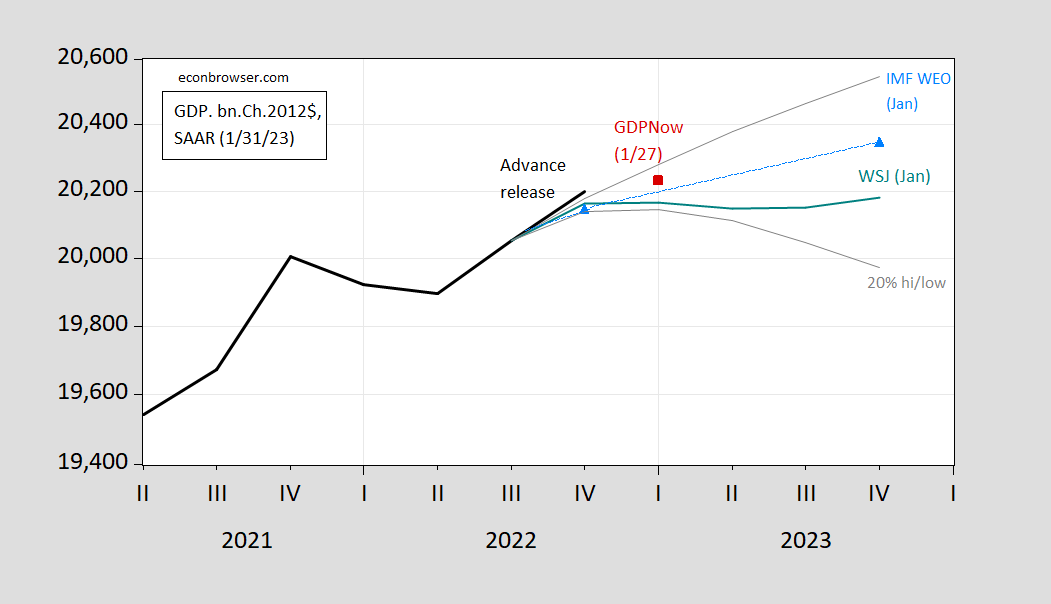

The IMF’s World Economic Outlook January update is out, with some slight upward revisions to world output projection growth for 2023, and more so to US and China. Here’s the US projection.

Figure 1: GDP as reported (black), IMF WEO update (sky blue triangles), WSJ January survey mean (teal), WSJ survey 20% trimmed high/low (gray lines), and GDPNow as of 1/27 (red square), all in billions Ch.2012$ SAAR. Source: BEA 2022Q4 advance, IMF WEO January update, WSJ January survey, Atlanta Fed, and author’ calculations.

The IMF forecast for US GDP is somewhat more optimistic than what Wall Street economists (as represented by the WSJ January survey). With only Q4/Q4 forecast growth rates reported, it’s hard to know whether a recession is projected by the IMF staff (especially if using the standard NBER criterion based on multiple series, rather than a 2-quarter GDP-based rule). The IMF does indicate a global recession is not projected, although growth will definitely be sub-par.

Global inflation will fall in 2023 and 2024 amid subpar economic growth

Global growth is projected to fall from an estimated 3.4 percent in 2022 to 2.9 percent in 2023, then rise to 3.1 percent in 2024. The forecast for 2023 is 0.2 percentage point higher than predicted in the October 2022 World Economic Outlook (WEO) but below the historical (2000–19) average of 3.8 percent. The rise in central bank rates to fight inflation and Russia’s war in Ukraine continue to weigh on economic activity. The rapid spread of COVID-19 in China dampened growth in 2022, but the recent reopening has paved the way for a faster-than-expected recovery. Global inflation is expected to fall from 8.8 percent in 2022 to 6.6 percent in 2023 and 4.3 percent in 2024, still above pre-pandemic (2017–19) levels of about 3.5 percent.

I get it – the Usual Suspects here will claim this is all Biden’s fault. But wait – world inflation is falling but not as fast as US inflation is falling.

Interesting, lacuna isn’t it, that growth rates for the US and China each deserve a comment but Russia does not. So what is the IMF saying about Russia?

“Russia’s Economy Forecast to Outperform U.S. Within Two Years…Russia’s economy is expected to grow faster than that of the U.S. in 2024, according to the International Monetary Fund (IMF).

Following Vladimir Putin’s invasion of Ukraine on February 24, 2022, Russia was hit by Western countries with tough economic sanctions designed to isolate it from the global financial system. In its report released Tuesday, the IMF said that Russia’s gross domestic product (GDP) growth had gone into negative figures (minus 2.2 percent) in 2022.

However, the IMF predicted that Russian GDP would rebound slightly in 2023 to 0.3 percent growth, and in 2024, the Russian economy is predicted to grow by 2.1 percent.

