From a paper by Carlos Vegh, (John Hopkins University), Daniel Riera-Crichton (Bates College) and Guillermo Vuletin (Brookings Institution) presented at the USC-JIMF conference “Financial Crisis in the Aftermath of Global Crisis” (described here):

Abstract: Using non-linear methods, we argue that existing estimates of government spending multipliers in expansion and recession may yield biased results by ignoring whether government spending is increasing or decreasing. For industrial countries, the problem originates in the fact that, contrary to ones priors, it is not always the case that government spending is going up in recessions (i.e., acting countercyclically). In almost as many cases, government spending is actually going down (i.e., acting procyclically). Since the economy does not respond symmetrically to government spending increases or decreases, the true long-run multiplier for bad times (and government spending going up) turns out to be 2.3 compared to 1.3 if we just distinguish between recession and expansion.

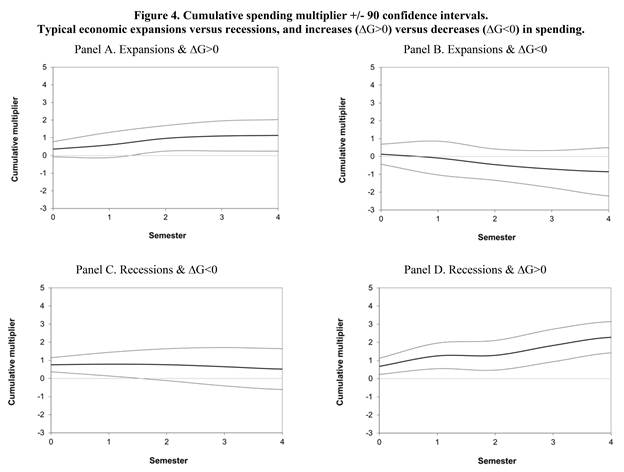

The authors examine a sample of 30 OECD countries over the 1986-2008 period, using the local projections method of Jorda (2005). In addition to allowing for differential effects depending upon whether the economy is in a contraction or expansion, an allowance is also made for differential impact depending upon whether government spending is going up or down. The resulting impulse response functions for recessions vs expansions are shown in Figure 4 from the paper.

Figure 4 from Riera-Crichton, Vegh, and Vuletin (2014).

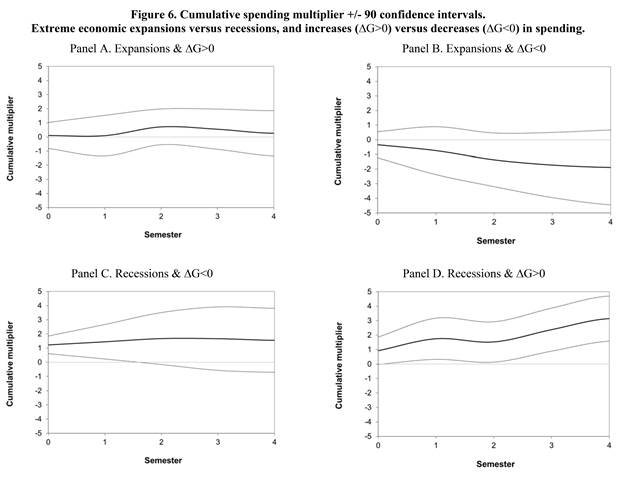

The authors also look for differential effects between extreme recessions and expansions. The resulting IRFs are shown in Figure 6.

Figure 6 from Riera-Crichton, Vegh, and Vuletin (2014).

The obvious point is that expansionary fiscal policy during a extreme contraction is highly expansionary. As the authors conclude:

Maybe more subtle, yet very important, both for expansionary and contractionary fiscal policy, is the distinction between typical and extreme recessions. In particular, the long-run multiplier for a typical recession and government spending going up is 2.3 compared to 3.2 when focusing on an extreme recession. Moreover, while cutting spending during typical recessions reduces output by less than one, doing so in extreme recessions reduces output by more than one (at the very least in the short and medium run). Applied to the current debate on austerity in the Eurozone, this would imply that debt to GDP ratios would increase in response to cuts in fi scal spending.

I think this result is intuitive. When output is contracting due to some aggregate demand shock, there is likely to be a lot of slack, such that a Keynesian model is more apt than a Classical model. In addition, monetary policy is likely to be accommodative. In contrast, expansionary fiscal policy in an extreme expansion has an impact that is not significantly different from zero (note than in an non-extreme expansion, the multiplier for expansionary fiscal policy is still about one).

