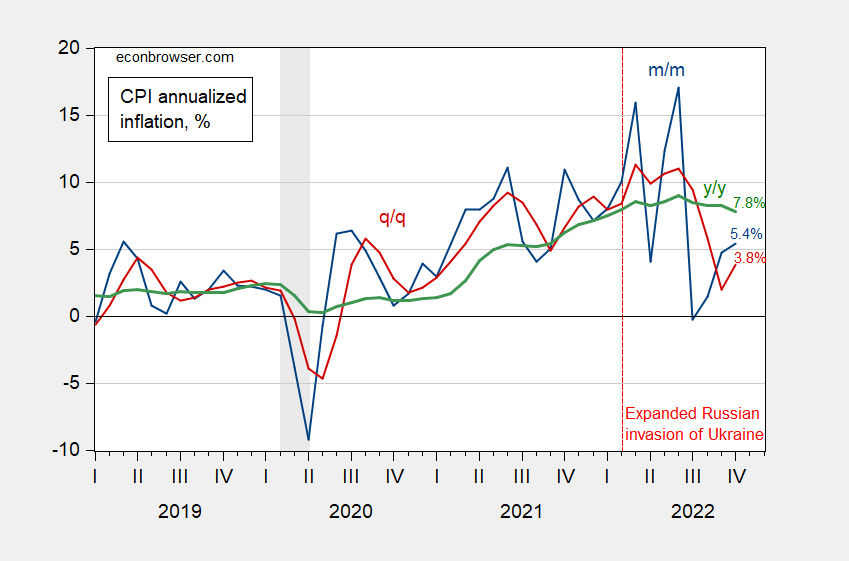

M/M CPI inflation 0.4% vs. Bloomberg consensus 0.6%, while core was 0.3% vs. 0.5%. All measures (m/m, q/q, y/y, headline/core) below recent peaks.

Figure 1: Headline CPI inflation, m/m (blue), q/q (red) and y/y (green), annualized, %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER and author’s calculations.

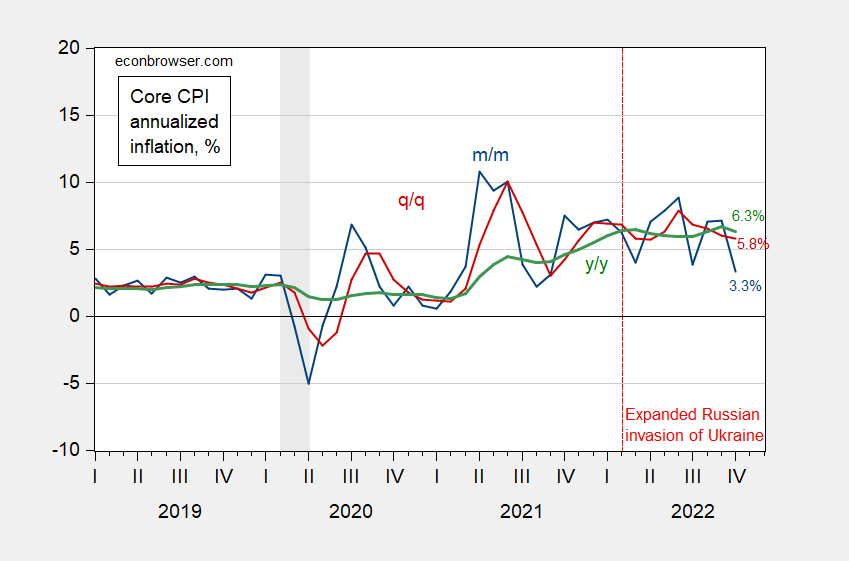

Here’s the evolution of the core CPI, using the same scale on the left axis as for headline.

Figure 2: Core CPI inflation, m/m (blue), q/q (red) and y/y (green), annualized, %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER and author’s calculations.

