Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

We present an update of the jobs-workers gap discussed in this post: https://econbrowser.com/archives/2022/09/guest-contribution-gauging-recessions-with-the-jobs-workers-gap.

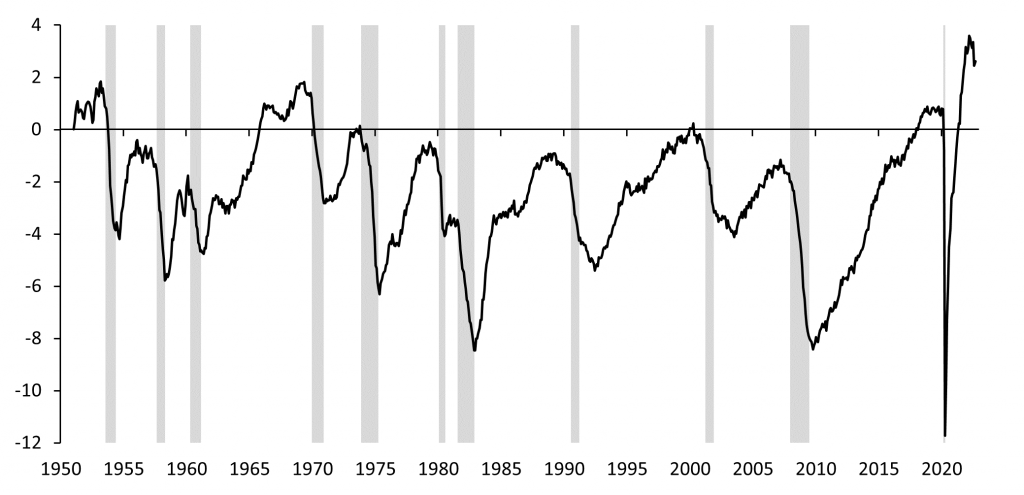

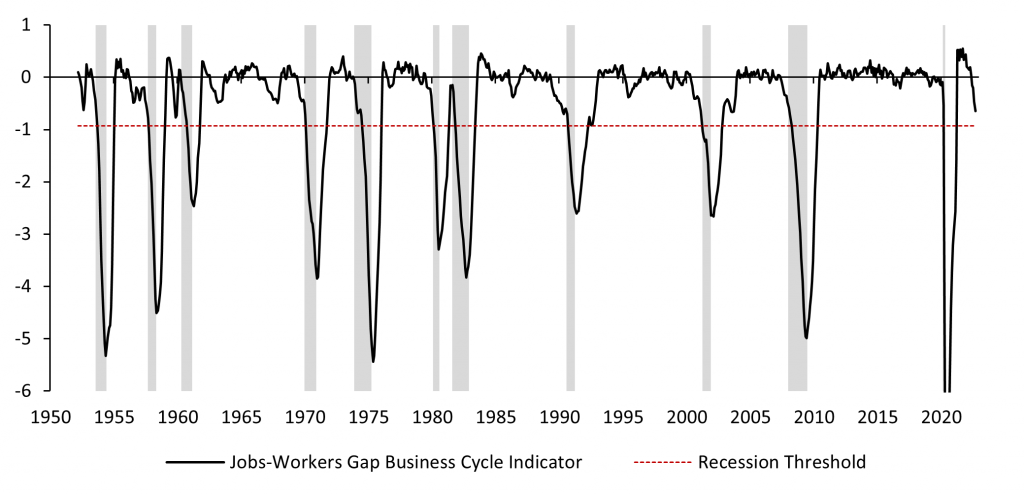

In August the jobs-workers gap declined to 2.5% from 3.4% in July owing to a significant drop in job openings. If we assume that job openings stay at August level in September and incorporate September data from the Household Survey we arrive at the gap of 2.6% in September. However, our business cycle indicator based on the jobs-workers gap, the JWGBCI, calculated as the change of the three-month moving average of the jobs-workers gap relative to its maximum during previous twelve months, drops from -0.5 pp in August to -0.6 pp in September. Recall that the recession trigger is at -0.9 pp.

Figure 1. Jobs-Workers Gap, %

Figure 2. Jobs-Workers Gap Business Cycle Indicator, Percentage Points

Conclusion: Labor market conditions eased and remain still consistent with the soft landing scenario.

This post written by Paweł Skrzypczyński.

From their earlier post:

‘As of July 2022 the jobs-workers gap was at 5.6mn workers, meaning that employment and job openings (total labor demand) exceeded labor force (total labor supply) by 3.4%. Historically this reading was near an all-time high level of 3.6% (5.9mn workers) reached in March 2022.’

