innovation Index (GII) 2022 * released by the World Intellectual Property Organization (WIPO), up one place from its 2021 ranking.

This elevation in rank marks the Chinese mainland’s 10th consecutive ascent, bringing it to the top of the 36 upper middle-income economies, according to the China National Intellectual Property Administration (CNIPA) on Thursday.

The GII tracks the most recent global innovation trends and reveals the most innovative economies in the world, ranking the innovation performances of approximately 130 economies, according to the WIPO.

In terms of innovation input sub-indicators, the Chinese mainland ranked first in domestic market scale and number of firms offering formal training, according to this year’s GII report.

In terms of innovation output sub-indicators, the Chinese mainland ranked first in patents by origin, utility models by origin, labor productivity growth, trademarks by origin and creative goods exports, according to the report.

* https://www.wipo.int/pressroom/en/articles/2022/article_0011.html

https://news.cgtn.com/news/2022-09-28/China-s-sci-tech-innovation-spending-hits-record-high-official-data-1dH8ETrfjTa/index.html

September 28, 2022

China’s sci-tech innovation spending hits record high: official data

With the massive increase in government spending on science and technology innovation, China has significantly improved its sci-tech strength and innovation competency over the past decade, according to data released by the National Bureau of Statistics on Tuesday.

China’s government expenditure on sci-tech innovation exceeded 1.07 trillion yuan (about $150.5 billion) in 2021, up 92.2 percent over 2012, maintaining an over-4-percent ratio to the national public expenditure in recent years. The country’s ratio of government spending on scientific research to GDP also jumped to 2.44 percent in 2021, from 1.91 percent in 2012.

In addition, the country’s funding for basic research grew at an average annual rate of 15.4 percent, which is 3.7 percentage points faster than that of the whole society in the same period.

Sci-tech innovations boost industrial development

In 2021, the number of new product projects developed by industrial enterprises with annual revenues of more than 20 million yuan was 959,000, which is 2.9 times that of 2012. The annual revenue of these enterprises from new products hit 29.6 trillion yuan, 2.7 times higher than in 2012.

China has also cultivated over 40,000 national specialized and sophisticated enterprises, as well as 4,762 “little giant” companies that serve as a dynamic force driving the country’s industrial chain innovation and cooperation….

https://news.cgtn.com/news/2022-09-30/C919-gets-airworthiness-permit-first-jet-to-be-delivered-by-end-2022-1dKLBicCvXG/index.html

September 30, 2022

China’s homegrown C919 gets airworthiness permit, first jet to be delivered by end-2022

By Cao Qingqing and You Yang

China will deliver its first homegrown C919 large passenger plane by the end of 2022.

The plane, developed by the Commercial Aircraft Corporation of China (COMAC), was granted a certificate of airworthiness by the country’s aviation regulator, the Civil Aviation Administration of China, on Thursday.

“The airworthiness certificate indicates that the C919 has met the basic safety level of commercial operations,” Qiao Shanxun, a member of the Chinese Society of Aeronautics and Astronautics, told CGTN.

Its certification signifies that China has the ability to independently develop world-class large passenger aircraft, and marks an important milestone for the country’s large aircraft industry.

American aerospace manufacturer Boeing and France-based Airbus have long been considered a duopoly in the commercial airline market, which is worth trillions of U.S. dollars….

Large narrow-bodied passenger planes will be added indefinitely to the Chinese fleet at about 300 planes a year. Manufacture of the planes entails highly sophisticated technology. Each of this class of planes costs $100 million and more. So, the technological and market importance of the domestic-technology C919 for China is dramatic.

https://www.msn.com/en-us/news/world/lindsey-graham-begs-biden-to-designate-russia-a-state-sponsor-of-terrorism-putin-a-war-criminal-on-steroids/ar-AA12rPIp?ocid=msedgdhp&pc=U531&cvid=4ecd118ac5fe4b5aacbd096c538b160f

Lindsey Graham, R-S.C., pleaded with President Biden to designate Russia as a state sponsor of terrorism Friday on “The Story” as President Vladimir Putin illegally annexes parts of Ukraine.

I finally agree with little Lindsey on something. But let’s be honest – little Lindsey worships his own terrorists known as Donald Trump. And Trump would have gone along with Putin’s war crimes as Trump is Putin’s minnie me.

pgl,

I may be wrong on this, but I think that Tramp actually went along with Tucker Carlson in suggesting that Biden and the US are behind the explosion and damage to the Nord Stream pipelines. This is the line of Putin, of course, who is calling Biden a “terrorist” over this.

It has not been proven the Russians did it, and as 2slugbaits has noted, it is possible that these problems simply happened due to bad quality of the pipes themselves, a Russian problem. But most observers think the Russians did it. The loudest claims about Biden doing it involve a statement he made at one point about how if Russia invaded Ukraine, Nord Stream II would get shut down. But the Germans decided to end it two days before the invasion happened, so this item is just the usual propogandistic garbage, even as we have US commentators repeating it.

I am surprised JohnH or maybe Anonymous have not leaped in here to spout this stuff.

“I may be wrong on this, but I think that Tramp actually went along with Tucker Carlson in suggesting that Biden and the US are behind the explosion and damage to the Nord Stream pipelines. This is the line of Putin, of course, who is calling Biden a “terrorist” over this.”

Makes sense as Tucker and Trump both work for Putin.