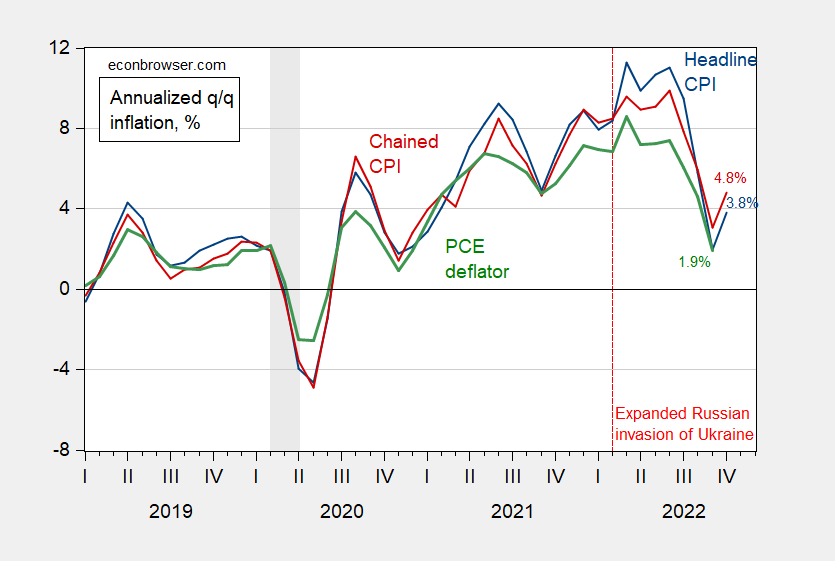

Finally, note the official CPI is a Laspeyres base year weights (with the weights changing more often in recent years), so tends to overstate — for any given bundle of goods and services — the rate of inflation. The chained CPI mitigates that by having the bundle change each year. The PCE deflator is a chained index which, aside from the included goods and services, should also incorporate spending changes more rapidly than the Laspeyres type indexes.

Figure 3: Headline CPI (blue), chained CPI (red) and personal consumption expenditure deflator (green), q/q annualized, %. Chained CPI adjusted using Census X-13, ARIMA X-11 seasonal adjustment. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, BEA, NBER and author’s calculations.

Addendum:

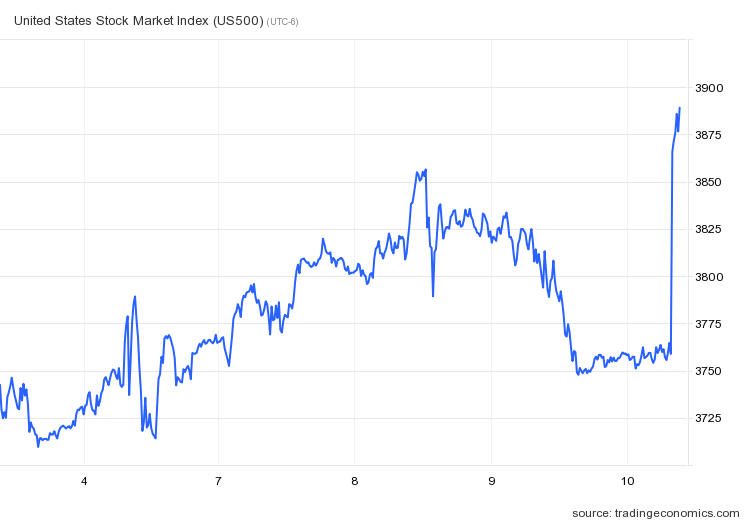

Market response was large and immediate. Ten year bond yield, dollar index both down. Stock market up.

So now we find out if the Fed really cares about inflation or just wants to break things.