That’s higher than the IMF’s projection for the United States, which it said would see only 1 percent GDP growth that year, and down from a predicted 1.4 percent in 2023, and the 2 percent the U.S. enjoyed in 2022….”

https://www.msn.com/en-us/money/markets/russias-economy-forecast-to-outperform-us-within-two-years/ar-AA16VE5U

That’s a far cry from the 30% decline in Russian GDP growth that was forecast here only 7 months ago. But maybe that was only projection…In fact it was “Ukraine [that suffered its sharpest economic decline in over 30 years in 2022…Preliminary economy ministry data on Thursday showed a 30.4% drop in gross domestic producthttps://www.msn.com/en-us/money/markets/russias-economy-forecast-to-outperform-us-within-two-years/ar-AA16VE5U

As I’ve said before, economic forecasts often seem to be political wishful thinking, designed to influence expectations, rather than predictive ones.

JohnH: Give me a little time, and I assure you I would’ve gotten to that (given how interesting it was).

You have to excuse Putin’s pet poodle. The folks at the Kremlin had no feed little Jonny for several days.

It seems some smart people disagree with that IMF forecast:

https://www.reuters.com/markets/rates-bonds/russia-hold-rates-feb-economy-seen-contracting-again-2023-2023-01-31/

Inflation expectations, a key indicator the central bank pays close attention to in the run up to meetings, fell to 11.6% in January, but remain elevated. The central bank said it sees inflation risks rising this year. Analysts’ expectations of a 2% drop in GDP this year contrast with that of the International Monetary Fund, which on Tuesday said it saw Russia’s economy growing 0.3%.

Now we get it. Jonny boy is going to lose it but he should rest assured that Putin has a task force that intends to poison these pesky analysts.

War is a huge boast to government spending and, therefore, GDP. Governments will steal, borrow or spend reserves to purchase and/or produce the weaponry they need at the front line. That doesn’t mean their economies will hum along just fine and dandy. The current strain in and long-term damage to Russias economy is not easy to measure in simple total GDP numbers and changes. Would be interesting to see some real time numbers on the different components of Russian GDP. The fall in hydrocarbon prices should have hurt their export by now (unless they are faking numbers).

Ukraine has not been producing most of their war machinery but getting that donated so it doesn’t help their GDP. However, they have had all the GDP downside from the war because it is being fought on their land.

“That’s a far cry from the 30% decline in Russian GDP growth that was forecast here only 7 months ago.”

I’m calling you out for one of your patented lies. I know I never made such a forecast. I doubt anyone else did either unless it was your BFF Princeton Steve who we all know just makes BS up. So show us the comment or post you are referring to – assuming you can.

You’re right pgl…you weren’t the one who made that problematic forecast. I have it bookmarked but won’t release it for reasons of decency and respect, attitudes that you don’t value.

Lord – that little excuse of yours was sheer stupidity. OK – you lied and you followed up the original lie with another lie.

https://news.yahoo.com/vladimir-putins-former-speechwriter-predicts-175237940.html

Abbas Gallyamov, a former speechwriter for Vladimir Putin, predicted this week that a coup to oust the Russian president is a “real possibility” in the next year. In an interview with CNN’s Erin Burnett, Gallyamov said mounting economic woes and the Russian death toll from its invasion of Ukraine could finally obliterate any patience for “an old tyrant, an old dictator.” “At this moment, I think a military coup or an elite coup, broadly speaking, will become possible,” he said on “OutFront” Monday. “So in one year when the political situation changes and there’s a really hated unpopular president at the head of the country and the war is really unpopular, and they need to shed blood for this ― at this moment, a coup becomes a real possibility.” Asked by Burnett if he was talking about a military coup, Gallyamov said yes but with “civilian allies.”

Such a coup would be great news not only for Ukraine but also for the average Russian. But wait – what will happen to Putin’s pet poodle JohnH? After all Jonny boy lost his soul a long time ago and now this little pet poodle will have no one to feed him.

“Boris Grozovski, a Russian economics expert from the Wilson Center think tank, told Newsweek the most interesting aspect of the IMF forecast was its estimate of 0.3 percent GDP growth for Russia this year, compared with Moscow’s prediction of a 0.8 percent decline. “In 2022, the economic downturn wasn’t as severe as expected, however it will be more prolonged,” he said. “Actually, the economic dynamics in 2023 will depend on the course of the war, sanctions and oil prices”

Grozovski – unlike Jonny boy – seems to be a smart level headed person. There has been talk of Putin being pushed out of power, which very well could be the best thing for the average Russian. Maybe the IMF forecast has incorporated this possibility which would end this horrific war.

But of course with Putin out of power, his little pet poodle JohnH would have no one to feed him. Awwwww!

pgl might be interested in reading this–Chris Hedges: “Ukraine: The War That Went Wrong…

The near hysterical calls to support Ukraine as a bulwark of liberty and democracy by the mandarins in Washington are a response to the palpable rot and decline of the U.S. empire. America’s global authority has been decimated by well-publicized war crimes, torture, economic decline, social disintegration — including the assault on the capital on January 6, the botched response to the pandemic, declining life expectancies and the plague of mass shootings — and a series of military debacles from Vietnam to Afghanistan. The coups, political assassinations, election fraud, black propaganda, blackmail, kidnapping, brutal counter-insurgency campaigns, U.S. sanctioned massacres, torture in global black sites, proxy wars and military interventions carried out by the United States around the globe since the end of World War II have never resulted in the establishment of a democratic government. Instead, these interventions have led to over 20 million killed and spawned a global revulsion for U.S. imperialism.”

