Just a quick observation today, elicited by a question: what has been a consistent source of growth since the recovery began?

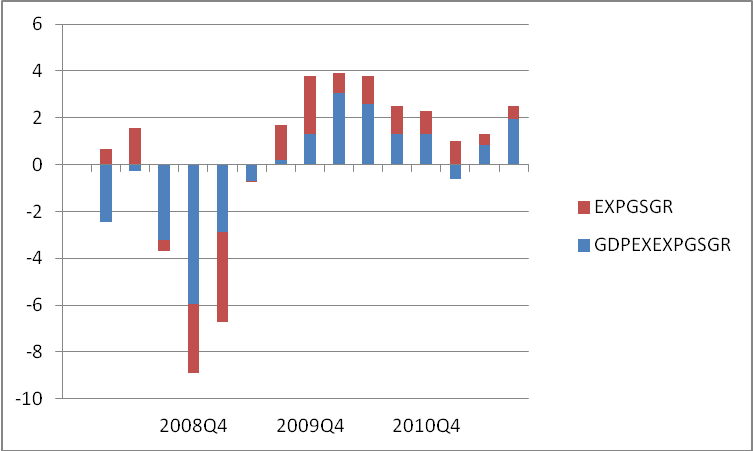

Figure 1: Contribution of exports of goods and services to GDP growth (red bar) and all other components (blue bar), q/q SAAR, 2008Q1-2011Q3. Source: BEA, 2011Q3 advance release.

It’s export growth. The question is whether that will continue, as European growth gets marked down (and indeed the rest of the world as well, although not as markedly).

(Note that the 2011Q3 figure is an advance one; the contribution of the trade components is estimated on the basis of only two months out of the quarter.)

And Canada’s GDP is hurting as well, so that’s another export market that looks weaker.

Oil. And petroleum product exports.

I estimate that shale oils and gas are worth cc $1500-2000 per US household annually. That’s just shale production, ie, horizontal drilling and hydrofracking.

I’ll have an article on this shortly.

What Steven Koptis said.

We’ve got some very strange market dynamics going on. Inland refineries are leveraging their access to (relatively) cheap WTI to produce gasoline and distillates for export (which are priced based on Brent).

They were doing this in ’07 and ’08, too, in the runnup to the Olympics. I figured then that it was an unsustainable trend (how on earth can a high cost refinery in, say, Oklahoma, be profitable by selling diesel fuel to China? Makes no sense.) But here we are. Funny how sustainable unsustainable things can be sometimes.

There are some inland refineries that are making money at a rate they have never made before (or at rates they only achieved during Katrina, when the Gulf Coast refineries were shut down). It is very rare for an integrated oil company to make more money from downstream than upstream, but that is the case in many situations right now.

The heating oil is a large contributor to the export.

Five years chart is looking good,season is looking the same.

http://www.census.gov/foreign-trade/Press-Release/current_press_release/ft900.pdf

On a more glacial mode,the balance of payment is often adjusted with the invisible items and it may have to.On a month to month or year to year the trade balance of goods and services is deteriorating (please refer to P7 ( http://www.census.gov/foreign-trade/Press-Release/current_press_release/ft900.pdf)

Net Exports of Goods & Services

http://research.stlouisfed.org/fred2/series/NETEXP

Increasing exports for an advanced economy is a signe of economic decline. It represents a net decline in capital. This is perhaps the worst component of GDP when attempting to anayze growth.

But that said inflation adjusted exports using the price of gold as the proxy for all goods and services have delined from a base year 2000 from $1,112b to $439B.

But inflation adjusted exports are declining at a slower rate than imports so US world trade is actually in a steep decline and that is seriously bad news.

And don’t forget US supranational firms’ shipments of capital equipment, intermediate goods, and components from the US to their subsidiaries and contract producers in China-Asia, which are referred to as “exports” but are actually shipments to firms’ offshore facilities from which further processed goods are then shipped back to the US as “imports” or within Asia to other producers.