There is a question of what sort of mechanism delivers the observed asymmetry in responses across expansionary and contractionary fiscal policy, as pointed out by the discussant Yuriy Gorodnichenko (coauthor with Auerbach of a related paper) and other participants.

Nonetheless, following up on earlier discussion of how conventional estimates of fiscal multipliers can be misleading when the state of the economy or the conduct of monetary is not controlled for, [1] (paper here) it seems to be the case that those who argued that fiscal policy would be ineffective in the last recession are ever more seen to be in the wrong.

Thanks for pointing this paper out. The more data we get, the more chance we have of making decent decompositions on fiscal policy across environments.

A few things that raised my eyebrows:

(1) Keep an eye on those confidence intervals – only 90’s, not the usual 95’s. At 95 (even at 90), they’d have a hard time rejecting most existing estimates. Can they reject the null that their multipliers are equal across the different situations? That would seem to be the main test they want to perform as this paper develops.

(2) Splitting time series between above- and below-trend makes sense. But they probably shouldn’t use the word “recession” to describe the below-trend times. E.g., do we want to think of spending in 2008 as “above trend” or as “recession-era”? For robustness, they might want to try some different definitions, such as defining recessions as from a biz cycle peak to the point where GDP recovers its previous peak.

(3) I worry about tax changes as an omitted variable, especially with extremely large output gaps. In two different datasets I use, tax changes and spending changes are correlated at about -0.8 over the 2009-2012 period among the handful of countries with falling GDP, despite cyclical factors which would push that correlation positive absent tax policy changes. When I think about a country cutting spending in a deep recession, I’d assume they’re making other major policy changes as well. Most papers that simultaneously estimate multipliers on both tax and spending changes find taxes are more powerful, especially after a few years.

Could you please provide a link to a couple of the papers that estimate multipliers for both tax and spending changes? I would like to know more about this.

Thanks!

Two things. First, just because expansionary fiscal policy is ‘very’ expansionary does not mean that the stimulus was money was effecient. In other words, it is not worth spending $800,000 (or insert your own estimate) to pull a person out of unemployment for 1-4 years. In the U.S., we spent $800B on stimulus and MAYBE one million people were saved from going on unemployment, and that is generous. Do we really want our kids to pay that kind of money ($800K) to pull people out of unemployment when the average salary is less than $50k? My answer is no. Stimulus would be efficient if we spent $35k per person that was saved from unemployment, not $800K.

Second, looking at 30 countries is great, but before we put too much stock into these studies we should look at what occurred in the US. Fiscal policy will not have the same effect in the US as other countries (not saying that we shouldn’t look at these studies, just that we should look at these studies as well as what occurred in the US after the 2009 stimulus package).

anonymous: Then read Auerbach and Gorodnichenko.

Given your comment, I do wonder if we econometricians should give up teaching and implement panel cross-section time series data analysis. Fixed effects – phooey! Can’t control enough for heterogeneity! Individual specific time trends? Phooey again, can’t control for time effects! Time fixed effects? Phooey again! Doesn’t account for cross-individual correlations… I could certainly shorten the syllabus, and let the students start summer break a month early…

Menzie –

That is not what I was trying to get across. What I am trying to say is that there are going to be hundreds of studies on this topic, all of which disagree in some small way. However, it will be best to look at what occurred in the U.S. first, then look at other countries. You agree with this study, and some other econometrician will come out with an analysis that you disagree with. When I do my analysis I look at my sector and region first, then rely on studies from other regions and sectors to supplement my initial analysis, not replace it.

I am assuming you agree with the first paragraph, then, since you did not comment on it?

Anonymous: No, I don’t agree at all. First, because some of the benefits go to corporations (I assume you don’t have a problem with that), as well as workers, so a per-worker metric is not my preferred one. In addition, a proper benefit-cost ratio would adduce higher benefits per dollar to low income than to high income households. That’s just the beginning. Instead of rehashing my previous posts on this subject, I’ll just refer you to the multiplier category on Econbrowser.

The per-worker metric is probably not the best metric, though it can be used as a ‘first glance’ back of the envelope metric that would probably surprise most people.

I appreciate that you do not want to rehash everything, but instead of having me wade through the entire ‘multiplier category’, can you direct me to your favorite post that clearly and/or relatively simply shows that the stimulus package matched what your models said they would when Obama was trying to pass the stimulus bill. Or, if the stimulus package did not meet your expecations, can you provide a post where you show that it was sufficiently effective in pushing unemployment lower compared to the $800B cost (which I realize will be paid back by wealthy people, but even they deserve some bang for their buck).

