If you dynamic score, dynamically score both expenditure and revenue measures.

Professor Lazear writes in a WSJ Op-Ed (ungated version):

Every piece of legislation has economic consequences. Most are small, but some are significant. When the CBO ignores them, it disregards the detrimental effects on economic growth of bad legislation as well as the positive effects on growth of good legislation.

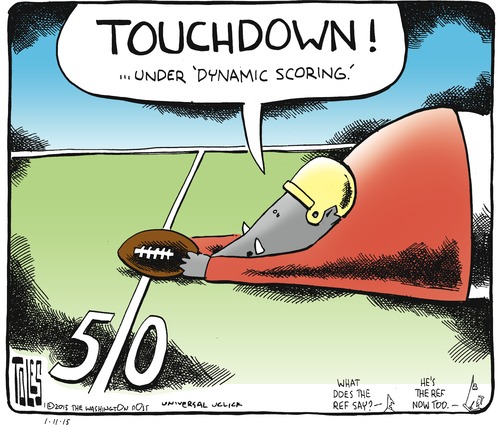

While Professor Lazear argues for dynamic scoring of tax legislation, he also argues for scoring of spending components. This puts both Professors Krugman and Lazear in agreement with Alan Auerbach (UC Berkeley) as well as yours truly. Unfortunately, as Krugman observes I think correctly, the desire to implement dynamic scoring is driven mainly by political objectives (lower taxes overall) rather than a desire to do the economic analysis correctly. Or, — despite the fact that I don’t usually use sports analogies — as succinctly put by Tom Toles:

More on a potential blue collar resurgence. Note the date.

“The average age of industrial equipment in the U.S. has passed 10 years old, the highest since 1938, according to estimates by Morgan Stanley & Co. economists.”

http://www.wsj.com/articles/companies-tiptoe-back-toward-made-in-the-u-s-a-1421206289?mod=trending_now_3

Good point, ignoring externalities or multipliers is silly. For example they keep saying the Keystone Pipeline will generate about 40,000 jobs. I have no idea over what time frame. But of course that does not include the multiplier effect, of what, 4 times that? So they should say what, 160,000 jobs. In Texas, the drilling slowdown is going to mean cuts in employment far beyond a few roughnecks.

There is no need to score Keystone XL. If TransCanada wants to build it, then they have already ascertained that its expected return more than covers its cost of capital. The direct externalities must be positive, eg, employment generation, more efficient movement of crude, etc. That’s axiomatic.

The residual issues are CO2, for which we have no reliable estimates, save that environmental groups figure that preventing Keystone, over its lifetime, might prevent a week’s worth of CO2 from entering the atmosphere. So if we don’t build Keystone, the planet gets another week. Wow.

Also to consider is the risk of spill. If this is a relative risk, ie, compared to rail, then pipeline is much lower. If it is compared to not moving the product, then of course the risk is lower if the oil stays in the ground. Pipeline spills tend to be rare and local. But if you think the pipeline risk is too high, then you would probably want to prohibit all movement of oil by rail, as the risk is both higher and less controlled.

The Canadian oil sands produce bitumen. Bitumen is unable to pass through a pipeline. It must first be mixed with a diluent, becoming dilbit. The real risk in a pipeline break is spillage of dilbit, which involves several volatile and nasty components not present in the unmixed bitumen – not to mention the proposed repurposing of a liquid propane pipeline to send the volatile diluent to Athabasca. Rail transport of unmixed bitumen may, in fact, be a safer method.

Yeah, that’s wrong, Benjamin.

steven, what is wrong? the chemical composition of the distributed mix or the safety of unmixed rail vs mixed pipeline product? i am not very informed regarding the transport of oil sand products.

Unfortunately, once you open the door to the subjectivity of dynamic scoring, you’ve politicized the CBO. We already have an example in the arguments over the dynamic scoring of the ARRA. With Republicans in charge, it’s simply going to be a tool for generating whatever result they want.

From Prof. Mark J. Perry :

College rape stats are heavily fraudulent, and expose the dishonesty of ‘feminism’ as a whole.

Prof Mark J. Perry is an economics professor of considerably higher stature than Menzie Chinn. Menzie Chinn is required to support ‘feminism’ no matter how deeply in conflicts with any basic principles of economics, statistics, logic, or humanity.

“…an economics professor of considerably higher stature…”

Says some guy named Darren, of no discernable stature. Even setting aside Darren’s lack of qualification to make such a judgment, that assertion of qualification amounts to an appeal to authority – one of those things intellectually honest people aren’t supposed to do.

And last but not least, this oh so statuesque Mark Perry works at AEI, so how can we possibly trust anything he says?

Darren: try to stay on topic!!! This is a forum for economics, not ideology

For those who are blocked by the WSJ wall, “here” is another article, not Ed Lazear’s, but some comments from other actors.

Ed

Dear Ed & All,

Just wanted to share a quick tip re: defeating the WSJ paywall (and this probably works for others).

1. In a browser other than internet explorer, bring up bing, the search engine.

2. type the name of the desired article you would like to read

3. click on the appropriate link from the results page. It should appear near the top.