Now I seem to recall that both JohnH and Princeton Steve at the time insisted we were in a recession. Labor demand being 1.034 times labor supply does not sound like a recession to me. OK labor demand now is only 1.025 times labor supply but this still is a very strong labor market.

Is it possible to have a technical recession due to labor shortages? I don’t see why not. As a thought exercise, it makes sense to have a shrinking economy overall while having a rising per capita income level. If the population is shrinking, as it has been in Japan for some time, it seems to be plausible. If the population declines significantly over time, the economy could “suffer” a long-term decline while individuals in that economy could benefit from improved income over the same period of time.

https://www.nytimes.com/2022/10/07/opinion/jolts-jobs-report-inflation-economy.html

October 7, 2022

Wonking out: A Jobs Survey Full of Good News

By Paul Krugman

For as long as I’ve been paying attention to economic news, pundits and investors have waited anxiously for the monthly report by the Bureau of Labor Statistics on the employment situation. That’s still true, and there was some important news in today’s report. More on that later.

But another report from the bureau, which came out on Tuesday, was a real eye-opener. It was, in particular, the best news about inflation we’ve seen in a long time — even though it never mentioned inflation.

JOLTS — the Job Offerings and Labor Turnover Survey — tracks, um, job offerings and labor turnover. That is, it asks employers how many unfilled positions they have, how many workers have quit or been fired and so on. It may seem obvious that this information is useful, but these days many economists believe that it’s even more so.

Some background: Standard macroeconomics relies a lot on an updated version of the Phillips curve. The original version of that theory asserted (based on historical evidence) that there was a downward-sloping relationship between unemployment and inflation: The higher the unemployment rate, the lower the inflation rate, all else being equal. Since the 1970s, almost everyone has assumed that expectations of inflation also play a big role. If the public expects a lot of inflation, as it did at the end of the 1970s, this will push up actual inflation for any given rate of unemployment.

So what explains the recent surge in inflation? The mystery is that while unemployment is low, it’s roughly the same as it was on the eve of the pandemic, yet inflation is much higher. This is true even if you focus on “core” inflation, which excludes volatile food and energy prices:

https://static01.nyt.com/images/2022/10/07/opinion/krugman071022_1/krugman071022_1-articleLarge.png

An ugly picture: the relationship between core inflation and the unemployment rate at points over the past 15 years.

Are we having a ’70s-type problem, with inflation driven by self-fulfilling expectations? Well, we have a lot of direct evidence on expected inflation, from both surveys and financial markets — and it isn’t especially high. Everyone seems to expect that the Federal Reserve will get inflation down, and fairly soon. So expectations aren’t the story.

What many economists have been suggesting, instead, is that the unemployment rate is an inadequate measure of how hot the economy is running. And some have argued that the best measure is the so-called Beveridge curve: the ratio of vacancies — unfilled job openings — to the number of unemployed workers. This is the basis of an influential recent paper * by Laurence Ball, Daniel Leigh and Pankaj Mishra that offers a pessimistic take on inflation based on the fact that the vacancy-to-unemployment ratio is very high, even though unemployment isn’t all that low. Here are some of their charts:

https://static01.nyt.com/images/2022/10/07/opinion/krugman071022_2/krugman071022_2-articleLarge.png

Two more ugly pictures.

Another recent paper, ** by Olivier Blanchard, Alex Domash and Larry Summers, showed that as of early summer, the relationship between unemployment and vacancies had greatly deteriorated, which they argued implied that the unemployment rate consistent with stable inflation is now well above its current level — roughly 5 percent versus its current 3.5.

But then came the latest JOLTS report, which showed a large drop in job offerings in August, even though unemployment didn’t rise significantly.

Let me offer a quick-and-dirty, though nerdy, way to understand that report’s implications. The following picture shows unemployment versus vacancies — the Beveridge curve — with each point representing that relationship at intervals over the past 15 years and with unemployment truncated at 8 percent to exclude the depths of the pandemic slump:

https://static01.nyt.com/images/2022/10/07/opinion/krugman071022_3/krugman071022_3-articleLarge.png

Not so ugly after all? …

* https://www.brookings.edu/bpea-articles/understanding-u-s-inflation-during-the-covid-era/

** https://www.piie.com/sites/default/files/documents/pb22-7.pdf

Idaho will resume cobalt mining for the first time in almost 30 years:

https://www.autonews.com/suppliers/why-cobalt-mining-has-resumed-us-after-30-years

First U.S. cobalt mine opens after more than 30-year hiatus

Booming demand for batteries powering the world’s shift into EVs is rekindling US cobalt production after at least a 30-year hiatus.