Anon,

It makes sense to spend $800,000 to get a job for someone paying $30,000 if you end up with $770,000 in your pocket. The unemployment business is booming, only not for the unemployed.

Lol – agreed

It would be more helpful to back up your implication that 770,000 ends up in non productive hands.

If it ended up in productive hands than unemployment would have been less by more than my one million person estimate, so my estimate implicitly suggests that the $770,000 was not productive enough to pull more people out of unemployment.

Where are the studies that confirm your statement?

It is my own logic. If the $770,000 was productively pulling people out of unemployment, than my estimate that 1 million people were saved from unemployment would be much higher, which would be pushing down the average $800K per person cost that it took to pull 1 million people out of unemployment.

I think what you are trying to say is that more than 1 million people were saved from unemployment due to the stimulus. If that is true, recommend your own number and then re-run the math and see for yourself how much it took to save one person from the unemployment line. Or, you could just follow along with Menzie’s and my stream above as he is pointing out that there are other metrics to use than the per-person metric (which he doesn’t like, hopefully for other reasons that it just makes the stimulus bill look very very bad).

Your 1 million estimate is pulled straight out of your ass???

My estimate is that we turned from losing 800K jobs per month to gaining 200K per months with the stimulus package. That is 1 million jobs PER MONTH for about 5 years. That is about 60 million jobs for about $600 billion of actual stimulus spending or $10,000 per job. Now remember that each created job is lasting for at least 10 years so that is about $1000 per job year. Now tax each of those jobs about $3000 per year and you have a huge return on stimulus investment just looking at the money (forgetting the human factor).

One million people is a lot, considering there are currently only about 10 million people unemployed. So in the recession, after the stimulus bill was passed, unemployment increased from about 9% to 10%, I am assuming that without the stimulus bill unemployment would have hit approximately 11%. Now you could argue that I am way off, that unemployment would have actually hit 12% or, if you are really extreme, that it would have hit 13%, but either way, even if you use those numbers, we are still paying at least $200,000 per unemployed person. To me, anything above the national average salary is too much, but $200K-800K is outrageous if you are trying to call the stimulus bill a ‘success’.

I am assuming your numbers are sarcastic, right? Unemployment would be negative 15-20% if you were right…

And what happened to their economy when they paid their borrowings back?

Salim Can they reject the null that their multipliers are equal across the different situations?

That is not exactly how I was taught to interpret confidence intervals. It’s not quite right to infer that all point estimates within the top and bottom bands are equal. What the bands tell you is that you cannot say with fill-in-the-blank level of confidence that any point estimate is different from the null of zero. That sorta, kinda sounds like saying all of the point estimates between the bands are equal, but that’s not what’s really going on. Or if you prefer the Animal Farm version, all point estimates might be equal, but some are more equal than others. You see this same kind of confusion in political polling results when they say that two candidates are statistically tied. Not quite. One outcome is still more likely than the other even if the two point estimates fall within overlapping error bands. Different point estimates can be unequally likely while still being statistically indistinguishable from each other at a given confidence level. Also, I don’t think there’s anything inherently wrong with using a 90% confidence bands (that’s actually typical in a lot of software showing VAR impulse/responses graphs). The appropriate confidence interval depends on the context and on the asymmetric loss functions of committing Type I or Type II errors. If I’m a policymaker worried about fighting a deep recession, I’d happily settle for an 80% confidence interval. And of course baseball managers decide whether to pitch to a righty or a lefty with even less confidence.

But that was picking nits. I am more interested in your comment about most studies showing tax cuts as being more powerful than spending increases. That may well be a true statement. I have no idea. But one thing I have noticed is that all of the studies I’ve seen that conclude tax cuts have more long run power also assume that the tax cuts are permanent and are never reversed. This creates a bit of a problem because it also creates permanent structural deficits unless you believe in the miraculous healing powers of supply side tax cuts that magically pay for themselves. So perhaps that’s why those studies show more staying power over the long run. On the other hand, with increases in government spending during a recession the accumulated multiplier is positive; but the charts also show that once the economy recovers and stimulus spending is no longer needed (or even desirable), it can be cut back without any statistically significant negative effect on output. In other words, tax cuts tend to leave permanent structural deficits in their wake while government spending stimulus tends to be transient and budget neutral over the long run. That sounds like a big two thumbs up for increased spending rather than tax cuts….especially if that government spending focuses on infrastructure and education.

Anonymous You might want to do a little more research and more careful number crunching. If you do the calculations correctly you will find that the average annual cost per job recovered from the stimulus is almost exactly equal to the average annual salary. The difference is ~$200/yr. And if you only halfway think about, that has to be true unless you believe all those dollars just magically disappeared into mattresses after leaving a few unemployed workers fabulously rich.

