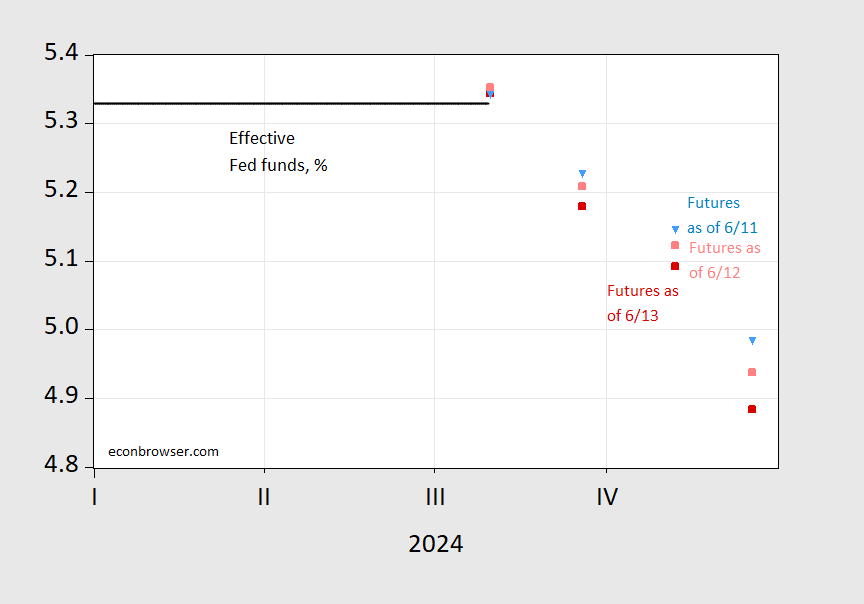

Following up on the PPI release (discussed along with other core measures) discussed here, how have markets responded, in terms of Fed funds futures, the ten year rate?

Source: CME accessed 6/12, 6/13/2024, 1:30pm CT.

The trajectory of Fed funds implied by futures is further depressed.

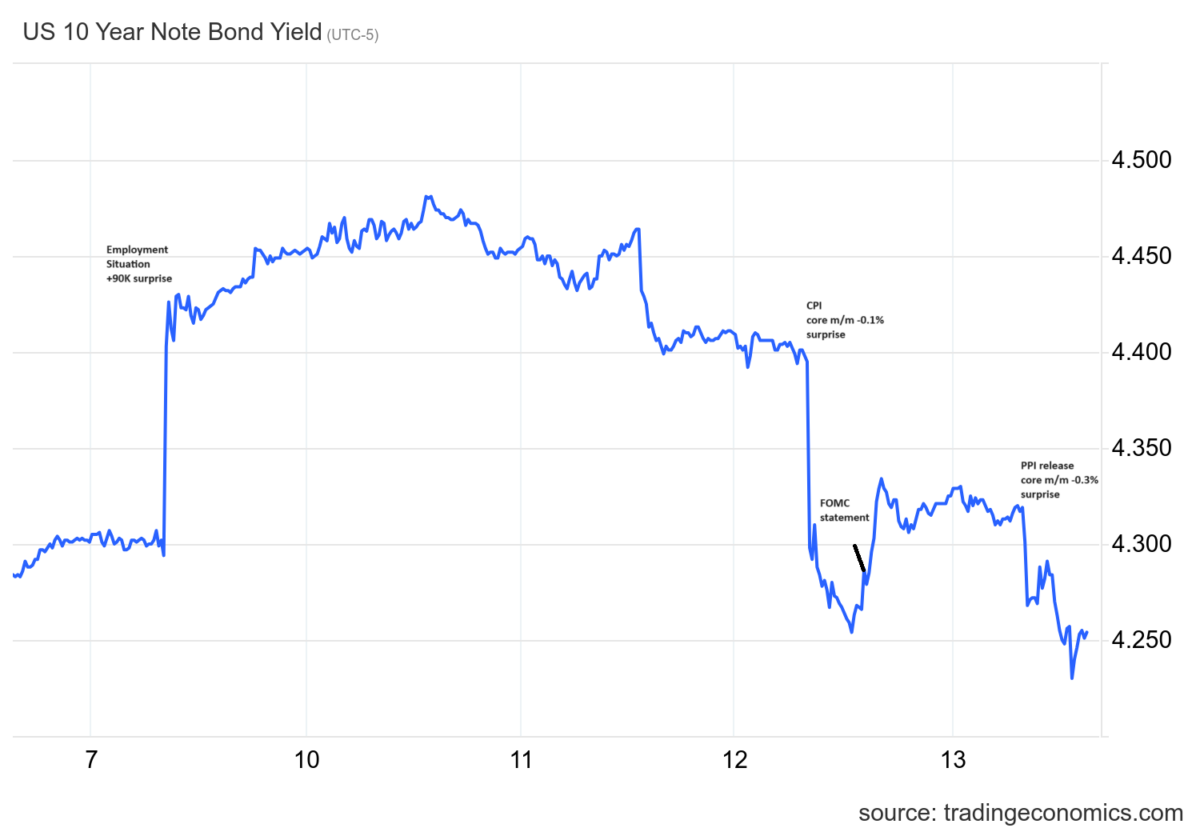

The ten year yield also dropped. In perspective:

Source: TradingEconomics, accessed 6/13/2024, edited by author.

We have consistent reactions — except for the PPI release — in the nominal value of the US dollar, as shown in the below figure (over the same period):

Source: TradingEconomics, accessed 6/13/2024, edited by author.

Of course, the dollar’s value against a basket of foreign currencies is affected by events and expectations revisions abroad, as well as at home.

Speaking of events and expectations revisions abroad, the ECB and BOC have both just cut rates. Both moves were expected. Does that mean expectations haven’t been revised? Not exactly. Notice that the ECB’s deposit facility rate, for instance, tends to keep moving in the same direction once it starts moving:

https://fred.stlouisfed.org/series/ECBDFR

Expectations of Fed cuts have, meanwhile, been disappointed so far this year. So it may be that we face greater certainty of rate cuts elsewhere vs in the U.S. That should be good for dollar strength for now.

Easy, clumsy test: assuming actual rate changes matter a little bit more than expected ones, the dollar should weaken after the Fed’s first cut even if that cut is pretty fully priced in before hand.

@ Macroduck

https://theovershoot.co/p/the-fed-looks-through-a-great-inflation

Hey friend, I already posted this in another thread, but it was a late add on and I wanted to make sure you didn’t miss it. Good reading whether you concur or not.