On the day in which President Biden announced the repurposing of the site that was to be Foxconn’s, I reprint this 2017 assessment.

From the Legislative Fiscal Bureau, the Memorandum of Understanding between Wisconsin and Foxconn states:

…Foxconn agrees to invest $10 billion to construct, over six years, a facility in Wisconsin and create up to 13,000 jobs, with a reported average salary of $53,875 over a period of up to six years. The state’s agreement, under the MOU, among other things, is to provide up to $3 billion in an economic package which would include refundable tax credits and a construction sales tax exemption for Foxconn.

What is the benefit cost calculation for the state’s taxpayers? To undertake the analysis, one would need to make a set of assumptions; these include:

- The project will require an average annual employment of approximately 10,200 construction workers and equipment suppliers earning an average total compensation of approximately $59,600 (including benefits) per year during the four-year construction period (from 2018 through 2021). Total income for these individuals is estimated at $2.4 billion.

- Nearly 6,000 indirect and induced jobs will be created during the construction period, with an average total compensation of $48,900.

- Additional construction-period jobs would generate increased state tax revenues (primarily income and sales taxes) equal to approximately 6.3% of the additional gross wages. The total increased state taxes associated with the construction period are estimated at $186.9 million.

- Permanent staff at the Foxconn facility are estimated to increase from about 1,000 in the second half of 2017 to 13,000 beginning in calendar year 2021. The average annual wage for these employees is estimated at $53,875… Total ongoing payroll at the company is projected to be $13.8 million for the remainder of this year and increase to approximately $700 million annually beginning in 2021.

- All employees are Wisconsin taxpayers (i.e., no Illinois residents).

- State tax revenues associated with the additional employees and wages are estimated to increase from about $900,000 this year to $44 million annually beginning in 2021.

- Indirect and induced jobs associated with the project are estimated to total 22,000 beginning in 2021, based on a multiplier of 2.7. Average annual wages for these individuals are estimated at approximately $51,000.

- Total ongoing wages are $1.12 billion annually, and related state taxes at $71 million per year. Smaller impacts are estimated in calendar years 2017 through 2020.

The conclusion:

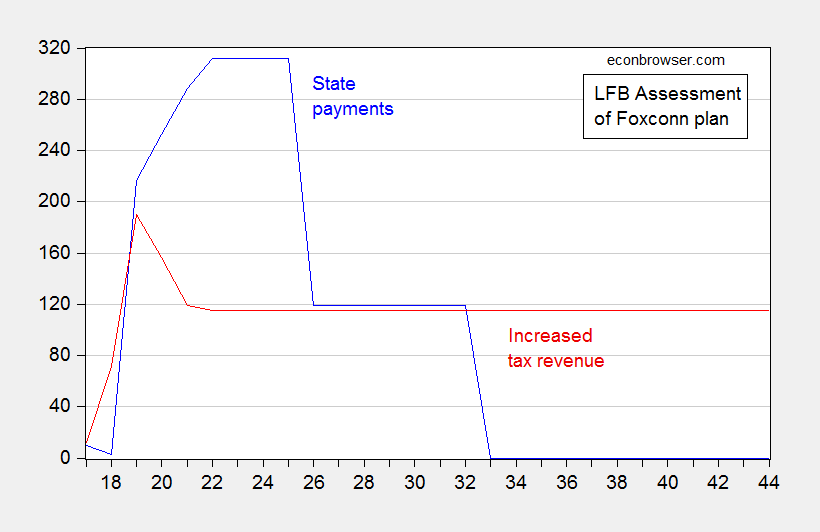

[Wisconsin Department of Administration] projects that the cost of the refundable state tax credits under the bill will exceed the potential increased tax revenues until the last EITM payroll credit is paid in fiscal year 2032-33. As of the end of that year, the cumulative net cost of the incentive package is estimated at $1.04 billion. Beginning in 2033-34, payments to the company would cease and increased state tax collections are estimated at $115 million per year. DOA estimates that the project’s break-even point would occur during the 2042-43 fiscal year.

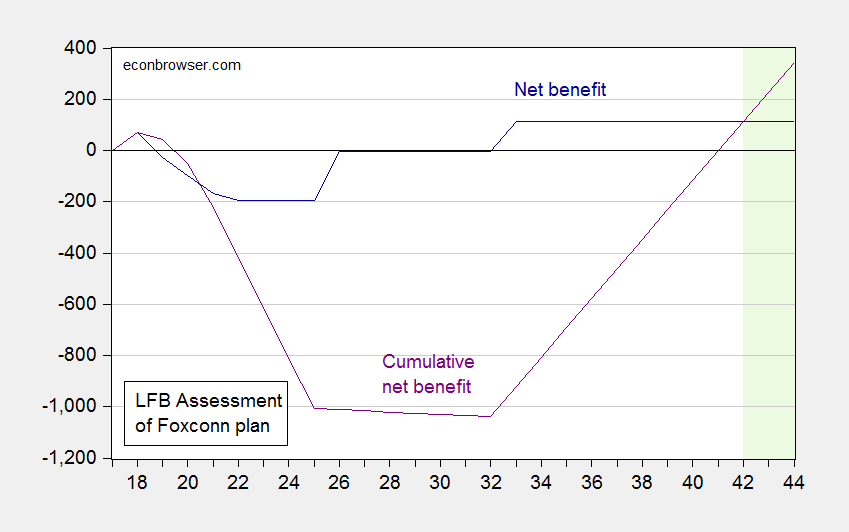

In Figures 1 and 2 below, I summarize state payments and revenue increases, and net benefits flow and cumulation, respectively. The astute will note that state payments is front loaded into the first 15 years (after which Foxconn could walk away), and that even under the fairly optimistic assumption of 13,000 additional jobs, the break-even occurs in FY 2042-43.

