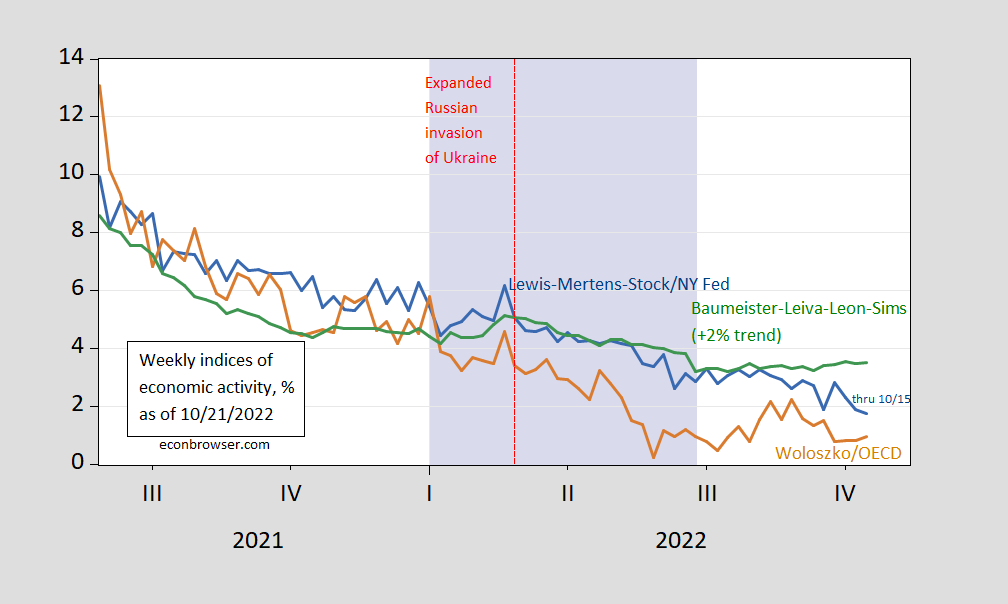

As measured by NY Fed WEI, OECD Weekly Tracker, and Baumeister, Leiva-Leon and Sims WECI.

Figure 1: Lewis-Mertens-Stock (NY Fed) Weekly Economic Index (blue), Woloszko (OECD) Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Lilac shading denotes a hypothetical 2022H1 recession. Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The WEI has been falling for three weeks now, to 1.2% from 2.8% for the week ending 9/24, while the Weekly Tracker and WECI both rose. The Weekly Tracker continues to indicate lower growth than the WEI, unsurprisingly, given the large differences in methodologies. The WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales). The Weekly Tracker — at 1.0% — is a “big data” approach that uses Google Trends and machine learning to track GDP.

The WEI reading for the week ending 10/15 of 1.2% is interpretable as a y/y quarter growth of 1.2% if the 1.2% reading were to persist for an entire quarter. The OECD Weekly Tracker reading of 1.0% is interpretable as a y/y growth rate of 1.0% for year ending 10/15. The Baumeister et al. reading of 1.5% is interpreted as a 1.5% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 3.5% growth rate for the year ending 10/15.

Since these are year-on-year growth rates, it’s possible we were in a recession in H1 as one observer asserted a couple months ago, but it (still) seems unlikely.

GDPNow for Q3 as of 10/19 is 2.9% q/q SAAR.

https://www.nytimes.com/2022/10/14/business/dealbook/albertsons-kroger-merger-explained.html

October 14, 2022

What the $24.6 Billion Kroger-Albertsons Merger Could Mean for Groceries

Two of the largest U.S. supermarket chains hope to join forces as inflation pushes food prices higher and as Amazon and Walmart become more powerful.

By Lauren Hirsch

The grocery giant Kroger announced plans on Friday to acquire Albertsons in a $24.6 billion deal that could reshape the supermarket landscape in the United States. If it is approved by officials, the deal would unite two of the country’s largest supermarket chains to create a corporate behemoth that collectively generates $209 billion in revenue a year and operates nearly 5,000 stores….

https://cepr.net/albertsons-and-kroger-merger-a-win-for-private-equity-and-loss-for-workers/

October 19, 2022

Albertsons and Kroger Merger a Win for Private Equity and Loss for Workers

By EILEEN APPELBAUM

Albertsons is poised to give away a third of the value of its grocery business to its former private equity owner Cerberus and the PE firm’s consortium of Wall Street investors. If payment of this dividend is not stopped by the SEC or other regulators, Albertsons—now a publicly traded supermarket chain—will pay a $4 billion special dividend in early November. This dividend equals about a third of the supermarket chain’s market value. Almost 70 percent of this special dividend will go to its former private equity owners plus Apollo Global Management, which purchased a minority share in Albertsons last year. This will be a spectacular windfall for Cerberus, enriching the PE firm and its owners while putting the future of the Albertsons chain and its workers at risk.

