Today, we are pleased to present a guest contribution written by Joshua Aizenman (University of Southern California).

In the Reykjavik roundtable on global economic challenges, September 1-2, 2022, organized by Robert McCauley, Robert Aliber, Gylfi Zoega, and Mar Gudmundsson, I overviewed my research on bilateral swap lines with Hiro Ito and Gurnain Pasricha in the context of past and future challenges.

The Covid-19 crisis became another test of the robustness of the dollar dominance at times when the U.S., EU and China have converged to a similar global GDP share of about 20%, PPP adjusted. Facing acute strains in the offshore dollar funding markets during the COVID-19 crisis, the Fed provided US dollar liquidity to the global economy by reactivating or enhancing swap arrangements with other central banks; and establishing a new repo facility, FIMA, for financial institutions and monetary authorities. The FIMA Repo Facility allows FIMA central banks and other international monetary authorities with accounts at the New York FED to enter into repurchase agreements with the FED. Approved FIMA account holders may temporarily exchange their U.S. Treasury securities held with the FED for U.S. dollars, that can then be made available to institutions in their jurisdictions. This facility provides, at a backstop rate, an alternative temporary source of U.S. dollars for foreign official holders of Treasury securities other than the sales of securities in the open market.

Studying the impact of these facilities suggests that access to Fed liquidity was driven by close financial and trade ties with the US. An economy’s share in US trade and a military alliance with the US are positive factors associated with access to a Fed swap agreement. An economy with high levels of banking and financial exposure to US, and stronger trade ties with the US tended to have greater access to Fed liquidity, via swap lines or FIMA. Economies with a large share of global trade, regardless of whether they are major trading partners of the US, also had greater access to US dollar liquidity via the Fed. Economies that faced appreciation pressures against the US dollar and whose local currency exchange rate became more volatile were more likely to auction greater amounts of US dollars in their domestic market. Swap-related announcements led to the appreciation of currencies against the US dollar and reduced these currencies’ deviations from CIP.