Booming demand for batteries powering the world’s shift into electric vehicles is rekindling U.S. cobalt production after at least a 30-year hiatus. Australia-based Jervois Global Ltd. is starting the first U.S. cobalt mine in Idaho on Friday, according to CEO Bryce Crocker. The mineral sits “at the top of the table” in terms of national security, said Crocker. “There aren’t many new sources of supply, particularly in stable jurisdictions, which is why this mine in the US is very important,” he said. Cobalt hasn’t been produced in the US since at least 1994, according to data from the United States Geological Survey….While more than two-thirds of the mined metal comes from the Democratic Republic of Congo, there’s been an increasing shift among manufacturers to source cobalt from outside the African nation due to allegations of corruption, human rights abuses and the use of child labor there.

The passage of the Inflation Reduction Act also provides incentives for battery materials sourced in the U.S. EVs can qualify for a $7,500 tax credit under President Joe Biden’s climate and tax bill, as long as their batteries contain minerals extracted from or processed in a country with a free trade agreement with the U.S., and providing part of the components are made or assembled in North America. The Idaho mine is expected to produce 2,000 tons of mined cobalt a year, according to Crocker. The concentrated cobalt will then be exported and converted into refined products outside the U.S. before ultimately brought back into the U.S. to serve customers, he added. Jervois owns a nickel and cobalt refinery in Brazil and is talking to third parties in countries such as Canada and Australia to convert the mined material. About 80 percent of global refining is concentrated in China, but capacity is growing elsewhere, including at Finland’s giant Kokkola refinery, which is owned by Jervois. Cobalt demand will grow from 127,500 tons in 2022 to 156,000 tons in 2030, as a result of the shift to iron-based batteries by major automakers, according to BloombergNEF.

The indicator presented uses a level change to signal recession. Figure 3 gives the impression that rate of change also provides information. Just eye-balling the Figure, I don’t see any nstance in which a rate of change as rapid as just experienced has not led to a level change in excess of 0.9%, and to recession.

So we’re not ithen recession, but Fed, by ths metric, is risking recession. By other metrics, as well.

current and recent employment numbers say we have not been in a recession, up until the present. we cannot say the same thing about the future. but if the fed continues to implement large rate hikes, a soft landing will be avoided and a recession will occur. the question becomes, why is the fed so intent on a recession within the next year? because right now, that is their stated goal. on the other hand, i think getting inflation under 5% should be considered a medium term goal. and doing so with a soft landing should be considered a success.

I suspect they are fighting the last war. Inflation that might reasonably have turned out to be transient did not, in fact, prove transient. So now, to avoid “making the same mistake twice” they are making the other mistake.

A claim was made by one of the talking heads on Bloomberg (?) that in an inflationary recession that employment is a late signal. I was not aware of this as something we have enough experience with to make that claim. Sounded like nonsense to me or is there some evidence that is true?

Steve

https://fred.stlouisfed.org/graph/?g=UGgs

January 15, 2018

Consumer Price Index and Employment-Population Ratio, * 1960-2022

* Employment age 25-54

(Percent change and Percent)

https://fred.stlouisfed.org/graph/?g=n81O

January 15, 2018

Consumer Price Index and Employment-Population Ratio, * 1992-2022

* Employment age 25-54

(Percent change and Percent)

Steve,

Here’s a look at changes in monthly employment:

https://fred.stlouisfed.org/graph/?g=UGos

I haven’t looked closely, but a casual glance says you are right, the Bloomberg guy was making stuff up. Inflationary recessions are those in the 1970s and 1980s. At a glance, they don’t look so different from others. But again, I haven’t done any math, so I’m not confident in this.

I should note a stylized fact regarding monetary policy, which does support the notion that employment softens late in an inflation-driven cycle. That stylized fact is that the effects of monetary policy occur with a lag. If a recession is caused by something other than monetary policy, say a pandemic or a housing crash, private firms may cause the recession more or less directly by laying off workers, while in a recession induced by monetary policy, layoffs may lag.