Salim – I 100% reject your statement. If you were right, than 16 million people would have been saved from unemployment, which is of course preposterours. (Calculation: $800B divided by average salary of $50K).

Great Article. Really interesting.

I have given this some modest publicity downunder.

this is of course the only time Keynes advocated using active fiscal polcy

A recession has begun. Prepare for receipts to fall, deficits to expand, and gov’t spending to private GDP to increase from a cyclical low.

The housing echo bubble has peaked and will burst this year along with the stock market echo bubble II.

QEternity – Taper will hardly be complete before The Chair is directed by the TBTE banksters to ramp up the fiat digital debt-money reserve printing press to bail out banks, insurers, and non-bank financial firms during the next debt-deflationary recession after inflating another corporate bond and derivatives bubble to put to shame the bubbles in 1998-2000 and 2004-2007.

Gentlemen, we are witnessing the emerging end game for the once-in-history fiat debt-money and asset bubble regime since 1973 and after WW II. I fully expect the TBTE banks to print trillions more to buy bank and insurer stocks, equity index futures (like POMOs), munis, and overtly US Treasury issuances, as the Fed will be the printer and buyer of last (desperate) resort for anything and everything.

Few will complain about the Fed printing trillions more in the years ahead, as they are fully vested in the unprecedented equity and corporate bond bubbles as a share of GDP and wages, and they will beg the Fed to print “whatever is required” to bail out their stock portfolios and public and private pensions, at the risk of a bourgeois revolt by the top 10%.

Bourgeoisie stock bubblers of the world, unite against stock and unreal estate bear markets and inconvenient capitalist recessions! Give us fiat digital debt-money bank reserve credits for the TBTE banks, or give us bailouts, inflated stock options, overpriced stock buybacks, predatory M&A, and money-for-nuthin’ seven-, eight-, and nine-figure sums in offshore domiciles.

The Chair is your friend, grounded on all fours and sitting pretty at the ready, finger firmly placed on the CTRL-P button, itching to press repeatedly.

What is perhaps most amazing is that grown men and women still believe (want to believe or are paid to believe and say so) that the Fed is “independent” and acts on anything other than the direction of the Fed’s benefactors, the rentier Power Elite owners of the TBTE banks.

Yellen is holding a Keynesian religious service today and her sermon is expected to be more of the same at least until next year because the economy is still not healthy.

Perhaps some of the brilliant here can help me. We have had the most massive attempt at Keynesian stimulus in the history of the world since 2008 (actually starting earlier in the Bush administration). Even though it is the most massive in the history of the world (with perhaps the exception of Wiemar Germany in the 1920s) the economy has hardly budged. Compared to the Reagan recovery the “Keynesian” recovery since 2008 is worse than horrible. Now I know many believe we are in recovery but Yellen’s message today will totally counter that opinion. This is not the first time the Keynesian fantasy has hit the rocks. At the end of the 1970s the general economic wisdom was that Keynesianism was dead. Well, like a zombie, Yellen will discuss the walking dead today. So, my question, how long must we continue this failed stimulus with no recovery (stated by both Bernanke and Yellen) before the Keynesians admit their prescription isn’t working?

Since the Reagan recovery did work, doesn’t it seem that we should give what worked a chance?

How do you factor in the decrease in government spending at the state and local level?

The Reagan recovery was just military Keynesianism plus Block Grant Keynesianism.

Menzie

I am particularly interested in the charts of Figures 4 & 6. Preliminaries first. Am I oversimplifying too much the definition by referenced paper of contraction (expansion) as an increasing (decreasing) of the output gap? Am I correct the definition of delta G 0) is actually government spending less (greater) than the expected level rather than an absolute lesser (greater) spending?

As to the charts, the result for complimentary expansion and contraction is always a higher multiplier for delta G > 0 than for delta G < 0. This leads to the the conclusion that government spending should always increase, and will result in government continually consuming a greater portion of GDP. An outcome that has been shown to be devastating to both human and economic freedom as well as economic growth.

A couple of other comments.

Well done was the clearness and clarity of the writers of the paper. Writing is a difficult art.

I found this paper a great resource for general background of fiscal multiplier. I think you should recommend it.

Ed

Ricardo

May 7, 2014 at 5:01 am

Since the Reagan recovery did work, doesn’t it seem that we should give what worked a chance?

First, we don’t have tax rates high to cut from as Reagan did. Second, do you really want to run massive deficits and double debt to GDP up even higher, like Reagan did. Is that what “worked?” Come to think about it, I think Obama is following the Reagan plan.