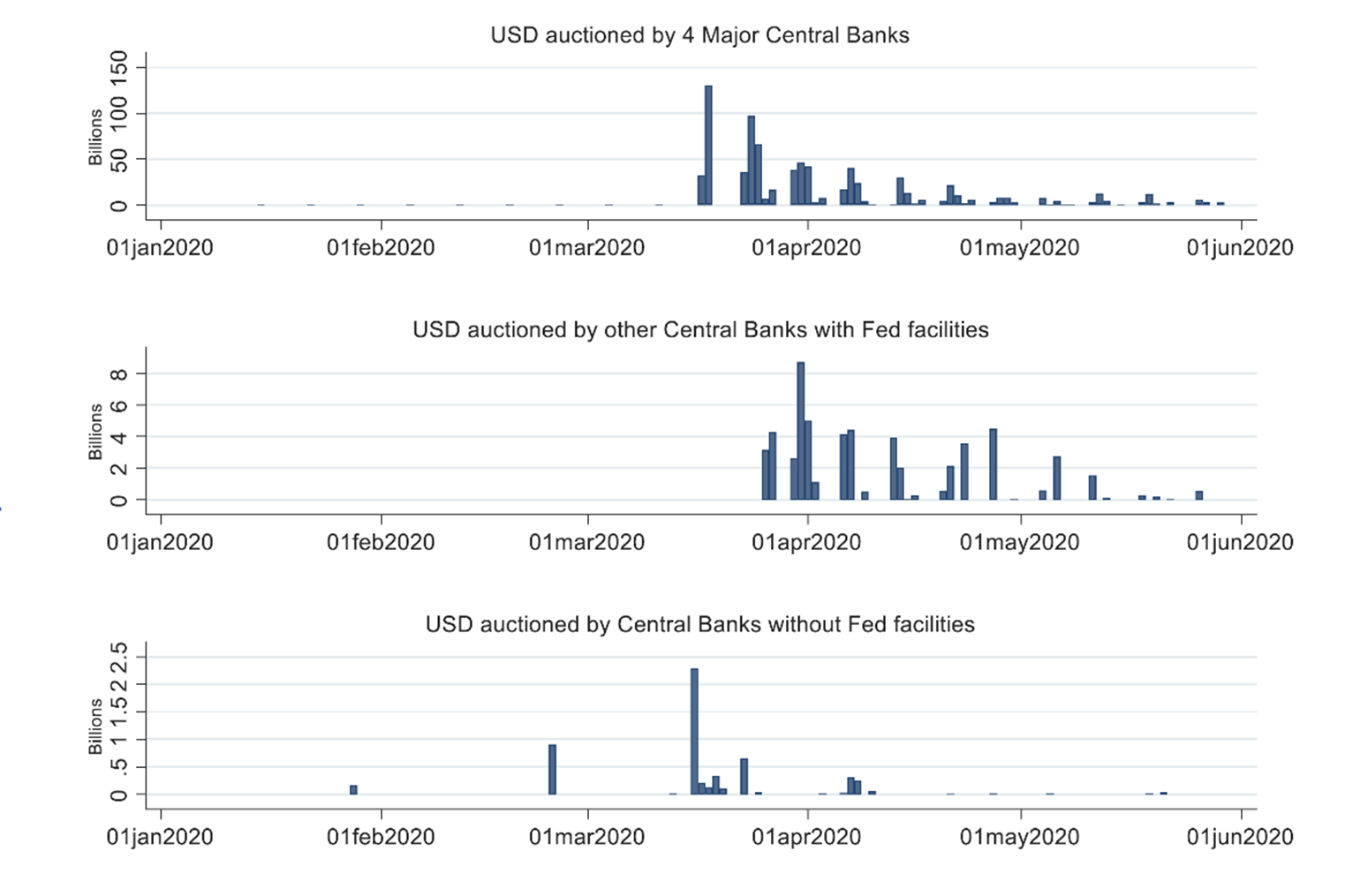

The auctions by the four major central banks – ECB, BOJ, SNB, and BOE – peaked in mid-March at about 112 billion US dollars per day and were the orders of magnitude larger than those by all other central banks (Figure 1). Dollar auctions by these major central banks generated spillovers: they led to a temporary appreciation of other currencies against the US dollar, to reduced CIP deviations, and to persistently reduced sovereign bond yields of other economies. However, dollar auctions done by non-major central banks with access to Fed facilities did not have a meaningful impact on key domestic financial variables. The impact of major central bank auctions was similar for economies with different financial and trade links with the US, and for economies with different balance sheet currency and foreign debt exposures. Consequently, the major central bank auctions benefitted even the more vulnerable economies.

Figure 1: Many advanced and emerging-market central banks auctioned US dollars during the COVID-19 crisis. Source: Aizenman, J., Ito, H., & Pasricha, G. K. (2022). Central bank swap arrangements in the covid-19 crisis. Journal of International Money and Finance.

Figure 1: Many advanced and emerging-market central banks auctioned US dollars during the COVID-19 crisis. Source: Aizenman, J., Ito, H., & Pasricha, G. K. (2022). Central bank swap arrangements in the covid-19 crisis. Journal of International Money and Finance.

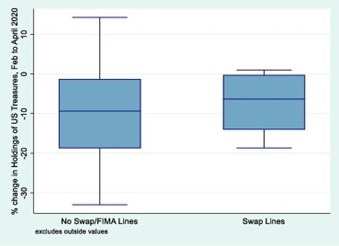

Notably, under the FIMA repo facility, the Fed supplies overnight US dollar liquidity in exchange for existing US Treasuries held by these institutions, and the transaction can be rolled over. The FIMA facility was expected to reduce the need for the sale of US Treasuries and mitigate pressure in this market. As a facility collateralized by US treasures (rather than foreign currency as in the case of swap lines), FIMA does not expose the US Fed to credit risk from the foreign central bank. The Fed facilities appear to have been successful in limiting the sale of US Treasuries – economies with access to Fed facilities on average saw smaller percentage declines in holdings of US treasuries between February and April 2020 (Figure 2). The figure plots the percentage change in the holding of US treasury securities between end-February and end-April 2020, for economies with or without access to Fed facilities as of the end of June 2020. The economies with Fed facilities include the 14 economies with Fed swap lines as well as Hong Kong (China), Indonesia, Chile, and Colombia. Economies without Fed facilities are 84 other economies on which data is available.

