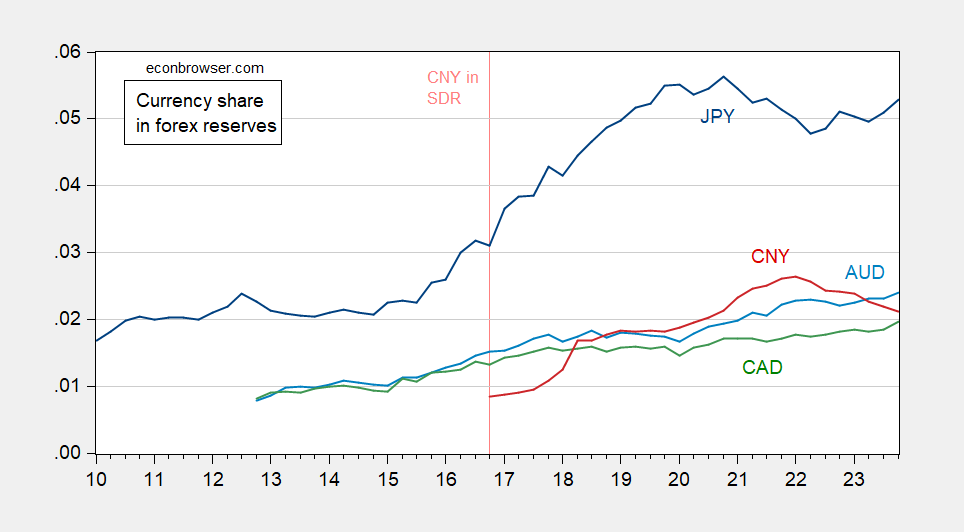

COFER data through December 2023:

Figure 1: Foreign exchange reserves in JPY as share of tota reserves (blue), AUD (light blue), CAD (green), CNY (red). Source: IMF COFER, access 6/18/2024, and author’s calculations.

Peak CNY was 2022Q1 at 2.6%, while latest is at 2.1%.

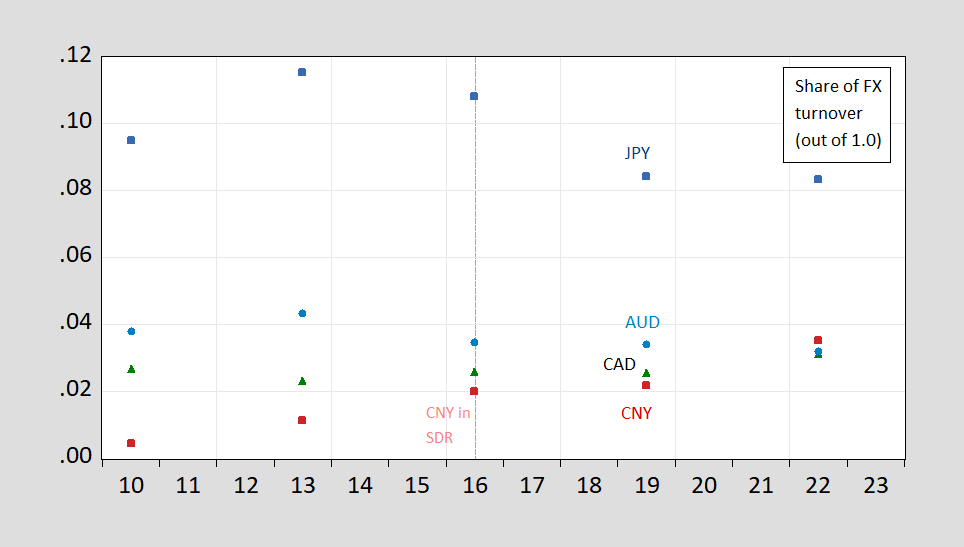

In terms of daily foreign exchange turnover, CNY was rising through April of 2022.

