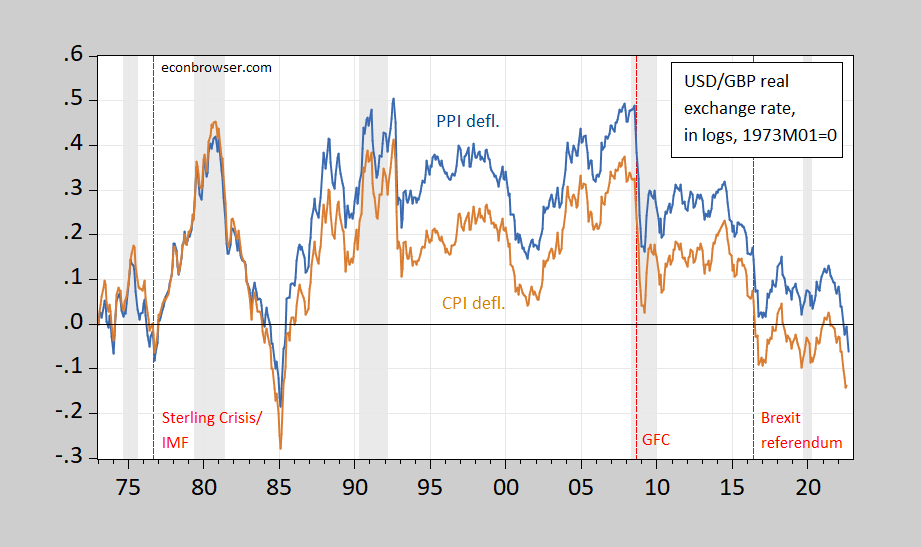

The drop in the pound over the last week was dramatic. But even with the recovery in the currency’s value to pre-mini-budget levels, the pound has been on a downward trend for the past six years, in inflation adjusted terms.

Figure 1: PPI deflated real GBP/USD exchange rate (blue), and CPI deflated (tan), both in logs, 1973M01=0. Downward movements denote depreciation of the Pound. Sept values for PPI assumes continued decline at August rate. Bloomberg consensus for UK CPI; Cleveland Fed nowcast for US CPI. ECRI defined recession peak-to-trough recession dates shaded gray. Source: Fed via FRED, BLS, ONS, and author’s calculations.

One way to look at the events of September is that its the third persistent negative terms of trade shock the pound has experienced in the past 15 years, the first being the Global Financial Crisis, and the second being Brexit. The downward moves in the PPI deflated real rate are more remarkable (in my opinion) since they reflect a deterioration in the terms of trade of ostensibly tradable goods.

How do formal statistical tests relate to this assertion. The PPI deflated rate rejects the unit root null at the 13% msl using the ADF test (6% for the unit root test). That means that PPP for traded goods/PPI is not strongly apparent. A Bai-Perron recursive structural break test identifies breaks at 1987, 2000, and 2015. The 2015 break is close to the Brexit referendum.

For more discussion of PPP, etc., see this.

Tax cut for the rich abandoned:

https://www.msn.com/en-gb/money/other/uk-scraps-tax-cut-for-wealthy-that-sparked-market-turmoil/ar-AA12vOzJ

The British government has dropped plans to cut income tax for top earners, part of a package of unfunded cuts that sparked turmoil on financial markets and sent the pound to record lows.

BIRMINGHAM, England (AP) — The British government has dropped plans to cut income tax for top earners, part of a package of unfunded cuts that sparked turmoil on financial markets and sent the pound to record lows.