4. You will be re-directed to the page in a way that bypasses the firewall.

I haven’t spent the time to investigate exactly why this works, but it has something to do with the way the webpages re-direct.

Last point, I thought the dynamic scoring applied to all bills worth more than 42 billion or otherwise selected for such treatment. When I read it the first time, it made me think it applied to all legislation, which, as mentioned earlier on this blog, could cut both ways because the IMF has studies out on the multiplier effects of infrastructure projects, etc.. Really last point, sorry if this posted twice, my internet cut-out on me during the first submission.

I believe this is an ungated version of the Lazear article

“‘Scoring’ Legislation for Growth”

Ed

Ed Hanson: Thanks, I’ve added the link.

One of the consultancies reported last night that US gasoline demand in December was up 7.2% on the same month previous year. Wow! Gasoline demand–that’s all road fuel.

If I assume that vehicle efficiency is improving at a 1.5% pace, then that would translate into 6%+ VMT growth (including diesel)–essentially in one month! Wow! We’re on the move again.

Let’s see how the dust settles, but right now, I would anticipate that low oil prices will light up the global economy like a Christmas tree.

Steven, I agree with you that lower oil prices are good for the economy, but not with your characterization that ” ..that would translate into 6%+ VMT growth (including diesel)–essentially in one month!”

It would amount to 6% increase in one YEAR, not one month.

I expect that Lazear has a presumption that all Government spending has a negative consequence on economic growth, at least long term. For instance, if there was no Social Security, most people would have to keep working until they died, like they use to in the 19th century, but at least they would be “productive!!” All the Clean Air and Clean Water Acts and hazardous substance bans just create “costs” with no benefits. The smog covered Los Angeles of 1970, or the Peking of today, with their premature death of thousands and the chronic illness of millions are visions of delight of “productivity” to him.

The wild card in the current Commodity crash (not just oil) is the impact on the financial system. Like when Housing started to crash in 2006-07, it took about year for the impact of bad loans and the derivative bets on those loans to start effecting banks income statements and balance sheets, so it may not be until the fall see the results of junk bond defaults and bankruptcies in the oil and gas industry hit the banks and the shadow banking system. There is already a flight to safety (see U.S., German, Swiss, UK, and Japanese bond rates). A credit crunch in the Fall could trigger the third recession in a row not principally triggered by the Federal Reserve sharply raising interest rates. (In both 2000 and 2007-08 the Fed was gradually tightening, but it was the plunge in long term rates, not sharp rise in short rates, that inverted the yield curve on both occasions as the respective Stock Market and Housing bubbles turned into busts.)

Steve Kopits wrote:

Let’s see how the dust settles, but right now, I would anticipate that low oil prices will light up the global economy like a Christmas tree.

Steve,

It is interesting. A declining currency value overprices commodities (oil) and that puts downward pressure on profit margins bankrupting marginal suppliers. Over time this trend flows to retail profit margins and the economy declines. An appreciating currency value underprices commodities (oil) and increases profit margins but it also bankrupts marginal suppliers. But there is an increase in production and consumption by efficient suppliers. (These are not the only effects but these relate to the discussion

It is curious. Right now we are seeing the strain between marginal oil producers staying above water and an increased demand for commodities. Both tend to indicate higher prices.

But it is also curious that either a depreciating or appreciating value of the currency puts marginal producers out of business. As we know economic activity is driven on the margin so it should be obvious that a stable currency is much more advantageous than a floating currency that blows to-and-fro like a ship without a rudder.

Your comment would seem to be saying that we are set for a replay of the late 1990s early 2000s.

No, the model is unambiguously 1986.

Because of our incredible oil production, our current account and economy are strong, and this is showing up in exchange rates.

In the oil patch, we now have a supply surplus of 870 kbpd (EIA), 1 mbpd (IEA), or 2.4 mbpd (OPEC). Take your pick. Until this is run off, oil prices will remain below marginal cost, and probably materially so.

Some oil companies may indeed go bankrupt. But their assets and the industry knowledge will remain, even if in some other company’s hands. I am not worried on that front. Unless OPEC moves to a volume strategy (my next piece in the UAE’s National; here’s today’s: http://www.thenational.ae/business/energy/a-guide-to-the-inner-workings-of-opec#full), we will need US shales back on line about this time next year. The industry is suffering a bit of a bust. It will be back soon.

Meanwhile, the US consumer is in his car and on the move. GM is upping its capex by 20%, and you’re going to see the municipalities start spending on infrastructure like drunk sailors on shore leave. I have suggested we should have a $300 bn national ‘master fund’, and I haven’t changed my mind. We have a lot of catching up to do on the infrastructure side.

Meanwhile, the oil importing countries of Europe–materially everyone except the UK and Norway–are getting an oil cost bonus of 1-2% of GDP across the board. This is far more valuable than any QE. Personally, if I were the ECB, I’d sit on my hands for three months and let some data roll in.