We shall se if they really are using the data i their decisions.

https://www.bls.gov/news.release/cpi.nr0.htm

Which part of the data should they use? Inflation will affect different economic groups differently. What should Joe Biden be doing to adjust his policies to reduce inflation in areas that significantly affect lower and middle income consumers?

https://www.cnn.com/2022/11/01/economy/larry-summers-oil-profits-windfall-tax/index.html

“I’m not sure [I] understand the argument for a windfall profits tax on energy companies,” Summers said on Twitter Tuesday morning. “If you reduce profitability, you will discourage investment which is the opposite of our objective.”

And we thought Summers was the most brilliant economist ever. He does not know the difference between a tax on economic rents v. taxes that raise the cost of capital? What happened here – did he have a Vulcan mind meld with our village idiot Bruce Hall or what?

The message from the Fed has been muddled. One constant line is that the labor market is tight – forward-looking and hawkish. Another is that recent inflation readings have been high, so relenting on rate hikes is impossible – backward-looking. The only way to square that circle is to say “we rely on inflation data to tell us how effective policy has been” which is backward-looking and ignores the Phillips curve – which is forward looking. There has been, to my knowledge, no emphasis on the global element of inflation, over which the Fed has limited influence.

I don’t have a strong feeling for what the outlook is, and I’ve made a living on this stuff. Makes me think Fed folk don’t have a strong view either, so they muddle. So far, it hasbeen a hawkish muddle, but with slight recent signs of relenting.

Keeping the labor market tight is actually one-half of their mandate.

Given that, they should not be relying solely on inflation data to make policy.

w,

Problem is, they turn upside-down on their jobs mandate in service of their inflation mandate. The logic is, if they delay in fighting inflation, the harm to employment is greater than if they move quickly. That makes sense, but the current stance looks too much like theater, too little like forward-looking policy, for my comfort.

Macroduck,

Take a look at the Thursday, November 10, 2022 WSJ, print edition page A2, “Inflation a Headache for Leaders Everywhere”. Greg Ip mentions, “Historically…inflation trends have been synchronized across the Western world….” I leave it to economists to agree or disagree, however, his comments summarize several past synchronized trends of inflation across the Western world.

A trend I have noticed is that the Y/Y percent change in CPI All has continued to parallel the trend of inflation for the 1973 to 1975 period, although current the Y/Y percent change which I assumed started about March of 2021 is much less than the 1973 to 1975 period. If we continue on the same trend, the Y/Y percent change in inflation should approach about 2.6% by March 2024. The current Y/Y percent change of 7.8% compares with a forecast change of 8.0%, so we may make the lower level sooner than March 2024.

How did you make a living on macroeconomics, teaching, consulting, investing or all of the above?

Up-and-down economics, interest-rates and economic, market and policy risk. It’s a hoot.

Does anyone else think it’s interesting, that Russia decided to retreat from Kherson, basically “to the day” that the “red wave” ceased to happen?? Pure coincidence?? Or could it be a result of Putin realizing he’s no longer matching wits with the burnt orange child, but rather, with a mature thinking adult. President Biden is a man with extensive foreign policy experience~~albeit excluding the act of relieving his bladder on a Moscow hotel mattress. The latter, no doubt, leaves President Biden lacking, in MAGA minds.

with the feckless russian military; going forward, the germans can deal with them and usa can pull all land and air forces out of germany and the uk…..

The withdrawal has been a prolonged process, so it seems unlikely the leave/stay decision depended on whether Josh Hawley is going to get a committee chairmanship. Timing, on the other hand, may reflect the election. If so, one result is probably as good as another. Well, for the purposes of face-saving distraction, one’s as good as another. Josh Hawley chairing a commity would be like a gift from Stalin for Pooti-Poot.

@ Macroduck

95% odds, you’re right. Damn it all. MAGA get to have wild theories, how come they get all the fun?? Rain on my parade.

Today, Putin was visiting a place that does brain surgery research. Perhaps he’s thinking of salvaging trump’s brain.