Chancellor of the Exchequer Kwasi Kwarteng speaking to the media ahead of the Conservative Party annual conference at the International Convention Centre in Birmingham. Picture date: Monday October 3, 2022. The British government has dropped plans to cut income tax for top earners, part of a package of unfunded cuts that sparked turmoil on financial markets and sent the pound to record lows. (Aaron Chown/PA via AP)

Chancellor of the Exchequer Kwasi Kwarteng speaking to the media ahead of the Conservative Party annual conference at the International Convention Centre in Birmingham. Picture date: Monday October 3, 2022. The British government has dropped plans to cut income tax for top earners, part of a package of unfunded cuts that sparked turmoil on financial markets and sent the pound to record lows. (Aaron Chown/PA via AP)

© Provided by Associated Press

Britain’s Chancellor of the Exchequer Kwasi Kwarteng speaks to the media ahead of the Conservative Party annual conference at the International Convention Centre in Birmingham, England, Monday, Oct. 3, 2022. The British government has dropped plans to cut income tax for top earners, part of a package of unfunded cuts that sparked turmoil on financial markets and sent the pound to record lows. (Aaron Chown/PA via AP)

Britain’s Chancellor of the Exchequer Kwasi Kwarteng speaks to the media ahead of the Conservative Party annual conference at the International Convention Centre in Birmingham, England, Monday, Oct. 3, 2022. The British government has dropped plans to cut income tax for top earners, part of a package of unfunded cuts that sparked turmoil on financial markets and sent the pound to record lows. In a dramatic about-face, Treasury chief Kwasi Kwarteng said Monday that he would abandon plans to scrap the top 45% rate of income tax paid on earnings above 150,000 pounds ($167,000) a year. “We get it, and we have listened,” he said in a statement. He said “it is clear that the abolition of the 45p tax rate has become a distraction from our overriding mission to tackle the challenges facing our country.” The U-turn came after a growing number of lawmakers from the governing Conservative Party turned on government tax plans announced 10 days ago.

Smart move by the Brits. Now if you Americans could only reverse our stupid 2017 tax law.

Not related to the post.

https://www.msn.com/en-us/news/politics/matt-gaetz-is-asking-the-government-to-fund-hurricane-ian-disaster-relief-in-florida-days-after-he-voted-against-fema-aid/ar-AA12vWJT

Florida Rep. Matt Gaetz is calling for the US to send aid to Floridians in the aftermath of Hurricane Ian — but he also voted “no” to a bill that carved out cash for the Federal Emergency Management Agency, or FEMA, to do just that.

Matt Gaetz also says he doesn’t have pay for his prostitutes because he gets his rich buddies to pay for them. What a guy!

Gosh, T. Shaw, and your comment is also not related to the post, but you have now put it up twice. What a hypocrite.

Are you the new police person of this blog? Who appointed you?

Barkley Rosser: My mistake – T. Shaw was previously banned by me, and I accidentally let through some posts. I have deleted his/her posts now.

Kevin Drum links to what may be a spot on editorial in the NYTimes on the Supreme Court – which I’m hoping someone (maybe ltr) can provide the entire discussion. Kevin provides a key snippet:

https://jabberwocking.com/the-supreme-court-is-now-the-third-branch-of-the-republican-party/

The actual cause of its historic unpopularity is no secret. Over the past several years, the court has been transformed into a judicial arm of the Republican Party.

Kevin adds:

Yep. The modern Republican Party consists of three branches: the Supreme Court, Fox News, and Donald Trump. Congratulations to SCOTUS for its official entry into this triumvirate.

https://www.nytimes.com/2022/10/02/us/conservative-supreme-court-legitimacy.html

October 2, 2022

As New Term Starts, Supreme Court Is Poised to Resume Rightward Push

The justices return to the bench on Monday to start a term that will include major cases on affirmative action, voting and discrimination against gay couples. Several will take on questions about race.

By Adam Liptak

WASHINGTON — The last Supreme Court term ended with a series of judicial bombshells in June that eliminated the right to abortion, established a right to carry guns outside the home and limited efforts to address climate change. As the justices return to the bench on Monday, there are few signs that the court’s race to the right is slowing.

The new term will feature major disputes on affirmative action, voting, religion, free speech and gay rights. And the court’s six-justice conservative supermajority seems poised to dominate the new term as it did the earlier one.

“On things that matter most,” said Irv Gornstein, the executive director of the Supreme Court Institute at Georgetown Law, “get ready for a lot of 6-3s.” …

T.S.,

This stream of comments is getting worse. Yeah, people should stick to the topic, but they don’t and no speechifying by a nobody like you will make them do it.