In fact, employment began softening well ahead of the 2008 housing-driven recession; the stylized fact fits in that case. Otherwise, I think you may be right – we have too few instances to judge whether employment lags more in inflation ( monetary policy) induced recessions than in other recessions.

https://www.huffpost.com/entry/gop-senator-tuberville-racist-comment-reparations_n_63433220e4b0e376dc02ec98

Republican Sen. Tommy Tuberville asserted that Democrats support reparations for the descendants of enslaved people because “they think the people that do the crime are owed that.” The first-term Alabama Republican spoke at a Saturday evening rally in Nevada featuring former President Donald Trump, a political ally. His comments were part of a broader critique in the final weeks before the Nov. 8 election, when control of Congress is at stake, about how Democrats have responded to rising crime rates. But Tuberville’s remarks about reparations played into racist stereotypes about Black people committing crimes.

MAGA hats are just the modern version of KKK ropes. Tuberville, Trump, and the rest of their crew are all blatant racists.

I kinda wonder what the people who played football for him think of all of this. Many of his players were descendants of enslaved people. He doesn’t seem to have learned much from them.

Mike Gundy at Oklahoma State has made similar comments and shown similar proclivities (Colorado Buffalo players said he used the N-word during his Quarterbacking days, and his “OAN” T-shirt broadcast over Twitter when OAN was harping hard against BLM in my opinion was a “dog whistle” Gundy didn’t think his players would pick up on). I suspect this is more common than people imagine. Black players for many of these guys are just a means to an end, like inanimate chess pieces. The only coaches I trust on this score are the Barry Switzers, Hayden Frys, Don Haskinses, Jerry Tarkanians, BIlly Tubbses, who did it before it was forced upon them from a pure talent imbalance perspective, i.e. “If I don’t start recruiting Black athletes [ read as, the best athletes ] I’m going onto the dung pile of irrelevancy as a coach”.

https://www.nytimes.com/2022/10/10/business/nobel-prize-economics-winner.html

October 10, 2022

Nobel Economics Prize Goes to Ben Bernanke, Douglas Diamond and Philip Dybvig for Research on Financial Crises

By Jeanna Smialek

The Nobel Memorial Prize in Economic Sciences was awarded on Monday to Ben S. Bernanke, the former Federal Reserve chair, and two other academics for their research into banks and financial crises.

Douglas W. Diamond, an economist at the University of Chicago, and Philip H. Dybvig at Washington University in St. Louis won the prize alongside Mr. Bernanke, who is now at the Brookings Institution in Washington.

Mr. Bernanke in 1983 wrote a paper * that broke ground in explaining that bank failures can propagate a financial crisis — rather than simply being a result of the crisis.

Mr. Diamond and Mr. Dybvig the same year wrote a paper on the risks inherent in maturity transformation — the process of turning short-term borrowing into long-term lending. Mr. Diamond also wrote about how banks monitor their borrowers, noting that knowledge about borrowers disappears upon bank failures, extending the consequences of the upheaval.

“The laureates have provided a foundation for our modern understanding of why banks are needed, why they’re vulnerable, and what to do about it,” said John Hassler, an economist at the Institute for International Economic Studies at Stockholm University and a member of the prize committee.

* https://www.nber.org/papers/w1054

** https://www.bu.edu/econ/files/2012/01/DD83jpe.pdf

https://www.nber.org/papers/w1054

January, 1983

Non-Monetary Effects of the Financial Crisis in the Propagation of the Great Depression

By Ben S. Bernanke

Abstract

This paper examines the effects of the financial crisis of the 1930s on the path of aggregate output during that period. Our approach is complementary to that of Friedman and Schwartz, who emphasized the monetary impact of the bank failures; we focus on non-monetary (primarily credit-related) aspects of the financial sector–output link and consider the problems of debtors as well as those of the banking system. We argue that the financial disruptions of 1930-33 reduced the efficiency of the credit allocation process; and that the resulting higher cost and reduced availability of credit acted to depress aggregate demand. Evidence suggests that effects of this type can help explain the unusual length and depth of the Great Depression. *

* https://www.nber.org/system/files/working_papers/w1054/w1054.pdf

I am fine with this prize.

I note that while the recipients have put these ideas into modern model forms, the ideas are not due to them. Bernanke essentially updated the debt-deflation theory of Irving Fisher. But if one goes back to the 19th century prior to Keynes and all that, bank failures leading to broader financial crises was the most widely asserted theory of macro downturns. It was the main argument of a numerous economists then, with John Stuart Mill and Karl Marx among the more prominent ones arguing it, although hardly the only ones.

This is actually a prize that reaffrims what was effectively the classical theory of macroeconomic decline.

