The abstract from article (free access to August 11) forthcoming in the Journal of International Money and Finance [link to ungated working paper version]:

We begin by examining determinants of aggregate foreign exchange reserve holdings by central banks (size of issuing country’s economy and financial markets, ability of the currency to hold value, and inertia). But understanding the determination of reserve holdings probably requires going beyond the aggregate numbers, instead observing individual central bank behavior, including characteristics of the holding country (bilateral trade with the issuing country, bilateral currency peg, and proxies for bilateral exposure to sanctions), in addition to the characteristics of the reserve currency issuer. On a currency-by-currency basis, US dollar holdings are somewhat well explained by several issuer characteristics; but the other currencies are less successfully explained. It may be that the results from currency-by-currency estimation are impaired by insufficient sample size. This consideration offers a motivation for pooling the data across the major currencies and imposing the constraints that reserve holdings are determined in the same way for each currency. In this setting, most economic determinants enter with significance: economic size as measured by GDP, bilateral currency peg, and bilateral trade share. While one geopolitical factor (congruence in voting in the UN) is typically significant in the expected manner (with the exception of the US dollar), the other geopolitical factor (sanctions) does not enter with significance.

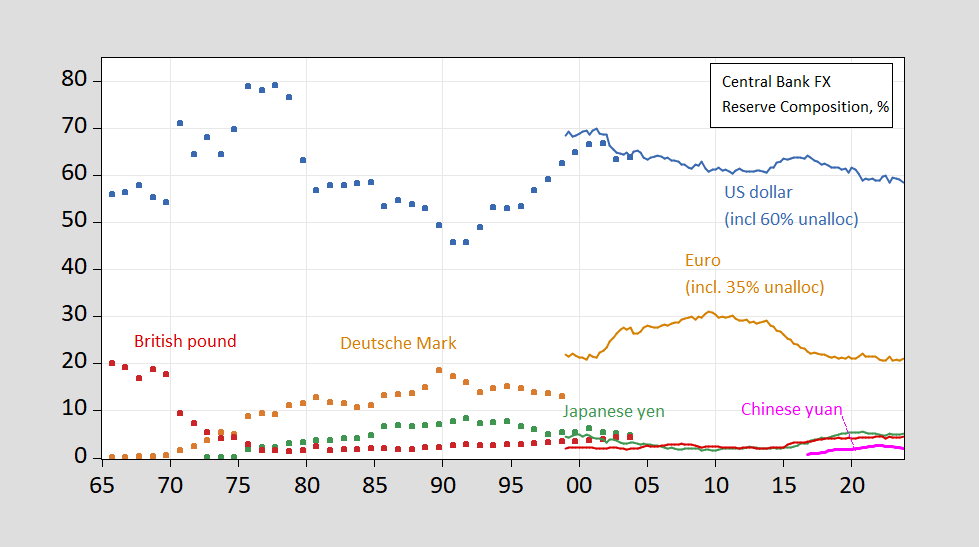

Here’s a picture of the aggregate currency shares, from the IMF’s COFER database, updated data released on June 11th.

Figure 1: Share of foreign exchange reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (green), GBP (sky blue), Swiss francs (purple), CNY (red). For 1999 data onward, estimates based on COFER data, and apportionment of unallocated reserves, described in text. Source: Chinn and Frankel (2007), IMF COFER accessed 6/20/2024, and author’s estimates.