And your additional comments have been totally stupid and wrong. Gaetz is an utterly disgusting human being, and this post by ltr looks pretty accurate. Are you trying to get into competition with CoRev and “Anonymous” for stupidest commenter on this blog?

JohnH has claimed Russia is winning in the Kherson region but his own Putin lackeys suggests otherwise:

https://www.msn.com/en-us/news/world/ukrainian-troops-overrun-russian-forces-break-through-lines-in-recently-annexed-kherson-live-updates/ar-AA12xBGO?ocid=msedgdhp&pc=U531&cvid=e52031e43861437495792addf8b0275e

Ukrainian troops overrun Russian forces, break through lines in recently annexed Kherson

A Ukrainian counteroffensive that already has reclaimed thousands of miles is breaking through Russian lines in the Kherson region recently annexed by Moscow, Kremlin-installed officials said Monday. Vladimir Saldo, the Russian-installed head of Ukraine’s Kherson region, said on state television that multiple settlements about 70 miles northeast of the city of Kherson on the bank of the Dnieper River had been overrun. “It’s tense, let’s put it that way,” Saldo said in a translation by Reuters.

It must be hard to be Putin’s pet poodle. Little Johnny may not get his bone today.

On top of that, which I reported in another thread earlier, it looks that Ukrainans have already taken the final metro area in Kharkiv oblast, Borova, that Putin is under pressure to withdraw troops from crucial Svatove in Luhanks, and Ukrainians are closing in on Kreminna, all of which I forecast here would be under Ukrainian control within days.

One rumor has it that Putin is preparing to give up northern Luhansk because he wants to hold Kherson, but indeed it looks that Ukrainians have broken through down there finally and are rolling.

One weird item is the continuing Russian efforts to move forward at Bakhmut, the only place they have made any advances in recent months, even as they have failed to take this unimportant location after three months of trying. I have speculated that they keep trying because they need some “gains” somewhere, even if just a few meters from time to time, to report to their population. But another theory floating around is that this is the Wagner Group, and its boss, Progozhin, is ordering it to continue with political ambitions in Moscow, with him highly criticial of the military leaders.

It would certainly be a lot better for Progozhin if the place his people are fighting were to outperform the places where the Russian military is fighting.

It has been reported that the Russian retreat from Lyman was a lot more orderly than what happened in Kharkiv Oblast and that some of the troops were sent to Bakhmut. That would suggest that the fall back to Svatove and Kreminna is not going to be that well staffed and may not hold for long. I doubt that we are talking days but weeks is very possible.

https://fred.stlouisfed.org/graph/?g=Ugyh

January 15, 2018

Real Narrow Effective Exchange Rate for United States and United Kingdom, 1964-2022

(Indexed to 1964)

https://fred.stlouisfed.org/graph/?g=UoHF

January 30, 2018

Interest Rate on 10-Year United Kingdom Government Bonds, 1964-2018

Correcting dating:

https://fred.stlouisfed.org/graph/?g=UoHF

January 30, 2018

Interest Rate on 10-Year United Kingdom Government Bonds, 1964-2022

UK 5-year CDS spread is only a little improved with the announcement that the richie-rich tax cut has been canceled:

http://www.worldgovernmentbonds.com/cds-historical-data/united-kingdom/5-years/

On the subject of CDS spreads, anybody watching Credit Suisse? Looking like it is on it’s way to a restructuring of debt:

https://www.ft.com/content/51480b88-9e08-477d-8a31-f973e4b337a1

CS is a partcular stinker, but contagion is a problem, no matter who changes payment patterns..

By the way, I saw a headline today about Credit Suisse driving a rally in Treasuries today. Seems wrong. Stocks were up today, too. Safe haven and risk appetite both in response to th same news?

First trading day of a new quarter, following three quarters of losses in both equities and bonds – seems like accounts just giving investing another try at the beginning of a new quarter. It’s what they are paid to do.