FIgure 2: Foreign exchange turnover share in April in CAN (blue square), in AUD (light blue circle), in CAD (green triangle), in CNY (red square), out of 1.00. Source: BIS Triennial Survey, 2022.

What’s happened to turnover since 2022 is an interesting question, particularly in light of the burgeoning trade between Russia and China, and hence invoicing/settlement in CNY. Here’s CSIS’s estimate of invoicing in RMB from 2011 to 2023Q1.

Source: DiPippo and Palazzi (2024).

This last graph indicates how the CNY can gain in use as international currency, driven by trade which China dominates in, while losing favor as a reserve currency, or a vehicle currency. However, the gap between what happens in the financial sphere, vs. the trade sphere, reinforces for me the proposition that as long as investors remain suspicious of Chinese government intents with respect to political risk (including tighter capital controls), one shouldn’t expect further large gains in use of the CNY as a reserve currency.

Addendum, 6/22/2024:

See also article in the Economist last week.

Foreign exchange in yen dominates the yuan, Aussie dollar, and even the Canadian dollar. But yea – China is a large part of international trade.

As most who go deep into this topic know, and probably all the profs who visit Menzie’s blog know. Gita Gopinath’s work has dealt heavily with the invoicing effects. She thinks it plays a pretty large role. Maybe not “dominating” role, but certainly a major factor.

Menzie – important topic – thank you!

However, I did notice the U.S. Bureau of Labor Statistics (BLS) preliminary estimates for May 2024, showed Wisconsin’s employment hit a record high of 3,048,000 during the month. This is 6,500 more people employed than a year ago. https://dwd.wisconsin.gov/press/2024/240620-may-state.htm

Clearly Wisconsin’s economy does better when there is a Democrat as Governor and as President. Biden and Evers’ progressive economic policies have done well for the people in the state. Compare to disastrous Trump admin and anemic job growth under Walker.

Also – note to out-of-state rich person Eric – I want to take away women’s access to reproductive healthcare – Hovde – wages are increasing faster than inflation and inflation in the Midwest is decreasing and close to Fed 2% target – https://www.bls.gov/regions/mountain-plains/news-release/consumerpriceindex_midwest.htm

By the way, even if just some of Trump’s economic policies get implemented – it would be a disaster https://www.vox.com/2024-elections/24137666/trump-agenda-inflation-prices-dollar-devaluation-tariffs

Sssssshhhhh!!!! Bruce Hall gets an upset tummy-tums when you alter the MAGA fantasyland of his imagination. And Ford, Chevy, and Chrysler still make outstanding products. Don’t you forget it. And those macho MAGA guys in the newest Ford Broncos whose engine explodes in fire going down the highway know a good car when they see one.

https://www.autoweek.com/news/trucks/a40774339/nhtsa-ford-bronco-engine-investigation/

https://static.nhtsa.gov/odi/inv/2022/INOA-PE22007-7888.PDF

Bruce Hall hasn’t been this proud of Ford since he helped out with the Pinto self-incinerating flameball.

“Under normal driving conditions without warning the vehicle may experience a loss of motive power without restart due to catastrophic engine failure related to an alleged faulty valve within 2.7 L Eco-Boost Engines.”

Now, now. Brucie’s finest achievement at Ford was to head the team that designed these valve systems.

Ron DeSantis telling those who work outdoors for a living in Florida to Just go ahead and die already.

https://www.npr.org/2024/04/12/1244316874/florida-blocks-heat-protections-for-workers-right-before-summer

These two posts, about reserves and about turnover, are what I had in mind when I moaned about Prasad’s “Foreign Affairs” arricle. This is the real stuff.

I’m especially happy to see reserves and turnover treated as seperate but related issues. The observation that one can go up while the other goes down is important but not surprising – I suspect Prasad would have framed it as surprising, since that’s what he did in his treatment of the dollar.

Liquidity, investment stocks, investment flows, reserves, invoicing, FX trade – they are all related, but all different, and all behave in their own way.