Dynamic scoring is not really the issue. The issue is the soundness of the theory behind the forecasts. Everyone (after supply siders demonstrated the truth) realize that dynamic scoring is important on both the revenue and expenditure side. The problem is that those who claim a stimulus have yet to prove their case while dynamic scoring of tax reductions is virtually universally accepted (Remember the analysis by Christina Romer when she was Obama’s Chair of the Council of Economic Advisers).

As is usually the case it is the validity of the theory more than the technique that is the key.

huh? the “proof” of beneficial affects of government spending is of precisely the same robustness as the “universally accepted” dynamic scoring of tax reductions.

but that’s not really an honest assessment anyhow: the dynamic scoring of tax reductions is not “universally accepted.” what is “universally accepted” is that static analysis is inherently inaccurate because every economic action changes the incentive structures and market actors respond. that doesn’t mean that simply marking up the anticipated revenues is “universally accepted.” in the absence of a valid model, there is far more “universal acceptance” that static analysis, with its known limitations, has a greater value than the extra levels of modelling (in the best case) or fantasy (in the typical right-wing think tank case) produce.

More on the blue collar boom:

http://www.progressivepolicy.org/blog/obamas-muni-broadband-initiative-bad-economics-bad-politics/

One of the interesting angles in scoring is legislation to beef up the IRS. Research (much of it under the auspices of the IRS, so make of that what you will) indicates very high payoffs. That would mean more audits, more prosecutions of evil-doers, etc. It would also mean more assistance for taxpayers, the lack of which may set of howls this tax season, as the IRS has itself warned, due to vengeful budget cuts from the wingnut Congress.

I think most people agree that taxing and spending policies do have economic effects. The devil is in estimating what those effects are. Five years after the ARRA, even professional economists still have a broad range of estimates as to what the spending multiplier is. Let’s face it, dynamic scoring is a difficult endeavor.

If the CRS does start dynamic scoring, then all their analysis is conditional on their assumptions and models regarding behavioral impact. What their results mean are then open to interpretation, wild speculation, and worse.

If the CRS sticks with static scoring, everyone recognizes their analyses have serious limitations. But at least we know what those limitations are. I think knowing a forecast is naive and why it is naive is probably better than having a more detailed forecast but knowing that detailed forecast makes a whole host of additional, perhaps untenable, assumptions.

Part of the problem is that people have different understandings about multipliers and dynamic scoring. When liberals and most academics talk about using multipliers in dynamic scoring, they are generally talking about the short-run dynamics in aggregate demand assuming some response (or non-response) from the central bank. When conservatives and “entrepreneurial” pseudo-economists like Stephen G. Moore and Grover Norquist talk about dynamic scoring they are almost always thinking in terms of some policy that shakes up long run deep structural parameters and consequently shift the aggregate supply curve. You don’t hear conservatives like Moore and Norquist talking about tax cuts as a way to stimulate aggregate demand; they almost always couch it in terms of “unleashing” some pent-up animal spirit and innovation. What conservatives like Moore and Norquist and Laffer might call a dynamic scoring multiplier would most likely be called a “spin off” or “intangible benefit” by someone on the left. Of the two types of multipliers it’s the simple short run fiscal multiplier that we understand best, and is therefore the easier one to defend.

Steven Kopits I don’t know what part of Benjamin‘s post was wrong. It pretty much squares with my understanding.

You need to distinguish two different environmental issues regarding the Keystone pipeline. The first environmental issue is the path of the pipeline, which traverses a critical water resource with a very shallow water table. Even a relatively small accidental spill would pose a serious threat to the water supply for about a quarter of the US…those folks are important even if it is flyover country for you. It would be all but impossible to clean up because the stuff sinks. Just ask the folks in Michigan about how difficult it is to clean up bitumen/dilbit. How many years have they been at it? The risk of a not-so-accidental spill are not trivial either, since you can be pretty sure the Keystone pipeline would be a juicy and easy target for terrorists in a way that no other pipeline even comes close to matching. The solution to the aquifer issue is relatively simple: just reroute the pipeline. Yes, it would cost Keystone some profits, but so what? The second environmental issue is the old “if you don’t stop eating donuts today you won’t stop tomorrow either” problem. True, the pipeline by itself won’t put us over the edge in terms of climate change, but at some point you’ve got to walk away from the donut box that’s sitting in the conference room. If you want to build the pipeline, then how about signing on to a carbon tax or some cap & trade deal to mitigate the damage done by the Keystone pipeline and all of the other pipelines that myopic and self-centered voters want to see built?

Lac-Mégantic

list of pipeline failures since 2000

http://en.wikipedia.org/wiki/List_of_pipeline_accidents_in_the_United_States_in_the_21st_century

steven, the problem with pressurized pipelines is they can fracture and unzip for miles! that is alot of crude that can eventually leak into the environment just from the fracture zone-much less additional material which continues to pump from the system. first thing you need to do in this debate is acknowledge the significant potential for risk associated with a pressurized pipeline. i am not saying pipelines are not useful. but at least let the public understand the risks involved. and that includes the risks for rail, as you noted.