More on the Credit Suisse problems and its restructuring plans:

https://money.usnews.com/investing/news/articles/2022-10-04/analysis-credit-suisses-turnaround-just-got-a-lot-tougher-as-market-reels

The good news about CS is that they’ve been stinking for years now. Dragging their heels on compliance with modern banking regulation, like petulant children. That gives lenders (and borrowers) some heads up. Current exposure reflects their doltish reputation. I think it’s the same story with Deutsche Bank. Doesn’t mean everything is peachy on the systemic risk front, of course.

https://www.nytimes.com/2022/10/03/opinion/truss-britain-bonds-taxes.html

October 3, 2022

Learning From the British Bond Debacle

By Paul Krugman

Liz Truss, who became Britain’s prime minister less than a month ago, may have set a political speed record. She certainly isn’t the first leader who has been forced to make a policy U-turn in the face of adverse market reactions. But announcing an economic program and then abandoning its central plank just 10 days later is something special.

And those of us on the center-left can, I think, be forgiven for feeling a bit of schadenfreude. Conservatives constantly warn that progressive policies will be punished by the “bond vigilantes,” who, they claim, will drive up interest rates at the prospect of any increase in public spending. Such warnings usually are proved wrong. In Britain, however, the bond vigilantes actually did make an appearance; interest rates shot up after the Truss government announced its economic plans. But the market wasn’t reacting to excessive spending, it was reacting to irresponsible tax cuts.

That said, the simple story — Truss proposed policies that would increase the budget deficit and feed inflation, and markets reacted by pushing interest rates up and the pound down — misses much of what really happened. This was both more and less than a matter of dollars and cents (or, I guess, pounds and pence). It was instead largely about a government squandering its intellectual and moral credibility.

How big a tax cut did Truss propose? She and her officials announced their policy without a budget score, which contributed to the market’s loss of confidence. However, there are independent estimates; for example, the Resolution Foundation, a British think tank, estimated the Truss tax cuts at 146 billion pounds over the next five years, which would be around 1 percent of projected G.D.P. over the same period. That’s not trivial, but it’s also not huge. And the particular tax cut that was just abandoned, a reduction in the top tax rate, was only part of that total.

So why was the market reaction so fierce? …

https://www.nytimes.com/2022/09/27/opinion/uk-pound-inflation-mortages.html

September 27, 2022

Why Is the Pound Getting Pounded?

By Paul Krugman

Financial markets usually give wealthy, politically stable nations a lot of fiscal space. In particular, a country like the United States, or for that matter Britain, can normally run quite big budget deficits without creating a run on its currency. This is because investors typically believe that nations like ours will, in the end, get their acts together and pay their bills; they also believe that central banks like the Federal Reserve and the Bank of England will do whatever it takes to prevent deficit spending from setting off runaway inflation….

https://www.nytimes.com/2022/09/23/opinion/uk-truss-tax-cut-economy.html

September 23, 2022

Wonking Out: The tax-cut zombie attacks Britain

By Paul Krugman

Britain is in a very difficult economic position. The British economy, like the U.S. economy, seems to be seriously overheated, with substantial amounts of inflation driven by high domestic demand. Unlike America, it is also facing the full force of Europe’s energy crisis, driven by the efforts of President Vladimir Putin of Russia to use a shut off of natural gas to bully the West into abandoning Ukraine.

So many of us expected Britain’s economy to go through a rough patch in the months, or maybe even years, ahead. What few foresaw, as far as I can tell, was a policy zombie apocalypse.

I’ve written a lot over the years about zombie economic ideas — ideas that have failed repeatedly in practice, and should be dead, but somehow are still shambling around, eating policymakers’ brains. The pre-eminent zombie in American economic discourse has long been the belief that cutting taxes on the rich will create an economic miracle….

https://news.cgtn.com/news/2022-10-04/A-shocking-10-days-for-the-UK-1dR1ZsO93MY/index.html

October 4, 2022

A shocking 10 days for the UK

By Mohamed A. El-Erian

The United Kingdom has had a sobering 10 days, with its economy, financial system, and citizens’ well-being suddenly at risk. But with rapid and coordinated action, policymakers can still salvage the situation.