Yes. Reagan tripled the debt and massively increased public spending. However, he did not have insolvent banks (at least not until he created the S&L crisis) and could constantly cut interest rates from very high levels to goose the economy.

Steve

“Federal Reserve Chair Janet Yellen made it clear she believes the economy still requires a strong dose of stimulus five years after the recession ended because unemployment and inflation are well short of the Fed’s goals.”

Interpretation: Yellen says it is not working so we are going to keep doing what is not working.

Agreed Rico, what we are doing will never “work,” and by work I mean reduce debt/gdp. But let’s not pretend doing what Reagan did then is perfectly applicable. He had high taxes to cut and low debt to run up. The fact of the matter is the only way out is to accept that it is time to pay the piper for the last 40 years of blowing a debt bubble and accept the reality that is our debt burden. Our options are either take our medicine and reduce QOL for everyone now, or slow decent into Japan where we just keep blowing the bubble until it bursts. And make no mistake, Japan will burst in the next 25 years. It will be ugly. My guess is we follow them because the voting populace are morons.

anonymous, not sure how reducing the debt/gdp ratio during economically down days helps to get the economy going. for the majority of people, having a low debt/gdp ratio but no job is not what they would consider an ideal outcome. but i guess you are one of the folks warning about the serious consequences of the bond vigilantes- for say the past six years!

I’d like to follow up on the voting public being morons. Strictly speaking, the fault lies not with the voting public. The public first needs information that is both substantive and truthful. Most of the public gets its information from the mainstream media – especially television. Moreover, for some decades now there has been a deliberate effort to dumb down the educational system. Are preschool and K-12 children responsible for their lack of critical thinking as they turn adult? Hardly. The causality lies a level deeper with the Carnegie, Rockefeller, and other foundations. This spills over to the university system, incestuously dependent as it is on grant money from the federal government and the NGOs. The mainstream media, now dominated in its entirety by the wealthy elite, is a fully-fledged member of the team, churning out biased, incomplete, party-line reportage as is its bidding.

I see tentative signs that the youngest generation is picking up on this. They are the ones most directly experiencing the joblessness and low-paying jobs of today in contrast to the opportunities their parents and grandparents had. They, however, are frustrated and clueless on what to do about it. Leaving the workforce and going back to school is not the answer. It’s just more of the same old indoctrination, with indenture by student loan debt adding another layer to their woes. The corruption of the political process is now beyond the pale. Help will not come from that quarter. Only a grassroots movement that’s organized will turn this tide. Organized is precisely what the wealthy elite manipulating the levers of power from behind the scenes is; and what the vastly more numerous broad public is not. Until the public becomes informed and organized, the decline of America and Western Civilization will continue. The pace is quickening. The one thing that might change this is another financial crisis. A graver one than the last that gets totally out of control and runs amuck like the French Revolution.

Ricardo Where do you get this nonsense? I realize that old men sometimes have a problem misremembering history, but would it really be too much of a bother to actually check the facts? Let me help you recover your failing memory:

Item #1: Yellen is the head of the central bank and fiscal policy is not in her portfolio. So why you are blathering on about the Fed and Keynesian spending is beyond me? Your comment is irrelevant and pointless.

Item #2: Your claim that the ARRA was the largest fiscal stimulus program in US history is simply wrong and with a little effort you could have checked the BEA and OMB historical tables. Just as a rough back-of-the-envelope calculation, ARRA was nominally $787B, but $77B of that was simply an extension of the AMT and was not stimulus (the first derivative was zero). The ARRA was spread out over 3 years. So ($710B / 3) / $15T ~ 1.6% of GDP per year. Hardly ground shaking. Way too small given the size of the problem. In 2008Q4 the economy was plunging at more than negative 8% per year. Since you think that Reagan’s post 81-82 performance was off the charts great, keep in mind that his best annualized growth rate was 8%. If 8% growth was fantastic, then perhaps an 8% drop in GDP is godawful.

Item #3: The economy has done more than just budge since ARRA was enacted. Growth has been disappointing, but then again the size of the stimulus package was disappointing. And oh by the way…did you know that we’re at the ZLB so the Fed has lost one of its major policy tools? During the Reagan/Volcker years we were safely above the ZLB. In fact, back then the possibility of a liquidity trap was considered laughable. No one is laughing today. Now it is true that virtually all of the post-Great Recession growth has gone to the top 10%…you know, your kind of people. The idle, rentier class.