Good to see monetary economics taking center stage. Three well deserved Nobel Prize winners.

https://www.bu.edu/econ/files/2012/01/DD83jpe.pdf

June, 1983

Bank Runs, Deposit Insurance, and Liquidity

By Douglas W. Diamond and Philip H. Dybvig

Abstract

This paper shows that bank deposit contracts can provide allocations superior to those of exchange markets, offering an explanation of how banks subject to runs can attract deposits. Investors face privately observed risks which lead to a demand for liquidity. Traditional demand deposit contracts which provide liquidity have multiple equilibria, one of which is a bank run. Bank runs in the model cause real economic damage, rather than simply reflecting other problems. Contracts which can prevent runs are studied, and the analysis shows that there are circumstances when government provision of deposit insurance can produce superior contracts.

Their paper as well as the paper by Dr. Bernanke should have been read more carefully during the banking deregulation heydays.

Whiny little baby Trump has found a new “defense” for taking classified documents to Maro Lago:

https://www.msn.com/en-us/news/politics/cnn-fact-checker-busts-trump-s-dishonest-claims-about-george-hw-bush-s-handling-of-classified-docs/ar-AA12N60u?ocid=msedgdhp&pc=U531&cvid=9469bba24086466c9955c978462d9ccc

The twice-impeached former president told supporters over the weekend at a Nevada rally that his Republican predecessor took numerous government records to a restaurant for storage, as the Department of Justice continues to investigate his own mishandling of classified materials. “George H.W. Bush took millions of documents to a former bowling alley and a former Chinese restaurant where they combined them,” Trump told supporters. “So they’re in a bowling alley-slash-Chinese restaurant.”

Oh my – did Bush41 really do that? Now I bet this line is the new defense from Ricky boy Stryker. Of course like everything else Trump has said – it is a flat out lie.

I guess when it comes to UK value-added taxes on marshmallows – size matters:

https://www.nytimes.com/2022/10/08/world/europe/marshmallow-uk-tax.html

A court in Britain looked at a bag of 27 marshmallows this summer and considered the future of the soft, sweet treats: Were these marshmallows destined to be eaten straight from the bag or turned into s’mores? The question may seem straightforward, but a tax tribunal presented with the sweets evaluated them in granular detail to determine if a food product called Mega Marshmallows would be subject to the same standard retail sales tax as regular marshmallows, which are about an inch shorter and about a half-inch thinner. The court, known as the First-Tier Tribunal, examined the Mega Marshmallow packaging, past and present, noting that one version included a cartoon chef next to the words “baking buddy”; inferred that people were more likely to roast the marshmallows over an open flame than eat them as a snack; and assessed whether marshmallows tasted better raw or roasted. “Larger marshmallows are equally palatable whether eaten as a snack or after roasting,” the court determined in a nine-page ruling issued last month. The court’s ruling is very detailed. Explaining a quote on the marshmallow’s packaging, the court wrote, “The reference to a great American tradition is to the tradition of roasting marshmallows over a campfire.” The court’s intensive deliberations ultimately favored the maker of the marshmallows, Innovative Bites Limited, which was allowed to sell Mega Marshmallows with a 0 percent value-added tax, or VAT, which is similar to sales tax. The court said that unlike standard marshmallows, which are subject to a VAT of 20 percent, these slightly larger marshmallows were not a confectionary and should therefore be subject to a 0 percent VAT, like most food. “The fact that it is sold and purchased as a product specifically for roasting, the marketing on the packaging of the product which confirms that purpose, the size of the product which makes it particularly suitable for roasting and the fact that it is positioned in supermarket aisles in the barbecue section during the summer months when most sales are made and otherwise in the world foods section, leads us to that conclusion,” the court said. It has become routine for tax tribunals in Britain and other countries that use VAT to examine in detail foods, games and even television personalities to decide how they should be taxed.

Not all Georgia’s Republicans are impressed with Hershell Walker:

https://www.axios.com/2022/10/09/geoff-duncan-herschel-walker-georgia-gop

Georgia’s Lt. Gov. Geoff Duncan (R) said last week that the embattled Senate candidate Herschel Walker “has not yet earned my vote,” per the Atlanta Journal-Constitution. Driving the news: “Walker won his Senate primary not because of his political chops or policy proposals,” Duncan wrote in an editorial published on CNN last week.

https://www.cnn.com/2022/10/06/opinions/herschel-walker-scandal-georgia-senate-gop-duncan/index.html

Remember when Ted Cruz opposed Obamacare because he wanted cheaper White Castle burgers? Now this is coming back to bite him with people in Texas:

https://www.dailydot.com/debug/ted-cruz-white-castle/

“Everyone I know in Texas loves Whataburger,” says actor and Texan Sonny Carl Davis in Richard Linklater’s most recent attack ad against Sen. Ted Cruz (R-Texas)…Cruz’s office called Cruz challenger Beto O’Rourke “a triple meat Whataburger liberal” in a confusing statement in August.