On September 30, the ratings agency Standard & Poor’s placed the UK’s AA credit rating on “negative watch”– effectively threatening the country with a downgrade – over concerns that the new government’s proposed package of unfunded tax cuts (the “mini-budget”) will increase the country’s debt burden. A downgrade would become more likely if “economic growth turns out weaker due to further deterioration of the economic environment or if the government’s borrowing costs increase more than expected, driven by market forces and monetary-policy tightening.”

While S&P’s rating action will not materially affect the UK’s access to credit, it represented yet another embarrassment – along with extraordinary borrowing-cost volatility and a rebuke from the International Monetary Fund – for Prime Minister Liz Truss’s government. It further undermines three pillars of the UK’s well-being: policymaking credibility, economic performance, and financial-market integrity.

S&P’s decision was far from the only consequence of Chancellor Kwasi Kwarteng’s announcement on September 23 of the mini-budget. The plan spooked financial markets and triggered a precipitous fall in the pound’s value, as it signaled that Kwarteng would be pressing hard on the stimulus accelerator, even as the Bank of England (BOE) taps on the brakes. In fact, just two days earlier, the BOE had decided to increase the policy interest rate from 1.75 percent to 2.25 percent – the highest level since the 2008 global financial crisis – and pointed to further hikes ahead.

Deepening the policy contradiction, the BOE’s chief economist warned a few days later that the government’s plan would demand a “significant monetary response.” But, the very next day, September 28, the BOE was forced to announce a two-week program to buy 65 billion pounds ($73 billion) of long-dated bonds, in order to restore financial stability and avoid a pensions-sector meltdown.

The threat of a financial-market accident thus significantly complicated the BOE’s already-tricky task of striking the right balance between fighting inflation and minimizing the damage to economic activity. Financial stability was suddenly also in play. Undermining the UK’s policy credibility yet further, the government attempted to bypass the established institutional framework as it advanced its budget measures, including by failing to consult adequately with the Office of Budgetary Responsibility (OBR) and other agencies.

The adverse consequences for the economy immediately started playing out in the market for housing finance – an important sector not just economically, but socially and psychologically as well. A surge in the cost of mortgages accompanied a disruption in their availability. Coming on top of the October 1 hikes in energy and gas prices, this is sure to further erode business and household confidence, despite measures to preclude additional energy price increases for some time.

The wild gyrations that seized UK financial markets for three days after the mini-budget announcement were unthinkable to many just a day earlier. Yet they pale in comparison to the BOE’s September 28 intervention….

Mohamed A. El-Erian, the President of Queens’ College at the University of Cambridge, is a professor at the Wharton School of the University of Pennsylvania.

https://mainlymacro.blogspot.com/2022/10/the-budget-has-left-uk-economy-with-no.html

October 3, 2022

The Budget has left the UK economy with no good options, so why did this government make such an expensive mistake?

Did the dreadful budget of 24th September create a crisis? It all depends on how you define a crisis, of course, but some of the commentary which focused on sterling was looking in the wrong place. It was interesting that sterling depreciated, but it only looked like a crisis if you mixed up dollar strength with that depreciation. Here is what happened to the Sterling Euro rate….

— Simon Wren-Lewis

what i saw last week: truss’ inflationary policies (supply side surge not credible there) in context of fed tightening.

view of a strong us$ vs weakening sterling.

yesterday seems fed credibility is in question

i do not see any evidence

powell may need to pull out the jackson hole speech.

why is fed credibility being questioned?

Back in the USA, 30-year mortgage rates as reported by Freddie Mac have risen from 5.0% two months ago to 6.7% now:

https://fred.stlouisfed.org/series/MORTGAGE30US/

Over the same period of time, the interest rate on 30-year government bonds rose from 3.0% to 3.7%. So of the 1.7% rise in mortgage rate, 0.7% of this increase was due to the higher interest rates on long-term government bonds.