For example, Intel produces chips and other components in the US that are shipped (“exported”) to Malaysia where Applied Materials sells (“exported”) US-produced (so far) equipment to Intel’s plant there. The Intel plant produces a higher value-added component that is then sold (“exported” from Malaysia) to Dell and shipped to Taiwan where Dell has a PC motherboard plant.

The completed Dell motherboard is then shipped (“exported” from Taiwan) to China where additional value-added processing occurs, and the finished component is then “exported” from China back to the US as an “import” to a Dell plant in Texas where the PC undergoes final assembly and testing, including installing a(n) (“imported”) Western Digital disk drive that was produced in Thailand with “imported” components from Taiwan, Malaysia, and China.

So, when Obama or any other POTUS talks about increasing US “exports” to grow the eCONomy under the present circumstances, he is advocating, wittingly or otherwise, the continuation of the 30-year deindustrialization and offshoring of the US eCONomy and further investment (and reinvestment) and unsustainable development of Asia’s eCONomy. He either does not know what he is talking about, is getting the standard dubious advice from eCONomists who don’t know what they’re talking about (or are paid well to know and not tell us what is actually happening), or is a dupe for those who are benefiting disproportionately from the post-peak US crude production era of deindustrialization, financialization, militarization, and increasing wealth and income concentration to the top 0.1-1% of US households.

Why look only at exports? Why not the net current account balance? If exports and imports grew in tandem, or if import growth out-stripped export growth, then international trade will have been a drag, rather than a spur to recovery. Isn’t that a more interesting question?

For example, suppose export growth came from growth in sales of intermediate input supplies to China. If the value of imports from China grew by more than the growth in exports, wouldn’t looking at exports alone give a seriously misleading picture of the effect of international trade?

Canada and Australia are classic cases of “Dutch Disease”, relying directly and indirectly upon US firms’ tens of billions of dollars of unsustainable foreign investment and “trade” in (and within) Asia, including the weaker US$ (at least against the euro and Yen, but not in trade-weighted Broad US$ Index terms).

Canada and Australia need US firms investing abroad and China-Asia booming as a result to keep the growth of the energy and materials sectors going.

However, with the price of oil at or above $100, prompting Canadian oil extraction, the US economy cannot afford the price of oil above $40 in order to sustain real private GDP growth per capita.

IOW, the world’s oil extractors and processors need the price of oil at $85-$100+ to encourage continuing investment and extraction at peak global production and little or no incremental production margin; but the economies of the US, EU, and Japan (two-thirds of the world GDP) cannot grow with the price of oil at current levels.

Eventually, if not already, the US, EU, and Japan falling back into recession will bring global real GDP per capita growth to an end.

I’m not sure why you chose to characterize exports as the “source” of economic growth. I look at that graph and see export growth as more of a factor when the recovery is small and less of a factor when the recovery is large–not exactly a “source” of growth.

i’ve observed that investment in equipment & software has also contributed heavily…

rjs: Exports average 2.6 ppts, nonresidential investment 1.5 ppts over the recovery to date. Equipment and software is 1.9 ppts.

It is true that exports have contributed solidly. But this is not where the focus should be. During the 9 recovery quarters thus far, net exports have mercilessly taken away from growth: exports plus 1.1 ppts, imports minus 1.4 ppts, hence net exports minus 0.3 ppt. This component needs focus like a laser. Americans want jobs and jobs require growth. The net export component is egregiously failing us. America is being hollowed out. At the heart of the problem is the artificially pegged yuan/dollar ratio and the ideological obstacle in Washington to ramping up domestic petroleum production.

Consider that if real GDP growth averaged 2½% going forward and policy regarding the terms of trade and domestic energy production swung net exports to a 0.5 ppt positive annual contribution, it would still take nearly 6 years to eliminate the trade deficit! Along the way another trillion (real) dollars of US debt vis-à-vis the rest of the world would have been incurred. At the current pace, GDP growth will be lucky to average 2%. Assuming it does, 6 years from now we will owe the rest of the world over 3 trillion dollars more, and still that will not be the end of it. Net exports will be in excess of minus a half trillion implying more and more debt to come.