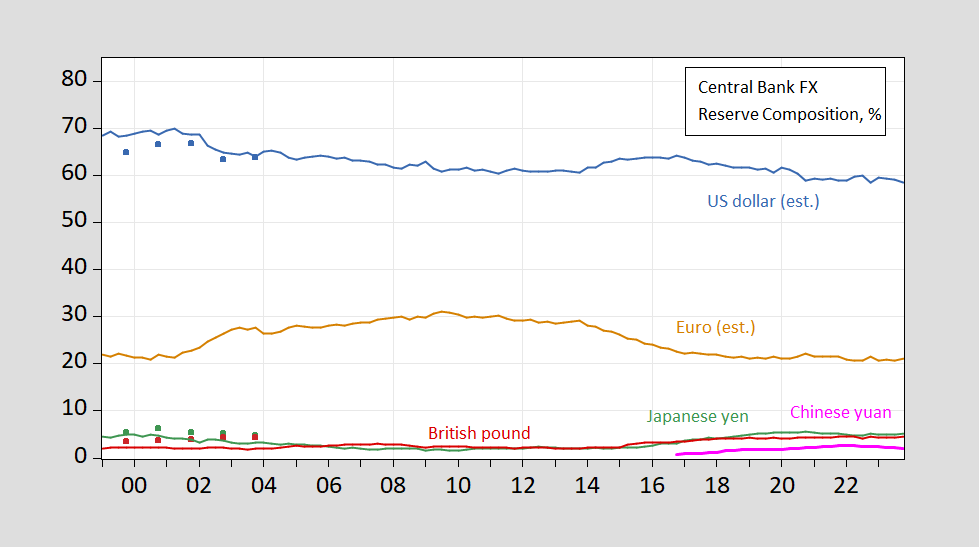

And here’s a detail, for 1999 onward:

Figure 2: Share of foreign exchange reserves held by central banks, in USD (blue), EUR (orange), JPY (green), GBP (sky blue), Swiss francs (purple), CNY (red). For 1999 data onward, estimates based on COFER data, and apportionment of unallocated reserves, described in text. Source: Chinn and Frankel (2007), IMF COFER accessed 6/20/2024, and author’s estimates.

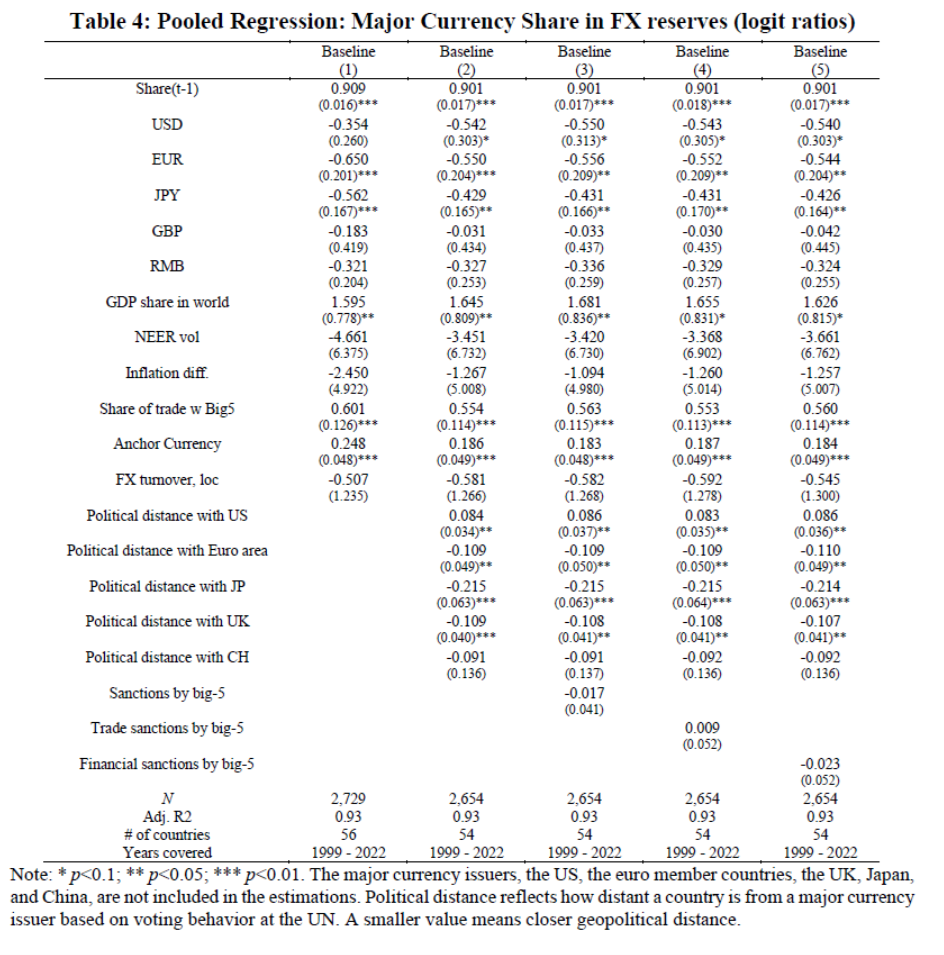

Equations used to estimate aggregate shares pre-EMU are pretty useless in predicting shares now. Hence, in this new paper, we rely on individual central bank data to estimate the determinants of shares. The results of a pooled cross-country cross-currency, unconstraining the geopolitical distance coefficient to vary across currency, are reported in Table 4.

Source: Chinn, Frankel, Ito (forthcoming, JIMF).