But wait – the credit spread was 2.0% two months ago but now is 3.0% now. Of all the people talking about interest rates (sometimes intelligently but all too often babbling BS), Macroduck is the one person here that really focuses on credit spreads in a reasonable way. So if he has any insights on this apparent rise in the mortgage market credit spread, I would love to hear from him.

Short answer –

The Fed stopped buying MBS and has for some time signaled a reduction in holdings. Perceived MBS risk has increased since 2016. Those two facts have led to MBS selling to reduce portfolio risk in a year when risk reduction is really popular. Wild speculation – I think mortgage investors expect a lot of mortgages to be under water soon.

Same answer, only longer –

Couple of thing I think are enlightening:

– Flow into and out of the Fed’s MBS portfolio and

– MBS spread peformance relative to corporate spreads.

They provide a type of evidence. After the evidence, I’ll speculate.

The Fed’s purchase of mortgages looks to have been pretty effective in driving mortgages spreads. The goal of MBS purchases has always been to create a relative shortage of risk, driving down risk spreads. It works.

Flow matters more than stock. In the FRED chart linked below, three periods of rapid flow of MBS into the Fed’s portfolio reliably lowered mortgage spreads, with one partial exception; from May 2021 forward, spreads stalled, even though inflow continued strong. Perhaps there is a sort of floor for MBS spreads in the 50 bp to 75 bp range. But if there isn’t some floor that is natural to the MBS market, that stall suggests some risk perception that Fed purchases couldn’t overcome. And then, what do you know, the end of Fed purchases set off a rapid widening of spreads. The cause of that rapid pace of widening needs explaining.

https://fred.stlouisfed.org/graph/?g=UpHa

Looking at a not-entirely analogous market spread, the corporate single-A bond spread, helps explain the pace of MBS spread widening, in a worrying way. Both spreads show that general risk appetite is down – we all knew that – with both spreads widening recently. Typically, corporate spreads react to serious economic and market stress more strongly than do mortgage spreads. Right now, it’s the other way around.

https://fred.stlouisfed.org/graph/?g=UpKh

Comparing spreads before and after the Great Financial Crisis shows MBS spreads narrowing relative to single-A corporate spreads after the GFC. MBS risk was reduced; the details of that reduction in risk are pretty well understood. Then, around the beginning of 2016, the two spreads swapped places again – the MBS market became relatively riskier, trading more like BBB than A. That change is not a perfect match with the end of Fed MBS purchases, which was at the end of 2015, so I don’t want to argue that the end of MBS purchases was the only thing going on. In fact, the difference between the MBS and single-A spreads are just about as high as it has ever been, suggesting something more than a change in flow is happening.

That’s the evidence. Fed portfolio flow has a big effect on mortgage spreads, and the Fed signalled it would lighten up its MBS holdings. The mortgage market has become riskier in the last 6 years than it was just after the GFC.

Now for the speculation. The widening in MBS spreads has been really fast. Shedding risk has been a big part of portfolio management this year, and MBS are riskier than Treasuries and single-A corporates, so MBS are being dumped to reduce portfolio risk.

Widening of MBS spreads has been faster than widening even of BBB spreads. Really fast. So here’s even more speculation: I think there is considerable risk that a lot of mortgages will be under water soon. When a mortgage holder loses a job and has equity in the house, selling is an option; the mortgage is cashed out – not good for MBS value, but there is no default. When a mortgage is under water, conventional selling is not an option. You either keep up payments, default on the mortgage or sell short, which is a default on the mortgage. Lots of job loss when lots of mortgages are under water means lots of default.

One saving grace is that there is a shortage of houses, unlike in 2007. That one factor is stacked up against an over-priced market, an inventory overhang, rate hikes and the likelihood of a weakening job market. In the usual ugly market calculus, bad news means wider spreads, which makes the bad news worse.

different markets,

t bills have rate risk and almost no default risk.

