Expect further contraction

This morning, the Philadelphia Fed released leading indices, forecasting growth over the next six months.

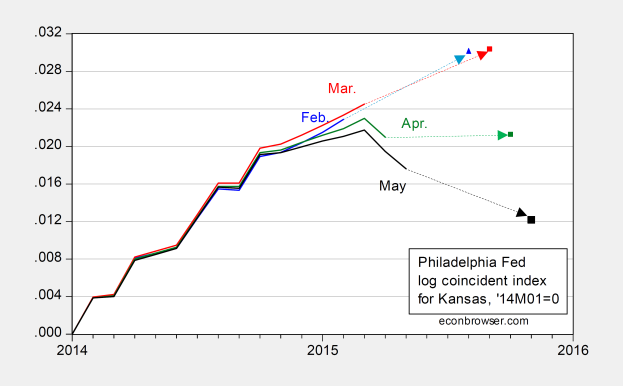

Figure 1: Log coincident index for Kansas, from February release (blue), March (red), April (green), and May (black), and associated implied forecasted levels. All normalized to 2014M01=0. Source: Philadelphia Fed coincident, leading, and author’s calculations.

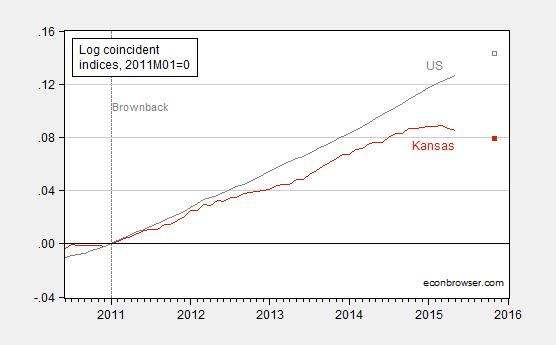

In contrast, the United States overall is still forecasted to grow. Figure 2 depicts the diverging paths.

Figure 2: Log coincident index for Kansas (dark red), and US (dark gray), and associated implied forecasted levels. All normalized to 2011M01=0. Source: Philadelphia Fed coincident, leading, and author’s calculations.

Interestingly, ALEC-Laffer’s Rich States, Poor States 2015 ranks Kansas’s economic outlook (based on tax rates, regulation, etc.) fairly high, at 18th out of 50. As an aside, the forecast for Wisconsin (ranked 13th) is -0.16% change over the next 6 months (0.32% annualized).

Funny that the disconnect begins right after ALEC-Laffer forecasted dramatic improvement. Almost as if the “economic adrenaline” for Kansas seemed to have entirely the opposite effect. Refresh my memory on the individual who was paid to design that program? oh yeah, now I remember.

Economic Outlook Kansas per ALEC-Laffer:

2008 – 29th

2009 – 24th

2010 – 25th

2011 – 27th

2012 – 26th

2013 – 11th

2014 – 15th

2015 – 18th

All of this points to the need for an in-depth analysis of what is optimal in the way of government taxation, spending, and debt to make the economy hum along. Are there “tipping points” for too little government and too much government? Is there a “guiding principle”? If “some” is not enough and “more” is good, when do we reach “too much”? Or is this all about change upsetting some equilibrium that needs time to reset? How do we know when we’ve screwed the pooch?

Would Kansas be thriving by increasing taxes versus prior levels versus lowering them? Wisconsin? Or is this “working out the kinks” whether we raise or lower taxes?

Bruce, the US economy, for better or worse, is globalized, and states such as Kansas are increasingly dependent upon US supranational firms’ foreign investment and “exports” to China-Asia and the rest of the EM to develop markets for demand for Doritos, Cheetos, Ding Dongs, Pepsi, Coca-Cola, corn syrup, undigestable dairy products (for 80%+ of the world’s population), McD’s, Pizza Hut, and all manner of junk food crap, as well as pharma, biomedical, and other “health” care products benefiting from the conditions resulting from US “exports” of crap to the rest of the world.

And this does not include US “exports” of all manner of armaments for war and mass destruction, as well as the fuels and supporting services to maintain the global imperial military machine abroad.

No eCONomist can make a living parsing these factors and presenting the results in a bipartisan, objective manner, whereas no politician is paid to understand and communicate to the American electorate the Anglo-American-Zionist imperial trade regime as it has evolved since the 1970s-80s. Therefore, we’re not going to understand “trade”, “exports”, and the effects on the US domestic economy.

Shale and commodities bust and crash hitting ag, mining/oil and gas, and mfg.

The shale bubble is a function of the financial crisis and resulting ZIRP and QEternity, which were in turn precipitated by the previous bubble that resulted in the financial crisis and Great Recession (?).

Demographics and slow, no, or negative growth of the labor force.

Bubble, crash. Bubble, crash. Bubble . . .

Whoa! Check out that exploding growth! Like an economy on steroids!