Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

We present an update of the jobs-workers gap discussed in previous posts: [1], [2], [3].

Recent BLS releases “The Employment Situation – January 2023” and “Job Openings and Labor Turnover – December 2022” allow us to update the jobs-workers gap and the business cycle indicator based on it. For January 2023 we assume that job openings level declined to 10.7 mn from December 2022 level of 11 mn, which would be in line what high-frequency data by Indeed suggests (https://www.hiringlab.org/data/).

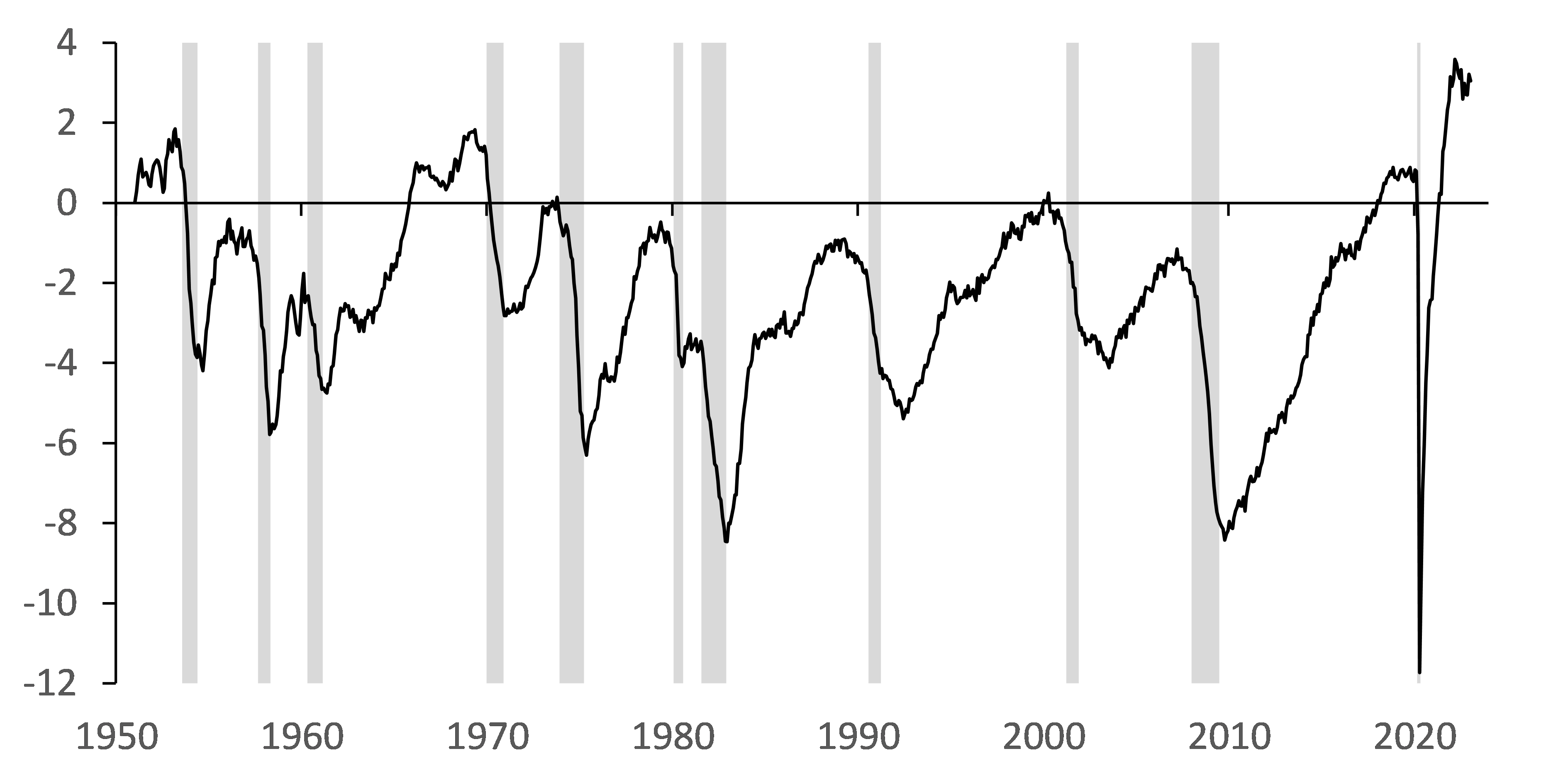

In January 2023 the jobs-workers gap was at 3.0% or 5.0 mn, down from December 2022 by 0.2 pp or 0.3 mn, however December 2022 m/m changes of the gap were 0.5 pp or 0.9 mn, respectively.

Figure 1. Jobs-Workers Gap (Percent)