If the financial hegemony of the dollar is goingto be reduced, we might see more instances of turnover (or some other measure of currency use) rising while reserves (or some other measure of currency use) falling. They will all behave in their own way.

Transitions change relationships. Changed relationships don’t behave like the old relationships. Lots to learn if dollar hegemony weakens.

Way off topic – Keynes and Fry:

I have had the bad judgement to study both a bit of economics and a bit of literature (’cause that’s where the real money is). I happened across this article and noticed a parallel in the patterns of thought among academic economists and literary critics:

https://harpers.org/archive/2024/07/yesterdays-men-alan-jacobs/

Ya know how Krugman pokes fun at doctrinaire “fresh water” economists for rejecting Keynes without ever having read him? Well, Northrup Fry once held a position in literary thought similar to that of Keynes in economics. Then, one day, citing Fry in a paper could get you laughed out of a graduate seminar. So what Fry has to teach us is no longer taught. Move on.

I particularly like this:

“…Jacques Derrida had come around to show that all structure somehow deconstructs itself. We didn’t quite know what that meant, but it sounded definitively dismissive…”

My issue with ol’ Jacques has always been “Fine, but now what? Just dismiss each new idea for relying on assumptions?”

Sorry; I’m mixing metaphors.

Anyhow, those interested in how academic “progress” is made may find the Harper’s piece interesting.

You always find some great reads. thanks for sharing. Still working on the Breugel/Friedman link, and one other you had recently, but 85% I will get around to reading them. Maybe Tuesday Wedensday during my drinkies. Extra adrenaline never hurts the reading speed.

Off topic – a disruption in the data:

https://edition.cnn.com/2024/06/21/business/cdk-global-car-dealership-outage/index.html

Car dealers, like just about every other profession, rely on particular types of software. When that software is unavailable, activity declines.

Two rounds of attacks on car selling software have occured this month, and that has cut into car sales. I don’t know how large the effect will be, but keep I mind when reading retails, auto sales and PCE data for June that there has been a supply glitch.

Moses, you know how I shovel good news about unionization your way? Sorry buddy, but this ain’t that:

https://www.bloomberg.com/news/articles/2024-06-21/teamsters-president-to-speak-at-republican-national-convention

O’Brien says his appearance is not an endorsement. Ass covered, I guess.

It’s extremely disappointing. But this is part of the reason people bad-mouth unions. Lack of honest/dependable leadership. I’m sure many here would argue with me (maybe even you Macroduck ) about this, but I’d take Hoffa over O’Brien. I mean the Hoffa who got lost in some Detroit body of water around the mid-’70s. At least the union still had sharp teeth then. And less illiterate membership than now. And there are a lot of “rank and file” union members who are Republican, so, yeah, as you say, “CYA”. A lot of white trash doing the same things as Hispanics and Blacks voting for trump. It’s really not terribly different than teen girls cutting their arms and legs with razors. Same exact mental problem.

Didn’t O’Brien almost get in a fight with Oklahoma Senator Markwayne Mullin? If I recall correctly, old Bernie Sanders had to break these two hot heads up.

I think that’s correct, it was some high ranking union guy. Probably O’Brien. I’d have to cheat and google it (like I usually do) but it was probably him. I would have loved to see him kick Mullin’s a$$. I’d pay tickets for that. I put at least $5 on O’Brien winning.

Grifters gonner grif, grift, grift.

https://www.nytimes.com/2024/06/23/us/politics/donald-trump-michael-flynn-qanon.html

Mike Flynn found and took over an old conservative non-profit and immediately began milking it of it’s $ 3 million in assets. Previously it had not paid its board members but suddenly Flynn and his family members became employees with huge salaries. Among the many loses was a 63K loss on a fundraiser held at Mar-a-Lago – so I guess Trump got his cut of the loot. When the fundraising on classic right wing causes didn’t work out. Flynn shifted to sex-trafficing and baby eating themes. Claiming to fight sexual exploitation of children is alway a hit (even as Flynn in private has mocked QAnon as “total nonsense”). A lot of people have childhood experiences that makes them particularly easy targets for conmen that claims to fight that stuff. They are using Churches to help bring in the sheeple for a gentle milking, but still lost $637K in 2022 and refuse to release financial statements for 2023.