Item #4: Were you taking a nap all through the Reagan years? News flash: Reagan ran huge deficits. Reagan’s federal spending as a percent of GDP was much higher than Obama’s. Reagan also gave us a pretty sharp increase in the deficit…it was 6% of GDP, but started from a much lower baseline. That’s quite a large fiscal shock. Obama’s deficit today is smaller than Reagan’s was even when the economy was well out of recession territory. But wait, it gets better. Volcker also lowered interest rates to re-animate the economy after his higher rates strangled inflation. So Reagan and Volcker used the full set of Keynesian tools: fiscal and monetary policy. You recommend that we go back to what worked with Reagan. Well, like a lot of old conservatives you are forever stuck in a bygone days and left with false memories. What Reagan pursued was pretty much standard Keynesian textbook stuff for that era. Don’t believe me? Go buy a used copy of the Dornbusch/Fischer textbook on macro, which was pretty much the saltwater seal-of-approval bible for old fashioned IS-LM macro at the time. Still don’t believe me? Go ask Reagan’s chief economic advisor, Marty Feldstein. Feldstein even wrote an apology as an NBER article explaining all this: http://www.nber.org/papers/w4324

Item #5: Since you recommended that we go with Reaganomics 2.0, does this mean you are recommending big fiscal stimulus and an active Fed that is guided by the old IS-LM framework?

Finally, this is the 100th anniversary of the First World War and there are a lot of really great new books on the war and its aftermath. I’ve read several, but my two favorites are probably the new one by Margaret Macmillan and the book “Lawrence in Arabia” by Scott Anderson. You might want to look around for some better history on the Weimar Republic. I know you’re trying to remember it from your lived personal experience back then, but don’t trust your memory. Go read serious history.

“At some point, QE became a permanent, accepted part of the American economy. Once seen as a radical expansion of the Fed’s power, it’s now just what reasonable people support, and no member of Congress would ever dare suggest that it should be ended, not even at some definite point in the future.”

Ryan McMaken

Slug,

You argue from a point of ignorance. I never mentioned the ARRA. When you combine the Bush and Obama administrations the closest you will find equavilent spending would be during WWII. But For this period of time you will find that Federal Reserve monetary expansion is massive. You argue like my daughters did when they wanted to do somthing I would not let them do. They always said, everyone else is doing it, it is just one time, it is not that bad, you never let me do anything. I guess based on your arguments you are right, it is must not a refutation of what I said.

slug, nice response although it gets wasted on ricardo. he is simply anti, with no real agenda other than he dislikes anything obama and the democracts would consider. i imagine he was a full supporter of romneycare until it became obamacare. he is anti fed, but when asked what the fed should be doing (ie what are they doing wrong) he does not want to give an answer which solves the current problems. he only wants to give an answer which serves his world view (eliminate the fed) but with no justification how that would improve the situation. you cannot argue with anti people because they are extremely selective about the issues they want to address, not he issues which actually exist in the world today.

Anon,

The Reagan “7 Fat Years” demonstrated that we can recover from a Keynesian induced recession by instituting policies that create production. During the 1980s we had a huge increase in new innovative businesses. Many of the businesses that grew from the 1980s are some of the only productive businesses today. While Slug and his cronies claim the Reagan years were a Keynesian utopia Janet Yellen just poured water all over their hypothesis. Our economy is still declining even after the money supply and the FED balance sheet shot up like a rocket. The problem with today’s Keynesians is that they look to successful times to try to justify their theory rather than looking to the theories behind the successful times.

Supply side policies worked in the 1920s. They worked after WWII to the consternation of the Keynesians. And they worked in the 1980s.

FDR’s devaluation of the dollar led to the recession of 1937. The Keynesian orgy of Lyndon Johnson and Richard Nixon led to the hyperinflation of the 1970s and they modern Keynesian policies led to the credit crisis of 2008.

We really need leaders who can understand the difference.

ricardo, your words are nothing short of propaganda from right wing radio nut jobs! hyperinflation of the 1970’s? you do not understand what hyperinflation is. keynesian policies leading to the 2008 financial crisis? really? supply side policies as an answer to an aggregate demand slump?

“During the 1980s we had a huge increase in new innovative businesses. Many of the businesses that grew from the 1980s are some of the only productive businesses today. ” what are these super businesses that resulted from reagan policy? or did reagan simply happen to be in office as the technology became available? please stop the propaganda it hurts the ears!