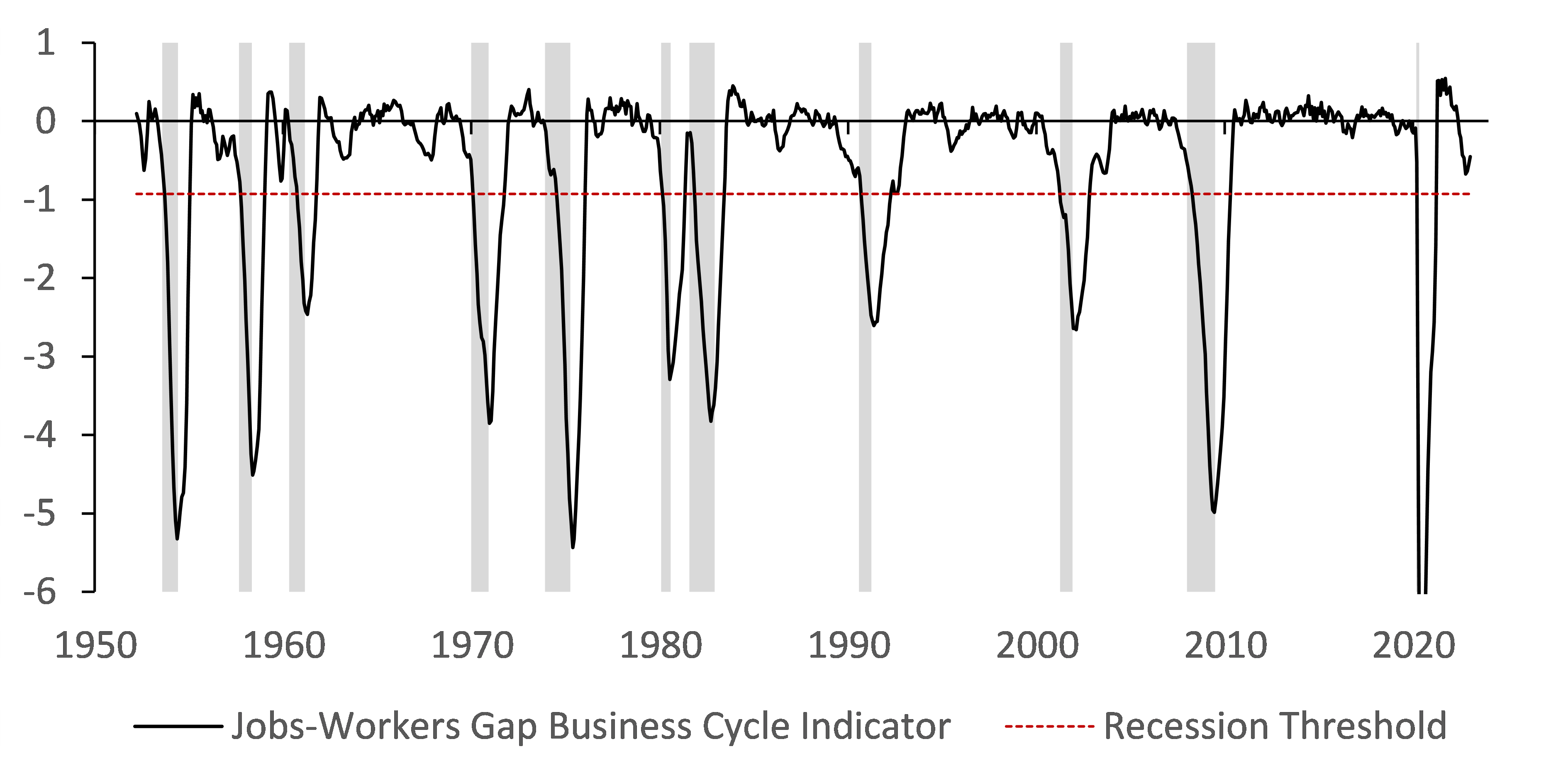

With this new data the jobs-workers gap business cycle indicator (JWGBCI) increased to -0.45 pp in January 2023 from -0.56 pp in December 2022 and -0.64 pp in November 2022, remaining above the recession threshold of -0.93 pp. Recall the indicator uses a smoothed gap, namely we calculate the change of the three-month moving average of the jobs-workers gap relative to its maximum during previous twelve months.

Figure 2. Jobs-Workers Gap Business Cycle Indicator (Percentage Points)