Has America’s Future filed it Form 990 for 2023? Here it is for 2022 which also shows the financials for 2021:

https://projects.propublica.org/nonprofits/organizations/131549794/202420319349301967/full

America’s Future strikes me as a front from MAGA moron BS so having a corrupt chief is just par for the course. I guess America’s Future has no real future!

This guy has always turned my stomach. National traitor. Amoral rotten to his core. But I keep going back to the same question (similar to Navarro, though different disciplines) How in the HELL did this bastard get so high up in the military?!?!?!? Unbelievable. Nice finds, thanks for sharing. You know there’ll be more. He’s a never-receding fountain of cr*p.

New York City turns retired power station into something incredible: ‘Able to power more than 10,000 households’

Innovative projects like this make it easier than ever for all of us to play a role in building a more sustainable future.

https://www.thecooldown.com/green-business/arthur-kill-power-station-battery-storage-nyc/#:~:text=Plans%20were%20announced%20to%20transform%20the%20site%20of,So%20why%20is%20this%20such%20an%20exciting%20development%3F

Plans were announced to transform the site of the old Arthur Kill Power Station on Staten Island into the city’s largest battery storage facility. When complete, the 60-megawatt-hour installation will be able to power over 10,000 households during times of peak electricity demand. So why is this such an exciting development? For one, it means saying goodbye to the polluting “peaker” plant that previously occupied the site and hello to clean, reliable energy storage. It’s also a key step toward meeting New York State’s ambitious goal of deploying 6 gigawatts of storage by 2030, reported by Utility Dive. But the benefits go beyond just the environment. For NYC residents, this project promises more affordable and dependable electricity access. By storing power in batteries when renewable generation is high and demand is low, the facility can feed that cheap, clean energy back onto the grid when demand spikes and supplies tighten.

I get CoRev got his trolling little self banned but can you just imagine all the tirades over this that he would have pollute this blog with? Oh well – we’ll just have to do with the usual lame MAGA moron objections ala Bruce Hall.

The cost of a natural gas peaker plant per MW produced are huge. Most of the time it sits there as a dead asset. Then maybe 20 days a year it is needed and powered up. Cost of battery storage on the other hand has been plummeting, with new much cheaper (although bulky) chemistries.

Dropping fossil fuel use has moved from the question of “can we afford this in order to save the planet” to a question of “can we afford to hang on to the old outdated ways, just because some fools have not realized that the calculations have changed”. Producing energy by solar and wind has become cheaper than even the most efficient modern (combined cycle) natural gas plants. Dealing with 24h, weekly and annual variations in energy demand has become much cheeper and muted the last desperate arguments for building any more hydrocarbon based plants. Unfortunately there will be a legacy of already build hydrocarbon plants where the investment is already “sunk in cost” and their continued operation will be cheeper than building from scratch replacement alternative energy plants. The hydrocarbon industry is desperately pushing a last ditch building boom because they know that any plant build today is a locked in customer for the next 3 decades.

Some of the new sodium based batteries not only are dirt cheep, they are good for 50,000 cycles. That is charge/discharge every day for over 125 years. At a solar plant they would replace the panels at least 4 times before it’s time for a new battery.

I get it – Marjorie Taylor Greene is dumber than a rock. But does she have to date such a pathetic loser?

https://www.msn.com/en-us/news/politics/video-marjorie-taylor-greene-s-boyfriend-in-heated-clash-with-trump-critic/ar-BB1oKpDI?ocid=msedgdhp&pc=U531&cvid=9480d116fbba47d9a1cd6ed9e18d42d6&ei=9

Video: Marjorie Taylor Greene’s Boyfriend in Heated Clash With Trump Critic

Watch the short video – this dude is a true moron.