Following the results in Chinn and Frankel (2007), we find economic size matters, as well as inertia. While we find store of value measures (inflation, exchange rate volatility) have a negative impact, those effects are not statistically significant. This special data set (central bank by year) allows us to investigate the impact of trade flows and peg, which turns out to be important. We replicate the finding obtained by Goldberg and Hannaoui (2024) that more geopolitically distant countries (as measured by coincidence in UN GA voting) hold greater dollar shares, while the reverse is true for the other currencies. While financial sanctions have a negative impact, the measured sensitivity is not statistically significant.

While we don’t explicitly record how dollar shares have declined, it’s useful to note that other studies (see Arslanalp, Eichengreen and Simpson-Bell (2024), and references therein) have documented that the slack is not in general being mostly take up by the RMB, but other unconventional currencies.

See also Eswar Prasad’s recent Foreign Affairs piece, the Third annual Fed-FRBNY conference on the international roles of the dollar, Kamin and Sobel (2024), Atlantic Council “Dollar Dominance Monitor”.

My Dad used to say that if you bought a USA atlas, that the test of whether it was a good atlas or not, was whether it included Yates Center Kansas on it. If it did then you knew it was a good atlas.

I say the true test of if a research paper on currency is top Grade A quality is it has any Gita Gopinath references. Yup, this one passes the sniff test. It has David Lee Roth’s bowl of only green M&Ms.

“…more geopolitically distant countries (as measured by coincidence in UN GA voting) hold greater dollar shares, while the reverse is true for the other currencies. While financial sanctions have a negative impact, the measured sensitivity is not statistically significant.”

A speculation as to cause from my barstool:

Political distance increases risk, not only of sanctions, but of limited cooperation in time of need; better lay aside some reserves.

Sanctions (never mind statistical significance) reduce access to dollar flows, resulting in a draining of reserves.

To repeat a link, these results seem to fit in well with the idea of financial hegemony:

https://archive.ph/o/F5Z3r/https://www.lse.ac.uk/Economic-History/Assets/Documents/Workshops/Financial-Crises-Cassis/Papers/Final-Brezis-financial-crisis-June-2024.pdf

Different topic but a bit alarming. I noted in an earlier comment that the stock price of Trump Media is plummeting. This may be one reason:

https://www.msn.com/en-us/money/companies/trump-media-announces-69-4m-in-initial-proceeds-from-warrant-exercise/ar-BB1oFsZ6?ocid=msedgdhp&pc=U531&cvid=0b2c7b080f504c8eb48e46c33afa9a33&ei=13

Trump Media & Technology Group (NASDAQ:DJT), operator of the Truth Social platform, on Friday announced that it expects to receive more than $69.4 million in proceeds from the cash exercise of warrants on June 20 and 21, 2024.

If all warrants covered by the Registration Statement are exercised for cash, TMTG may receive up to an aggregate of approximately $247 million in proceeds.

Additionally, $40 million of restricted cash on the company’s balance sheet will become unrestricted as a result of the Registration Statement becoming effective.

These funds are in addition to the more than $200 million in unrestricted cash held by the company as of June 18, 2024.

The SEC should step in immediately as Trump and his minions are ripping off the other shareholders big time.

TMTG might use the money to pay bills.

Only kidding. Since when has Trump paid his bills?

TMTG?? I thought it was the “VSG”??

“While financial sanctions have a negative impact, the measured sensitivity is not statistically significant.”

I’ll admit I still have some mixed feelings about sanctions. That being said….. one wonders if anyone in MAGA land is even weighing the empirical evidence/data here. If they were serious about fulfilling their duty then this would at least be part of their equation.

I’m going through this slowly/methodically (what can I say, my brain isn’t that great and much of it is thick reading for me). Trying to find things of interest to comment on.

Very bottom of page 13: Being less aligned with the US seems to result in higher dollar holdings. This is the same (surprising) result as in Goldberg and Hannoui (2023).”

I don’t think this is surprising at all. If we assume countries which contradict the US on UN voting tend to be despotic/troublemakers (on the world stage) it’s not surprising that nations that have destabilizing policies both politically and economically would want more US dollar reserves as a “margin of safety” for them. China is a terrific example. Xi JInping spends 3/4ths of his public speaking time to badmouth the USA, yet China’s government holds more U.S. dollar reserves than anyone.

https://www.cfr.org/blog/how-hide-your-foreign-exchange-reserves-users-guide

That is NOT “surprising”. It makes PERFECT SENSE,100% logical and expected