30 year mortgage is burdened by the role of originators, services and the mbs market. in addition to rate risk mortgage instrument has default risk with principle and earning lost in foreclosure, early redemption risk which increases with higher original rates, and secondary market pressures.

i am not in this but i think a 200 bp spread is not bad especially as the housing market is becoming sketchy.

bill mcbride would be the expert here.

i am a troll

Even the MAGA hat crowd is getting tired of Trump’s BS:

https://www.msn.com/en-us/news/politics/video-shows-steady-stream-leaving-trump-rally-after-just-15-minutes/ar-AA12wBJN?ocid=msedgdhp&pc=U531&cvid=87992b5a1d7c49af9c443db849f0754f

Donald Trump supporters reportedly started leaving the venue in large numbers just 15 minutes into his speech at a rally in Michigan on Saturday night. The former president held another campaign-style rally at a community college gymnasium in Warren, Michigan and spoke for about 102 minutes in total, as he repeated unproven allegations that the 2020 election was stolen and endorsed several Republican candidates for the upcoming midterms. A reporter who was live-tweeting from the Macomb College Sports & Expo Center suggested the crowd was far from the arena’s full capacity of 6,600. One picture purportedly taken 10 minutes before the end of the rally showed sparsely populated seating towards the rear of the venue. Attendees began leaving the venue after only 15 minutes as Mr Trump launched into a list of his familiar grievances, Detroit Free Press reporter Paul Egan said in a tweet. “There’s also been a steady stream of attendees heading for the exits since about the 15-minute mark of this now hour-long and ongoing speech. Former president Trump said a few words about the #MIGOP candidates and launched into familiar grievances #TrumpRally,” he said.

Weird. They showed up for a Trump rally and got … Trump. What else did they expect? An adult? Decent television?

Sure it wasn’t weather-related?

While being reminded of Brexit, this somewhat suggests the open question “Has Brexit been as bad as was predicted thus far??” Would love to see a Professor Chinn post or Krugman NYT column with this headline title.

https://gasprices.aaa.com/?state=CA

October 3, 2022

What does it mean that national gas prices were at $3.799, while gas prices in Los Angeles were at $6.382 today?

Herschel Walker wants the government to take away a woman’s right to choose but then …

https://www.huffpost.com/entry/herschel-walker-girlfriend-abortion-report_n_633b7d42e4b02816452ce8e7

Herschel Walker, the Republican nominee for Georgia’s U.S. Senate race who says he opposes abortion under any circumstances, pushed a woman he was dating in 2009 to get an abortion and then reimbursed her for the procedure, The Daily Beast reported. A woman who asked not to be identified told the news outlet that the former NFL star urged her to get an abortion after they conceived a child while they were dating more than a decade ago. She said she had the procedure and Walker reimbursed her for it, supporting her claim with a $575 receipt from an abortion clinic dated Sept. 12, 2009, a “get well” card allegedly signed by Walker and a bank deposit receipt containing an image of a signed $700 personal check from Walker dated Sept. 17, 2009.

My god, this guy is just a huge clustermakelove. Almost Trumpian.

The best part:

Shortly after Walker released his statement in response to the story, his son Christian Walker, a conservative influencer, slammed him on Twitter.

“Every family member of Herschel Walker asked him to not to run for office, because we all knew (some of) his past,” Christian Walker tweeted. “Every single one. He decided to give us the middle finger and air out all of his dirty laundry in public, while simultaneously lying about it.”

The Guardian headline on this same story: “Herschel Walker’s son calls candidate a liar and hypocrite over abortion denial”

https://www.theguardian.com/us-news/2022/oct/04/christian-walker-son-herschel-abortion-hypocrite

He is the personification of terrible.

Walker says he does not know this woman even though they had a child together a few years after her abortion. I guess Walker is indeed an absentee dad.

Did I forget to click “Post Comment”??

Mose,

You forgot to get on that plane to PRC.

But, hey, we understand that as our most important super secret national security agent, there is no way you could have accepted their invitation, :-).

[edited-MDC]

Personal attacks regarding hygiene, appearance will be deleted, and cause for banning.

Huh? Are you losing your mind, Moses?

Only those who read the comment can say with any chance of certainty.