The Kherson retreat was inevitable and should have happened 2-3 month ago when the military professionals in Russia wanted it. Some of the best Russian troops wasted their life trying to drag out the inevitable, at the same time they were desperately needed somewhere else. Russia just could not provide enough military hardware and soft bodies, to go anywhere but slowly back on the west bank of Dnipro river. The risk of having 40K soldiers out of ammo and trapped on the wrong side of a river was slowly increasing and would be a nightmare.

The withdrawal from Kherson had been slowly going on for about a week or two before the official announcement. The timing of the official statement was probably politically motivated – they did not want to give Biden a political “tough guy” victory just before the election.

After Ukraine got the ability to make high precision hits 40 miles behind the front line, it was just a matter of when (not whether) they would cut down supplies across the Dnipro river sufficiently to make Russias occupation of the west bank non-viable.

Its like Russias failing attempt to destroy Ukraines civilian infrastructure. They have had to stop it because they cannot produce/procure enough drones and missiles to keep up with the Ukrainian repair teams. Now Russia is presumably stockpiling that precious ammo in order to repeat those attacks sometime in the winter (when it will hurt civilians the most). But that is also giving the west time to build up Ukraines defenses against drones and missiles.

From a military point, the whole infrastructure attack campaign was a disaster, and classic example of how domestic political goals can sabotage the efforts on the front lines. Clueless Russian right wingers demanded that Ukrainians be “punished” for their resistance. Those who had a clue and knew how limited Russian stockpiles of the needed weapons were, could predict the eventual failure to get past the inconvenience of rolling blackouts in Ukraine. They had to use drones from Iran (that quickly encountered an 80%+ interception rate).

The whole thing has been to great advantage for Ukraines military. The ammo was wasted rather than deployed where it could have military effects. The west has been outraged and further united behind helping Ukraine defend itself. Top of the line new air and missile defense systems have been delivered and promised to Ukraine so they can defend innocent civilians (or whatever they decide/need to defend). A complete disaster for Russia because screening morons, rather than military professionals, got to set the strategy. That may be the biggest of all the Russian weaknesses that this conflict has revealed.

I seriously doubt that anything happening in Kherson has anything to do with the midterms.Putin is behaving very prudently; better a tactical withdrawal to a more defensible position on the other bank of the Dnepir, than risk the (very likely) possibility of Russia’s forces being cutoff and pushed up against the banks of the river, an outcome that would be catastrophic, both militarily and politically.

Three political items I thought were important and worthy of note:

Results of state AGs who denied legitimacy of American elections:

https://fivethirtyeight.com/live-blog/2022-midterm-election/349967/

An important time stamp, for those closely watching undecided elections in Arizona:

https://fivethirtyeight.com/live-blog/2022-midterm-election/349928/

Lauren Boebert is behind by about 100 votes in Colorado:

https://www.wsj.com/livecoverage/election-midterms-2022/card/lauren-boebert-vs-adam-frisch-colorado-race-remains-too-close-to-call-IpofROZWq0FBaEDzVZY7

Boebert would be a major takedown for those who oppose MAGA insanity. Her husband got drunk and was threatening and bullying his own next door neighbors. “Exercising his freedoms”?? Imagine this loser with a gun handy.

https://nypost.com/2022/08/13/911-calls-reveal-rep-boeberts-neighbors-fight-with-husband/

It appears now Boebert has a decent chance to win her Colorado race. Most likely you’d get a Colorado law required recount, with Boebert winning the recount.

And Mark Kelly has a solid chance to win Arizona. Arizona Governor’s race (Hobbs vs Lake) is still a complete toss-up until we get more of the outstanding votes tabulated.

The Boebert update nearly makes me physically ill, but unless there’s a drastic change in trend on the remaining uncounted, it’s hard to envision how she loses her race.

