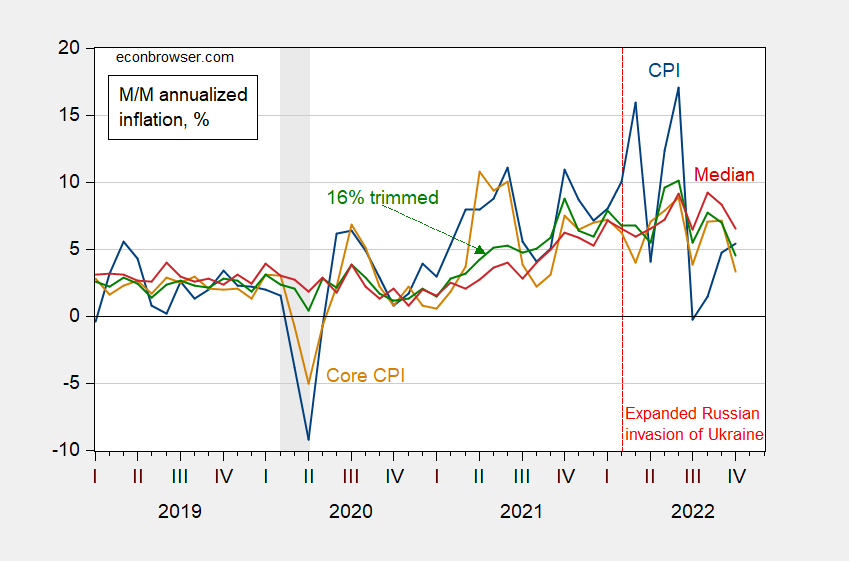

M/M headline vs. core vs. trimmed mean vs. median:

Figure 1: Headline CPI inflation (blue), core CPI (tan), 16% trimmed mean CPI (green), median CPI (red), m/m annualized, %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Cleveland Fed via FRED, NBER and author’s calculations.

should we be examining annualised rates or the annual rate? does annualised rates give you a better ‘feel’ for where inflation is heading?

i prefer the x axis time, and the y axis cpi- urban wages…..

if one wants to smother and estimate 1st and second derivative…….

Conventional measures of consumer prices mostly include owners equivalent rent, which changes direction with a considerable lag to real housing activity and with somewhat less lag to housing prices. OER also changes direction more slowly than consumer prices in general. As a result, OER is climbing much faster than most other prices now and boosting most conventional measures of consumer price inflation:

https://fred.stlouisfed.org/graph/?g=WiUt

That means we can anticipate with considerable confidence a further slowing in a large component of CPI. Today’s CPI reading, though below the median forecast(s), was still distorted to the upside by OER. A good reason to pay more attention to the core PCE deflator in preference to CPI.

Health insurance costs fell 4% and have a 0.9% weight in the index -that made a dent. That 4% drop is the result of one of CPI’s many calculating quirks – deriving from health insurance firms’ financial data instead of actual prices. Expectations are for a pretty sharp rise in health insurance premiums when annual resets are posted. So the CPI reading for September was distorted to the downside by insurance costs. Thing is, neither monetary policy nor the general state of the economy have much impact on health insurance premia, so there is reason for policy-makers to drop this out of CPI when using it for monetary policy guidance. One more reason to pay attention to the core PCE deflator in preference to CPI.

Fed folk got right back to saying “we still have an inflation fight to fight” after the data. Machines, which went nuts on the data release, apparently couldn’t hear the Fed folk. We’ll find out what humans think over the early part of next week, assuming election news doesn’t get in the way.

Hey…markets seem to like the failure of Republicans to win big…

piped gas went down mom.

i doubt that will happen over the next few….

used cars went down, but not near what will happen with rates up

https://www.bls.gov/cpi/

Just so you know:

“If Congress wants to slow inflation, both parties will need to work together to find solutions to the entitlement crisis. It isn’t rocket science,” he (Mitt Romney) said.

https://www.cbsnews.com/live-updates/2022-elections-midterms-results-house-senate-polls-2022-11-10/

So the above-it-all, never-Trump wise man of the Republican Party is actually the gazillionare, “47% takers” class warrior we remember from 2020. Gotta make sure the poor get poorer on their way to a not-soon-enough grave.

It’s funny how people who believe there is an “entitlement crisis” tend to be from the sticks, from rural areas… or very wealthy. In other words, people who do not know much about other people or deal much with other people. Major US cities – where people understand the “people” problems – are almost universally blue, and strongly so. The ruralites take offense when the city folks poke into agricultural policy and water policy but they themselves feel entitled to spout off on things they know nothing about. (And I’m saying this as someone who has lived in both those worlds).

the problem with entitlements: in the 60’s entitlements was to the pentagon as 1 is to 2+

in the 2020’s entitlements to the pentagon is as 3 is to 1.

they cannot abide the pentagon loss of “share”.

or in the 60’s it was ~9% gdp for the pentagon now it is 3%+, how could boeing and lockheed lose share???