Figure 2. Economies with access to Fed liquidity lines saw smaller decline in US treasury holdings between February and April 2020

The above results confirm the ‘Narrow circle, broad effect’ of US FED swap lines during the GFC and the Covid-19 crisis. A buoyant interpretation of the FED’s experience with bilateral swap lines and FIMA is ‘mission accomplished’ – the FED acted successfully in stabilizing the global financial system, by providing elastic supply of liquidity to systemic financial centers and to close US allies, at backstop rates, encouraging them to provide dollar liquidity to their systemic institutions. The timing and magnitude of these innervations was adequate, triggered by the heightened global instability and ‘flight to the safety of the dollar.’ These steps solidified the notion that the FED is committed to defend the global stability of the USD network, in line with Gourinchas and Rey (2007). The division of backstop services reflect a balancing act: FED emergency credit lines to foreign central banks provided the global backstop that prevented the panic equilibrium induced by the attempts to liquidate dollar exposure in fire sales, where the ‘flight to safety’ in the abases of the lender of last resort ends with a self-fulfilling financial crisis (Diamond and Dybvig (1983)). The foreign central banks acted as the lender of last resort in their jurisdiction.

One may hope that by now the FED established credibility of its policies, and the blueprint of emergency BSLs will be enacted in the future at times of heightened instability triggering global risk-off and flight to quality. Yet, there is no reason to presume that the future will resemble the past. Future challenges to the US dollar standard may dilute the effectiveness or willingness of the FED to provide the global backstop services. We close with open questions about future developments, the answer to which would determine the robustness of the US dollar dominance, and the functioning of the global financial system in times of perils:

- Will the closer alliance between the US and the EU survive beyond the Biden administration? During the GFC and the Covid crisis the FED and the ECB cooperated by invoking similar policy stance, providing positive spillovers. The possible return of a future US administration that will apply “America First” isolationist policies may raise questions on the credibility and the depth of US FED backstop Dollar policies.

- Will the deepening of sovereign € bonds and the greater ECB and EU commitment to backstop these bonds, mitigate $ dominance? These trends may strengthen the € global position by increasing the size, liquidity and the safe haven status of sovereign € bonds issued by Euro Zone states.

- Will weaponizing the $ dominance, and the greater geopolitical tension between the West (OECD countries) and the East (China, Russia and their allies) induce growing fragmentation of trade and local barter and credit arrangements, mitigating overtime the $ dominance?

- Will the exit from QE and low interest policies triggered by adverse stagflationay shocks, constrain the future application of BSLs and destabilize the $ dominance?

- Are we heading from the era of illusive stabilizing ‘irreversible globalization’ into a fragmentation period that would rhyme with the first half of the 20thcentury, this time with the destructive capabilities of modern technologies, modern global warming and climate volatility, and more than doubled global population?

Thus, chances are that the dollar standard would be tested again in more challenging environment, where FED policies would possibly be less successful.

Selective References:

Aizenman, J. (2022). The Fed’s swap lines: Narrow circle, broad effect?.

Aizenman, J., Ito, H., & Pasricha, G. K. (2022). Central bank swap arrangements in the covid-19 crisis Journal of International Money and Finance.

Bordo, M. D., O/ F. Humpage, and J. Schwartz. “The evolution of the Federal Reserve swap lines since 1962.” IMF Economic Review 63.2 (2015): 353-372.

Diamond, Douglas W., and Philip H. Dybvig. “Bank runs, deposit insurance, and liquidity.” Journal of political economy 91.3 (1983): 401-419.

Goldberg, L. S., Lerman, R., & Reichgott, D. (2022). The US Dollar’s Global Roles: Revisiting Where Things Stand (No. 20220705a). Federal Reserve Bank of New York.

Gourinchas, P. O. and H. Rey (2007) ‘From World Banker to World Venture Capitalist: US External Adjustment and the Exorbitant Privilege’, in R. H. Clarida (ed.),G7 Current Account Imbalances: Sustainability and Adjustment, Chicago: University of Chicago Press.

Liao, G., & Zhang, T. 2020. The hedging channel of exchange rate determination. FRB International Finance Discussion Paper (1283).

McCauley, R.N. and Schenk, C.R. (2020). Central bank swaps then and now: swaps and dollar liquidity in the 1960s.

Obstfeld, M., Shambaugh, J. C., & Taylor, A. M. (2009). Financial instability, reserves, and central bank swap lines in the panic of 2008. American Economic Review, 99(2), 480-86.

This post written by Joshua Aizenman.

“A temporary FIMA Repo Facility was established March 31, 2020, and the facility was made a standing facility on July 28, 2021.”

So says the Board:

https://www.federalreserve.gov/monetarypolicy/fima-repo-facility.htm

That’ll help with dollar liquidity, but we’ve seen evidence lately that dollar liquidity can still be tight, even with central bank $ repo lines.

It looks that the Fed facility got established because of the outburst of auctions by the central banks that happened as the pendemic-induced financial crisis hit, but then things got more or less stabilized.

Would this picture look any different if we saw data on all this for the Chinese central bank?