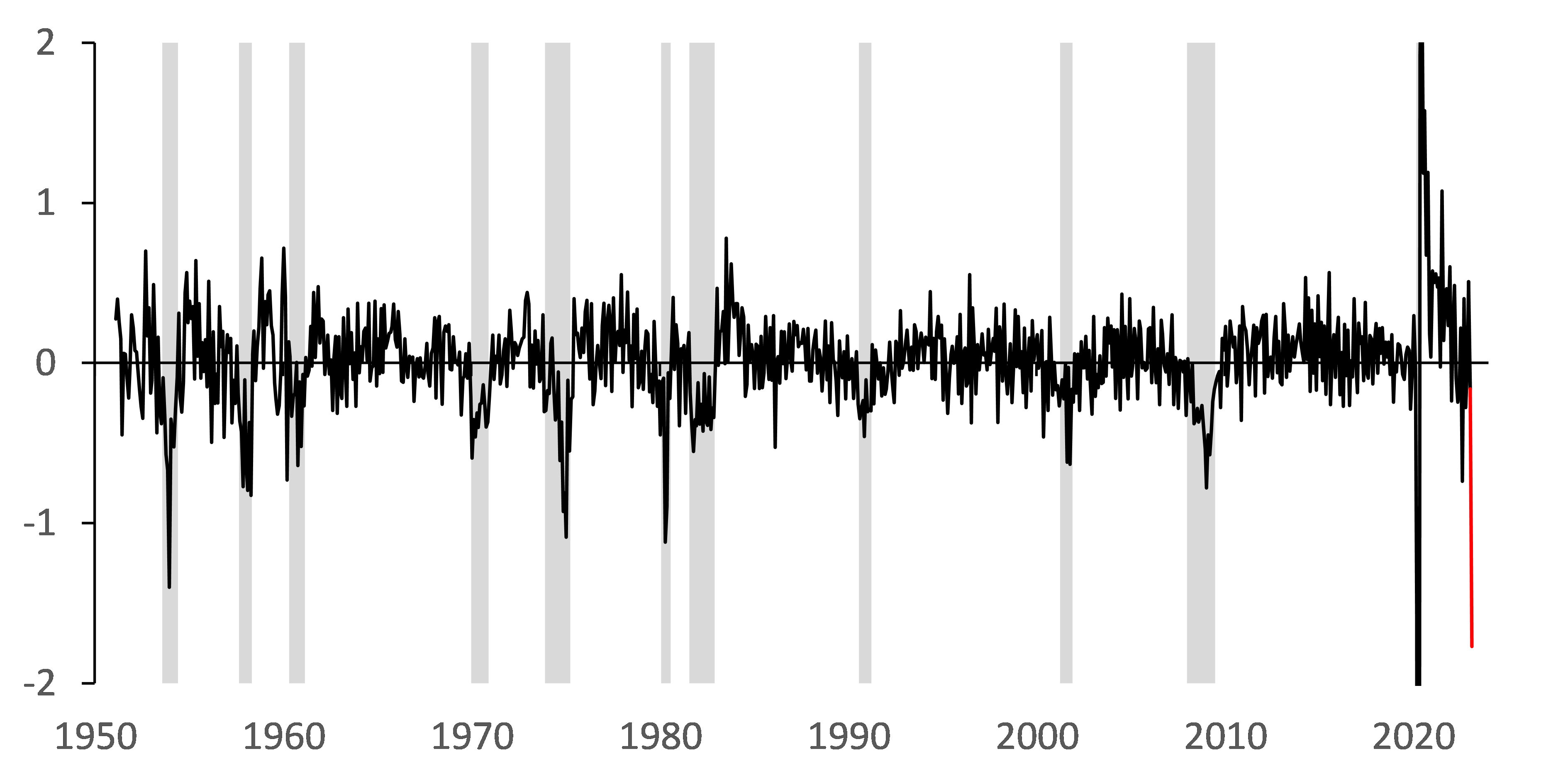

What magnitude of m/m change in the jobs-workers gap would be needed in February 2023 to make a recession call? The jobs-workers gap (not smoothed) would need to collapse to 1.27% from 3.04% in January, that is 1.77 pp which corresponds to 3.7 standard deviations of historical volatility. Figure below presents this change (marked red) in historical perspective. Such a big change seems rather unlikely, as it would most likely mean deep contraction of employment or job openings, or both in m/m terms as of February.

Figure 3. Jobs-Workers Gap 1-Month Change (Percentage Points)

Conclusion of this update remains similar to previous ones. Recent readings of the jobs-workers gap and the business cycle indicator based on it suggest that labor market remains tight and resilient to monetary policy tightening.

This post written by Paweł Skrzypczyński.

Figure 2 shows that large downward departures from zero often, but not always, lead to recession signals and to recession. Also that large upward departures are often followed by downward departures without recession. So that’s good.

Off topic, inflation and yields-

We have recently been instructed by our local “I don’t need evidence” declaimer that yield moves are driven by inflation, not the Fed. This is consistent with the same declaimer’s insistence that nothing the Fed does matters to inflation, growth or financial market performance. Well, there’s this:

https://fred.stlouisfed.org/graph/?g=ZADl

Don’t see how the *only* causal factor in yields can run around so independently from yields. But that’s just me and my silly reliance on evidence.