https://scheerpost.com/2023/01/29/chris-hedges-ukraine-the-war-that-went-wrong/

Chris Hedges was a foreign correspondent for the NY Times during the Gulf War and its Balkan Bureau Chief during the wars in Yugoslavia. Obviously, he a highly competent guy. He was fired after he spoke out against the War in Iraq. (Gotta silence those damned dissidents! Better to keep Judith Miller on staff…)

https://en.wikipedia.org/wiki/Chris_Hedges

Wars almost always start out with a lot of media fueled, jingoist hysteria and braggadocio until eventually the reality of a yet another pointless and futile misadventure sours public opinion enough to end the stupidity. Neocon and liberal interventionists running the foreign policy blob seem to have learned that the best way to keep public opinion from souring is to keep it uninformed about what’s really going on. It worked well in Afghanistan, another pointless and futile, misadventure backing a local kleptocracy. No Chris Hedges style truth teller is about to be allowed to darken the doorstep of the NY Times!

How many Russian bots did Putin to dig that one up? And more importantly – how many bones did Putin just give his little poodle.

actually, i agree with most of Chris Hedges’ take in that article…does that make me a Russian bot?

“Wars almost always start out with a lot of media fueled, jingoist hysteria and braggadocio until eventually the reality of a yet another pointless and futile misadventure sours public opinion enough to end the stupidity.”

Well Putin certain stirred up his own jingoist hysteria and braggadocio in his attempt to justify his war crimes committed on innocent Ukrainians. And JohnH is one of his main spokespersons. Hey Jonny boy – look in the damn mirror as you are guilty as it gets in this regard. Kids being murdered, women being raped, and Jonny boy cheers all of it on.

pgl’s dementia precludes him from recalling the propaganda driven hysteria before the Iraq War…”Saddam has WMDs”…rewind, repeat…ad nauseum. The preparation of the public for war with Russia began in earnest began with the demonization of Russia during the RussiaGate propaganda campaign. Taibbi has the smoking guns from the Twitter files.

https://www.racket.news/p/listen-to-this-article-move-over-906#details

pgl just gobbles up whatever propaganda is dished up…his dementia blocks any skepticism, questioning, or critical thinking.

‘JohnH

February 2, 2023 at 5:39 pm

pgl’s dementia precludes him from recalling the propaganda driven hysteria before the Iraq War’

I opposed the Iraq War starting back in 2002. Now Jonny boy decided only recently that he realized what a mistake this was. So when Jonny boy tries to smear people with statements like that – Jonny boy is doing what he does best. LYING.

fwiw, here’s what i have on this week’s revisions to last week’s GDP; check my arithmetic:

Construction spending in December was higher than was estimated by the BEA in their advance estimate of 4th quarter GDP last week, while October’s and November’s annualized construction spending figures were revised $9.8 billion and $5.1 billion higher respectively…The BEA’s key source data and assumptions (xls) accompanying last week’s 4th quarter GDP report indicates that they had estimated that December’s residential construction would decrease by an annualized $7.4 billion from previously published figures, that nonresidential construction would increase by an annualized $3.2 billion from last month’s report, and that December’s public construction would increase by an annualized $1.2 billion from the figures shown in November’s construction spending report….hence, by totaling the changes of those BEA estimates, we find the BEA had estimated December construction spending to be $3.0 lower than previously reported November levels, which have now been revised $9.8 billion higher…since this report indicated that total construction spending for December was $7.5 billion lower than the revised November figure, that means the net of the annualized construction figures used for December in the GDP report was $5.3 billion too low…averaging the differences between the monthly annual rates in this report and those used in the GDP report for the three months of the 4th quarter would mean that this report suggests that the nominal construction spending figures used as source for the 4th quarter GDP report was underestimated by $6.7 billion (at an annual rate), implying an upward revision to the related GDP components at a rate that should result in addition of about 0.13 percentage points to 4th quarter GDP when the 2nd estimate is released at the end of the month, an estimate that should be considered very rough, since i have only allowed for an average aggregate deflator for the revisions, rather than one addressing the specific components that were revised…

then in the full factory report today; “Inventories of manufactured nondurable goods, down five of the last six months, decreased $0.5 billion or 0.2 percent to $314.2 billion”

the BEA’s key source data and assumptions (xls) for 4th quarter GDP indicates that they had estimated that the value of non-durable goods inventories would decrease by $0.2 billion on a Census basis in December before they estimated the 4th quarter’s output, so the actual $0.5 billion decrease, following a $0.3 billion downward revision to November’s non-durable goods inventories, would indicate that they overestimated the end of 4th quarter GDP non-durable factory inventory component by about $0.9 billion (ie, $0.6 billion in December and $0.3 billion in November)…that would work out to around $3.6 billion on an annualized basis, or about $3.0 billion in 2012 dollars, which would suggest that the change in 4th quarter GDP would have to be revised downwards by about 0.05 percentage points to account for what this report shows..