The merger of Kroger and Albertsons, the first and second largest supermarket chains in the United States, was announced on Friday, October 14, 2022. The merger announcement contained a bombshell, hidden in plain sight, that most financial writers failed to notice.

The merger announcement said that, as part of the transaction, Albertsons Companies will pay a special cash dividend of up to $4 billion to its shareholders of record on October 24, 2022. A dividend of this size could bankrupt the debt-ridden supermarket chain.

While the general view of financial markets is that the FTC and the courts will not let the merger go through, the payment of this special dividend sets Albertsons up for failure and provides Kroger with a powerful “failing firm” defense of its merger proposal. Kroger can argue that Albertsons will face bankruptcy if the merger is not approved.

Approval of the merger would be bad news for both workers and shoppers.

Kroger, as a behemoth supermarket chain, would be able to set what it would pay its suppliers and what it would charge its customers. The merged company would be able to squeeze farmers and others in the supply chain serving this grocery retailer and raise the prices it charges shoppers. The merger would end up depressing wages and raising the cost of food, worsening inflation and inequality.

Regulators must halt payment of this special dividend both because its payment will unfairly enrich its former PE owners and because payment of the dividend will set Albertsons up for failure and increase the probability that the merger with Kroger will be approved….

Albertsons merged with Safeway a while back which allowed food prices to rise and grocery worker wages to fall. This merger would be worse.

“ Albertsons merged with Safeway a while back which allowed food prices to rise…”

But according to esteemed economists like pgl, industry concentration and corporate price gouging decisions don’t contribute to inflation!

Fortunately, there are a few (very few) who actually care enough about this major issue to study it.

https://www.epi.org/blog/corporate-profits-have-contributed-disproportionately-to-inflation-how-should-policymakers-respond/

JohnH,

Not for the first time, you are making yourself look just totally foolish. Here pgl criticizes this merger, and you dump on him. Gag.

Please, get thee to the nearest vomitorium.

“Barkley Rosser

October 22, 2022 at 12:19 am

JohnH,

Not for the first time, you are making yourself look just totally foolish. Here pgl criticizes this merger, and you dump on him.”

Barkley is spot on but hey I’m used to your childish dishonesty since you have done this garbage way back in the Mark Thoma blog days.

Johnny – maybe you should take note that EVERYONE here gets what a weasel and a liar you are.

Josh Bivens is one of those well respected economists you love to disparage with your intellectual garbage. But I do declare you pulled a Bruce Hall – reading the title but not the text. Try this moron:

‘It is unlikely that either the extent of corporate greed or even the power of corporations generally has increased during the past two years. Instead, the already-excessive power of corporations has been channeled into raising prices rather than the more traditional form it has taken in recent decades: suppressing wages. That said, one effective way to prevent corporate power from being channeled into higher prices in the coming year would be a temporary excess profits tax.

The historically high profit margins in the economic recovery from the pandemic sit very uneasily with explanations of recent inflation based purely on macroeconomic overheating. Evidence from the past 40 years suggests strongly that profit margins should shrink and the share of corporate sector income going to labor compensation (or the labor share of income) should rise as unemployment falls and the economy heats up. The fact that the exact opposite pattern has happened so far in the recovery should cast much doubt on inflation expectations rooted simply in claims of macroeconomic overheating.’

Bivens is NOT endorsing your pet little theory. Of course you are too stupid to get that.

Since the trough of the COVID-19 recession in the second quarter of 2020, overall prices in the NFC sector have risen at an annualized rate of 6.1%—a pronounced acceleration over the 1.8% price growth that characterized the pre-pandemic business cycle of 2007–2019. Strikingly, over half of this increase (53.9%) can be attributed to fatter profit margins, with labor costs contributing less than 8% of this increase. This is not normal. From 1979 to 2019, profits only contributed about 11% to price growth and labor costs over 60%, as shown in Figure A below. Nonlabor inputs—a decent indicator for supply-chain snarls—are also driving up prices more than usual in the current economic recovery.