“Five Thirty Eight” blog update. Most likely this will be the best and most thorough data you’ll get until early Friday morning, or later. So if you read this link through, you’ll have all you need until after you get a good sleep:

https://fivethirtyeight.com/live-blog/2022-midterm-election/350051/

I’ll tell you one thing that dawns on me just now, and some people are gonna think I’m joking, I’m dead serious. Pelosi has been such an inept and vapid “leader” I don’t even think losing the House of Reps means sh*t anyway, because when the hell has she ever gotten anything done??~~other than delaying impeachment proceedings, delaying evidence that could have been used in court against the orange creature, and embarrassing the party on a regular basis. Hell, let McCarthy run the show. Tell me how that hurts Democrats anymore than her and her infantile oratory and 24/7 sh*t eating grin??? Hell, the more I think about her getting her “buh buh buh doy uh er, doy, buh buh buh doy uh er” convo the F**K off the stage the more it delights me.

Moses,

Well, there were impeachment hearings, two rounds. There has been a Januar 6 copmmitee that most think did a pretty good job. Then there was he infrastructure bill, the CHIPs bill, the IRRA bill, and several others. As it is, in fact this has been one of the most productive Congresses we have seen in decades, with it mostly doing good things. The problems have been over on the Senate side with that 60 vote filibuster limit and Manchin and Sinema causing all kinds of problems. Frankly, Pelosi has done an excellent job. You are in total fantasyland with this denunciation. Are you going to next suggest that she ate fancy ice cream while overseeing child sex traffickers in a pizza parlot basement, or maybe she ordered the hit on her husband?

You left out Mr. Boebert’s sausage show.

According to the Cook Political Report, as of Thursday morning, November 10, Republicans have won 50,113,534 votes, or 52.3% of the vote, compared to 44,251,768, or 46.2% of the vote. Republicans lead by 6.1%, which is better than their average in “generic congressional ballot” polls, in which the party led by 2.5% in the final RealClearPolitics average before the election. But Republicans have only managed to flip nine seats thus far — likely enough to control the House, but far short of a “wave” result many anticipated.

The mismatch between overall votes cast for Republicans and the actual result reflects the polarized nature of congressional maps. It also reflects the fact that Republican losses against many Democratic incumbents were very narrow. However, it could also suggest that Democrats ran a more effective campaign, concentrating resources where they were needed to defend their vulnerable positions.

Hmmm, didn’t Hillary Clinton rail against a voting system where more votes didn’t result in more wins? Looks like Democratcy is safe for another two years.

After the Republicans changed the rules in all sorts of ways – little Brucie wants to change the rules even more? Hey Brucie – it seems your attempt to kidnap your governor backfired and she will reign for another 4 years. Awwww!

LOL! I see AOC got ripped by her Democratic Party buddy who lost his seat after AOC campaigned for his primary opponent. Don’t need to change rules back to the pre-pandemic order. Dems can lose in election chaos, too. How’s that Adams Tent City working out for NYC’s homeless? Oh, wait, citizens don’t matter.

“didn’t Hillary Clinton rail against a voting system where more votes didn’t result in more wins?”

No that would be your boy Trump. Hillary accepted the results of the 2016 election. It was your boy Trump who had domestic terrorist storm the Capitol after he lost the 2020 election BIG TIME. Heck he is still denying he lost two years later. And of course he is spreading lies about the Arizona governor election. Hey Brucie – get out your AK 47 and head to Phoenix and help your racist buddies install loser Kari Lake into office. Oh that’s right – you are still hiding in your mother’s basement. Never mind.

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=HKys

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=FmWS

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MMHi

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=NFCn

January 15, 2020

Prices of US Diesel and Regular Gas, 2020-2022

https://fred.stlouisfed.org/graph/?g=If40

January 15, 2018

Prices of US Diesel and Regular Gas, 2017-2022

(Indexed to 2017)

In other news, in case you missed it, “ Productivity down 1.4 percent, real hourly compensation down 3.4 percent, over past year.