https://www.youtube.com/watch?time_continue=25&v=zAvKZAPhOUU

As Texas Monthly said after the incident, the phrase was perhaps meant to describe how liberal O’Rourke is—much like the phrase, “limousine liberal,” or “champagne socialist.” But, as Davis says, the phrase doesn’t make much sense. What’s more, Whataburger is a Texas classic. Why risk messing with the beloved burger chain just to try and make “Triple meat Whataburger liberal” happen? As Davis might say, it’s not going to happen, Ted. The ad also features clips from Cruz’s Affordable Care Act filibuster in 2013, in which he praised White Castle. “Just as a consumer, I’m a big fan of eating White Castle burgers,” Cruz says in one of the clips. “I like their little burgers.” “There’s not a White Castle within 900 miles of Texas, Ted!” Davis says in the ad. “Maybe up in Canada,” he continues, referencing one President Trump’s favorite attacks on the senator.

I never had a Whataburger but yea White Castle is pretty good. But as fat as Ted Cruz is – maybe he should just eat a salad.

Off topic, financial stability –

Y’all know about Wicksell’s natural rate notion – there is an interest rate which is consistent with maintaining GDP at potential without causing (acceleration of) inflation. The idea is that there is some interest rate which, absent supply shocks, produces economic stability.

NY Fed economists have proposed another “natural rate”, one which assures financial stability. The idea is that there is a rate at which a credit constrain is just binding on the economy. No more and no less credit than is needed is available at the “financial stability real interest rate”. This idea is actually pretty conventional, part of normal discussion. It is also used in practice when central banks confront financial crisis with liquidity. It has been a long-standing criticism of the Fed and other central banks that excess liquidity provision has proven destabilizing. In effect, during disinflationary times, central banks have often not set a rate which credit is at all binding on the economy.

The two natural rates are not the same, which is where the fun starts.

https://www.newyorkfed.org/research/staff_reports/sr946#:~:text=The%20financial%20stability%20interest%20rate,the%20level%20of%20r**.

This paper looks like an effort to formalize what we already know, a step toward getting policy makers to reconsider the risks of excess liquidity.

From the NY Fed report in the financial stability real interest rate, we gat this entirely unsurprising result:

“…as the banking sector becomes more leveraged, the financial stability interest rate becomes lower,…this has implications for monetary policy, in that even relatively low levels of the real interest rate could trigger financial instability.”

Leverage creates risk. Low rates encourage leverage. The Fed’s long effort to rebuild the power of monetary policy by raising inflation and inflation expectations came at the cost of lowering the rate at which financial instability is induced.

I think the authors might want to give more thought to nominal rates, since much of the lending in the world is in nominal terms.

Off topic, China’s growth model –

As countries grow, they change. China has done both.

The FT carries “A New Model for Chinese Growth” which is behind a pay wall. Rats!

https://www.ft.com/content/ae8c8bf3-070b-46dd-94e4-22497638db3f

Michael Pettis chimes in – This proposed model “…requires that China shift from a growth model in which households are structurally locked into transfers that subsidize government and businesses to one in which government and businesses are structurally locked into transfers that subsidize households.

Any change which would reduce distortions in the financial sector is likely to reduce malinvestment and slow the growth in bad debt. Household subsidies to business have come, in part, through caps on interest rates paid to savers at below the rate of inflation. That has led households to trade bank savings for real estate contracts. You know the rest.

Are Marjorie Taylor Greene and CoRev the same person?

https://www.msn.com/en-us/news/politics/what-s-he-going-to-do-when-it-s-not-windy-marjorie-taylor-greene-fumes-about-biden-s-clean-energy-plans/ar-AA12NBjc?ocid=msedgdhp&pc=U531&cvid=cb7bcdcc9b244a13835460b676af244f

Rep. Marjorie Taylor Greene (R-GA) recently attacked President Joe Biden for supporting developing wind power on the grounds that it is not always windy outside. In a video clip flagged by @PatriotTakes, the Georgia congresswoman accused Biden of not doing enough to “prop up American oil and gas,” and instead putting his support in a green energy agenda. “He thinks wind turbines are the way to go!” she complained. “I mean what is he going to do when it’s not a windy day? Is he going to stand out there and blow hot air at all the wind turbines? Because that’s basically what he does!” In fact, wind turbines are just one part of a comprehensive strategy to reduce America’s fossil fuel emissions, as the recently passed Inflation Reduction Act also includes significant incentives to build out solar and nuclear energy, as well as a hastening of a transition from gas-powered to electric vehicles.