Figure 1: State payments (blue) and increased tax revenue (red) under August 2017 Special Session Assembly Bill 1, in millions of dollars, by fiscal year (2018 indicates FY 2018-19). Source: Legislative Fiscal Bureau, Table 4.

Figure 2: Net benefits calculated as increased tax revenue minus state payments under August 2017 Special Session Assembly Bill 1 (dark blue), and cumulative (purple), in millions of dollars, by fiscal year (2018 indicates FY 2018-19). Source: Legislative Fiscal Bureau, Table 4.

As noted, there is wide uncertainty over the increase in employment. LFB blandly observes:

There have been press accounts suggesting that employment at the proposed facility would be closer to 3,000 instead of 13,000 permanent positions. If this were the case, using the other assumptions outlined above, payments of the EITM payroll tax credit would be reduced from just under $1.5 billion to approximately $345 million over the 15-year life of the EITM zone, but the capital expenditure credit would still be estimated at $1.35 billion. The estimated ongoing tax benefits from the project would decrease from $115 million to $27 million per year, and the breakeven point would be well past 2044-45.

There is a serious question of whether Foxconn will fulfill its commitments. Hiltzik at LA Times highlights the 2013 Pennsylvania deal.

Foxconn itself is getting a reputation for making lavish promises and letting them lapse, as appears to have been the case with a project the company touted for Harrisburg, Pa., in 2013. That deal was for a $30-million plant employing 500 workers. But the plant hasn’t materialized.

And from Wisconsin Gazette:

In the midst of all the jubilation and hype, it’s important to remember that Foxconn has earned a reputation for failing to meet its pledges. The business publication Crain’s warns, “Foxconn Technology Group … has a history of big promises with little to no payoff in the United States.”

Foxconn abandoned the commitments it made to Harrisburg, Pennsylvania, where CEO Terry Gou promised that its small 50-person operation would be expanded into a manufacturing facility with 500 workers. Its announcement generated an “intense buzz” that was “created by a chief executive known to promise projects all over the world that never quite pan out,” The Washington Post reported.

Promises of new or expanded investment by Foxconn also have been broken in Brazil, China, India, Indonesia and Vietnam.

“There’s a pattern here,” observed Alberto Moel, a senior analyst with Bernstein Research in Hong Kong.

Bloomberg News noted that Foxconn’s total commitments now stand at $27.5 billion, which is more than Hon Hai has spent in the past 23 years.

The fact that this venture does not seem to be a big positive for Wisconsin seems to match the literature that indicates state tax incentives to relocate businesses do not typically have big payoffs. From a survey by Buss (2001):

Tax literature, nowin hundreds of publications, provides little guidance to policy makers trying to fine-tune economic development. Taxes should matter to states, but researchers cannot say how, when, and where with much certainty. Firms may need tax incentives to increase their viability in some locations, but researchers cannot definitively say which businesses or which locations.

Perhaps more relevant to this specific case:

…declining companies tended to take advantage of programs targeted toward distressed areas, whereas growth companies tended to locate in nondistressed counties. Tax incentives made distressed areas worse or no better off, whereas nondistressed areas always improved

Abstract from a roughly contemporaneous analysis by Noah Williams, formerly of UW Madison.

In this paper I evaluate the potential economic impact of the Foxconn plant on the Wisconsin economy. I consider factors affecting both the direct impact of the Foxconn plant, as well as the additional broader impacts that it may have. If implemented as planned, the direct impact of the plant will be substantial, and the broader impacts could go far beyond typical fiscal policies. In particular, the opening of a large scale high tech manufacturing operation by a multinational corporation has the potential to generate significant spillovers. Drawing on the economic literature on plant openings and foreign direct investment, I analyze the magnitude of these potential gains. While direct employment multipliers in the literature range from 1.7 to more than 3, those most relevant in this case are in the 2.5-3.0 range. Thus if Foxconn accounts for 13,000 direct jobs, it may generate a total of 32,000-39,000 jobs directly and through its supply chain, suppliers of employees, spillovers on existing firms, and new investments. I also review the economic evaluations which have been previously carried out, and evaluate some of the concerns that have been raised about the proposal. In the overall evaluation of the Foxconn package, the uncertain but potentially large gains in jobs, wages, output, and incomes must be weighed against the certain fiscal costs.

Now let’s discount those net benefits by a risk-adjusted return to capital using current government bond rates as the risk-free rate.

As noted, most of these deals are simply corporate welfare. The only local beneficiaries are local real estate owners (who may be able to unload stuff before reality sets in) and politicians who can pretend they did something good.

The main thing you always have to demand is backloading of the corporate benefits – with reduction (or loss) of those benefits unless the predicted jobs show up. Also look very carefully at how much money is paid for each direct new job.

Source: Legislative Fiscal Bureau, Table 4.

I would love to see these figures but the link does not work.