JohnH must not be able to read. Bivens clearly said that during past episodes of inflation, rising profits were not the driving factor. Yes – this period is different. Why is it different. Bivens tries to explain the recenet data but he is not endorsing John’s pet theory at all. And this is JohnH’s proof of his pet theory. Seriously?

barks,

how much would a new vomitorium cost in San Fran, and how many years to complete?

the word vomitorium recall sophomoric chatter in Latin class at 13…

In an IGM Booth survey of economists, only 7% agreed that “a significant factor behind today’s higher US inflation is dominant corporations in uncompetitive markets taking advantage of their market power to raise prices in order to increase their profit margins.“

https://www.igmchicago.org/surveys/inflation-market-power-and-price-controls/

Their main argument seems to be that corporations never abused their market power before, so obviously it’s inconceivable that they would start start now. Now that’s an opinion backed by serious research [NOT!]

Apparently corporate friendly economists can’t imagine that corporations would change their behavior in response to a changed environment that allows them to behave opportunistically. Clearly, corporate managers’ resonses are more flexible and adaptive than those of mainstream economists.

Fortunately, as I said before, there are a precious few who are actually willing to study the matter (and be consigned to oblivion.)

“The US economy is at least 50 percent more concentrated today than it was in 2005. In this paper, the authors estimate the effect of this increase on the pass-through of cost shocks into prices. Their estimates imply that the pass-through becomes about 25 percentage points greater when there is an increase in concentration similar to the one observed since the beginning of this century. The resulting above-trend price growth lasts for about four quarters. The authors’ findings suggest that the increase in industry concentration over the past two decades could be amplifying the inflationary pressure from current supply-chain disruptions and a tight labor market.”

https://www.bostonfed.org/publications/current-policy-perspectives/2022/cost-price-relationships-in-a-concentrated-economy.aspx?utm_source=email-alert&utm_medium=email&utm_campaign=res&utm_content=cpp220523

Lastly, let’s not forget what “Kroger CEO Rodney McMullen said on an earnings call. “A little bit of inflation is always good in our business.””

JohnH,

There is a very serious reason why so few economists pin the major blame for inflation on corporate power. It has not increased all that much recently, although it has been steadily increasing fore a long time. But inflation has fairly recently suddenly taken off and has become unpleasantly persistent in many nations. So, the idea that somehow the outburst of inflation was due to this rise in monopoly power looks not credible, especially given that we know there were all these exogenous shocks on the supply side that could have set it off, from the pandemic to Putin’s invasion of Ukraine, which you keep trying to cover for, which all obviously helped set it off.

On its persistence, you may have a case that the long running increase in monopoly power has made that worse. But it is not the main reason why inflation took off. That is a theory for idiots.

“Their main argument seems to be that corporations never abused their market power before, so obviously it’s inconceivable that they would start start now. Now that’s an opinion backed by serious research [NOT!]”

NONE of those questions and their replies addressed what you just claim. None if one of the questions addressed

whether there was the existence of market power most economists get that. Now you had to either blatantly LIE about what other people think (which you routinely do) or you seriously do not understand the English language.

Come on Johnny boy – have you not embarrassed your poor mother enough already? You certainly have polluted yet another economist blog with your serial intellectual garbage. Proud of yourself?

“Apparently corporate friendly economists can’t imagine that corporations would change their behavior in response to a changed environment that allows them to behave opportunistically. Clearly, corporate managers’ resonses are more flexible and adaptive than those of mainstream economists.”

One has to wonder if poor Johnny boy even gets the fact that firms exploit their market power even when inflation is low. Maybe he is too stupid to understand the difference between high relative prices and widespread changes in nominal prices. I would mention levels v. first derivatives but then Ricky Stryker boy would pull out his worthless complications and the fun would really begin.

But let’s go back to the 1980’s when Saint Ronald Reagan undermined anti-trust efforts. What happened to inflation? It fell. So I guess Johnny boy would tell us that St. Reagan broke up monopoly power. Yea – he is THAT DUMB.

https://www.msn.com/en-us/news/politics/steve-bannon-trump-ally-sentenced-to-four-months-for-contempt-of-congress/ar-AA13eo29?ocid=msedgntp&cvid=862f50afec194d538279391e905804ac

Bannon gets a 4 month sentence. Can we get these Appeals over with so this fat disgusting POS has to sit in prison and have to worry about becoming Bubba’s boy friend.