Ian rocked Florida a lot like Sandy rocked NYC. Hmmm:

https://www.politifact.com/factchecks/2022/sep/30/yuh-line-niou/did-rubio-and-desantis-vote-against-hurricane-sand/

The requests from the Republicans for help from a Democratic president and administration prompted many Twitter users to suggest that Rubio and DeSantis are hypocrites. They said the Republicans opposed federal relief for New York and New Jersey after Hurricane Sandy battered those states in 2012. “Just a reminder to New York … Marco Rubio and Ron DeSantis (who was then in Congress) voted against aid for Hurricane Sandy. But because we are New York, we care about everyone,” tweeted Yuh-Line Niou, a Democrat who represents areas of Manhattan in the New York Assembly. “Even when they don’t care about us.”

New Yorkers will come to the aid of the citizens of Florida even though about a decade ago the current governor of Florida told us to eff off. I wish the best for the citizens of Florida but can you please get rid of the racist piece of garbage DeSantis.

let me include my comment from the prior thread here, since it is more relevant to this thread..

suffice it to say i really can’t imagine a way for 3rd quarter GDP growth to get to a 2.4% rate, ie, it would take a 2.0% MoM increase in September real PCE just to get 3rd quarter PCE growth to a 2.4% annual rate, and then all the other GDP components would have to get there too….yes, international trade has improved, but there were big upward revisions to 1st & 2nd quarter inventories, and 3rd quarter growth has to at least match the 2nd quarter’s inventory growth to avoid pulling GDP lower..

https://www.credit-suisse.com/about-us/en/reports-research/global-wealth-report.html

2022

Global Wealth Report 2022

By Credit Suisse Research Institute

A record 2021 for household wealth

[ Well worth reading and referring to. Thank you. ]

The model I constructed and use:

https://fred.stlouisfed.org/graph/?g=AuPx

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=Se7b

January 15, 2020

Shares of Potential Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

(Indexed to 2020)

Agreed.

Mathematically, the combined effect of inventory and net export changes can amount to 2.4% annualized growth, all by themselves. Often, they are offsetting, but when the run in the same direction – as might happen with a slowing in domestic final demand growth – the two can add (or subtract) quite a bit to (from) GDP:

https://fred.stlouisfed.org/graph/?g=UlNo

But I do share your doubt about Q3 growth running at 2.4%. For one thing, inventory growth, while it has slowed a lot, was still high by pre-Covid standards in July and so likely to continue slowing:

https://fred.stlouisfed.org/graph/?g=UlNL

The idea that a rise in net exports will accompany a increase in the growth of inventories when inventory growth would naturally be declining seems a stretch.

this morning’s construction spending report is the source data for 3 subcomponents of GDP; investment in private non-residential structures, investment in residential structures, and government investment outlays, for both state and local and Federal governments….i’ve attempted to estimate its impact, but before i even start i have to lay out a big caveat…since the BEA uses a multitude of deflators for the various components of non-residential investment, i’m just using the producer price index for final demand construction as an inexact shortcut to make a price adjustment needed in order to make a ballpark estimate.

https://data.bls.gov/timeseries/WPSFD43?output_view=pct_1mth

as you see, that index shows a 5.0% increase in construction costs between June and July; you don’t need to be a rocket scientist to see how that big an increase would impact the inflation adjustments between the 2nd and 3rd quarters…but that’s an anomaly; construction costs rose 0.3% in August,, by 0.5% in June and by 0.3% from April to May, so i feel the 5.0% increase shown for July is suspect…

this morning’s report shows annualized construction spending in millions of dollars for the second quarter months at $1,803,791 for June, $1,793,778 for May, and $1,780,890 for April in this report, while it was at $1,793,514 million for July and $1,781,278 million for August….using that PPI index, i figure ((1,781,278 + 1,793,514 * 1.003) / 2 ) / (( 1,803,791 * 1.053 + 1,793,778 * 1.058 + 1,780,890 *1.061) / 3) = 0.94435, meaning real construction over July and August was 5.565% lower than that of the 2nd quarter..hence, real construction for the 3rd quarter fell at a 20.47% annual rate from that of the 2nd quarter…means that if September should show no improvement, the pullback in real construction would subtract a net of about 2.08 percentage points from 3rd quarter GDP across those components that it influences…

again, i have a low confidence in that estimate, since the real figures are largely predicated on the 5.0% increase in July construction costs i used as a basis for my computation..

if anyone wants more accuracy, be my guest; Chapter 6 here shows the dozens of deflators actually used for construction: https://www.bea.gov/resources/methodologies/nipa-handbook

Missed opportunity to end the stupid Trump trade war:

https://www.pwc.com/us/en/services/tax/library/ustr-to-continue-section-301-tariffs-on-chinese-imports-for-now.html

The United States Trade Representative (USTR) announced on September 2 that added customs tariffs on certain imports from China would not be terminated and instead would be continued pending further review. USTR in its notice indicated that it is retaining the tariffs because of requests received for their continuation from representatives of domestic industries that benefit from the tariffs.

The added tariffs initially were put in place as of July 16, 2018, and August 23, 2018, under Section 301 in the investigation of China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation. USTR undertook this review of whether to continue the tariffs pursuant to a statutory four-year review.

Note the reasoning for continuing these tariffs – ‘requests received for their continuation from representatives of domestic industries that benefit from the tariffs’. Trump corruption continues.

Happy days are here again!

It appears the federal government’s response to hurricanes has improved. As has availability of inoculations, those with jobs to go to, and even a President who doesn’t advise people to drink toxic bleach. But if YOU feel like drinking bleach today T. Shaw I won’t tell you otherwise.