From the third quarter of 2021 to the third quarter of 2022, nonfarm business sector labor productivity decreased 1.4 percent, reflecting a 1.9-percent increase in output and a 3.4-percent increase in hours worked. This quarter marks the first time this measure has seen three consecutive year-over-year declines since 1982.“

https://www.bls.gov/opub/ted/2022/productivity-down-1-4-percent-real-hourly-compensation-down-3-4-percent-over-past-year.htm

When it comes to productivity, the effects of Covid and of composition need to be taken into account:

https://fred.stlouisfed.org/graph/?g=WiQn

There is nothing troubling nor surprising about the productivity story, whatever “quiet quitting” silliness Summers may think he has discovered.

Over the period of the past three quarters, real compensation is mostly an inflation and labor scarcity issue, not a productivity issue. Otherwise, these two tracks would have diverged more extensively in response to Covid and the converged in recent quarters, the same pattern as seen in output per hour. Instead, they mostly move together – a common factor, inflation, driving both:

https://fred.stlouisfed.org/graph/?g=WiP8

The better performance from overall compensation relative to factory compensation is because labor scarcity drove up nominal wages outside the factory sector.

JohnH,

Of course you are right! Shame on the stock market for not noticing that and booming!

https://jabberwocking.com/i-predict-that-kari-lake-will-lose-in-arizona/

Kevin Drum is predicting that Kari Lake will not become the next governor of Arizona. Let’s hope he is right.

https://www.globaltimes.cn/page/202211/1279176.shtml

November 10, 2022

Chinese research team from Yunnan University breeds perennial rice with high yields over years with one planting: report

A research team from the Yunnan University in Southwest China’s Yunnan Province has successfully bred perennial rice (PR), which can produce high yields over two to four consecutive years with a single planting, according to a report * published by the team in the Journal of Nature Sustainability, the university’s official WeChat announced on Tuesday.

The report noted that perennial cultivars are strongly preferred by farmers as growing them saves 58.1 percent of labor and 49.2 percent of input costs in each growth cycle.

Crop perennialization, the conversion of annual grains to perennial forms, has showed a possibility to intensify sustainability, increase crop productivity, farming income and soil health using fewer resources.

The PR 23, released to farmers in China in 2018, marks a key milestone in the commercialization of perennial grains bred via interspecific hybridization.

Three recently released cultivars of PR that the team bred including PR23, PR25 and PR107 can produce high yields over two to four consecutive years for each of four to 10 cycles of growth-harvest-regrowth on plants from a single planting, representing a step change that makes ratooning an economically attractive option for irrigated production environments that are not limited in duration by cold weather or other adverse environmental conditions, per the report.

The cultivation of PR, after more than 20 years of efforts, represents a cropping system that simultaneously achieves grain production, labor reduction and ecological security, especially for terraced and fragile farmland, according to the report. PR has demonstrated good yield potential, and agronomic traits for four years and eight cropping seasons from a single planting, which can enhance soil fertility and reduce requirements for inputs through ecological intensification with simplified management….

* https://www.nature.com/articles/s41893-022-00997-3

https://www.bls.gov/opub/ted/2022/real-average-hourly-earnings-for-all-employees-increased-0-1-percent-from-november-to-december-2021.htm

Real (adjusted for inflation) average hourly earnings for all employees increased 0.1 percent from November to December 2021. This resulted from an increase of 0.6 percent in average hourly earnings combined with an increase of 0.5 percent in the Consumer Price Index for All Urban Consumers.

Yea I am posted this January 2022 release but bear with me. JohnH in his usual worthless lying is trying to insist he only posts comments about real median wages, which is something else the BLS does provide. Heck Dr. Chinn had a recent post on real median wages, which is an important concept no doubt.

But it is true that JohnH has used “Real (adjusted for inflation) average hourly earnings for all employees” in recent comments. And there would be nothing wrong with that but this weasel is now trying to say he only post real median wages. Maybe he is too dumb to know the difference but everyone else knows: (a) BLS provides both types of data; and (b) there are differences.