OK Barkley. Since Majorie Taylor Greene is the dumbest woman ever (and a family racist) which means she is CoRev, CoRev is indeed the dumbest troll ever.

pgl,

Better be careful here. CoRev is likely to show up and shower us with yet another set of incoherent questions he will demand that lots of people answer.

Curious that the Sveriges Riksbank prize was given for knowing hot to avoid great depressions rather than combating inflation, which I thought it might be for, if it was not to go one of those obvioius candidates like Acemoglu or List, who will both have to wait a bit longer to get theirs.

Am I reading the Nobel choice wrong, or did the committee just award the prize for research which concludes “don’t break the banking system”? Sort of like when Obama won the peace prize for not being the lesser George Bush, this prize is awarded as a comment on the curent situation. Hope it works.

At the same time, I hope that message is read alongside this one:

https://www.newyorkfed.org/research/staff_reports/sr946#:~:text=The%20financial%20stability%20interest%20rate,the%20level%20of%20r**.

Don’t break banks, and don’t let banks break us.

MD,

I think part of what we see with this prize is that they are a long time in the making. Inflation may be the hot macro topic right now, but pretty obviously they have been working on giving one for avoiding a full on great depression back in 2008. So that one finally arrived.

By your explanation the award should have then gone to Brooksley Born.

https://www.nytimes.com/2022/10/11/business/imf-world-economy-forecast.html

October 11, 2022

I.M.F. Warns ‘Stormy Waters’ Ahead for World Economy

The I.M.F. lowered its growth outlook for 2023 and suggested interest rate hikes could spur a harsh global recession.

By Alan Rappeport

The International Monetary Fund said on Tuesday that the world economy is headed for “stormy waters” as it downgraded its global growth projections for next year and warned of a harsh worldwide recession if policymakers mishandle the fight against inflation.

The dark assessment was detailed in the fund’s closely watched World Economic Outlook report, which was published as the world’s top economic officials traveled to Washington for the annual meetings of the World Bank and the I.M.F.

The gathering comes at a fraught time, as persistent supply chain disruptions and Russia’s war in Ukraine have led to surging food and energy prices over the last year, forcing central bankers to raise interest rates sharply to cool off their economies.

“In short, the worst is yet to come, and for many people 2023 will feel like a recession,” the report said.

The I.M.F. maintained its most recent forecast that the global economy will grow by 3.2 percent this year but now projects that will slow to 2.7 percent in 2023, slightly lower than its previous estimate. But at the start of the year, the I.M.F. projected much stronger global growth of 4.4 percent in 2022 and 3.8 percent in 2023, highlighting how the outlook has darkened in recent months.

Inflation is expected to peak later this year and decline from 8.8 percent in 2022 to 6.5 percent in 2023.

“The risks are accumulating,” Pierre-Olivier Gourinchas, the I.M.F.’s chief economist, said in an interview where he described the global economy as weakening. “We’re expecting about a third of the global economy to be in a technical recession.” …

Drug addiction is a big issue in Ohio. So what happened in the debate last night?

https://www.msn.com/en-us/news/politics/tim-ryan-drags-jd-vance-over-fake-nonprofit-that-hired-big-pharma-doc-while-pretending-to-help-addicts/ar-AA12OFjs

Rep. Tim Ryan (D-OH) faced off against “Hillbilly Elegy” author JD Vance during a live debate on Monday as both candidates vie for the Senate seat currently held by Sen. Rob Portman (R-OH). At one point in the debate, Ryan dragged Vance over his anti-drug nonprofit “Our Ohio Renewal,” which Ryan said took advantage of Ohioans struggling with drug addiction.

“You know what I haven’t done?” Ryan asked during the debate at WJW Fox 8’s headquarters in Cleveland. “I didn’t start a fake nonprofit pretending I was going to help people with addiction like JD Vance did — literally started a nonprofit and didn’t spend one nickel on anybody.”

“In fact, he brought in somebody from Perdue Pharma to be the spokesperson for the nonprofit,” Ryan continued. “The same drug company, Big Pharma, the big drug company, that had all the pill mills going, got everybody addicted. One million people died, JD. One million people died. And you started a nonprofit to try and take advantage of people in Ohio. And you know what? All you did with it was launch your political career.”