Of course, the relevant multiplier is not an “average” over the course of the cycle. The profound reason for this is that the universe operates on the margin. The efficaciousness of fiscal stimulus is a curvilinear function (approximated by a log function) of time. In the neighborhood of the cycle trough, the multiplier is at its maximum positive value. The injection of stimulus at t=1 cannot be one-shot. It must be an ongoing flow to be efficacious. Removing stimulus at t=2 would be almost wholly self-defeating. Each additional increment of stimulus, assumed for simplicity to be uniform (equal amounts each time period), will have less multiplier impact. Eventually the incremental impacts go negative.

A fundamental concept not found in the literature is that of optimal debt (debt-to-GDP). The debt ratio going into a recession is an important conditioning variable for the multiplier. If debt is below optimal, the multiplier will be greater all along its time dimension. If the debt ratio is beyond optimal (that is, larger), the log curve of the multiplier will be lowered. The cumulative multiplier will turn negative faster. The Reinhart Rogoff studies imply the 60% debt ratio going into the 2008 crisis was already beyond optimal.

Since the gross debt ratio was only 33% going into the Reagan recession, the surprise unwanted deficits in that era were more palatable and undoubtedly had a larger multiplier effect. At the same time, they had the pernicious effect of driving the debt ratio above optimum after a couple decades of golden age. By the end of the Reagan era, the debt ratio had climbed to 52%. The starting point of low debt in 1981, by the way, is one of the reasons the Reagan recovery was far more successful than the current recovery. Another reason is that the 4-plank program Reagan came to office with was pro-growth. The current administration’s program is just the opposite – redistributionist. The administration’s signature program – the ACA – is precisely redistributionist. Its anti-growth effect was never in doubt.

Of the pre-2008 papers giving significant independent measurement of the multiplier, my subjective judgment based on reviewing scores of them is that not one in ten included debt as a conditioning variable. Any meta-study worth its salt must throw the other 90% out. Significantly independent here encompasses different structural models and different statistical methodologies, and minimizes the double-counting of clone studies. The objective being to triangulate on a highly complex thing to get a more robust estimate of it.

The multiplier of ultimate importance to policy makers is the cumulative long-term multiplier which integrates both above and below the x-axis to calculate the final net amount of impact on growth properly time discounted. The current debt ratio of 102% carries a cost. As it is above optimal, future growth will be constrained by the need to get debt back down. The contributions of fiscal stimulus in t=1, t=2, etc. to the level of debt in early periods, present period, and future periods must have their more distant and hence more hidden costs of constraining growth apportioned back to the present period multiplier calculations so as to net with the more visible and immediate benefits of the stimulus. These costs should be apportioned back to each respective t=1, t=2, etc. When this is done, the log curve of the multiplier will slice below the x-axis sooner. Some portion of growth presumably multipliered up by fiscal stimulus is in fact illusory. As aggregate demand depends on the increment of income and the increment of credit, during the three decades prior to the crisis the unsustainable increments of credit created “illusory growth.” We are now, and for a generation will be, in the payback period. There is no such thing as a free lunch. To my knowledge, no study has yet been done incorporating these insights.

As indicated above, the largest multiplier occurs in the close neighborhood of the cycle trough. This happens for a reason. As a recession gets underway, the economic process goes into reverse. Excesses that had built up in the expansion must be purged. Overdue structural changes that had been put off get underway. Malinvestment inherent in the boom phase of the cycle visibly surfaces and puts in an appearance in write-offs, bankruptcies, bond defaults, negative wealth effects, and the like. A cumulative downward spiral results. It ramifies throughout the economy. The deepest most profound value of fiscal stimulus and its associated multiplier at this point is in keeping the economic decline from going past some difficult-to-measure nonetheless very real “natural” point. The specific case of the 2008-09 recession is illustrative. The financial system was in jeopardy of collapsing. To the extent that the $787 billion fiscal package was integral (necessary) to staving this off, the multiplier in t=1 was a huge positive number. Once this journeyman task is accomplished, the multiplier quickly falls below 1 and toward the negative zone.

baffling,

we will have “economically down days” forever.

Ricardo,

You’re not getting it. We can’t cut tax rates from 75%+ marginal rates like Reagan did because we don’t have 75%+ marginal rates. We are running deficits, like Reagan did, but the marginal return to debt increases as you lever up an economy, and we are already too levered for debt spending to help.

JBH

you are hands down the best commentor on this site. Do you have a blog? Twitter? Something?