Now for the life of me – I do not understand why JohnH keeps going on and on and on over such a basic point. But that is what he do. WHATEVER!

BTW – when I try to point out that these two series may be different, JohnH goes off on how I somehow want real wages to decline. Yea – it isa a childish rant but hey – it is what he do!

pgl had to back a year to finally find something he said about real wages? That proves my point.

A perfunctory CYA annual comment pretty much sums up the importance of the average American worker in today’s economic reporting, doesn’t it?

I guess you could not be bothered to read my FIRST sentence. Come on Johnny boy – I get you feel lonely in the Kremlin now that Putin has decided you are too worthless for his attention but DAMN!

Maybe one of those smart Russians can finally teach you the difference between medians and means which was my point that you have eluded over and over.

BTW MY POINT was that BLS’s reporting to real average hourly earnings has been around for a lot longer than this year. So what if I provided a discussion from January? Do you really think the definitions of mean v. median have changed in the last few months? I guess you do think that as you really are DUMB!

https://news.cgtn.com/news/2022-11-09/Researchers-develop-green-efficient-electric-rare-earth-mining-tech-1eP0N7aXtL2/index.html

November 9, 2022

Researchers develop green, efficient electric rare earth mining tech

Mining rare earth has long been considered a dirty business, as it can lead to water and soil pollution, but a new technology developed by Chinese scientists may reverse the trend, offering a greener alternative for the industry.

Rare earth elements (REEs), especially heavy REEs, are an essential part of many high-tech devices, from the iPhone to the Tesla electric engine to LED lights. More than 90 percent of the global heavy REE demand is sourced from ion-adsorption deposits, which form within weathering crusts.

However, conventional mining applies excessive usage of chemical agents to recover REEs from these deposits, not only exhibiting low efficiency but also polluting the environment.

Researchers from the Chinese Academy of Sciences’ Guangzhou Institute of Geochemistry proposed a new approach * in the journal Nature Sustainability earlier this month, showing that employing electrokinetic mining techniques to extract REEs from weathering crusts can be both clean and economical.

In this approach, researchers generated an electric field by putting electrodes on the top and bottom of a volume of soil. Electrokinetic effects can accelerate the migration of REEs, reducing the need for harmful chemical agents.

To evaluate the feasibility of the new method, they carried out several experiments of different scales. Results suggested that the new method outperformed traditional mining techniques. For instance, the scaled-up experiments achieved a recovery efficiency of 96 percent within 67 hours by using electrokinetics, while that using the conventional technique was only 62 percent at 130 hours.

The difference between the impact of the old and the new approach was even more significant in an on-site field test: using electrokinetics can achieve a recovery efficiency higher than 90 percent, an 80 percent decrease in polluting agent usage and a 70 percent reduction in metallic impurities….

* https://www.nature.com/articles/s41893-022-00989-3

I am generally reluctant to recommend anyone pick up the NY Post but this one is a riot:

https://www.msn.com/en-us/news/politics/new-york-post-targets-trumpty-dumpty-in-scathing-cover/ar-AA13XVGq?ocid=msedgdhp&pc=U531&cvid=7d4d0a7c5b3c442f9668ca6d67aa36c5

Rupert Murdoch’s conservative media empire helped propel Donald Trump’s remarkable rise from tabloid-friendly New York real estate mogul and reality show star to the presidency. But in the wake of disappointing results for the Republican Party in Tuesday’s midterm elections, Murdoch-owned media outlets — the New York Post, Fox News and the Wall Street Journal — are blaming Trump for the GOP’s lackluster performance, and appear ready to move on from the former president. On its front page Wednesday morning, the New York Post anointed Florida Gov. Ron DeSantis “DeFuture” of the GOP. On Thursday it took fresh aim at Trump, depicting him as “Trumpty Dumpty.”