I should lay my cards on the table. I have myself made the argument that the Fed’s power to influence economic (not market) outcomes is reduced in a low-yield environment. In making that argument, I attempted to marshal evidence. (There I go with the “evidence” malarkey again.)

What I don’t see is any evidence, at all, anywhere, that Fed policy is irrelevant to financial market performance. That’s just silly. And with higher yields comes increased influence for the Fed on the economy.

This was interesting. A lot more interesting than the confused mess from Princeton Steve who never understood this data in the first place. Stevie and the other RECESSION cheerleaders should note the conclusion:

‘Recent readings of the jobs-workers gap and the business cycle indicator based on it suggest that labor market remains tight and resilient to monetary policy tightening.’

One of publishing’s perils is on display in today’s WSJ. Front page, below the break story headline:

Cooling Job Market Puts Bosses Back In The Driver’s Seat.

Went to press before the January jobs report.

Speaking of the WSJ, Brainard may be leaving the Fed. ‘Cause Deese is leaving the White House.

I’m not sure that WSJ statement is wrong, wage growth is slowing—that spells more power for “bosses”. I knew about Deese, I missed the story about Brainard. Interesting, thanks for the heads up. I think I would be tempted to just stay at the Fed if I was her. Unless she feels some patriotic “your President needs you” pull at the heart strings, the Fed Vice Chair seems to hold more job security, and I’m not even sure Vice Chair is just not an out-and-out better job. Lots of status, less hassles and arguing than Deese’s job.

“Dewey Defeats Truman” was the banner headline on the front page of the Chicago Daily Tribune on November 3, 1948. I guess the WSJ feels like the Trib did some 75 years ago.