It has taken a long time. The first step was in letting go of considerable baggage from my formal education. The difficulty was in finding what to replace it with. Reading widely is a requisite. Some pieces have fallen in place from beyond economics. Someplace along the way I realized that the great geniuses wrote about their subjects with exceptional clarity. I judge that this is because they knew their subject to a level far deeper than that at which they were writing. What resulted was distilled clarity. In economics, read Carl Menger’s Principles of Economics (1871). He simply thought real hard about the subject. Which is why he was so original and so clear. So I try to do the same. It’s important to permit ambiguity to take up residence in your head for long periods of time. It’s important to be constantly on the lookout for anomalies. These are more often than not a rich source of new insight. It is also important to engage in cosmic dome thinking. From a distance you can better sort priority from trivia. Being stuck at a sub-optimal lower level of discourse can lead one quite astray. This is because in moving from one level to the next emergence takes place. Certain new rules operate at higher levels but not at the lower levels that underpin them.

Eventually I came to understand that of all the logic errors that can be made, the error of false initial premise is the gravest. A science is only as good as its foundational axioms. Once this is understood, it then becomes imperative to take things down to bedrock to convince yourself. Fairly early on, Buckminster Fuller did just that. And that was an inspiration for me. As it is science we are talking, there can be no substitute for getting your hands dirty with the data. But if you start from the wrong axioms – blindly accepting those you were taught, and by bona fide professors who had simply accepted without much questioning the texts they taught from – you will often not see what the empirical data is actually telling you. The endnote to all this is: whatever you come up with, it must predict in real time.

As for a blog, there aren’t enough extra hours in the day. Since after many years I finally have a handle on macroeconomics, I’m in the process of writing it up. This blog is a helpful catalyst. Thank you for the compliment. This humble discourse on methodology is my way of repaying that.

JBH It is well known that the stimulus for period t+2 has to be larger than the stimulus for period t+1. I am both pleased and surprised that you mentioned this because Paul Krugman was making exactly this same point 5 years ago in one of his columns. That’s when conservatives were criticizing the ARRA because it appeared to them that much of the stimulus was backloaded. They attributed this to political motives; i.e., juice the economy right before the 2010 election. Your fellow traveler CoRev frequently made this charge. As I (and others) tried to explain to CoRev and his ilk, you have to increase the stimulus increments as the economy recovers because each increment has to affect a bigger economy. You have to do this until aggregate demand from the private sector is able to replace the stimulus. So I’m glad you’re on board with this very Keynesian idea.

The multiplier of ultimate importance to policy makers is the cumulative long-term multiplier

Note that the graphs in Menzie’s post are cumulative responses.

Where your post goes off the rails is the Austrian mumbo-jumbo stuff about having to purge malinvestment. This is not serious economics, but it is the kind of stuff I hear a lot from business types. Even if “malinvestment” contributed to the collapse in aggregate demand, that does not mean purging that “malinvestment” is the right way to restore aggregate demand. This is the “hair of the dog” theory that drunks invoke each morning when they wake up with a hangover. And aren’t you even in the least bit bothered by a market system that must be regularly getting things so spectacularly wrong that we keep having these “malinvestment” episodes? Are businessmen and businesswomen really that incompetent? Who needs Marxists ranting against capitalism when there seem to be so many Austrians wringing their hands over chronic malinvestment by capitalists?

The R&R paper isn’t something that I would want to hang my hat on. Several recent studies have put some time scripts on those debt and GDP numbers and crunched some loess regressions. The conclusions have been that R&R pretty much got the cause and effect all backwards. For example, see Miles Kimball’s (actually one of his student’s) efforts along this line. In any event, it’s a little strange to hear conservatives whining about high debt levels constraining our fiscal options. Wasn’t that something that liberals complained about back when Bush #43 was running all those structural deficits when the economy was at full employment? I’m guessing that you voted for Bush twice. If so, then you contributed to the problem. But you play the hand you’re dealt. Even though I would much rather have gone into this recession with a much lower debt level, it’s still true that a larger fiscal stimulus would have been better. Remember, it was the GOP that kept saying we couldn’t afford a bigger stimulus because of past debt. That’s a really stupid argument. And self-defeating because this halfway-in, halfway-out policy only drags out the slow recovery. When all is said and done the debt level will be higher than it would have been if we had bitten the bullet 5 years ago and passed a $1.4T package.

Finally, the ACA makes the economy more efficient, not less efficient. The ACA reduces deadweight distortions in the labor market. It reduces insurance premiums on those who already had good plans (and by “good plans” I mean to exclude the fake plans that many people had prior to this year). It imposes a tax on free riders like the Rick Stryker family. The ACA has digitized medical records. It penalizes “Cadillac” plans that drive up healthcare costs. The reason business types don’t like the ACA is because it takes back some of the unearned rents that doctors and businesses enjoyed. But retaining unearned rents is a miserable excuse for an economic policy.

well said slug!