“The warning comes as finance and central bank chiefs gather in Washington for the lender’s annual meetings. Speaking at the opening on Monday, IMF Managing Director Kristalina Georgieva cautioned that higher borrowing costs in the US, the world’s largest economy, are “starting to bite,” while World Bank President David Malpass flagged the “real danger” of a global recession.”

https://www.bloomberg.com/news/articles/2022-10-11/imf-warns-worst-to-come-as-steps-to-slow-inflation-raise-risks

“WASHINGTON, Oct 7 (Reuters) – U.S. job growth likely slowed in September as rapidly rising interest rates leave businesses more cautious about the economic outlook, but overall labor market conditions remain tight, providing the Federal Reserve with cover to maintain its aggressive monetary policy tightening campaign for a while.”

https://www.reuters.com/markets/us/slower-us-job-growth-anticipated-september-labor-market-still-tight-2022-10-07/

“Women have overtaken men and now account for more than half (50.7%) of the college-educated labor force in the United States, according to a Pew Research Center analysis of government data. The change occurred in the fourth quarter of 2019 and remains the case today, even though the COVID-19 pandemic resulted in a sharp recession and an overall decline in the size of the nation’s labor force.” (equity accomplished)

https://www.pewresearch.org/fact-tank/2022/09/26/women-now-outnumber-men-in-the-u-s-college-educated-labor-force/

I at first thought this was your patented RECESSION CHEERLEADER rant but your real complaint came late:

“Women have overtaken men and now account for more than half (50.7%) of the college-educated labor force in the United States, according to a Pew Research Center analysis of government data.”

For a MAGA hat wearing sexist like you this must be the end of civilization. Of course, most women I know are 100 times smarter than you so yea – college educated woman workers are a good thing.

pgl,

I do not think this puts BH stupider than his abysmal rivals, but it is almost hilarious. So, women moving up in the labor market is somehow connected to IMF warnings of possible future global recession? Adk!!!

To Bruce: Maybe you do not care about this totally sub debate between me and pgl over just which of you guys is the dumbest regular commenter here. But, hey, I have been sort of your defender, arguing you are not quite as stupid as either “Anonymous” or the totally abysmal CoRev.

But here you go reminding us that even if you are not quite as dumb as those two clowns, you are kind of a joke.

So, why did you attach a story about women moving up in labor markets with IMF worries about a future global recession? Did you REALLY want to suggest that somehow this possible future global recession is due to women gaining in labor markets? I mean really, is that what was your bottom line?

Sorry, boy, you are back in competition for at least being below the idiot who cannot even come up with a decent fake name for himself, the also increasingly self-embarrassing “Anonymous.”

Oh, of course neither of you comes close to being beneath CoRev, which pgl goes back and forth on, mostly ignoring the anonymous “Anonymous” while focusing on the debate over whether or not you or CoRev is the stupidest regular commenter here, a matter on which my view has been long and unequivocally known. It is not you, Bruce, even as you from time to time seem to make efforts to support pgl’s arguments that it is you.

This is getting fun – Trump’s Maro Lago attorneys have formed a circular firing squad!

https://www.msn.com/en-us/news/politics/trump-attorney-reportedly-blames-other-trump-attorney-hires-her-own-attorney/ar-AA12PrI2?ocid=msedgntp&cvid=56a8ff710d1341feb1d119d287c3741b

One of Donald Trump’s attorneys has reportedly hired an attorney of her own ― and is pointing the finger at yet another of the ex-president’s lawyers about an alleged false statement made earlier this year. According to NBC News, Trump attorney Christina Bobb spoke to federal investigators last week about the June statement she signed that claimed Trump had turned over all documents related to a subpoena, and no longer had any classified material at Mar-a-Lago. As the FBI search of Mar-a-Lago in August revealed, he still possessed hundreds of files.

Bobb told investigators she didn’t write the statement she signed, NBC News reported. She claimed it was drafted by Evan Corcoran, another Trump attorney. She signed it only after adding a disclaimer that said it was “based upon the information that has been provided to me.” The Guardian confirmed that Bobb said she was instructed to sign the document at the direction of Corcoran despite not actually conducting the search for those records herself, and that she had insisted on the disclaimer. Bobb was Trump’s custodian of records at the time. Both news organizations also reported that she said another Trump attorney, Boris Epshteyn, was involved. In addition, NBC News reported that Bobb had retained Tampa-based criminal defense attorney John Lauro.

Wait – wasn’t Ricky boy Stryker running around pretending he was part of this lying pathetic team? We have not heard from him of late. I guess he is hiding in his basement hoping this all blows over!