Romney would know about entitlement. He is the jedi master of entitlement (even if we exclude the fact Mitt was born with a silver spoon up his A$$):

https://swampland.time.com/2012/02/15/mitt-romney-took-advantage-of-government-subsidies-at-bain/

https://www.cato.org/commentary/republicans-are-weak-farm-subsidies#

Now that we’re in the thick of the 2024 presidential campaign, I thought it worth mentioning the book thing. Presidential candidates write (sic) books. For instance:

Profiles in Courage

John F. Kennedy

It Takes a Village

&

Hard Choices

Hillary Clinton

The Audacity of Hope

Barack Obama

Promise Me, Dad

&

Promises to Keep

Joe Biden

The Art of the Deal

Tony Schwartz

Also, ahead of the 2020 race: Cory Booker, Kirsten Gillibrand, Kamala D. Harris, Bernard Sanders, Elizabeth Warren, John W. Hickenlooper, Pete Buttigieg, Amy Klobuchar, Andrew Yang, Julián Castro, Little Marco Rubio, Lyin’ Ted Cruz, Low Energy Jeb Bush, Mitt Romney, Sleepy Ben Carson.

So, with that as background, guess who is publishing a book on November 15…

So Help Me God

Mike Pence

What’s not clear to me is whether long-ago books count in letting the world know how presidental one is. But for good measure:

Dreams From Our Founding Fathers: First Principles in the Age of Obama

Ron DeSantis

and

Citizenville: Connecting People and Government in the Digital Age

&

Ben and Emma’s Big Hit

Gavin Newsom

I heard all of the living presidents are getting together to co-author a book “The Art of the Grafting of Nations: A Compendium of Thoughts From Winners of the Electoral College”

Going to rank up there with the Bob Woodward books, only this book will be ghost written by Oprah and Tony Robbins.

https://images.app.goo.gl/kEVdtQjojYB5FY738

Are you feeling the aura, tingles, and microvibrations yet?? Oprah feels vibrations when she looks at Tony, if you know what I mean.

What did the early 1970s look like?

So yesterday the stock market created more than $2 trillion in a single day. Yet people get all fired up if the Fed prints a few billion a day? The little mouse Powell is nothing compared to the big Wall Street elephants.

“So yesterday the stock market created more than $2 trillion in a single day.”

I’m surprised that we have not seen a patented Princeton Steve rant declaring that the stock market is now in a bubble!

sell the bull!

broaden your horizons

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

fed doing better with quantitative tightening!

https://www.nytimes.com/2022/11/11/business/ftx-bankruptcy.html

November 11, 2022

Embattled Crypto Exchange FTX Files for Bankruptcy

The announcement capped a stunning week that has sent shock waves through the crypto industry.

By David Yaffe-Bellany

On Monday, Sam Bankman-Fried, the chief executive of the cryptocurrency exchange FTX, took to Twitter to reassure his customers: “FTX is fine,” he wrote. “Assets are fine.”

On Friday, FTX announced that it was filing for bankruptcy, capping an extraordinary week of corporate drama that has upended crypto markets and sent shock waves through the industry. In a statement on Twitter, the company said that Mr. Bankman-Fried had resigned, with John J. Ray III, a corporate turnaround specialist, taking over as chief executive.

The speed of FTX’s downfall has left crypto insiders stunned. Just days ago, Mr. Bankman-Fried was considered one of the smartest figures in the crypto industry, an influential figure in Washington who was lobbying to shape crypto regulations. And FTX was widely viewed as one of the most stable and responsible companies in the freewheeling, loosely regulated crypto industry.

Now, the bankruptcy has set up a rush among investors and customers to salvage funds from what remains of FTX. A surge of customers tried to withdraw funds from the platform this week, and the company couldn’t meet the demand. The exchange owes as much as $8 billion, according to people familiar with its finances.

FTX’s collapse has destabilized the crypto industry, which was already reeling from a crash in the spring that drained $1 trillion from the market. The prices of the leading cryptocurrencies, Bitcoin and Ether, have plummeted. The crypto lender BlockFi, which was closely entangled with FTX, announced on Thursday that it was suspending operations as a result of FTX’s collapse….

Keeping this simple. The consumer price index just reported is only 0.93% higher than it was in June. OK that is 4-months not a year. Annualized we have inflation at a mere 3.7%. But the press keeps talking as if the inflation rate is twice that.