The headline with Trumpty Dumpty sitting on a wall made my day!

https://www.msn.com/en-us/health/other/kellyanne-s-comments-from-monday-about-tuesday-s-midterms-have-aged-worse-than-milk-by-wednesday/ar-AA13VS04?ocid=msedgdhp&pc=U531&cvid=9a89c3d284ec4e3bb5cbb72ba2c56611

Kelly Anne Conway on Monday was crowing how Trump’s candidate would do great and Trump would have a lot to say on Wednesday. Well! It seems both of them are not talking that much in the last couple of days, which is a very good thing!

The Trimmed mean annual rate is 6% is way too high and THIS is the measure to watch. Just ask our Central Bank down under. you yanks are slow on the uptake.

Every central bank was way too slow to get back to a neutral rate.

Perhaps it is just the markets celebrating the nth death of cryptocurrency. I’m continually amazed that otherwise smart people continue to throw money into Ponzi schemes. I guess IQ is no measure for the gullibility of humankind.

Was the Andy Biggs comment about Paul Pelosi being brutally attacked the most disgusting of them all?

https://www.msn.com/en-us/news/politics/disgusting-gop-rep-andy-biggs-taunts-nancy-pelosi-with-hammer-joke-days-after-assault/ar-AA13Ucsi

But Biggs ― who reportedly sought a pardon from President Donald Trump in the days after the Jan. 6, 2021, assault on the U.S. Capitol ― used that as fodder for a joke at an event on Tuesday. “We’re gonna show Nancy Pelosi the door very shortly. Don’t let it hit you on the backside, Nancy,” he said Tuesday. “She’s losing the gavel but finding the hammer. Too soon? Is that too soon?”

Actually that is only the 2nd most disgusting pathetic like joke. Yes Donald Trump went lower calling Nancy Pelosi an “animal”. Why is she an animal? Oh yea Trump got impeached twice.

While on the subject of inflation, I am reminded of the famous bet between Julian Simon and Paul Ehrlich:

https://www.futurelearn.com/info/courses/overpopulation-resource-depletion-and-human-innovation/0/steps/289658

Wehat is now widely know as “the bet” was inspired by a disagreement regarding the outlook for non-renewable resource scarcity. Erhlich foresaw a future in which human population would outstrip the earth’s resources – a neo-Malthusian view – and Simon expressed confidence that human resourcefulness, reacting to market prices, would always provide for increasing human needs.

The terms of “the bet”, which involved the inflation-adjusted price of five metals over ten years, reflected the naivete of a biologist, Ehrlich, dabbling outside his area of specialty. Commodity prices, and prices in general, had been rising at an accelerating pace prior to “the bet” and civilians have a strong tendency to build price expectations on recent price performance. “The bet” was made in 1981 and Paul Volcker had become FOMC chairman in mid-1979. The Fed made sure that Ehrlich lost the bet:

https://fred.stlouisfed.org/series/FEDFUNDS

It may be that Ehrlich was unaware of the tendency for commodity prices to respond more strongly to monetary and economic conditions than do consumer prices:

https://fred.stlouisfed.org/graph/?g=WitM

In any case, Ehrlich lost in part due to bad timing and in part due to the large part that the cost of carry plays in commodity prices.

Accolites of Julian Simon often cite “the bet” as evidence for Simon’s position – that human intellect and the working of markets will always provide solutions to resource problems. That claim looks a bit smug these days, even though we can find echos of Simon’s view in, for instance, ill-founded mockery of the “peak oil” hypothesis. We all know what energy prices have been up to, but “the bet” involved metals prices. Here’s a peek:

https://fred.stlouisfed.org/graph/?g=WiBq

At any time since roughly 1995, Ehrlich would probably have won “the bet”. Ehrlich just got his timing wrong. He was a biologist. What did he know about market timing?

Ehrlich and Simon were negotiating the terms of a second bet when Simon died in 1998. That bet would have been based on temperature. Ehrlich is very likely to have won that bet:

https://www.climate.gov/media/13223

Herman Daly has just died.